lambert strether blogs at Corrente.

Last time I was in Bangkok, my hosts instructed me to go shopping for some clothes so I could learn to bargain, at a humongous multi-storied megamall complex they called the Platinum Center. So I got off the train in the steamy heat, map in hand, and set out for, yes, there it is on the map, “Platinum Center.” Now, Bangkok is huge, it makes LA look like a village, so I expected some melty, slow-footed wandering about. What I didn’t expect — although food carts eased the pain — was an hour of peering up at the signage of one über-luxury megamall after another, and not seeing the name that I sought. Did Platinum Center exist? Had it been renamed? Moved? Was the map wrong? Until, finally, I looked up at the sign of what turned out to be my destination, and struck my forehead as it hit me (I do that a lot in Bangkok) that the sign, which I had looked at twice, at least, read–

“Pratunam” (say it). Platinum. ZOMG!!!! The building was six stories of platinum-colored metal sheathing, too. Well, er… Anyhow, in some ways, the Platinum Coin controversy (so over, or not) reminds me of my trek through the heat and haze to the Platinum Center: The goal was so large and so obvious that I couldn’t see it. But there’s also feeling of being, well … Being stupid. Of course, Bangkok doesn’t want to make people stupid. But plenty of players in The Coin controversy did and do, and in a bit I’ll look at some of their methods.

The Big Lie

The Big Lie is that the we’re “going broke,” “running out of money,” or even that a nation must “pay its own way” (to whom?). Dan Kervick has the right of it.

The coin debate triggered something. The platinum coin is a big shiny, reminder that in some way, somehow, the monetary authority of the United States rests with the American people, even if the plutocratic architects of our financial system and the owners of our country have succeeded over time in burying that authority under many layers of convoluted technocracy and confusing delegations.

We have it within our power to make sure the Treasury account is fully funded to accomplish whatever we might want to do with it, subject only to limitations on the real assets of the Unites States and the energies and capacities of its people. Currency assets can be created at will, and allocated to whatever tasks we select for them. It is entirely a matter of public policy choice whether we pay people interest in exchange for temporarily transferring dollar balances from their own accounts to the Treasury account. If we don’t want to pay the interest, we can either tax away those balances, or create new balances directly in exactly the same way the Fed creates them every day in the exercise of monetary policy. People now see that if you can create a balance in the Treasury by minting a coin and depositing it, you can also create a balance in the Treasury without the interposition of any barbaric and anachronistic metallurgy.

In other words, whether the powers that be like it or not, and whether people use the form of words or not, the conversation is about [lightning strike; roll of thunder; creak of door] fiat money. And it’s to be hoped that there are many more forehead-slapping, ZOMG!!!! moments to come.

Fiat money, that is, is Platinum Center: The building that is so big that I could not see it. And now to Pratinum vs. Platinum: The nits that cause us all so much trouble, by design or no.

The Wrong Stuff

Formatting note: In this section, I’ve helpfully marked the bullshit [บี เอส] with italics. If only the real world worked like that!

Mind-boggling falsehoods

A coin is worth the metal that’s in it. FOX: A $1 trillion platinum coin would weigh 17,773,995 tons. Rep. Greg Walden: “[T]he last thing we need for Treasury to mint a new coin made out of platinum that would weigh, by the way, Neil, 44 million pounds if it was tied to the value of platinum like gold has to be tied. I mean it would sink the Titanic.” Yglesias: “In my wallet right now I have a bunch of $20 bills, a few $1 bills, and a $5 bill. These bills are worth different amounts of money due to the fact that they have different numerals written on them. … Coins are the same.” D’oh. Even I understand this. And yet the conflation of a coin’s value with the price of its metal was ubiquitous.

Mischaracterizations

To describe The Coin, trick was a favorite, as were gimmick and magical. The deeper thinkers in the political class settled on banana republic. These characterizations were and are one and all false. Nixon went off the gold standard. FDR confiscated gold held in private hands. FDR also printed a $100,000 bill. JP Morgan is said to have saved the government with an obscure coinage loophole. And then there were Lincoln’s greenbacks.

None of these monetary maneuvers turned the United States into a banana republic (and if that’s what we are, it’s money in the wrong hands, not soft money, that’s the problem). If these be tricks, let us make the most of them!

Obfuscatory humor

Most of the (mediocre) jokes about the coin focused on the mind-boggling falsehoods or mischaracterizations above; same deal with the design contests, which necessarily focus on the coin as metal. The Coin was also said (falsely) to not merely to be like a Simpson’s episode — if true, so what? — but to have originated on a Simpson’s episode. (Early coverage of the coin was rife with faulty and careless provenance.)

Weak framing

Chris Hayes: “The genius of the trillion dollar … illustrates the uncomfortable foundational reality of modern capitalism. Money is nothing more than a shared illusion. It`s a kind of magic. But is it good magic or bad magic?”

Well, I don’t buy “illusion” for a minute. For one thing, when I write a check to my fuel guy tomorrow, it’s sure not going to feel like an illusion or a magic trick. More seriously, money is about as illusory as, say, a GET under the HTTP request/response protocol which cannot be seen, touched, or weighed, but which builds the web page you are reading now, and not by magic. I’ll close with an obscure blogger (one Jerry Khachoyan) who gets it right where Hayes gets it wrong:

“Why #MintTheCoin Has Already Won 1) The debate has shown who GETS what money is and who does not. Plain and simple. We operate in a world where the dollar (and many other currencies) is free-floating and nonconvertible. It is truly fiat. Yes, that may sound scary, but it’s the reality in the world we operate.

Anyway, hopefully the #MintTheCoin conversation has opened many people’s eyes as to what money truly is and where it comes from. It’s not something dug from underground, or something China sends to us; it’s a social construct [not “illusion”] (very simplified, but that’s the very core of it). Also, on the flip-side, it has publicized and thus discredited the many that don’t understand what it is.

Indeed.

Trivialization

In his near real-time intellectual history of the coin, Joe Firestone has distinguished between “small ball” approaches to The Coin, which treat coin seignorage as a tactic in the debt ceiling fight, and a “game changing” approach that would “end any perceived need for austerity.” The political class almost unanimously plumped for the “small ball” approach, trivializing it. Ironically, the comedian Jon Stewart seems to be one of the few who have gone down this road (“go big or go home”), and he was swatted around by progressives for his pains.

Conclusion

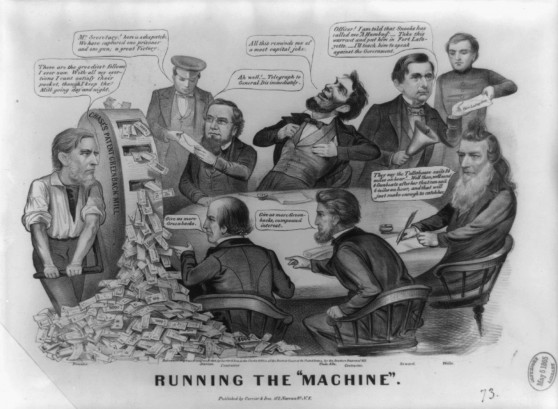

Word of the day: Agnotology (hat tip, Yves). That’s the science (“-ology”) of making people stupid. A real seventy-five-center, eh? Be sure to impress your friends by sharing it! I’d like to see it deployed a lot. In this post, we’ve seen various disciplines within Agnotology — the Big Lie, and all The Wrong Stuff — all working away to good effect. I like Agnotology as a general category for the immense structure of bullshit, propaganda, mis- and disinformation, talking points, tropes, memes, dead metaphors, half truths, deflections, distractions, and outright lies (“noble” or not) that it is the pleasant task of our political, media, and technocratic classes to maintain, because as with any branch of knowledge, we can think of agnotology as having personnel and a reward structure (see under “academic choice theory”). We might also imagine practical and theoretical agnotologists forming learned societies, journals, creating funding models, inter-breeding, and so forth. One could no doubt use the sociological and historical tools from history of science and intellectual history. Life’s rich pageant!

