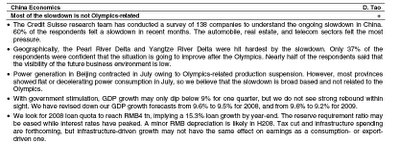

Reader Michael sent us a Credit Suisse Equities research report dated August 27 and called our attention to the section on China. Note that the analysts did some primary research to try to get a grip on the post-Olympics outlook. They expect a widespread, albeit not too severe, slowdown (click to enlarge, and yes, it is quite readable once you do so):

Most of the slowdown probably related to the recent marketing of Ping Pong Playa

http://www.pingpongplaya.com/intl/index.html

GDP is obviously fake as hell; think net domestic growth here!

RE: "Gross domestic income, or the money earned by the people, businesses and government agencies whose purchases go into calculating gross domestic product, rose 0.3 percent in the 12 months ended in June after adjusting for inflation, according to Bloomberg calculations based on today's Commerce Department growth report. GDP expanded 2.2 percent."

"Incomes last quarter grew 1.9 percent at an annual rate after adjusting for inflation, a little more than half the 3.3 percent gain posted by GDP, according to Bloomberg calculations. The figures showed incomes dropped in each of the prior two quarters"

“The GDI numbers raise the potential that GDP is overstating growth.''

"Corporate profits were down 7 percent in the year to June, the biggest drop since the last economic contraction in 2001, according to the Commerce Department. The government also said wages and salaries increased by $52.5 billion in the first three months of the year, $20.2 billion less than previously estimated. "

"The income numbers are more in line with other figures that indicate the economy struggled from April through June. The jobless rate was 5.5 percent in June, up from 5.1 percent at the end of the first quarter, and employers cut 165,000 workers from payrolls, according to the Labor Department. "

“I'm looking at the labor market, and the GDP income numbers make more sense,'' said Ryding. “It certainly did not feel like 3.3 percent growth.''

"The earnings data may more accurately predict the start of economic contractions, according to researchers at the Federal Reserve.

http://www.bloomberg.com/apps/ne…fzl8& refer=home

Measuring the economy of China reminds me of the effort to measure the oil reserves of oil producers. It also reminds me of measuring the worth of Investment Bank investments.

In each case the entity being measured has no interest in providing accurate data. Instead these seem to prefer making inaccurate and misleading announcements.

If one can not measure a thing, then one can not be sure that thing exists.

In China, the buildup of industrializaton appears to be state sponsored. Unless they have perfected the art of the Command Economy, then a collapse is likely.

China (and others) hoard US Treasury Bonds. This hoarding is not meant to finance spending in the United States and Europe. The Treasury Bonds exist to provide a safe landing for the Fearless Leaders.

Some don’t seem to understand what the GDP covers or what the GDP deflator measures. GDP covers more than the US consumer – GDP and its growth include the contribution of net exports. And exports have been undergoing disinflation due to the cheaper dollar. This brings down the deflator.

In other words, the proper inflation measure of GDP includes the effect of prices on foreign buyers as well as American consumers.

It’s an open economy after all.

One of the bloggers you quote is also famous for promoting the idea that the measurement of savings is wrong because it doesn’t include marked to market changes for assets.

Similar errors – the problem lies in not understanding (or being unwilling to understand) what the scope of the measurement is intended to be.

sorry – 10 p.m. meant for other post