By Philip Pilkington, a writer and research assistant at Kingston University in London. You can follow him on Twitter @pilkingtonphil

There’s a lot of talk flying around about the Japanese stimulus. Some appears to be misguided, some appears to be sensible. Let’s review the off-base reactions first, then the sensible talk and then finally review the results of the previous stimulus to see what the present stimulus might produce.

In a recent article, Bloomberg cited a number of economists from various banks who argued the stimulus probably won’t work very well. One of these, Azusa Kato from BNP Paribus, sums up this attitude nicely.

“Fiscal stimulus is like morphine, because if you want to maintain the same level of effect you have to keep upping the dose,” said Azusa Kato, an economist at BNP Paribas in Tokyo. “Japan has failed to achieve a sustainable economic expansion, and the country’s record proves the strategy is wrong.”

Nice metaphor, but what does it mean? When economists discuss the effects of fiscal stimulus they generally refer to what they call the “multiplier”. The multiplier is the amount by which national income and employment will increase when new spending or investment is injected into the economy. So, for example, if the Japanese government hires a bunch of construction workers it is assumed that these workers will spend some of their income on consumer goods. This then generates employment and incomes in the consumer goods sector and these people in turn spend their income on, say, other consumer goods which generates further employment. This process goes on and on in an ever-diminishing cascade until finally comes to a halt. The amount of income this generates at the end of the process is known as the “multiplier” or the “Keynesian multiplier”.

Now, what Kato seems to be saying is that the multiplier falls every time another stimulus is undertaken or, to put it another way, that government stimulus programs are subject to diminishing returns. Kato does not provide any support for this and neither I nor a group of other economists I discussed this with can think of any economic argument as to why this might happen. Yes, Japan seems to have some structural issues which we will discuss below, but there seems no reason to assume that fiscal stimulus will have diminishing returns. At worst, it will probably just persistently have the same effects. And if it has worse effects than the previous stimulus this will be due to other contingent factors, not due to some inherent tendency for government intervention to be subject to diminishing returns.

Richard Koo, a long time champion of fiscal stimulus, on the other hand, is quite optimistic. He claims that deflation is no longer the problem that it was in 2009 when the last stimulus was enacted. He claims, probably rightly, that deflation has a depressing effect on business and consumer confidence and that this was one of the reasons that the last stimulus only had a short-term effect. Koo is also interested in the possibility of providing tax incentives for business which, although the present government have not announced as of yet, they are apparently considering them.

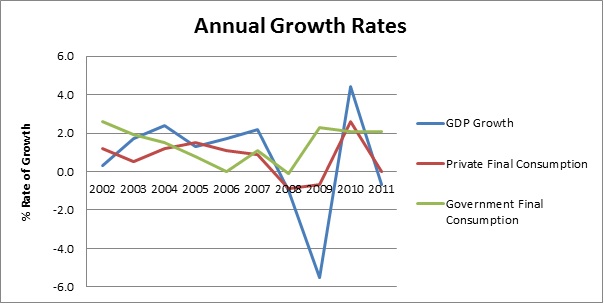

So, what is actually going on with Japan? In order to understand this better we need to look at the data with respect to the last stimulus to see what it did and what it didn’t do, and try to figure out why. The first graph below is Japan’s annual GDP growth rate plotted together with annual growth rates of private sector final consumption – that is, by households and businesses – and government sector final consumption. This, I think, is the key graph to understanding the nature of the so-called Japanese disease.

As we can see, the economy went into recession along with the rest of the world in 2008. As it bounced back the government undertook a stimulus program of similar size to the one announced this year in April 2009. This led to a spurt of growth which was, by any measure, quite brief and by no means sustained.

One of the reasons for this can be seen quite clearly in the graph. While government final consumption maintained its levels as the government poured money into the economy, the private sector only bounced back for a brief period of time and then stopped consuming. This appears to be the key feature of the Japanese disease (one which, incidentally, is not so much a problem in the US). The authorities there simply cannot lift consumers’ spirits for any sustained period of time. The 2009 stimulus proved able to coax the Japanese consumer out of its cave for a brief period but they soon thereafter retreated back into the darkness.