“I’ll take crazy over ‘agnotology’ any day.”

“Two things are infinite: the universe and human ‘agnotology’; and I’m not sure about the universe.”

“In politics, ‘agnotologity’ is not a handicap.”

“’Agnotologity’ isn’t punishable by death. If it was, there would be a hell of a population drop.”

“If complete and utter chaos was lightning, then he’d be the sort to stand on a hilltop in a thunderstorm wearing wet copper armor and shouting ‘All gods are bastards!”

(pratchett ‘laughed’ it, anyway he’s one my favs’)

“Whenever a man does a thoroughly ‘anotological’ thing, it is always from the noblest motives.”

“There is more ‘anotologity’ than hydrogen in the universe, and it has a longer shelf life.”

(zappa can end this set, cheers)

Agnotology, My computer’s dictionary is so dumbed down it doesn’t include the word. This is also true of most of the other words I look up. Sadly, the OED is in storage.

Those who take the trouble to contemplate the meaning of the platinum coin realize that what is routinely done for the 1% could be done for the rest of us. What we have is a political crisis, not an economic one.

The word is in Wikipedia, and according to Wikipedia it’s only existed since 1995. The Greek roots are as venerable, though, as any other word’s Greek roots.

You would destroy your own purchasing power with that kind of idea. There is a reason why “stimulus” funds go almost entirely to banks. If those funds were distributed among the public to spend into the economy you would see bubbles of large inflation pop up all over the country. As soon as a few people start raising prices that effect snowballs. As someone who lives on tight margins and works at a small business if I start paying more for my inputs and costs of living then I must pass those costs on to my customers. I really don’t understand why people can’t see this.

In nature there are no free lunches. We as humans are part of the web of nature. In the west we have artificially created free lunches partly through technology and partly through passing the labor off onto other people(think Asian outsourcing). A generation has grown up under this illusion and so it makes sense to them that you can just create the money out of thin air and people will accept it for goods and services that they had to actually work hard to produce.

People will speculate with the extra money. That will drive up costs which in turn will be passed on to you. Your net gain over time from any extra “money” you received will be zero…because it was never real to begin with.

You’d be right if the economy were running at full capacity — no unemployment, business humming. It’s not. There’s not enough money in the right hands to buy the things the economy is capable of producing. If more money was given to people to spend, businesses (including yours) would expand to handle the additional demand. You’d hire more people and sell more stuff. Inflation would only kick in if there weren’t more people to employ or the necessary resources weren’t available. This may happen in the future (a plague, peak oil) but we’re nowhere close to that yet.

“Inflation would only kick in if there weren’t more people to employ or the necessary resources weren’t available.”

But the resources aren’t available. Or more rightly said, “freely” available. In fact this is why we wage wars in the middle east…for energy resources(and arguably others-see Afghanistan mineral resources). This is why the Chinese are buying up commodities and looking to expand into resource rich areas of Africa. There will always be a “floor” of demand under these basic inputs of energy and commodities because you cannot “mint” them out of thin air.

As you create more money in the system to chase this finite amount of real world resources you will just drive up thier costs. And like Maslow’s Pyramid everything above depends on what is below. Those increases in costs will transfer up the pyramid. With 7 billion people and counting on the planet, all looking to lead better lives you have immense competition for that which is REAL, i.e. Food, energy, construction inputs.

How do you convince people to keep accepting as payment something which you just create out of thin air whenever you feel like it? You do it at the barrel of a gun…which is in fact what the U.S. is doing as we sit here speaking. If you are in doubt look at our military bases all over the world and ask yourself…”why?”. It has nothing to do with terrorism and everything to do with empire. And I say that knowingly as someone who benefits from the extraction of REAL wealth.

There *are* resources available. Mostly labor.

There’s plenty of sand, too, to make solar panels. We’re not running out of the minor ingredients for solar panels, either.

So, frankly, we could print a bunch of money and spend it hiring people to manufacture and install solar panels. Right now. It would work.

You’re correct that printed money shouldn’t be spent on oil, which we are running out of, or on highly oil-dependent activities.

But we could print money and spend it on renewable energy, and employ people. Right now.

Nathanael-

I agree that this would be a “productive debt”. But you are not cynical enough. The government is not interested in empowering the people through cheap/clean energy. They are interested in maintaining their stranglehold on authority.

Our government is captured by special interests and corporations. They are running the show and only lip-service will be paid to people ignorant enough to believe in a government “by and for the people”.

The founders of the U.S.A. understood that power corrupts and like gravity in space it attracts more power to itself over time. The constitution is basically a collection of curtailments on government…in an attempt to head off any over-reach. Sadly it has utterly failed or been circumvented.

Speaking about agnotology, this is one of my favorite episodes of the Keiser report–an interview with Micheal Betancourt (starts about 12 minutes in):

http://www.youtube.com/watch?v=iRTfex2VQ7g

Coincidentally enough, it’s an interview about agnotology as it relates to the modern implementation of fiat capitalism. The idea here is that that our electronic-fiat system that has nothing backing it but belief always trends toward greater and greater disequilibrium until finally there is an inevitable collapse. For me, one of the best signs that this collapse is beginning to take place right now is that some people were actually taking this platinum coin hokum seriously.

Kicking the legs out from underneath the paper fiat system by killing the idea that all money that is lent into existence is tethered by something (debt and interest) would be a very good way to get the economic collapse rolling. And the funny thing is that even by just taking the inane idea somewhat seriously–without it even being implemented–has already severely undermined the fiat regime:

http://www.zerohedge.com/news/2013-01-14/it-begins-bundesbank-commence-repatriating-gold-new-york-fed

The standard response of the powers that be to ideas which challenge their control are:

Ignore > trivialize > co-opt > demonize > outlaw.

With the platinum coin, they are now somewhere between 3 and 4.

Thanks, Hugh. Their control of the creation and distribution of money is key to their control of us. Lambert’s brief summary and the president’s quick dismissal of the proposal revealed both their fear, and the responsiveness and extent to which they use media to suppress alternatives to the status quo and the road to Austerity.

It is now clear to all that they are hellbent on continuing to implement deeply damaging Austerity policies when alternatives exist. My question remains Why?

imho, you answered your question in the 1st sentence: Control

‘they’ are banking on probabilities:

‘i’ll rebel against this system Until they force me to witness the starvation of my child’…then they may have my attention (which i’ll count on their indulged egos to confuse with fear/respect…historically a tipping point mistake on the part of ‘tptb’)

This article shows with unmistakeable clarity why the Trillion$ coin was always such a bad idea: It’s too confusing, hence politically disastrous. The media can’t understand it and thus can’t explain it to anybody, it seems stupid to the American people and worst of all, it lets the Republicans off the hook for their insane grandstanding.

It’s easy to make fun of Fox News for their idiotic “the coin would weigh ten trillion tons” theme — but how many Americans actually know that the amount of silver in a coin does NOT equal the coin’s value? Certainly a lot less than 1/2. Remember that people were unhappy when quarters started having the copper strip in the middle, because that made the coins seem “cheaper”?

Anyway, the fix is already in. The Koch brothers just came out against defaulting on the debt limit and they hold all the purse strings. Very rich people stand to lose very much money, so the GOP can’t actually cause a default. There’s not much left now except right wing angst and bloviating.

Once Obama signaled he wouldn’t negotiate over the debt limit (but WOULD capitulate in budget negotiations), then it was all over. Republicans have ZERO ability to actually default, they just need Obama to “negotiate.”

If he refuses, they have no choice but to fold. And they will fold in the most painless way possible; just allow a vote in the House on a clean debt limit bill, which will pass with all Democrats and 30-40 Republicans.

This is one of my favorite photos of Hemingway: http://media.aphelis.net/wp-content/uploads/2012/03/BRYSON_1959_Hemingway_kicks_can.jpg

there is no silver in anything other than special commemorative coins at this point;since 1965.Since 1965,silver colored coins are called “clad” which just means alloy.I believe the silver color comes from nickel.The copper core is just a layer.

