It’s becoming increasingly obvious to Mr. Market that the officialdom in Europe is not on a path to resolving its burgeoning sovereign/bank crisis. It is insisting on imposing austerity on debt burdened countries, which will only shrink their GDPs, making their debt hangovers even worse.

And Germany wants to have its cake and eat it too. It wants to preserve the Eurozone for the express reason of maintaining its trade surpluses, yet not continue to lend to its trade partners. Angela Merkel has stated the reason not to allow Greece to exit the currency union and depreciate its currency is that the Euro would rise on the assumption that other periphery countries would exit, and a strong Euro would hurt German exports. Duh. The Eurozone needs a combination of debt writeoffs, recapitalization of banks, and a program to reduce the magnitude of German surpluses with its EU trade partners. Even if the Eurocrats can figure out a way to create a big enough rescue facility to get through the next year or so, a solution will break down under continuing stresses unless the fundamental pressures are addressed.

The immediate trigger for the market downdraft was the admission by Greece over the weekend that it won’t meet its debt targets. The Financial Times points out that the latest ISM report today wasn’t terrible, but the two forward looking components, new orders and inventories, weren’t encouraging. New orders were flat and inventories fell a smide (which is a positive, it means parties in the supply chain will presumably at some point need to place orders to increase inventory levels). But the inventory decline was small, 0.3%, and lower than the rate of the month prior.

Unfortunately, this focus on the sustained but subpar activity in the real economy sounds an awful lot like early Great Depression statements that nothing had changed in the wake of the market crash. While the 1929 market meltdown was not the primary cause of the Depression, there were similar unsustainable accumulations of private sector debt, and a disastrous decision to go back on the gold standard by the participants in the Great War which put deflationary pressures on countries burdened by war debts. We know how that movie ended. We have banking systems in the US and the Eurozone that are too large relative to the real economy and are increasingly extractive in their behavior. Until we have a significant change in the role and posture of the major capital markets players, we are unlikely to see a solid recovery.

An overview from the Wall Street Journal:

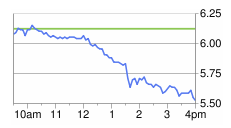

The Dow Jones Industrial Average dropped 258.08 points, or 2.4%, to 10655.30. Selling accelerated throughout the trading session, with stocks finishing at their lows of the day. The blue-chip index set a 2011 low, wiping away the previous level hit on Aug. 10.

The Standard & Poor’s 500-stock index slipped 32.19 points, or 2.9%, to 1099.23. All 10 of the index’s sectors closed in negative territory, led lower by declines in financial and energy stocks. The index, which also set a 2011 closing low, is down 19% from its high point for the year. It only is nine points from bear-market territory, considered a drop of at least 20%.

The technology-oriented Nasdaq Composite lost 79.57 points, or 3.3%, to 2335.83, marking its lowest close since Sept. 23, 2010.

The wave of selling picked up in the afternoon as worries over Greece and Europe’s sovereign-debt woes offset better-than-expected readings on manufacturing and construction spending in the U.S. Greece said over the weekend that it would miss its deficit targets this year. The acknowledgment raises concerns that the country may not get necessary bailout funds to avoid a default.

Gold may have regained some of its luster as a store of value. It rose over 2% today to $1657 per ounce, while Brent crude fell 2%. The euro fell to just under 1.32.

Bank of America’s stock fell 9.6% today. The possible news triggers for its rout were the exit of California attorney general Kamala Harris from the “50 state” attorney general whitewash settlement negotiations and a new analyst report suggesting that banks may be exposed to yet another source of mortgage related damage. Per Reuters:

A federal housing insurance program may be forced to deny bank claims for money lost in home loan foreclosures, costing them another $13.5 billion in mortgage-related losses, according to a report on Monday from bank analyst Paul Miller of FBR Capital Markets.

Bank of America Corp, JPMorgan Chase & Co and Wells Fargo, three of the four largest U.S. banks, are at risk for the biggest losses, the analyst estimated.

