Dear readers, this is a bit of an experiment (think of it as the econblog analogy to open source).

When Geithner presented his bank plan, such as it was, I was particularly disgusted by the “public/private partnership plan rubbish. It struck me as a costly way to paper over the irresolvable conundrum with Paulson’s two failed “let’s buy bad assets” plans, his private sector MLEC, and the taxpayer funded TARP.

The problem with both is that there is a gap between the market price of the bad assets and where they are carried on the bank’s books (of course, in theory, this paper should be valued at market, but between Level 3 accounting and other fudges, this is less true than we’d all like to believe). So the banks will sell only at book value or a higher price, meaning above market (there would be no need for this sort of nonsense if the garbage was carried at market value; they could simply unload it; they are not willing to sell it for less, since they would book a loss, and Uncle Sam does not want to inflict losses on bank, even when it would be in the collective best interest).

So in the TARP scenario. the Treasury would pay an above-market price, which would constitute an undisclosed subsidy (the public would not know the split between fair value for assets purchased and overpayment) and considerably reduce the likelihood of achieving the government’s PR spin, that the taxpayer would not lose money on this exercise.

I had not thought more deeply about the public/private partnership idea, because it could not close this gap; it merely represents a convoluted (and likely more costly) way of disguising the underlying problem from the public. And I had also assumed (or more accurately hoped) that it would, like the Paulson variants, die a slow death as the Treasury realized it could not make it achieve all the intended objectives.

But that assumption could be very wrong. It is possible the program will be created, but will be too small (as in there will only be a small subset of dud assets that the banks will be amenable to unloading that will also appeal to investors under the program’s constraints) to make real difference to any institution. Thus the public/private partnership will have enriched investors without achieving any useful end.

I not focused on any of the speculation on what the program might look like, figuring we’d all have a chance to analyze it once finalized. But that may be a mistake. It might be better to foment discussion on the program now, while it is still in play, in the hope that the media might pick up on this theme and carry it forward.

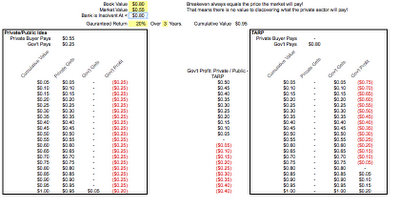

To that end, I am featuring a message sent by a reader who calls himself MinniRenter. He also sent an Excel spreadsheet; I snapshotted the output.

I encourage readers to focus on his assumptions first. If his assumption are wrong (or perhaps correct, but not the only scenario under debate). then it does not make much sense to dig into his analysis. But if the assumptions pass muster, then further prodding makes sense.

From reader MinniRenter:

This spreadsheet shows that the Public/Private (P/P) plan is inferior to the initial TARP idea (TARP). That does not mean TARP I is a good idea. Here are the rough details that I have heard about the P/P:

-Government pays bank difference between market price and book price (or price that keeps the bank solvent).

-Private buyer pays market price.

-Private buyer is paid a preferential or hurdle return before the government gets a dime.

-After the government is repaid in full the two parties share gains pro-rata.

This idea was proposed as an enhancement to the TARP because the government doesn’t know how to value these assets. The attached spreadsheet shows that the information that the private buyer reveals, does the governmnet absolutely no good, unless the private buyer is wrong.

I suppose one argument for P/P over TARP is that there are some assets that the bank would not be able to offload in P/P that they would be able to get rid of under TARP. I would counter that P/P is not guaranteed to do anything for the banks because the criteria dictating how many and which assets are sold is the generation of good returns for the private investors. Private investors will not just continue to buy assets because Timmy says the banks are not solvent yet. So it tries to accomplish recapitalization with a program that is really designed to make private investors rich.

Click to enlarge:

Needless to say, comments appreciated.

The P/P plan manages to combine price-fixing (for the sellers) with loss for the government and profits for the buyers. It’s paying $2 for a $1 bill and then selling the $1 bill for 80 pennies. Two private winners, one public loser. That’s change a banker can believe in. (Wait till GS sets up a fund to buy back at 22 the paper it has sold to Uncle at par. And wait till Uncle starts loaning the buyers a portion of the purchase price.)

Probably needless to point out that Uncle will have to extend price-fixing beyond the banks to avoid failures by other holders of similar paper — insurance companies, pension funds, and hedge funds.

I am not as smart as you Yves, but the premise is that in P/P there is an above boeard guaranteed return ‘investment’, that will be priced with zero option value given for upside to that investor (since it is a hidden government subsidy, there is no upside possible).

If that ‘investment’ has fixed and known returns (the guarantee), and is backed by the government (the guarantee) is is effectively a government bond in disguise.

Why would the government pay more than market value for a bond?

I feel like I am missing something obvious.

I can smell a bit of circular reasoning here. But as the TARP2 plan seems to be fairly ill defined (what are its real goals, how is it exactly implemented), I feel it is moot to discuss the presented sheet. For its simple assumptions it seems to be correct.

Now, if TARP2 is about price discovery, there can only be one meaningful price, and that is the clearing price (when all bad assets are taken off the bank sheets). But as banks apparently don’t have to sell for a price they don’t like, the clearing price (and the sums involved) must be high enough to prove the banks to be solvent. So, who is more desperate, Geithner or the banks? Who is holding whom hostage? Did we finally arrive at assured mutual destruction? I am curious. I have been skeptical about the bubbles. But slowly this is getting bigger than my wildest fears.

Finally, a discussion about this topic can be found here:

http://brontecapital.blogspot.com/2009/02/private-equity-involvement-in-bailout.html

My concern remains, that there might not be a market for many “assets” at any price. This is along your “there will only be a small subset of dud assets that the banks will be amenable to unloading that will also appeal to investors”.

I am not getting the spreadsheet….but first:

The assumption here is that the government is willing to eat 25 cents on each deal. Geithner is trying to leverage it 10×1, so that is a non starter.

Unless I totally don’t get it.

Anyway, regarding not understanding it, the first column labeled cumulative value — I assume that that is the terminal value of the asset.

It seems like you need some assumptions regarding the probability of each of those terminal values before you have a good idea of comparative costs.

Where is the plan where WE win.

skippy

RE: HAIRCUTS

It is important to use an accepted methodology as a starting point, and be able to measure or estimate specific parameters, which can include agreed statistical confidence levels, in order to calculate the agreed haircuts. Having an undisputed formula allows institutions to re-set haircuts when collateral price valuations change, to compute new haircuts easily for new types of collateral using the same conventions and to revise haircuts by mutually agreeing tochange confidence levels when market conditions change.

Instrument Haircut Variables

The generally accepted methodology for calculating haircuts is based on some estimation, either statistically- or dynamically-calculated, that considers what a piece of collateral might be worth if the collateral holder ever had to sell it. Below are explanations of the different variables that may be used in calculating haircuts…

Instrument Tenor (Time Remaining to Maturity) Collateral is often grouped in tenor buckets, with longer tenors leading to higher haircuts.

… but haircuts are used to cover only the worst expected aggregate negative price move over the holding period. Haircuts are most often expressed as a percentage which isdeducted from the market value of each collateral asset type. It is the sum of the collateral values after application of the haircuts which has to be sufficient to cover the exposure that is being secured. The rarer practice of viewing haircuts (or margins) as a percentage which is added to the exposure is not as practicable where collateral portfolios consist of different asset types requiring varying haircuts. Haircuts are based on the quality of the assets being used as collateral, and not on the credit risk of the collateral giver. Consequently, haircuts are not adjusted for the credit risk of the collateral giver.

Haircuts need to be computed for the appropriate holding period. A traditional holdingperiod is one month, although market practice seems to be moving towards ten businessdays in some areas. If the holding period is one month, and one month volatilities areused, no conversion is needed.