Yes but back in the 60’s you could get a ~gallon of gas for the silver quater. How much gas can you get for your current quater? It’s all relative. It’s still a quater, but what does a quater mean if it only has the purchasing power of a penny?

All that ever happened was that money got diluted over time to make it easier to pay off existing debts. Sure some goes to productive investment but much more goes to inflation…and not inflation of your wages either.

You know when you can mint a trillion dollar coin and see no ill effects? When we have free energy.

Considerthesource: that’s what hydropower, wind power, geothermal, and especially solar power are for.

Free energy. It really exists. Most of it is coming straight from the sun.

@Hugh

Excellent (Ghandiesque) conceptualization of real stages! I think there’s a fuzzy area between #2 and #3. E.g., where would distraction or imaginary “cliffs” fit in? I’d say that’s where the platinum coin is.

Not three people in 1,000 understand that the “debt limit” is self imposed. A majority of our Congress Critters could eliminate it tomorrow, and these are the same geniuses who vote appropriations. They can also exempt certain expenditures for important things like Imperial Wars. Oh, wait, they’ve done that, right?

SO simple without make wow ..in comment ( idon’t like ) to impress noone by my logic

i will try to finde (ena tripa sto nero).

SYMBAN is unlimitet..

MONEY IS SOMETHING BUT NOT EVERYTHING

IF YOU CAN NOT LEAVE WITHOUT THAM YOU ARE LUCKY.

LIE IS THEATRO ..

REALLY IS FACT

THANK YOU I DON’T BY CLOTH BY PLATINUM

Just a note: Chris Hayes said money was a “shared illusion”, he did not say it was not real and did not have a function. It is when we take this shared illusion, this concept, to be the same thing that it represents (time, resources, power) that we start having all these problems.

Imagine if Bill Gates could not use money (or digital 0’s and 1’s) to represent his wealth, where would he store all that stuff? How

Money talks, bullshit walks. Any money dumped on the streets of Philadelphia does not have a long half life. (1.) I haven’t really seen a different attitude anywhere else in the world. The US Government is the sole point of origin of money. It is the only money we are allowed to use and it only comes from the US Treasury and its manufacturing facilities at mints and special printing facilities. Additionally, any variation on money, comes solely from the US Government.

Exhibit A.)

Check 21 FAQ: From Fed website….

“How will Check 21 make check processing more efficient?

Instead of physically moving paper checks from one bank to another, Check 21 will allow banks to process more checks electronically. Banks can capture a picture of the front and back of the check along with the associated payment information and transmit this information electronically. If a receiving bank or its customer requires a paper check, the bank can use the electronic picture and payment information to create a paper “substitute check.” This process enables banks to reduce the cost of physically handling and transporting original paper checks, which can be very expensive.”

http://www.federalreserve.gov/paymentsystems/regcc-faq-check21.htm

http://www.check21.com/

My credit union has an app for smart phones which allows me to take a picture of a check and submit that for deposit. Then, electronically, using the digital image, which is a legal check, is more efficiently processed, by the new Check 21 clearing process. The shock of 9/11 and the grounding of all air flight, essentially stopped all retail banking from functioning, because the state of the art check clearing process, ACH, required chartered jets with bags of paper checks to criss cross the country for processing at Federal Reserve banks around the nation. Congress wanted to know why the banks weren’t using the internet, which would have made the US Economy safer under an attack, from failure of the banking systems to conduct necessary day to day operations that people need to buy food and gas and function. So, Check 21 came on line, relatively quickly in 2004.

It’s not a mystery, really, to people, who use debit cards, sign up for direct deposit and now, use apps on phones to deposit checks. Really, the only mystery is how stupid and condescending TV commentators are when talking and trying to mystify a public that already has a pretty firm grasp that money is not thing or more intellectually for the NC community, money is not a commodity, buy a meta-commodity, used to facilitate the exchange of all other commodities. And, it only comes from the US Government. Once accumulated as profits, it may increase in quantity due to corporate banking, but they are also a franchise of the sovereign state.

(1.)http://en.wikipedia.org/wiki/Money_for_Nothing_%281993_film%29

Paul Tioxon: ” The US Government is the sole point of origin of money. It is the only money we are allowed to use and it only comes from the US Treasury and its manufacturing facilities at mints and special printing facilities.”

True, but not exhaustive.

Anybody who has control over real resources can create money. A self sufficient farm would be a good example. The farmer can create a currency and use it to pay workers who can use it for any and all food, shelter and other resources available only on the farm. “Foreign” exchange is the big problem, since the farmers currency has no larger legitimacy. Wouldn’t that be the reason that ‘Markets’ were chartered back in the middle ages, when universal currency availability was spotty, and there was need for the various manors and farms to exchange goods? The universal currency gets used predominantly at the market. That would be a good location for taxing people, too.

So in this sense the analogy of a farm’s budget to compare with a National budget would be a whole lot more useful than the ‘household budget’ analogy.

Stephen, this USA and the year is 2013. It is illegal to make money by your definition. It is called counterfeiting, whatever went on the Middle Ages, stayed in Middle Ages. Our money is universal. Everyone recognizes that, except for the theoretical musing that go on here, among other places, counter factual tale spinning is not a description of the world we live in, but a description of the vague notions in someone’s mind.

If you have ever even tried some alternative type of credit system, like a baby sitting coop at a university, you would be visited by the government. Money facilitates exchanging goods and services and even in the relatively simple instance, where people in fact did as you suggest farmers do, the IRS said no. Sovereign means no higher power, so right here and right now, we already have a universal currency in the USD. You can not secede from the USA and set up your own currency. Sorry.

The US government is the sole source of legal tender currency, base money, but it is not the sole source of money. Bank money, bank deposits, bank credit is money. As are “local currencies” like the Ithaca Dollar. They just aren’t as good money as Uncle Sam’s money.

Ithaca Hour. :-)

The problem is currency bleed to the outside. If the local economy were entirely self-sufficient, or stronger in exports than in imports, it would be pretty easy to set up your own local currency.

Stephen N., I thought about this also. Their are several local currencies using the model you explained.

The current model is this: the govt. takes everything it can from us and moves as far away from accountability to the people as possible. We must reverse this state of affairs. I think your model is a way to make the reversal. We should make the money and we should make this govt. superfluous.

The people who run things are incompetent, cruel and evil. They should not have power. They should not have money to spend for a pack of gum, let alone for all the weapons and financial fraud they currently engage in. If they can move away from us, we can move away from them. We can try to do right by each other.

Of course, others are correct to say these powers will outlaw any attempt to make them superfluous. We should still try. For this we need powerful, peaceful strategies of resistance.

The only “peaceful” strategy proven to work is non-participation. Ghandi did it in India and Martin Luther King jr. did here in the U.S.

And non-participation means self-induced austerity. Can you live like a monk? Because that is what it will take to starve the beast.

There are fairly effective ways to not participate, to the extent possible, without living like a monk. It requires having an entire community and a large startup investment.

Of course, try that and the government may gun you down like they did David Koresh. (Yes, he was an abusive cult leader, but that’s very similar to the most effective way to be a non-participant without living like a monk.)

Nathanael-

You have to avoid paying federal taxes anyway possible. In many areas you should really avoid paying state taxes as well. Many states are completely corrupted by the federal government..California..New York…

Of course I would never encourage breaking the law…I could be put on some “bad list” or indefintely detained you know? I can remember a time when people would laugh at the possiblity of something like warrantless search and seizure and indefinte detainment…it could never happen here.

yeap-

actually, your interpretation of money is completely off.Real things can be traded,by consenting parties.This is bartering.”off the grid”,local currencies aren’t actually “worth” anything,outside of the group who agrees on its value to them.These ad-hoc currencies are actually like many that have gone before.That is why the early capitalists/merchants wanted a “gold standard”.So that their trading partners had a reliable fixed asset,to judge the value of their currency against.It has always been arbitrary,as gold has little inherent value.

