Oceans are ‘too noisy’ for whales BBC

India’s use of brain scans in courts dismays critics International Herald Tribune

Lehman’s Bankruptcy Petition Credit Slips

Jobs cull begins in London and New York as Lehman Brothers goes to the wall The Guardian

Who’s next after Lehman Brothers is fed to the wolves? Ambrose Evan-Pritchard, Telegraph. We know the answer already, but some interesting observations.

On Wall St. as on Main St., a Problem of Denial Joe Nocera, New York Times

After 73 years: the last gasp of the broker-dealer John Gapper, Financial Times

AIG Has Financials Staring into the Abyss Paul Jackson, Housing Wire

Back to the Real Side of the Economy: Recession Watch Menzie Chinn, Econbrowser

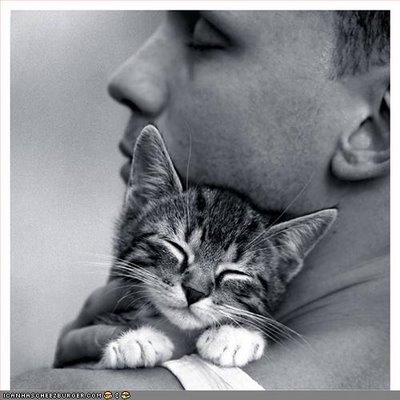

Antidote du jour:

Evan-Pritchard: As the bankruptcies mount, the state will have an obligation to step in to preserve social stability. If that means the temporary nationalisation of large chunks of the Western economy, so be it.

What a profoundly evil rat.

Especially when Evan-Pritchard states before that: However, the root cause lies in the actions of governments across the Western world.

So the governments caused the problem through the unintended consequences of easy money, but then a sweeping policy with an untold number of other unintended consequences is going to fix it? This doesn’t even begin to make sense.

Finance world is very crazy… i can’t believe a big company as Lehman is dead !… poor capitalism…

It is great that someone has noticed that ‘recapitalization’ of the failing business models on Wall St is another misallocation of capital and will worsen the problem rather than alleviate it.

For a guy that has spent a lifetime studying the great depression, Bernanke shows a remarkable lack of vision.

The fact that AIG is to be allowed to canabalize itself is proof enough that these failing business models should be allowed to fail sooner, rather than later.

River