The officialdom has moved on to a new form of theater, namely legislative mud wrestling, which serves as a useful distraction from the failure to deliver on what ought to have been the first order of business, namely reining in the financiers. As we’ve said repeatedly, cleaning up the banking system is a necessary precursor for recovery from a serious financial crisis. Instead, whether by dumb luck or design, enough Americans have become fixated with various forms of jealousy over advantages they believe their neighbors have (whether accurate or not) that it is providing a great smokescreen for the oligarchs to continue their looting.

The fact that the economy has moved up up from a serious trough is hailed as a recovery. But to the vast majority of Americans, the talk of better times rings hollow. The top echelons are back to spending smartly, and Wall Street bonuses for 2009 and 2010 were lavish.

But even though spending economy-wide perked up in December, some question whether it was savings fatigue rather than a return of consumerism. And while some have argued that the economy had entered sustainable recovery, federal fiscal stimulus is likely to be met if not exceeded by state and local budget cuts. And that’s before we see the impact of Eurozone wobbles and rising commodity prices, particularly if oil continues to rise thanks to widening turmoil in the Middle East.

Dave Dayen provides an apt description of the parallel universe in which policy decisions are being made:

Consider that Meet the Press managed to get through an entire show yesterday on the economy while mentioning jobs and unemployment exactly once, and you can see what I mean. Washington concerns aren’t being driven by outside agitators so much as by their penchant to cover up the misdeeds of elites. If we don’t address the financial system and their role in the crisis, if we don’t address the jobs crisis, then there’s really nowhere else to go to but the budget. And so we have this warped conversation where deficits stand in for economic growth and opportunity, despite all evidence to the contrary…

And yet, we basically have two parties who are fighting over the same patch of turf, both trying to claim the mantle of deficit reduction. Both parties speak about tax increases as if they were talking about syphillis. Democrats at least talk about job creation, but they haven’t infused it with any passion or sense of urgency. Democrats don’t have to co-opt the Tea Party, but they’re giving it a shot – and mainly to please donors in the next election, in my view, signaling to them that their businesses will not be disrupted and their untold riches are safe.

Contrast this with the latest report from the not-for-profit credit counseling agency CreditAbility. Its latest report (hat tip Doug Smith) shows that, contrary to media cheerleading, consumer conditions deteriorated in the fourth quarter of 2010. That means not only did conditions worsen during all of last year, but the standing of household budgets is at its worst level since the first quarter of 2010.

And Mark Cole, who is oversees the credit index, does not see reports of improved economic conditions translating into healthier consumer finances:

“Improved stock prices have increased the value of 401(k) and other investment accounts in the average US household, but high unemployment continues to stifle income growth, causing many homeowners to miss mortgage payments,” Cole said. “While an increase in consumer spending helped the economy in the fourth quarter, the index showed that an increasing number of people failed to prudently manage their household budgets. This lack of savings could cause financial problems if they need to rely on their savings in the future.”

Cole does note that households with stable and unimpaired incomes are beginning to spend more freely, but distress is becoming more acute for those whose cash flow has not recovered. And the number of people in the latter category is large enough to call the happy talk about the state of the economy into question.

Definitely one of those “Let them eat cake.” moments. The upper crust is rapidly turning into a scab over an open wound.

I think your response is correct but insufficient. The elites are the clear winners here in Smash and Grab America, but they are joined by the following segment of the middle class: anyone who bought a house before 2004, or who lives in part of flyoverland which never got bubbly AND who did not lose their job.

That’s about half of America, which means that this crisis has a pretty random element to it that is NOT class-based. Of course, of those who escaped job and salary cuts, a substantial percentage are public employees, hence the latest phase of the crisis now unfolding.

You basically mean everyone not currently food for the debt based monetary system.

Capitalism only works so long as there is viable demand for the supply. That means you need a fairly balanced convective cycle of appreciating assets and precipitating benefits. Trickle down economics just leaves enormous storm clouds of surplus wealth hanging over a parched economy.

The wealthy can rewrite every civil and criminal law in their favor, but they can’t change the laws of nature.

Whistling past graveyards seems clever, or is perhaps the core of denial. But the insecurity of the middle class is a class issue. Labor arbitrage only suits the rentier class and a few of their agents. Offshoring is a dead loss to the people in the losing country. The myth of the nest egg is looking thinner and thinner. And despite what Reagan always said, sunrise industries didn’t replace sunset industries.

