By Edward Harrison of Credit Writedowns

In the lead-up to the credit crisis, I really didn’t write a considerable amount about second mortgages despite my focus on credit writedowns. At that time, I was more focused on writedowns from securitized mortgage paper (and later construction loans and commercial real estate because of the stress these loan types put on regional financials). However, second liens are a very big deal and I believe they will loom that much larger in 2010 because of the rise in strategic defaults in prime and Alt-A categories.

When the crisis first developed, in February of 2007, it was subprime where the worries were, with the lion’s share of writedowns coming from mark-to-market losses in the securitisation market. However, subprime was a relatively small part of the overall market, making up 14% of loans outstanding at that time. Alt-A loans were 27% and prime loans were 57% respectively of loans outstanding according to a Banc of America Securities report.

As the 2004-2007 co-horts of Alt-A option ARM mortgages have started to reset and prime borrowers have come under stress, we have started to see defaults in markets which are an order of magnitude larger than subprime.

There are no specific numbers on how many option ARM loans there are. But analysts estimate that as many as 1.3 million borrowers took out $389 billion in option ARMs in 2004 and 2005 alone.

Many of those option ARM loans have already re-adjusted to higher payments, but more are on the way. Some 88 percent of Option ARMs originated between 2004 and 2007 are going to adjust higher between now and 2012. Those option ARM borrowers could see their housing bills go up as much as 63 percent, according to Fitch ratings.

The chosen solutions thus far has been to arrest the fall in house prices so that they are still at elevated levels. This is one reason the Fed is loath to raise interest rates; doing so would make interest payments unaffordable for many homebuyers and homeowners.

Nevertheless, the reset and strategic default issues are still with us and they bring second mortgages into view. I have been interested in the problem presented by second mortgages since I wrote a few posts on legal cases involving foreclosure, second mortgages and mortgage servicers.

What was clear then is that mortgage servicers were not incentivized to modify existing mortgages. The incentive for servicers is to service an existing mortgage for as long as they can in order to collect the fees associated with that servicing. The big four commercial banks are by far the largest servicers of loans. Here is the breakdown from an October post linked just below.

- Bank of America: $2.1 trillion, up from $530 billion a year earlier (via its acquisition of Countrywide – this is WHY bank of America bought Countrywide)

- Wells Fargo: $1.8 trillion, up from $1.5 trillion a year earlier

- JPMorgan Chase: $1.5 trillion, up from $795 billion a year ago (thanks in large part to its acquisition of Washington Mutual)

- CitiMortgage (a division of Citigroup): $792 billion, down from $799 billion a year earlier. Citi is hurting i everywhere)

- ResCap: $391 billion, down from $449 billion in the first quarter of 2008.

See Why mortgages aren’t modified and what a ruling stopping foreclosures means.

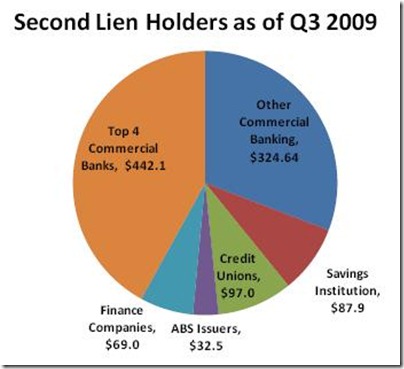

But, as coincidence would have it, the big four commercial banks are at once the largest mortgage servicers and the largest second mortgage lenders. Here are the numbers from Amherst Securities’ Laurie Goodman via FT Alphaville.

The interesting bit is that, according to Reuters’ Felix Salmon, the lion’s share of writedowns on second liens to date come from that small sliver of ABS Issuers. The reason of course comes from the dichotomy between how loans and securities were treated before mark-to-market rules were liberalized last year.

You should have noticed that most of the assets written down in the past two years have been marked-to-market. Securities traded in the open market are marked to market. Loans held to maturity are not. This is one reason that large international institutions which participate in the securitisation markets have taken the lion’s share of writedowns, despite the low percentage that marked-to-market assets represent on bank balance sheets. But, this should end because of new guidelines in marked-to-market accounting. However, the new guidelines do have two major implications. First, there are still many distressed loans on the books of U.S. banks that if marked to market would reveal devastating losses. Second, there will also now be many distressed securities on bank balance sheets that if marked-to-market would reveal yet more losses. In essence, the new guidelines are helpful only to the degree that it prevents assets being marked down due to temporary impairment. If much of the impairment is real, as I believe it is, we are storing up problems for later.