In the middle ages,many did not have money.and many didn’t travel far enough to need to barter with people they couldn’t trade foodstock or products with.the various empires created their own money, this doesn’t mean it was universally accepted.Even in the early 19th century in america, US dollars were redeemable at different rates depending WHERE you tried to exchange them for gold.THe gold standard, wasn’t really a “standard”…

You should look over at the American monetary institutes website.And stephen zarlenge’s “lost science of money” book.

rob,

Thank you so much, you certainly are improvement over the previous history of money, but we are not dealing with history, we are dealing with the present, in America. But you get brownie points for denouncing me in a civil tone and bringing your argument from the Middle Ages all the way up to the 19th century, kudos, only two more centuries to go, and you will be HERE! I want to thank all of the dreamers for staying firmly put in their minds where they are coming up with bold alternatives to the lousy world we all live in. Also, your website references are impeccable. Seriously, not a condemnation at all, science of money has a lot of goods ideas. But then, a lot of those ideas are what we talk about all of the time here. But I can’t indulge in barter talk, that just is not a sufficient cultural norm for a complex society such as we have. Start with the resources that you have, and organize around them. This is policy analysis for a nation state, not neighborhood flea markets or rural counties.

One idea I heard that could make sense as money: the kilowatt-hour. When it gets right down to it, energy is the real money.

The only reason I have oil stock, is because energy represents real money.

Rob, your history is not quite correct. Look up ancient Sumerian money. The “local currencies” arrived *first*.

The “metal standard” was developed to deal with transactions between two countries which were non-cooperative — ones which were frequently at war with each other, for instance.

In Egypt, which maintained a stable central government from a very early period, they never *needed* money, let alone metal-backed money. They had a state-published schedule of fair barter rates and state-run accounting to keep track of who was owed how much.

Money “backed” by something is only necessary in an environment of weak governments, war, and general lack of trust. If you need it, things are going really really badly already.

Modern economies work on credit. Credit by definition is deficit marked up on balance sheets. Credit is created from nothing by both the private banking sector and government. Looked at on one global balance sheet when the deficit from the private banking sector declines or slows down in its creation it’s logical to increase government deficit creation to maintain demand. The Neo-Liberal economic thinking that dominates minds throughout the planet, with the exception of Chinese Communist Party leaders, fails to understand this despite it being around from the 1930’s writings of Keynes.

http://data.worldbank.org/indicator/FS.AST.DOMS.GD.ZS

http://data.worldbank.org/indicator/FS.AST.DOMS.GD.ZS/countries/US-GB-DE?display=graph

Lambert, I suggest you might want to check your map again – just to make sure you did indeed reach you intended destination.

You see, Platinum Fashion Mall (six floors of “vibrant” shopping) is smack in the centre of Pratunam – a district that specializes in wholesale fashion clothing (and “accessories”). However, Pratunam Market is also is a major market selling clothes, shoes, and fashion accessories”(but, at “wholesale prices”) and is located at the intersection of Ratchaprop and Petchburi roads (nowhere near Pratunam district). You being an international man of mystery, I’d hate to think that you’re missing out on some quality 70’s retro-style ruffle shirt and a pair of drain-pipes (which, really, will come back into fashion quite soon).

Though, if it’ is platinum (Pt) you’re really interested in, I suggest Tang-To-Kang (oldest precious metal dealer in Thailand) on Golden Road (take the subway to in the Hualampong then a cab to Yaowarat); you can’t miss it – it’s right next to a big fashion mall…..

Another beautiful metaphor exploded! Well, I’ll just have to back and clarify matters “on the ground.” What a shame.

I encourage your research efforts…. :-) But, as my great grandfather use to say of the sartorial, post war (II) splendors he preened around town in (tailored by first generation Indian immigrants to Bangkok’s Sukhumvit Road – London’s Jermyn St), “never mind the quality m’boy, feel the width”. Ah! Quantity over quality…. who could argue with that in Bangkok? Cheers!

Lambert,

From an earlier thread:

>> If the government’s net contribution of money to the economy increases, that only causes inflation when the economy is at or near capacity. We’re nowhere near that point.

Houses are up 20% in 3 years in the markets I follow, cars up 15%, gas doubled, food increased, health care costs are rising. All without the economy being “at or near capacity”.

So, do you have another theory? Or would you agree with my earlier statement that:

“Printing new (credit or money) increases the amount in circulation and depreciates the purchasing power of my savings and my yearly salary. The inflation tax is a tax.”

?

>> Of course, we don’t really print money; money’s digital, kept on spreadsheets.

Gee, thanks for nitpicking, Lambert. (But, of course, it’s not really kept on spreadsheets. It’s kept in databases. Right?)

Dr.Housing Bubble is on this. http://www.doctorhousingbubble.com/

I was going to cite particular articles, but if you hurry, at least two of the first three are on this topic. A couple of things are happening:

1) Financial Institutions are delaying forclosures and sales to keep from flooding the (existent?) market, and keep prices up.

2) There’s lots of investment capital floating around desperate for places to go.

Generally, expanding consumer income is NOT what’s pushing those increases.

Dr. Housing Bubble is right.

There are regional variations. The large lots of REO homes being siphoned off to PE at 1980s prices in some parts of the country are evidence of that (e.g. as in the East Bay versus San Francisco).

So the doctor may seem repetitious — a one-trick pony — but the his/her single message, beneath all the variations, is absolutely correct.

Thanks, Mel. Your points “1” and “2” are consistent with my argument.

Let’s look at them in reverse order:

>> 2) There’s lots of investment capital floating around desperate for places to go.

Gee, where does that come from? It’s coming from the trillions the Fed printed into existence and gave away in a fraudulent “exchange for assets” that wouldn’t sell in an open market without big writedowns.

>> 1) Financial Institutions are delaying forclosures and sales to keep from flooding the (existent?) market, and keep prices up.

And why do they delay foreclosures? Because they expect prices to increase later on. In turn, why do they expect prices to increase? Do you think it might be related to their expectation of what money-printing does to prices?

>> Generally, expanding consumer income is NOT what’s pushing those increases.

Agree.

Also, from Mark:

>> The large lots of REO homes being siphoned off to PE at 1980s prices in some parts of the country are evidence of that (e.g. as in the East Bay versus San Francisco).

Again, where is this PE money coming from? The Fed prints and gives away fresh money to investurds. No matter who gets it first, that money flows somewhere and eventually flows into the hands of someone or some group who in turn outbid me on a house.

How is my purchasing power not being taxed in all this?? How is this not “price inflation”??

There’s no inflation due to the use of PCS itself, whether a $1 T coin is involved or whether a $100 T coin is involved. The basic reasons are: 1) when debt is paid off the reserves swapped for the debt are less inflationary than the reserves that are added in their place; and 2) the reserves added to the economy during deficit spending are no more inflationary than if the net result of deficit spending is new securities added to the economy, which is the net result of deficit spending as it is now managed.

The dynamics here are analyzed in detail by myself here: http://neweconomicperspectives.org/2012/12/platinum-coin-seigniorage-issuing-debt-keystroking-deficit-spending-and-inflation.html In addition be sure to read Scott Fullwiler’s post linked to in mine, and also Eric Tymoigne’s post as well. Read these carefully, then if you have specific objections I’ll be happy to discuss them; but the material already written is far to detailed to repeat here.

I can put this more simply. (You may find this useful for explaining things to people in the future)

Inflation cannot be caused by increasing the amount of money *in existence*.

Inflation can only caused by increasing the amount of money *in circulation*, being used to buy goods and services.

If the money’s sitting in a vault (or the electronic equivalent), it’s like it doesn’t exist, for purposes of inflation.

Minting the platinum coin avoids the stupid debt limit law, but it doesn’t actually increase the amount of money *in circulation* — being used to buy goods and services. You’d have to increase spending in order to do that.

(Lending doesn’t necessarily increase the amount of money in circulation, *either*, unless the lent money is spent. If you borrow money and put it in your bank account, there is no increase in the amount of money in circulation.)

