By Delusional Economics, who is unhappy with the current dumbed-down vested interest economic reporting. Cross posted from MacroBusiness

With the economic world firmly focussed on the US debt debacle this week it is likely that Europe will slip off the radar a little. I suspect, as many people do, that for the US there will be an eleventh hour resolution followed by a short lived bounce in the world markets. Once that bounce heads back to earth again it is likely that the world’s eyes will turn back to Europe. There is much to see.

It hasn’t taken very long for the world to wake up to the fact the that EFSF is only going to work if there is a sudden stabilisation of Europe’s weak economies. That obviously isn’t about to happen so the markets have already started pecking at the weak links.

Spain’s 10-year bonds declined, with yields ending the week above 6 percent for the second time this year after Moody’s said it is reviewing the nation’s Aa2 classification.

Ten-year Spanish yields climbed 31 basis points to 6.08 percent. They have added more than 60 basis points this month. The nation plans to sell 3.4 percent securities maturing in April 2014 and 4.4 percent bonds maturing in 2015 at an auction on August 4.

Italian 10-year bond yields advanced 46 basis points to 5.87 percent. Two-year Italian note yields added 67 basis points to 4.32 percent.

Apart from the fact that two contributors are already in strife there is also the small issue that the EFSF may not even be ready to help Greece in time for the next tranche.

The euro zone’s sovereign rescue fund may not be ready to pay the next batch of loans due to Greece by mid-September, euro-zone officials said, requiring Italy and Spain to lend directly to Greece even as both countries face alarmingly high borrowing costs themselves.

The issue was discussed by euro-zone finance officials in a conference call Thursday, including the possibility that Italy and Spain would opt out of making the next payment, one official said.

“We’re trying to get around this obstacle by getting the EFSF to finance the next tranche,” the official said. “The only problem is this is on very short notice.”

Euro-zone leaders at their summit last week directed the European Financial Stability Facility to make the next loan payment to Greece of EUR5.8 billion, replacing the bilateral loan system that euro-zone governments set up for Greece in 2010. But the EFSF must raise money on financial markets before it can make these loans. That could be difficult by mid-September, particularly during August when most of Europe is on vacation.

Complicating matters is the apparent need for several national parliaments to back new rules for the EFSF before the fund can lend to Greece. For the Netherlands and Finland in particular, this step will require the euro-zone and Greece’s private-sector creditors to agree on the specifics of the bond exchange proposed by the Institute of International Finance, the global association representing financial institutions in the Greek talks.

Negotiations between Greece and its private-sector lenders began Thursday, officials said.

The stunning inability of the Euro-elite to come up with a plan to solve the economic woes of even the smallest periphery nations has seeded the doubt for the larger economies. As the WSJ reported over the weekend that doubt has now moved to the core.

Is the euro-zone apple rotten to the core?

Greece, Ireland and Portugal are on bailout lifelines. Cyprus, significantly exposed to Greece through its banks and hit by economic and political turmoil, may be next. Spain has called early elections as it battles with its budget deficit and, along with Italy, is under the market microscope. Repeated emergency summits and pledges to protect the euro have fallen flat.

Cracks may now be emerging at the heart of the euro zone as government bond markets distinguish between French and German debt. French 10-year bonds, at 3.22%, now yield 0.68 percentage point more than German securities, far more than the 0.3-0.4 point gap seen for much of the year, and a level that has only been seen in the months following the collapse of Lehman….

But that doesn’t mean there isn’t cause for concern. France has vulnerabilities: Of the six triple-A-rated countries in the euro zone, it has the highest deficit, 7% of gross domestic product in 2010, and the second-highest debt, at 81.7% of GDP

.

My readers will be aware that I agree with the France prognosis, but most worryingly for the French, the IMF now have a “plan” for them.

The International Monetary Fund warned this week that France might have to take more measures to hit budget targets in 2012-2013. France is vulnerable to slowdowns in Spain and Italy, and its banks are exposed to debt in those countries.

Other problems aren’t directly of its making: the euro-zone crisis and the policy response to it. Each country that becomes affected simply reduces the number of options European government bond investors have, as well as increasing the strain on the strong countries that are on the hook to fund rescues.

I have spoken many times previously about the eventual outcome for imbalanced Euro-nations that take the IMF route.

