Yves here. I’ve heretofore avoided the topic of Bitcoin, since I recall the brief fad of the Second Life currency, which then flamed out impressively. And Bitcoin already has had the US Treasury clear its throat and say if market participants try exchanging Bitcoin for dollars, it takes a dim view of that. Recall that the IRS threatened to tax frequent flier miles, but later dropped that idea. But there is a more obvious choke point with Bitcoin, and the Treasury may come up with others if it were to be used as commercial tender. Nevertheless, the fact that Treasury has taken notice suggests that at least some readers are interested in it as well.

There are also some good skeptical comments at MacroBusiness, where this post first ran, and I encourage readers to give them a look. Consider this one (and make allowances for the command of English):

Conclusion: MtGox can pay journalists with 1.1 million dollars investment they got, so, medias will popularize BTC one period and after that BTC will go down. Most of users of BTC are exchangers who enjoy in speculating in order to gain profit, mass of people don’t have capital to be exchanger and speculate anything, therefore Bitcoin will not be used by masses/population than only by exchangers. Beside it, American law makers are against Bitcoin and MtGox owners are not ready to do anything against the law, so, MtGox will be closed before or later and then all BTC will become worthless. Without MtGox, there is no market of BTC, they possess 80% of BTC trade. When police and judge abolish MtGox, ordinary user can bankrupt if he has all his savings in the form of Bitcoins. And Americans can impose their law even in other countries because they finance many governments, when America forbid BTC, many other countries will do the same. So, investors in Bitcoin will bankrupt, MtGox will sell every BTC they can and take cash and then close MtGox, so, ordinary users and investors (who already spent their money for marketing of bitcoin) will loose money, MtGox owners will save themselves.

From Unconventional Economist, via Bullion Barron and MacroBusiness

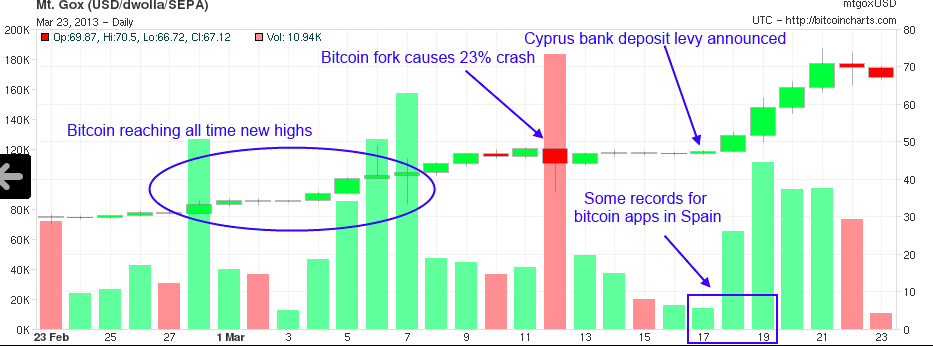

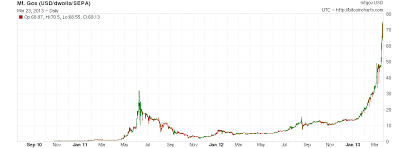

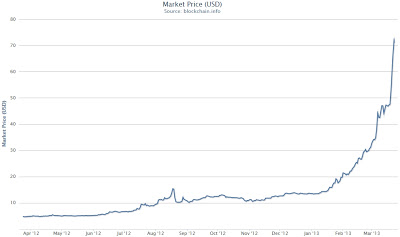

Bitcoins have been making headlines on mainstream news sites, on blogs and even on precious metal forums recently and with good reason given the vertical rise in price per Bitcoin:

But is this rise part of a bubble or a new paradigm for virtual currencies as their utility increases and becomes more mainstream?

There is a lot of speculation that the Bitcoin mania has been a result of the recent Cyrpus crisis, however much of this speculation was due to an increase in app downloads in a single country where iPhones do not have a large market share:

This was spotted by BGR writer Tero Kuittinen, who noted that three iOS apps — Bitcoin Gold, Bitcoin Ticker and Bitcoin App — each jumped up the App Store charts in Spain, all on the same day, as the news broke from Cyprus. Compare their download histories to those from a country like the UK and it’s clear that the upward trend is more pronounced in the more at-risk nation. Bitcoin Gold’s all-time high ranking of 83 in Spain came on 17 March; for Bitcoin Ticker, 68 on 17 March; Bitcoin App reached a high of 147 on 19 March. The highest rankings for those apps in the UK are lower — 293, 201 and 48 — and they were all records set months or even years ago. Indeed, there hasn’t been any kind of correlation between the Cyprus news and an uptick in Bitcoin app interest in the UK, going from this. The huge caveat to this, though, is that the iPhone’s market share in Spain is tiny, at roughly four percent of the total smartphone market as of mid-2012. Only a percentage of people who trade Bitcoins will trade or keep up to date with prices on their smartphones, too. A spike in iOS app downloads in one Eurozone country is a terribly small sample from which to draw conclusions about whether the Eurozone crisis is driving more people across the continent to Bitcoins. Wired

It seems more likely to me that the increase in Bitcoin app activity was a result of the surge in Bitcoin price that had recently taken the price to all new highs by the 17th of March, the further rally which took the price to levels above US$50 (which probably sparked even more interest) & the crash that had occurred several days earlier due to a glitch in the blocks/programming.

Click to Enlarge: Timeline of Events, 2 Months

With this number of events all occurring in unison, it’s not hard to see there were other reasons for the increase in Bitcoin activity, other than finding a safe haven currency to avoid depositor haircuts as some have speculated was the case.

For those who are not familiar with Bitcoins, they are a virtual currency. First created in 2009, they can be transacted peer to peer and through exchanges such as the most popular Mt.Gox. Their creation is not controlled by a central authority, their supply is expanded with the use of a mathematical algorithm.

The price of a Bitcoin has risen from around US$10 to over US$70 in the space of 4 months. Some might call that a bubble with little more thought given, but scratch under the surface of the price and there could be valid reasons for the increase in price.

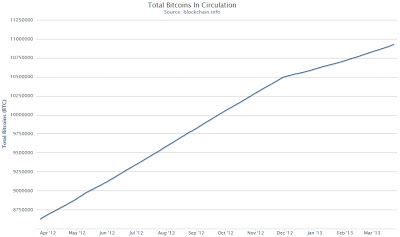

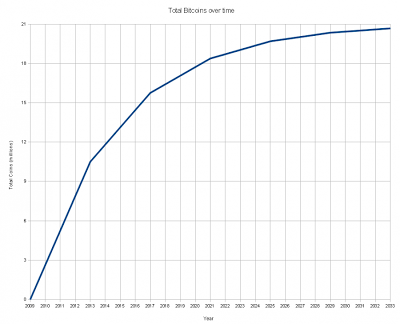

One of the reasons for the large rise in price is a combination of a slowing number of them being added to circulation:

Bitcoin: Total Bitcoins in Circulation

Starting from 2009 the number of Bitcoins generated every 10 minutes was roughly 50, every 210,000 generations (approximately 4 years) the creation rate drops in half (50, 25, 12.5, etc), the number of Bitcoins in circulation will never number more than 21 million:

As is evident from the above charts, the first halving of Bitcoin inflation has taken place toward the end of 2012, near the recent price lows and start of the rally which culminated in the parabolic spike. Plenty of speculation on what would happen (including expectations of a rising price) was taking place last year:

The implications to this are huge and for the most part unknowable. There are two ways I can see it going;– Mining is a delicate balance of difficulty vs electricity costs, the price of bitcoin depends on the electricity cost to generate those coins so if the cost to generate a bitcoin increases the price of a bitcoin rises to match.

