Yves here. Although this VoxEU is heavier on economese than may suit the tastes of most NC readers, it’s nevertheless worth your attention. It takes issue with a popular view among economists, that one of the ways to reduce systemic risk is to reduce cyclical swings in asset prices (or more accurately, to prevent banks from all following some great new lending fad and running off a cliff tout ensemble). The wee problem with that is economists were patting themselves on the back in 2007 that they had engineered a Great Moderation and the overwhelming majority were in denial about the existence of a global credit bubble. In fairness, many are thinking about how to create automatic counter-cyclical stabilizers, since as Ian MacFarlane, the former Governor of the Reserve Bank of Australia pointed out, an asset bubble looks like increased wealth to the community, so anyone who stands in its way is going to be extremely unpopular.

This VoxEU article offers an alternate line of thinking on how to to lower systemic risk.

By Giovanni Favara and Lev Ratnovski, Economists in the Research Department of the IMF. Cross posted from VoxEU

Macroprudential policy is meant to reduce the risks from the financial sector spilling over to the wider economy. But the debate over how to do so goes on. This column argues that macroprudential policy can be analysed through the prism of market failures that it is supposed to address.

The purpose of macroprudential policy is to reduce ‘systemic risk’. While hard to define formally, systemic risk is understood as ‘the risk of developments that threaten the stability of the financial system as a whole and consequently the broader economy” (Bernanke, 2009). The notion is meant to include the types of financial imbalances that led to the 2007-2008 bust.

It is common to distinguish two key aspects of systemic risk. One is the “time-series dimension”: the procyclicality of the financial system, that manifests in excess risk-taking in booms and excess deleveraging in busts. Another is the ‘cross-sectional dimension’: the risk of contagion due to simultaneous weakness or failure of financial institutions. Accordingly, macroprudential policy it thought of as a set of tools that help reduce these two forms of risk (Borio 2009; Bank of England 2011).

Yet thinking about macroprudential policy by looking solely at these two dimensions of risk is unsatisfactory. First, this view, per se, does not provide a justification for regulatory intervention. For example, is it really desirable to avoid any form of cyclicality and have a zero risk of contagion in the financial system? Second, it is not a priori clear what can macroprudential policy achieve that traditional micro-prudential regulation cannot.

Understanding Market Failures

In a recent IMF study (DeNicolò et al. 2012), we aim to tackle these questions. We start by articulating that, as for any form of regulatory intervention, the objective of macroprudential regulation must be to address market failures.

Important market failures that create systemic risk are the risk externalities across financial institutions and between the financial sector and the real economy. The literature allows classifying such externalities as driven by 1) strategic complementarities (herding): the strategic interactions of financial institutions causing the build-up of vulnerabilities during the expansionary phase of a financial cycle; 2) fire sales: the generalised sell-off of financial assets causing a decline in asset prices and a deterioration of the balance sheets of intermediaries; and 3) interconnectedness: the risk of contagion caused by the propagation of shocks from systemic institutions or through financial networks. The need to correct these market failures offers a clear economic rationale to macroprudential policy.

The idea that macroprudential policy is needed to correct market failures, rather than to smooth financial cycles, is important, because prudential measures that restrict credit availability (and possibly bank profits) may encounter non-trivial political challenges. The identification and correction of market failures is a clearer, uncontroversial objective for a macroprudential regulator.

The emphasis on market failures that arise because of interaction between financial institutions also helps clarify why micro-prudential regulation is not enough for containing systemic risk. Micro-prudential regulation focuses on the individual stability of financial institutions. Having strong individual institutions is necessary but not sufficient to minimise systemic risk. For example, micro-prudential policy may not take sufficient account of correlation risks. Or, a focus on maintaining high capital ratios of individual institutions during a recession may result in asset fire-sales, exacerbating existing vulnerabilities. Hence the need for additional, macroprudential policy to try to correct such market failures.

Optimal Tools

The policy debate has suggested a number of macroprudential policy tools: pro-cyclical and systemic risk-based capital surcharges, dynamic provisioning, liquidity regulation (including dealing with the risks of wholesale funding), lending limits (LTV and DTI caps), restrictions on activities (Volcker and Vickers rules), different forms of corrective taxes.