Telling a country that has large public and private debt, a trade imbalance and no control over its monetary policy to cut spending will have the same effect it has had in every other country in the same situation. It will cause a sharp rise in unemployment and sharp fall in GDP. This will inevitably lead to further falls in government revenue which will make the problem worse not better. As this happens the EU and the IMF will tell the country that it isn’t trying hard enough and tell it to sell public assets and anything else that could actually help it get back on its economic feet and actually be able to pay the money back.

The IMF plan is always the same, you can read a recent piece on Greece to understand the finer details. It seems, however, that Sarkozy is in agreement with the agency now run by his former finance minister and has already set a course for the French economy.

The International Monetary Fund warned France on Wednesday it would miss its 3 percent deficit target for 2013 unless it took further steps to cut medium-term spending, which were needed to safeguard its AAA credit rating.

With France gearing up for presidential elections in April, the Fund backed President Nicolas Sarkozy’s proposal to write balancing the budget into the constitution — a move bitterly opposed by the opposition Socialist Party.

Sarkozy has staked his reputation on cutting France’s deficit from 7.1 percent of GDP last year to the limit of 3 percent under the euro zone’s Stability and Growth Pact by 2013.

Budget Minister Valerie Pecresse said on Wednesday that pledge was “sacrosanct”.

In its annual review of France’s economy, the Fund said it expected growth and tax revenues to miss government projections. It forecast France’s deficit would decline from 5.7 percent of GDP this year to 4.8 percent by 2012 but not fall below 3.8 percent by the end of 2013.

“Under staff’s current projections, achieving the deficit target of 3 percent of GDP by 2013 requires further measures,” the report said.

With tax rates already amongst the highest in Europe, France’s only option was for the government to reduce its spending to meet its fiscal targets, the IMF said, particularly in areas such as pensions and healthcare.

The Fund said a reduction in the deficit of 0.2 percent of GDP was needed in 2012 and 0.6 percent in 2013.

Pecresse said that, if needed, the government stood ready to make further reductions in tax exemptions to meet its fiscal targets.

“The deficit reduction target is sacrosanct. France has to have a deficit of 3 percent in 2013,” she said.

The French government can promise whatever it wants but this is simple economics. A reduction of government spending in an economy highly reliant on debt and with a negative trade balance will deliver the exact opposite of what the IMF promises, as it did for Greece.

With concern over contagion sending shock-waves through the euro zone, President Nicolas Sarkozy played a decisive role in securing a deal last week on a second Greek bailout.

But economists say France’s top-notch credit rating remains under scrutiny.

France has the highest deficit, debt and primary deficit — which excludes interest payments — among the AAA-rated euro zone countries.

“France cannot risk missing its medium-term fiscal targets given the need to strengthen implementation of the Stability and Growth Pact (SGP) and keep borrowing costs low by securing France’s AAA rating,” the IMF staff report said.

Under its baseline scenario, the IMF said France’s debt would peak at 88 percent of GDP in 2013, but it warned that it could climb as high as 95 percent of GDP if interest rates were higher than expected and economic growth slower.

The government forecasts that debt will peak at 86.9 percent of GDP in 2012.

The Fund said the constitutional reform being debated by parliament would “help to unequivocally signal the authorities’ commitment to the adjustment path”.

It also called for France to instigate a multi-year budget plan based on independent economic forecasts and urged deeper reform of the pensions and healthcare system to secure long-term fiscal sustainability.

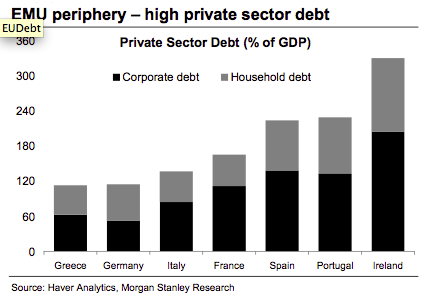

Obviously that report is ignoring private sector debt, which if included takes France’s total debt well over 100% of GDP and actually far worse than that of Greece.

As I stated in a previous post on France:

A quick glance at French fundamentals tells you they are in the same position as the Portugal, Italy, Greece and Spain. High debt in both the public and private sectors, trade imbalance that continues to grow and a current account that has been in the red for years.