A simple solution to this would be for the government to just keep pumping money into the economy until the Japanese consumer becomes so flush with funds that to continue saving would be ridiculous. To what level this would need to be done is anyone’s guess, but if the government spent enough to push the economy up to its inflation barrier I’m fairly confident that would do it – that is, if the Japanese government spent up to full employment so that mild inflation began to occur due to excess demand in relation to supply. Likewise a sustained program of spending guaranteed to remain in place until the economy recovered – like, for example, an MMT-inspired Jobs Guarantee program – would also probably do the trick. But neither of these possibilities seem in the cards.Japan’s government seems intent on pursuing silly stop-start “Keynesian” pump-priming policies instead, so we’re stuck analysing the potential effects of these.

We will then consider a few more things about the contemporary scene in Japan before retiring to our respective armchairs and simply waiting to see what happens. Firstly and very importantly, the above stimulus was undertaken after a very sharp downturn and there was, as everyone will remember, far more uncertainty among both consumers and investors in the years after 2008 then there is today. Perhaps then this will mean that the new stimulus proves more effective as the spirits of our Japanese friends might not be so down in the dumps and they might emerge from the darkness of depression into the light of recovery.

Secondly, we should be quite clear on a point touched upon above: there is absolutely no logical reason why this stimulus will suffer from “diminishing returns” as argued by Kato above. At the very least it will be as effective as the previous stimulus. If the reader hears an economist making these arguments do me a favour and press them to explain them logically and within the bounds of economic theory. I am pretty confident that the person who presses this point will quickly find that the emperor has no clothes.

Thirdly, there has been much talk about a yen depreciation providing a boost to exports. Some within the Japanese government are hoping that this acts as the nitrous oxide to the stimulus gasoline, providing a boost on both sides of the economy and getting the whole freight moving once more. There are two things to consider when mulling over this view. First of all, if we compare the exchange rate of the yen to the dollar today to the exchange rate in 2009 it is quite clear, as the reader will see in the graph below, that despite the fact it has declined somewhat since its highs last year it is still far, far above its 2009 level.

This raises the question of just how much the Japanese government are going to allow the yen to depreciate relative to other currencies – and how much other countries, mired as they are in recession or borderline recession, are going to allow. In order to reach 2009 levels the yen will have to depreciate by another by at least another 10% – and may even need another 15-20% depreciation to see real tangible results. This is by no means impossible, but it will require a steady hand by Japanese officials.

On the other hand, the world markets, while being by no means strong, are nevertheless far more buoyant than they were in the dark years of 2008-2009 when the last stimulus was enacted. This provides some hope that if the Japanese play their cards right the rest of the world might provide them with a sufficient boost to get the economy ticking over again.

The above points are not to provide the reader with a crystal ball with which to see into the future. Any economist who engages in such an undertaking is either a charlatan or a fool. They do, however, provide signposts with which to navigate the coming months. Whether the stimulus does work or not, however, Japan can teach us a quite simple lesson: namely, that stop-start pump-priming pseudo-Keynesian policies are a poor means by which to promote economic recovery. If a government is not willing to jump right in at the deep-end and spend up to the inflation barrier for political reasons, then they should instead introduce solid institutions that will mop up excess capacity automatically when the economy goes into a serious downturn. They should, in other words, guarantee businesses that there will always be a market for their goods and services to ensure a perpetually functioning economic machine.

thanks philip. isn’t the lack of traction of japanese fiscal stimulus evidence that actors in the economy don’t believe that the government can afford these giveaways and will simply have to raise taxes at some point? mrs. watanabe is quite clear that japan’s enormous debt/gdp level (the product of an endless stream of fiscal stiumulus over the last 20 years) is obviously unsustainable. interest rates have now reached the zero bound all over the world but japan has been in a liquidity trap for over a decade. fiscal policy is constrained all over the developed world but in japan they have room to spend; the problem is that the usual menu of public works (concrete riverbanks, motorways which go nowhere) lost its multiplier a long time ago. govt spending is the path of least resistance; japanese politicians should rather have the courage and imagination to address the country’s dysfunctional domestic economy.

Yes, we’ve been told for a decade now that Japan’s finances are “unsustainable”, with absolutely no evidence to support that conclusion. How are deficits unsustainable when yields are permanently at zero? Have you considered that ZIRP may actually be deflationary by removing interest income from the Japanese People’s savings accounts?

