Yves here. Mr. Market is in a tizzy today over, per Bloomberg, “concerns over the slowdown of growth”. Cynics might note that journalists have to attribute motives to market moves, when their waxing and waning often defies logic. Nevertheless, we’ve had disappointing reports out of China, a bad Philly Fed manufacturing report, a less than stellar initial jobless claims report, and not so hot housing data this AM, and more and more signs of inability to bail out the sinking Titanic of the Eurozone (a meaningless announcement compounded by continued focus on ongoing German court challenges to more aggressive support of rescues. Even if these cases lose, any uncertainty and delay has the potential to accelerate the ongoing bank run out of periphery countries).

This post from VoxEU is a good short form summary of how the Eurozone got into this fix. Its last para takes an unduly scolding tone that may turn off some readers, and does not reiterate the point made at the top, which is that the ECB needs to step up in a serious way to stem the crisis. Other remedies will take too long to implement and thus cannot change the trajectory under way.

By Charles Wyplosz, Professor of International Economics at the Graduate Institute, Geneva; Director of the International Centre for Money and Banking Studies. Cross posted from VoxEU

The EZ rescue strategy adopted in May 2010 failed to restore debt sustainability, avoid contagion, or reduce moral hazard. This column argues that a volte face is needed. The debt of Greece, Portugal and Italy – and perhaps Ireland, Spain and France as well – must be restructured to restore growth and end the crisis. All EZ nations should pay since their leaders’ decision to violate the Maastricht Treaty’s no-bail out clause is what brought us here.

Chancellor Angela Merkel has sent word that Germany cannot save the euro. She is right.

From the very start of the Eurozone crisis, it was clear that a domino game was under way and that a highly indebted German government should not be seen as the residual saviour. But keeping the euro will be costly and Germany will have to share the burden.

The solution will have to combine debt structuring and ECB lending in last resort to banks and governments. Angela Merkel needs now to lift the German veto.

All Eurozone leaders, including Mrs Merkel, are to blame for today’s predicament.

• The politically expedient decision of May 2010 – to bailout Greece but promise that it would be “unique and exceptional” – was officially sold as necessary to avoid contagion.

• Two years later, it is obvious that this has been a historical but predictable policy mistake (Wyplosz 2010).

The crisis has engulfed three small countries – Greece, Ireland and Portugal – and is now on its way towards Spain and Italy. France might well be next. These six countries’ public debts amount to 200% of German GDP. With its own debt of 80% of GDP, Germany cannot indeed stop the rot.

Moralistic rather than economic reasoning

The public debate in Germany and elsewhere is often moralistic, matching the economists’ concern with moral hazard.

• Countries that have long considered the government budget as a purely theoretical constraint cannot now simply ask for help.

• The same applies to countries that have allowed their banks to fuel a housing price bubble and now socialize the resulting private losses.

There is no case against the view that bad policies must have consequences. In this the moralisers are right.

But the issue is more complicated than meets the eye. We must ask:

• Which countries trampled the Eurozone’s fiscal discipline?

• What should be the consequences? and

• What are the costs for the monetary union as a whole?

Many ‘debt sinners’ in 2007

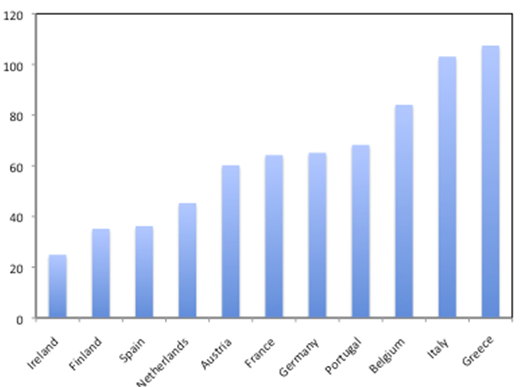

Right before the financial crisis of 2007-8, few Eurozone countries could claim to have been fiscally disciplined. The figure below shows that Finland, Spain and Ireland could, but not Greece and Italy. Most other Eurozone nations – including Germany – were in the grey zone. Then the wheels of fortune that drive self-fulfilling crises started to spin, leaving us with an impression that strong moral judgments have to be terribly relative.