–The Fake Recovery, April 2009

So, when people default strategically, two things happen to the mortgage holder’s balance sheet. First, the losses become realized and must be accounted for. Second, the second mortgage gets vaporized.

I’m still trying to get to grips with the motivations of the too-big-to-fail banks given their outsized holdings of both second mortgages and service contracts and the lack of first mortgage holding. But, it seems that the interests of the servicer are to extend and pretend existing mortgages in order to get as much fee income as possible. So the Home Affordable Modification Plan (HAMP) isn’t going to be the preferred approach here and that’s why it is largely a failure.

But what about the second mortgage holder? They clearly don’t want a modification either because they are subordinated to the primary mortgage and must take all of the initial hit in a modification. So the government has set up a second lien modification program.

The Second Lien Program announced today will work in tandem with first lien modifications offered under the Home Affordable Modification Program to deliver a comprehensive affordability solution for struggling borrowers. Second mortgages can create significant challenges in helping borrowers avoid foreclosure, even when a first lien is modified. Up to 50 percent of at-risk mortgages have second liens, and many properties in foreclosure have more than one lien. Under the Second Lien Program, when a Home Affordable Modification is initiated on a first lien, servicers participating in the Second Lien Program will automatically reduce payments on the associated second lien according to a pre-set protocol. Alternatively, servicers will have the option to extinguish the second lien in return for a lump sum payment under a pre-set formula determined by Treasury, allowing servicers to target principal extinguishment to the borrowers where extinguishment is most appropriate.

–Obama Administration Announces New Details on Making Home Affordable Program, U.S. Treasury Department, April 2009

Sounds pretty complicated if you asked me. As a large servicer who also has a lot of second liens, why would I agree to this if I could extend and pretend – especially since most modifications end up in foreclosure anyway? As I see it, the optimal response would be:

- extend the loan and get as many payments as you can from the homeowner

- meanwhile collect all the servicing fees in that time frame

- at some juncture, this pretense comes to a close. So, avoid a foreclosure by inducing a short sale in which you (secretly?) get some compensation (see my post “Short sale fraud”).

That way if you end up getting a foreclosure anyway, you can get the most money out of the situation. Again, this assumes you don’t have any residual exposure to the primary mortgage since you securitized that. What am I missing here?

Your thoughts on this subject are appreciated. See also “This Crisis Won’t Stop Moving,” a recent article on second liens from the New York Times.

What are some of the common reasons for getting a second mortgage?

Capital to start a small business, home improvements, medical bills, bridge loan to cope with income loss, and tuition.

Of course, what gets more attention is new cars and vacations.

Debt consolidation. Basically some of these banks leant money in a 2nd mortgage so people could pay off credit card debt to the same bank. I wonder if there are any statistics on that.

by far the biggest use of second mortgages was to avoid downpayments or private mortgage insurance (e.g. 80-10-10).

Thanks, all, but how does a second mortgage differ from a HELOC, with the exception of avoiding downpayments or private mortgage insurance (e.g. 80-10-10)?

A HELOC is essentially a credit card-like account that’s secured by a house. Most HELOC’s will have a set credit limit and will allow the borrower to make draws on that credit limit at the borrower’s discretion. As draws are made or payments on the existing balance are made, the amount of available credit changes over time. Some HELOC’s also have a nifty land mine in them: even if you pay an existing balance on a HELOC by refinancing your property, the HELOC will survive the refinance if your closing agent (or the new lender) forgets to get a letter from you closing that account.

A second mortgage is just like a first mortgage. You borrow a specific amount of money at execution and then pay it off for 15/30 years with no further opportunity to receive additional money based on that note. The only difference between a second mortgage and a first mortgage is the amount borrowed (generally the second is smaller) and the order of payment in the event of a change in ownership of the property mortgaged.

I think a more interesting question is what a lender would take for a second mortgage at present.

Could it be that a servicer might see an opportunity in buying out the second mortgage at cents on the dollar, and then as mentioned in the post playing ducks and drakes to maximise the servicing fees.

I’ve been wondering for some time about regulatory “relief” on second mortgage portfolios. I suspect some serious play-pretend is going on, both to maintain fictitious capital ratios at banks and thrifts…and to not deal with the little problem of the FHLBs holding seconds as collateral. Is the Atlanta FHLB still holding the crap juniors pledged by Countrywide, or (fat chance) did BoA buy back the collateral?

Are first lien holders really powerless against second lien holders who hold a renegotiation hostage? Wouldn’t it have been the case that before a second lien could be added to a title, the first lien people had to give their consent first, and would likely have made the second lien people sign away certain rights? After all, the second lien is introducing added risk to the mortgage, so no first lien holder would normally allow that without making sure the second lien can’t muck everything up afterwards.