As we ride out the dying momentum of the New Deal and all it built, there will be some who ride in comfort. There were citizens of the Roman empire who lived their entire lives without being pillaged by barbarians, but their grandchildren ended up in the Dark Ages. Union labor can hold on, one hopes, and doctors won’t follow nurses and computer programmers into casual labor. Maybe.

It might be another’s trouble and none of your own. Then again, it might be them today, you tomorrow. Here in Smash and Grab America, even those of us not out on the street pass the empty shops and read about our neighbors and know the rich divide the human race into “people” and “the help.” We, not the people.

Leviathan, I think your post is disjointed but excessive.

I tried to empathize and find some kind of point of view that might produce what you wrote, so that I could just ignore it. I failed, hence this response.

You start out saying the elites were bad. Then you make an observation that a number of people, mostly in the center of the US, managed to make it through the crisis, so far, without major problems. Somehow, you seem to group these people with the banksters as a group that isn’t a class, and through some mystical math, deduce they are half of America.

Some of them are public employees, therefore (as I read it) crushing the unions is the next, and logical, step.

Sheesh.

Wiki says Leviathan is one of the seven princes of Hell and its gatekeeper, but the image you use with your posting name seems to be of the Dali Lama. This schitzo identity may illuminate the logic of your post.

I just read that the ski industry in the northeast is having a stellar season. What does that mean? Well, many in the middle to upper middle class seem to have a ton of money (and time) to recreate this winter.

Mike – that the snow has been fantastic this season is a huge driver of this. Certainly not the only one, but it is an industry whose business cycle has the weather superimposed over it way, way more than other industires. Sno-cone sales will be up if its 105 in Philadelphia in July – bet on it.

Yeah, well, skiing is still an incredibly expensive activity for the average family. I never had the pleasure of outfitting a small clan and piling them into a large SUV and driving them up to a hill and house them there and feed them and then buy four lift tickets a day after renting the equipment.

I would have bet someone a nice sum that three or four major hills would be bankrupt by this time after the crash a few years ago, but, nope, people like to ski, it seems, and have the cash or credit to do it.

Yeah, last month I drove my oldest daughter up to central Wisconsin for a long day of skiing and one night in a hotel. Total cost: $350. But I think the “average” family is much more likely to spend 5 or 10 times that much on a big trip to plastic fantastic Disneyworld. Skiing isn’t just for Biff and Buffy. And it’s a hell of a lot more fun than the mind-numbing passive entertainment that most people go for.

The average family has an income of about $40,000 a year. I don’t think they’ll be going to disneyland this decade.

$350? Sure. Now, if you want to be like the “average” skier in America, multiply that by, maybe ten times, because you’re going to visit the slopes that much. You should, if you want to be any kind of skier. A day or two a year doesn’t include you in the club. Do you want to spend the rest of your life wedging down a beginner’s hill?

Now, subtract that 3500 bucks from the average income, and, you’ll understand what I mean about it being only for the wealthy or profligate.

“If we don’t address the financial system and their role in the crisis, if we don’t address the jobs crisis, then there’s really nowhere else to go to but the budget.”

That was it, folks. The 111th Congress is all there was or ever will be. Dodd-Frank and the FCIC report WERE the Democrats’ response to the financial system and its role in the crisis. ARRA WAS the jobs plan.

So, if you’re waiting for a Glass-Steagall or a Pecora Report, or a WPA or a CCC, if you’re waiting for the “people’s party” to repudiate thirty years of trickle-down foolishness, if you’re waiting for “objective” professional and academic economists to admit they were completely wrong about the service economy, free trade and deregulation, stop waiting. It ain’t gonna happen. We’re back to cutting our way to bipartisan prosperity.

The most intelligent – albeit ruthless – way to handle the situation would have been to go to Dimon and the others and say, “how would you like to help us knee cap the biggest, baddest mother on the block, and in return, we won’t go after you?”

The administration missed the bus, which truly destroyed the Democrats last fall, on putting a bunch of guys in orange jumpsuits. Hint: Madoff wasn’t enough.

“You don’t bat zero for the season without a plan.”

The Fed (comliments of its “duel mandate”) has apparently fired first (and often) giving global consumers a mortal gunshot wound.