Figure 1. Public debts in 2007 (% of GDP)

Source: AMECO, European Commission

Banking supervision laxity

As we know, poor bank supervision is what drove Ireland and Spain into the camp of guilty countries. Here again, the story is not over and several countries may soon be found guilty of forbearance.

• Top of the list are France and Germany.

• Had Greece not been rescued then some large French and German banks, already fragilised by the subprime crisis, could well have been ripe for costly bailouts.

The debt reduction scheme applied to Greece effectively provided these banks with an exit strategy, and was delayed long enough for them to dispose of a large part of their initial holdings of Greek public debt. Even so, these same banks remain on the danger list if more defaults are needed, which is in fact the case. The list of truly innocent countries includes a small number of small countries.

The consequences of bad debt and banking policy

As for consequences, the issue is incredibly difficult. Austerity has been the accepted norm for punishment.

Austerity proponents at first sought to characterise austerity as only moderately painful – and this a ‘good pain’ that would provide a useful lesson for future generations.

But the facts have now completely undermined this view.

• The myth of expansionary fiscal contractions, also known as the negative multipliers, has now been proven disastrously wrong.

• Its last proponents point to Latvia as proof that it works, but it unclear where this assessment comes from.

The Latvian public debt is still rising as a percentage of GDP and GDP is now 15% lower than in 2007 before the stabilization plan. True, this is up from a loss of 20% in 2010, but this merely illustrates how positive the multipliers are.

The costs to Latvia have been massive.

• Unemployment jumped to a rate 20% and still is at 16% and emigration has apparently been massive.

• Banks are foreign-owned and the owners decided to stay and absorb the losses.

• The only good news from Latvia is that the economic collapse only lasted three years, largely because wages have been quite flexible in this very small and very open economy, leading Blanchard (2012) to conclude that “the lessons are not easily exportable”.

Greece

The Greek experience is one of never-ending economic decline, massive unemployment and intense social hardship. Sure, the Greeks are being taught a lesson, but which one?

• Resistance to economic reforms is as intense now as it was before the crisis but xenophobia and the appeal of populist politicians is rising spectacularly.

• The multiplier debate tends to conceal the political consequences of austerity in the midst of a recession.

As economists, we also need to look slightly beyond our pond.

When these aspects are factored in, the consequences of the strategy adopted in 2010 are simply not justifiable, even on moral grounds. This is so especially as those who are punished most are not those that benefitted most from fiscal indiscipline in the run up to the EZ crisis.

The May 2010 strategy is a disaster: Admit mistakes and move on

The strategy adopted in May 2010 has not just failed to achieve its aims: restore debt sustainability, avoid contagion and reduce moral hazard. It has not produced a solution that is likely to bring the crisis to its end. A 180-degree turn is still needed.

Unfortunately it will be costly.

• A number of countries will never be able to achieve sustainable growth under the weight of their current public debts.

• This is the case of Greece, Portugal and Italy,

• The list may eventually widen to include Ireland, Spain and France.

Their governments will have to restructure their debts, totally in the case of Greece, partially – if done early enough – in the other cases.

• As the banks in these nations fail (because they did not adequately diversify their portfolios), bank bailouts will also have to be financed from outside.

Who will pay?

• Foreign banks will, of course, end up writing down the restructured sovereign debt; they, in turn, may have to be bailed out by their own governments.

• Official creditors too will suffer losses.

This includes the ECB, to the extent that it imposed insufficient haircuts in its various refinancing programs, and the shareholders of the EFSF and the ESM, which also happen to be the shareholders of the ECB.

Waiting only raises the eventual price

The more we wait, the deeper the economic deterioration – more lending to governments and more non-performing loans in banks – and the bigger the eventual costs.