To the contrary, it appears Japan could go on like this forever.

Ben you are quite right that betting against the status quo has been a road to ruin – they don’t call shorting JGBs ‘The Widowmaker’ for nothing! In fact the hedge funds are back on this at the moment, betting that the tipping point is at hand whereby the ageing Japanese population become net spenders (ie net sellers of JGBs). We’ll see. To my mind the interesting paradox is that the Japanese government may have become hostage to its debt mountain in the sense that they can’t afford for growth or inflation to break out in Japan and thereby raise JGB yields….

Ehh, if you are Japan and borrow 100 yen / second at 0.25% yield over 10 years, you have to pay back 100.25 yen eventually. It’s not like you can borrow like crazy forever and have to pay back only the 0.25 yen. Who cares who are you borrowing from – you ain’t going to pay everything back, ever.

This is the Ricardian Equivalence argument as originally put forwardby Robert Barro:

http://en.wikipedia.org/wiki/Ricardian_equivalence

This a strongly theoretical and, I would say, stupid idea. The evidence to support it in other countries is very weak.

When you look into Japan you see that the savings propensities probably come from elsewhere. I think the aging population plays a part and I also think that two decades of deleveraging (i.e. paying down debt) have led to a low consumption culture. As I said in the piece, however, this could probably be broken with the right policy mix and may even be broken by the present stimulus if the chips all fall in the right place.

As to the “unsustainability” of Japanese debt, Ben is correct. The Japanese have their own currency. It’s simply not an issue. If yields go up, the Japanese central bank can push them down with OMOs or more QE.

‘They should, in other words, guarantee businesses that there will always be a market for their goods and services to ensure a perpetually functioning economic machine.’ Are you seriously proposing that the Japanese government start stockpiliing unwanted widgets in a downturn to keep the factories humming? The Japanese need more market discipline in their domestic economy, not less!

Who said that? I said that the Japanese government should act as employer of last resort. This would ensure super full employment — probably around 1.5-2% which is significantly below what it now is. They could then use this program to raise the baseline wage and increase demand. All the products bought would be consumed by households.

But as a thought experiment, yes, the Japanese government could just buy up goods from companies and dump them in the ocean. That’s essentially how the US recovered from the Great Depression (i.e. wartime spending, the products of which were blown up). I’m not advocating this but it would, by accounting identity, work. There is no doubt about that.

Philip that excerpt was the last sentence of your article. What on earth would all these government employees actually do? I have seen the ‘synthetic’ employment already widespread in Japan (beautifully dressed women whose only job is to bow at you as you exit the elevator in Tokyo department stores, men who stand over the road from petrol stations to wave you out into the traffic when you exit). In that case the shareholders are being robbed, just as taxpayers are by mindless public works programmes with no incremental economic value. Honestly how useful are thought experiments with no relation to political reality? The Japanese refusal to allow immigration means they are heading inexorably for a future I heard nicely described as ‘an old people’s home run by robots’. The relentless logic of an ageing population and shrinking workforce make it all the more imperative for the young employed to save to provide for their own future, not consume, no matter how much stimulus you throw at them.

The last sentence was referencing the idea I put forward a few sentences back:

“Likewise a sustained program of spending guaranteed to remain in place until the economy recovered – like, for example, an MMT-inspired Jobs Guarantee program – would also probably do the trick. But neither of these possibilities seem in the cards.”

It is the Jobs Guarantee program that is the guarantor of demand for private goods and services. You can find out more about it here — and that should clear up what these people are supposed to do:

http://neweconomicperspectives.org/2012/03/mmp-blog-42-introduction-the-the-job-guarantee-or-employer-of-last-resort.html

Oh, and I should point out that its sort of contradictory to fuss over the fact that the aging population will need care and then claim that you cannot think of anything for unemployed workers to do.

This part of your commentmakes no sense to me:

“In that case the shareholders are being robbed, just as taxpayers are by mindless public works programmes with no incremental economic value.”

First of all, the Jobs Guarantee program would be hiring those presently unemployed, so even if they were cleaning up graffiti or looking after old people they would be adding more value than they would be if they were sitting at home watching the Japanese equivalent of Montel. Your “marginal value” terminology is derived from economic ideas that assume full employmet. Once there is unemployment it ceases to mean anything.