Yeah, but the federal government spends the money obtained via the platinum coin (or other fictions) into circulation.

Doesn’t that then reverse your conclusion?

…

RUT is at an all-time high and the SPX isn’t far behind. Average gas prices in 2012 were the highest for any year, even with a significant decrease in miles driven. I’m once again shut out of housing markets like I was in 2003. Should I believe you otherwise-dependable NC commentators or my lying eyes? ;-)

The Federal government spends it already. The appropriations were made, they have to be spent. :shrug:

You are assuming wayyy too much with your statements.

“Inflation cannot be caused by increasing the amount of money *in existence*.

Inflation can only caused by increasing the amount of money *in circulation*, being used to buy goods and services.

If the money’s sitting in a vault (or the electronic equivalent), it’s like it doesn’t exist, for purposes of inflation.”

If people were to perceive that uncontrolled creation of money were to lead to inflation then they might run from your currency. Sometimes all that is needed is the perception of something to trigger an event. This is called Mass Psychology and James Dines wrote a book on it. It has a huge influence in things as nebulous as economics.

“Minting the platinum coin avoids the stupid debt limit law, but it doesn’t actually increase the amount of money *in circulation* — being used to buy goods and services. You’d have to increase spending in order to do that.”

Here is a chart on total federal government spending from 1960 to the present.

http://www.usgovernmentspending.com/spending_chart_1960_2012USb_13s1li011mcn_F0f

It is a mountainside. If it were a ski slope it would be a double black diamond. As you can see the government simply cannot or will not control its’ spending increases year-over-year. While technically the debt limit concerns spending that has already been approved where in that chart is ANYTHING that even remotely shows that if you allow them to spend today they will somehow miraculously curtail increases next year?

And all this money that they borrow…do you think it sits in a vault somewhere? No it is spent into the economy paying government employee salaries, buying up guns and ammo for the military or DHS. It goes as bribes..err I mean foreign aid. Anything and everything. A trillion dollars extra every year than can be extracted forcibly from a productive public…and it will only increase.

It would be ok if you sat at home with your ideas while you stared out the window. But the fact that you come out in public and expouse such ignorance makes you dangerous.

Unbelievable…

“While technically the debt limit concerns spending that has already been approved ”

Which is exactly the point here. The spending is already happening.

You can’t cut spending by gobbledegook mumbo-jumbo debt limits, you can’t cut spending by cutting taxes, you can’t cut spending by any method other than actually electing a Congress which will cut spending.

And we do need to cut military spending. But as for other spending? We shouldn’t cut it. In healthy economies, 50% of economic activity is government spending; we’re LOW.

To respond to your ignorance, I know waaaaaaaay more about this stuff than you. I would appreciate it if you wouldn’t come out and expose *your* ignorance.

There are a lot of moving parts. First among them is the political problem. This is going to solve itself in a rather unpleasant collapse. The question becomes, what do we replace the government with after it’s collapsed?

Answer: we want to replace it with a government which knows enough to know that it doesn’t have to “borrow money” from rich people at interest in order to fund government functions. The post-revolutionary government needs to understand that it really can print money.

Therefore, we need to get the ideas — the *correct* ideas — about how money works out there. For *after* the existing government collapses. As long as people like you are stuck thinking within the paradigm of the existing system, we won’t be able to develop a sensible replacement for the existing government, and in the power vacuum after it collapses, we’ll get incompetent results, warlords, and/or fascism.

“If people were to perceive that uncontrolled creation of money were to lead to inflation then they might run from your currency.”

This has never happened in the history of the world.

“Sometimes all that is needed is the perception of something to trigger an event. This is called Mass Psychology and James Dines wrote a book on it. It has a huge influence in things as nebulous as economics.”

Of course. It’s important to work out what ACTUALLY triggers such events, though. From my study of history and my reading of other analyses, I’m quite sure that monetary revulsion is caused almost every time by NON-monetary untrustworthiness. I’ve explained this before: the Iraq war, the “kill list”, Bush v. Gore are all things which increase the risk of monetary revulsion.

Printing money? Harmless.

For more proof of how safe it is to print money, look at de Gaulle’s devaluation of the franc. (This caused intentional inflation.) No hyperinflation, no currency revulsion. Why? The government was *generally* trustworthy.

I think we may not be that far off philosophically, actually. Perhaps you simply hadn’t spotted that I’m already expecting the collapse of the current system of government, so my comments are related to preparing what another commenter referred to as “White Papers for the Shadow Government” (the government of the future).

Nathanael-

I won’t argue with you anymore after this. I think your comments speak for yourself. But if you really believe that runaway inflation events are caused by non-monetary untrustworthiness I think you have gotten lost in the details.

While non-monetary untrustworhtiness may be a factor most every runaway inflation event is really a complex postive feed-back loop of money printing–>fear–>spending–>inflation–>more money printing and in higher denominations..until the wheels blow off.

I’d invite any skeptics to research my analyses. And while simplistic for the sake of conciseness on a blog I think it is basically correct.

So to get back to the main point…what does saying to the world and holders of your currency that you are going to mint a trillion dollar coin do? It causes fear.

I don’t believe you can have a successful long-term fiat currency. Human nature and all biology has built in intra-species competition. Our genes compete to stay in the present even as we wither away and die. We do have altruism, but for many it only manifests naturally to family members. Some don’t seem to possess it at all. So to say that a “claim on real wealth or labor”(money) can be printed at will and backed by nothing. I say that we as human beings..as animals with competing genes..will always find a way to abuse that system for our own personal gain or that of our specific group.

Best of luck and I apologize for being an asshole.

We disagree, but you’re not an asshole so don’t apologize.

I think you just stated the nub of our disagreement — your belief that fiat currency is backed by nothing. Not so. It’s backed by the full productive capacity of the economy, instead of being tied to some commodity of which at any time there may be arbitrarily much or little. There should be enough currency to enable the economy to run at full capacity, doing whatever we want it to do. The constraints on economic activity should be labor, resources, and the decisions we make on how to utilize them. Money should not be such a constraint.

Kudos. [More precisely, they may be an asshole, but not for the reason stated ;-) ]

The problem with the platinum coin idea is not only that it’s a gimmick, but that it diverts our attention from more fundamental issues:

1. Tactically, what Obama should be doing about the debt limit is NOT issuing a platinum coin, which would make him a laughingstock, but challenging the constitutionality of the law requiring congressional approval every time the debt limit needs to be increased. It would, of course, be a huge mistake for him to defy congress on the basis of the 14th amendment and raise the limit anyhow — that would almost certainly lead to impeachment proceedings in the House. Far more effective would be a direct challenge of congress’s right to defy the 14 amendment by forcing the US to default on its debts. The challenge should be taken to the Supreme Court as soon as possible. The amendment is clear: “The validity of the public debt of the United States, authorized by law, including debts incurred for payments of pensions and bounties for services in suppressing insurrection or rebellion, shall not be questioned.” Since the intent of the Republican dominated House is in fact to question the validity of that debt, even the conservative court would be hard put to dismiss such a challenge.

2. Strategically, what every liberal, progressive, Democrat, independent, etc. needs to remember is that, as far as the nation as a whole is concerned, there is no basis for any argument that this country is living beyond its means. No way we can or should plead poverty. There is far more wealth in the US of A than at any time in history, and hence the Tea Party claim that our deficit is “out of control” is sheer nonsense.

What is out of control is the ideology of those in denial over the need to pay our debts — and the way in which we have always payed our debts is via taxation. Which is one reason I’m so opposed to the idea behind the platinum coin, because that too is based on a very similar something-for-nothing ideology. The long term solution to our monetary woes is not creative accounting ala Enron, based on the notion that we don’t really need to pay for government, but convincing the American people that returning to the progressive tax structure of the Nixon era is a sensible way to fund all the many programs that make this country work for everyone.

This would require leadership from the President. He isn’t a leader, and he won’t go after the people who fund the GOP and their Democratic allies.