• Importantly, the list of ‘bailer outs’ shrinks as the list of ‘bailed outs’ expands, so the costs of the rescue become concentrated on a decreasing number of healthy countries.

• Waiting too long implies that there is no healthy country left or no Eurozone any more, probably both.

The moral question reconsidered

Why should German and other taxpayers, mostly from the north, pay for the others, mostly from the south? Because their governments are responsible for the disastrous situation we are in.

• The rather well-crafted Maastricht Treaty had a no-bailout clause that was designed to protect all Eurozone taxpayers from fiscal indiscipline in other countries.

• Under Merkel’s leadership, this clause was first violated in May 2010, and then again to bail out Ireland, and again for Portugal and now for Spain.

This was an economic policy ‘crime’. It looked cheap at the time, at least under the assumption that there would be no contagion.

A basic moral principle is that criminals must be held responsible for the consequences of their acts, even if those acts are unintended. Eurozone taxpayers are the victims of their elected leaders. They now face the choice between breaking up the Eurozone and paying up. Paying up still is the cheaper alternative, but not for long.

They now face the choice between breaking up the Eurozone and paying up. Charles Wyplosz

Steve Keen says there is another option – a universal bailout of the entire Euro-zone population, including German savers, plus new restrictions on the banks to keep the problem from reoccurring. See “A Modern Jubilee” at http://www.debtdeflation.com/blogs/2012/01/03/the-debtwatch-manifesto/

My question is like that. Why not print lots and lots of 20 Euro notes and mail 50 of them to every man jack in Greece?

I’ve read the analysis for five years now and it’s all a confusing mess. Print money. Hand it out. The working stiffs on the bottom of the heap will take care of the rest of you. And have a few wild parties along the way.

Myself, I’d be just delighted if I got three such envelopes in the mail, each stuffed with 50 Jacksons. One for my wife, one for my daughter, one for me.

Why do we make this so hard?

I’ve been wanting TPTB to do that here in the US since late 2008.

Here is how the bankers’ game works:

http://aquinums-razor.blogspot.com/2011/11/here-is-how-bankers-game-works.html

mansoor h. khan

The ECB does not lend to states but to banks only (bad idea). The states can (in principle) redistribute money more or less as you say, “basic rent” or “welfare” is called, but private banks will never do anything like that because they are profit-oriented loan sharks.

That’s why EQ, in Europe or the USA does not work: because lending to the banks does not really help the economy at all. It’s much better to just throw cases of bank notes away to the general public… but for the rich that’s sacrilege, and they control the game by all corners.

Yes, it goes something like this. Give every Eurozone country the capacity to repay its debt to the banks, based on population levels.

The banks balance sheets are restored. Countries’ balance sheets are restored and taxes which would otherwise go to interest are now available for services or infrastructure-job-creation programs.

Never happen, mainstream economists have declared this sort of strategy inflationary and the end of the Euro. And sadly, those that could put this into action are listening.

Steve Keen and his ilk, MMTers and the like, are perceived to be radicals and out of touch.

mainstream economists have declared this sort of strategy inflationary Chris

Yet a total ban on new credit creation would be massively deflationary as existing credit debt was paid off with no new credit debt to replace it. Thus a total ban on new credit creation and an appropriately metered universal bailout could be combined for no net change in the total money supply (bank reserves + credit).

One hand washes the other: Reform allows a bailout without inflation and a bailout allows reform without deflation.

Actually jobless claims show the slowdown has stopped. Now we wait and see if things boost again in Q3 like 2011.

on friday

look for greece vs. germany in the world european soccer cup

the greek fans has been screaming for this

The above peice provides an interesting juxtaposition with the interview with Lavoie down the page. Charles Wyplosz position is that governments have bought about the crisis because they deliberately chose spending policies that increased the debt to GDP ratios. In contrast Lavoie argues that government deficits are basically endogenous variables. Government deficits increase in recession because of automatic stabilizers, and variables associated with private sector saving and trade balances, none of which governments control (or have little control).

