By Matt Stoller, the former Senior Policy Advisor to Rep. Alan Grayson and a fellow at the Roosevelt Institute. You can reach him at stoller (at) gmail.com or follow him on Twitter at @matthewstoller.

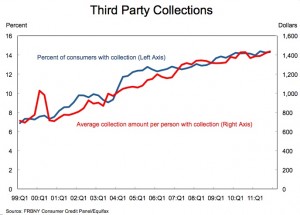

I went through the Federal Reserve’s Quarterly Release on Household Debt and Credit released today, and there were two notable trends. One is that the amount of consumer debt is declining, but that delinquency rates are stabilizing above what they were before the crisis. And the second is in this graph, which is that the number of people subject to third party collections has doubled since 2000, from a little less than 7% to a little over 14% of consumers. Ten years ago, one in fourteen American consumers were pursued by debt collectors. Today it’s one in seven.

I went through the Federal Reserve’s Quarterly Release on Household Debt and Credit released today, and there were two notable trends. One is that the amount of consumer debt is declining, but that delinquency rates are stabilizing above what they were before the crisis. And the second is in this graph, which is that the number of people subject to third party collections has doubled since 2000, from a little less than 7% to a little over 14% of consumers. Ten years ago, one in fourteen American consumers were pursued by debt collectors. Today it’s one in seven.

The experience of debt collection can be chilling, as this 2007 ABC News report suggests.

Consumers around the country have taped threatening phone calls from collectors who have called in the middle of the night, used abusive language and have threatened to have people fired from work or thrown in jail. All of these tactics are illegal under federal law.

One of the characteristics of the new social contract ushered in by both George W. Bush and Barack Obama is the increasing power of creditors to govern outright, from tax farming by banks to the use of credit checks to access employment opportunities.

There are now thousands of people legally jailed because they aren’t paying their bills, ie. debtor’s prisons have returned. Occasionally elites let it slip that this is not an accident, but is their goal – former Comptroller General David Walker has wistfully pined for debtor’s prisons overtly (on CNBC, no less).

This may be somewhat mediated by government action, as the CFPB is beginning to make noise around debt collection and credit ratings, and Illinois Attorney General Lisa Madigan is working to stop debt-related arrest warrants. But only somewhat, only where the government can protect you and only when there is the political will to do so. Increasingly, creditors are coming to set up the institutional structures for financial surveillance, state-sponsored enforcement of their claims through tightened bankruptcy laws and the selective use of jail, and the denial of economic opportunity based on one’s interaction with the financial system.

This is part of the new social contract. The sheer percentage of consumers with third party collections in pursuit is striking. Additionally, the uptrend through both Bush boom and Obama bust years of the percentage of people being tracked down by third party collection agencies suggests we live in a different country than we did just ten years ago.

Again, ten years ago, one in fourteen Americans were pursued by debt collectors. Today it’s one in seven. I suspect this number will keep going up. And though debt collection is a highly competitive field, it’s also a growth industry.

“Ten years ago, one in fourteen American consumers were pursued by debt collectors. Today it’s one in seven.”

This doubling is certainly alarming. Question is, how much of it is attributable to the increasingly rude methods of the debt collectors. And how much is warranted because consumers increased their debt to much, lived for to long beyond their means.

I have been married 37 yrs . Off and On , about half those years my wife worked out of the home . At no time did we ever decide to get into debt more than what just my income could handle. That is a first must . The next must is GET RID OF THE GOTTA HAVE IT NOW MINDSET . Turn off TV ( Propaganda Box )and you will spend less .Not on cable savings ,but by just not getting sucked in by the consumeristic system . SAY NO TO SPENDING . AVOID THE TRAP !

AVOID THE TRAP ! Bill

How does one avoid the government enforced/backed counterfeiting cartel, the banking system? To not borrow is to be effectively priced out of the market forever by those who do borrow; it is a “Tragedy of the Commons” situation.

it’s a lifestyle choice, carrying debt today is very, very risky. why would anyone want to engage in this debt system? also, there are studies out there that show the more tv you watch, the more you spend (as I recall, these were studies done before you could bypass the commercials).

why worry about being priced out of a system that is collapsing. those without debt will come out ahead. it’s time to create new ways to live, there are better ways to experience being human. trying to “own” things is not freedom.

why worry about being priced out of a system that is collapsing. mk

Cause I don’t want to be wishing for a Great Depression, massive human misery and possibly WW III so I can buy a house cheap?

those without debt will come out ahead. mk

You would do better to hope for a universal and equal bailout of everyone, including non-debtors, PLUS fundamental reform to prevent the problem from reoccurring.

FB,

By 2003-04 we had figured out what was coming and did protect ourselves, paying off all debt including house-cars. We threw away t.v. Fine. We are fine,

but lend $$$$ to relatives who aren’t, attempting to help as we can. We even

payed our son’s university education up front.

But this is STILL the “society” we live in…it’s a disaster…..and few are discussing…we have politicians running on “job creation” completely and totally unwilling to go into job destruction-Wall $treet taking over economy-19% 2001, today 41% of U.S. economy…unwilling to discuss how much $ it takes to destroy a U.S. $6.5 trillion, world $16.5 trillion per year economies for over 3 years already, on the way to 10-20 more….HOW MUCH DOES IT TAKE? Follow the $$$$$?

The city of Compton, California, is declaring bankruptcy, which will become more and more frequent through these years…and still no “transparency, oversight, accountability” for Wall $treet crimes….

My wife had ruined her own credit years ago. Then she secretly opened credit cards in my name, and ran them up on business trips to places like Miami. When I found out, I had two choices:

1. Send her to prison.

2. Deal with the enormous debt I now have.

I will never get out of debt now, never. Declaring bankruptcy would be tempting, but I see it as a last resort. I just have to deal with this now.

I blame her, she’s a weak, weak person. But I blame the banks more. She used her Mom’s address to get the credit cards, and no one from the banks even talked to me before opening them.

