By Tom Adams, an attorney and former monoline executive, and Yves Smith

As reported in the Financial Times, Senator Carl Levin of the Senate permanent investigations released damaging e-mails in which Goldman traders discuss “killing” some mortgage-related CDS shorts in May 2007. Levin understood the implications, that damaging the shorts would allow Goldman to buy CDS even more cheaply, but did not tease out the logical conclusion. This move was a likely a major step that allowed Goldman (and fellow dealers not under investigation who likely pursued parallel strategies) to package its remaining mortgage dreck into CDOs, which were launched as the reported squeeze evidently took place, and unload as much toxic inventory as possible before the wheels came hopelessly off the subprime bandwagon.

Goldman gives the usual pious denials, arguing that the market tanked, but the market action in later March to June 2007 belies their claims. And Levin may have unwittingly given Goldman an out by pegging the time of the short squeeze a bit late.

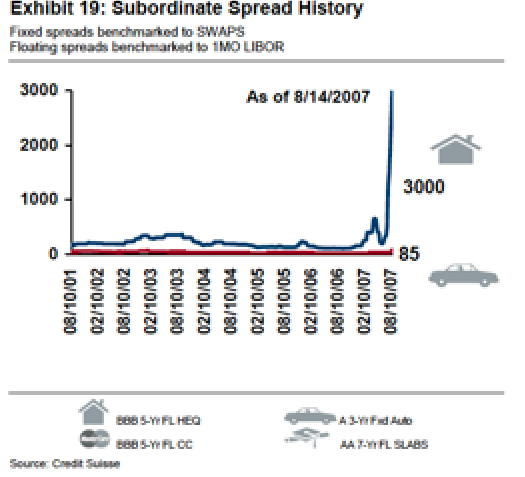

It’s a bit hard to see on the scale of this chart, but CDS spreads on subordinated bonds widened markedly in February and continued into March of 2007. And even though that move looks tame compared to what later came to pass, it was enough to create havoc in the subprime market.

Another way to look at it is from the ABX index (which is a price index rather than a CDS spread index). For instance, the BBB 206-2 index, which traded in the 97-96 range in December 2006, fell to 73 at the end of February. The BBB 2007-1 index, launched at 98 in late January, dropped to 70 by the end of February.

So what had happened? You can clearly see the that spreads kicked way up in early 2007, then dropped nearly all the way back in April, then blew way out by end of July. This change was in the absence of any fundamental improvement in the market. . If anything, the continuing drumbeat of bad news should have solidified the impression that a bubble was coming to an end and saner valuations would prevail.

In addition, Tom Adams was a market participant at that time. All of the hedge funds he spoke to then complained about how some banks were making margin calls on their portfolios of sub bonds, even though the spreads didn’t reflect such marked down values. It isn’t hard to imagine that Goldman, the biggest prime broker, was a major actor, as well as Deutsche Bank (another major player in the CDO market and the number three prime broker) as well as Morgan Stanley (number two prime broker, but a minor CDO market participant)

In part, the short squeeze would have been caused by the last fling of CDO issuance, which was quite significant in April to June. Anyone trying to issue a CDO to clear out their inventory would have benefited from such a short squeeze, since they got their CDOs off at better prices.

Of course, many banks were using the apparent improvement in conditions to say the worries were overblown. That’s a very convenient view to take when you are trying to sell lemons. It made it difficult for professionals who recognized that something was amiss but had institutional pressures to be in the market to ask for more credit protection and better prices.

Not surprisingly, Paulson and Bernanke were cheerleaders for the last blowout of subprime. Bernanke declared subprime to be contained in March, with an estimate of losses well below that of any private sector analyst (recall Bernanke was relatively new at his job then, and this comment was widely seen as proof of Fed out-to-lunchness, particularly since subprime had never been a market of much interest to them). But banks jumped on it immediately and used his remarks to push for lower spreads on CDS.