As France has a much larger economy than the periphery I can only assume that people thought that it is somehow immune to the same problems. But any nation in this situation that decides to address debt before addressing productivity is committing economic suicide. France, like so many nations before it, is now reaching for the same discarded revolver that Greece has already discharged into it’s own head.

It is only a matter of time before the next “European Crisis”.

>>> most worryingly for the French, the IMF now have a “plan” for them. <<<

Is there any chance we can put Dominique Strauss-Kahn in charge of that plan?…LOL

I have spoken many times previously about the eventual outcome for imbalanced Euro-nations that take the IMF route.

Telling a country that has large public and private debt, a trade imbalance and no control over its monetary policy to cut spending will have the same effect it has had in every other country in the same situation. It will cause a sharp rise in unemployment and sharp fall in GDP. This will inevitably lead to further falls in government revenue which will make the problem worse not better. As this happens the EU and the IMF will tell the country that it isn’t trying hard enough and tell it to sell public assets and anything else that could actually help it get back on its economic feet and actually be able to pay the money back.

The IMF plan is always the same, you can read a recent piece on Greece to understand the finer details. It seems, however, that Sarkozy is in agreement with the agency now run by his former finance minister and has already set a course for the French economy.

People of France, you’re up again.

Last autumn they put up a good fight against a preliminary austerity assault and lost, primarily because they obeyed their unions and their “Left” establishment and, predictably, were sold out.

Now, also predicted, the enemy’s coming right back at them with a far more comprehensive assault. (And we know this will always continue, everywhere, for as long as we allow it.)

One thing’s for sure – if the French people want to fight again, they’d better do so according to their own plan and interests, not under the Leadership of business unions whose treachery is proven.

“… a sharp rise in unemployment and sharp fall in GDP. This will inevitably lead to further falls in government revenue which will make the problem worse not better. As this happens the EU and the IMF will tell the country that it isn’t trying hard enough and tell it to sell public assets… ”

Funny, this is just what California has done, even without the IMF’s demands.

Could it be that the Wall St. lenders offer the same demands when states in the US need loans?

Curious. Probably not just a coincidence.

…FOR AS LONG AS WE ALLOW IT!

You need to study all the different manifestos of neoliberalism. It can be done at the personal level or the global level. Neolibs don’t like tying up capital in social programs but if they must, those programs are better privatized to create a revenue stream. Any time money changes hands in a consistent pattern, there is a potential revenue stream that can be securitized or “taxed” profitably. Asset sales are one-off revenue streams. Debt is a traditional revenue stream. In the end, someone wins and someone loses, hardly sound economic advice. A global economy run by fast money and speculators.

Excellent observation. You might say that “revenue streams” are held for ransome, Ransome. One nit I would pick though, the term cash flows as opposed to revenue streams might be more technically correct.

Oops, did I make a potatoe error? It would also be more technically correct for me to say “held for ransom, Ransome”.

To err is human…

Personally, I am glad that the “people of France” are up. The same way I am glad that the people of the United States are up. I hope they enjoy their diet of neo-liberalism. They loved watching others suffer, and they cheered and rejoiced when French and American bombs were being dropped on the people of other countries. They felt privileged, special, and entitled and said nothing while their governments raped and plundered other nations.

So, my dear Frenchmen and Frenchwomen, how do you like to be treated the way you had treated the people of Haiti for hundreds of years? Or the way your genocidal country has raped and abused so many other nations? You did not stand up for those peoples when they were being murdered in your names. And you still do not stand up for them even now. But you protest when your 2-month vacations are being cut?!

So suck it up, you French sissies, because you’re all Haitians now! Get used to it! What goes around, comes around. And boy, am I glad to see it happen in my lifetime.

Thank God, there is justice in this Universe!

It sounds like you’d like Fanon, if you haven’t read him already.

Today Haiti’s under vicious assault by the same neoliberal cabal as is assaulting the workers of France and the US. So I think the constructive view is that the enemy of my enemy is my (sort of) friend.

Indeed, I have no compassion for the French, Americans, Brits, and other such profligate peoples who took pride and pleasure watching how their genocidal empires have raped and plundered other people. As such, I rejoice seeing the on-going collapse of capitalism and the Western system of colonialism. But I do feel solidarity with the Greeks, as they too have been kicked around for hundreds of years, and have not shown arrogance to others.