>> I don't know if Wall Street or The Treasury, or Obama or anyone in Congress or in jail knows this, but there is a lot of info out there on haircuts!

RE: HAIRCUTS

It is important to use an accepted methodology as a starting point, and be able to measure or estimate specific parameters, which can include agreed statistical confidence levels, in order to calculate the agreed haircuts. Having an undisputed formula allows institutions to re-set haircuts when collateral price valuations change, to compute new haircuts easily for new types of collateral using the same conventions and to revise haircuts by mutually agreeing tochange confidence levels when market conditions change.

Instrument Haircut Variables

The generally accepted methodology for calculating haircuts is based on some estimation, either statistically- or dynamically-calculated, that considers what a piece of collateral might be worth if the collateral holder ever had to sell it. Below are explanations of the different variables that may be used in calculating haircuts…

Instrument Tenor (Time Remaining to Maturity) Collateral is often grouped in tenor buckets, with longer tenors leading to higher haircuts.

… but haircuts are used to cover only the worst expected aggregate negative price move over the holding period. Haircuts are most often expressed as a percentage which isdeducted from the market value of each collateral asset type. It is the sum of the collateral values after application of the haircuts which has to be sufficient to cover the exposure that is being secured. The rarer practice of viewing haircuts (or margins) as a percentage which is added to the exposure is not as practicable where collateral portfolios consist of different asset types requiring varying haircuts. Haircuts are based on the quality of the assets being used as collateral, and not on the credit risk of the collateral giver. Consequently, haircuts are not adjusted for the credit risk of the collateral giver.

Haircuts need to be computed for the appropriate holding period. A traditional holdingperiod is one month, although market practice seems to be moving towards ten businessdays in some areas. If the holding period is one month, and one month volatilities areused, no conversion is needed.

>> I don't know if Wall Street or The Treasury, or Obama or anyone in Congress or in jail knows this, but there is a lot of info out there on haircuts!

If the government wants to entice investors to buy assets that they won’t touch, by offering attractive financing and guarantees, I would have no objection to that, as long as EVERYONE is allowed to buy them. No bundling them up and back-channeling them to Goldman Sachs – offer the same deal to Joe and Jane small investor (maybe a nice Fidelity mutual fund can be set up – with the best due diligence people pouring through the entrails) – same loan terms (non-recourse, aren’t they?), same loan-to-value leverage, same backstop guarantees, same profit split. Wow! More buyers! Problem solved! (if it truly is a good deal for the investors – there’s a lot of idle money waiting for a good opportunity).

If Treasury is going to pick up the subsidy bill to help unload this crap and keep it from clogging the pipelines, let’s just make sure that there are no sweetheart arrangements for “special” investors – offer the same deal to the marketplace writ large. More buyers means higher sales price (less taxpayer risk). And if it’s offered to all, there will be no opaque fleecing – instead there will be a transparent market.

I’ve got some cash on the sidelines. I’ll be happy to read the prospectus to see what Mr. Geithner is offering to entice me to help solve his problems.

How about…

1. Banks sell off ‘toxic assets’ to the government or private investors — buyers get this stuff as cheap as they can. Do an honest assessment of what the value is, maybe being slightly pessimistic. We force banks to sell them. Value them on bank balance sheets at $0.

2. Government hands banks a big bag of ‘free money’ to recap.

3. (optional) Send the bill to bank management.

If we, as a nation, are going to be paying money to banks, we at least deserve to see what the actual number is. I’m tired of schemes that try to hide this. Hiding is the cause of all the chaos. Air out the bad news now, before we kill the economy of the entire planet.

I just have to toss this in as a late night wandering thought ….zzzz

Treasury and The Fed are making crap up as they go and going from panic to panic and now Obama is on the run, having taking the handoff from Bush, who dropped the ball years ago. We could all go back and toss insults at Clinton and then go back to 1932 and chew on The Glass-Steagall Act and then visit The, It’s A Wonderful Life bank run and then evolve to modern day corruption with The Gramm-Leach-Bliley Act, and then piss and moan about banking deregulation and the lack of banking regulation — but, no, why not focus on the explosion of the derivatives market and the lobby groups like SIFMA that co-engineered a political agenda with FASB which was linked to the industry-wide collusion and corruption which fostered and nurtured accounting fraud.

We saw this build up to The Enron era and then 8 years of zero accountability or regulation for anyone — but, along the crooked path, we did have real statistical models, we did have SEC accounting theory and generally accepted IRS-like FASB-backed rules and then, all the derivative people and financial services apparently understood accounting law, valuation methods, risk and reward, securities structuring and engineering and of course, offshore tax evasion — and as suggested above (in the previous derivatives post) the pirates all agreed on methods of haircuts, and potential styling tricks and blow-dry tips for those bad hair days, like today — but now, in the face of reality, all the sudden, no one anywhere has a clue what to do, and if yah want my opinion, it’s just more of the same collusion bullshit that brought us to this point! These people that are re-decorating offices and going to get their fat asses waxed, are currently obstructing justice and they are giving false and misleading information to the public, they are suddenly unwilling to use generally accepted methodology, to measure or estimate specific parameters, which can include agreed statistical confidence levels. Where are the accounting firms, the rating agencies, the audits, the books, the records, the evidence for this congame that is now being directly linked to Congressional ATM’s? Where is DOJ, FBI or someone that has a damn clue as to why all these crooks are running around free and and getting bigger bonuses?

Why is that? WTF? Why is Treasury so friggn retarded that they don’t have a clue, or a model in place to value the securities that they guarantee … huh, huh, why is that Timmy The Punk?

Why do we have Paulson’s TARP and now an even bigger mess with Obama’s TARP — when this is just a matter of going back and playing by the rules that were in place??

I feel better now…

I can't help it; too many M&M's?

This is an old (June 1, 2007) example of an interesting combination that relies on hybrid securities mixing and also, pleaze don't forget the once famous Covered Bonds* Thing from last year, as one of the ways to make those tender pig lips look juicy!

FYI: "Some public fund investors are forbidden from buying junk- rated or unrated portions of CDOs. Wall Street has come up with ways to sell dressed-up CDO toxic waste so that it qualifies as investment grade. One is called principal protection.

Bear Stearns offered this hypothetical example at its Las Vegas presentation: A pension fund wants to buy $100 of CDO equity. Instead of buying it directly, the fund buys a zero-coupon government bond for $46 that will be redeemed for $100 in 12 years. That bond is paired with a $54 investment in CDO equity.

Zero-coupon bonds pay no interest; the investor is paid the full face amount — that's $100 in this hypothetical situation — when the bond matures.

Principal Protection

“Principal protection is guaranteed,'' Fleischhacker says. “It's AAA since you're buying a U.S. Treasury.'' If there are no defaults, this method of investing in CDO equity would return 9.3 percent annually, she says.

The presence of the zero-coupon bond ensures the pension fund will recover its $100 investment even if the equity tranche becomes worthless. While the fund wouldn't lose any money if that happened, there would be no return on the investment for 12 years.

If a fund manager puts all of the same hypothetical $100 into zero-coupon bonds only, it would more than double its money in 12 years, Das says. “I would have thought with pension fund money, they don't really want to lose principal,'' Das says of this equity tranche sales technique. “And clearly here the principal is very much at risk. You've got a highly leveraged bet on no defaults, or very minimal defaults.''

Chippeaux says she concluded the principal-protection plan was good for her fund in New Mexico at a time when the state required that public funds buy only investment-grade debt."