The Fed’s duel mandate of watching out for wall street and watching out for lobby groups has been a successful charade, but as for the reality of the average American struggling in this Great Depression — things are still getting worse!

Lets summarize:

Yves opposes QE2, the stimulus generally, bailouts to banks, etc.

Supports new consumer protection bureau, punitive action against banks, etc.

Criticizes Washington government for doing nothing.

If you are criticizing the government for inaction, perhaps you should recommend an approach? Personally, I think there isn’t really anything the government can do to boost the economy. So I am a little bored of these articles that blame Obama for not providing some magic economic rocket fuel to jump-start the economy.

The economy was jump-started, but…turns out that the gas tank doesn’t have much in it. The stimulus worked. But it doesn’t erase the fact of the massive private debt hangover, only somewhat reduced since 07.

Obama is actually trying to get us to invest in some magic rocket fuel — science and math education. Guess who did that once in America, with spectacular long term results… Eisenhower.

Yves is asleep right now, but I’ll try and make an educated guess and answer your question, then later on Yves might answer too.

Problem A – The economy is constipated with debt right now. You can’t cure constipation with coffee and snorts of coke.

The actions would be to (1) help deserving homeowners with loan mods. (2)clean up bank balance sheets with write offs, etc….(this one is complicated of course)

Clean up the legal/regulatory system.

I’m glad you are so well set up that you can afford to be bored in the face of so much suffering in the country. The two parties are doing something for ordinary Americans in Washington but it is akin to throwing lead weights to a drowning person. There is no magic needed for what ails us. What we need to do is direct the wealth flows that have been going to the rich for the last 35 years back to the lower and middle classes. This is not likely to happen until there is rioting in the streets, and probably not even then. Obama is as big a kleptocrat as any but then so is every member of the House and Senate, bar none. Nothing will change until every Democrat and Republican in Washington and the state house is removed from office. Every vote for a Democrat or a Republican is a vote for kleptocracy.

You have this dead wrong. I favored fiscal stimulus when there is economic slack. Were you asleep when I’ve written and crossposted against austerity? I had a ton of posts last summer on sectoral balances and even had a co-authored New York Times op ed which explained why government deficits were necessary when companies and households were net savers, which is what we see now.

I am dead opposed to QE2 as an inefficient, dangerous (as in it undermines price signals and stokes asset bubbles), extrabudgetary (as in arguably Constitution abusing, but too hard to make the case in court) method of trying to achieve the same end.

But all the evidence is YOU NEED TO CLEAN UP THE BANKS FIRST. Funny you airbrush out this part.

Yves, all consumer spending does is accelerate wealth extraction from communities. If I go spend an extra $1,000 at the local Home Depot, that money is moved to some overseas account and distributed as bonuses to executives or used to gamble on credit. Maybe a little is left to pay wages. But that cycle just continues until all the wealth is drained from a community and the community becomes a ghost town. While all that wealth is accumulated at the top where it doesn’t circulate anywhere. I believe Robert Reich was discussing this on Thom Hartmann the other day. So at the community level, you have people “trading” in the same wealth at was always there. And you have some that make a little more while some make less. but those that make more spend it and it goes back to the less. Nothing is ever gained. It’s just trading money back and forth. This is not growth. It is thievery.

“But even though spending economy-wide perked up in December, some question whether it was savings fatigue rather than a return of consumerism.”

I witnessed this during holiday charity drives, which were a teensy bit better than the same group from 2009, which hardly gave at all. I think people are just tired of being pinched.

And Eric, I’m sure much more eloquent posters will answer you, but I would say first and foremost that one thing Obama could have done is raise taxes a puny 3% back to Clinton-era levels in order to increase revenue. Instead he took the easy way out and allowed the wealthy to enjoy a zillion dollar tantrum at the expense of the country and the middle class. And not for the first time.

We should be concerned about one-industry (banking) rule or one class (the rich) rule as much as one-party rule.

None of them is healthy.

400,000 people die yearly from tobacco related illness. The GOP understands we are experiencing hard times and decided to donate just shy of 230 million dollars to this industry in 2009. Your tax dollars at work for a better America.

divide and conquer, a little shell game there, and lots of righteous indignation from the Corporate overlords was all that was needed to take American down.

those that survive the scam called Corporatism will be few and far between.

we are seeing the “new America” that follows this effective and quite successful theft of American and the “little people.” a return to the Dark Ages, in so many ways.

i can’t even imagine anyone/group or entity countering the Big Lie of the last 30 years in any tangible way.

our Goose is cooked. and someone said they wouldn’t kill the Golden Goose.