Some good food for thought on the mechanics of foreclosure here and the difficulties involved, I will spare you my intentionally created divisiveness rap …

Excerpt;

“Okay, so let’s establish three or four teensey-weensey facts about foreclosures right up front.

First of all, as we all should know by now, on February 18, 2009, when President Obama said in his speech introducing his Making Home Affordable foreclosure rescue plan, that getting a modification of a home mortgage was free and easy… that all you had to do was call the handy dandy, toll-free government phone number… or just call your bank directly… he was… um… er… well… mistaken, optimistic, full of shit, or high. Sorry about that, but come on… seriously?

Second of all, it should by now no longer be contentious to say that people need help to negotiate a loan modification with a bank or mortgage servicer. I say this because even President Obama thinks that people need help and that’s why he’s spent tens of millions funding various nonprofit agencies across the country. I also say it because to-date there have been hundreds, if not thousands of stories of servicers abusing homeowners who have tried it on their own, and because I’ve personally been contacted by thousands of homeowners who said they tried it on their own before giving up and seeking someone to help them.

Thirdly, there should be no debate about the HAMP, or Home Affordable Modification Program. It’s a prodigious failure on an Herculean scale… the contrast between its promise and what it has delivered is staggering. It’s claim to fame is that it out-performed Dubya’s Hope-4-Homeowners plan, which after six months had only modified one solitary mortgage.

As a corollary, trial modifications are the biggest loan modification scam the country has ever seen. Here’s how they work in real life: The bank tells you to make three payments of some amount that won’t reduce your indebtedness, but will be reported to the credit bureaus as delinquent payments, so that after you’ve made all three on time and as agreed, they can sell your home without notice. Most people learn of their house having sold when they come home one day to find investors standing on their front porch looking in the windows.

And fourth, the number of foreclosures has continued to rise steadily and there is no light at the end of the tunnel, because not even the government can afford to pay the electric bill. Housing prices remain in a free fall, and any blips in the market have only been caused by some distorted combination of government give-a-ways and government propaganda. Sort of like if Joseph Goebbels and Leni Riefenstahl had partnered up with David Lerah, the ex-Chief Economist for the National Association of Realtors… and maybe Carrot Top.

So, all in all, the whole save-my-house-through-a-loan-modification thing is going swimmingly, I think would be a fair way to phrase it.

With all of this in mind, the Federal Trade Commission (“FTC”) has decided that the best way to protect homeowners from “scammers” who promise to help homeowners obtain a loan modification, but fail to deliver on that promise… is to eliminate the private sector from the field entirely… including attorneys.”

More here …

http://mandelman.ml-implode.com/2010/02/ftc-considers-wrong-approach-to-protecting-homeowners-from-loan-modification-scams/

Deception is the strongest political force on the planet.

Saw this and thought of you: Rendering Fear: The Graphic Design of Al Qaeda

http://www.fastcompany.com/pics/rendering-fear-graphic-design-al-qaeda?slide=0

Skippy…enjoy!

Thanks Skip … interesting.

well done.

Ed,

A couple of comments that you might have already considered.

The only thing that makes a second mortgage a second mortgage is the time at which it was recorded. If you look at typical second mortgage or HELOC documentation, the deed of trust or mortgage, depending on the relevant state convention, is identical to the primary mortgage. It is in second position simply because it was recorded after the first mortgage. Nowhere does it state that it is now and forever subordinate to the existing or subsequent first mortgages.Students in law school remind themselves of this fact at test time by memorizing this: “First in time, first in line.”

If you refinance a first mortgage then in order to preserve your priority it is required that the second mortgage holder agree to subordinate his interest to the new first mortgage and to it only.

Now, how do you handle the event of a loan modification? If the modification is extensive and the terms are recorded, at what point can it be deemed to be a new loan and absent a subordination on the part of the second mortgage holder having a lower priority than the existing second mortgage holder.In other words, could a bank put its first lien in second position merely by modifying the loan? Could it be that the banks are either looking at this option as a means of enhancing their second mortgage portfolios’ potential for recovery. Or maybe more plausibly that there is so much ambiguity that paralysis has ensued.

As far as short sales are concerned, keep in mind the first mortgage holder cannot bind the second mortgage holder. Both must agree to whatever compensation is settled upon in order to transfer the property free of lenders’ liens. Since the primary lender is taking a haircut already, it shouldn’t be surprising that they have no interest in agreeing to any payment to a subordinate lender. At the same time the subordinate lender knows that they still wield a veto and are using that power to extract some payment. The fact that it seems to be occurring under the table is despicable but not all that unexpected.