Secondly, this would be deficit spending. It would not be funded by taxpayers. So, people being “robbed” for “pointless” programs is somewhat meaningless. No one is being charged for this. Its deficit funded finance. But will taxpayers eventually have to “pay this back”? Again, no. The debt will be eroded not by taxation but by long-term economic growth. This is how the US eroded their debt after WWII. Remember, that the era after WWII was a Golden Era of high growth, it is not remembered as an era of austerity where the government gouged taxpayers.

“I have seen the ‘synthetic’ employment already widespread in Japan (beautifully dressed women whose only job is to bow at you as you exit the elevator in Tokyo department stores, men who stand over the road from petrol stations to wave you out into the traffic when you exit).”

Sorry, that is a profoundly ethnocentric thing to say. Such jobs may mean little to us, but if they meant nothing to the Japanese, the Japanese would not hire people to do them.

And looking into our robotic future, which society will be better able to adapt? The Japanese will have such jobs, while we will be squabbling over welfare. ;)

Isn’t a “low consumption” culture a good thing – I mean for the planet?

Yes!

James Howard Kunstler, the notable “prophet of doom,” thinks that Japan will be the first developed nation to unplug from the world-wide industrial capitalist grid, and return to local. Here’s hoping! We’re in dire need of a of a prototype culture these days. Maybe one day…

To do that, japan would need to solve its (and by proxy the rest of the planets) energy crisis. Unless of course this “unplugging” implies de-electrification of society and removal of surplus produced via that electricity.

For the point of an experiment I would like to take two works-related stimulus measures and compare them.

Building a road to nowhere has the immediate multiplier of giving an individual/company work, they and their company then spend their income on goods and services, and that works its way through the economy as continued stimulus. The government then takes on the debt accrued from the stimulus.

Investing in energy efficiency, has the immediate multiplier of giving an individual/company work, they and their company then spend their income on goods and services, and that works its way through the economy as stimulus. But, then the debt accrued is paid back through the efficiency which allows for reduced costs in the future, either to reduce the country’s debt (unlikely), spend on other programs (fungibility), or increased efficiency investments (ideal).

The point of the thought experiment is stimulus is good, but stimulus that has a net benefit of additional savings is ridiculously better. This doesn’t have to apply to only energy efficiency, but can be formulated in a manner that reduces net public costs like: health costs, water/environmental resources, incarceration, public transportation, or adds concurrently to the productivity of the nation (research/new technologies/education), etc. Some will have a much more clear payback then others which may be more experimental or have unintended consequences.

When we discuss works-based stimulus can we keep the discussion within this narrative. All stimulus measures are not equal to each other. Otherwise we end up in the world we currently occupy where pet public works projects are all the same and politicians distribute pork to ‘constituents’ and stroke their egos with sometimes useless public works and glamour projects. This has the overall net effect of giving stimulus a bad name.

The only important issue in Japan is unemployment. The people already have more stuff than their tiny living quarters can hold, the streets are clean, there’s little or no crime, etc.

How extensive is unemployment in Japan and how are the unemployed treated (and cared for) if anybody knows?

Demographics will fix the unemployment problem within a couple of decades.

Big Japanese companies have tremendous wage compression (hardly any difference between wages of senior and junior roles) to preserve employment. The exact reverse of what you see in the US. They’ve also had to hire many people as temps, which is really bad in their society (men who are temps don’t get integrated into the social fabric of the company which is hugely demoralizing in that society, and they pretty much can’t get married, women see them as undesirable).

http://www.oecd.org/employment/harmonisedunemploymentrateshursoecd-updatedoctober2012.htm shows that the Japanese unemployment rate is about 4%.

I’ve lived in Japan for the past 5 years and to be honest although I have never stopped hearing about the “2 lost decades” and the “crisis of the Japanese economy”, it’s very hard for me to see that in the street.

Japanese consumption is low? I dare you to find a shopping mall that is not full almost everyday, a new cool mobile phone model that doesn’t have people queuing to buy it, hilariously niche shops (like selling only costumes for dogs) that stay open, etc. The average Japanese person is really a model consumer and sometimes they don’t buy more because they don’t have where to put it.

Do they have a savings culture as well? you bet, they are really responsible about this and I fail to see how’s that a bad thing, something to macroeconomically target.