People stop mining bitcoin because the cost outweighs the return and the difficulty of generating a bitcoin (currently at 3368767) plummets until it is once again profitable to mine.

I believe that it will be a mix of both, I think the price will rise and the difficulty will drop but that is just me speculating. The truth is we are in for an interesting time, I don’t even want to factor in the new bitcoin mining hardware (ASIC) that seem to be about to hit the market. MineForeman

Can the halving of creation rate alone justify a 7x rise in the price of Bitcoins? Probably not by itself.

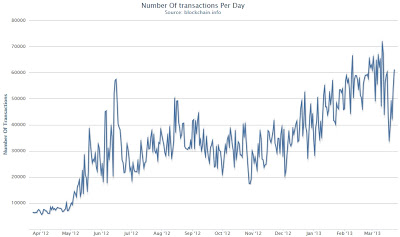

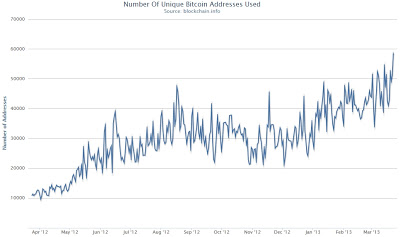

Along with the halving of creation rate, we’ve also seen the number of transactions and unique addresses used for transactions rise (together these numbers indicate an increasing number of people using Bitcoin rather than increase in number of addresses used per person):

Bitcoin: Number of Transactions Per Day

Bitcoin: Number of Unique Bitcoin Addresses Used

An increased number of people using Bitcoin has resulted in a “network effect” where its value has risen as demand increases:

In economics and business, a network effect (also called network externality or demand-side economies of scale) is the effect that one user of a good or service has on the value of that product to other people. When network effect is present, the value of a product or service is dependent on the number of others using it. The classic example is the telephone. The more people own telephones, the more valuable the telephone is to each owner. This creates a positive externality because a user may purchase a telephone without intending to create value for other users, but does so in any case. Online social networks work in the same way, with sites like Twitter, Facebook, and Google+ becoming more useful as more users join.

The expression “network effect” is applied most commonly to positive network externalities as in the case of the telephone. Negative network externalities can also occur, where more users make a product less valuable, but are more commonly referred to as “congestion” (as in traffic congestion or network congestion).

Over time, positive network effects can create a bandwagon effect as the network becomes more valuable and more people join, in a positive feedback loop. Wikipedia

The network effect can very much apply to currencies, especially so where the Government/central banks can’t increase the number of currency units to meet demand, so Gold has also benefited from the network effect over the bull market as an increasing number of people want to own it, but where there is no easy way to increase the amount (while Gold doesn’t have a known limit like Bitcoin, there are other reasons we can’t dig more up on a whim including declining grades available to mine).

Despite the positives for Bitcoin, there are still risks which have the potential to impact on price.

ASIC(s) – Application Specific Integrated Circuits are essentially specialised computer chips designed for mining Bitcoins in the most efficient way possible. To date much of the Bitcoin mining that occurs has been via powerful computers which also have a high running cost (e.g. gaming rigs with specific graphics cards which lend themselves to the process), but with these new systems comes lower entry& running costs which will result in more competition… how much effect this will have on the price of Bitcoins is yet to be seen as consumer ASICs have only started shipping early this year (read more here). They could have a dampening effect on the price in the short term (lower cost to mine), but then as they become more common the competition will force a reduction in the profits for the early adopters, driving the cost to mine higher again.

Regulation – Recent news out of the US includes threats of regulation of the BitCoin market:

The U.S. is applying money-laundering rules to “virtual currencies,” amid growing concern that new forms of cash bought on the Internet are being used to fund illicit activities. The move means that firms that issue or exchange the increasingly popular online cash will now be regulated in a similar manner as traditional money-order providers such as Western Union Co. WU +1.04% They would have new bookkeeping requirements and mandatory reporting for transactions of more than $10,000.

Moreover, firms that receive legal tender in exchange for online currencies or anyone conducting a transaction on someone else’s behalf would be subject to new scrutiny, said proponents of Internet currencies. Wall Street Journal

As transacting the currency can occur peer to peer, there is little any one Government could do to stamp out use, however if the large exchanges (where currency for Bitcoin swaps take place) were targeted, there is the potential for it to have a negative effect on the ease of use and market for Bitcoins.

Hacking – The most obvious risk to a virtual currency is the risk of storing them. Hold them on your local computer and they are at risk if you accidentally delete them or your hard drive crashes. There is also the potential someone could hack into your computer and transfer them out if you haven’t stored them securely enough. The problem is that all transactions are irreversible and difficult to trace, so once they are gone it’s unlikely you will see them again. Not only are criminals targeting individuals who hold Bitcoins, but also exchanges and sites offering online stored wallets/Bitcoins. As the value of Bitcoins increases so will the sophistication and efforts of criminals to steal them. It was a hacked exchange which resulted in the 2011 crash in price (from a peak just above US$30):

Click to Enlarge: Bitcoin Chart Showing 2011 Crash and Today’s Boom

The Bitcoin community faced another crisis on Sunday afternoon as the price of the currency on the most popular exchange, Mt.Gox, fell from $17 to pennies in a matter of minutes. Trading was quickly suspended and visitors to the home page were redirected to a statement blaming the crash on a compromised user account. Mt.Gox’s Mark Karpeles said that the exchange would be taken offline to give administrators time to roll back the suspect transactions.The extent of the compromise became clear when a copy of Mt.Gox’s user database began circulating online. The file included username, email addres, and hashed password for thousands of Mt.Gox users. Karpeles’s statement was updated to acknowledge the breach. He warned users who have re-used the Mt.Gox passwords on other sites to change them. Ars Technica

The increase in value of Bitcoins (market capitalisation of all Bitcoins rose from just over $100m to almost $800m with the recent price rise) is likely to paint a larger target on the Bitcoin exchanges and people with a large number of Bitcoins in their virtual wallets. Who knows what sort of exchange hacks or malicious code could end up affecting the Bitcoin market in a negative way.

So all this said, with rational reasons for an increase in price (although perhaps not to the extent it has) is the Bullion Baron about to run out and purchase some Bitcoins and hope their utility and in turn value continues to increase? Not likely. The main problem I see for the investor/speculator (see this post for my definitions) is that there is no accurate way to value the Bitcoin and while precious metals are much the same, there are several key differences:

• Precious metals are a physical commodity, Bitcoins are a virtual currency.