>> * Covered Bonds: On July 28, 2008, US Treasury Secretary Henry Paulson announced that, along with four large US banks, the Treasury would attempt to kick-start a market for these securities in the U.S., primarily to provide an alternative form of mortgage-backed securities. The guidelines issued specifically address covered bonds backed by pools of eligible mortgages.

Covered bonds are debt securities backed by cash flows from mortgages or public sector loans. They are similar in many ways to asset-backed securities created in securitization, but covered bond assets remain on the issuer’s consolidated balance sheet.

Ok, I'm done, I'll leave you in peace

Thanks for posting this, which is useful because policy-makers need to be reminded that this is a silly, unworkable, idea of theirs.

We have in the past couple of days seen a shift in attitudes towards nationalisation. That is no coincidence but is in part the result of posts on blogs and sites like Naked Capitalism over the past weeks and months.

What I do however miss is a blueprint for a U.S. bank bailout à la suédoise. We know what we do not want and have a pretty good idea what we think should be done. But I miss the 10-20 pages bullet point document that sets out “the plan”. Policy-makers are panicking right now and the Administration’s comments yesterday about preferring private ownership to nationalisation (who doesn’t?) are testimony of that.

Now would, in my view, be the time to launch an “open source” version of the bailout proposal. Should it take root, it could become a powerful component of the debate.

Yves, a small suggestion: Could you draft the first 10 bullet points, post them, and see where it takes us?

Keep up the good work.

i guess since this post makes me hegemon-for-a-day i will say: these are only a few banks and they are huge: we would not expect one formula to predict outcomes in every EU member or every US state. is a single pretty mechanism being used (a) to hide or (b) to help the affairs of multinational financial mercantilist associations?

I’m clearly missing something. If the banks says you most sell this asset in 10 days and the public will replenish your capital at some rate.

So if bank A has 50 million dollars of Level 3 assets on it books and it needs to auction these assets off in the next 30 days. Lets assume that they sell for 10 million dollars. Couldn’t the government just buy equity in the bank for 40 million dollars.

This would dilute the current shareholders but it could technically keep the bank in private hands

The fundamental premise here is that price discovery is the goal. I think that premise is false. The basic goal (of Geithner, et al) is to stimulate demand in this market to prop up the prices of these derivatives. It’s the same goal they have in the housing market and are trying to address with the foreclosure plan (the “keeping people in their homes” talk is BS). These people believe that if we can just prop up asset prices to their pre-2007 levels everything will be ok and the economy will come roaring back to life. It ain’t gonna happen folks.

Any government subsidy to the bank must be offset by both equity in the bank and a very senior claim on future revenues (surely ahead of compensation to executive officers) — in essence a synthetic super senior bond.

Any discussion of ‘sharing’ in gains on the purchased asset is nothing but a distraction to take the focus away from the fact that a private sector company has obtained taxpayer funds.

It’s the same damn thing transferring the loses to the taxpayers, the only difference is who get to grab the most share of the fleecing.

So Skippy, it’s us on one team and the planners on the other; ergo, there IS no plan where we win. Get it now?

The operation were we win has a revolution ‘long ’bout the third quarter. But that’s kinda the ‘nuclear operation,’ like the kind for cancer, so I’m hoping that some of the planners change teams.

But we do know, (within reason) how much the assets are worth, because Merrill sold half of their exposure for $0.22 on the dollar last year.

http://money.cnn.com/2008/07/29/news/newsmakers/thain.denial.fortune/index.htm?postversion=2008072915

The paper is probably worth 0.10 on the dollar. The holders of that paper are probably insolvent. Take them into conservatorship, sell those components that have the potential of being profitable to NEW and COMPENTENT ownership. The shareholders lose absolutely, the bondholders share in the proceeds of sale. The taxpayer bears the administrative cost of the conservatorship.

the P/P plan is an outrage beyond all prior outrages. The idea that 1) the government is going to ‘fix’ the financial crisis, by providing a guaranteed profit to a select group of wealthy individuals at vast taxpayer expense, and 2) No one, absolutely no one, bats an eye, or questions when government got in the business of creating private wealth, tells us quite simply that the 1) The public, and the cognescenti are completely asleep, and 2) the social compact is unraveling right in front of their eyes. The right wing wants us to believe that Social Security is some kind of vast conspiracy that we cannot afford, but we can afford to shovel trillions annually into the arms of individual investors, and prop up the stock market. Too bad that most of those who are supporting this plan will not be among the winners. When they find out they’ve been had do you think they’ll whine and complain and cry about being cheated? Do you think it will matter?

The Iraq War, it’s true, was run as an opportunity to funnel taxpayer money to private corporations, and has been an absolute godsend for a select group of well connected corporations. The fact that this pattern is now becoming the modus operandi of the US government (under a new administration elected to fix the errors of the Bush administration) for all situations makes quite plain that despite talk these days about ‘government coming to the rescue’ the reality is that the great and final victory of the government is evil/’free markets uber ales’ crowd is upon us.

When government is run as money funnel, to benefit vastly, a well connected private few, at the expense of the society at large, you can be quite sure that real change really is in the wings, for that is completely antithetical to democracy as it is possible to be. Ten years from now this country will be unrecognizable. Oh thank God those nightmare days of peace and prosperity have passed — snark.

YS:

Call me stupid. We learn in finance that investment and financing decisions are separable. If the assets are worth 55 cents, that’s what they’re worth. If they will produce ABCD future cash flows, that’s what they will produce no matter who owns them. The difference between their book value to the banks, 85 cents and their market value, or 30 cents is a loss that goes somewhere. What am I missing? This looks like a new scam to shuffle some profits off to Geithner’s cronies at the public’s expense. Kill Citigroup now! Sue KPMG for its defective Citigroup audits now. By the way, we should also name the PCAOB in the KPMG suit. Why does anyone think the PCAOB does anything useful?

I agree with Swedish Lex, 100%.

Let’s find a venue to lay out a proposal, spreadsheet and all, and see what withstands public scrutiny.

Yves, do you want first crack at it? You certainly have earned the kind of audience that can competently, and civilly, help you discuss the nuts and bolts of an open source plan.

As I look at it (even without your reader’s analysis), the only difference between TARP I and TARP II is that the taxpayer gets screwed TWICE in the latter. While it’s likely that the USG would overpay in TI–forcing the taxpayer to take the loss on overpricing–the taxpayer can’t even get any gains in TII if there are any. They would all go to the usual financial suspects.

No, to toxic asset purchases.

Every time I try to think the matter through, I get hung up on two things:

1) I don’t know exactly what “assets” I’m trying to value. Are they mezz CDOs? Stranded LBO loans? Whole loan Option ARM pools? Auction-rate bonds backed by student loans and munis? Commercial MBS? The assets are so heterogeneous to defy categorical pricing by class. And using rating-agency risk grades for the purpose is, as is now revealed, useless.

2) I don’t know the nominal value of the assets are contained within the banks for these numerous subcategories, so the total scope of the problem is hard to grasp. Current management culture at these institutions encourage obfuscation on all matters accounting, deepening this difficulty.

It’s plausible to me that after 18 months, Geithner, now free of Paulson and the rest of the Goldman cadre sitting on his shoulders, decided to try and take action to move these assets off the books at fair value, and placing into receivership those institutions that were too far gone.

But he may have run up against these same two barriers. And there is no way for Treasury to build up the staffing and expertise to try and value the entire toxic asset ecosystem in all its malignant diversity, so the thought now is to outsource the job to the pros.

The pros, however, have no dry powder at present, so Treasury rents them out some cheap balance sheet for the task at hand. Is that better than creating an agency on the fly that has to eat what it prices? As I don’t know the scope of the problem, I can’t say. It was odd that Geithner didn’t identify at least a handful of potential partners to speak to their end of the bargain, so this all feels very “concept phase.”