“consumers increased their debt too much” = “lenders lent too much.” Both parties willingly engaged in that transaction. OF COURSE the debt levels went up when we made it more difficult to get bankruptcy protection. There will always be people willing to borrow their way to the poor house. ALWAYS. The only way to prevent the creation of a large class of debt-peons is to disuade banks from lending them ever more money. Take the shovel away, and they won’t be able to dig themselves into a deep a hole. But by changing the bankruptcy laws, we have encouraged banks to keep lending to the profligate until the hole they are in is even harder to climb out of.

“There will always be people willing to borrow their way to the poor house. ALWAYS.”

This can’t be said enough. When you get down to it, the “two-way street” idea is straight up BS. The real change which caused the debt problem was on the lending side, and the borrowers followed. Period.

Or, you could think of lending behavior as the “engine”, and borrower behavior as the “brake”… Yes, in theory if you educated borrowers enough to not borrow recklessly when there is profligate lending, that might help, but even then I doubt it would help much.

Also, how much of it is because the creditors have slammed the consumer with costs, fees and charges that are either outright incorrect or a “gotcha” charge based on an obscure provision that the consumer was unaware of.

I actually read my bills each month and am stunned by the growth of this kind of think from the cable company to fuel suppliers to cell phone services. Many of these companies have no internal mechanism to adjust bills or even respond to reasonable disputes. It’s cheaper to rake in the money from people who don’t read/question their bills and send the rest off to debt collectors for some percentage of the balance.

Sam,

That is not at all the ?..were you oblivious when credit card companies offered

thousands of credit cards per year, at cheap (at first) interest? Were you oblivious when credit card companies lobbied strenuously for tougher, new bankruptcy laws, having a hand in writing said laws?

What did you think when this was going on? I thought one whole helluva lot of Americans were going to go bankrupt…this was 2005…yet another canary in the coal mine…

I recently started reading Elizabeth Warren’s “The Two Income Trap” and was horrified to read that 1 in 7 families with children were going bankrupt — by 2003. In other words, before the Economic Meltdown.

The data assembled in the book is absolutely chilling, and clearly things have only become worse since it was published in 2003.

The book is absolutely mind-blowing.

The book also gives the lie to the idea that people today are profligate compared to how we were 30 – 40 years ago. We actually spend less on “stuff” now than we did then, but wages have stagnated while the cost of basics like housing, medical care, and education have sky-rocketed. Those are the main causes of middle-class debt.

Values on the right-hand scale hint that credit cards could be a primary source of the debt at issue. Credit cards seem to remain the preferred alternative to cash for millions of Americans standing at the cashier. As long as the choice of alternatives is between check and credit card, I can understand why: the credit card offers has advantages over checking in the area of bookkeeping.

At one time the notion of credit worthiness played a role, but the efforts of financial industry talent from 2003 to 2009 effectively destroyed the notion of creditworthiness for retail consumers.

“As long as the choice of alternatives is between check and credit card”

What about cash?

See the sentence above the one you cite:

“Credit cards seem to remain the preferred alternative to cash.”

Ultimately I want to argue that credit cards wouldn’t be such a hit with financial industry talent if there weren’t checking. Checking has hung around despite manifold deficits because it make credit cards look good – it’s like the lousy opening act after which the debauched and fading rock star appears to be brilliant.

What about having the capitalist system pay a fair, living wage? Inflation goes up on all commodities, and wages have stayed flat for at least 30 years. The system is rigged against the wage-earner, forcing them to use credit, which is the whole idea.

It’s called “neoliberalism”. Here’s a link to the definition.

http://www.globalexchange.org/resources/econ101/neoliberalismdefined

It would be nice if some of the commenters here would stop defending it.

This has been the argument of Elizabeth Warren, Robert Reich, Paul Krugman and many others.

Thirty years of enormous productivity gains by American workers have resulted in an enormous enrichment of the elite with barely a farthing of that gain actually going to the workers who made it happen. Workers responded to the reality of no real income gains by first, sending wives to work and second, borrowing up to their eyeballs. There are no obvious remaining sources of ancillary income out there to tap so a real and significant drop in standard of living is occurring and will continue.

Wait, the kids aren’t working, yet.

http://digitaljournalist.org/issue0309/lm06.html

Was probably my inscrutable sarcasm – I’m not a fan of creative destruction. You are right – the system, American capitalism forces wage-earners to use credit. It invites us to over-consume and then off-shores our jobs.

Why checking survives in the US is an academic interest of mine. It does not exist as an everyday alternative to cash in Germany. Does it exist on a comparable scale anywhere else in the world? In Canada? UK? Australia?

My guess is that it serves to distract consumers into a preference for the other alternative to cash: credit cards. Debit cards are more and more in use in the US, often accompanied by various in my opinion inexplicable hitches. They are the standard in Germany, without any hitches.

What kinds of hitches? I use debit cards almost entirely; they’re more convenient than checks, and I know the $$ is gone from my account immediately. Credit cards, I understand, have what might generously called “hitches” (more like traps), but I’m not aware of the same things in reference to debit cards.

Bmeisen –

Do businesses use checking in those places you mention? Or direct deposit/direct debit?

In America, every business I’ve ever worked for still uses checking for not only paying their bills, but also receiving payments from suppliers. (In fact, my current company still gets paid in check form from a TBTF bank, which could presumably simply credit our account….) I imagine the float involved in check transactions makes for a tidy sum of pure profit on either end, if invested properly…..

SD – hitches like not usable at ATMs and monthly fees. I don’t know how widespread debit cards are and I’m grateful to read that you use one all the time. The question remains: why does checking exist at all if debit cards work so well?

Kiting and fee income from bounced checks, i.e. predatory scumbag extraction.