As a servicer, if you enter into modification agreements which a court deems to constitute a new loan and subordinate to other existing liens, then you are probably going to be subject to a fair amount of litigation on the part of the investors you represent.

Lots of if, ands, maybes and buts in all of this, but as is too true of most of our lives these days, the law and lawyers often rule the day. What might seem like a simple problem to attack is actually one that has a lot of embedded land mines.

When it is 12:00am EST, it is 7:00am in Greece. Such a failed state. The oligarchs will get the little people into line with the necessary austerity package when they see the USS Ronald Reagan and her glorious battle fleet pass through the Straights of Gibraltar.

“We are all Americans!” Yes!

We may have to destroy the country to save it, but that has never stopped us before. Once Greece is reduce to a puking pile of ruin, Senator McCain could be helicoptered in to do a victorious duck walk on the carrier’s deck.

Just imagine the grand display of military power. We could all be proud. The Empire could live, once again!

I am convinced that we will continue to see major downward pressure in real estate prices in much of America particularly when the threat of a second credit crunch becomes reality.

http://whatisthatwhistlingsound.blogspot.com/2010/01/real-estate-heading-south.html

I found this interesting:

“The chosen solutions thus far has been to arrest the fall in house prices so that they are still at elevated levels. This is one reason the Fed is loath to raise interest rates; doing so would make interest payments unaffordable for many homebuyers and homeowners.”

And from a Wash. Post article on the Federal Reserve buying MBS:

“…getting the Fed out of the business of subsidizing mortgages.”

Conservatives should think about this sentence. Not only do you… people… get a tax break from mortgage interest, but the only thing propping up the value of your pathetic house is this bailout – your bailout.

Your welcome.

Question–does it make any difference if ONE lender underwrote both the first and second mortgages? I mean, it’s the same entity holding both mortgages. Does that make a modification more likely to happen? Thanks for any info you can share!

My experience (in IL) has been that it doesn’t help when the same lender underwrites both mortgages on a property (such as an “80/20” loan). One of two things happens: the mortgages get sold into different investment vehicles so there are different requirements for modifying the loans, or the loans get sold to different servicing agents who have no incentive to cooperate on the modifications. I hear stories from homeowners all the time who have managed to modify their primary mortgage and then realize that they’ve got to start the process all over again with the second mortgage holder.

Here’s a question I’d love an answer to (although I have my own guess): WHY do banks hold so many of these second mortgages? My explanation is that it’s because these are predominantly shorter-term, floating-rate, hence better matched to their funding.

Another way in which the obsession with fixed-rate mortgages with asymmetrical prepayment rights has, in the long term, damaged the US market.

Globally, these 30-year fixed with no prepayment penalty mortgages are (almost) unheard of, and there’s a reason for that.

This is what finally brings down the Wells and the Citis and banks like Suntrust. Seconds are a complete wash-out at all levels. The values are going to fall more than 50% and not come back for years. After the first Depression property didn’t bounce back for 20 years when the baby boom started in the 50s. Even people staying in their homes will risk that 2nd failing especially when tied to lines of credit. What are they going to do, pay tons of legal fees to sell a home that isn’t worth the value of the first?

Commercial and card and second lien losses are piling up at the door while we focus on the tripling residential foreclosures. Beginners to the left, beginners to the right and the Depression II Train right in front of us.

It is beginning to look very much like 1930. The stock market recovered that year too. Until real estate falls 50% renewed demand in unlikely. There is a reason they call all this extend and pretend. The only thing looking positive is multinational overseas profits. Can the Chinese drink enough Coca Cola and eat enough hamburgers? We’ll see.

As I remarked on the FT Alphaville article you refer to, I would expect the second lienholders to start using HAMP and HAMP2 to press the firsts to reduce principal enough that there is some house value left to cover the seconds. That way the seconds can avoid having their liens stripped off in a Chapter 13 down the road when the borrowers fail to make the payments, which is typical. The seconds will have protected themselves a bit, at the expense of the firsts and the unsecureds.

At least for a little while. Then when the borrowers still can’t pay, and they find they’ve signed away any benefit they could have gotten from Chapter 13 because they can’t get rid of the seconds, they will have no choice but to dive into Chapter 7 and liquidate. And the foreclosures will roll, and the prices will fall, and the seconds will find themselves back out in the cold, after pilfering a few more coins from everyone else in the system.