So until there’s more disclosure around points #1 and #2, I feel like we’re trying to describe an animal by just feeling its tail.

Thanks much to all thoughtful comments on the blog. It’s a big part of why I enjoy this site.

You can’t beat a liquidity trap. You can manipulate prices all you want but the market price is what a buyer would pay based on the estimated potential return as adjusted for risk. If the government is to share in profits then it will just reduce the market piece and increase the amount paid to the banks for the difference between book and market. The math is simple, you can move the pea in the pod around all you want, it is still the same pea or pig with lipstick. Of course if government limits downside risk to “private investors”, generally all those who suck up to the government, then you are talking about a different kind of pig altogether.

I’m a system admin by trade with the resources to host a site dedicated to formulating an “Open Source” Plan. I’ll host it on my dime.

I figure a site would need at bare minimum forums and an easy way to publish content. There are tons of content management systems that can do these simple tasks. Contact me at mpapet@yahoo.com to get started.

Changing gears, Miguel is 100% right.

There is the complex matter of establishing *what* is for sale in a transparent way. The banks would battle to their last lawyer to obfuscate the value. Nationalization might fix that… Establishing a method/market to sell the assets would be next.

The first buyers will be taking the greatest risks, so they’ll get the biggest discounts. Over time, prices would rise.

Finally, I would jump into a mutual fund that traded these assets.

I want to address mark-to-market for a moment. I find it kind of interesting that so many folks are vehemently on one side of this issue or the other. Me, I think both sides make valid points, so I’m kind of in the middle (in a case of Hamlet-like indecision). And I actually work in the banking industry.

So, a couple of questions for the mark-to-market proponents.

Issue Number 1: Market Value of Deposits (pardon the funky formatting below – I copied and pasted this first issue from an email I sent to a colleague)

If a bank’s assets are going to get marked to market, shouldn’t the deposits get marked to market as well? In other words, shouldn’t we treat the liabilities that would otherwise trade at a premium to their book value (and only deposits

fit this description) in the open market the same way? Now, I don’t like it when

companies show “earnings” because the market value of their debt has declined

(that, to me, is nonsensical). But debt and deposits are two entirely different

things. The debt must be repaid at par AND cannot be sold in the market at a

premium. Deposits, on the other hand, are always sold at a premium – varying by

the quality of the deposit base, desirability of the branch footprint and market value

of the underlying branch land (if applicable) – due to their low cost relative to other

funding alternatives. Granted, as interest rates decline, the short-term value

of deposits declines as well (as we are witnessing now). But the long-term

value doesn’t change much if one values them in light of a full interest-rate

cycle.

So, to use an example, Bank of America has over $800 billion in deposits. Back

in the heyday, these deposits and the resulting deposit franchise would have

been awarded a 15%+ deposit premium if sold in the open market (that excludes

the bank’s other assets and businesses – let’s look at the deposit franchise

alone). But let’s assume today that the deposits are worth just 5%. That would

be a mark-to-market adjustment of $40 billion (that is, assets increase by $40

billion, or a contra account reduces the value of the deposit liability by $40

billion – take your pick), or almost the value of the bank’s reported tangible

common equity. $40 billion fills a lot holes on the asset side of the balance

sheet, even as screwed up as Bank of America is.

And, for the record, I have no dog in the BofA fight. It can fail as far as I’m concerned. So, that’s the first issue.

Issue Number 2: Relative cost of funding (or cost of capital, if you like)

If a bank can fund a portfolio using 3% deposits and generate a spread of 4% on the assets (and be content with that), should the value of those assets be determined in a market where the only buyers are hedge funds and private equity funds who require a 25% IRR? Some part of the bid/ask spread on the MBS and CDOs is due to the buyers (funds) discounting the prospective cash flows at a discount rate that’s 4-5x that of the banks that hold them. Now certainly some of that is due to increased perceived risk, but I doubt that explains the entire gulf in the bid/ask spread.

Thoughts?

I confess that I could not really follow the reasoning behind the spread sheet, that in is in part because a basic assumption has been made that I don’t feel comfortable with. These assets have three prices not two as everyone suggests. These are the market value if sold, the book value and the hold to maturity value.

All the discussion and ideas behind tarp are centered around market value and this to me assumes that securitisation and the selling on of loans is important to banking. I am not convinced that banks should just not hold these loans or in fact all loans to maturity. Perhaps a percentage of each loan can be sold on with a gurantee bought from the government.

Recapitalising based on a stress test most likely reflecting worst case scenarios from the last twenty years seems frough with risk especially since probably the last 30 years of banking have been abnormally quiet.

Also on the issue of market value versus HTM value… I find it interesting that many of the same folks who acknowledge that the market goes haywire sometimes (that is, is inefficient in the extreme at times – think Nasdaq 5000) refuse to acknowledge that possibly… just possibly… the same inefficiency is at work on the downside in some of these bank assets. Again, I’m not particularly trustful of the big banks as they’ve engaged in some totally reckless, reprehensible behavior, but… it doesn’t necessarily mean that they’re completely wrong in their current estimates of HTM value. It seems that lots of folks want to believe that the markets are only inefficient on the upside. That doesn’t seem like a defensible view on the whole. Although, admittedly, it doesn’t mean that these bank assets are worth what the banks say they are either.

i have no idea how all you commenters and bloggers can come up with a judgement of the plan as good or bad without knowledge about these assets and how they are priced in the capital markets. except for the rare exception (cap vandal and john hempton among them) people are responding purely emotionally to this situation. and we are getting set to take over the banks based on this? momentum is building — so what? the logic of the mob is the logic of mob justice. it’s time for people to step back and _learn_ what these instruments are and how many they are and how they are valued — ie the DETAILS — which make the picture.

‘where is the plan where we win”? BofC says they don’t need the gov’t help. so why any plan? let them all live with their bad decisions and over the top risk taking.

the moral outrage directed by many towards the mortgage plan seem to culminate with the idea that folks should live with their bad decisions and the tax payer should not have to pay for someone elses mortgage.

clearly the banks should just live with their bad decisions as well..then, no??

stress test the banks using mark to market principles and put insolvant banks in receivership, clean them up and put them bad in private hands. avoid the dreaded Nationalisation word and get on with it.

this habit of privatizing profit and nationalizing loses has to stop somewhere..student loans (the banks win either way plus service fees), foreign loans like mexico decade ago..(banks win both ways). the tax payer is alway put at risk..and we call that capitalism. give me a break already.

the chant we should all begin is why privatize the treasury??? not why nationalise the banks.

by the way…who is selling the cds about ireland going down…for example..and can whoever they are cover the payout it does go down. anyone checking their reserves or will that too become another bail out like AIG (or maybe its AIG after all…happy to collect the fees wth no capacity to pay out if they lose the bet)???

Michael Donner

The overview points presented by MinniRenter expose the Pee-Pee plan as socially objectionable for the same reason as the TARP scenario – in both cases the agenda is to quickly sell over-priced assets to the public (which, to state the obvious, is a sector that has no representation in this latest backroom dealing). Under both programs, the public will be forced to eat – by its own government and private entities – the difference between the current fair, market value and the unfair price charged by the private entities.

Going through MinniRenter’s points, the eureka button is hit with the second bullet. At this point the reader pauses to wonder, “Why is a private buyer paying the public less for the same asset that the public bought from a private seller at an inflated price?” Doesn’t this question serve as immediate proof that these assets depreciate in value? Just as occurs when a driver moves a new vehicle purchased off the sales lot? That vehicle is never going to later appreciate (even under an inflation scenario).