• Precious metals have history spanning thousands of years as money and a store of value, Bitcoins have a few short & volatile years as a virtual currency.

• Precious metals have utility outside of monetary use (industrial, jewellery, etc), Bitcoins are only useful as a currency used in transactions.

• Precious metals are more easily purchased (at least that is the case in Australia, from my experience).

• Precious metals have a history of cycling in value against other assets such as oil, stocks & land, Bitcoins have no such history.

They do also have some similarities:

• Neither have a governing body/central authority that can produce them in unlimited quantities.

• They are both a limited resource (Gold by it’s natural occurrence in the earths crust and Bitcoins by the algorithm which controls the number created).

• Both will be harder and more expensive to mine over time (Gold due to decreasing grades and rising input costs, Bitcoins due to increased competition, technology advances and the reducing number created until peak 21m reached).

• Precious metals and Bitcoins are both seen as a threat to official currencies and are likely to see action as a result (more regulation).

There is no reason to expect that Bitcoins will act as a store of value over the long term, but then if their popularity continues to increase then likely so will their price over the long term. The number of sites and services that can be used with Bitcoins is increasing regularly, there is quite an extensive list here: Spend Bitcoins and there has even been news of Bitcoin ATMs to make funding your account even easier:

Zach Harvey has an ambitious plan to accelerate adoption of the Internet’s favorite alternative currency: installing in thousands of bars, restaurants, and grocery stores ATMs that will let you buy Bitcoins anonymously.

It’s the opposite of a traditional automated teller that dispenses currency. Instead, these Bitcoin ATMs will accept dollar bills — using the same validation mechanism as vending machines — and instantly convert the amount to Bitcoins and deposit the result in your account. CNET

My gut tells me that at US$70 Bitcoins are probably closer to a short term bubble peak (given the short term nature of the rise) than at the base of an immediate move to $150 or other high price targets I have seen thrown around ($500+), but that doesn’t mean they can’t head higher (in the short or long term).I think to a degree the price in the short term will depend a lot on who is holding Bitcoins and for what purpose. If there are a lot of speculators or people storing large amounts with no reason to transact then a move to sell and take profit could drive the price lower. If there are few of these types though and the price is being driven higher by a genuine need for Bitcoins for use in transactions then the price could keep moving higher.

Personally though even if I thought Bitcoins were undervalued, after rising 700%, their risks and weaknesses would stop me from putting any significant amount of money into them, a couple of thousand dollars maybe for a punt, but nothing serious. Although they have similarities to precious metals, they are far from a replacement.

> As transacting the currency can occur peer to peer, there is little any one Government could do to stamp out use […]

This is false. If a government cared (and they will if btc hits $500/coin) they could attack the bitcoin block chain. I won’t get into the technical details here, unless someone asks me too, but a government that controls >50% of processing power could forge coins, delete coins, and create all sorts of other mischief. Throw some cryptogrophers and super computers at the problem, and all of a sudden nation statess are not o powerless.

Mt. Gox — the bitcoin exchange — is dedicated to making the price go up. They do this through a number of ways, including making it hard to get USD out of mtgox. USD in, no problem. BTC out, no problem. USD out causes delays and technical problems and repeated verifications. Mt Gox holds on to your USD as long as possible.

Also Mt. Gox is almost certainly doing more traditional pump and dump scams. They control >80% of the btc market; why wouldn’t they.

The electricity discussion is misleading (the price of btc will go up as people learn about it, not as electricity prices rise) but there is one important thing to note about the electricity: bitcoin production pollutes. A lot.

> My gut tells me that at US$70 Bitcoins are probably closer to a short term bubble peak […]

Bitcoins will go up in value until they are destroyed or the exchange is destroyed. I have had some coins since they were 33 cents, and have been told they were in a short term bubble at a dollar, five dollars, no way they can hold ten, then 20, 30, and now we are in the 70s.

Bitcoins are deflationary and algorithmically designed to be so. There are a small number of coins, which mostly went out to a few early apdopters (I am one of them) and are divisible to 8 decimal points. They are designed to go up in value as more people know about them. They are a pyramid scheme that will (likely) last until a powerful government cares.

The claims of ‘a quant prop derivatives trader at an investment bank’ for those who haven’t seen this discussion before —

‘Bitcoin takes the monetary system back essentially a hundred years. We know how to beat that system. In fact, we know how to nuke it for profit. Bitcoin is volatile, inherently deflationary and has no lender of last resort. Cornering and squeezing would work well – they use mass in a finite trading space. Modern predatory algos like bandsaw (testing markets by raising and suddenly dropping prices), sharktooth (electronically front-running orders), and band-burst (creating self-perpetuating volatile equilibria in a leverage-sensitive trading space, e.g. an inherently deflationary one), would rapidly wreak havoc. There is also a part of me that figures regulators will turn a blind eye to Bitcoin shenanigans.’

More, with maths, here —

http://news.ycombinator.com/item?id=3787375

This might be true if any of the exchanges for bitcoin were remotely efficient. Mt. Gox has had lag in posting transactions of 30 minutes or more in the last few months (and always has, whenever there has been any significant activity).

I’m really pretty shocked anyone is taking bitcoin seriously as a currency. Though an interesting thought experiment, its implementation contains significant problems for a medium of exchange, and its infrastructure is laughably amateurish. It’s also more deflationary than may be appreciated; while money creation is regulated mathematically, destruction is haphazard and widespread. Coins can be irretrievably lost if someone deletes their wallet or loses the password to it. This happened a lot in the early days of bitcoin, when it was easy to mine lots of coins and they were virtually worthless so no one took them seriously. As a result, a lot of very fat wallets contain coins that will never be spent. (This is less likely going forward, but some additional loss is inevitable.)

As a commodity, its only value is as a fetish object; it doesn’t even provide the aesthetic or prestige value of virtual video game items. At least gold is useful for electronics manufacturers, and any physical commodity may see demand spike as a use is found for it. This is almost definitionally impossible for bitcoin; it’s only value is extrinsic, either under the “shared illusion” theory of value or in the event someone accepts taxes in it.

Bitcoin does have one financially interesting property: If records of both the currency -> bitcoin and bitcoin -> currency exchanges are not kept, it would be very difficult to trace the origins of funds. This makes it potentially ripe for money laundering, and requires that the party doing those transactions do good record keeping. (That party is usually Mt. Gox, the same organization that gets minutes behind on even moderate transaction volume. I don’t view them as a model of competence and probity.)

So: Someone is erecting a mansion on the toothpicks of a fundamentally flawed currency (or alternatively, a commodity with no intrinsic value), with potentially a lot of value as a money laundering vehicle. It think it’s obvious what my opinion of the recent price rise is. What I’m certain it isn’t is a reflection of any kind of economic activity or underlying value. At best, it’s tulip mania; at worst, it’s tulip mania predicated on criminal enterprise.