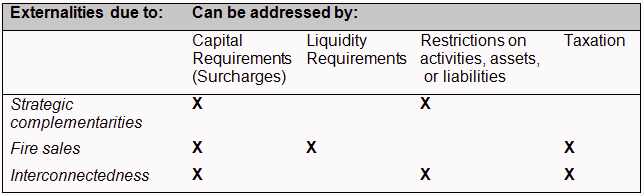

An analysis of how these tools can correct the three identified externalities, summarised in Table 1 below, offers some important implications for the design of macroprudential policy.

Table 1. Externalities and macroprudential policies

One important result of the analysis is that each of the externalities can be corrected by multiple policy tools.

For example, both capital requirements and limits on bank asset allocation can correct the externalities associated with strategic complementarities of banks. Capital requirements induce banks to internalise more of the cost of engaging in risky lending; restrictions on asset allocation prevent banks from taking large risk exposures.

However, since capital requirements may become less effective in booms (when capital ratios increase due to buoyant asset prices), direct quantity restrictions, such as debt-to-income (DTI) or loan-to-value (LTV) ratios, can also be useful complements. These restrictions affect directly the asset side of banks’ balance sheet and are meant to limit the fall in lending standards during boom times.

Similarly, capital and stable funding measures are complements in addressing the risk of fire sales, since they focus on vulnerabilities stemming from different sides of a financial institution’s balance sheet. The externalities associated with fire sales arise because banks fail to internalise the consequences of not taking precautionary measures in normal times, and thus need to adjust by shedding assets ex-post in the event of a negative aggregate shock. Capital and liquidity requirements provide buffers that reduce the risk of fire sales.

Also, capital surcharges can weaken the incentives of banks to become systemic and ensure that they dispose of a larger buffer in case of distress. Complementary restrictions on the composition of bank assets (as envisioned e.g., by the Volcker rule) serve to limit banks’ exposure to excessive risk.

The second result, a corollary, is that since the alternative policy tools are often complementary, there is not a “silver bullet” policy instrument. Since each tool has different advantages and limitations, a combination is likely to provide a better solution to the problem of correcting the same externality. Goodhart et al. (2012) reach similar conclusions using a theoretical model of financial instability.

The third result is that capital surcharges, more than any other tools, can be effective in dealing with any of the externalities. For this reason, and because they are closely linked to microprudential regulation and are part of the Basel III framework, capital requirements (surcharges) are likely to form the core of any macroprudential policy framework. The other instruments can be seen as complements in cases when capital surcharges are less effective.

There are also important areas for further research. Even though the mapping from externalities to policy tools helps identify the pros and cons of alternative policy interventions, a major challenge in the implementation of macroprudential policy rests on the calibration of instruments. Despite recent evidence on the effectiveness of some tools, little is known quantitatively (Dell Ariccia et al. 2012). For example, it is far from clear how high capital surcharges should be, or what the optimal LTV ratio should be. Accordingly, further fundamental and applied research on the optimal choice and calibration of macroprudential policy tools is required to justify policy intervention and avoid regulatory discretion.

The views expressed in this column are those of the authors and should not be attributed to the IMF, its Executive Board, or its management.

Reduce leverage in the markets to a significant extent…Problem solved.

Public employees of public services such as teachers, police, fire fighters, and city workers repairing potholes, don’t make too much money, if any, for the 1%. This is usually taxpayer money paying people to benefit people that pay taxes(kind of a circular money flow within the public sector), doesn’t benefit the 1% at all. The same for social security as the money flow is from taxpayer to government to retiree and the 1% is left out of the loop. The 1% don’t use public roads, bridges, and public transportation, along with the education system and other public services. (Senator Kennedy used to fly in his private jet to and from the senate.) Do you actually think mitt would wait at the DMV for hours to renew his driver’s license or wait in an ER for his turn to be seen by a doctor? So, in order to gain more money and power there is no need for public services as they don’t service the 1%. The 1%, as they gain political power, are decimating the public sector and eventually it will simply “disappear”. The unbelievable part is that the average taxpayer agrees with the 1% that public employees are the problem by being paid too much and have too many benefits sucking up the money and benefits from the average private citizen causing and contributing to the financial, deficit, and economic and jobs crisis. The mess, was in fact, created and perpetrated upon the 99% in order to gain more power and money and the process becomes self sustaining: The more the 1% takes the more it can take. An example is housing. Your house “lost” about 30-40% in value (but only if you sell do you realize the loss) the 1% has no intention of selling, they are buying and accumulating wealth at bargain prices. There is a purpose to their madness as they grow wealth at the 99% expense..