Aren’t the self-interested parties negotiating in backrooms then knowingly committing fraud-in-the-moment by asserting, to the public, that these assets might appreciate? The public understands that increasing prices do not mean appreciation under inflationary conditions. And many in the public sector suspect that our current government officials and elected representatives are intent on fanning the flames of inflation.

Anon of 1:45 PM,

First, John Hempton has acknowledged to me that he does not understand the capital markets operations of the big banks and brokerage firms. Most of the really dubious assets are in these operations. And they should properly be marked to market; hold to marturity is NOT permitted for these sort of assets. However, given the complexity and opacity (and hetereogenity) of many of these assets, quite a few are Level 3 assets (and some Level 3 assets are not conceptually complex, just not liquid, like private equity exposures).

There is a lot of anecdotal evidence that says the values of a lot of Level 3 and even Level 2 assets are overstated. For instance, PE firms have been sending portfolio valuations to investors that seem frankly unbelievable given the fall in stock prices (PE is effectively levered equity). There is also evidence that holders of collateralized loan obligations were trading small lots between themselves at fictive prices so they could use the high, phony prices for valuing their books.

As for the accuracy of the “hold to maturity” prices, Meredith Whitney has written for some time that the home price decline assumptions used by the big banks are too optimistic, in most cases, by a considerable degree. BofA has the most conservative (negative) assumptions, but she did not regard them as negative enough (and provided a lot of info as to why).

So your charge that the skeptics are being emotional is not warranted. I have covered these issues in other posts, and many readers have seen similar coverage elsewhere.

Okay, I broke with the cardinal rule to never say “never.” So, let me assume a non-inflationary scenario whereby toxic assets may appear to increase in value. The only viable one that I can think of entails re-inflating the FIRE sector bubble. While this is certain to happen again, the eventual social costs should be apparent.

Therefore, in a future scenario of either no inflation, inflation, or speculative bubble, the public cannot possibly benefit over the long-term by being forced to buy “assets” at inflated prices.

~Now would, in my view, be the time to launch an “open source” version of the bailout proposal. Should it take root, it could become a powerful component of the debate.~

brilliant idea, swedish lex.

how about a wiki format?

that way we can have discussions on each section and it rewrites itself.

http://en.wikipedia.org/wiki/Comparison_of_wiki_farms

anyone know a nice free wiki farm?

I’ve read Hempton on “the banking system is really solvent” and am not impressed. The guy got burned on WaMu and now is licking his wounds and trying to rationalize that trade.

His logic is “well WaMu really has close to zero equity but could have earned its way out”. That is NOT how bank regulators work in the US. Yes, they normally take out only super sick banks, but in theory, any bank with zero equity is toast. And he overlooks that a run had started on WaMu. This was not abuse of discretion, as he keeps wailing. WaMu was in real trouble.

He then extends his “banks in the US earn good spreads, we just need to leave them alone and earn their way out.” First, he ignores that banks in the US became heavily dependent on fee income from securitization; that income has collapsed (and at many banks, since they’d warehouse the paper, the fees were lumped in with interest income). Freddie and Fannie fees to originators are much much lower than what private parties paid, and credit card securitization is way way down. That is not coming back very soon, if ever.

Plus the Fed has driven short rates to zero. Spreads being decent is due to heavy government intervention. What happens if the Fed gets what it wants, creates some inflation, and has to turn on a dime and raise short rates (most economists think this is what the Fed will have to do). Um, that kills the banks. If they had enough equity, they could take it, but Hempton claims it would be OK to let them run on near zero levels.

He also said somewhere the US banks have more equity than they need. No one buys that; the whole direction of regulation is to have banks hold less risky assets and/or more equity. When I saw that, it was hard for me to take him seriously.

sorry asphaltjesus…

your idea is better.

and while i'm still not convinced there is a workable solution to this problem, it would be fun to try…

just for shoots & googles while waiting for the End.

one thing's for sure: the discussion thrown around here makes the most sense so far.

in the end, there are no secrets. maybe that's one of the things we're are all learning right now.

Ummm, yes, I see the problem now with mark-to-market, Treasury Curve problems and the issues related to the imbalances between non-marketable Treasuries and private securities like the derivatives used in this mess:

FYI: Although division by zero is undefined with real numbers and integers, it is possible to consistently define division by zero in other mathematical structures, for instance on the Riemann sphere. See also hyperreal numbers and surreal numbers where division by non-zero infinitesimals is possible. If a number system forms a commutative ring, as does the integers, the real numbers, and the complex numbers, for instance, it can be extended to a wheel in which division by zero is always possible, but division has then a slightly different meaning.

Sorry baby, but your money has decoupled from reality!

Steve: "The P/P plan manages to combine price-fixing (for the sellers) with loss for the government and profits for the buyers. It's paying $2 for a $1 bill and then selling the $1 bill for 80 pennies. Two private winners, one public loser. That's change a banker can believe in. (Wait till GS sets up a fund to buy back at 22 the paper it has sold to Uncle at par. And wait till Uncle starts loaning the buyers a portion of the purchase price.) Probably needless to point out that Uncle will have to extend price-fixing beyond the banks to avoid failures by other holders of similar paper — insurance companies, pension funds, and hedge funds."

Steve has it exactly right. The plan is to overpay for assets hurting their shar price (pier loans, CDO's based on 2nd lien mortgages in bubble zones, CLO's based on bad LBO loans, etc), and then sell them at below market prices to players politically connected to Summers/Rahm/&co (DE Shaw, GS, BlackRock, etc).

FT has Rodgen Cohen shilling against "nationalization". Cohen is obviously a lawyer who represents banks. Cohen likes the cash for trash plans that Summers/Geithner are proposing. He dismissed the Swedish approach by saying it's like expecting strategies that work in high school sports to work in the pro's. The arrogance. Cohen/Summers are totally corrupt. They want the federal government to overpay for bank assets, and give gifts to bank shareholders and bondholders.

I hate the word "nationalization". The dictionary definition refers to state ownership. I want receivership/conservatorship, where the US government acts as a referee/trustee/regulator. It may acquire legal title, but invests no money, and takes no stake in the enterprise. It forces the big creditors of banks to write down or write off their debt stakes in exchange for an equity stake, and maybe forces a spin off to shrink the big banks a separate the high risk and utility functions. But it invests nothing.

“FT has Rodgen Cohen shilling against “nationalization”. Cohen is obviously a lawyer who represents banks. Cohen likes the cash for trash plans that Summers/Geithner are proposing.”

We need to start tracking everything that anti-nationalization lawyers say. If Cohen or bank lawyers like him lie to the public, and we catch them, we might be able to get them disbarred. It violates the rules of legal ethics for them to lie to people on behalf of a client.

Anon of 4:22 PM,

I wish it could be so. Cohen is one of the five most powerful lawyers in the US. Will never happen.

And his firm has long been the outside counsel for Goldman Sachs.

The idea of marking something to hold to maturity value with essentially zero visibility on future default rates is somewhat insulting to my intelligence. On a default risk adjusted and present value basis, hold to maturity valuations should be essentially equal, or at least ball park. All the 11x ebitda speculative grade stuff we were financing LBOs with, all the CMBS coming due in the next couple years, and pressure on prime mortgages, this will all have drastically different default risks than history indicated, and it will affect investment grade tranches of anything that’s been structured. HTM only prolongs the time horizon on which losses are booked, but some commentators are acting as if it changes the underlying default characteristics.

Am I missing something?

My M&M's are talking to me again:

Modeling the yield curve

Once a curve has been fitted, the user can then define various measures of shift, twist and butterfly, and calculate their values from the calculated parameters. For instance, the amount of shift in a curve modeled by a polynomial function can be modeled as the difference between the polynomial a0 parameters at successive dates. In practice, the Nelson-Siegel function has the advantages that it is well-behaved at long maturities, and that its parameters can be set to model virtually any yield curve (see Nelson and Siegel [1987]). Yup, it's all just magic! Isn't this fun?