Unemployment is barely over structural (in an overcrowded country with no resources), crime is non existent, transportation is world class, industry leads the world in too many markets to count …

Of course there are problems, there seems to be a lot more temp workers, national debt is too high, etc. but I think really all this should be taken in perspective by western economists. I hear too many times “we don’t want to end like Japan” when in fact that would be an order of magnitude better than what I’m seeing on a daily basis in my home country (in Europe).

The japanese are known to be very hard workers as well Phillip, as you may know some have even killed themselves from overwork. It may take exhaustion and probably even a few deaths for them to reach that inflation barrier! :D

The limits to Japans real rather then nominal growth is Qatar and its LNG supply…….

More internal growth in Japan means less European export markets as they switch off their gas power stations to be replaced by lower quality coal (see UK energy trends which was one of the biggest LNG consumers until 2012)

Globalization is at its limits.

http://www.lngworldnews.com/japan-utilities-dec-lng-usage-climbs-yoy/

Too much energy is lost in trade , not translation.

The price of oil is the main constraint on growth. Behind oil, I suspect water, other fossil fuels, common industrial minerals, and human capital are other constraints on growth. These inputs affect the price of everything and ,in my opinion, drive the real inflation rate.

You know, it’s just simpler to say that the world is suffering from human overpopulation.

Contrary to the fervent wishes of the most idealistic of people; the Japanese people will not see any benefits from this latest round of money printing. Free money is not used for the benefit of ordinary people. It will continue to decrease the value of their savings by not paying a fair market interest rate, while it simultaneously erodes the purchasing power that could’ve been spent into the economy.

Wait, what am I saying? This is all great news for Japan’s financial sector! Japanese multinationals get to use this bonanza of free cash to carry out more mergers and acquisitions. Wooooo!

?????

I’ll elaborate further because apparently my sarcasm was lost in translation. It’s not like we haven’t seen the same song and dance from the Liberal Democrats before. This isn’t anything we haven’t seen at least a half a dozen times over the last two decades. It won’t work for the same reasons previous attempts failed.

One of those glaring reasons is that Japan will ultimately pay for it’s fiscal stimulus through monetary printing. The only funds which will be raised to help pay for the stimulus will probably be through an increase in their VAT tax. Which is a regressive tax that helps suppress consumer demand on the lower end of the economic spectrum. They will not raise corporate taxes, nor the upper income brackets. There will be no other policies which lead to a redistribution of wealth that helps the lower classes regain purchasing power. Which is what is needed desperately. Particularly in a country like Japan that is so resource poor with a horrible demographic problem on the horizon.

It is only in countries with a narrow distribution of wealth that an export driven recovery is ultimately successful. Otherwise there will be no recovery that can sustain itself without the injection of more stimulus. Which is why I went directly for the cognitive kill switch; the real beneficiaries of the latest round of stimulus will be the financial sector and Japanese multinationals. They’re the only people getting a truckload of cash dropped on them. Recovery? Forget about it.

But sure, this time it could be different. Really.

Don’t worry. It wasn’t the sarcasm. It was the fact that your argument makes no sense. For example, everyone knows that the financial sector does not benefit from a devalued currency, it benefits from a strong currency and high interest rates. I could engage it point-by-point because they’re literally all wrong, but I don’t have the time.

“For example, everyone knows that the financial sector does not benefit from a devalued currency, it benefits from a strong currency and high interest rates.”

If that’s the case then banks like JPMorgan should not be posting record profits. But they are. I’m quite unwilling to believe “everyone” including Jamie Dimon when he stated that the Fed’s low interest rate policy and QE3 policy hurt the financial sector.

Huh, imagine that.

Correlation is not causation. But if you have a new theory of finance, interest rates and the value of the currency you should write a paper. If its coherent I’ll get it published. I promise.

Andrew,

With all due respect, you really do not know what you are talking about. Philip is 100% correct re currency strength. Why do you think Clinton favored a strong dollar? This was Bob Rubin’s policy and it has been carried forward faithfully by every successive US administration. Look at how, despite grousing, we’ve never designated China a currency manipulator. Finance centers need to have strong currencies to maintain their clout. I discuss this longer form in ECONNED.

