A very useful post comes from Robert Dekle, Jonathan Eaton, and Samuel S. Kortum at VoxEU. The authors steer clear of the “when will global imbalances end” question (as in when will China, Japan, Taiwan, and the Gulf States tire of funding our current account deficit) to focus on one at least as important: “what will it take to achieve rebalancing?”

The analysis will warm the hearts of dollar bears and comes to a conclusion that might surprise some readers: Japan comes out better than China. However, the paper looks at the “pure” case of a perfect rebalancing, something we will never see. There will no doubt be overshoots by some countries, failures to adjust enough by others. But at a minimum, this post gives an idea of how far the dollar needs to fall for the US to get its house in order.

Bottom line: if you are an American and plan on seeing the world, better do it sooner rather than later.

From VoxEU:

A correction of international imbalances seems inevitable. What will that entail? This column presents estimates of the changes in trade flows required to rebalance the world’s current accounts and analyses which countries will bear the burdens of adjustment.

The US runs the largest current account deficit in the world. In 2006 the US deficit reached $788.1 billion, nearly 6% of US GDP and more than the surpluses of Japan, Germany, and China combined. The US deficit has been financed largely through the accumulation of US liabilities by foreign central banks. As their appetite for US IOUs can only be finite, a predominant view is that a reversal in the US trade deficit is inevitable. As Herbert Stein diagnosed a similar situation long ago, “If something can’t go on forever, it won’t.”

While the dynamic forces driving trade imbalances remain too poorly understood to allow us to say with much precision when a correction will occur, our understanding of what drives international trade can tell us a lot about what a correction will look like when it does happen.

What must happen to fully rebalance the US current account?

What would a full “correction” of current account imbalances mean for the value of the dollar, the relative size of the US economy, and US living standards? What sort of adjustments inside the US economy will be needed? What will happen to the major surplus countries as well as to smaller players whose economies are tightly linked to the US, such as Canada and Mexico? To answer this question, we must have a way of linking trade flows – in particular US exports and imports – to economic factors such as the real exchange rate, US GDP, etc. Here the gravity model comes in.

A successful venture in international trade has been the gravity model of bilateral trade. Pioneers in econometric modelling, such as Tinbergen (1962) and Pöyhönen (1963), observed that trade between country A and country B followed a simple formula. Exports from A to B correlate very well with the size (e.g. GDP) of country A’s economy multiplied by the size of country B’s economy divided by the distance between them. For a long time, this relationship lacked a theory. More recent work, particularly by Anderson (1979) and Deardorff (1998), tied this relationship to standard models of international trade. In Eaton and Kortum (2002), two of us developed a particular model that allowed for production of a large number of goods that can be traded but at a cost. A feature of this model is that an increase in exports can occur at both the intensive margin (selling more of the same good) and the extensive margin (selling a broader variety of goods).

Recently we have adapted this framework to address the US current account question (Dekle, Eaton, and Kortum 2008). Fitting the model to 2004 data on GDP and bilateral trade flows among 42 countries, we solve for the new equilibrium in which trade in manufactures (the major component of the current account imbalances of the big players such as the US, Japan, Germany, and China) adjusts to eliminate all current account imbalances. While achieving exactly this outcome would be a remarkable coincidence, the exercise gives some sense of the magnitudes rebalancing would entail.

The effects of correcting international imbalances

We perform this exercise making different assumptions about the flexibility of national economies in adapting to a rebalanced world. How easily can productive resources (most importantly workers) move between the production of non-traded goods and manufactures? How easily can countries expand exports by increasing the range of products that they can produce and sell abroad?

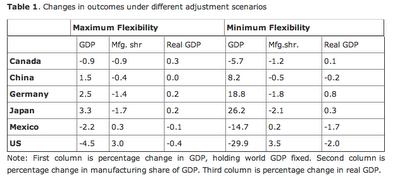

Table 1 presents a synopsis of our results (for a handful of countries) in the two most extreme cases.

Flexible case: Economies are fully flexible in both respects. Workers can seamlessly change sectors, and countries can seamlessly change the portfolio of products that they sell in different markets.

Inflexible case: Workers are stuck in their initial sectors and exports to a market can adjust only at the intensive margin, by selling more or less of the same set of goods.

One can think of the first scenario as reflecting the ultimate long-term consequences and the second the immediate effect of a sudden change.

For each scenario, Table 1 reports in the first column the percentage change in the country’s GDP relative to world GDP. This change is likely to correspond most closely to the change in the country’s exchange rate. The second column reports the percentage point change in the share of manufacturing in the country’s GDP. The third column reports the percentage change in GDP deflated by the change in local prices (click to enlarge):

Beginning with the second column, we note that in either scenario adjustment requires a substantial increase in the size of the US manufacturing sector, between 3 and 3.5 percentage points. The reasons behind the change in the two scenarios are different, however. In the flexible case US manufacturing expands because resources move there. In the inflexible case, the wages of workers in manufacturing rise relative to those in the rest of the economy.Looking at the implied change in GDP (first column) and considering the flexible case, we see that the change in the relative sizes of the different economies under the flexible case is quite modest. The US as a share of the world economy falls by just 4.5% while Japan’s rises by 3.3%. The inflexible case, however, requires a much more radical realignment in the relative size of the major economies. The US declines by nearly 30% relative to the world while Japan grows by over 26%. (Combining the numbers, the adjustment would require over a 50% devaluation of the US dollar in terms of the Japanese yen).