So who will end up proven right? My money is on endogenous – on the basis that those who argue exogenous appear to be advocating policies that just seem to sway the crisis from one sector (financial) to another (sovereign) without improving stability. What a grand experiment, I would hate to be one of the lab rats …damn

The problem or rather a great part of the problem is that the euro is too strong vs. the dollar and therefore the yuan. The result is the EU does not export much anymore (exports here considered only selling outside of EU, most EU-member “exports” are EU internal market in fact). If you do not export and you are not the USA, you slump. We can’t be buying Chinese pots, Russian gas and Arab oil just out of sheer willpower, in the mid-run we must give something else than just overvalued (but weak) euro paper-money: we must export.

Exports mean industrial production, what means jobs and means a strong economy, by art of which we can import some stuff again.

Of course this mismanagement is horribly bad for the global economy because the Russian, the Chinese and the Arabs all need the European markets, and this disaster will damage their economies. They should tell Germany or whoever is in charge to dump the euro strength and start producing again instead of just importing everything.

That would go down really well in the US, not!!!!

Romney’s already threatening China with trade reprisals if it doesn’t significantly revalue the yuan. Imagine the impact of a suddenly 25% cheaper Euro on the US/Germany trade balance.

It’s irrelevant how it falls in the USA: the problem has been caused by US money dumping in order to reduce its own debt by means of inflation (inflation that it’s partly exported because of the special “gold pattern” role that the USD plays in the global economy).

China is not “dumping” the yuan, just keeping the relative parity with the US dollar, something that the Eurozone should have done since c. 2003. In 2000 a euro was worth 0.90 dollars and now it is 1.25 and has been as high as 1.45. We need a euro that is roughly in parity with the US dollar, not stronger.

Whether or not the strategy is a disaster depends, I suggest, on what you are trying to achieve. One possible explanation is that Germany wants greater integration but on its terms, in which case allowing the eurozone economy to get into major difficulties could be a very effective way of pressurising the other major players into movement. This is of course extremely tough on innocent parties who get hurt in the process (it was de Gaulle I recall who described states as cold monsters) but time will tell if this is indeed the German strategy and whether it succeeds.

The calendar year is 2012, not 1939.

I was thinking more like 1932 2.0.

This time Greece is Weimart. Hungary is Italy. Which bank will be Creditanstalt? And yes there is an insane plot to bring most of Europe under a single ruling government which will treat citizens awefully in the name of “improving Europe.”

And no, no effort to reunite the Roman Empire/Christendom/Europe at a political level has worked very well or long. But what’s 1600ish years of historical momentum when you’ve got neoliberal economics on your side?

Why does the German voter get such short shrift? It’s as if progressives, so concerned about democracy in the US, disregard it in Germany, so long as the “Eurozone Experiment” continues. Why do so many of you continue to insist in the integrity of a fatally-flawed contrived construct?

At the very least, if progressives continue to believe in the Eurozone, why not put forth what that means: A United States of Europe, based in Berlin, with all armed forces under German command, with fiscal transfers from the North to the South. Furthermore, it would mean that, from day 1 onward, the German voter would have supermajority rights in Parliament, to ensure that the peripheral countries can’t ever impose their will on the North.

Otherwise, if I’m a German voter, I’m better off realizing the couple of hundred billion Euros in losses today.

Jim, I do not know where you live but I am European and I feel European, what means that I feel the need of some sort of European continental organization, which does not need the EU-as-it-is. After all state borders in Western Europe are not less artificial than in Africa even if they have a few more centuries of pedigree, hence it’s best to overcome them and the sooner the better.

So whatever the faults of the European project as-it-is, there’s no alternative to it in general. We have to fix it, change its parameters radically (I’m for a USSR of Europe, more or less) but we do not wish to destroy it. At least not I. The alternative is a failed state with fascist tendencies (Spain) and it sucks.