On electricity costs, I agree with you, it was a quote from another site. While the price of Bitcoin doesn’t explicitly relate to electricity cost I think Bitcoin miners are more likely to spend their Bitcoins promptly while the price is high if they’ve mined them for a much lower cost, so introduction of ASICs could add to short term pressures on price.

“Bitcoins will go up in value until they are destroyed or the exchange is destroyed.”

That doesn’t mean that we can’t see short term tops as speculators push around the price. You will note I didn’t say it was a permanant top, I speculated we might be near a short term bubble top.

No.

A 51% attack does not allow you to forge or steal coins, it just allows you to delay/block legitimate transactions.

Also there are technical responses to a 51% attack that could be used to mitigate those kind of attacks. Basically, the community could ask moral authorities (Gavin, Satoshi, the Bitcoin foundation, well-known mining pools…) to create a web of trust and ignore any block that has been produced outside this web of trust.

A more realistic attack would be to prevent the bitcoin exchanges from accessing the banking payment infrastructure. That would seriously damage Bitcoin but this still wouldn’t kill it as it has been designed to work outside the banking system.

I thought bitcoin speculation was over in 2011. that 2013 curve says “bubble” to me.

It is easy to have explosive increases in circulation of alternative currency by early adoptors (spike in 2011). But once people realize they can only spend x amount on falafel or whatever, then the bubble bursts (also 2011). It’s hardest to get an adequate supply of services to accept novel currencies which limits their ultimate success. Most of the list for businesses accepting bitcoin are small business/novelty items and services. Not so much real elements in the economy. (meaning you can buy arduinos and porn, but you can’t get the service of a decent dentist) Like most alternative currencies, you almost have to go out of your way to figure out how to actually spend them.

In times of economic hardship, people are looking for safehavens like gold and hoping bitcoin is the next big thing. Wasn’t it predominantly a trendy NYC phenomenon at first?

I agree with the skeptical quote: “Most of users of BTC are exchangers who enjoy in speculating.” Limiting the creation of new bitcoins and then opening the spanish access when Cyprus goes into crisis, it makes sense that there was a buying frenzy and prices flew up. I would not read into it any further than that. not going to be allowed as a “new currency” but the fed will come up with their own knock off eventually.

The problem with hierarchical currencies in general (i.e. currencies generated by some force external to the real economy which they serve; whether that be the earth, the gubmint, or computing power and time) is that they are all essentially anti-social and they encourage anti-social behavior in those who suffer under their yoke.

Consider: while fiat currencies are, in theory (and at the macro level), infinite in supply, they are definitely finite for each of us individually. Since individuals don’t have the ability to create the currency, they must stuggle and strive to attain it, and hope that there is enough of it around and available that they will be able to get their hands on some of it.

Every person becomes a competitor of every other person in the never-ending drive to obtain more currency. People become selfish, since the sharing of one’s scarce currency may lead to one’s own penury. You may be strong and healthy, intelligent and hard-working; you may own valuable material objects–a house, a car–you may be able to produce all manner of goods and services, but if there is not sufficient currency available, all of this will avail you not.

And so we are made to compete with each other over an artificially scarce item. There is food aplenty, and yet people starve because there are not enough green pieces of paper to go around. It is both tragedy and farce.

It should not be surprising that hierarchical money creates anti social behavior. As many have pointed out (David Graeber, most eloquently), coin money was originally created by and for soldiers. Precious metals were traditionally only used in exchanges with strangers, people whom one could not trust, and whom one would not likely see again or form a relationship with.

What is the humane currency alternative? Certainly not bitcoin. The solution to artificial currency scarcity, imho, is the re-institution of ‘grassroots currencies,’ that are created as accounting entries at the time of transaction, as needed. The Greeks have already started down this road, out of necessity not ideology. Their TEMs system is a bottom-up currency system of this sort…and it works! Bernard Lietaer talks about this a lot as well.

Of course, you can’t speculate with this type of currency (yet), or manipulate it to get rich quick (yet)…so obviously it’s not perfect (yet) {snark}

When Lietaer was talking about the second Swiss currency, the WIR (?), he said it has worked to create economic stability since its inception because it is business to business and requires no banking and no interest. Pure cooperation. And also because it can be used to pay taxes. It’s the taxes part that’s most interesting. Leading me to think that multiple types of currency can be successful. Because they are a direct representation of the value they serve. And then the thought: taxes, like single currency systems, should also be diversified. According to the currency used and the underlying social value it supports. I don’t understand bitcoin at all, but specific currencies sounds very interesting.

You bring up a lot of good points.

I still maintain that there are 2 separate markets… one for soft assets (services)and the other for hard assets (goods) where the first is unlimited and the second limited.

These 2 markets could be separate but would need to connect in some way because everyone needs some food and other material goods. If too much money from the soft asset market goes into the hard asset market, then we would end up with huge inflation.

The problem is that hard assets will always be more attractive than soft assets because they are more scarce.

That is why the elite always want to corner the market for hard assets and control the money supply.

That’s why countries should nationalize profits emanating from hard assets and privatze profits from soft assets.

Obvious bubble.

I remember back when it was introduced at pennies on the bitcoin, I ignored it entirely.

Sure I feel dumb for not just putting $100 to buy hundreds of bitcoins, but I had no idea the black market would adopt Bitcoin as a medium of exchange so openly. I also figured the FTC/Treasury/etc. would have been more aggressive in shutting them down by now if it did get this big.

Clearly it’s a vehicle for money laundering and won’t be around much longer, but how long will the bubble continue? A lot of financial press types have been getting in on the discussion as well. But clearly its value is derived entirely from black market industrial demand, and as such it is unsustainable.

On some of the bitcoin forums there have been attempts to produce a derivatives market to allow for short-sales, or some orderly way to ensure proper borrowing of bitcoins for purposes of shorting/covering. This would help calm the market down, but instead it’s going to burn out really hard.

I’m not sure exactly when, but i’d say by the end of this year bitcoin will be worth significantly less than its current levels.

“Clearly it’s a vehicle for money laundering and won’t be around much longer”

You’re right of course…HSBC won’t stand for the competition.

Yea really remember: 1) only Cyprus and the Russians are engaged in tax evasion and 2) only illegitimate dodgy and new fangled institutions like bitcoin are involved in money laundering and criminal enterprise not large and venerable banks with their precious fiat money. That’s why governments are so interested in bitcoin and not HSBC. The system works, all’s for the best, sleep tight and don’t let the bedbugs bite.

There is nothing that you can do with Bitcoin that you cannot do with USD.

Also, bitcoins are just numbers so preventing people to exchange them could fall short of the first amendment.

Last, Bitcoin is bigger than the US. Most Americans do not know this but Washington does not have global jurisdiction.

Ask Kim Dotcom how that’s working out.

~chortle~ … :)

Oh, no.

Not scary money laundering.

Your framing and/or worldview is banal, to say the least.

