Whales ‘offset carbon emissions’ BBC

Airplanes Punch Holes in Clouds, Make it Rain Discovery

Food prices to rise by up to 40% over next decade, UN report warns Guardian

Migration Maps: The Real Social Networks (II) Paul Kedrosky

Court Order Highlights U.S. Legal Distortions Daphne Eviatar, Huffington Post

Auditors for Lehman Aim To Return $22 Billion Wall Street Journal. I’ve pinged a colleague who has some knowledge of this BK, but I can’t see how this works legally (and his initial reaction was that this doesn’t make sense). This is effectively an effort to force a global settlement (literally), when bankruptcy is a judicial process, and Lehman has various entities in jurisdictions all over the world. I don’t see how you can sweep aside legal procedures in the relevant countries.

Ernst & Young faces probe over Lehman audit MarketWatch

Russell Simmons, Interchange Crusader Adam Levitin, Credit Slips

Bank Profile: Capital One Financial (COF) Chris Whalen. Has some observations in his preamble to this analysis about the state of the housing and commercial real estate markets. Not pretty.

Obama’s Oil Speech Panned: Short On Details, Broader Climate Plan Huffington Post

BP Swaps Rise to Record at 35% Odds of Default Bloomberg

BofA to limit duration of trades with BP Reuters

BP’s Options to Limit Liability From the Oil Spill New York Times

“Sarah Palin Says “Drill, Baby, Drill” Was Right” Menzie Chinn. Can the reader that put a hex on BP also put a hex on her? Just have all bad stuff she does come back to her, pronto, particularly her lies. I’m not expert in that terrain, but I suspect anything more than that is probably bad karma.

The Sovereign State of BP – Down for the Count? The Economic Populist

BP enlists help from Kevin Costner in cleanup CNN (hat tip reader John D). Build it and they will come…

Weak Euro Casts Uneven Benefits Across Bloc Wall Street Journal

Nightmare vision for Europe as EU chief warns ‘democracy could disappear’ in Greece, Spain and Portugal Daily Mail (hat tip reader Scott). Yes, I know it’s the Daily Mail (so you need to discount some of the rest of the piece considerably), but the quote is for real, and no other medial outlet seems to have picked up on this remark.

Soros: European recession next year “almost inevitable” Reuters

Spain plays high-stakes poker game with Germany as borrowing costs surge Telegraph. Spain wants the ECB stress test data on its banks released. If this were done, it would stoke demands to see the results for German and French banks, which would presumably be pretty ugly.

European Commission wants Spain to cut even more Eurointelligence

Is Germany Saving Itself to Death? Der Spiegel

Why economy may not save 2010 Democrats James Pethokoukis

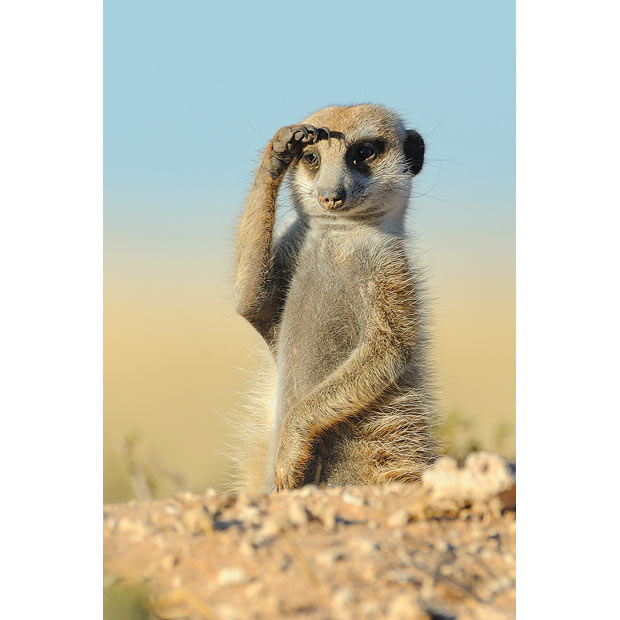

Antidote du jour (hat tip reader Barbara B, from Colours of the Kalahari: a new book of pictures by South African wildlife photographer Hannes Lochner in Telegraph):

Re Barrasso:

IOW he’s warning that unless Greece et. al. submit to the destruction of whatever democracy they have left at the hands of the EU and global finance, they’re bound to end up under a different kind of dictatorship. So they shouldn’t dare try to go with actual democracy instead and reject the tyranny under which the globalization criminals want to crush them.