Make that about 1.3 trillion, according to latest estimates. And then there is the problem of competitiveness and exports with the DM, which will be much stronger than the euro, at the same time pitted against the devalued currencies of former EZ members. And then there are all the geopolitical considerations, including the greatest of Germany’s fears, the Russian bear.

This isn’t easy. If it were, Germany would have left the EZ the moment it bailed out stealthily its banking sector in Greece and Portugal by offloading all risk on European taxpayers. Keep in mind, for every euro the German banks were able to bring back home, 22 cents fell on German taxpayers and 78 cents on the rest of Europe’s taxpayers.

http://www.bloomberg.com/news/2012-05-23/merkel-should-know-her-country-has-been-bailed-out-too.html

The “Russian Bear”? C’mon, Alan. That’s absurd. The best move Germany could make would be to turn TO Russia and the rest of Eastern Europe, and AWAY from the utterly corrupt US/UK global financial system which has been savaging Europe from the the outset.

I don’t know if that fear is irrational or not, because you may be right, or wrong, but it’s what it is. Talk to any German who is part of the elite and see what he/she says.

Yeah, well, since I don’t have a collection of elite German friends to consult privately, as you apparently do, I have to result to facts as reported. Things like, from a “Google” consisting of: German economic relations with Russia.

The first page alone yields:

http://www.ft.com/intl/cms/s/0/929ae496-aefd-11e0-bb89-00144feabdc0.html#axzz1yZSPqdDW

http://en.rian.ru/international_affairs/20120214/171307971.html

http://www.stratfor.com/weekly/20100621_germany_and_russia_move_closer

http://www.dw.de/dw/article/0,,16043516,00.html

http://english.ruvr.ru/tag_9074844/

http://iuwest.wordpress.com/2011/07/20/german-russian-relations/

And many, many more. Where you see talk of a “crisis” now between Merkel and Putin is the sort of BS one might expect from a lower-level flunkie from the US Embassy:

http://www.spiegel.de/international/germany/german-and-russian-relations-are-at-an-impasse-a-835862.html

It’s the US that is peeved with Putin. The suggestion that there is anything seriously wrong in the relationship is pure MSM noise.

How about you use Google to see some results on Germany’s dependence on Russian energy?

And Germany “moving closer” to Russia economically doesn’t disprove my point, unless Google results on closer US and China co-operation or US and Russia co-operation or even China and Russia economic co-operation somehow proves that they are not geopolitical competitors anymore or even worse that they can soon be best of friends!

In the end, as I said, I don’t take a position on the rationality of Germany’s fears regarding Russia, regardless of the economic or “terrorism fighting” co-operation of the moment. I simply stated a fact. Armchair warriors and thinkers may believe all problems in the world can be fixed with a few brilliant ideas, but the people who actually make this kind of decisions tend to move more slowly, especially when on the one hand they have an energy dependency, and on the other they still have lots of American soldiers and bases in their country, something you seem to conveniently forget. There is a reason Germany thinks she needs the EZ and a united Europe, even if I am not sure and you disagree outright.

… says the home of such marvelous banks as the likes of Deutsche and Commerz. They are just innocent victims, I guess, no matter how much my own personal experience defies such a narrative.

One of the things that this crisis has exposed is that it’s utter folly for countries like Germany to blame “Anglo-Saxon” finance. Even outside the financial sector and big corporations like Siemens, the German policies re Europe so far have been straight out of the worst part of “Anglo-Saxon” supply-side economics that the bankers tend to love. I don’t know how anyone could say otherwise.

Have you ever heard of the US Empire? Do you suppose for 1 moment that empire operates only in the military plane? Case closed.

There is a deeper Industrial policy problem – the Rotterdam / Rhur / Rhine area is the most effiecent heavy production area in the world , yet it is borrowing off all of the peripheries accounts to suck in the remaining raw materials needed to sustain this mercantile monster.

http://www.youtube.com/watch?v=aRghETHFvYs

We don’t need no more cars in Europe – we need cheaper Nat gas and we need to stop exporting our money to Arabia for oil.