In mathematics, the Lebesgue measure, named after Henri Lebesgue, is the standard way of assigning a length, area or volume to subsets of Euclidean space. It is used throughout real analysis, in particular to define Lebesgue integration. Sets which can be assigned a volume are called Lebesgue measurable; the volume or measure of the Lebesgue measurable set A is denoted by λ(A). A Lebesgue measure of ∞ is possible, but even so, assuming the axiom of choice, not all subsets of Rn are Lebesgue measurable. The "strange" behavior of non-measurable sets gives rise to such statements as the Banach-Tarski paradox, a consequence of the axiom of choice.

>> So, why is it that mutual funds, money markets, banks, pension orgs, corporations like Ford and GM and people all over the world wanna play financial gurus and then disguise obvious risk, while playing casino dealers and lotto ticket speculators?

No one — none of these people, and no one at The Fed, SEC, DOJ, IRS, FASB, SIFMA or BIS has a clue as to what derivatives do, or how they function, or how to value them — so why The F are these financial casino chips at the heart, soul and core of this systemic collapse, where people suddenly think someone should be able to value smoke and mirrors in relation to some on-the-fly mark-to-market guess about why smoke has a certain shade of blue at a certain time of the month?

No regulator on earth had any friggn clue what they were doing, as they allowed this virus to be cloned into supercharged global plague, which has the potential to literally destroy The World as we knew it to be!

FYI: Data on the five-fold growth of derivatives to $516 trillion in five years comes from the most recent survey by the Bank of International Settlements, the world's clearinghouse for central banks in Basel, Switzerland.

Re: The financial crisis and credit crunch has spurred policymakers to improve transparency across several markets.

Regulators on both sides of the Atlantic say the global $27 trillion credit derivatives sector — most of which is in the form of CDS — is too opaque, making it hard to quickly assess the extent of risk when things go wrong.

> Thanks for waking up boys and girls, you can go back to the casino and spin the wheel again!

Ahhh, that feels so nice…

“The idea of marking something to hold to maturity value with essentially zero visibility on future default rates is somewhat insulting to my intelligence. On a default risk adjusted and present value basis, hold to maturity valuations should be essentially equal, or at least ball park. …

Am I missing something?”

The PR spin is that fear has scared away regular investors, so bids a are “artificially” low due to vultures wanting to get discounts big enough to give them a 20+% return.

But yeah, after you back out discounts for default rate, recovery rate, illiquidity, etc, intrinsic value isn’t much difference from the bids people see. The only differentiator I can see is that vultures demand a high discount rate, and if regular bond funds (t rowe, fidelity, etc) were bidding, they’d offer higher prices because their investors expect lower returns.

The issue is with your implied assumptions.

1. You assume that there is a market value that is a fair reflection of the fundamental financial value of the asset.

2. Arising from this, you assume that any payment above this market value is strictly a subsidy or transfer payment to banks.

I believe the fundamental argument behind TARP is that these two assumptions are actually *wrong*.

===

At issue, I believe is a gap between the fundamental financial value of the asset and the market value of the asset. I’ll return at the end and justify my argument on sound principles… but let’s start top-down.

1. Assume that the assets will pay out an average, risk adjusted stream of income that would make the asset worth, today, 80c on the face-dollar.

2. Assume that the market is only paying 60c on the face-dollar today.

Naturally, banks would be unwilling to sell assets for 60c if they believe that the returns would fully justify 80c. They also would resist a “mark-to-market” on these assets because they would be forced to fill an “unjustified” 20c gap.

If this were true, the government could enter at 75c, largely eliminating the mark-to-market issues without costing the tax payers anything (paying 75c for something worth 80c).

More salient to this post, in a P/P structure, the 20c difference would accrue to the private buyer while the public would bear the cost of floating the difference over the short term. This would be a __STUPID__ way to structure the government’s financial action.

Ok. That’s the why… now the how…

===

So how is this possible? Obviously, we all know that markets are efficient and fairly price assets.

The problem is that the real world does not comply with all the assumptions required for this to be true. I won’t list them all… but a couple that are easy to see:

1. Information Asymmetry and Adverse Selection. Assuming that the bank is better informed about the value of assets than the market… and the market makes an offer on several different assets owned by the bank… the bank will always sell the assets which the market overprices by the greatest amount. They are basically guaranteed to get the worst value.

When dealing with mortgage-based assets, the financial trail is so long and complex that private buyers cannot cost-effectively value the assets that they’re trying to buy. Instead, they need to “discount” this offer for knowledge-based risk.

So what if someone with enough money decided to try and fairly value the asset?

2. Sunk Costs and the Free-Rider Problem. Again, assume someone could spend the money to fairly value each asset. It’s a stretch but it makes the point just that much stronger. If a buyer knew that the market was selling, for 60c, stuff that’s really worth 80c, then there’s a lot of money to be made. Unfortunately, this doesn’t work.

Assume the buyer spends $1m valuing $50m in assets (2% asset value). If it’s worth 80c on the dollar, the buyer can offer 2% or so less to recover their costs to price the issue. Let’s assume they offer 73c on the dollar to lock in 5% profit and recover their approx 2% in costs.

What does the second buyer do? They now know that 73c is fair and is certainly below costs. Since a second buyer hasn’t paid to price the asset, they can pay 79c and still profit (while the first bidder is now losing 1c on the transaction).

It’s in no one’s benefit to price these assets privately unless they can ensure substantial privacy which could be very difficult in this market and, of course, any error in their pricing would lead us back to problem #1.

===

So we see how the market could underprice assets… and we see how P/P guarantees to hurt the government while TARP purchases can actually defend tax payer money…

but you have to have the right assumptions to understand the solution.

If there are so many opportunities in garbage barge assets, why don’t Fidelity, American Funds, Vanguard, and other fund companies hire a bunch of unemployed CDO engineers and traders to buy them?

Something doesnt’ compute.

First, TARP has clearly overpaid:

http://ethisphere.com/ethisphere-tarp-index-report

Second, Downgrades are flying and many are from AAA to C level. A summation from Bennet Sedacca is in today’s Barron’s. TARP losses will only mount.

Third, too early to judge merits of private/public. For my part I am hopeful but I want it verified.

will it be Obama Smartypants or Obama Nancypants? We’ll see.

The negative market reaction is a positive through my lens. Suggests it may be reality-based and not fantasy-based.

Re: Risk premium,

I’ve heard that argument before that the goal is to get as many bidders as possible to bring in bidders with lower IRR expectations, but is it not possible that the risk premium reflects the assets and their leverage, and not the institution making the investment? The reason a vulture firm expects a 25% IRR reflects the nature of the risks they undertake, it’s not just something in their prospectus.

Fear is, contrary to popular belief, a good thing, especially in investing. Downright paranoia is often times the best of things.

Can I make another point here, huh, huh? I hope I am not wearing out my welcome, but then again, I was never invited, so, perhaps Yves will take pity on me?

In regard to this nested topic of valuation, I decided, hey, WTF, why not go backwards into time and see what was going on a few years ago, just as a way to help understand how some of these securities were structured and what sort of info was offered — I mean gads, people were buying this shit, but why?

As a random example, this popped up:

FYI: COPYRIGHT 2004 Business Wire

NEW YORK — Fitch Ratings affirms two classes and upgrades four classes of Ares Leveraged Investment Fund II, L.P. (Ares II). The following rating actions are effective immediately.

