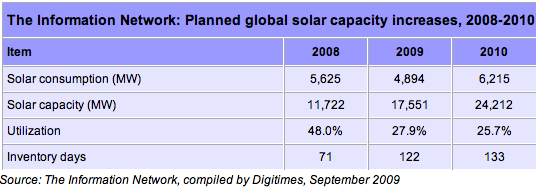

The solar industry is already suffering from significant overcapacity, yet incumbents are adding still more manufacturing to try to secure a cost competitive position after the shakeout. This chart, prepared by Digitimes using data from The Information Network (hat tip reader Michael), sums up the yawning gap between demand and capacity:

The Information Network forecasts that as many as 50% of the producers could fail in 2010 as prices plunge:

A key reason is increased supply from China, which added an additional 1GW of capacity. The price per watt has now dropped to US$1.80 for polysilicon-based products, which is lower than the US$1.85 level ….By way of comparison, the average selling price in the third quarter of 2008 was US$4.05 per watt.

The Information Network doesn’t expect other industry players to back down from increased competition from China. Other makers are expected to increase their capacities despite the low utilization rates in order to reach economies of scale and better compete against the Chinese…

Average selling prices could drop below US$1 per watt in 2010 and US$0.50 in 2011. As many as 50% of the more than 200 solar manufacturers, mired in red ink with current selling prices above US$2.00 per watt, may not survive.

I don’t know what this post is meant to imply, whether a “green” bubble, or the immaturity and non-cost-competitiveness of the technologies, but over-production and “competitive” shake-out and consolidation of emergent technologies/industries is the classic capitalist pattern.

http://www.affordable-solar.com/solar-panels-by-the-pallet.htm

Evergreen Solar

Evergreen ES-A-205-fa3b Blm Pallet 28 pal3716B 12 5740watt $ 2.69p/w $ 15,440.60

Yves, I am in the market for a solar system, but have not received prices like you are suggesting are the market. Can you give me some names of producers and current prices so I can follow up on this?

Thanks!

BA

I think the good news is that the world solar market is on the verge of a tipping-point in terms of market pull. The bad news (for me, as a westerner) is that it will probably be an industry “owned” from the get-go by China rather than the US, Europe or other western nations. Unlike previous industrial revolutions (the airplane, the silicon chip, nuclear power etc) this one will be driven by the Chinese from the outset – no more playing world’s factory worker to westerners design and engineering! This is the culmination of all that off-shoring and out-sourcing has produced – an industrial capability in every way a match for our own, and possibly even better.

On another point, I came across this interesting chart that claims to show the amount of geographic area required to be covered in solar panels in order to meet world energy needs. The surprising thing is just how SMALL this is — in relative terms anyway … http://www.landartgenerator.org/blagi/archives/127

If that cost projection indeed comes to pass, I suspect the demand curve will be hit with a step change.

For example, at US$0.50 the payback time where I live would be well under 3 years for consumption costs alone. People living in locations with significant connection fees would suddenly find solar a no-brainer.

Australia has several million square miles of (currently) low-value land which reliably receives a lot of sunlight . . .

@ozajh — as an Aussie myself (as I suspect you are too), that’s pretty much all we’ve got mate!

Oh I dunno.

We’ve got a lot of really expensive housing . . .

sorry, wrong reply button

DH: “This is the culmination of all that off-shoring and out-sourcing has produced – an industrial capability in every way a match for our own, and possibly even better.” Errr, not so much. Look, the Chinese were going to develop a world-competitive industrial sector regardless. Offshoring has had a significant impact on the _speed_ of that transition in my view, yes, but not much impact on the eventuality of that transition.

And the ‘this’ in that statement refers to Chinese acquisition of market share through lower cost production . . . which is very likely largely due to lower cost _labor_ rather than any technological superiority in the manufacturing process, though it would be interesting to hear detail on that specific issue from those who possess it. So the Chinese are doing here what is classically the case of developmental leap-frogging, coming on with emerging technologies but grabbing market share (and associated skill acquisition) lead through lower labor costs. No one should be surprised by this, not least because this is very much how the US got its lead. There were other issues in the US of great importance. Our natural resource base was enormous and very advantageous, and our larger domestic markets allowed economies of scale unachievable in the smaller countries of Europe. But we acquired no overall ‘technological lead’ until after WW I, at the earliest. It isn’t the technology which makes the leader generally, is what the history is, its the relative cost/scale positions. And these were going to make China a major player on the global scale regardless of US help barring an actual blockade of their coastline. Which thankfully ended in the 1970s.