By the way, Amy Goodman, on her daily news program DemocracyNow! ( http://www.democracynow.com ) has had a large number of programs dedicated to the Haiti issue. A few months ago she was also the only journalist allowed to accompany Aristide on his return from exile. Her last show about Haiti was just 2 weeks ago:

http://www.democracynow.org/2011/7/14/dr_paul_farmer_on_how_us

I remember saying here over a year ago that I thought France was going down.

Now, I would like to predict that by spring next year, Germany will also be in trouble. But by then the IMF will be all out of money, so I foresee that Germany will desperately beg Turkey for help. Turkey will agree to help, in exchange for the former German Democratic Republic. Angela Merkle will gladly give up East Germany, and as a sign of her personal submission to the Sultan, she’ll immediately start wearing a burqa at all official engagements.

Like they say, “the bigger they are, the harder they fall”…LOL

Hm,m…

Is it possible that capitalism isn’t all that good for just regular people?

Oh no. No chance of that. The problem is, there is to much government regulation interfering with free market forces…LOL

I wish I could remember where, but I recently read where Europe has created something very dangerous, and it is this:

The hodge-podge of institutions is removing the people’s option of “throw the bum out.” Greece is a perfect example; they have a leader who publically takes orders from a whole chain of faceless, souless institutions, none of which are Greek. These institutions are demanding that he harm his people.

The only time this usually happens is with an occupying army present.

Michael Pettis thinks it has the potential to blow sky high.

Hard to argue with.

OK, where is the European Parliament?

It was showing promising signs of flexing its muscle a few years back. Where is it?

Why isn’t it seizing power, like Parliament did back in England during the period in which England developed its democracy?

Why isn’t it coming out and saying “This will not be allowed. We will coin money to revive the economy, and we will do it now.” ?

The bully pulpit value of Europarl’s legitimacy is very significant, regardless of what the “treaties” say.

…”Greece is a perfect example; they have a leader who publically takes orders from a whole chain of faceless, souless institutions, none of which are Greek..”’

The same in Ireland.We had the pleasure of verbal beatings from Sarkhosy over Irish Corporation tax a couple of years after he had promised it would never be an issue if the Irish revoted in the Lisbon Treaty they had rejected.

In Ireland Sarkhosy represents everything bad about Europe,he is a proven liar and a bully of smaller states.

Roll on the bankruptcy of France .Roll on the implosion of the Euro.Roll on the destruction of the fascist EU superstate.

Sean,

There are some like mined folk in fascist America that think it would be a good idea to have a multi-national force against fascism and IMO the global inherited rich that seem to own everything and put these socipaths in positions of government and corporate control.

It is my opinion that the existing power structure is intent on playing us off against each other until, I can only conjecture, the death and misery please them enough and then maybe they will do it some more. Its a sick world and I hope that us pond scum can rise above the perversion of our fellow humans and try and create a more humanistic society.

Peace brother…..

There is this thing called a mind (minded, above) that I seemed to have lost somewhere…..please return if found.

Psycho

If we hadn’t defeated the Axis powers in WWII, Europe and the U.S. would be ruled today by Fascists. Wait a minute….. Anyone see my mind laying around?

So, the IMF (and Moody’s, and other rating agencies), are a form of world government–the economic masters’ control–above the elected governments; the IMF gives an order (a “plan”, a “recommendation”), and the president or prime minister of that gov. slaves to make it happen, (or gets replaced); this is how the invisible hands–international elites– manipulate “democracies.” Is this simple view correct? Disaster democracy, to modify N. Klein’s term; or, perhaps ‘disaster capitalism’ should be recognized as a political term, and a type of government–or did she say that? (Have not read the book). The new IMF president is a French woman, so, she was cynically chosen to do it to her own, kind of like we had to have a democrat to enable attacking Social Security and other pro-corporate/banking/financial laws? So, a financial juggernaut of elites is seeking to rule the world by banking invasion and occupation of assets and debt, as M. Keiser always says. Is this true, or just another c.theory? Just wondering what people think.

That’s some sharp insight rafael.

Charging against Italy and France may be the last and fatal error of the IMF-banskter mafia. Buy doing this they are making the crisis pan-European… though, well, maybe it was from the beginning, several years ago, and it’s just that the racist obsession with the “PIGS” blinded everyone.