It reminds me of the 1930s quote about Hitler “threatening peace with forced labor.”

Speaking of democracy, the “Sovereign State of BP” piece reminds us of how the US government and BP joined up to crush it before in Iran, just as they’d like to do today in America.

But then it goes in for pathetic bluster like this:

The rapid demise of the president’s popularity and power has not escaped his attention, nor will it be tolerated by his team trained in hardball Chicago politics. It’s one thing to foul up the Gulf of Mexico. It’s another to threaten those who control the world’s most valuable political franchise. But that’s exactly what BP’s arrogance and incompetence did.

Gee, why didn’t that work in the cases of the banks or the health insurance rackets? And why hasn’t it looked at all that way so far with BP?

It’s just pathetic the lengths to which Obama cultists will go to synthesize some kind of faith in this clown. And nothing’s more laughable than when they try to represent this cowardly little wimp as a tough guy.

Last night’s speech was the latest object lesson in Obama’s fecklessness. He’s really utterly incompetent as a political performer at this level. The Peter Principle has set in with great ferocity.

Here’s what I think happened with Obama.

1. He started out in law school as a glib, smooth, sociopathic con man, styling himself as a neoliberal version of Clarence Thomas.

2. His personal ambition dovetailed well with powerful interests who smoothed his fast political rise. His whole career was one continuous PR blitz, nothing more.

3. Now that he’s president, he’s finally spotlit on a stage where for the first time he really has to pretend to be a leader, pretend to be responsible. Those are things he never had to do in phony, irresponsible situations like the Illinois legislature, the Senate, or the ivory tower.

4. Having to perform in reality, where there’s real pressure from reality and a vast audience beyond his claque, he’s proving to be a complete failure.

He’s simply a mediocre person – unwise, unimaginative, shallow, narrow-minded, vacuous.

Well Germany is not the only country with a trade surplus to invest:

http://www.telegraph.co.uk/finance/7829889/China-invests-billions-of-euros-in-debt-laden-Greece.html

I see that some commentators take this as asign that Chian cares more for the welfare of Greeks than does Anglo-American financial companies do.

I would not make that assumption.

But I would not dismiss it out of hand:

exporters need importers who can afford to buy their goods.

Somewhere.

Yves,

I spotted this on Cryptogon.com . Thought you might find it of interest.

http://www.zdnet.com.au/internet-kill-switch-proposed-for-us-339303838.htm

This is scary on so many levels.

looks like Lieberman is working overtime on advice of his Zionist intel genuis lobbyist group.

Wow!

Paranoia much, Lieberman?

This guy’s menace, pure and simple.

What’s next? The Ministry of Truth?

Obama’s Speech

I loved this line, “In the coming days and weeks, these efforts should capture up to 90% of the oil leaking out of the well.”

Wow! You can take that to the bank, my friends.

Madison Avenue, in its greatest days, could not have come up with a nicer-sounding phrase that is any more vague and vacuous.

In the coming days and weeks some oil may or may not be captured, but we have been assured that at least 10% of the oil will continue to leak.

I feel so much better now.

That meerkat is probably watching a home builder encroach onto his lot, cut the trees down, and build a new subdivision.

The meerkats look out for one another, unlike some of us. This one is probably watching for signs for invading Homo Not-So-Sapiens Not-So-Sapiens.

“Weak Euro Casts Uneven Benefits Across Bloc…”

So the American MSM is trying to repeat the lie that the euro is “weak”. At this level vs the dollar, the euro is *not* weak, more on the normal-strongish side. Below 1.10 you can start calling the euro weak. Methinks the American authorities are preparing for another round of competitive devaluation.