But there is a larger issue here, to me. Solar has been more expensive than carbon as long as they have both been around. So while the long-term advantages of solar have been very real, the higher initial costs have stymied both production and installation. The only way to overcome that is through extensive public subsidies. This has produced signicant solar capacity in Germany and in some places in the EU; somewhat problematic capacity, yes, but a real effort. But the US has been niggardly with subsidies generally. Given the higher labor costs in the US anyway, the lack of subsidies has made it prohibitive for the US to build any market share lead in solar production. We do the research, but the production slips away because we let ‘the market’ determine costs.

The desirability of solar aside, this equation means, if you think it through, that the US will at this point _NEVER_ be able to achieve any market share lead in the _production_ of emergent technologies. We can design all the iPods we want, but production quickly slips offshore because we refuse to produce large-scale subsidies in the early stages when production is still not cost-effective on shore at market rates. By clinging to ideology here we ensure that the US will henceforth be a loser at production market share due to the structural disadvantages of higher costs. The ‘strategy’ of the last generation has been to try to bust down the US producer to Third World cost structures, to remain ‘competitive.’ The alternative, of course, is to subsidize scale-up. It’s difficult, and there are losers as well as winners in new production vectors, but if we don’t subsidize either we become a Third World country, or we lose production capacity until we more nearly resemble a fat-waisted Second World country, so to speak. Solar is the ‘proof of concept’ on that proposition, to me.

I wouldn’t worry about Chinese companies getting solar market share. If you look at their structure, those “Chinese” companies do the manufacturing mainly in China, but R&D is done in Japan, Europe and the US, and financing is done through US/European stock exchanges.

So they are Chinese in name only, which helps them get Chinese subsidies and market share in China. On the other hand, they are probably not as competitive as assumed: I’ve heard many Chinese solar companies are planning to open production centers in relatively expensive Spain.

So I wouldn’t worry. Even though they don’t realize it yet, the Chinese are only subsidizing the rest of the world.

Those “Chinese companies” are mostly General Electric, ready and willing to take federal green money, but to manufacture same in China (factory already up & going) for the cheap labor.

Part of the loans our government “guaranteed” (that means the taxpayers) for Immelt and GE went to their Chinese factories.

This is a win-win. Cheaper solar and increased use in sunny places will hopefully reduce or at least restrain the rising cost of fossil fuels, which I need to keep warm in frigid (and increasingly cool) Iowa. When they talk about putting it where the sun don’t shine, I think they meant Iowa in October – March.

Falling solar module prices (now $1.80/watt, vs $4+ in ’08) are a good thing for consumers, it’s true…though we are starting to see diminishing returns from the price collapse, because installation (hiring someone to put the things on your roof, secure them, transform the power, & connect it to the grid) isn’t dropping in price, and represents an increasing percentage of the total cost.

The point of this article, though, was to note that the sudden drop in prices, led by Chinese producers, is hurting profitability for manufacturers, and is likely to end by driving most of the US & Euro manufacturers out of business.

The price drop is occurring for two reasons. First, the raw material used in making crystalline silicon modules, polysilicon, was in shortage for several years (driving price up from $25/kg in ’04 to $450/kg in ’08), but massive capacity additions + global downturn in credit markets have created a glut. Price of poly has dropped in past 12 months by close to 90% (now ~$60/kg), but glut continues to worsen due to lags in capacity coming to market (takes 2 yrs to get new plant on line)…expect market to get worse in 2010, 2011 and 2012.

Second, the Chinese manufacturers have used a combination of cheap labor & some (unfair?) gov’t subsidies (cheap electricity & cheap credit) to drive down the non-polysilicon costs of manufacturing to $0.75/watt, roughly 40% below where the non-Chinese competitors have been able to get to.

Surprisingly, there is relative little intellectual property in building a solar module (most firms have R&D as % of sales = less than 1%), so there isn’t much chance for western firms to “out-innovate” Chinese rivals. As the western firms have belatedly realized this (for several years, the quality of Chinese modules was lower than the quality of western modules, but this was more a factor of the Chinese, as new entrants, being unable to get access to high grade polysilicon, due to the shortage, than it was any technical deficiency…with the poly glut, this is no longer a problem, and Chinese module quality has improved)…they’ve tried to move manufacturing to lower cost locations. But this takes time, and the mkt price is collapsing now…plus which, part of the Chinese firms’ advantage is from hidden gov’t subsidies (power + credit), not just cheap labor.

