We were very critical of the SEC settlement with Citigroup, negotiated by its head of enforcement Robert Khuzami, over Citi’s failure to report losses on subprime holdings as the market for those holding tanked. In our post “The Wages of Sin: Former Citi Execs Pay Token Fines for Lying to Investors,” we remarked:

A news story today provides further confirmation of the rule by the banking classes in the US, with only token gestures to the rule of law. Per Bloomberg (hat tip Tom Adams), Citigroup is ponying up $75 million to settle SEC charges that the giant bank was not sufficiently forthcoming in the runup to the financial crisis about losses on billions of dollars of subprime exposures….

Yves here. I guess I am a bit thick. In 2007, subrpime exposure was the thing investors were most worried about. Recall that the first acute phase of the financial was in August-September 2007, when the asset backed commercial paper started contracting and money market investors shunned funds that had any taint of subprime.

Recall also that Sarbanes Oxley, passed in 2002, provides that a public company’s principal executive and principal financial officers certify both annual and quarterly financial statements for accuracy and completeness. Section 906 further

contains a certification requirement subject to specific federal criminal provisions and that is separate and distinct from the certification requirement mandated by Section 302.

So….what do we have here? A $75 million fine, imposed on the company…and so coming out of Citi’s coffers, which comes (in theory) from shareholders (but given that financial firms pay high percentages of revenues in bonuses, this fine would have a microscopic impact on pay levels).

More striking is the mere slap on the wrist of the execs involved. The former Citi chief financial officer, Gary Crittenden, who held the job from March 2007 to March 2009, will pay $100,000 of the total $180,000, with Arthur Tildesley, then in charge of investor relations, agreeing to cough up $80,000 to settle charges.

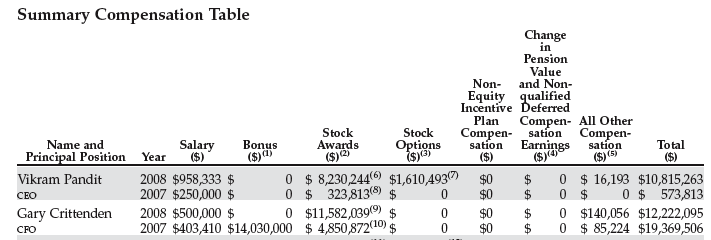

To give you a sense of proportion, Crittenden was Citigroup’s second highest paid officer. From Citigroup’s 2009 proxy:

He also sits on 8 boards. Do the math: this settlement is a mere inconvenience. And note, more important, the failure of the SEC to pursue Chuck Prince (in charge through November 2007). If investors weren’t finding the answers to vital questions in the bank’s financial statements, one could argue the written disclosures weren’t adequate either (it appears the SEC wasn’t willing to pursue this angle).

And Citi virtually thumbed its nose at the charges in its statement:

Mr. Tildesley is a highly valued employee of Citi and is making significant contributions to the company.

As Tom Adams noted:

When people talk about banksters this is what they mean – lying with impunity is not only not problematic, it is critical to career advancement and company “success”.

The message seems pretty clear. Sarbox was intended to curtail phony corporate accounting in the wake of Enron. But why resort to complicated transactions like the energy company’s famed Raptors when Citi shows that mere lying will produce the same results with much less fuss?

Back to the current post. It looks like we aren’t the only people to have found the settlement appallingly light. Per Bloomberg:

The U.S. Securities and Exchange Commission’s internal watchdog is reviewing an allegation that Robert Khuzami, the agency’s top enforcement official, gave preferential treatment to Citigroup Inc. executives in the agency’s $75 million settlement with the firm in July.

Inspector General H. David Kotz opened the probe after a request from U.S. Senator Charles Grassley, an Iowa Republican, who forwarded an unsigned letter making the allegation. Khuzami told his staff to soften claims against two executives after conferring with a lawyer representing the bank, according to the letter….

According to the letter, the SEC’s staff was prepared to file fraud claims against both individuals. Khuzami ordered his staff to drop the claims after holding a “secret conversation, without telling the staff, with a prominent defense lawyer who is a good friend” of his and “who was counsel for the company, not the individuals affected,” according to a copy of the letter reviewed by Bloomberg News.

Yves here. This is why prominent lawyers and other high level fixers earn as much as they do. They have ongoing personal relationships with influential figures and can pull strings when they need to. But how a seasoned and supposedly tough prosecutor like Khuzami ever thought this settlement would pass muster is beyond me. Did he really think no one would notice or care, that this was a sufficiently old matter that any objections to it would die down quickly?