SD,

There are VERY good reasons to prefer credit to debit cards. Merchant disputes. If you buy something and discover you have a lemon, and return it in good condition, with a credit card you are pretty much guaranteed to get your money back. With a debit card, you are fucked if the merchant refusea to cooperate.

And I would never in a million years use a debit card. The security is terrible. If someone steals your wallet, they can drain your account. They don’t have the $50 loss limit of credit cards.

I only use an ATM card. The PIN protection makes it a ton safer.

Living in Germany I use a debit card almost daily to pay for purchases and get cash from ATMs. When my balance on the account drops below €1000 I pay €5/month. Security is a negligible issue because there is a daily withdrawal limit (€1000) and general purchase limit (something like €2000). Transactions are reversable and in almost 20 years of using these cards here in Germany I have never been nor heard of a card holder who got cheated on a transaction. A relative’s wallet was stolen, including a post-it with PIN number and the thief withdrew €1000 from an ATM around the corner. We got a picture of him – a very “German”-looking man – and lost the €1000.

Still – why checking? One argument may be that differences in commercial regulation between states make checks preferable. Germany has a federal system and 16 states with sometimes conflicting approaches in many ways and I haven’t used a check since I can’T remember when. I use a credit card a few times a year for car rentals and overseas purchases.

Bmeisen,

I supsect you’re right on the source of a lot of the debt. In fact, looking at the report that Matt uses as his source, I saw:

““During 2011Q4 the number of open credit card accounts rose…to 386 million, but remained 22% below its 2008Q2 peak of 496 million. Balances on those cards were 19.1% below their 2008Q4 peak of $870 billion.”

So there are now 110M fewer credit cards with balances 19% lower. A lot of those balances probably were written off and are now in the hands of debt collectors.

http://data.newyorkfed.org/research/national_economy/householdcredit/DistrictReport_Q42011.pdf

Thanks for the informative link. Agreed, with about 12% of credit card accounts 90+ delinquent, compared to substantially lower numbers for other forms of credit, it looks like credit cards are especially relevant for our discussion.

The comeback of debtor’s prisons is surely not to be taken lightly considering a private company has approached states about running their prisons with the guarantee they (states)will keep them 90% filled.

“I suspect this number will keep going up.” –

What could possibly go wrong with a 63.7% NILF rate, wage deflation against CPI YoY increases? That’s just for starters.

http://www.uscourts.gov/News/NewsView/11-02-15/Growth_in_Bankruptcy_Filings_Slows_In_Calendar_Year_2010.aspx

Can’t wait to see what the 2011 data shows, talk about deleveraging (Ch. 7 & 13 filings). Wait until all those new and old student still can’t pay off those $50-100k student loan debts, or even better, all those freshly minted lawyers schools keep churning out with tight legal markets.

What a great idea, let’s put them all in jail too so taxpayers can feed and house them too. Brilliant.

student loan debt is greater today than credit card debt…

‘The Two Income Trap’ is an eye opening book. Part of the reason two incomes are a trap today, and that there is less discretionary income today with two incomes than with one income in the ’60s is that our expectations for home size, child development, and so on have changed. Also, health care takes up a much larger portion of our paychecks now.

IIRC, the book pointed out that houses today are not much bigger than they were 40 years ago. The real cost driver is (or was until lately) competition for housing in areas with good schools. That combined with the costs of education itself, health care, and stagnating wages are the sources of middle-class debt. People today actually spend a smaller percentage of income on other consumer goods than we did then.

Just to temper the tenor of this post, many, many years ago I was a debt collector (although we didn’t use such a harsh term. We were called adjusters).

I did this for a little over two years. In that period of time, I only encountered ONE customer I felt sorry for. The rest were just deadbeats.

So 1 in every 7 adult Americans is a deadbeat?

Middyfeek, I have to ask you, how long ago? And, if you know, how long was the average credit card agreement at the time, and how often did it change? The game has changed, and it wasn’t the consumers who changed it.

“The rest were just deadbeats.” –

I know right? It’s not like millions of Americans have lost their jobs or anything right? Or that certain sectors of our economy are never coming back huh?

Yea, they’re all “deadbeats”, fuck em’, they’re as useless now as they were then. Maybe we can do society a favor and just shoot them? That way you and I don’t have to use our tax dollars to support all those “deadbeats”?

Come back in about 6-8 years and lets us know how many deadbeats there are. Pretty sure by then the Rule of Law won’t apply to even “deadbeats”, then they can just shoot you instead. Sound good?

All but one refused to give you a blow job, huh?

How bad would it be to cancel all student debt?

Get government guarantees out of the picture and it might be possible to grow colleges that provide competitive programs. Raise state and federal tax on the wealthy — not just $1,000,000 incomes and support schools as if the future of this country depends on an educated public. Put emphasis on and support for talented students and encourage science and math. Crazy, huh?

Pretty sickening descent for the world’s richest economy if the only jobs in the private sector are lobbyists, insurance denial personnel, debt collectors, and personal servants to the wealthy. Glad I don’t live in the USA!

You forgot being a guard in a private prison. And working for Xe and like. Good pay for killing foreigners!

Mr. Gamesh;

The problem is, once you socialize people to accept the killing of ‘civilians’ overseas, they quite easily transfer that ability to killing civilians ‘at home.’ Keep your eyes on any move in the near future to change the laws so that ‘Security Companies’ can begin working in the U.S. with the same exemptions from ‘local’ laws they have forced foreign peoples to tolerate. For a rough idea of what I mean, look up the history of the Pinkerton Detective Agency, with an especial focus on the Robber Baron Era.

Howard Zinn would be proud of you, Ambrit…”Matewan”…

Too late. Blackwater was hired by private interests in New Orleans in the aftermath of Katrina to keep the peace and guard businesses. Local police allowed, even encouraged, the private cops, and Blackwater had pretty much free rein to do what they considered “necessary” including beating people in the streets who questioned their authority.