Turning the implications for the change in real GDP (third column), we see that large changes in relative GDP translate into much more muted changes in real GDP. For instance, the real GDP of the US falls by only 2%. The reason is that the more the US relative wage (and hence relative GDP) needs to decline to make US exports (e.g., tractors, wide-bodied aircraft) more competitive abroad, the lower the price of what Americans produce for themselves (e.g., medical services, personal training, auto repair), which comprise the lion’s share of what Americans (and other people) spend money on.

The outcomes for the large surplus economies (Japan, Germany, and China) are the reverse image of those for the US. Note that in either scenario the US pulls down the relative GDPs of Canada and Mexico, even though Canada starts out running a surplus and Mexico only a small deficit. The reason is that these countries’ largest foreign customer shrinks substantially. Despite the decline in the size of the Canadian economy, Canadian GDP can buy more, since goods from its largest foreign supplier have gotten much cheaper still. Hence its real GDP rises.

To summarise, the realignment that is necessary depends on flexibility, with more flexibility requiring less adjustment. Even if movements in relative GDP’s are substantial, however, once price changes are taken into account real effects are much more modest.

The adjustment in progress

In fact, there are signs that the correction has already begun. From 1 March 2007 to 1 March 2008 the value of the US dollar declined by nearly 18% against the Canadian dollar, over 16% against the Mexican peso, by nearly 14% against the Euro, and by over 8% against the Chinese yuan. Various trade-weighted exchange rates reported by the IMF show a US dollar decline of 10 to 13% from the first quarter of 2007 to the first quarter of 2008. During this same period US merchandise exports grew 18.4% and merchandise imports grew 12.7%. Some of this growth is the consequence of the commodity boom. But even removing soybeans, corn, and wheat from exports leaves growth in the remaining categories of US exports at a hefty 16.8%. Moreover, if imports of crude oil are taken out, US spending on imports grew by only 5.9%.

Much larger changes than these are needed to bring the US current account into balance. How much more of a dollar decline is needed depends on how adaptable the US economy is at moving resources into the production of goods that are exported or used to replace imports and on how successfully it expands the range of products it can produce and sell abroad.

An alternative view –

$400B/year – end the Iraq/Afghan wars.

$700B/year – switch to an electric infrastructure for transportation.

There is your adjustment.

One of the problems of these studies is that it is a closed system. It assumes that the production and jobs are going back to US once China, Japan and East Asia appreciate against USD. No, jobs will go to Vienam, India, Africa…The system is an open end system. It should at least use game theory to model the market erter/exit decision in the international trade.

Simply going to an electric infrastructure would readjust where we get our imports from.

Our current largest form of electric energy comes from coal (almost 50% as of 2006). This would mean that while petroleum demand would decrease, coal (amongst other sources of raw energy material) would increase.

As of April 2007, the DOE released in its coal review showing that the U.S. demand for coal out strips supply.

The moral of the story? With the devaluing U.S. dollar, that will hopefully induce import prices to elevate beyond those of local alternatives.

Sources:

Net Generation by Energy Source by Type of Producer — http://www.eia.doe.gov/cneaf/electricity/epa/epat1p1.html

U.S. Coal Supply and Demand (2007 Review) — http://www.eia.doe.gov/cneaf/coal/page/special/feature.html

2 comments:

1) I wonder how accurate the “gravity” model is when looking at trade in services. I can understand the “divide by distance” bit as a crude approximation of the difficulty of transporting manufactured products. But in the internet age, services have essentially zero transport costs. Whether your call center is located in Mexico or Bangalore doesn’t really change the transport costs.

2) This analysis is limited by looking only at trade in manufacturing. Does anyone know what percentage of our trade is currently manufacturing vs. services? The U.S. economy is much more dependent on services and changes in the services trade may be far more important to the picture than changes in manufacturing.

According to U.S. Dept of State, United States 2006 GDP component makeup was:

67.8% Service

12.4% Government

12.1% Manufacturing

4.9% Construction

1.9% Mining

0.9% Agriculture, Forestry, and Fishing

Source: http://usinfo.state.gov/products/pubs/economy-in-brief/page3.html

Does this take into consideration the possibility of formal or informal US restrictions on foreign trade? In other words, potential boycotts of Chinese or other foreign goods unless trade parity is reached? In a real downturn, things could get ugly and the US consumer could turn against China.

Trade, as presented, has become more of a political than economic category, i.e. it continues a long-held notion that any good/svc which crosses an intl polit border = trade.

But, in 2006, “Related party trade” is trade by U.S. companies with their subsidiaries abroad as well as trade by U.S. subsidiaries of foreign companies with their parent companies. Related party trade accounted for 46.8 percent ($863 billion) of consumption imports and 30.8 percent ($319 billion) of total exports". USDC, U.S. GOODS TRADE: Imports & Exports by Related Parties: 2006 , May 10, 2007)

Rather than 'trade', most of this is intra-firm transfer which, on a world scale accounts for 1/3 to 1/2 of total trade. 'Rebalancing' might require a re-think.

Bottom line: if you are an American and plan on seeing the world, better do it sooner rather than later.

Or hold your net asset currency exposures in a PV-of-expected-expenditure weighted basket of currencies, and sleep well at night. JPY/EUR/USD gives you a pretty good spread.

Not that hard to do these days.