And the happy talk continues, as these May 17 remarks from Bernanke demonstrate:

All that said, given the fundamental factors in place that should support the demand for housing, we believe the effect of the troubles in the subprime sector on the broader housing market will likely be limited, and we do not expect significant spillovers from the subprime market to the rest of the economy or to the financial system. The vast majority of mortgages, including even subprime mortgages, continue to perform well. Past gains in house prices have left most homeowners with significant amounts of home equity, and growth in jobs and incomes should help keep the financial obligations of most households manageable.

We know all too well how this movie really ended.

For what its worth I can absolutely confirm this is true having seen it first hand. This is Goldman being Goldman and anyone with significant experience in the business knows to be wary when doing business with them. Especially in esoteric securities.

If this rigged system is what passes for a ‘market’, then we urgently need some new economic thinking. The term ‘market’ appears to be a fig leaf for what was really going on here.

You have to be well versed in at least two charting methodologies for today’s markets, one for tracking mob mentality and one for recognizing manipulation. How silver trades is a good example of manipulation. Most of the time fundamentals don’t apply just follow the money.

The interesting, and more difficult part, to recognising manipulation is recognising it early enough to be part of it. Otherwise, why bother?

Got any good computer programs or tipsters to suggest? GS names preferred, of course…

If you like staring at 5 minute charts, you can see at certain times of the day where the manipulators footprints show up or at favored price points.

Better off finding a trend line and betting on that just ignore the inter-day gyrations, you could get squashed like a bug playing with the big boys.

Here’s a silver fundamentals on manipulation interview…

http://www.youtube.com/watch?v=K-92A2rYoB0&feature=player_embedded

CDS is nohwere near that liquid….those sort of techniques not relevant, plus no screen traded prices on single name, and indexes not that liquid either.

Wasn’t this very thing confirmed in Michael Lewis’ book “The Big Short”?

Mannwich: From what I remember of ‘the big short’.. Mr Lewis does not talk very much about how the ‘big short’ worked inside of the big banks, his focus is on three hedge funds. Did I miss something? I remember Greg Lippman of Deutschebank going out and pushing people to buy CDS. I was under the impression this was to help their Synthetic CDO creation department get fees, since Synth CDOs require CDS buyers (shorts) to exist. I very confused to how it would all fit together with a ‘short squeeze’ though, im not too fast on the uptake on these things.

funny that the only place i have seen the phrase ‘the big short’ is in an goldman email (released by Congress) where the Goldman men are discussing how they got saved when an MBS tanked, they had shorted one tranch while long in another tranch of the same MBS.

on the other hand, ok. FrontPoint Partners, one of Lewis’s three protagonist funds, is ‘within’ Morgan Stanley. Technically, Steve Eisman worked somewhat under morgan stanley. now im super confused.

haha ok actually.. im an idiot.

Steve Eisman was working for Morgan Stanley.

The Big Short is not about three scrappy iconoclast hedge funds.

It’s about two scrappy iconoclast hedge funds, and a couple of employees of a massive wall street investment bank.

Answer: no.

Not disputing anything in this post, but who in their right minds would have been shorting CDS in May 2007?

If Tom Adams and the hedge funds cited and the emails held by Sen. Levin were all put together in one handy document wouldn’t this be a synopsis of a RICO action against GS and the other two players mentioned ? Or does the RICO statute and enforcement not exist in this MegaBankWallStreetian universe ?

im just a simple cave man internet poster.

what i could use is an explanation of how the CDO prices are linked to CDS prices, and to RMBS prices, that even a knuckle dragging slope brow like myself can understand.

and are we talking synthetic CDO, cds on cash cdo, cds on MBS? all three? what?

the hedge funds got ‘margin calls’ on their mortgage bonds..wait what? they bought MBS on margin? why did the banks do that? what about the hedgies who had shorted MBS? im so confused… sorry.