This means the entire Euro Industrial stragergy is a mess as it orbited around bank credit related products rather then Fiat products …i.e the commons (Article 123 has effectively destroyed the European post war fabric)

Back in the day We needed to direct half of the capital that goes into car product into light rail and we needed a French scale nuclear programme in Germany.

But they won’t play ball – they are as happy as a Pig in Shit.

But their mercantile policey will enter a event horizon soon…..as it is all just too late to turn around this sick Euro trash Spaceship.

http://www.youtube.com/watch?v=gNIVpMXHqlk

Its time Germany just beat it as it produces product we don’t need yet starves us of capital to continue this madness.

http://www.youtube.com/watch?v=3mvuQ6Es6Do

Well said.

Breton

As long as money creation is based on a materialistic world, not much will change.

William C has stated what seems to me to be an obvious truth. When the European banking cartel which controls the ECB and other Euro central banks started down this path their initial intention seemed to be to bust the unions with “structural reforms” and happy-talk of “competitiveness”, etc.

What is now on the table is the complete destruction of democracy in the EU with ECB controlling all EZ budgets, fiscal policy and related legislation, ie, a bankers’ coup – built, of course, around neoliberal faith based economics.

Picture bankers in jack boots on stage addressing the Nuremberg rallies in Leni Riefenstahl’s “Triumph of the Will.” It took about 70 years, but hey: “Mission Accomplished.”

Glad to see someone besides me sees this as nothing but an attempt by the banks to stop covertly controlling the world, but to actually bring it out into the open. Create a disaster, i.e. “Great Depression”, and then come in and claim to save the world, in exchange for the very powers the founding fathers warned against. Who knows? Maybe Mario will grace the cover of Time Magazine as the “Man that save Europe”.

Do you lend your money without having some control on the outcome?

Now that banks are increasingly being forced to better allocate capital, everyone is appalled.

It’s not “their” capital but the money that the ECB (or the Fed in the USA) gives to them: it’s public money, social money, and we are all equally entitled to it – or you can’t talk of democracy and human rights anymore.

The point is that banks and governement misallocated capital.

Now, some people was to starve the beast with austerity and others want them to print.

At the end of the day, they are hated if they do and hated if they don’t.

The reality is that I would not trust our dear leaders to know where to cut and I would not trust them to know what to stimulate.

Therefore, not matter what they do, we are stuck in the wringer for a while.

Agreed. excellent comment.

This is only a disaster for the 99%s of Europe. The 1%s in both the core and periphery are doing fine. I agree with Yves that some of the initial points of where countries were in 2007 is interesting, but for the rest Wyplosz buys into the line that the European political classes are operating in good faith but have simply chosen bad policies.

Wyplosz is also vague about bank bailouts. He assumes a domino effect but there is no discussion of the multiplicative effect of swaps exposure that would be created by this cascade. There is no talk of wiping out the equity holders. Wyplosz does say “Official creditors too will suffer losses”. But for me at least this is quite different from burning the bondholders.

Finally, you can see the fatal flaw that flows from his assumption of good faith because there is nothing on dumping bank managements, prosecuting them where possible, and restricting bank activities to plain vanilla operations so that they will and can not in future engage in the same kind of system threatening behavior. Of course, to get this done, Europe’s political elites would have to be replaced as well.

Polite society in those circles cannot possibly talk about the reality of plutocracy. It’s a bad word, and it makes one sound like a commie. It might also upset one’s social schedule irreparably.

Wyplosz also doesn’t mention where Germany was in 2005 — very much in need of a bailout. ECB’s actions in “helping” Germany may have been a significant cause of the loose distribution of ECB funds (Germany could not be treated differently than others in the Maastricht Treaty) that fueled massive credit orgies in the so-called peripheral countries. See Richard Koo (Nomura) as cited in BusinessInsider.

http://www.businessinsider.com/richard-koo-the-entire-crisis-in-europe-started-with-a-big-ecb-bailout-of-germany-2012-6

Nomura’s Richard Koo has interesting, slightly different, observations.

http://www.businessinsider.com/richard-koo-the-entire-crisis-in-europe-started-with-a-big-ecb-bailout-of-germany-2012-6

It is clear to anyone with wit to see that this whole scenario is going to blow sky-high, regardless of the hocus pocus of central bankers and entrenched politicians.