Bitcoins are worse than gold as money since there is an absolute limit on the number of Bitcoins that can be “mined.” Bitcoin is a money hoarder’s dream come true EXCEPT that government is not there to force people to use them as was the case with gold under the gold standard.

Bitcoin appears to be an unintended mockery of gold as money (e.g. difficulty of “mining” creates value).

Common stock is a sensible, democratic (at least per share) ETHICAL form of private money creation but most are wedded to our current government backed usury for stolen purchasing power paradigm if only it can be (after 400 years of trying!) successfully regulated.

But perhaps the God who forbids theft, oppression of the poor and usury from one’s fellow countrymen can be successfully mocked?

By this logic, we should just print up $100 bills by the truckload and ship them out to every man, woman, and child in the US. That should take care of the apparent currency supply problem preventing most of us for achieving affluence.

What you aren’t apprehending is if BitCoin really takes off and people really start using it as a means of exchange, then the value of each BitCoin will have to increase over time since the supply is limited. So, for example, a bag of coffee beans might cost you 1 BTC today. In five years’ time, assuming BTCs gain more traction, that same bag of coffee beans might set you back 0.75 BTC. Or 0.075 BTC. Unlike gold, BTCs can much more easily be transacted in fractional units.

Bitcoin has significant structural issues, as several commenters point out. But it offers something that government currencies don’t: privacy. Which can be highly useful:

Whether Bitcoin is the right vehicle or not, ultimately the only way that mankind is going to escape the human slavery of neofeudalism imposed by rich-world surveillance states is to have recourse to an anonymous system of exchange and storage of wealth, which paranoid gov’ts can do f**k-all about.

There are some errors in the posts above:

Dental Services are accepting bitcoins (yea its not so common yet but what would you expect so early in this game?): http://www.dcdclinic.org/

Mt Gox (the biggest exchange) has around 68% of the trading volume, not >80%: http://bitcoincharts.com/charts/volumepie/

They are also splitting off their North American Customers (probably to avoid problems with the US government): http://www.forbes.com/sites/jonmatonis/2013/03/02/bitcoin-exchange-deal-repatriates-assets-to-u-s/

Governments have not yet appeared hostile towards bitcoin. FinCEN has released guidance stating that trading bitcoin is not illegal but exchanges need to be registered as a MSB:http://fincen.gov/statutes_regs/guidance/html/FIN-2013-G001.html

Bitcoins have many legitimate users and merchants. There has been consistent growth in this area. At least $2 million/month in legitimate economic activity: http://uptweet.com/viewStory?id=1115

If Mark P could really “wreck havoc” on the bitcoin markets and make money off of it he would already be doing it. I’m no expert trader but all those algos sound like they would lose him money in bitcoin. This is even addressed by someone in his link who he never responded to. 30 day USD volume on Mt Gox is now an order of magnitude larger than when he was toying with the idea a year ago, so I would encourage him to get in and make some money.

As to the drastic price increase: Keep in mind the limited number of bitcoins that will be generated compared to the amount of USD and EUR out there. If bitcoin finds a niche as an online medium of exchange or safe haven for wealth, which it appears to be doing, $70 each is not unreasonable.

“so I would encourage him to get in and make some money”

Smells like a pyramid scheme.

Well it was not meant that way. Please reread his criticisms of bitcoin. It was that he knows how to “nuke it for profit” because it is old fashioned.

Ah, no. You misunderstood me. I was quoting what someone who claimed to be a trader said during a discussion about Bitcoin elsewhere.

It would be pretty to think that Bitcoin is viable long-term. We can all feel that. However, the putative trader’s claims about “nuking” it struck me as very plausible, so I passed them on.

Ah sorry about that. Assumptions…

Was bitcoin designed to hoard or to spend? I think it was designed to spend and keep commerce running in spite of the big banksters and fatcats who have almost brought commerce to a screeching halt. Hoarding bitcoin is not such a clever idea as bitcoin must be exchanged to account for its value. But until you “cash out” you can use it to buy and sell forever. Right?

Yes, unless you are treating it as a get rich quick scheme, the only reason to cash out is because you ran out of other currencies and can not use it to attain some neccessity such as paying your rent. It is obviously hoped by people using bitcoin that this situation will become less common in the future. For an example of progress on this front, the internet archive will pay its employees in bitcoins if they so choose, so the loop is closing: http://blog.archive.org/2013/02/21/employees-to-be-paid-in-bitcoin-please-donate/

The deflationary aspect that leads to saving at the expense of spending is for two reasons. First, it is to encourage adoption and use of the currency via the network effect. Second, unless it can be adjusted to match very closely the growth of the underlying economy, inflation encourages wasteful consumerism. Lack of complete information about the state of the economy as well as political pressures often lead to improperly control inflation.

While sudden deflation of the USD could lead to a “deflationary spiral”, deflation of a currency that everyone knows is deflationary is not expected to have this effect. It is the ability to plan for the deflation that makes all the difference. It is thought that people will still spend the currency on good investments and things that they need. Further, a bitcoin is basically infinitely divisible since there is no actual coin that exists, they are only entries in a public ledger book. The limited supply and divisibility of gold are what made it less suitable as a currency during the recent centuries of vast economic growth. Bitcoin only has a limited supply so it does not have this problem. In reality if enough stakeholders in the system agreed to raise the number of coins sometime in the future for some reason this could be done, so there is a social aspect to the system as well.

It is the ability to plan for the deflation that makes all the difference. It is thought that people will still spend the currency on good investments and things that they need.

See, the thing with deflation is that the way you plan for it is by hoarding. Once “not spending money” becomes a good investment, that becomes the default investment for everybody who isn’t compelled by necessity to spend–any other imaginable investment opportunity will just have a lower barrier to entry in the future when you pay for it with fewer more-valuable dollars. (And by whom is it thought, exactly, anyway?)

Further, a bitcoin is basically infinitely divisible… In reality if enough stakeholders in the system agreed to raise the number of coins sometime in the future for some reason this could be done, so there is a social aspect to the system as well.

I’m glad you’re aware of the social aspect here. I trust you understand why there would be a huge social barrier to voluntary adoption of a currency in which a small minority of well-connected early adopters have millions of dollars’ worth of pre-existing wealth? What value would Joe Bitcoin User get, assuming dollar-bitcoin exchange rates have become stable, by voluntarily playing with a bunch of super-millionaires? People who could, at any point, completely overwhelm your 2-mB savings by spending a hair more on some other good?

You have just explained why the US dollar is still the world’s reserve currency despite being a rather ad hoc outcome of WWII. What is a fair way to initially distribute a new currency, especially one that loses value over time? No one can ever agree. One solution is design it to increase in value and then do first come, first serve.

The reason a late adopter would want some bitcoin is that once you get over the learning curve, they are just such a useful tool if you know how to use a smart phone and a computer. Hopefully in the future this learning curve can be reduced further.

Also, how do you differentiate between saving and hoarding? At the societal level, both have the effect of less consumption now, leading to preservation of true wealth, natural resources, for the future. At the personal level, they both increase the chance one can comfortably survive times of hardship.