— $282,500,000 senior secured revolving credit facility affirmed at 'AA';

— $185,000,000 senior secured notes affirmed at 'AAA';

— $70,000,000 first senior subordinated secured notes upgraded to 'A+' from 'A';

— $110,000,000 second senior subordinated secured notes upgraded to 'BBB+' from 'BBB';

————————-

****************

>>>>>

Here we are a few years later:

Fitch affirms the 'BBB' rating on the remaining $35,800,000 class C notes issued by Ares Leveraged Investment Fund II, LP (Ares II). This rating action is the result of the review process under Fitch's updated Market Value Structures (MVS) criteria, published April 18, 2008, and is effective immediately.

Ares II is a market value collateralized debt obligation (MV CDO) that initially closed in October 1998 and was subsequently refinanced in October 2005. It is managed by Ares Management LLC. Ares II has a portfolio composed of bank loans, high yield bonds, and mezzanine and special situation assets. Included in this review, Fitch discussed the current state of the portfolio with the asset manager and their portfolio management strategy going forward.

The affirmation is supported by a continued increase in over-collateralization (OC) and credit enhancement due to the deleveraging of the senior credit facilities. The class C notes OC ratio was 244%, as reported by the trustee. However, under Fitch's new criteria, which reflect Fitch's current views on MVS, the class C notes OC ratio was 120% – sufficiently above the test level of 100%. Under Fitch's new methodology, all of the portfolio's illiquid assets were classified as Category 4 assets and received minimal credit in the test calculation. Illiquid assets currently make up 45.8% of the portfolio as of the most recent trustee report available, dated April 11, 2008.

>>> So, what was that refi all about?

Oct. 18, 2005

On October 18, 2005, Ares Management LLC closed on Ares IIR CLO Ltd., a $250 million collateralized loan obligation fund (CLO) underwritten by Lehman Brothers. Ares IIR refinanced a portion of the assets in Ares Leveraged Investment Fund II, L.P. Ares IIR assets consist of a diversified portfolio of Senior Secured Bank Loans, Other Senior Secured Obligations and High Yield Bonds.

>> Ok,I'm too dumb to know if The 2005 Ares IIR, which seems to be a CLO, is the CDO from 2004?

>> So, what is this Ares Thing?

EXCHANGE AGREEMENT, dated as of November 13, 2003, among DFG Holdings, Inc., a Delaware corporation (the “Company”), GS Mezzanine Partners, L.P., a limited partnership organized under the laws of Delaware (“GS Mezzanine”), GS Mezzanine Partners Offshore, L.P., an exempted limited partnership organized under the laws of the Cayman Islands (“GS Mezzanine Offshore”), Stone Street Fund 1998, L.P., a limited partnership organized under the laws of Delaware (“Stone Street”), Bridge Street Fund 1998, L.P., a limited partnership organized under the laws of Delaware (“Bridge Street”, and collectively with Stone Street, GS Mezzanine and GS Mezzanine Offshore, the “GSMP Purchasers”), Ares Leveraged Investment Fund, L.P., a limited partnership organized under the laws of Delaware (“Ares I”) and Ares Leveraged Investment Fund II, L.P., a limited partnership organized under the laws of Delaware (“Ares II” and, collectively with Ares I, “Ares” and, collectively with the GSMP Purchasers, the “Purchasers”).

ARES LEVERAGED

INVESTMENT

FUND, L.P.

1999 Avenue of the Stars, Suite

1900

Los Angeles, California 90067

Telecopy: (310) 201-4170

Attention: Jeff Serota

>> I just hate this stuff, because it never ends anywhere, in terms of valuation, because it turns out, that CDO apparently is somehow related to this: Dollar Financial Corp · S-1/A · On 7/16/04 · EX-10.28

About all I got out of that, was a new phrase, i.e, under-banked and that should be in The TARP Vocabulary:

Dollar Financial Corp is a leading international financial services company serving under-banked consumers. Its customers are typically service sector individuals who require basic financial services but for reasons of convenience and accessibility purchase some or all of their financial services from the Company rather than from banks and other financial institutions.

>> And finally, I'm too bored to care if this is even related, but seems to flow in circles:

JPMorgan is said to be tapping the Federal Reserve Bank's new primary dealer credit facility to fund its recent collateralized loan obligation, according to Total Securitization, a CIN sister publication. The deal, the $1 billion Ares Enhanced Loan Investment Strategy 2008-3, is similar in structure to Lehman Brothers' Freedom CLO 2008-1. It comprises one large tranche and an equity piece and unloads a number of investment-grade loans sitting on the bank's books. The Ares Enhanced Loan Investment Strategy 2008-3 is managed by Ares Management and has an $800 million AAA-rated tranche.

All I see is the pile of debt getting bigger and no details! So how do you value this stuff, that doesn't exist?

Sorry to waste your time, but how can you value something like a CDO, SIV, SPE, SPV or any of that crap floating from hot bank to hot bank? This all will come down to forgiving debt, just like they did after WWll, and this sure as hell is WW lll and The Financial Terrorists on wall street should all be put in prison camps!

Reverse Engineering CDO Deal Structure

Its quite simple really – the answer is that there is no way to compare because the market would very likely react differently between TARP 1 and PP.

For PP, the eventual return for Private buyers would probably be quite close to the 20-30% range, going by Goldman Sachs/Lonestar deals in Asia during the Asian crisis. The interaction between the whole universe of distressed buyers and the market for these assets (what Soros call refelxivity) will quickly converge such that the assets’ final prices within 2 to 3 years would settle at levels to produce the expected 20-30% return for Private buyers. and the government would end up getting back very little or nothing. In TARP 1’s case, there would not be any adjustment in prices of assets because 1) there is no transparency of what premium the government actually pays, and 2) even if this premium was known, the market would not belive the price to be correct as the market would continue to think it was a bailout rather than a fair price.

Erich Riesenberg

In a private / public purchase of bad assets, the private participants can do well even if the partnership pays above market and loses money.

If the partnership is funded with 1 part private and 9 part taxpayer funds, the financial industry can unload a lot of bad assets at good prices, and private investors can be pretend to be taking a risk alongside the Treasury, while the industry as a whole benefits with taxpayers taking most of the loss.

It seems obvious the quickest and cleanest way to deal with insovlent institutions is through recievership / nationalization. It is too bad most people opposed to nationalization do not understand the term.

Has anyone read this article yet?

http://www.nytimes.com/2009/02/20/business/20lend.html?_r=1

The Obama administration hopes to jump-start this crucial machinery(OUR CREDIT MARKETS) by effectively subsidizing the profits of big private investment firms in the bond markets. The Treasury Department and the Federal Reserve plan to spend as much as $1 trillion to provide low-cost loans and guarantees to hedge funds and private equity firms that buy securities backed by consumer and business loans.

http://www.nytimes.com/2009/02/20/business/20lend.html?_r=1

“although there’s been no conclusion reached regarding the resulting bid/ask spread for the assets. Regardless…

No one has explained to me why bank deposits shouldn’t be marked to market.”

The bid/ask spread is there because banks don’t want to take write downs to prices low enough to deliver favorable returns to buyers. Regardless of whether the buyers are vultures who want a discount big enough to deliver 20 or 30% returns, or mutual funds looking for 7 or 8%.

Marking the liabilities to market doesn’t help the situation. If all assets sell at vulture bids, creditors take all assets.

“I wish it could be so. Cohen is one of the five most powerful lawyers in the US. Will never happen. And his firm has long been the outside counsel for Goldman Sachs.”

And so? POWERFUL how exactly? I’ve met Rodgin Cohen. The man’s afraid of his own shadow.

If that is what it comes down to is how ‘POWERFUL’ they are, that so be it. I hope they understand that the end game of the game they choose to play is RAW POWER stripped of all pretenses.