Investors may be coming to grips with the fact that the legal liability facing the bank is likely to be overwhelming. Warren Buffett’s vote of confidence won’t cut any ice with judges (and one has to note his investment was likely defensive, since if Bank of America comes a cropper, all eyes will be on Wells Fargo, whose mortgage exposures are even larger relative to the size of the bank).

Citi was hit even harder, suggesting that Mr. Market is back to worrying about the banks that nearly perished in the financial crisis. Its stock fell nearly 9.8%:

The plunge in the price of Bank of America’s stock today suggests the US regulators are going to have the opportunity that they missed in 2009, to resolve a major bank and send a warning to the rest that the costs of failure will be imposed on those responsible, management and the board, and those who signed up to invest in risk capital, meaning BofA stock and bondholders. But as we indicated last year, Team Obama has cast its lot in with the banks, and no “Nixon goes to China” moment can be expected from the banksters’ best friend, Timothy Geithner.

The ONLY good thing about our money system is that it damages the banks too. Why is that good? Because if the money system hurts everyone (and it does) then the political consensus to bailout everyone can be found.

It’s only money and money is just electronic bookkeeping entries. What are we waiting for? Great Depression II followed by WW III?

I’m sure the people on this site know this, but just to restate the obvious:

Remember that the big banks are not the same as the Wall Street insiders. The people in charge may not care if (for example) Bank of America goes down, just as long as they have looted everything of value from it first.

Remember also that there need not be any proportionality. If an insider makes a personal profit of a billion dollars, and it costs the rest of us or a publicly traded corporation 100 billion, so what? The insider has still made a billion dollars.

One also wonders how many bets the people running the system have made that it will collapse… A lot of people might be very well positioned for what’s coming, hard to say…

“so what? The insider has still made a billion dollars”

Well, they are ‘saavy businessmen’.

Historically speaking, saavy has a way of becoming…savory…in the end.

And so I encourage all Americans to vote for the Donner Party in 2012. Our platform: Eat the Rich!

The Warren Buffet effect is more folklore than fact. Today he bears no resemblance to the younger self that earned his reputation. The few deals he does get are more by reputation, size and connection to gov’t than investment acumen. It’s clear that BAC is undercapitalized and it’s even more obvious that the the solution is wiping out equity and restructure/convert debt to equity(there’s more than enough), but somehow gov’t has decided we no longer want capitalism to work so we play games that create zombie banks that trade for $5.50 a share which is still to high.

Yep, the banksters and the regulators who work for them are the last folks to believe in capitalism. They’re extractive oligarchs and speculators with the dough of others after all; actual _production_ is the furthest thing from their interests or operations.

Perhaps Mr. Market is finally realizing that no matter what kinds of bailouts, write offs, accounting tricks, “exotic” products, press releases, investigations, “friends in high places,” or “high level emergency meetings” it has…

…the end is inevitable as a New System, created by a New Consciousness…arises to take its place.

“Perhaps Mr. Market is finally realizing that no matter what kinds of bailouts, write offs, accounting tricks, “exotic” products, press releases, investigations, “friends in high places,” or “high level emergency meetings” it has…

…the end is inevitable as a New System, created by a New Consciousness…arises to take its place.”

Insolvent is insolvent. Also, too, morally bankrupt. The question is do they take down all (GD2 and WW3, as Mr Beard so artfully puts it) before the New System is in place?

It is not as if there is no alternative, I mean if you have to say it, it is due to the fact that it is not perfectly obvious that there are not alternatives. For example, the transition from feudalism to capitalism, did not have to happen, and certainly, did not all at once. Aristocratic land barons operated side by side the growing merchant traders and bankers. Industrialization occurs in many places in Europe, side by side with small scale skilled craft fabricators. Look at the non profit sectors of various cities, what percent of the economy are universities, medical centers, research parks, museums etc ? Right now, it is clear that capitalism has problems, but there are alternatives growing now, and that have been present, such as credit unions.