Since CDOs and CDS were/are? traded OTC they are were/are? considered private contracts. Complex contracts with language not available to all. So any counter-trading against them has to originate from insiders who know what parts of the contract language to attack to upset their values. I think it is impossible for a layman to figure them out even if they were put in front of them.

Apparently banksters are in trouble in figuring them out since they are so complicated that betting on them doesn’t always work out in their favor with lack of them being properly funded. Enter the bailout monies, where any other time someone would go broke.

Cds = building blocks of sythetics, so the price of one dictates the price of the other and the arb in deal creation.

I’m writing this before going to look, so I may have it wrong, but in the archives at Calculated Risk is a series of posts by the late, great Tanta. It’s titled “how To Be A Wonk,” or something like that. I think there are about six of them. They explain on a very basic level how all the different alphabet soups worked. I started reading the first one about a year ago, and I think I’m going to go back and read them all before I do anything else. Normally I can follow along with what Yves is talking about, but this one baffled me, too.

Roger Expat i stewed a couple hours i think i MIGHT have an idea what she and Tom and others are saying.

The subprime assembly line (bad loans, MBS, CDOs, mezz CDOs, synth CDOs) only worked as long as the players contined to pretend everything is OK.

The CDS ‘protection sellers’ (subprime longs) players begin to stop playing circa Mach 07. They raise the price they charge for ‘protection’ because they fear they might have to actually pay out to the ‘short’s. IE the ‘CDS spreads’ ‘widen’.

But thisMars 2007 is too soon, March 07. Goldman and other banks still have a ton of subprime MBS and CDOs they havent sold off to investors yet! What do they do!!

Answer to problem: force CDS prices back down. The panic will stop, the machine can keep churning. but How?

Answer: manipulate the market. through hedgies, or whatever. The subprime assembly line goes back to normal for a month or two, (May 2007),, This is long enough for Goldman and others to 1. unload subprime off their books, sell it to investors, and 2. to make their own ‘big short’ bets against subprime.

seems an reasonable interpretation?

forgot this key point: what happens if longs stop playing subprime game? then the game ends. if CDS are allowed to rise, it sets off a ‘death spiral’, a self-feeding feedback cycle, where people start to panic. CDS prices rise, more people want them, so prices rise more. other players see this and start panicking, selling assets for low values. low values of assets make seler rise prices on CDS rise even more. investors begin to lose confidence, start pulling money out of funds, out of stocks and bonds. markets begin to freeze up. etc.

this is complete amateur guesswork after low sleep and too many cookies. im probably totally wrong but maybe someone will be inspired to bitchslap me and we can all learn something.

We’ve discussed CDOs here at nauseating length, as well as in ECONNED. Chatper 9 has a detailed discussion. Not to toot our horn, but NC has had far more coverage of CDOs than any other site.

We even reverse engineered nearly all of the AIG CDO portfolio before Rep. Issa released the details. We demonstrated the Fed claims it needed to be kept secret were BS, most of the info was in the public domain.

I suggest you look up past posts here or ECONNED. Tanta really did not cover CDOs.

Yves,

Your arrogance shines through on particular moments. Ever heard of a site named ZeroHedge???? And if you’re counting pure writing and not “copy and paste”, James Kwak has you passed by about 2 light years of travel.

You do a good job on CDOs and CDSs. One of the best, not THE best. Lets pat ourselves on the back along with a light whiff of reality shall we?????

I meant to say “slight” or “Lite”. The point was made. Gin doesn’t do much for my typing but I get style points on accuracy of thought.

Yves,

WOW…… and I just noticed the shot at Tanta, “Classy” Yves, very “classy” knocking an expired blogger with near sainthood. Just stop for a moment and imagine how that came across to blogging junkies like me and you’ll know this comment is a favor to you.

The first paragraph had me a bit confused until I recalled (from reading The Big Short) that the “short position” was created by going long Credit Default Swaps on housing-backed securities.

I don’t see the crime in unloading inventory in advance of a big price decline. Caveat emptor still applies, no?