Friends;

I was even thinking of Dashiell Hammetts books, like “Red Harvest,” “The Dain Curse,” etc. Hammett was a Pinkerton during the strike busting days.

As for Blackwater ‘patrolling’ the Big Easy during and after Katrina, being from that region at that time, I’ve heard lots of ‘stories’ and ‘rumours’ about what went on there at that time. The general tenor of the remarks I got from several who were there at the time was that the private dicks ran about like a bunch of cowboys, which is par for the course since the local police did precisely the same.

Condottiere anyone?

In New Orleans after Katrina and the Flood, Blackwater also confiscated guns and kicked residents out of dry homes, *just like that*!

This was the Bush Dynasty’s trial run for their NWO martial law with mercenary contractors who were NOT citizens of the City or even of the State. Nefarious.

First Blackwater, then Xe, now company is Academi http://hamptonroads.com/2011/12/first-blackwater-then-xe-now-company-calls-itself-academi

Monday that the choice of the name Academi reflects an intent to refocus on training.

“We chose the name because we want to let people know that part of our strategy is to lead with training and focus on training,” Wright said.

The word “academy” is traceable to a school run by the ancient Greek philosopher Plato.

“Excellence, dignity, discipline, honor, integrity,” Wright said. “That’s the ethos that we want this company to have.”

Wright heads a leadership team assembled by USTC Holdings, an investor-owned consortium that acquired Xe from founder Erik Prince a year ago.

Rebranded… what is that I smell?

Cheech & Ching explain http://www.youtube.com/watch?v=eY7ZX6ngOSs

that’s Chong, of course (not Ching)… I swear there’s a gremlin in my keyboard…

or maybe you just remembered Cheech using the Spanish verb “ching” a lot :)

@curlydan, my memories from back then are all…

Up in Smoke http://www.youtube.com/watch?v=k2pXxHW1DHs

Dear Valissa;

Could you be confusing them with the Cheech Wizard?

After a quick trip to Wikipedia to figure out what you said… Cheech Wizard rocks! Erik Prince was never that cool ;)

Valissa, it’s hard for them to outrun their bad name, whatever it may be.

Valissa, Erik Prince of the AMWAY (DeVos) dynasty in Michigan.

@j.grmwd I didn’t mean to imply what you infer. However, in view of the current economic & financial situation, and the last half-century of same, how much of an exagerration would it be to say that our whole society, taken as a unit, is a deadbeat?

@Gordon Brooks it was 45 years ago. It wasn’t credit card debt, it was mostly secured debt (auto loans). But the thrust is, not only are there people out there who buy things they can’t afford, whether you believe it or not, there are people who buy things they have no intention of paying for.

Yes, there are always people who will over-extend, and those who buy with no intention to pay. But we are talking about 14% here, a huge jump. Clearly something has happened, and I don’t for a moment believe it is a doubling of the number of deadbeats in a single decade.

I’m one of those dumbasses that went in for a law degree and student loans the size of a modest mortgage (hey, I happen to be good at literary analytics and oral advocacy – would you rather have a 17th cen french lit doctorate?).

I also have no plans whatsoever to pay them back, and the feds realize won’t most as well. Current loan forgiveness, including public interest and income based means that many, many with high student debt will never pay it back.

Furthermore, as much as all deride the gov’t programs at work in many places, myself including, I have lived in state subsidized housing during the entire period (I’ve also worked consistently, either through internships or work study, so I’m no “deadbeat”). My subsidized housing has let my family and I live a comfortable lifestyle with no cable, but reasonable vacations and a nice glass of box wine with dinner, the entire time. I, maybe unreasonably, expect income based repayment of loans will do the same.

Are these unrealistic expectations? Would you call me a “deadbeat”? Can this type of gaming possibly be more morally hazardous than the profit motive of institutions that make unsecured loans?

If the 17th century French Lit student covered Voltaire, he would likely be as

informed-literate…likely would have seen this entire mess coming…didn’t you?

I actually did read Candide. And like I said above, I feel I am to certain extent prepared. I am a well educated, hard working, self-reflecting, authority-challenging person with a loving family and a relatively comfortable lifestyle I expect to continue by legally not repaying my loans. If I work in the non-profit world for an average american salary I can do this and pay less than face price for my education.

Again, the question is, does that make me a deadbeat because I know how to game our system to ensure I don’t have to pay the outrageous rentiers?

@Gordon Brooks it was 45 years ago. It wasn’t credit card debt, it was mostly secured debt (auto loans). But the thrust is, not only are there people out there who buy things they can’t afford, whether you believe it or not, there are people who buy things they have no intention of paying for.

I really get tired of the whining about people buying things they have no intention of paying for. It isn’t like anyone is forcing people to LEND these folks the money to begin with. In most cases the reason that the money is lent to begin with is that the lenders make an awful lot of money on the interest rates they charge “bad borrowers” and then they whine incessantly when they do get burned.

When do lenders get some level of accountability in the whole borrowing and lending paradigm?

Additionally, I have to wonder how much of this debt is medical. If over 50% of bankruptcies were caused by a medical malady before bankruptcy law and millions more of people are not covered by health insurance it stands to reason that a good portion of the “deadbeats” are people who basically got forced into a situation where they were forced to choose between their health, their families health and avoiding debt. I blame them a heck of a lot less than I blame a system that allows a 90% discount for a third party but tells a person who doesn’t have insurance that their “cost” for the same procedure is 9 times the insured member’s cost. I’ve actually seen an “uninsured bill” vs. a “insured bill” and the difference between what insurance companies pay as an allowable cost and what the charge Joe Average is ludicrous.

OK. OK. OK. Oh boy. Listen, there is no question that lenders should be responsible and engage in reputable business practices.

But at the same time, fraud is fraud, and fraud by borrowers does not seem so much less objectionable to me that fraud by lenders. If a borrower obtains a loan through fraudulent or makes a covenant that he or she clearly does not intend to uphold, I’m not sympathetic to that. I’m never going to be. Don’t wait for it, or waste any more of your breath on it.

