I followed a rather circuitous, unorthodox route to the little corner of Wall Street I occupy, so I don’t really know what goes on in all those big, glass-walled buildings that turns eager, bright-eyed young graduates of the finest schools into cynical, herd-following, careerists. But I imagine that early in orientation an avuncular veteran of the wars is trotted out to impart the wisdom of his years. Buy low, sell high. Bond yields up, bond prices down. Don’t fight the Fed.

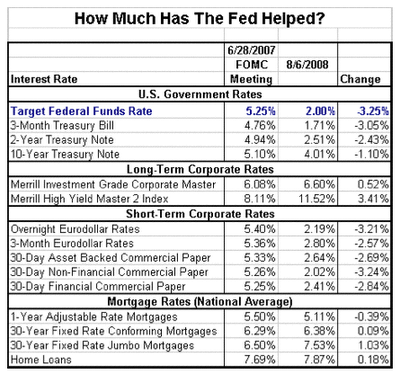

The wisdom of that last saw is called into question when the events of this decade are scrutinized. Oh sure, the markets manage their reflexive, 3% jumps on the days when the Fed cuts, particularly when it goes 50 or 75 bps 40 minutes before the markets open after a long weekend, as has been its wont in the recent past. But viewed from a slightly longer term perspective, the Fed’s interest-rate setting power—note the distinction between that specific power and the myriad special “facilities” it has established over the last 8 or so months, where the Fed most certainly has had an impact—has become less and less effective over time.

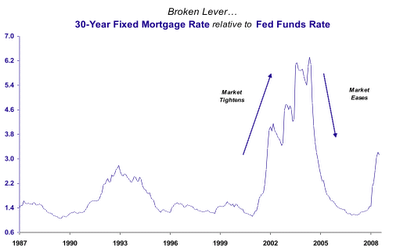

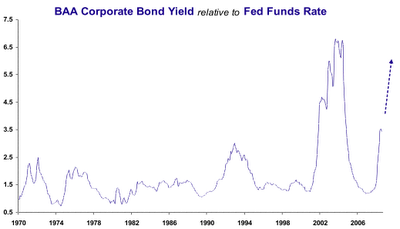

Roughly since the bursting of the tech bubble, the credit markets have frustrated Fed policy at every turn, moving in opposition to the Fed funds. Stephanie Pomboy of MacroMavens refers to this as the broken lever. Below are two charts illustrating the Fed’s impotence, courtesy of MacroMavens.

One could argue that the ineffectiveness of Fed interest policy today is simply a function of the old concept of pushing on a string, that the monetary transmission mechanism breaks down during a debt deflation/liquidity trap. You’ll get no argument from me; that’s definitely a big piece of the puzzle. But I think there’s another factor at work here as well.

In it, Noland goes so far as to speculate that Greenspan’s infamous endorsement of adjustable rate mortgages, spectacularly ill-timed to coincide with interest rate lows, was a desperate attempt to transfer the enormous interest rate risk sitting on the GSEs’ balance sheets to the individual homeowner. Talk about your unintended consequences! And talk about your irony, with the poor homeowner, or no longer homeowner, but still taxpayer, again on the hook, more directly this time, for Fannie and Freddie’s ill-conceived and overleveraged balance sheet risk.

great post

The data speaks for itself. The Fed’s silly, rate cuts have actually added fuel to the fire, not extinguished it.

The Fed has been on a crusade against savings for seven years. Until it stops, the asset bubble will linger. I guess that is probably the objective.

“The market has yet to come to grips with the thought that the Fed’s not in control here.”

In my opinion, this above statement explains why the Dow is not sub-10,000 right now. Very, very nice article. Like George Soros said, [paraphrased] just because the Fed takes action doesn’t mean it will be the right action. The wrong action can actually make things WORSE. Broken lever is very accurate description. It’s always nice to read articles that truly dig for the truth as opposed to article written only to sound good. Thanks.