As usual the guys who write this tripe have nothing to say about the activities of the fiancial sector which are responsible for 99% of the systemic risk. These are the OTC credit derivatives, notably credit default swaps, hundreds of trillions of dollars of which have swamped the system, stymied any meaningful regulation and dwarfed what remains of the so called real economy. The amazing thing is that firms continue to trade these things with counterparties they have no reason to trust apart from the likelihood of continuing central bank bailouts. While such bailouts continue they continue ballooning fictitious capital and fictitious profits and real bonuses in the hands of our only real criminal class, the smooth talking bankers parading daily on that moronic business network. Everything else is simply opera.

Maybe, though I would assume anyone serious about too much “interconnectedness” would argue for the elimination of CDS and most derivatives.

Exactly.

TBTF isn’t the problem. Rather, “too complex to fail” is.

So once again, it’s really in large part a problem of political will.

And yet again, no mention of tax havens.

Although this is an interesting post, I see no mention of corporate structures (rooted in the Anglo-American system, for the most part). I see no mention of fundamentally re-organizing the nature of the corporate structures that appear to equate ‘credit’ with bank profit. That is a given *only* under the existing legal (and therefore ‘political’) structures. Perhaps I missed something in the piece, but it seems that fundamentally we need structures that enable people to recognize, and address, reality. Rather than what we have now, which is a system of legal machicolations that enable fantasies, illusions, and lunacy.

That said, anything that can better address, expose, detail, and account for externalities would be a huge improvement over what we have today.

” an asset bubble looks like increased wealth to the community, so anyone who stands in its way is going to be extremely unpopular.” Yves Smith

I’d say it IS increased wealth. The problem is that it was built with TEMPORARY money – so-called “credit” – that is lent into existence and is destroyed as it is repaid.

But what if we used PERMANENT money exclusively for lending purposes? Might that not eliminate the boom bust cycle? Especially if that permanent money supply steadily grew? Note that this suggestion is NOT Milton Friedman’s idea that credit creation could be controlled via the size of the base money supply (the money multiplier myth) because there would be NO credit creation. All lending would be done with existing money, what is typically called “bank reserves” today or “base money”.

Of course there is not nearly enough base money to lend without MASSIVE deflation if further credit creation was banned. That’s one reason (besides Justice) that we need a universal bailout of the entire population with new fiat – to provide the new base money needed for honest lending.

The Market, if it actually exists, can only do one of two things. It can expand or it can contract. In both options contagion is the mechanism by which it expands and contracts. Contagion, in a sense, is the market. It’s a dirty word here because we just saw the “market” collapse and we are looking for explanations. The article talks about market failures as something to be controlled, when in reality failure is what markets do. It assumes there are points of failure, like bubbles, that can be controlled without harming the other sacred functions of the market. I think this view wants to have its cake and eat it too. We will kill the market by smoothing out the dreaded risks, or we stand back and let the market kill itself in a crash. But we can’t have it both ways. I’m in favor of draconian regulation. I don’t think that is the kind of regulation this article is implying. If the Market were controlled to the point of making it almost static I think it would be a good thing because it has become such a totally artificial construct anyway. And it seems crazy to try to correct itself with a superimposed derivatives market. That’s just one more market con. I wish I understood all this.

I wonder if this distinction might be useful – if an item/service is not essential for the general welfare, let the market have it and play with it – e.g. the price and availability of potato chips. If it is something that is inherently necessary for welfare like water or healthcare, e.g. then it becomes something soc., through its gov/admin bodies, is required to provide for all it’s citizens.

To the extent that services/items that were once novelties/luxuries have become “necessities”, they need to be removed from the private and put in the public sphere as “utilities”. This has all sorts of interesting implications, IMO …. not the least of which is the degree to which companies/corps manipulate the public/process to turn their “goods” into “necessities” ….. Want to keep your company and its product in private hands (and this includes so called “public companies”)? Keep it small and “unnecessary” ….

Government backing of the banking cartel violates “Equal Protection Under the Law.” Why do the banks have accounts at the Fed but the general population doesn’t? Why are the banks allowed to borrow at the “Discount Window” but the rest of the population isn’t? What are the banks that deposits with them are insured by the Government?

“Stability” is a value for the rulers, not the ruled:

http://strikelawyer.wordpress.com/2012/08/06/stability/

Optics alert. Interconnectedness undoubtedly contributes to systemic risk, but how is it a market failure? It’s a feature.