It’s really gotten to this point? We just can’t see both sides of an issue? It has to be Black-and-White? There can’t be both borrowers *and* lenders who are complicit in the problem?

It’s like this. When we have a system that allows everyone who wants a job to have a job, rather than a system where at least 5% of the workforce are kept on the unemployment line as an inflation control, then we’ll talk about lazy blaggers on benefits.

When we have a system in which the worker’s productivity increases are matched by their wage increases, then we’ll talk about the minority that continue to run up credit card bills with no intention to pay.

My anarchistic wet-dream—-

Every single person on the globe who is in debt declares bankruptcy, all on the same day.

Kind of like a Debt Jubilee, but instead of waiting to “get” it from them, we “get” it forced on them, by us.

What will the 1%-ers do then?

I know, I know…..

http://articles.businessinsider.com/2011-03-22/news/30073732_1_stock-market-seiu-secret-plan

sl0wy, has Lerner worked this out with Goldman Sucks, JP Morgue, and John Paulson on the short side of the market, all ready with their CDS *insurance* against the tank?

..they will hire half the populace to execute-jail the other half, reductively, over and over…

That’s called ‘austerity’.

Simplified, its traced to women entering the traditional workforce.

Origianlly, women were equal economic partners who provided economic value to the household by fabricating household needs in-house. When upper-income women entered part-time workforce to suppliment and provide additional discretionary spending to the household, Business recognized an underutilized low-cost workforce and increasingly hired women to the exclusion of men while co-opting women’s in-home economic contributions. (Marketing plans included women’s ‘self-realization.’)The initial increase in household disposible income allowed out-sourcing of traditional in-home economic contributions until the cost exceeded the benefit. Hence, the family’s consumer debt increased to suppliment the difference between the income and the cost of outsourcing of a traditional women’s economic contribution.

Ockham’s razor. Flatlined wages for 40 years, not feminism. Weren’t you offed in a sanitarium?

Yes indeed, by a woman no less, Charlotte Corday.

But, you know, Marat is talking sense.

Madama;

Yes, unfortunately so. The original Marat spoke sense too. That one was eliminated by a supposedly deranged fanatic. Making sense is no protection against fate.

ambrit *Corday*–sounds and spells Hungarian rather than French

Working through collection events has become increasingly simple. Putting a plan together and implementing it over an average 24 months is ideal. If a 24 month plan is not feasible than bankruptcy typically begins to make more sense.

Arrests for unpaid unsecured debts are the result of civil suits where a judges orders were not followed (Failure to Appear) and a bench warrant issued. If this occurs because of sewer service where the consumer was unaware they were sued – Big Problem. Sewer service occurs frequently.

People do put their head in the sand and ignore collection issues they are fully aware of. Simple steps ignored and missed opportunities later can create more problems.

This article highlights some of the issues and references a woman in Minnesota checked into the gray bar hotel over a 250.00 credit card debt:

http://consumerrecoverynetwork.com/lawsuits-to-collect-debt-vs-suing-a-debt-collector/

JPMC, BoA, and Citigroup, in response to the cited report, have vowed to redouble their efforts to provide relief….to their senior executives. “These rates are fucking terrible. One out of two Americans should be hounded by collection agencies. And debtors should be hanged…why waste prison space. There are too many Negroes walking around in my opinion.” J. Dimon, for the TBTP cartel.

Now that’s funny!

The attitude at Capital One is worse than the three banks you listed combined.

Of all national credit card issuers Chase and BofA are the most accessible to their card members for arranging some type of alternative payments. Their loss mitigation strategies with unsecured debt is the opposite of how they handle secured debts.

GG, “Negroes” framed by Dimon, He needs to do time as *strange fruit*.

Are you making that up to be funny?

I’m inclined to think you are but, honestly, I feel like there’s so much toxic sludge out there (and “up there”) that I can’t even tell anymore.

JTF– nah, just *poetic justice*

and ten years ago, we were not in a severe recession. Where the unemployment rate was 5%.

I’m constantly receiving mail and phone calls from debt collectors. But they’re never looking for me. Instead, they’re all looking for various people I’ve never met or looking for information about a neighbor. Since my landline phone is old (w/o call screening) I just unplugged it. My cell phone has screening and I never answer a call from a number I don’t recognize.

Regarding credit scores, it’s a requirement for you to take on debt to get scored. Your score improves if you get more credit cards and improves even more if you use them often. Sadly, my score keeps going down because I don’t use my credit cards often enough. Never mind that I pay off the credit cards in full every billing cycle, that I have no other debt and always paid debts on time. I’m a shitty credit risk!!

Oh, what a great society and such a wonderful contract we have here in the USA.

Its always annoying how the “deadbeat” meme pops up. Always somebody trumpeting their virtue–I never got in debt, live within your means and so forth. 14% is a lot of people. As economy contracts guess what wages and employment go down so people cannot meet basic obligsations. meanwhile taxes in various ways have gone up–5 mile over limit traffic tick in d.c. went from 45 to 95 bucks. If over 10 miles you get a 200 dollar ticket. Health insurance high. Real wages falling. Its odd how so many make it a virtue thing and do not note that the government is the biggest dead beat of em all. People in Illinois going to Jail over 1000 visa bill meanwhile state shafts vendors (like me) for tens of millions of dollars. Do wish people got off the morality deadbeat thing. I do hope and pray that everyone who has called somebody a deadbeat and has passed judgement gets unemplolyed, loses most of investments and then has to go to hospital and insurance company does not cover most treatment–then somebody can call you a low life dead beat as you beg for mercy.

It annoys me too. Being in a position to save money in the US today is, in fact, a privilege that all too many people can’t even recognize as such.

This crazed, haranguing blindness is well beyond socially irresponsible.