Me thinks…that’s what we’re about to find out!

FYI: There are a lot of souls on the planet right now who are very much aware of the “transition” phase we’re just getting into, and are doing what they can to gently “nudge” us in a direction which brings about [major] transformation sans that trauma and drama stuff. (And if what I wrote sounds too “woo woo” for you…kindly note, from a quantum physics perspective, we’re all just energy patterns coagulating form via consciousness and intention. Forming a holographic representation of “reality.” Translate: We’ve got a lot more input into how this all unfolds than we might think – and it’s not all from a tangible, “To Do” list perspective.)

“There is no reality in the absence of observation.” – The Copenhagen Interpretation of Quantum Mechanics

“Yet at a deeper level [matter and consciousness] are actually inseparable and interwoven, just as in the computer game the player and the screen are united by participation in common loops. In this view, mind and matter are two aspects of one whole and no more separable than are form and content.” Physicist (and Einstein protege) David Bohm

“All matter originates and exists only by virtue of a force which brings the particle of an atom to vibration and holds this most minute solar system of the atom together. We must assume behind this force the existence of a conscious and intelligent mind. This mind is the matrix of all matter.” Nobel prize winning physicist Max Planck

BTW: Thanks for responding, and for your thoughtful questions.

I don’t know if it’s time to slide back to shamanism just yet, Cap.

Sure. hell. lets give the Voodoo its final, one-more-last chance. Or,better yet, lets just skip that.

“There are a lot of souls on the planet right now…”

Yep. Pretty sure that’s our biggest most difficult problem.

If yeast had blogs, I wonder what kind of discussions they would have when there were billions of them and most of the sugar had already been converted to alcohol?

Pretty sure that’s our biggest most difficult problem. Rex

In that case, off yourself and “decrease the excess population”, why don’t you?

If yeast had blogs, Rex

You compare human beings to yeast? Is that your self-evaluation? The who are we to disagree?

But speak only for yourself.

F. Beard,

Why do people think they are better than other life forms? Because they can think.? (That could be an answer or a question.)

The yeast need their sugar; we need oil (at least to sustain the population frenzy of the last century). Some of the yeast can get moved to another jug. Unlikely for us.

I think the comparison is valid except that we do more damage to our surroundings than yeast.

And I thought you got some of your philosophy from the bible. Why do you wish me dead? I never made any threats, only an observation. If we are going to go Obama Predator mode, I could propose some better people than me to start with.

Why do you wish me dead? Rex

Why would it matter if you’re no better than a yeast?

there is opportunity to create something different, that’s what I like about the attitude at occupy wall st, decision making by consensus, figuring out what it is we all want and how to present it, the 99%, leaderless movement, lots of very good ideas…

Let us cheer B of A down to the very bottom. What ever the damage “America” can be fine without their Bank!

http://www.aesop-fable.com/tortoise/the-tortoise-and-the-eagle

Cheer ’em to the bottom? Hell: Kick ’em off the ledge into the furnace. Put those zombies down boys; headshots, and proto (’cause they’re devouring the real economy).

I think its high time we started a daily BofA guess the stock price game for NC readers…

I call inexplicable rally tomorrow — up $.25

I call continued worries over Greece – down 12 cents.

Woo-Hoo, 2 cents off! Thank you inexplicable rally!!!

http://www.youtube.com/watch?v=nC-wMcWv2_w

The dynamic today is growth v sustainability.

Growth has been based on leverage for many years. Its not real. Congratulations to EU on recognising what everyone else is pretending does not exist. We should base our money on something real

Growth has been based on leverage for many years. Its not real. RBHoughton

The growth was real but the money isn’t. Our so-called “elastic money supply” is a bitch. It has little connection with reality other than to destroy and distort it.

We live in a perverse society where banks threaten to go bankrupt and bring down the entire universe unless their demands are met 100%.

We need a President who has the testosterone to say that he’ll see BAC in hell.