Yves,

I only brought up the JPMorgan example to disprove Mr. Pilkington’s point that low interest rates do not help financial profits. When in fact JPMorgan in it’s own filing attributes it’s record profits to historically low interest rates as well as other government initiatives which helped to improve the mortgage market. Despite public proclamations to the contrary. That was a bit off topic about the Japanese dilemma though.

However what you stated only really applies to the United States and what used to be called the Washington Consensus. The Japanese situation is far different from the United States. Though they both suffer from some of the same maladies. Without writing a book on the matter a strong yen does little to improve the economic prospects that Japan faces.

As I see it.

Jamie Dimon scapegoats anything conceivable when JPM earnings are not up to snuff. He’s not a credible source on this topic.

Andrew, you do not understand it. Printing money works! That’s why

(i) we experience a stable financial environment now and (ii) Zimbabwe is the richest country in the world.

You’re in Krugman world here. Please adapt and shut off logic.

What? There is no money printing you idiot.

Very Interesting..I watched “Overdose”, the “Journeyman TV” doc. on YouTube. The last part of the movie is about “stimulus bubbles”

You also need to incorporate in your analysis at least two other factors.

Firstly, the propensity of any stimulus to both suck in imports and encourage the outsourcing of investment and jobs to service the stimulus.

Secondly, you need to take into account the behavior of any currency pegging country in two respects. It has to find a home for the money it’s sucked out of its own economy to avoid a currency evaluation and it makes sense to make that home its principal importing countries and/or that of its main competitors. To illustrate this China not only buys US government bonds it has started to buy Japanese government bonds. Both have the effect of artificially maintaining the value of the currency of these two countries if not increasing it. This means both countries are better able to suck in Chinese made goods. It also means that Japanese manufactured goods are made more expensive in their export markets. Japan has played this game of artificially propping up the currency of its principal import countries and now it’s being hoist by its own petard!

In short you need to also take into account the international trade games being played that distort the possibility of value being achieved through normal market discovery processes and this in turn will have a bearing on the effectiveness of any government stimulus. Even shorter. Neo-Liberal economics are screwing the free market processes of a great many countries around the planet!

Ok…. as hard as I try I just dont get “…. the government keeps spending until the economy recovers” …..”a job guarantee programme”…..

If the jobs are value destroying then what?

What if the insiders know it is a scam and skim from the economy to pad their own bank accounts and then leave? (think China here).

Why not print a kazillion yen and just buy all the oil, and natural resources in the world and declare victory?

Please help me here – is there just one example where a country that has printed its way to a recovered healthy productive economy?

Si

If the jobs are value destroying then what?

Yes, value destroying jobs are BAAD. But if they don’t destroy too much value, they can be a net benefit. For example, the US military does nothing but rob, murder and destroy value and endanger access to resources and stability for no sane reason, but military spending props up the US economy.

The amazingly brilliant solution is – government spending for NON- value destroying jobs. Wow! Where’s my Nobel?

Please help me here – is there just one example where a country that has printed its way to a recovered healthy productive economy?

Practically any country at any time in history, after a (successful) war. The prime example is the USA during/after WWII. The New Deal was lifting the country out of the Great Depression, but the war completely eradicated it. Created enough financial stability for the whole world to go along for decades until the morons of academia and government managed to recreate 1929 in 2008.

If you don’t like China – look at Australia immediately after the crisis – before they went back to their psychotic budget surplus obsession. Made ’em healthy enough to survive this obsessive poison-drinking.

Simon says:-

“Please help me here – is there just one example where a country that has printed its way to a recovered healthy productive economy?”

Yes, after a fashion, China because it uses MMT and in a couple of years will overtake the US as the country with the world’s highest GDP.

China is a model you’d like to see us emulate? Godd grief!

Philip,

It seems to me there exists the following argument in favor of a reducing multiplier over the Neo-Liberal era.

To the extent that government spending finds its way into the pockets of the rich, the multiplier deteriorates. This seems likely in that the rich spend less of their income, storing more an more of it as it accumulates in increasingly inflated financial assets that do nothing for effective demand.

I doubt you would want to make the argument that over the Neo-Liberal era government spending has been increasingly steered away from the rich. What mechanism prevents the increasing capture of government expenditure by the connected wealthy from depleting the multiplier?