If corporations are “people” then you can sue them in small claims court for small amounts. Amounts perhaps too small for them to send one of those meat and sauce human representitives to contest (no lawyers allowed).

You must document your injury from the corporation and figure out the cost benefit ratio of profit in the suit to name your amount and then find a means of serving “the person”.

Cal, I think you’ve found the key: How do you *serve* a Corporation? A subpoena must be received by the person. A *Corporation* is an ABSTRACT *person*, not a *person*. Corporations are not people, because they cannot receive a subpoena as a person, as people, can.

This is the deal breaker.

Not a word here about medical debt, which must be driving a lot of these collections….With “deductibles” (is there a more contemptible, Orwellian word for “your money”?) ranging upwards of $2500, it is easy with a small scrape to run up bills that, in the opinion of the hospitals, must be paid immediately.

Bill collectors/finance department people at hospitals can be, in my experience, just as short tempered as “professional” bill collectors. Pleas of unemployment and/or financial hardship fall on deaf ears, and they determine the payback schedule based on THEIR requirements, not yours – the bill is $800? Well, you can pay $200 a month for four months. Nevermind if your UI check is $300 a week…….

Medical debt, job loss and divorce/separation are the leading causes of bankruptcy. Not the debtbeatism meme parroted about.

Some of the most comprehensive bankruptcy data available to date was compiled by Warren and Bob Lawless. If memory serves, less than 5% of bankuptcy filings can be attributed to gamers. Yet, you have banks gaming consumers by ordering check and debit transactions in a manner that maximizes overdraft fees. Chase made an estimated 500 million from the practice and just recently settled out for 110 million.

Whose gaming who?

Michael rowed that boat ashore…divide and conquer propaganda is the game..

Oh, no doubt! I have serious chronic medical problems and good insurance. I know what my insurance should and should not pay for. I already pay 10K a year in medical costs so I refuse to pay bills the insurance company should pay. In the last about 7 years there has been a dramatic shift in medical providers sending bills to debt collectors although it often takes a full year to fix some bills-that they screwed up! I’m always in and out of debt collection, though in the end never end up having to pay because I didn’t owe.

I’m actually going to start a business to help people like me that may not have the time or wits to deal with this problem. I want to be able to do it by taking donations so the client doesn’t have to pay. Do you all think that model would work?

Gee, I guess when GWB wanted to turn the USA into an “ownership society” he meant he wanted us all to become debtors so the banks could OWN US. You gotta hand to ol’ George – Mission Accomplished.

Some of you people sure are masters of the obvious.You get yourselves into high dudgeon, set up a straw man and off you go.

Obviously people with major medical expenses aren’t deadbeats. As a matter of fact, the one guy I felt sorry for fell into that category. But when you find yourself chasing the same people month after month, believe me they’re not all Bob Cratchit.

Not all creditors are Ebeneezer Scrooge either.

“Obviously people with major medical expenses aren’t deadbeats”

Yes, dear. The majority of bankruptcies in this country are at base, medically caused. It was one of the reasons 80% of us called and are calling for single payer health care.

Yes, kindly family mega hospitals turn over bills to debt collectors. All the time. And I’ve known them to hassle patients still in the midst of chemotherapy.

Hospitals will sue to take every single item of value from anyone unlucky enough to get in their clutches. The debt collectors are just one part of it.

Medicine is a commercial enterprise in this country. Health, wellness, healing, recovery, these are just accidental byproducts, often unintended consequences. Their attitude to anyone who owes them money, or who they say owes them money, is at least as nasty as a mob loan shark.

You must look up rules and regs from the FDCPA. I have issued a cease and desist, when the debt collector continued to call me. I recorded their continued calls and I sued. After 6 months, I won a $14,000 settlement over what was originally a $175 bill because I failed to return a cable box back to the cable company.

Beat them at their own games. I did.

I am a debt collector for 16 years. At some point we need to stop babying these debtors and stimulate this economy. I dont believe in jail but if you avoid even speaking to the people you owe, we should be able to be aggressive. No different than IRS who don’t even have the courtesy to try and reach consumers before they garnish or levy. Credit is adult business and if can rack up the debt, face your responsibility and stop trying to hire attorneys and make money off of us. We are the future. We are the way.

If I ever go broke from medical bills, you can kiss my ass.

If I ever run up a debt I can’t pay for food when I can’t get a job, you can kiss my ass.

It’s people like you who make me want to just run up a debt and say, kiss my ass.

You wouldn’t have problems with attorneys if you followed the law. Not paying back a loan isn’t illegal, as much as you want it to be

Credit is adult business Eric

Credit is essentially counterfeit money; it steals purchasing power from all money holders.

“We are the future. We are the way.”

You know what else? Cult deprogramming is also adult business, and I can see the future in that looks bright.

:)

“I am a debt collector for 16 years. ”

Bullying people for a living says it all.

“At some point we need to stop babying these debtors and stimulate this economy.”

The economy is is permanant depression because of unpayable debt and large amounts of money sequestered by wealthy individuals. Bankrupting people won’t get any more people into jobs. Indeed, as we see in Greece, enforcing poverty just leads to more poverty.

“I dont believe in jail but if you avoid even speaking to the people you owe, we should be able to be aggressive.”

Since most bill collectors start out assholes and then get unpleasant, it’s unsurprising people avoid them. And if all you’re going to say is “can’t get blood out of a stone” for the umpteenth time, it’s not a very stimulating conversation.

Most payment plans come out to permanent debt slavery, paying less than the increased interest/fees/gimmes. One theme of the mortgage crisis is servicers jacking up the debt until it’s too great a burden and then foreclosing. It works with credit cards, too.

“No different than IRS who don’t even have the courtesy to try and reach consumers before they garnish or levy.”

Very different. The government is government and business is business.

A lot of anti-government types aren’t pro-freedom, there’s just envious of the powers of government and are angling to take them over. Anyone declaring they have an unpaid bill and grabbing someone’s paycheck with no legal process is just as scary as it sounds.