Yo Scott, I agree with your summation as presented, and its details. I’m going to reframe the issue slightly, however, as an illustration of _why_ the Fed’s actions presently have so little immediate action, and perhaps little ultimate action, too.

In principle, a CB such as the Fed would want to have rates be ‘neutral’ at the time they act, that is stable in a narrow range of say +/- 25 bips relative to inflation or deflation, regardless of the absolute level of the rates. That way, the number is ‘real,’ without a strong momentum up or down, at least at the time of action since rates are never ‘hard’ fixed over any length of time in market economies. In those conditions, a Fed rate move, even a small one, has disproportionate impact. Consider that ‘real rate’ as balanced on a fence rail, where a push to either side has a disproportionate impact on the direction of movement, regardless of direction.

Now consider a rate that is far from equilibrium at the time of Fed rate action. That is, the rate of change in rates on the street is signficantly negative or positive. The Fed’s ‘little rate kisses’ in such conditions have far less impact given the momentum of money’s mass, whether the Fed is pushing counter or pro that momentum. This is the problem with both inflation and deflation: in either case, the actual momentum of rates is far from equilibrium, and it often requires quite brutal CB rates set at far from equilibrium levels to brake the momentum of rates even further from equilibrium.

Now let’s see where Ben the Printer’s Apprentice has been standing. He inherited a situation where _real rates_ were far from equilibrium thanks to St. Alan the Greenspender, in that case much more negative than the grossly distorted public statistics. Bernanke and Co. not wholly inappropriately attempted to redress this by raising rates gradually for some time before things, for other reasons, went soar in July 07. But his rate raises were too tiny timid to really brake those negative real rates, especially with the essentially uncontrolled force of phoney credit creation behind those neg rates. Of course, when the crisis hit, and the credit markets wholly dependent upon short term paper in consequence of those neg real rates locked up tight, it looked like the Fed rates were too high, and that ‘Ben killed the money tree.’ Someone else will have to go back and look at the real number, but I doubt that we EVER hit a positive interest rate even in midsummer 07; it was bad debt that killed the markets, but that’s a separate tail to the tale.

I don’t know that it is so much an issue of the shadow banking system capturing Fed policy outright as the fact that the shadow system was created to have a permanent bias toward massive credit creation, i.e. permanent hidden inflation, which no public policy in the US or elsewhere has in anyway reined in, regulated, or come to grips with. It’s as if the captain on the Fed bridge sends signals which the black gang and the engineer simply ignore because they have long been out of his chain of command.

So what was Ben the Paperhanger’s response? To crashdive rates to severely negative levels within six months, more than 300 bips down. But again the Fed’s moves cannot have a major impact fast if at all when rates on the street are far from equilibrium. Which they still are, and moreso after his action. We have had credit demand decline, somewhat, at the consumer level in the US, but deflation really hasn’t reached the _retail_ level yet. We have asset deflation, but not price deflation, and in fact in areas where consumer purchases are concentrated we have continued to have price inflation, severely so in the cases of fuel and food.

And here’s something not in Ben’s book: Banks can’t make bucks lending at 2% or under. So when the Fed lends to them at that level (to bail them out as everyone but the media and the taxpayers understand), they don’t pass that level along, but lend at higher levels if they can find fools, er _customers_ willing to sign on the line for high costs in low profit times.

I think that we can expect all kinds of funny money gimmicks from Ben over the next 18 months, to try to nudge a drifting oil tanker of money with his rubber dinghy of effect. All of the special lending windows may well go to zero interest in rolling over their ibank big billion puts, for example. That’s right ‘free loans’ for the banking plutocracy. Which will NOT be passed on to the real economy. I think the main point here to me is that it’s a fool’s gambit to try to recapitalize the banking system with neg real rates: this is another poisonous legacy of Alan Greenspan, a willingness to sack the real economy to the benefit of the financial economy. We would do much better to have nearer to real rates and a direct re-capitaliation of _select portions_ of the banking system. That would be be best bang for the buck, and the best moral example in letting big money speculators fail.