The platinum coin is a strategy for dealing with Obama as President. Its easy, and most people won’t care at the end of the day. There are too many problems to be dealing with the false-debt ceiling fiasco every three months.

The Republicans won’t be lobbied by popular outcry. There voters are idiots. If they weren’t idiots, they wouldn’t vote Republican. The GOP know Obama is weak. He let off Wall Street without even trotting out a few token sacrificial lambs. They get what they want from him and offer nothing in return. Obama’s harshest response is to whine. This is why the platinum coin is the sensible short term policy. Obama is the President and “leader” of the Democratic Party. Until there is a new nominee, Obama will be the leader of the Democratic Party, and very few will advocate a policy until they’ve seen Obama’s cards because he can crush their future prospects.

I agree that Obama isn’t much of a leader. But use of the platinum coin also requires leadership, and since Obama is the only one with the power to implement such a tactic, forget it, won’t happen.

But digging a bit deeper into this issue, any attempt to mint such a coin for the purpose of dodging the debt bullet would be met with a Supreme Court challenge, and since the whole idea is regarded by so many as patently nutty, the conservatives on the court would have a field day and it would be literally laughed out of court.

I’m not talking at this point about the validity of the idea in narrowly technical terms, but the fact that it would widely be perceived as a gimmick and have little chance of getting past the court.

In any case, you are right, there is no argument anyone could make that would scare the Republicans straight. They are determined to create a crisis and there is apparently nothing that could stop them — certainly not a platinum coin.

As I see it, Obama’s only recourse would be a Supreme Court challenge to the law authorizing the vote to begin with. I think he’d have a fighting chance of getting that law tossed, but it would be a fight for sure, and I agree: Obama is far from being a forceful leader.

My guess is that he’ll wind up simply folding and giving the Republicans what they want at the last minute. That’s been his pattern so far. His strategy has been to first bluff and then, when he feels forced to give in, whine — as you say, and I agree, he’s a whiner.

I also think it possible that he’s convinced himself there is no other recourse but drastically cutting the so-called “entitlements.” I must add that I’m disgusted at his willingness to renew the outrageous Bush tax cuts, which in themselves produced a large chunk of the deficits. Instead of exposing the Republicans as the hypocrites they are, he went along with the fiction that failure to renew those cuts would be a drastic increase in taxes. It would not have been. It would have been a return to an older taxation system that was both fair and sensible.

I’m not particularly worried by a court challenge. Any judge who wants to move up in the world has to recognize the Dems will be in the White House for some time. They may kick it up, but the Supreme Court doesn’t exactly respond to current events. Even if Obama did it, who is to say it might make the docket for October?

Roberts is still Chief Justice, and after the healthcare fiasco, I’ve come to the conclusion the man does recognize the Supreme Court only has power when its on the side of the people if attention is being paid. The man may be a prick, but he doesn’t want to be Dred Scott. People are watching the Court. If there was a ruling, it wouldn’t come around until after 2014 when they can hide behind an election.

John Roberts doesn’t want to be Roger B Taney (the judge who wrote the Dred Scott Decision).

I’m sure he doesn’t want to be Dred Scott (a man condemned to go into slavery) either, but that’s not quite the point you’re making. :-)

It’s not just that he isn’t a leader, NTG. It’s that he actually believes we are living beyond our means.

Don’t you dare call people who fall for a trick due to being mentally exhausted, unprepared, and conditioned by decades of living in a manipulative system which has (from their perspective) treated them relatively well “idiots”.

+100. As we said back in the day “check your privilege.” I’m so tired of hearing “the American people are stupid,” or “the sheeple,” etc.

Particularly on a thread whose theme — agnotology — is how there are very well-funded people whose goal in life is to make people stupid!

“the way in which we have always payed our debts is via taxation”

We are facing a group, the 0.1%, who do not want to pay their taxes. They have been extremely successful starting in the 60s.

If we cannot get Congress to raise their taxes, printing money is the second-best way of reducing their wealth.

Would it be necessary to deposit a platinum coin to fully fund the Treasury account? Can’t we just make it so without need for the coin deposit, thereby removing the magical slight of hand appearance of it all? Seems to me the coin is just symbolic, worth what it is because it is said to be worth what it is. So why not have the same effect without the coin?

Also, can any country do this? Or is it the privilege of a few (which countries?) or of just the US? If it is just a few or of the US only, why is that so?

No, the coin would not be necessary. The whole thing has turned into some sort of absurd urban legend. Obama, the Treasury and the Fed could put their heads together and figure out a way to simply “print” fiat money — electronically, natch. But this would inevitably lead to a supreme court challenge and the court would knock it down. Maybe without as much laughter and derision as the coin, but just as decisively.

What I don’t understand is why the obvious alternative isn’t being discussed. Obama could certainly challenge the constitutionality of the law instituting this fiasco in the first place. The 14th amendment is clear enough on this matter (see above). If the law is struck down, then that’s the end of it, no more hostage-taking. And I think there’s a good chance it would be since that law clearly violates both the letter and spirit of the 14th.

One appeal of The Coin, whether as “small ball” or “game changer,” is that the legal avenue through seigniorage was really clear. So the process could be operationalized.

“Put their heads together” isn’t quite in that class. Got any research on this?

doc – STM the “obvious alternative” isn’t being discussed because Obama does not WANT an alternative to being “forced to negotiate”. He wants to whack social programs, he’s wanted to for “ages” BUT he also doesn’t want to openly give the lie to the only thing left that even ostensibly separates Ds from Rs – defense of those programs – hey, reveal that to be a total hoax and the jig for the duopoly is up …

So, as long as the “only” alternatives are “bargaining” with the Reps or the dreaded default – gee what’s a guy to do? He can whack the social programs, claiming the Reps made him do it and he did it to save the country from default and probably even have the chutzpah to claim he did it in a way that strengthened the programs (I am still guessing he might sweeten the pot with rolling the payroll tax back again, but let’s see ..)

STM that’s the only thing that makes any real sense – he has been presented with several outs to keep from having to negotiate, he has rejected them all – let’s see what happens …

The only other thing I can think of is that he has made a deal with the Reps, whereby they “back down” now in return for an even sweeter deal later …. All depends on which of the Reps is running the show – the batshit ones will take it to the mat, the more savvy ones would go for the better deal …

And yes, any country that prints its own money (unlike the countries of the Eurozone) can always print more. The problem is they can’t do that without risking out of control inflation. The current fantasy is that somehow the US is an exception, since as we are constantly being reminded by pompous pundits like Paul Krugman, the risk of inflation is currently low. Sorry, but back in the day prior to 2008, the risk of an out of control housing bubble was also considered low. After all, everyone needs a place to live, right? Right . . .

As we learned in 2007-2008, the situation can turn around awfully fast and lots of old certainties can go up in smoke in the process. And we’re not talking small change here, but 1 trillion bucks worth of new money entering the financial system. The pundits are telling us no it isn’t really the same, because . . . well, just because.

If it were so easy for this or any govt. to generate funds to pay its bills, then that would truly be a wonderful solution to all sorts of problems. Think of a world with no taxes, no poverty, health care for all, unlimited welfare (and warfare), free of charge. Let the 1% keep their billions. Or why not even let them print more, as much as they like? Oh Brave New World . . .

“Think of a world with unlimited welfare …(for) warfare, free of charge. Let the 1% keep their billions. Or why not even let them print more, as much as they like?”

And yet, my friend, the above is de facto the exact world you have been living in for the last forty-two years. That is, since August, 1971, when Nixon took America off the gold standard and the dollar nevertheless remained the global reserve currency.

Hell of a trick, and arguably as much an advance over the British empire as that was over the Roman one. I suggest you read Michael Hudson’s SUPER IMPERIALISM: THE ECONOMIC STRUCTURE OF AMERICAN EMPIRE, first published in 1972, revised version in 2003.