All of this is to say: if Obama wants to create tons of high paying green jobs, PV solar module production is unlikely to be the way to do it. And for those looking to make a killing in the stock market by playing solar as the “next big thing,” you’re more likely to make your killing by playing the stocks from the short side rather than the long side, because the economics of solar module manufacturing are bad & likely to get much worse as this price war deepens.

Sorry to ramble on…this just happens to be a topic I spend a fair amount of time on (as a hedge fund manager in the technology sector)…more info on request.

I am not clear on several issues. Help would be very appreciated.

I thought electricity is easy to produce but more difficult to transport from China to US (over water?) and even harder to store. In other words production of MW in China should not affect the US but maybe EU, assuming there is a electrical line running this far?

Furthermore, as pointed out above, isn’t this supply demand (with the initial subsidies) just playing out? if price goes down, wouldn’t consumption go up? we are seeing the consumption go down in these numbers… how do they know?

Surely if some capacity is destroyed price will go up etc…

What is really at play here besides the alarmist headline? a more in-depth analysis would be very welcome…

You’re right, transporting electricity from China is not economically feasible. What is being produced in China is simply the solar panels…no electricity gets produced until the panels are then installed (electricity is then produced by photons striking the panels and causing electrons to move across the panels, with wires creating a circuit).

The problem is that, even with the much-reduced cost this year, producing electricity from PV solar still is not economically competititive with coal, natural gas, hydro, nuclear or even wind. To stimulate the market, some countries (particularly in Europe) have provided generous subsidies for electricity generated from solar panels. The cost of these subsidies are borne by consumers…either through higher taxes, or through higher electricity prices (depending on whether the subsidy comes from the government or the utility).

Depending on your view, this is either a good or a poor use of taxpayer money. It depends on whether you believe the subsidies will be effective in jump-starting the market, helping it get scale, and driving costs down to the point where solar is economical without the subsidies (the jury’s still out). Also, from a political perspective, it is much harder to justify these subsidies if the taxpayers dollars (or euros) are disproportionately going to non-domestic firms.

This is REALLY where the problem lies in Yves’ post. Namely, the price collapse is driving domestic (US & European) firms from the market, while Chinese firms, rather than reacting to the glut by slowing investment, seem to be ACCELERATING their capacity additions, making the glut even worse. Partly this is general fallout from the misguided Chinese stimulus (increased bank lending forcing more & more dubious loans onto firms in commodity businesses); partly it is a result of a specific government policy. China sees solar as a nascent industry it can dominate…it can continue to fund firms that are losing money (through extending cheap credit, giving tax credits, providing below-market electricity, etc), helping them gain a leg up. In fact, in the short run, all the better if there’s a market crash, because it’ll drive out other competitors and help the Chinese firms gain scale that can act as a barrier to entry in the future.

This is a strategy used by Japan, Korea and Taiwan in the semiconductor memory business, another commodity business with similar characteristics that was originally dominated by American and European firms (all of whom, other than Micron, have long since been driven from the market).

I helped build the only full scale coal gassification plant in the US in the aftermath of the late seventies commodities boom. It was never used because oil went to 10$. I think the latest idea for it’s use is a museum.

My 1973 senior year mechanical engineering project professor insisted we build a solar collector since it was a no brainer that solar would heat all our homes after the Arab oil embargo.

Read Socionomics for more insight into how late in commodity booms society’s mass psychological mood always shifts toward conserving/protecting resources. These “green” movements always end when the bust comes. The second (larger) phase of the bust starts now. Solar will come back in about thirty years when you start hearing the term “peak oil” again.

http://econospeak.blogspot.com/2009/09/different-environmental-threat-peak.html#links

“One of the keys to Green Technology may be buried in China. It has only recently begun to appear in the media, but for very different reasons. A couple of years ago, the New Scientist published a piece about the risks of the scarcity of rare minerals.

Cohen, David. 2007. “Earth’s Natural Wealth: An Audit.” New Scientist Issue 2605 (23 May): pp. 35-41.

Three facts are bringing this looming shortage to the attention of mainstream media. First, the US is dependent on exports of these minerals, while China is the main exporter. Second, these minerals are crucial for high technology, including both military and so-called Green Technologies.”

The lowest cost solar panels are made in the USA.

nanosolar.com

They do not have the capacity yet to produce all the solar panels (well, they don’t exactly produce panels; they produce something like a sheet – flexible) to fill the market, but as they do, they’ll be able to sell for very low (their estimated manufacturing cost is $0.30/W).

By the way, I think the point of this article was to point out stocks that you should short or be out of.

Thanks Dan I was trying to remember their name, although they rely on even more exotic rare earth minerals if memory serves abet in lower concentrations.