Investment is use of economic resources in a way that increases the productive capacity of the real economy (take my excess grain and buy a loom, or an enlarged sheep pen, etc). While I’m thinking of my own gain, by making this investment I wind up increasing the amount of cloth the whole country can produce, improving the productive capacity of the real economy.

Saving is deferring consumption against future needs which may not be met out of estimated future flows (keep my grain in a silo in case next year’s harvest is poor). This doesn’t improve the productive capacity, which is one (of several) justifications for providing a social insurance scheme so that I don’t have to self-insure.

Hoarding is removing resources from the real economy, in the form of cash or a static-supply status commodity (precious metals, shiny rocks, etc), in the hopes that it will be worth more later, or because one cannot find anything better to do with it. (intentionally keep some of my grain from the market because I anticipate selling it for higher prices when the drought comes). This does not add to productive capacity; if anything it reduces it, because it disemploys loom makers while raising prices for all other laborers, some of whom may even starve.

Deflation drives expenditures away from investment and toward hoarding, because there’s no reason to risk any specific investment when my currency itself is appreciating. (If I know we’ll never have another wheat harvest, why would I sell you a bushel of wheat for a loom when next year you’ll be desperate enough to sell it to me for a peck?)

Otherwise put: Investment anticipates enlarged future flows; saving anticipates future need; hoarding anticipates future appreciation of present goods/monetary instruments.

Well I would say the reason to invest under deflation is that you think something is a good idea that really should get done. Even if you are a pure rational economic being then you would only invest in projects likely to pay off moreso than the “hoarding”. In other words people would have higher standards and not throw their money into highly speculative investments or TBTF schemes.

Apparently it won’t let me reply to your other post because the subthread got to long, indicating we are supposed to stop I guess. Interesting conversation though.

If it looks like bubble and quacks like a duck… then it is a pyramid scheme. Cash them fast if you own any.

Your “close blockquote” tag (or whatever you call it) at the end of this sentence–“Precious metals and Bitcoins are both seen as a threat to official currencies and are likely to see action as a result (more regulation).”–is misplaced. Might wanna fix that, it looks a little funky (the “bullet point ellipsis” is kinda weird too).

Posting at midnight…jeesh…no wonder…

Are you implying that the world starts in Vermont and finishes in California?

No, I’m referring to the fact that the time stamp on the post is 12:05 am, which I assume was the time wherever Yves happened to be posting from (NY, no?).

Because of the inherent deflationary nature of bitcoins, they’re going to be unusable as a medium of exchange pretty soon.

Shortly afterwards, they’ll become useless as a store of value. Funny how that works.

Well, that is the point of the experiment. Rather than assumptions being thrown around we will now have some data to look at. I just hope there are enough thinking people in positions of power so that it can either become a success or failure on its own.

The question is”What is value?”

Value is subjective and depends on context.

The extreme weakness in the Bitcoin scheme is the exchange mechanisms.

This is the same weakness in any ’emerging’ currency.

The nature of the algorithm is Bitcoin’s strength, but it is also it’s weakness, and leads to extreme volatility and speculation.

I have looked into this several times, with the help of my son who is a mathematician and engineer, and I concluded that Bitcoin is a speculative instrument more than anything else.

The lack of fair and transparent exchanges is going to be its biggest impediment.

Currencies are foggier than bitcoin. Explaining why it takes time to cash out. Irony rules.

Bitcoin is a classic tulip craze. The price goes up because the supply is limited and new buyers are entering the market constantly… but in the end the coin is valueless (it can’t even produce a pretty flower) so the person caught holding it when new buyers stop entering is wiped out.

The problem with Bitcoin is that there are no Bitcoin-denominated tax liabilities for it to extinguish. Thus is it not really money in the sense we generally understand the term in the modern context. Real money is created by a currency issuer and destroyed by a taxation authority. There is no taxation authority for Bitcoin, so a piece of its life cycle is missing.

As with any tulip craze, those who bought early and sell before the crash will do quite well. Others will lose everything. It’s completely inevitable. However, as bubble-watchers have failed to learn so many times, “inevitable” and “soon” are not synonyms. The party can continue as long as there are new buyers.

The other thing to note is that the transaction history of the entire bitcoin ecosystem is public. You have handy sites like http://blockexplorer.com/ or http://blockexplorer.com/

It should be born in mind because one supposed selling point is anonymity and limited traceability.

One thing that makes this perhaps slightly less of an issue is that exchanges like MtGox keep bitcoins in the bitcoins they are in charge of in large common wallets (or at the very least used to) rather than store a separate wallet for each of their customers. That rather helps anonymity as only MtGox can keep track of who authorised the transaction. But that also means you have to trust MtGox. I would also bet that they have all kind of co-mingled funds all over the place.

Indeed. Who was it that said “trust is the brother of fraud?” Hmm, I can’t remember, so let’s attribute it to me! :D

Good point. It’s anonymous as long as some guys who works at a wierd, unreguulated trade exchange is 100% honest, always, and forever.

Another thing, if this currency volatillity continues, how many retailers will want to take them? Not many.

It’s one thing for a bunch of early adopters and online criminals, but we can’t all be funky NY web designers, or ganga dealers.

No boring business people want to have anything to do with a currency that fluctuates wildy in value, and can’t be used to pay taxes or bank interest.

If you keep your own wallet, you can make it pretty anonymous. The only identity info that leaks out (IIRC) is the usage pattern.

I just love the smell of MERS in the morning…

I thinks it´s important to distinguish between the current implementation and the general concept. There´s the technology and the current variables that have been chosen. Just like other p2p networks the technology will very likely play a role in the future, the current economic assumptions behind this specific implementation may very well not.

It´s important to note though, that the protocol works with anything from a fixed amount of money supply to moderate increases to exponential increases(as seen in most current fiat currencies).

This particular implementation is a bit like the wild west(no one can tell for example if Mt.Gox is fully reserved, run on a fractional reserve basis or purely a “money in > money out scheme”).

The core ands ancilliary technology that has been developed since 2009 however is compatible with any implementation(in terms of economic variables) and far superior to the current financial framework.

This might very well be the YAHOO of this framework, but a Google is sure to emerge…

Currency

Which is the lie?

A. there is no money for social services;

B. free money;

C. law;

D. all of the above.

So, the baby sharks piled into real estate rentals, assuming the Fed will maintain its course in perpetuity. Now, you know who they are and where they are, and, more importantly, you know their common characteristics. If you don’t want big sharks, don’t feed the babies, and they will consume each other. If you are in the middle class, what you care about is equality between capital and labor. All other arguments are misdirection. Teach your children not to lie so they can see their path to the future, beyond all the lies.

Labor does not incorporate, lies in its foundation; that’s capital’s gig.

Hey guys, maybe this isn’t a bubble; maybe Bitcoinland’s “exports” are up. You know… illegal transfer payments for child porn, kidnappings and all that.