“Credit is adult business and if can rack up the debt, face your responsibility and stop trying to hire attorneys and make money off of us.”

Yes. Credit is a business transaction, with the creditor taking a risk on the borrower. If that risk goes south, stop the tantrums. The contractual resposibility of a borrower is limited by the reality principle in law and in life; if there’s nothing there, we all walk away.

And many “bills” turn out to be bogus.

“We are the future. We are the way.”

Mussolini’s motto. And The Way was a 70’s Christian cult that ended up burning out because the evangelist running it was boinking all the starry-eyed young girls.

Private use of force to enforce public contracts. Thumb busting limited to verbal abuse, thankfully. If law enforcement was on its toes, you and most of your friends would see the jailhouse in a whole new way.

I will go to work tomorrow and treat the Central American janitor who cleans up the shit in the office men’s room with deep and abiding respect, keeping in mind what you do for a living. I can see what an honest job looks like.

Eric, got your jackboots on?

Be so kind as to include in your near future a self-administered dose of high velocity intracranial lead therapy.

Said therapy is a total relief from life suffering. In your case, it would also provide to the human gene pool, a much needed removal of a non-negligible quantity of pure asshatery.

I believe I paid 23,500 on $6000 debt over seven years after the TILA was amended to permit for universal default and other tricks and traps. You picked the profession. I admire sex workers more than I admire you. I hope you are FDCPA’ed right the heck out of business, and soon. Then, you can drop dead.

unsecured debt and now bought by a 3rd party who has nothing to do with the origination and transaction…from now on use only cash and dont pay them back and they cant do a thing

J, the *third party* collector was an integral part of the profiteering *mortgage crisis* PLANNED, and ramped up after Katrina by Bush and his buddies, who were long in gold waiting for the insider payday.

Economic recovery is inhibited by making more consumers tarnished by being caught up in the collapse of the economy. Anyone who walked away from a property that was hopelessly upside down, anyone who excercised a short sale, anyone who filed bankruptcy is now essentially dead in the water for the short term. Certainly, many people know how to get high risk/interest (payday,auto title) loans, pre-paid limit credit cards and re-establish their credit relatively quickly but even then, they are likely to still be subjected to premium interest rates for a substantial amount of time.

When you read “Why Nations Fail” you quickly understand that the US could easily join the ranks of failed states.

It is absolutely abnormal for such a rich nation to have so many people on the financial edge, while so much financial criminality go unpunished, and even gets rewarded, conformity is enforced with threats of prison and loss of everything (how many financial whistleblowers have won their case??).

A very important finding of the book is, as Simon Johnson eloquently writes:

No one in Washington is interested in keeping the powerful in check. This does not bode well for the country. And yes! Other countries can surpass us over the long term.

FT, we have become the Banana Republic with Puppet Government described in “Confessions of the Economic Hit Man”–“THE SHOCK DOCTRINE” brought home to roost. The .01% Rentier Reich and their .99% Agency are the only winners.

The same scam was recognized by Thorstein Veblen several wars ago, as recounted in “CONJURING HITLER…” by Guido Giacomo Preparata.

We have an emergency red phone at work. There’s no dial, no buttons, no nothing. If there’s an emergency, you pick up the handset and tell security what’s going on.

Every couple of weeks, this red emergency phone rings, and a robocaller comes on, saying something like “This call is for Joe Smith. If you are Joe Smith, please stay on the line. By staying on the line, you certify that you are Joe Smith.” I usually just put the handset down for awhile and let them talk to the air for a while. I bet it’s a creditor, but calling an emergency phone? And I thought robocalls from corporations was illegal.

hd – “act like negroes” – ?

harry dong, what is the average unpaid bill for fucking? Curious minds suppose you’d know.

Mz Patricia;

I sincerely hope that when the “unseen hand” expunges Mr. H.D.s comment for, ahem, ‘rampant’ Trollery, your rejoinder is left to mystify and amuse!

Also, apparently, when poor Mr. H.D. considers aforesaid unpaid bills, his only response is that his knee grows. No wonder he’s so upset that he can’t spell correctly.

G’night ambrit

ambrit, indeed: reminiscent of Justice Clarence Thomas’s *nickname*.

I am reading an excellent new book, “Why America Failed”, by Morris Berman. It’s a very well researched and referenced “post-mortem style” analysis of why America is already irreversibly failed and collapsed.

At this point, sane Americans REALLY need to start making preparations to emigrate, as many already have. Incidentally, the author of the book I mentioned above has moved to Mexico 5 years ago, and says he only regrets not having done so 20 years ago.

Psychoanalystus

Morris Berman – Why America failed

http://www.youtube.com/watch?v=nMghstZuuh0

Skippy… best part, past the turkey and celibate genocide… pass the squash.

Cheers.

skippy, great link. Thanks.

The capitalist system is based on companies selling goods and services to customers. But if consumers only pay cash, the level of economic activity (therefore profit) is going to be constrained. Credit lets people buy more, thus increasing profits. Lenders make additional profit from interest. Our business/financial sector has made a conscious effort for at least 50 years to get people to buy more on credit. In a time of ever-increasing incomes, this “worked”, in the sense that people were able to pay the interest. But absent income growth (i.e., the last 40 years, papered over temporarily by two-income families), debt winds up accumulating. That still works for a while, as interest is relatively low compared to what it bought, but over time it accumulates until it can no longer be sustained.

This is the business model of our economic system. They know that many people will eventually be unable to pay their debts, but in the mean time much money has been earned on interest. In the end, they will squeeze every last dime they possibly can out of the debtor, including a portion of all future earnings until death. The “losses” from bad debts are more than compensated by higher sales on the producer side and interest and fees for the lenders. This is a gigantic, very intentional system for transferring as much money as possible from ordinary people to the producer/financial sector.