If Ben did something radical like raising rates a tad to get closer to a neutral rate and a solid currency where policy actions may really have weight, then of course the insolvency of the banking system becomes inescapably apparent. And the public financial authorities have clearly staked out the position that they will do anything up to and well beyond reason and reality to avoid engaging with that particular issue. Not that it is an insoluable one, it’s simply an unthinkable one (for them). We could recapitalize the banking system without many of the present players, but the public authorities will throw any amount of women, children, and future revenues overboard to save the feckless bankers first. And as long as Ben and Co. refuse to engage with reality, they will continue to fumble about with ineffective rate noughies in a massively neg real rate environment which shrugs them off, their feeble clinging love notwithstanding.

Two points here:

Doesn’t this seems awfully like Japan? Trying to recapitalise the banks by giving them free money so they can put it out along the curve. That process has taken a long longtime.

But at the same time where does that leave the bond market? As someone who lost plenty shorting JGBs i’m loath to short the US bond market but at some point that baby has to give.

Asset delation and price inflation is not a receipe for a happy market.

Okay, well consider the alternative. If fed actions haven’t achieved the desired outcome of improving the liquidity in the system, where would we be if they had done nothing? All of the inflation fear-mongers would be happier if Bernanke told Wall Street to sit on it and stuffed us into a real GDP shrink?

And who thinks that the fed rate should drive 30 year mortgages? How about the concept of yield curve steepening, flattening and duration in general. Ben Bernanke is not driving 30 rates with overnight deposit requirements.

This meltdown began with mortgages and it will end with mortgages. Recapitalizing the homeowner, i.e. 50 year amortization at 4% interest, would turn the economy on a dime, and not cost the taxpayer one. But today we see Fannie Mai and Freddie Mac annoucing that they are going to charge higher fees to cover the risk they are carrying. The Feds actions are having the opposite effect. It is all about the monthly mortgage payment, baby.

“Ben Bernanke is not driving 30 rates with overnight deposit requirements.” – You arde not serious with that statement I hope…

50 year mortgages at 4% interest rates is renting.

Finally negative GDP print is exactly what is required. All attempts to sustain an unsustianable equilibrium point will fail (can;t say when, but printing money to fill holes is simply delaying the fuse). Until a massive amount of debt gets destroyed, likley including the US Bond market.

By the way, putin isn;t stupid. The US is rapidly approaching its own Suez moment.

Last, the US bond market is the ultimate bubble. It dwarfs subprime. Paulson cow towing to Sovereign holders is the tell. The gov’t will do anything and everything to keeps its financing window open, in the interest of itself. The more focus on down 11,000, dow 10,000 or whatever the better. At least the spotlight is off the bond market as Treasury pumps out the ten years. The disinformazia continues with story after story of the “massive” demand for the 30 year.

Kline you are dead right on the only poeple who don’t get this are the media and the taxpayers. Also agree that the fastest cure is debt destruction, ring fence deposits and move on. I suspect the other side of that process is so grim that keeping the wheel turing as long as possible is the only alternative. Scary.

Most people move, on average every 5 years, or buy more than one house in their life. They are renting anyway. How about auto loans. How many people pay those off. Renting also. People who own a home, regardless of how it is financed, will take care of it, and most likely make improvements. This stabilizes the community and allows homeowners the luxury of paying for higher food and fuel prices. Besides, the point is to keep the economy from collapsing until all markets can be stabilized and we can move on to solving our other serious problems, like globalization.

Greenspan recapitalized the banks in 1991-92 with the same strategy. He said he was cutting rates to stimulate business lending. But as yields on medium-term treasuries rose, the banks stopped lending to business and played the federal yield curve. (I assume he knew what he was doing; you couldn’t hide it, altho the press never noticed.)