I give it two years. Maybe three. If the market doesn’t destroy itelf, the authorities will. They know who is likely to use this “currency”.

http://cryptome.org/2012/05/fbi-bitcoin.pdf

You’re more cautious than me. I’m calling it for this year.

You have to be careful predicting the burst of bubbles based on your feelings about the unsoundness of the valuation; even if your feelings are exactly correct you may be led astray. Bubbles burst when new buyers stop showing up with money, and not usually because anyone has a moment of clarity about how stupid the whole thing is.

The unknowable fact is – how many greater fools are left? As long as there is a supply of new fools a bubble need never burst. That’s sort of the case with gold, or seems to be. There is always a new supply of people willing to believe that gold never crashes, so gold never crashes. An eternal bubble! At least, until, you know…

It is true that the FUD Philip is spreading is a common attack on any non-corporate controlled part of the internet: https://en.wikipedia.org/wiki/Four_Horsemen_of_the_Infocalypse

If for some reason authorities wished to destroy bitcoin they would likely use this attack as part of an attempt to discredit it, however there is no evidence that this is yet underway. In fact, unless you are very careful, USD cash is much more anonymous than bitcoin, so if the goal were to stop these activities bitcoin use would be preferred by the authorities.

The dollar is the main tool used worldwide for these shady tasks, and will likely remain so. It is a shame that this kind of FUD is so easily spread about unfamiliar technologies, but it is a known issue and the bitcoin community is working hard to prove that this is an incorrect portrayel. Knowledge of this strategy is also why proponents of bitcoin attempt to get as many people to try it out for legimate uses, so they are less affected by the FUD. Sometimes this can be interpreted as “pyramid scheme” like behaviour, which is unfortunate but understandable.

Maybe it is a conspiracy by The Man to ensure that internet freedom is stifled… or maybe the FBI’s concerns are legitimate. You say that people can do illegal transactions with dollars if they are careful.. well, yes, IF THEY ARE CAREFUL. Many people are not. That is why lots of people get caught with their credit card details on child porn sites. These same people would definitely use bitcoin if it was an easy option.

Bitcoin gives people an EASY option to engage in illegal activity and that concerns the FBI — probably rightly. This is because morons who would other trip themselves up and get themselves caught doing stupid illegal stuff on the internet will be able to avoid getting caught. The FBI do not like this.

Does this mean that everyone in the bitcoin community is a terrorist or a paedophile? No. But their attempts to “subvert” currencies or whatever it is they do gets them noticed by th authorities. It’s not because The Man is trying to keep them down. It’s because, realistically, they are giving dodgy people an opportunity to get away with stuf that they otherwise wouldn’t.

You are unfamiliar with bitcoin. It is much easier to track bitcoin than cash. People using their own credit cards to purchase CP, etc will also fail to cover their tracks with bitcoin. People who use stolen credit cards, prepaid credit cards, or cash will not prefer bitcoin.

That said, yes, the FBI should be aware of bitcoin, the unique challenges they face in tracking it, and that it can be used for nefarious purchases, just as they are aware of the other payment methods. If you read your own link they say all this.

We’ll see. I don’t see any purpose to the currency EXCEPT to engage in anonymous transactions. All the other “uses” are either speculative or novelty.

Bitcoins are nothing but digital tulips.

Their value as I see it breaks down to two main components:

1) Speculation/hoarding (i.e., people only buy bitcoin because they think it will go up in value by meaningful currency denomination like eur/dollar that are tied to taxation/industrial bases/markets)

2) Black market trading

The black market guys most typically are worried about getting dollars so they can pay their dollar-denominated bills, or maybe they buy into the 1) part.

This has potential to go on for a while, but they’re just digital tulips, bound for a panic sale just like happened in ’11 before.

There’s no driving value component that I can see which justifies any real equilibrium price above 0 (or whatever the value-addition is of secrecy to buy drugs/porn/whatever).

It is possible to store a large amount of value in a small, easily transportable space. You can use it to cheaply send money anywhere in the world. Merchants can accept it without any ongoing subscription fees. The tradeoff is a lack of chargebacks, which are sometimes desirable for the consumer and worth paying for, although escrow solutions are becoming more common.

My personal favorite use is as the “local currency” of the internet: providing and paying for small contract services (programming, translations) that can be available to anyone online without sharing personal information. I believe this very-small business usage gives bitcoin its greatest value.

Every bitcoin you buy to make payment to someone on the internet is money you miss out on from holding bitcoin for the day as the price increases.

As for “holding a lot of money in small space” — we’ve had credit cards forever now, bitcoins do not add anything new to this dimension.

Its true that I may miss out on having more valuable bitcoins in the future. However, if I want something now and bitcoins are the easiest way for me to get it I will use them.

Credit and debit cards are also useful, but spending money from them is more expensive due to elevated fees to cover chargeback risk and taking advantage of monopoly positions.

If I do not expect the need for a chargeback I would rather just use the cheaper method.

Also, as we have seen with Cyprus, there is always some level of counterparty risk in letting someone else store your money. Whether it is a risk worth taking is up to the individual situation. For this use case, bitcoin is just one more option with its own advantages and drawbacks.

Aside from money laundering and speculation, I don’t really understand the goal of Bitcoin. If one wanted to undermine a corrupt, authoritarian government, one could live naturally in a commune sharing goods and services as necessary. I fix your computer, you share your vegetables, a third person teaches the kids, etc.

Bitcoin is worse than the gold standard in that the creation of currency corresponds even less to the amount of economic activity.

Bitcoins are tulip futures.

Get out in time, make a fortune — but unlike commodities or fiat currency, they are backed solely by collective delusion. They have no intrinsic value, and thus aren’t a commodity; they have no compulsory market participation created by state tax authority, and thus aren’t currency… what are they? Real stores of value always have the potential to meet some need–commodities can be used (nobody wants your beans, you eat the beans); fiat currency satisfies tax obligations. But the only needs satisfied by bitcoins are in opposition to each other: hoarding, and facilitating secure anonymous transactions. The more people hoard them to take advantage of real-currency-denominated price appreciation, the less useful they are as an actual medium of exchange.

Fortunately there’s a solution. Bitcoins are entirely network-dependent. For their value, sure, they depend on actual economic agents willing to transact in them; but more importantly for their existence they depend on the network of machines doing the processing that maintains the secure transaction history. Separating the coins from the network is impossible.

This provides a really obvious way to get around the deflationary peril of electronic currencies: when Bitcoins get too expensive to use, simply start a new network with the same algorithm. Hey presto, creating large amounts of virtual currency is cheap again thanks to Bitcoin’. People who transact heavily in BitCoin will have no MORE reason to fear Citcoin and Ditcoin and Eitcoin…

save that the gold bugs and mouth-breathing fiat-phobes who make up the majority of bitcoin cheerleaders would react in horror to this idea. But that proves the original point: bitcoin isn’t being used for its actual value proposition (privacy via anonymous verifiable transactions) but as a means of speculation that inherently creates bubbles. (Btw, I’m now officially dubbing that “aphrizogenic.” You heard it here first folks.) Disconnect BitCoin from convertibility to a real-world currency, and most of its users would have no desire to transact in it at all.