Just wondering about the rock and hard spot Japan is wedged in. China and Japan just signed a technology cooperation agreement for Japan to build cars in China (right?). So how does that work? China will sell those cars domestically and the yuan is worth a lot less than the yen and so Japan repatriates more profit if it devalues the yen? Simultaneously Japan is generously buying EU bonds to make EU exports to China more expensive? Russia is calling it a currency war that is approaching critical mass. I don’t see how trade is the solution. It looks like the problem because it creates net losses. (today’s links on oil; Chris Martenson) The whole world is completely irrational.

I do not understand how borrowing more and destroying the currency’s value, impoverishing the savers for the sake of returning to some illusory 5% growth would solve anything, in the face of growing deficits and huge debt. I guess in the current state, the japanese should eat nothing and consume nothing for 2 years while producing at full capacity only to pay the debt back?!

Interesting as usual, but here is something else to think about:

Because Japan has a roughly stable population, it simply doesn’t need economic growth. Indeed, it’s economy could arguably shrink somewhat with no decrease in the standard of living (think of an individual who pays off the mortgage on their house – they can live better on less money, right?). If Japan could maintain an average economic rate of growth of 0.5%/year they will be far better off than Americans even if we somehow manage 3-4 % annual growth rates… (The need for capital investment and the higher per-capita costs of high-density development means that without an open frontier a growing population needs an economy that grows much faster than the population. Every economist knows this: that’s why we need 3-4% annual economic growth just to stay even even though our population is only growing by about 1.1%/year)

Certainly Japan has many problems before it, but they are more connected with their high population density and lack of resources than with their aging population. Not to get into all the details, but the notion that the Japanese would be better off if they swapped their current problems with the problems of Bangladesh or Pakistan is simply ludicrous.

It would seem to me that an issue is that Japan has achieved a very high and stable level of prosperity, which is physically fine, but current financial models are based on debt and growth. Even Keynes had trouble with that one…

Right and wrong. But their economy has been in real contraction for 2 decades. Which means even if the stimulus helps with keeping things grounded, it is a success.

Your mistake is thinking this is for some big “growth surge”. Wrong on all accounts.

I think people are missing the point……..

Japan took out Detroits industry

China took out Americas industry

The bits and pieces of Detroit went down south to avoid labour value

The bits and pieces of America went even further south to Mexico to avoid labour value.

This increased non labour capital ($ price oil) inputs

…

There is no shortage of coal in the world.

But the $ price of oil is the true price of capital…….

If Industry comes back to rust belt North America what happens to Japan ?

It a big Ocean – the Pacific …………

Global trade is now far too costly.

The UK is already shifting it focus back to America as the Asian trade routes are far too long.

http://www.youtube.com/watch?v=AoY8OxuvvXc

The big question is who gets the surplus Australian coal ?

I’ll bet that China will get most of it.

I hope that godforsaken idea of a Jobs Guarantee program never comes to life, when im unemployed I need time to look for work and money to survive because looking for work takes more time than ever especially if you have to take written tests and theres no guarantee you will even get the job. I dont want to get stuck doing some crappy job that pays crappy wages even if above minimum wage cleaning gum off the bottom of some park bench while a drunk homeless man yells at me. I need time and money to look for a job and gas or bus passes are not cheap so no to being stuck at a useless job, getting a check works for me just fine otherwise I might as well give up and work at MC Donalds.

If you have not noticed… we have over capacity coupled with lack of demand (demand for crap granted). So with that one simple observation… where are you going to get that dream job…. eh.

Skippy… welcome to the down side of the slope…

Yup, any job will do in a resource, automated world. Amazing people can’t see that.

Free Market intellectuals should be hunted down like dogs.

I understand there’s no demand in the economy but getting a check works for me. If I want to do something than I can always volunteer at a homeless shelter or something but don’t make my income dependant on forced work that is not in the field I was trained for and spent 5 years in school for, looking for work really is a full time job and I talk about this from experience and with my unemployment checks I still create demand in the economy anyway.

The fact of the matter is that most of your fellow Americans don’t think you’re entitled to social welfare just because you can’t find work in the field you trained for. In addition to that, no one thinks you’re entitled to a job that fits your education. According to them, if you don’t have a job it’s for three of the following reasons.