I’ve been enjoying (well, “being depressed by”, but in a good way) your tremendously useful and informative blog for some weeks now. I just wanted to delurk to say that I doubt very much that the choice in Greece is dictatorship or austerity. This quote is simply an indirect way of saying “those protesters who claim to be left wing/anarchists are really tools of fascism, which is why their critique is not legitimate.” It’s important for existing politicians to remind everyone that protest of austerity is not only useless but vaguely wicked so that the rest of us don’t get any ideas.

If a dictator is installed in Greece (I’m most familiar with the situation in Greece) he will almost certainly be there at the behest of the banks, the EU and the US to enforce austerity. The US, for example, has always been very cozy with right-wing governments in Greece.

RE:BP’s Options to Limit Liability From the Oil Spill

The issue of cost for cleaning up the mining messes has squarely been on taxpayers over the years due to political clout of the industry that may be reaching an important turning point at least one of recognition by the public.

Fractal mining for gas deposits in the Northeast has the potential for large scale environmental damage to watersheds. In the future could property owners that leased land along with the mining companies be held liable if local cities and county water supplies are ruined? Will smaller drillers for gas and oil be able to afford or find insurance to cover large liability claims? or even large drilling operation? Drill baby Drill meets financial reality?

“I don’t see how you can sweep aside legal procedures in the relevant countries.” Change We Can Believe In.

Grow-op in Vancouver, BC was financed by banks

Alarm bells should have gone off the moment Hai Le walked into the Bank of Montreal and asked to refinance the mortgage on his million-dollar home in Vancouver’s up-and-coming Marpole area.

His alleged inability to provide proof he had the means to make the hefty monthly payments of about $4,000 should have been reason enough to crumple up and toss the application into the nearest trash can.

Le, a “sales manager,” was also asking the bank to mortgage the property for its full value, a strategy that authorities say marijuana growers often use to minimize their losses should and when they get busted.

Yet despite these blatant red flags, the bank approved Le’s application for a $976,000 mortgage on Oct. 22, 2008, some 15 months after he’d bought the house from a Viet Van Truong for $980,000.

Ten months after the purchase, in August 2009, Vancouver police raided Le’s West 63rd Avenue home and uncovered a massive grow-op. Two days later, Le sought and received a $70,000 mortgage from the Royal Bank of Canada.

The property is now before B.C. Supreme Court in a potentially precedent-setting civil forfeiture case that calls into question the role banks play, knowingly or unwittingly, in the province’s multibillion-dollar drug trade.

http://www.theprovince.com/business/Grow+financed+banks/3148569/story.html

Very interesting to consider Germany’s saving patterns and its potential impact on its overall economy.

I don’t want to leap on the anti-Obama bandwagon, but the James Pethokoukis article at the bottom of the pile of links makes a very good point. The economy won’t save the Democrats in 2010 because the US economy is still performing poorly by any measure. The Democrats are reduced to arguing “well it would have been worse without us”, which is an amazingly weak argument to take into an election.

The Democrats only real hope is that the Republicans have made themselves unelectable during their stint in power. Post World War II Japan, Italy, and to some extent Mexico are examples of places where one party won election after election, regardless of its performance in government, due to the main opposition party being unelectable. Fortunately for Japan, the LDP record on the whole was not that bad, but this situation is not good for a country’s political system.

Re: Spain vs Germany

Even though the article makes it appear that Spain has its own out-of-sight dirty laundry in the ‘cajas,’ there is just the slightest glimmer of hope that the Spanish gambit can start to unravel ‘extend and pretend,’ and begin some real disclosure of big banks’ balance sheets. Hopefully there will be a domino effect around the world.

Here’s hoping, but I’m not gonna bet on it.

I like Whalen’s analysis usually, especially when he sticks to reciting hard facts about the banking industry and trying to find meaning therein.

But look at this sentence: “The politicians who run the Congress still have yet to have an original idea when it comes to the economy.”