Is this the fault of the consumer/debtor? Maybe, but they have been bombarded by ads and offers that are incredibly dishonest, manipulative, and opaque. It reminds me of the Brits forcing China to let them import opium. Was the resulting addiction totally the fault of the addicts? The lenders and producers who pumped debt-fueled consumption throughout our economy are hardly innocent victims. The last thing they want is sustainable, cash-based consumption.

An Alternative to Capitalism (if the people knew about it, they would demand it)

Several decades ago, Margaret Thatcher claimed: “There is no alternative”. She was referring to capitalism. Today, this negative attitude still persists.

I would like to offer an alternative to capitalism for the American people to consider. Please click on the following link. It will take you to an essay titled: “Home of the Brave?” which was published by the Athenaeum Library of Philosophy:

http://evans-experientialism.freewebspace.com/steinsvold.htm

John Steinsvold

“Insanity is doing the same thing over and over and expecting a different result.”

~ Albert Einstein

The Debtor State can be eliminated in a few years by establishing an “International Private Mutual Welfare Trust (IPMWT or Trust)”.

The IPMWT has the propensity to achieve effective demand & sustained growth which allows full employment & economic growth without inflation & recessions.

Please view our Website & Video that shows how this is accomplished.

Dear Matt,

First let me tell you, in case you’re wondering, the reason why I’m contacting you. I’m desperate, that’s why, and honestly no matter whom I contact they always say they’re sorry but they cannot help us. I just don’t know who is out there who CAN help. We saw an attorney, but he wanted $2,500 to accompany us to our HEMP meeting in April, and he said that without an attorney, we stand no chance whatsoever of getting anywhere because the program’s guidelines are so stringently written. YIKES!

I’m not sure if you’re familiar with Dave Lieber’s column in the Star-Telegram paper; on Friday, he wrote an article about my problem with RCS that you might find interesting. The link to view the article is:

http://www.star-telegram.com/2012/03/01/3777227/frustrated-nj-homeowner-digs-into.html?storylink=addthis#.T1CxO1nfDfc.email

I am scared beyond words about losing our home, and I’ve run out of solutions. Residential Credit Solutions, a foreclosure mill in Fort Worth, has refused to do a loan modification with us after stalling for months and is now foreclosing on our home. I’ve done extensive and exhaustive research on RCS and its chief executives and have found alarming information that I don’t know what to do with! RCS took over our mortgage from Indy Mac who took it over from Countrywide. They’re using a P.C. firm called “Fein, Such, Kahn, and Shepard” who are just as sketchy as RCS and about whom I’ve read nothing but negative things.

Residential Credit Solutions, hereinafter referred to as RCS, acquired the financial assets of Aames in 2009 and Aames Financial were a lead investor in RCS. Aames have securities fraud charges from the SEC and have a class action lawsuit against them for fraud. Several executives who were employed at Aames are now working for RCS, including their VP of Internal Audit, Steven Sinn and Michael Kajrkyan, and Becky Muro was the analyst for Aames and RCS.

The president of RCS, Dennis G. Stowe, was the President and COO for Saxon Mortgage. There is no end to the number of complaints and lawsuits against Saxon Mortgage including a Class Action Complaint for thwarting HAMP and fraudulent foreclosures. A number of key executives who were at Saxon are now at RCS including Kelly O’Bannon and Mark Rogers. There is an endless list of robo-signers who were employed by Saxon too. Dennis is president and CEO of Fort Worth-based Residential Credit Solutions, Inc., which he set up in 2007 with private equity firm Equifin Capital. He was previously president and COO at Saxon Capital, Inc. and ran the company’s servicing operations until it was sold to Morgan Stanley in late 2006.

In November of 2007, Equifin Capital partnered with Dennis Stowe to form RCS. Equifin teamed with New York-based hedge fund Och-Ziff Capital Management in January to invest $125 million in mortgages and related assets. They also bought a home-loan billing and collections unit from San Diego-based Accredited Home Lenders Holding Co. Mani Sadeghi was a partner of Equifin and is now the Chairman of Residential Credit Holdings, a parent company of Residential Credit Solutions.

In 2009, Massachusetts, Attorney General Martha Coakley reached a $10 million settlement in June with subprime lender Fremont Investment & Loan for its unfair lending practices. Vivian Delfin was at Fremont and is now, of course, employed by RCS. Lender Processing Services and RCS both used the same law firm for foreclosures – Ruzicka and Wallace. LPS, MERS, and RCS are affiliated, and Dennis Honda was with LPS and is now at RCS. Title loan officers and various employees of Lender Processing Services were indicted on more than 600 felony charges for fraud. Nevada’s attorney General Catherine Cortez Masto filed civil fraud charges against Lender Processing Services and two subsidiaries alleging the company engaged in a widespread fraud of forging foreclosure documents. ETERIYA MATEVOSYAN was the Title Curator at Lender Processing Services and is now the REO specialist at RCS! Linda Green, an infamous robo-signer, was employed at LPS and DocX.

Look, I don’t know if your office can help us or not, but I feel like I’m whistling in the wind, and I’m really not sure what to do. The executives at RCS seem to all have been affiliated at one time with companies who have been charged with fraudulent mortgage foreclosures and fraudulent, deceitful practices and then moved on to form RCS! Please let me know what I can do.

Thank you for your time. Wendy and Al Smith, 137 Stephens State Park Road, Hackettstown, NJ 07840

Increasingly, the sheer volume of the lawsuit filed by these debt collection firms has led to cutting the corners of civil procedure. “Sewer Service” (and fraudulent filing of proof-of-service) are the norm, not the exception. Judicial capture is occurring already. Creditors can skip your rights to collect, but you couldn’t avoid punitive interest rates under the Truth-in-Lending Act prior to Dodd-Frank Wallstreet amendments. See Chase Bank NA v. McCoy for insight how the supreme court helped to contribute to the wave of third-party debt collection firms.