Needless to say, I’m glad to see this investigation move forward, but sadly, this initiative is just about certain to be an exception to the general rule of “banks get their way”.

Harry Schultz, after a remarkable 45 year period of publishing the International Harry Schultz Letter, has retired. His final letter, just out, included this warning:

Roughly speaking, the mess we are in is the worst since 17th century financial collapse. Comparisons with the 1930’s are ludicrous. We’ve gone far beyond that. And, alas, the courage & political will to recognize the mess & act wisely to reverse gears, is absent in U.S. leadership, where the problems were hatched & where the rot is by far the deepest.

I think the Harry Schultz quote you provided says it all. He sums things up perfectly

I worked with Art Tildesley for quite a few years (a ways back). He is an honest and upright guy and I am extremely doubtful that he would have knowingly passed along false information to investors. My guess is that he was made the fall guy by the company to protect their big money traders who conjured up the bullshit marks in the first place (and probably were in a position to rat out senior management as to how much they knew and when).

(Sorry about that first post in the wrong place)

Your choices are:

1. Rubbish at his job.

2. Stupid.

3. Complicit.

Please feel free to register your vote.

Reply

Ok. I vote that you’re stupid.

Your friend is a criminal. It is hard to face, and I am sure he is honest on the golf course, but this is how fascism works.

Yves, I suggest that NC adopt my style choice of always putting the word “regulators” in quotes.

Sorry, just because you assert something doesn’t make it true. Or am I wrong, because you somehow possess all the facts of what actually happened in this case? If so, please share them with all us us.

They obviously don’t care who notices. Who’s going to stop them now? Their friends in the AG’s office who are also complicit in a number of other cover ups?

I spent nearly 25 years toiling as an attorney at the SEC, leaving at the end of 2007. I thought it couldn’t get any worse than it was during the Bush administration. My friends who are still there tell me that the Obama appointees are a) just as anti-regulation as the Bush appointees were; b) totally owned by the registrants and c) just plain incompetent. Khuzami’s appointment was widely panned at the time it was made. Same for the boy wonder he brought in from Goldman, or Citi or wherever it was. This is the kind of thing that was happening every week in every division at the SEC. Think back to the enforcement attorney who was fired because he wanted to subpoena the head of Morgan Stanley. The woman who headed the division then took phone calls from his attorney at home on a Sunday night and lo and behold, the subpoena wasn’t issued, the investigation was dropped and the SEC attorney was fired. So how long do you think it will be before Khuzami does a Peter Orszag and heads off to Citi or Goldman or equivalent?

thank you for writing about this… it is good to hear from someone inside the SEC! That perspective seems to be missing from most of the crisis books.

This jives perfectly with the axiom stating that Obama is to the financial industry what Bush was to the energy industry.

USA…marching with gusto toward Banana Republic Land. We had the Argentina of the colonels, we shall have the US of the DHS.

It’s only a matter of time and it won’t be pretty around here.

Got a 2nd passport?

BTW, for those who would think I’m being hyperbolic, please consider this:

http://www.salon.com/news/opinion/glenn_greenwald/2011/01/11/justice

Read this article carefully; then, ask yourself if such an article would even have seen the light of day, let’s say 20 years ago.

That is how low we’ve gone, and the slide has just begun.

“[F]or those who believe that leading right-wing figures are inspiring violence … shouldn’t they be treated the same way American citizen Anwar al-Awlaki is: i.e., targeted by the U.S. Government with due-process-free assassination for inciting violence? Doesn’t the mentality justifying Obama’s assassination program necessarily extend to other Americans accused of ‘inciting’ violence with their political speech?”

Hard to argue with that logic. That’s exactly where we are under Obama.

The Greenwald post that Fracois gave ties in well with the Greenwald “Fear” post in the last Links entry. The US seems to be seriously devolving.

Tonight, I just noticed that the PBS Frontline show scheduled next week sounds interesting:

“Dana Priest investigates the terrorism-industrial complex that grew up in the wake of 9/11.”

The SEC has never had any mission other than pretending to regulate big time Wall Street crooks. It keeps busy issuing press releases, demanding the preparation and filing of impenetrable and meaningless documents and harrassing penny ante chislers. The essential idea is to make investors believe Wall Street runs an honest game. Without this belief the business as usual cons could not be run.

