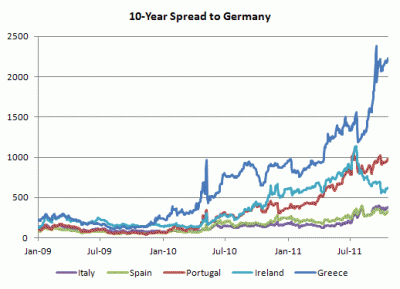

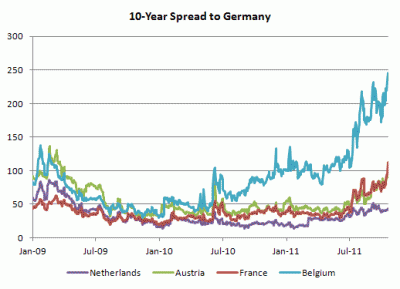

Look at these charts that Win Thin has crafted on sovereign bond spreads.

Yes, the periphery looks bad. But look at Belgium, Austria and France. That’s the euro zone core.

As I predicted in August and reiterated most recently last week when I saw Belgium’s CDS indicating a one in four chance of default:

we are going to get another crisis flare. What you need is a trigger for a gap up move in yields that would signal the next flaring of the crisis. The trigger and its timing are unknown, but the crisis they will precipitate is inevitable until the euro zone’s structural deficits are dealt with. As this is a rolling crisis, any gap up will also infect Belgium and France and potentially Austria.

My hope is that Europe moves to address the medium- and long-term issues before the crisis flares. However, I don’t anticipate they will.

–Felix Zulauf on the inevitability of further crisis in Europe

Belgium is clearly suffering some serious credit revulsion. France and Austria are being carried in tow. That’s where we stand now. The word is that the EFSF will get levered up and banks will be recapped. This may provide some relief but ultimately the euro crisis is more fundamental. Martin Wolf is right when he writes:

The fundamental challenge is not financing, but adjustment. Eurozone policymakers have long insisted that the balance of payments cannot matter inside a currency union. Indeed, it is a quasi-religious belief that only fiscal deficits matter: all other balances within the economy will equilibrate automatically. This is nonsense. By far the best predictor of subsequent difficulties were the pre-crisis external deficits, not the fiscal deficits

Deciding between breakup and deep fiscal integration is the only long-term crisis remedy

Belgium has been core only on paper for a long time now. Poor little country. While Austria is probably paying for its empire (again and again!). France’s development is strange. But not to give up, Merkozy is trying to lever up the rescue fund to 2e12 Euros (gotta love logarithms). http://www.guardian.co.uk/business/2011/oct/18/france-and-germany-move-towards-2tn-euro-fund

The only thing remaining: is it going to be allowed to be monetized by the ECB?

My guess is that without external financing, external deficits wouldn’t matter so much. (Since deficits need to be financed.) You’d think after this whole mess there would be much stricter laws on cross border lending, especially to countries that are already running a deficit.

Looking at Spain for example, with almost a trillion in foreign loans outstanding, one wonders if the real estate boom could ever have happened without cheap credit from the core Euro countires.

If you look at the numbers, the real estate boom was, in fact, driven by Core investment. And it wasn’t just the recent one, either; Ireland’s housing bubble, Eastern Europe’s, and the one Spain had in, iirc, 2002-2003, were all driven by core lending.

Belgium is being affected by Dexia’s 4bn bailout (+ unknown recap need). Meaning they would be stretched pretty thin (read can’t do) if they needed to do anything else.

People have been getting their money out of Europe since early June. This has been months in the making. Merkel and Sarkozy have shown how useless they are in actually trying to a) understand what is going on (solvency not liquidity)and b)making real leadership decisions. Oy. I look forward to when the two of them are gone. Sarkozy the most…

‘The word is that the EFSF will get levered up and banks will be recapped. This may provide some relief but ultimately the euro crisis is more fundamental.’

As others have pointed out, 20% insurance is not enough in an environment of correlated defaults, where typical recovery rates might be only 50%.

The levered EFSF is a pig in a poke. I reckon it’s gonna smack the wall in spectacular fashion this weekend, as Europe’s October 23rd rescue rave descends into unscripted chaos. These clowns are wildly out of control, and the market knows it.

Right on schedule:

France’s Sarkozy says Euro zone deal talks stuck over relations between EFSF and ECB according to centre right legislators – RTRS

France’s Sarkozy ready to travel to Berlin this afternoon to make progress on Euro-zone deal according to MPs – RTRS

Chinese fire drill time — sometimes life is suck!

It really is quite amazing how many people seem to think that if they just pretend a problem is what they hope it to be long enough, that it will become that. The GFC and elite reaction to it has been a real eye-opener for me, and I would hope many others, about just how “intelligent”, “on-the-ball”, “pragmatic”, and “serious” our technocrats are. Meritocracy, indeed; at least my plumber has the good sense to trust his lying eyes.

OMG, welcome to Euro Lala Land!

http://www.marketwatch.com/story/euro-zone-leaders-still-short-of-a-deal-report-2011-10-19?siteid=bigcharts&dist=bigcharts

Haircuts! Dancing bears! Vodka! Ibogaine!

Man, I hope I have enough crack to make it through the weekend …

FULL CLOWN POSSE:

http://www.marketwatch.com/story/sarkozy-flies-to-germany-for-euro-talks-reports-2011-10-19?siteid=bigcharts&dist=bigcharts

As G.W. Bush used to say … “Brownie, you’re doing a heck of a job.”

New European Bank Regulations Kick Ass..

http://www.youtube.com/watch?v=jSi899uhyQM