“We need a President who has the testosterone to say that he’ll see BAC in hell.”

Easy enough to get a President who’ll say that. Much harder to get one who will do something like that. Now look here, we’ve got a President… that said a lot of things… and is getting fired up… to say a lot more.

If we all chipped in, do you think we could afford to purchase a guy who would actually work for US?

Obama has shown us very clearly that change isn’t coming from the White House, doesn’t matter who we elect.

… bring on the Greek default. I shall throw a party where all and sundry shall celebrate the re-establishment of a sovereign Greek currency! There will be wine! Women! Song! And cupcakes!

http://goo.gl/OmP1x

Let us know where and when!

Interestingly, the same EU that is demanding that Greece and Ireland fire doctors and cut the remaining doctors’ salaries is now threatening to sue the two countries because the remaining doctors have to work too many hours. http://ec.europa.eu/social/main.jsp?langId=en&catId=89&newsId=1083&furtherNews=yes

If the EU Commission does sue Greece in the EU Court of Justice, would either panel have the authority to overrule the Troika and its demands that Greece fire still more doctors?

I wish that there were such a thing as “enlightened self-interest.”

I’m surprised that nobody is rejoicing that the rumors are out there that GS had a horrible 3Q and may, gulp, miss any bonuses for the year. Yup, that’s right, zero, zip.

That is the scariest news we’ve had since before the Great Depression. When GS stops their bonuses, things have got to be bad, really bad.

If GS miss their bonuses I for one will party like it’s 1999… cup cakes or no cup cakes.

CDS levels from ZH late this afternoon:

MS +53 at 547bps,

BAC +34 at 451,

GS +60 at 387,

C +32 at 347

…and Insurers

AIG +70 at 540bps,

HIG +45 at 465,

MET +27 at 390,

PRU +35 at 340,

BRK +20 at 270

Sorry, I’m a bit thick and just a normal citizen. Why any CDS is still allowed to exist boggles my mind.

Is your list telling me that someone offers CDS on the insurers? Who?

If they swallow their tails any deeper they’ll turn inside out.

With that $5 debit fee, the impression I get is that B of A is getting cleaned out before they torch the place. You like risk and want to play the table? Buy it up. Who knows, maybe the fix is already in – again.

Tomorrow, Mr. Market will be happy. The news will tell me it’s because “investors” will be cheering Greece or something somebody will say. Why won’t they just say it’s traders just swishing money around the bucket again.

The wheels on the bus go ’round and ’round…

In American English “trader” and “traitor” are pronounced the same.

Those wheels are flats, and we’re riding on rims.. the rubber is getting shredded, and I’m seeing sparks fly up from underneath the carriage. We’ve got a full gas tank though so hopefully those sparks don’t make contact with any of that.

This is more optimistic than I’ve been in years. I’m feeling downright bullish.. think I’ll go spend the rest of my cash on some more ammunition and canned goods.

“Angela Merkel has stated the reason not to allow Greece to exit the currency union and depreciate its currency is that the Euro would rise on the assumption that other periphery countries would exit, and a strong Euro would hurt German exports.’

Is Germany really dictating national, policy decisions for its soveriegn neighbors (even neighbors that owe it money)?

Again, already?

Seems like this Euro situation has all the participants by the balls and Sarkozy/Merkel are the ones calling the shots.

I hope a bunch of countries jump out of the Euro.

The markets are rigged and kleptocracy is not monolithic. That is how we get days like Friday and today. The rich are heading for the exits in so far as they can, positioning themselves to take advantage of any crash. Those who get out first get out best. If some fall by the wayside, it’s not like the other kleptocrats will mourn them.

The really anomalous movement on markets the last few weeks has not been these episodes of cliff diving. It has been the rallies. The euro is collapsing. So is BAC. Yet despite this there have been 500 point rallies on the Dow. It is rather like first class passengers on the Titanic, knowing the ship is sinking, elbowing their way ahead of everyone else to get on the few lifeboats, then sneaking back onboard a few times to steal more of the silver. To us 99%ers, this looks like madness and pathological greed, but it is important to realize that this is the kleptocratic perspective and as long as they have us and our government to loot they know they can get away with this because they have been getting away with it for 35 years.