Au Contraire!!

..the outright lies that have led to this moment (Malcolm said “The chickens are coming home to roost”) have compiled in my lifetime since JFK-RFK-Malcolm-MLK, and so many, many

more..

So many perceptive awarenesses above..negated by lies from Bushit, 911, internationally illegal invasion of Iraq, torture and kidnapping, economic devastation.

Someone spoke of the 50% in “flyover land” who avoided it all by not overextending…we KNEW 10 years ago where this was headed, told everyone we knew (largely didn’t want to hear it) and paid off everything we owed..it doesn’t help.

We care too much about others…whom we work to help.

Obama was supposed to DO transparency, oversight, accountability for the lies…”The Nation” has a fine article by Obama I.T. guy who brought it all together for election-says they were put out to pasture after election, so the politicians wouldn’t be inhibited by grassroots..sounds true.

sooooo, does that mean Ron Paul gets to whack American next?

I’m confused.

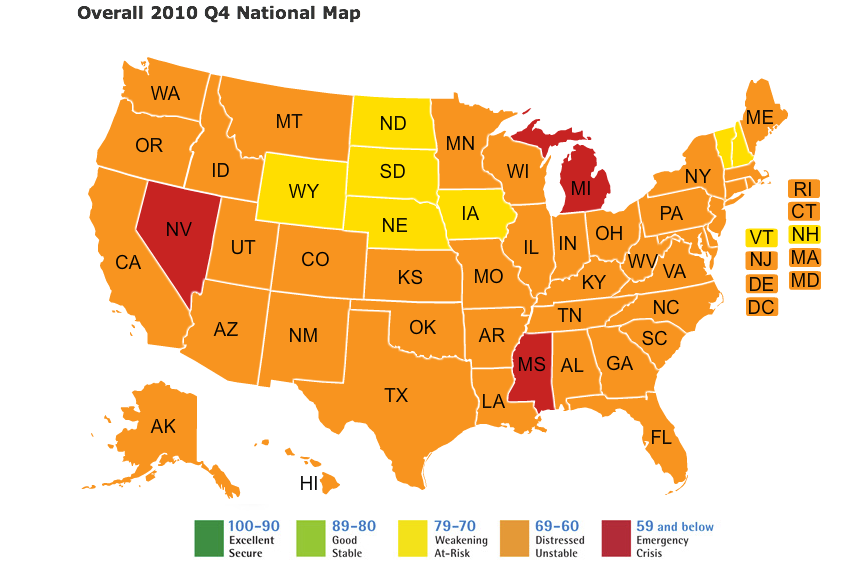

1)Why is the Upper Midwest weakening? Prices for wheat, soybeans and corn have increased over the past twelve months….as has the price for farmland.

2) and Wyoming? I thought this was an oil exporter (again, rising prices…….

??

Um…trickle down economics has become a very dry martini…where only the cap of vermouth is presented over the cocktail in its construction…its a martini only in name.

There are bizarre ideas circulating about economics. For example, the idea that stimulus should be used to assist a non-productive sector of the economy, banking. Banks produce nothing themselves. If the system needs money, then give the banks earmarked funds to lend, fixing rates and fees at nominal levels.

Then there is the concept of eternal indebtedness. A government can and should run permanent deficits to benefit the economy. Of course, as long as the economy grows this debt will grow and since it has been quasi-institutionalized to never reduce the debt, it will grow rapidly during stimulus without concurrent reductions when the economy has recovered. Ultimately this is, of course, unsustainable.

Washington has decided once and for all that wages and benefits no longer matter. It is merely necessary to increase consumer spending by any other means possible including increased debt by subsidizing purchases of things such as houses and cars. Debt creates a virtuous cycle for the banking industry as they reap the usurious interest rates and then get government bailouts when the consumer cash-cow is bled dry.

I would not so much say “Fuck America” as “Fuck Mankind and the Leaders it produces”. Our very culture is warped and twisted.

I’m really impressed with your writing skills as well as with the layout on your weblog. Is this a paid theme or did you modify it yourself? Either way keep up the excellent quality writing, it’s rare to see a great blog like this one these days..