There is simply nothing that will convince Germans to vote for subsidies of the lazy and corrupt.

Haven’t all the wars of Europe been fought under the guise of unification of some sort or another? Enough already. Let the French be French, let the Germans be German, let the Greeks be Greek. Those espousing internationalism follow in a long line of murderers and sociopaths.

From my perch, things are proceeding pretty much according to the Wall Street/Washington Master Looting Plan I’ve depicted here since I first showed up. “Markets”, those Central Bank/bankster weapons of choice since their efficacy was so decisively demonstrated in the coup of 2007/2008, continue to set up and knock down political and policy deadlines like so many duckpins – raking in the loot both ways even while consolidating the emergent lines of transnational corporate power.

Germany, the one sovereign in the West capable of pursuing an alternative route (Japan is Asian, and may well turn East), just received yet another boot in the pants as follow-up to the G20 sbsurdist public theatre: eat a far larger share of global losses loosed by the crisis than is their due or “markets” will destroy them (also note both the haste and strategic “leverage” of the Trans-Pacific trade talks in this context).

And again, they are going to cough up major amounts of money, though in what precise form and with how much IMF participation is not clear. Whatever it is, it will be big enough for now, and with better terms for Greece et al, at least in the short run, as there is 1 bottom line requirement that must be met this year, i.e., Obama’s re-election. He has advanced the cause of US-based global financial and corporate predators beyond their wildest dreams. They will not risk the election of an oaf like Romney.

One further observation: when the biggest US banks are allowed to keep 2 sets of books, one of them deemed of “national security interest”, it’s simply untenable to pretend there is any distinction whatever between private and public power elites or the nature of the sewer they share:

http://www.commondreams.org/view/2012/06/20

Haven’t been much about the finances of California, is it sorted or is the attention deflected elsewhere?

Jesper take a look at this http://www.washingtonsblog.com/2012/06/cafr-summary-if-600b-fund-cant-fund-27b-pension-16b-budget-deficit-why-have-it.html

An alternative strategy to the mainstream ‘austerity’ and Keens jubilee/helidrop would be for the German gov to lend its own citzens say 1-4000 euros every month at .5% interest with the conditions that 1, they pay down their debts 2, they take holidays in the piigs 3, they buy real estate in the piigs They could issue bonds at -2% to cover the costs, no one would be forced to borrow any more than they wanted per month, but conversely the scheme would be run for 3 years minimum, and whilst the interest must be paid back anually repaying the principle need not start for 5 years.

This would have a much greater impact than throwing good money after bad into ECB/ESM/ETC bank scams

We’ll get a Marshall Plan equivalent but only after everyone who needs to lose his/her shirt has lost it…

Nobody will pony up money unless they are in control… so that means a lot more donwside ahead.

I agree but one issue is not mentioned: Lehman.

Apparantly a single bank collapse can bring down the world economy, I don’t think the people who wrote the no bailout clause ever imagined this.

So how to restructure debts, which means restructure banks, without the economy collapsing? I think the EU leaders are under a lot of pressure by Obama to bailout the banks.

I do not think Lehman’s collapse brought down the economy. Certainly not as much as the Goldman Sachs bailout.

If all the corrupt inefficient private companies would be allowed to collapse (or be nationalized after preventive bankruptcy, with the state guaranteeing only lesser deposits and current accounts in the case of banks), then there would be a MARKET, which is based in the free concurrence of many (as approximate to infinite as possible) companies.

Instead by rescuing the rotting dinosaurs, they are extending and pretending, what is always bad.