Here’s the PDF —

http://michael-hudson.com/wp-content/uploads/2010/03/superimperialism.pdf

Sorry, but when last I checked, I still pay taxes, both income and payroll, there is still lots of poverty in this country, in fact far too much and getting much worse, health care has become unaffordable for most, pensions are vanishing — so what’s your point?

Sure, we don’t seem to have much of a problem paying for our wars, and the billionaires certain do seem to be minting money for sure. All that tells me is we have a problem with the distribution of wealth, which is patently unfair and unsustainable, a problem we would NOT have if we could pay all our bills with unlimited “fiat money.”

Are you actually suggesting we could?

What makes you think we’re not paying “our” bills with fiat money now? It’s not “fiat’ that’s the missing piece here, it’s “fiat money for public purpose” with public purpose being defined by public institutions using democratic processes.

Lambert –

“It’s not “fiat’ that’s the missing piece here, it’s ‘fiat money for public purpose'”

Bingo! And that is not going to change unless and until you change the folks who run the show – this is not an “economic” problem, it is a political one ….

Lambert is correct. Printing money is perfectly safe. Unless there is a real resource limit (preferably full employment, but perhaps peak oil) it can’t cause inflation.

The big question in our country is the distribution of wealth. We need to print money and *use it for useful things* or *give it to the average people*.

Instead, our elites have been doing the equivalent of printing money… and giving it to criminal bankers and criminal CEOs, and blowing it up in foreign wars which we then lose. This is just bad policy.

Under the current rules the Federal Reserve is the monopoly supplier of reserves, which are need for payments to clear in banking transactions. The only way for the Treasury to get those reserves would be to make a deposit at the Fed. It’s not set it stone, it’s just an accounting structure and can be changed, but for now yes, the Treasury would have to make an actual deposit.

Don: the need for the platinum coin is due solely to a quirk of the laws written by the US Congress.

Congress is supreme under the US Constitution. It happens to have prohibited most forms of seignorage, but not this one.

Any country can use money-printing.

Gawd.

Again.

Ummm, it should be not about the debt ceiling, and ways to get around the debt-ceiling.

Like issuing Platinum- (or nickel-) backed coin of a $Trillion denomination in order to pay the expenses of government, notably interest on its debt, if not its debt outright.

HELLOOOO !

The government of WE THE PEOPLE has the right to create the nation’s money and to issue it into existence and to determine its value.

So, the questio that should be at the fore is :

Why TF is the government that has the money-creation power borrowing money from the bankcorporate persons that it gave the money-creation power to in the first place?

No debt.

No debt ceiling.

No debt crisis.

Only money.

The People’s Money.

The Money System Common.

Paradigm shifts are difficult to leap over or get across. I am new enough to the concepts of fiat money that I remember the uncomfortable feelings that arose whn I tried to get my mind around the idea. So, we need to be empathetic to those who are just beginning the journey. The platinum coin really helped bring some of the unexamined dogma into relief. “Why just a one trillion dollar coin? Why not a 20 trillion dollar coin?” And so the journey begins …

I’m in a similar place as far as being new to the fiat money reality.

One thing that TPTB do to maintain the illusion is the choice of words, such as “deficit” and “revenues”—words that have a moralistic tone.

It has been helpful for me to use words such as ,”infusion”,”inflow”, “outflow” which have a more realistic descriptive sense than deficits and revenues.

Just my own attempt to understand.

Agreed. The terms “deficit” and “surplus” are too value-laden to be used objectively. The moment someone hears the former they think “bad” and the latter, “good”.

I’ve been thinking about the terminology problem for a while and have recently begun ussing the terms “positive balance” and “negative balance”. This can be explained to someone in terms of a battery: there are two terminals, one labelled positive and one negative. The point of the label is to describe which way the juice is flowing; it does not mean that one terminal is “bad” or one “good”. If the government is in negative balance this simply tells us which way net financial assets are flowing as the non-government sector is simultaneously in positive balance.

Feedback is appreciated.

Ben – i think you have a real point. This whole thing can be analogized in a number of ways – the pos/neg works for you, great – i am sure that there are a number of other images that would work as well for other people, and that, ISTM is what folks should be working on – coming up with as many analogies, pictures, whatever to get the idea across – instead of using a particular set of terms which wind up being terms of art that work or “light up” only in the minds of those who are steeped or trained in those terms …

It’s a “coin trick” etc because it was always a silly stunt. Its promoters chose to enter public debate in a manner which attracted attention because it was a silly stunt, but because it was a silly stunt it was also easily ridiculed—as predicted during the first go-round.

Now they want to complain about it because too many people called it for what it is. But this is like Anna Nicole Smith complaining about the nature of her claim to fame. Which she, at least, was smart enough not to do.

As for Obama and those who advise him, they were never under any kind of illusion about what they’re doing. Obama knows he’s not “running out of money,” so positing a stunt he could pull– based on a Bill about collector’s edition coins that everyone knows was not intended to be used this way, no less– was never going to change anything in the administration or inside the beltway that protects him.

Moreover, no one inside the beltway thinks Obama is “running out of money” tomorrow either. Everyone thinks Obama is making long term spending choices, and there is an array of opinion on that. The coin trick doesn’t actually address this.

So, let’s suppose the point of the coin trick is to educate the public, which is reputedly so dumb that it thinks the finances of the global hegemon look exactly like those of “their own households” and therefore Obama really is “running out of money” tomorrow.

There, I’m not sure the coin trick absurdity doesn’t just mystify public finance further, because you have to understand The Coin as a rhetorical vehicle before you can understand anything else. The real message, which is actually pretty simple and therefore does not benefit from needlessly complicating stunts, never manages to see the light of day—because the silly stunt is getting in the way.

But the know-it-all promoters of The Coin—who are nothing if not very much taken with their own moral (and frequently moralistic) self righteousness and notoriously don’t take criticism very well, regardless of what part of their program or their tactics are up for discussion– will no doubt continue declaring victory where none occurred.

I haven’t, for example, seen anyone produce links that point to any kind of illumination on the part of the internet public that was exposed to this stunt, however readily some of them may jump into the cheering section of any idea that seems like it might produce a policy result they want in the near term.

These being mostly people who believe that Congress is limiting Obama and his Treasury advisors, who can be appealed to directly, whereas it is just as true to say that it is Obama and his Treasury advisors who limit Congress. This is just as Obama did during the healthcare process, because Obama and his advisors are in the pocket of a narrow business interest and it was Obama’s charge to ensure that Congress effected the results this business interest wanted to see.

This willingness jump on board an idea that they ill comprehend—because it is needlessly obfuscatory—is just a sign of political desperation. Its needless obfuscation is right there in Dan Kervick’s latest hypocrisy, where one promoter of “barbaric and anachronistic metallurgy,” now complains about the very thing he pushed into debate as legitimate and bewails when people reject it as a “coin trick.”

Well, which is it? Let us know so we can avoid the ire of the cult the next time it decides to kick up a fuss.

I don’t begrudge anyone their 15 minutes any more than I begrudge Anna Nicole—and indeed it can get awfully boring around here in this nation of depressed jobbers living under the thumb of a narrow authoritarian faction with every intention of pursuing its own agenda regardless of what anyone else wants, so we all may as well take our excitement where we can find it—but at the end of the day, this kind of self trivialization is what it is and when you end up lampooned you don’t get to complain about it.

I don’t see Honey Boo Boo’s mama complainin’.

Wouldn’t it be simpler if you just made a compendium and linked to it? Saves repetition.

Some of us enjoy JTF’s commentary on this issue. Why are you so intolerant of those who don’t “believe” in The Sacred Coin? Why can’t you be a good sport about it and accept that people have different points of view and that they can all be valid. You know… agree to disagree… that’s how pluralism works, as opposed to monotheism.

It is true that JTF seems to have dialled back on the personal assaults. Perhaps the 2×4 got his attention.