Yves: “While the 1929 market meltdown was not the primary cause of the Depression, there were similar unsustainable accumulations of private sector debt….”

I wonder how many folks understand that the primary causes for THIS ongoing-(for all intents and purposes) recession are not due to the financial meltdown (much that same as Yves comment about 1929). While the flood of liquidity has not solved the fundamental solvency issue and enormous economic structure imbalance, if the other fundamental causes were not operative, we would have some time ago come out of this recession (for real).

I also don’t see anyone, including Calculated Risk, really taking into account that, if you consider new jobs needed for population growth, we never recovered from the ’employment recession’ of 2001. The job deficit, taking into account population growth job needs, bottomed out at down 5.541% in December of 2003 and had only recovered to a still deficit level down 4.496% when the current recession started in 2007 (using BLS CES data). Similarly, again taking into account additional population growth jobs needed, the bottom occurred in ‘this recession’ in February 2010 down 8.268% and, again taking into account new population growth needs, has been ABSOLUTELY FLAT with NO net gain for the past 20 months (actually currently up at the end of the 20 months by 0.224% – essentially flat). If we were to consider that our socio-economic structure requires the same percentage of jobs as at the start of the 2001 recession (62.1% using BLS CES), then the ‘current’ recession has bottomed out at down 12.013% in February 2010 and we are still at 11.798% down 20 months later – compared to the ‘normal’ economy prior to 2001.

The enormous ‘pretend’ game (including all economists I have read) ignores this true jobs reality. However the economy has never been known to respond to the ‘pretend’ game for very long. Hello Mr. Market.

@EC : “The enormous ‘pretend’ game (including all economists I have read) ignores this true jobs reality.”

Try Paul Krugman, he has been preaching jobs rather than deficit reduction so as long as I can remember (including yesterday: http://krugman.blogs.nytimes.com/2011/10/03/more-on-china-and-jobs/). His assertion is that ,in a liquidity trap with interest rates pegged near zero, normal rules do not apply.

Jim

“While the 1929 market meltdown was not the primary cause of the Depression, there were similar unsustainable accumulations of private sector debt….”

and the accounting flip side of private sector debt usually is …

Frau Merkel, it really is a euro crisis

Ambrose Evans-Pritchard

“this austerity fetishism repeats the fatal error of the 1930s Gold Standard when surplus states (France and the US then) failed to recycle their gold hoard and instead imposed the full burden of adjustment on the deficit countries — until these countries broke free and inflicted condign revenge.”

Time to think the unthinkable and start printing again

Martin Wolf

“The time has come to employ this nuclear option on a grand scale. The alternative is likely to be a lost decade. The waste is more than unnecessary; it is cruel. Sadists seem to revel in that cruelty. Sane people should reject it. It is wrong, intellectually and morally.”

…

“Personally, I would favour the “helicopter money”, recommended by that radical economist, Milton Friedman. This would be a quasi-fiscal operation. Central bank money could pass via the government to the public at large. Alternatively, the government could fund itself from the central bank, directly. Better still, the government could increase its deficits, perhaps by slashing taxes, and taking needed funds from the central bank. Under any of these alternatives, the central bank would be behaving like any other bank, creating money in the act of lending.

…

Some will argue that a policy of direct financing by the central bank must be inflationary. This is wrong. No automatic link exists between central bank money and the overall money supply. Above all, the policy would be inflationary only if it led to chronic excess demand.”

U.S., European and Asian stock markets were under pressure again, this situation has taken a turn for the worse this week as Greece will apparently not meet its deficit targets this year.

Oh well, long-term? Hold on to your gold!!!

BoA has long been the bank that would be targeted for “example” status if and when deemed politically necessary – by the other Wall Street banks, which also means Geithner and Bernanke.