And if so, when the SRHTF (and the way they play ensures that outcome, as long as the rest of us defer to their ‘POWER’ and all docilely go along with it), the 1st place I’m going is Park Avenue to scout out Mr. Cohen, Mr. Dimon, Mr. Blankfein et al. And if they already flew the coop, then I’ll hunt them down wherever they are in the world and once and for all really determine in this world what POWER really is.

Until that moment, everything is up for grabs. F… JPM, F… GS, F… Rodgin Cohen. Anyone who plays by their rules just because they are ‘POWERFUL’, please step aside and keep your mouth shut. I’m sorry to be so blunt, but you’re really not helping matters.

And for all those who want to try a different way of doing things, here’s Mr. Cohen’s email for starters:

cohenhr@sullcrom.com

Feel free to tell him how you feel.

And feel free to tell him that the end game of HIS game is High Noon on Park Avenue.

His mounds of paper I’ll burn with a butane torch, so he better have a silver bullet, because my slingshot full of gold is aiming for his eye.

It doesn’t really matter what the bank assets are worth from a God’s eye view with perfect information/analysis. There is a huge disconnect between bids for bank assets and the enterprise value of the bank. The arbs, hedgies, and vultures will move in and force convergence by going long bank assets and short bank stock and debt. Convergence will likely force the feds to choose between letting some big banks restructure in chapter 11 or putting them into some kind of conservatorship.

“And so? POWERFUL how exactly? I’ve met Rodgin Cohen. The man’s afraid of his own shadow.”

Just watch what Rodgin Cohen and all the other bank lawyers say. If we catch them lying to the government or the public in order to get handouts from the government, we can report them to Cuomo. I’ll bet Cuomo would love to do a perp walk of fancy pants lawyers, to show joe six pack that Coumo is fighting for the common man.

I think people are a little too paranoid that Geithner wants to give the banks a giant handout. I think he just wants to make sure that the assets are not sold at too low a price.

I think most likely there is a very big bid-ask spread for these toxic assets. They certainly are not worth par. Everyone knows that. But they may be worth a lot more than what the market is paying for them. Some of this is because market participants are waiting for better deals. Lets say a super senior tranche of some RMBS is selling at a 20% yield where par value was 4%. Lets also say that a rational estimate is that losses will cut through all lower tranches but only result in a 5-10% loss in this super senior tranche. So it may be yielding 20% with an expected loss of 5-10% with a 10-15% final yield. Now a 10-15% yield is normally pretty good but given all he mayhem may not be good enough for investors to jump in. They may be demanding more like 20-30% returns if they are going to give up liquidity in a time like this.

It appears that they Fed is now willing to help finance these purchases with the new TALF program.

http://certainruin.blogspot.com/2009/02/talf-what-hath-god-wrought.html

The idea is that if investors can borrow at 2% from the Fed and make leveraged purchases, they will buy the assets at a fair price of 15-20% yield maybe even better prices. The leverage creates more liquidity and lower bid-ask spreads.

I am not saying that I like this idea but this is what I think they have in mind. Remember it is hard for them to get money out of congress but it is easily to get financing from the Fed.

David says “The idea is that if investors can borrow at 2% from the Fed and make leveraged purchases, they will buy the assets at a fair price of 15-20% yield maybe even better prices. The leverage creates more liquidity and lower bid-ask spreads.”

No, the idea is that Geithner wants to give giant handout to banks to bail out their bondholders and shareholders. He does this by lending non-recourse at inflated prices and by lending at below market rates.

And Hempton and the other yahoos arguing the banks have all this value the government are inflating asset values with (i) hope of a government bail out, (ii) access to the Fed discount window, (iii) ability to act as a treasury dealer, (iv) Fed guarantees. None of those 4 things inure to the benefit of shareholders, except accidentally. They exist to protect the taxpayer and the depositors, and should be backed out of any valuation analysis of a bank.

@ Doc Holiday 7:00 PM

That is hilarious. All that sophisticated modeling and structuring, thousands of man-hours of work and study, the pinnacle of modern financial sophistication……all to finance what appears to be a seedy payday lending scheme (at the customary usurious rates). You may have just come across the perfect symbol of our times.

And yes, good luck to all and any who try and price that thing. And the thousands of other little gems like it.

Anon and others. What incentive goes Geithner have to bail out banks or bondholders? He is a lifelong civil servant not a Wall Street guy. I am going to give him the benefit of the doubt until he actually lays out his plan.

Geithner is a protege of Robert Rubin. And being paid off in some form is hardly the only or even the main reason for making bad decisions. Look at Greenspan. No one alleged he had any financial motive, and look at the wreckage he left in his wake. Merely having bad assumptions about the motives and capabilities of the banking sector will do.

YS:

I read the Cohen piece in the FT. For $1,000 a hour, a guy like that would say anything. Why should anyone listen to him? Who cares what an obvious shill for the banking industry thinks?

DAvid, "Anon and others. What incentive goes Geithner have to bail out banks or bondholders? He is a lifelong civil servant not a Wall Street guy. I am going to give him the benefit of the doubt until he actually lays out his plan."

Geithner probably wants a nice private sector job like Rubin at Citi, Greenspan at Pimco and Paulson & Co, or Summers at DE Shaw. It is an easy way for Geithner to pay for his kids through school, and a Carribean cabana by Representative Rangel's.

IA, "YS:

I read the Cohen piece in the FT. For $1,000 a hour, a guy like that would say anything. Why should anyone listen to him? Who cares what an obvious shill for the banking industry thinks?"

Don't forget about the other lawyer mentioned Adam Chinn. He's an ex-Wachtell guy who has done a lot of bank M&A work. Just another shill for the big banks who want a handout from the taxpayer.

Anon says

"Geithner probably wants a nice private sector job like Rubin at Citi, Greenspan at Pimco and Paulson & Co, or Summers at DE Shaw. "

No. That is crap. He started in Treasury and made his way to the top of the NY Fed. His ambitions are certainly not becoming super wealthy. The fact that he worked with Summers and Rubin does not make him guilty of anything.

If he was really such a kiss ass he would have bailed out my AIG instead of taking 80%.

You can't blame these guys for trying to keep the banking system private. It is clearly the right thing to do unless it becomes impossible to do fairly. Nationalization of course is the plan B but you don't want to rush into that until you have exhausted efforts to get them recapitalized with private capital. I am not sure that we are past that point.

Also keep in mind that there may be unintended consequences from nationalization just like with any drastic actions. Here is just one example. Do you think the government want to be owning the banks as they are foreclosing on houses and businesses like banks have to do. They don't want to run banks for the same reason they don't want to conduct monetary policy. They don't want their hands bloodied.

David:

What is the point of TARP or P/P if not to bridge the gap between prices that the market is willing to pay and prices banks are able to accept?

The availability of cheap leverage does not change the price a truly intelligent buyer is willing to pay, and you are gradually seeing unintelligent investors become a smaller portion of the pool.

Hold-To-Maturity prices:

How much productive capital, our savings, do you want to commit to these large institutions so that they can earn a zero rate of return over a long period of time by holding onto these assets? Who does that benefit? No one would willingly commit fresh capital to that investment in a free market. Government intervention against mark-to-market, along with FDIC guarantees on debt will cause a misallocation of productive resources to unproductive entities.

I do feel that receivership is the best way to go. Government does not exist to protect asset owners, but rather to deal with market failures and externalities. The creation of the FDIC, while mitigating bank runs, also creates a market failure where insolvent institutions can continue to attract capital (zombie banks). The FDIC mitigates this failure by taking over insolvent banks. “To big too fail” has similar problems to those of the FDIC, but there is no corollary to the “bank failure Friday” mechanism.

-MinniRenter