Khuzami is just the latest in a long line of empty suits soon to be moving on to a big bucks job representing and defending corporate criminals.

Khuzami was a prosecutor in some terrorism and financial cases in the Southern District of NY. He then went to work for Deutsche Bank from 2004-2009. The guy who hired him at Deutsche Bank recommended him for the job at the SEC. He is also a McCain Republican if that helps. All in all it seems a case of the chickens needing protection and giving the job to a highly respected fox. The results are what you would expect, good for the foxes, not so good for the chickens.

Adam Storch, by the way, was the young Goldman boy who was hired on at the SEC as chief operating officer. Khuzami applauded the choice.

http://www.huffingtonpost.com/2009/10/16/adam-storch-sec-hires-exg_n_323526.html

Take a look at David Bergers, Director, Boston Regional Office, and his settlement with the Boston Stock Exchange in 2007. My calculations are that the Specialists made 100’s of $MM for front running, trading ahead, etc.. and the SEC made a settlement with an old retired BSX President for $75,000. I am just waiting for the right situation to release the real story behind what actually happened. Maybe even a tie into the Madoff saga….

PAYBACK is HELL….

BDH

We are ready when you are :)

Don’t wait too long. Statute of limitations and all that.

I don’t know who is right or wrong or whether or not this is even relevant, but my memory hole is not that big. When I read this, this is what came to mind.

2. Robert Khuzami is a bad ass, no-nonsense, thorough, award winning Prosecutor: This guy is the real deal — he busted terrorist rings, broke up the mob, took down security frauds. He is now the director of SEC enforcement. He is fearless, and was awarded the Attorney General’s Exceptional Service Award (1996), for “extraordinary courage and voluntary risk of life in performing an act resulting in direct benefits to the Department of Justice or the nation.”

http://www.ritholtz.com/blog/2010/04/10-things-you-dont-know-gs-case/

Don’t worry, he is a bought-off shit-head. Since our chilrens’ futures are being destroyed, perhaps the children of financial terrorists should, in a controlled and totally legal way, be informed of their parents crimes.

let Khuzami explain to his child why he protects financial terrorists.

YS:

I have been screaming about the SEC as being a “paper tiger” owned by Wall Street for years. Why is anyone surprised at this? I opposed Khuzami’s appointment as enforcement chief because of his prior Wall Street affiliations. Look at the SEC’s $550 million Goldman settlement, only 4.2% of the $13 billion Goldman got from AIG. What a farce SEC enforcement is.

THE ROPE

Jesus! WHATS THAT?

Looks like a rope.

What kind of a rope?

Looks like the same rope that the SEC fed Madoff for thirty years.

What do you mean?

The SEC fed Madoff a rope for thirty years hoping that he would finally hook himself. Imagine the shock when the SEC found themselves looking down the barrel of a full blown confession From Madoff himself after thirty years of everyone telling them he was running a 50 billion dollar phonzi scheme.

What did they do?

Well, I heard the SEC Chairman went looking for a newer version of Debbie Does Dallas.

Didn’t they put him in prison?

Yeah they did and they gave him 125 years which at his age now means he might spend two years in there before he croaks.

So what is the Sec doing with this rope now?

Looks like they are fishing again. Looky there! They are playing out both ends. Maybe the FDIC is fishing with the other end.

Kinda like they are looking to catch two fish with one rope?

Sort of I guess. Kinda like jigging.

Who they fishing for?

Well the cess pool is full of the Madoff types. Thieves are every where. There is Thayne, Diamon, Fuld, Ken Lewis, Killinger, Mozilla the list is a long one.

Think they will catch anyone?

The SEC is forced to at this point. The FED budget is so bad that the SEC and FDIC both need the 10% rake to keep them afloat. Maybe this time it won’t take 30 years.

Maybe the Tin Man can Help?

I doubt it; I heard he fell down the hole on top of Alice. Banged them both up pretty bad and last anyone saw of them they were being dragged down the Yellow Brick Road. Shiiiish!! Quick Call the FDIC and let them know to let out some more slack. I think we are into the evening bite, and get some Pundits up here! Their gonna want to see this.

OK! But If the SEC and FDIC let out to much slack they might get confused and bite their own hook.

I think they may have already with Citi and Goldman. They might even snag a couple of Paulsons in the process.

Duh! Uh uh wh wha whats uh whats that?

They call them Stutter Fish. Jesushoppedupjahosafat. Where have you been?

Johnny Lunch Box

JPM