JT – I would agree that the trillion dollar platinum coin concept is a gimmick, however, it is a useful gimmick. It opened (at least partly) a discussion of sovereign coinage (or whatever the proper term for the government minting money and setting monetary policy). And yes, while the gimmick did start the conversation, it was easily discounted as a gimmick and the conversation did not get very far. But I agree with Lambert that it was media and some very serious people who thoroughly lampooned what was and remains a potential solution. It is beyond disturbing that within days of dissing the trillion dollar coin as a step too far for the POTUS to take alone, he again threatened to “take all necessary measures” to prevent Iran from obtaining nukes. Think about this for a second folks, our president is perfectly willing to be extorted into cutting the budget by his own Congress, yet is unwilling to face Iran as an equal. Let me be clear – the authority to mint coins is constitutionally a power of Congress and the Coinage Act placed that authority in Treasury. The Constitution does not grant the president the authority to invade foreign countries absent a Congressional declaration of war. I am just saying that while our president fears usurping the power of Congress as regards coinage, he is perfectly willing to usurp their power to go to war. Nice guy.

You are too quick to dismiss the idea that the treasury CAN issue this “coin”.This is within their legal authority.The treasury was granted this power specifically in the constitution.It is also within the legal requirement of the federal reserve to ACCEPT, whatever the treasury calls a coin and HAS to accept the legally designated “value thereof”.The treasury has the right to issue a coin, and designate the value therof.This is something even a layman like myself can read in the constitution. It is right there for all to read.

Why is nobody talking about the fact that the executive branch doesn’t really have the authority to decide what laws it will enforce and which laws it won’t?Despite it happening everyday.Here is a case where geitner,bernanke, and obama are all standing up and saying,I won’t do my job.If they had a better idea, that would be a reason to say,lets do this, rather than do that… but they are heading right into a pre-ordained path to austerity, with a factual knowledge it will hurt the economy. as austerity always does.The fact they are willing to not do their job, and take america on the least desireable path, is cause for impeachment.

Of course, they are only on board the same train all the current representatives in the house,senate and executive branch and their overlords on wall st,are on.So there is no one calling for impeachment,but they all should be tarred and feathered.

I am not for the platinum coin idea.as it is a “gimmick”. But the reason it isn’t happening isn’t because it can’t. The reason is because it shows the truth of a fiat money system.It shows that we could have a hand in our monetary sovereignty.

So nevermind what honey boo boo says…whoever that is.

The US dollar is still the reserve currency of the world.

Rule number 1: Don’t piss off your customers (by minting trillion dollar coins to blanantly devalue your customers holding).

I mean is best not to make the fact that money is fiat so obvious. Bondholders do like to view bonds as a store of wealth after all. Rather we need to boil our customers, I mean frogs, slowly.

So why is it that Treasury creating money out of nothing is a problem but the Fed doing it is ok?

If all of our international “customers” were really so worried about their dollar holdings being devalued, you would think that QE-Infinity would have them up in arms…but no, barely a peep.

Kindly examine the Fed’s balance sheet before raising ridiculous fears of currency devaluation due to PCS.

Because the Treasury is (at least theoretically) a democratic institution, and the Fed (by design and practice) is not.

Bingo!

The global elites have less control over the Treasury and therefore could never be guaranteed that monetary policies made by it would promote their personal interests.

It’s all about control.

Fascism — defined by Mussolini as the merger of corporate and government power.

Democratic control is the enemy of fascism, because the people don’t usually want to be bossed around by corporate CEOs.

The Canadian dollar may soon become a reserve currency:

http://business.financialpost.com/2012/11/19/imf-considering-loonie-as-reserve-currency/

Tim: so who the hell are our customers?

Criminal CEOs of criminal multinational corporations? If so, I think I would like to piss them off and get them to stop screwing around with the US dollar.

China? They don’t care what we do; they’ll just devalue their currency as necessary to maintain their exports.

The common people? Would be benefitted by the trillion dollar coin.

Lambert, this is a beautifully written piece, though I did miss a reference to the incompetent Heidi Moore’s piece in the Guardian. No survey of the idiocy produced by the mainstream in response to the coin is complete without noting her manifold contributions. Bill Black’s done a great job on her, over at NEP for those interested.

I also note that there’s been surprisingly little response in the discussion here to my distinction between small-ball and game-changing PCS. In fact, many of the comments critical of the coin by people here seem to hold for small ball advocacy; but would completely break down for a $60 T or $100 T, including the idea that Obama would be a laughing stock for minting it. “They” might well laugh at him for a $1 T coin; but they’ll be apoplectic at a $60 T coin because it means no more US bond market. Gee, not funny at all.

Anyway, we all need to note that the President’s move on Saturday doesn’t take the coin off the table of options. The coin’s still legal and if it should happen, which I agree seems less likely today than last week, that the House will run us into default over the debt ceiling, then the President is free to mint a coin of any denomination at any time: http://www.nakedcapitalism.com/2013/01/joe-firestone-austerian-obama-kisses-platinum-coin-bargaining-chip-goodbye-but-the-coin-may-rise-again.html#comment-1023352

Yes, I seem to have completely repressed Heidi Moore. That’s one of the problems with studying agnotology: The mind is repelled (as Keynes said in another, or perhaps not another, context).

There was a whole spate of “humourous” assaults like Moore’s, which read like she auditioning to be MoDo’s understudy.

There is a stronger position than Obama being “free to,” and that is that he must.

Indeed: Obama is required to mint the coin.

I agree with the assessment that Obama is required to spend Congressionally appropriated money if he has a legal way of acquiring it. And every lawyer agrees that he does: the platinum coin.

I hope someone is setting up the court case. If Obama attempts to not mail out checks with the “debt ceiling” as the excuse, someone had better be in court forcing him to.

… as one employed in the business of these internets, I found the GET/HTTP analogy particularly refreshing. Thank you, Lambert.

I think it has legs, actually (and I am not insensible of the generational appeal).

For example, I don’t think that “shared illusion” is a useful way to categorize RFC 2616, but “social construct” is, even if we can’t touch the bytes, can’t read the code on the web page, and don’t even understand the operations by which the server delivers resources to us.

Social constructs are shared illusions.

The term “shared illusion” is used to break through people’s instinctive “But it’s money if I can bite it!” idea. Once that’s been broken through, then you explain that it’s a social construct, and that those are very real, just like love and marriage (also shared illusions).

On a purely pragmatic basis, I don’t think a framing that demands that love be viewed as illusion will have much staying power…

Except that since every bloody thing in heaven and earth is a “social construct”- it isn’t a very useful phrase, except to remind people of what everybody used to know, when people understood classical, that is genuine, philosophy. And pretty much the more people nowadays insist something is an “illusion” or “imaginary” like money or truth or whatever – the realer it really is. Far realer than what they think is real sayeth this dialectical materialist/absolute idealist.

Because that’s what money IS.

A legal, social construct.

And not, debt.

If the idea is to use government investment to expand the economy, it’s a fucking idiotic plan. Practically all wealth creation these days is taken by the so-called 1%, the people who own the economy. If you make the pie larger, our slice will still be the same size- maybe even smaller, since the rich could employ part of their new wealth to expand the arsenal they use to coerce us to accept less.

Forget about the government. You will NEVER get it to do what you want. It’s a black hole. It’s where movements go to die.

Are “movements” not temporary by definition? Why should they not die?

They should only die after they succeed!

Not all of them!

Okay, the ones we like. Nazi movements should be smothered in the cradle.

RD you are correct. Any financial legislation going through the Congress will be subverted. If something good for consumers gets through then it will be enforced – if at all – in a way that undermines its purpose. If Obama or the Congress went with the Platinum Coin idea, you can be certain the $trillion would be spent to fix a “problem,” such as paying off the worst of junk mortgages to the benefit of the 5 major banks (or the fed) currently holding them with the cover story being “we’re helping these poor former homeowners get out of debt.”

Policies advocated by sophisticated civic minded people cannot be realized under the govt we have.

One way to get a better government (whether that’s a good idea is another thread) is to present policies to the public that have great appeal, but which the government cannot implement.