Is that supposed to be funny? Is it supposed to make a point through hyperbole? What does it accomplish?

It is obviously not true (at least, I guess, depending on how you define “original”). And even if you debate the *possibility* of the statement’s truth, one could never actually know or prove it was true.

I just don’t understand how people expect to be persuasive when they fail to argue with precision. It just depresses me.

RE BofA to limit duration of trades with BP

Interesting article on the BoA announcement, thanks for posting it… BoA is my banksta (that’s with a Boston accent, and his name couldn’t be more Irish!) so I’m always especially curious about their corporate doings. I found their choice to replace Ken Lewis with Brian Moynihan most interesting. Moynihan has experience in many different aspects of banking… seems like he worked his way up very astutely, and he’s NOT a sales guy. Although he has many years in the banking industry, he has a law degree (see his Wikipedia article)and from December 2008 to January 2009, Moynihan served as General Counsel for Bank of America. Then he was appointed President of Consumer and Small Business Banking in January 2009.

I can tell you that the customer service at my local BoA branch has gotten much stronger in the past 18 months or so. It is obvious that all the bank staff have gotten some kind of extra customer service training. They now have roving staff being very friendly and helpful to customers as they walk in, and this includes eye contact. It’s an interesting PR/branding/don’t-hate-our-bank-we’re-nice strategy.

Back to Moynihan… given his law degree and experience as bank counsel, I’d say he sees legal problems ahead for BP and doesn’t want to get caught in the blowout (so to speak).

Also wondering if CEO’s with law degrees is the new trend… given the current economic situation I can see the logic in that.

Yves, I am thinking that voodoo is one of the few remaining industries in Louisiana right now . . . .surely you can find a bokor who will accommodate you on that hex.

Re the article calling for 40% food price inflation over the next decade: This is a little late–and it won’t take 10 years. Two years ago the price of both people and pet food jumped anywhere from 25% to 60%. The mainstream media never said a thing. I guess these journalists are too busy eating on the publisher’s credit card to know what food costs.

University of Chicago economist Raghuram G. Rajan has published a provocative book titled “Fault Lines: How Hidden Fractures Still Threaten the Global Economy” , Princeton University Press. Introduction from publishers website.

http://press.princeton.edu/titles/9111.html

We should be so lucky as to save ourselves to death.

The alternative is we spend ourselves to death. How’s that been working out for us? Obama is certainly down with that program. Let’s see how long it lasts.

Yes yes, I know. If private sector saves, public sector must run deficit, blah blah blah. Quoted in an earlier piece on “Austerity is Risky Business” — “Note that it is impossible for all three sectors to net save – that is, to run a financial surplus – at the same time. All three sectors could run a financial balance, but they cannot all accomplish a financial surplus and accumulate financial assets at the same time – some sector has to be issuing liabilities [borrowing].”

Key words here are “financial assets.” Because these are increasingly manipulated, and subject to the whims of moral deviants imagining themselves wizards, I’m thinking that physical assets will be what we need to survive with the fruits of labor somewhat intact. Plus skills in self-sufficiency. Just keep it up with the mad spending, and more people will come around to this point of view, and I do not think you will like the consequences. I’m sorry I don’t have a formula for that. It just stands to reason. People can accumulate as much gold or silver or ammunition or other tradeable items — i.e. non-financial assets, but savings nevertheless — and it does not create an automatic demand for the government to borrow and spend or for exports to surge.

On the other hand, if people decide to save quatloos and the government borrows and spends quatloos, thus creating “balance,” what does the government spend the quatloos for? And does this create real wealth? I’m increasingly dubious about this prospect, and I suspect the number of my fellows who are also losing faith in the whole fiat quatloo reserve system is on the rise.

________

If you are confused by the reference to “quatloos,” search on Star Trek The Original Series, “Gamesters of Triskelion.” Come to think of it, that alien society was based on gambling, just like our own stock market. Thus predicted the Prophet Roddenberry. Then again, perhaps quatloos were backed by gold-pressed latinum. ;)