1. You’re not trying hard enough to look for one,

or,

2. You’re not good enough to get the job you’d like,

or,

3. You wasted your time learning something useless.

That is what people who have good jobs will think of you if you say what you just did in person. Liberals and conservatives who reside in enclaves of gainful employment in the professional class, will most likely blame the job-seeker for not having a good job.

The fuse is lit on Japan’s debt bomb. The arguments of Abe and Pilkington keep it burning bright. The sequence I propose is as follows:

– Inflation targeting drives debt to GDP up increasing the debt burden and decreasing the value of the yen relative to other large currencies.

– The decreasing value of the yen results in an increase in the cost of all their imports especially energy. They import 85% of their energy needs.

– Energy as a primary input to virtually every aspect of the economy drives up the economy wide price level including interest rates. The central bank’s capacity to repress interest rates is neutered once their inflation target is exceeded.

– A relatively small increase in interest rates drives up the ratio of resources spent on interest expense and drives down the resources spent on make-work programs, adding an air of instability.

– Institutions responsible for pension funds seek to protect themselves from the inflation and instability by spending yen on western assets further devaluing the yen. The yen starts a step downward spiral. The fuse is consumed.

– The JGB market explodes

– Abe symbolically becomes one of Taleb’s headless turkeys. He defends himself “We had deflation for 20 years, we didn’t see this coming.”

I’ll speculate the fuse is two years or less long.

Aren’t some government bonds indexed to the inflation rate so that investors are not paid back in devalued dollars in the future? I’m not sure I like the reality painted by Keynesian that investors simply can’t find a reasonable return on investment in the private sector and are willing to accept a zero return on investment by lending to government.

Keynesians have proposed that their money creation is harmless. In fact, it’s making U.S. exports competitive! Well, this an exaggeration. Most non-subsidized U.S. exports are STILL much more expensive than domestic equivalents. The most important claim Keynesian make is that money creation does not lead to inflation. It’s not going to lead to inflation if U.S. companies are not expanding in the U.S. as much as they are abroad. If most new investments are being made overseas, then most of the inflation has to be occurring over there. The inflation one might expect from money printing and general economic stimulus is still occurring in places like China, and India, where inflation due to economic growth is pushing the prices of wages and commodities way up. If the price of oil, for example, were to reach levels just before the 2007 crash, there would probably be food riots in the developing world again.

I don’t know how a stimulus can work for a country in a world where capital is global. It’s simply going to get leaked to export-model countries. Increased liquidity will simply get invested in areas that will not benefit U.S. workers.

Thanks Haigh. Some of the theoreticians really seem to have left the building. From one of Philip’s replies above: ‘this would be deficit spending. It would not be funded by taxpayers…..noone is being charged for this. Its deficit funded finance. But will taxpayers eventually have to “pay this back”? Again, no. The debt will be eroded not by taxation but by long-term economic growth.’ Is it me or is it mind-boggling, in an age of sovereign debt crises, to regard the unconstrained increase of government liabilities as costless? Rather like the shareholders of an overleveraged company, taxpayers are right in the line of fire should goldilocks growth fail to come through – just ask the Irish, Spanish, Portuguese etc. And in the case of Japan the numbers are terrifying: as Kyle Bass is happy to remind everyone (http://www.zerohedge.com/news/2013-01-18/detonating-japanese-debt-time-bomb-kyle-bass), the Japanese government already spends 25% of revenue on debt servicing, and every 100 basis point rise in their financing costs will take out another 25% of revenue. The bond market’s job is to discount growth/inflation etc 12 months ahead, but the rise in yields will be a scary story in itself given the government’s precarious finances. Japan is indeed in a trap: as I said above, the country cannot afford growth to break out, let alone a malign bout of cost-push inflation.

No, the Japanese stimulus will not work. Their problems are structural and societal. Money will not fix the latter.

Japanese society is not seeing enough births. Period. And they are in for the long haul for supporting an aging populace – something neo-Liberal Capitalism has failed to account for in its voodoo models.

And what are the infrastructure costs to maintain Japan? Look at the US with the trillions we need to our infrastructre, where the money is instead being spent on multi-trillion dollar weapons systems, well – the US will continue to see its infrastructure decay into worse-than-third-world conditions. Already, such conditions are increasingly becoming noticeable.