Whatever the case, this will put France, Italy (and surely Belgium, Denmark and the UK, which is only outside the radar because of having a distinct free-falling currency) in a similar situation to that of Spain. France had a major general strike last year, mobilizing millions, effectively threatening oil supplies, etcetera, etcetera.

When it comes to taking the streets and paralyzing the economy with strikes and popular action, we have to admit that the French are the best. I’d dare say that only the French People can lead the European People into a continental revolution, as it has done at least once in the past. I may be wrong but everything suggests it is still the case today, more than two centuries later.

So I look to this new stage with interest rather than fear. I mean: there’s a limit to what a snake can swallow, right?

I hope you are right. We desperately need someone(people) to take the lead and get the ball rolling.

According to the Guardian, Greeks are increasingly unwilling to cooperate with a government that is no longer theirs, if it ever was.

http://www.guardian.co.uk/world/2011/jul/31/greece-debt-crisis-anti-austerity

I love “We Won’t Pay”. All non-rich people everywhere should do it. With taxes too.

I hadn’t been following it in Greece, but it’s great to hear it’s still going strong.

Two serious problems with it:

(1) It assumes the validity of the hegemonic currency. A real change movement should issue their own currency.

(2) It seems from the description to be preventing ordinary workers from getting paid. Bus fares? Doctors’ fees? Who’s paying the bus drivers and doctors? Are the members of the “We Won’t Pay” movement paying directly to drivers of private taxis, or not? Is it merely the government they’re withholding money from, or everyone?

Like the US, Europe has a job crisis!

psychohistorain: “It is my opinion that the existing power structure is intent on playing us off against each”

An Euroland perspective:

“The Anglo-Saxon financial operators have played sorcerer’s apprentice for the last year and a half and the first headlines in the Financial Times in December 2009 on the Greek crisis quickly became a so-called “Euro crisis”. We will not dwell on the vicissitudes of this enormous chicanery with a news item orchestrated from the City of London and Wall Street[…]

We estimated in 2009 that the world had about 30 trillion USD in ghost assets. Almost half went up in smoke in the six months between September 2008 and March 2009. […] it’s now the other half’s turn, the 15 trillion USD of ghost assets remaining, purely and simply vanishing between July 2011 and January 2012. […]

We can see the exhaustion of the “end of the Euro” dialogue by the fact that Wall Street is now reduced to get Nouriel Roubini to intervene regularly to attempt to try to give credibility to this fairy story. […]

When the Anglo-Saxon experts and media really can’t invent anything more to justify keeping « the Euro crisis » as a headline. […]

[…] it is obvious that part of the Greek debt belongs these 15 trillion USD ghost assets that will evaporate in the months to come.

No matter the word used, “restructuring”, “default”…, Euroland will organize a process that will cause the least powerful or most exposed creditors to lose significantly on their Greek exposure.

[…], at this point, the problem will be moved to the United States, Japan and the United Kingdom and nobody will pay attention to the Greek case where the amounts are ridiculous in comparison: Greece, €300 billion; USA, 15 trillion dollars.

http://www.leap2020.eu/GEAB-N-56-Special-Summer-2011-is-available-Global-systemic-crisis-Last-warning-before-the-Autumn-2011-shock-when-15_a6679.html

France is badly run. Agreed.

However, France has twice as many civil servants per million inhabitants than Germany. Is shedding a million or so useless guys such a bad idea? Of course, in a normal country, one would do that and devalue by say 30% to increase competitiveness.

The way things are, the government has absolutely not an inch of room in which to maneuver. All revenues are sucked up by the civil servants salaries plus all the benefits to the -too many- jobless.

I do not think there is any way out except leaving the euro. If France did such a move, it would immediately be followed by Spain and Italy.

Don’t you think this is going to happen anyway? The longer France and the others wait the more painful it is going to be.

It’s now pretty evident that the Euro was an anti-democratic, big capital power play in disguise. I hope it goes the way of the Dodo.

I think you’re making stupid assumptions as to whether the civil servants are useful.

Here in the US, for instance, it’s obvious that we have too FEW civil servants — important work just isn’t getting done because of understaffing. (And too many who think they, rather than the people, are the masters of the government, but that’s another matter…)

K Ackermann:

“they have a leader who publically takes orders from a whole chain of faceless, souless institutions”

Just to clarify, were you refering to Greece or the US?