In short, bitcoins do have a value proposition, but there’s no reason that practical benefit should be tied to the original BitCoin network. But this realization would probably make the entire bottom fall out of the BitCoin market.

Actually it is more likely that there will be multiple decentralized currencies being used in parallel (these already exist) following different rulesets in order to serve different purposes. It is difficult to get people to trust a new centralized currency, and difficult to get them to try out any that does not have an upper limit on supply.

Another possible outcome is that the limit will simply be raised in the future by agreement, however this is unlikely as it would devalue the work of securing the network.

Thank You Yves… and posters. This is one to keep an eye one. The wagering man in me thinks the gig is up in three to five years.

But Wait!

http://mashable.com/2013/03/26/cyprus-bitcoin-atm/

Uh Oh…

Some interesting comments, and many knee-jerk and uninformed assertions.

The truth, as Yves so wisely states, is that none of us know how this will play out. Zero Hedge has posted a summary of a running survey going of bitcoin users and the data they have is interesting:

“The ‘average Bitcoin user’ is male (96%), 32.7 years old, libertarian / anarcho-capitalist (37%), non-religious (61%), with a full time job (43%), and is in a relationship (56%). The biggest motivation for new users are curiosity, profit, and politics; and 39% of users do not drink, smoke, gamble, or take drugs. Just over half of users have mined bitcoins and the greatest community fear for Bitcoin is “regulatory/legal intervention” followed by ”reputation problems”. Overall more people seem to find Bitcoin intellectually rewarding (70% have learned more about cryptography) than socially rewarding (22% have made friends).

…

The most common use of bitcoins was for gifts/donations (55%), while computer services was also quite high (38%). Only 11% of respondents have bought narcotics (using Bitcoin that is). In fact the community has a contingent of clean-living ascetics, 39% of respondents do not drink, smoke, take drugs, or gamble.”

–http://www.zerohedge.com/news/2013-03-10/demographics-bitcoin

From these results its seems that the black market uses are a negligible part of the bitcoin universe, and most users are speculating but have a sense that this is also a political move (the large minority of libertarian/anarcho-capitalist types is telling here).

I have also read (on reddit) that the backlog for “verified” accounts on MtGox has been up to and over 3,000 requests recently. Verified accounts are needed to withdraw substantial daily and monthly bitcoins and USD. However, the regular daily withdrawal amount for bitcoins is 400, which tells me that people are cashing in and want to get their USD out. There has been a price drop over the past few days from the all time high of roughly $73 to the current rate of $62, which also suggests people are dumping bitcoins and getting their money out. This is all understandable short term activity given the meteoric rise over the past few months (many bitcoin speculators had probably just left their bitcoins sitting in their accounts for months or years while the rate stayed relatively flat and now want to cash them out).

None of the above answers the question of why the incredible rise over the past few months. It is likely a combination of things: new interest as a critical mass of awareness is reached leading to and cycling with new entrants buying in and raising prices, the apparent fact that some bankster traders are getting in on the action (I read that some of the exchanges are getting lots of hits from IP addresses at investment banks), the fact that most users are speculators that were likely continually buying in while the rise was ongoing, and I’m sure others I can’t think of.

I agree with Yves’ instinct that this is likely a short term bubble. The question is where will the price drop to and when. Nobody can say. A lot of the younger generation doesn’t see any value in gold, or at least has enough faith in computer tech to believe bitcoin does have value. And the fact that quite an ecosystem is developing around it makes it less likely it will just collapse and die, at least all at once.

Bitcoin does have utility as indicated in the survey: the biggest use aside from speculation is the purchase of computer services, which is a catch all term that indicates there are tangible services that can be purchased with bitcoins. Web hosting, proxy services, satoshidice gambling, and many other services likely fall into this category.

The amount of bitcoin is increasing at a decent, if slowed rate, which means fears of an imminent collapse are likely misplaced.

Regarding government intervention this is unlikely given the relatively tiny size of the bitcoin market at a puny $800 million with the recent massive gains.

Again, its too soon to tell and those scoffing and mocking may be right, at least in part. But the fact is that anonymous online purchasing is not going away. Even if bitcoin collapses as a speculation tool, and barring a total collapse in the technology backing it (which is unlikely at this point, after 4 years of near constant availability), it will still exist as a purchasing tool. And even if it completely fails, there will be another to take its place.

The basis of ZH’s data (as usual) is shaky. They’re taking it from a voluntary online survey:

https://docs.google.com/spreadsheet/viewform?formkey=dENNRkZ5SVhwSUJFamtxM0lJZzF3S0E6MQ

The survey is aimed at Bitcoin “community” members. So, my guess is that there will be a lot of computer enthusiasts hanging around and very few child porn fans.

The drug trade in bitcoin has already taken off:

http://gawker.com/5805928/the-underground-website-where-you-can-buy-any-drug-imaginable

Given that I support decriminalisation this doesn’t concern me very much (although it WILL concern the FBI and the DEA…), but I would imagine that far more dubious ventures are using bitcoin too.

But until you’ve got data to contradict ZH’s data, that’s all it is: you, imagining things.

After reading some of this comments it seems the average person writing a comment does not have a glue what he is talking about. If Bitcoin is not working, there are already several other virtual currencys waiting to take its place. Maybe get some information about PPcoin, litecoins, etc.

If you are not buying Bitcoins, there are already thousands of people waiting and not only in the US, to get their hands on some of them. Its time to wake up… digital cash will be the future!

But, but, but…It’s MATH….

Math is not an edge.

Bicoin is whatever you want it to be. Untraceble, easy to track…fat free AND an energy loaded food with tons of calories.

Buyer beware. Sellers, as usual, and by definition, make the “money”, which is usually denomated in $.

Layman’s question for anyone: do these currencies have any ramifications for workers’ rights and standards of living?

The anarchocapitalist/libertarian basis of people who are interested suggests that there might be a correlation between people who are pushing an unregulated money and people who want markets unfettered by labor law. This has been why bitcoin leaves a bad taste in my mouth.

Suppose you could get a job, but the hiror goes “we’re only paying in bitcoin .. take our terms or move on, we don’t care.”

Is this plausible.. is it something that unions, or the diaspora of people-who-arent-in-a-union-but-think-workers-acting-in-tandem-to-get-more-power-is-a-good-idea should pay attention to as a threat?

I’m not totally clear on what you are asking, but some would say that bitcoin would be preferred by the working class because it’s value should not reduce over the course of time (in the long term, right now it is still new so the value is very uncertain and volatile).

One of the problems with inflation is that wages constantly need to be raised, which requires frequent negotiation between management and labor. The way it works out is that wage increases lag price increases, concentrating more money in the hands of capital. It also forces the “average person” to get involved making investments in the stockmarket, which is something many have neither the time nor propensity for, meaning they are more likely to be ripped off or have further percents of their wealth shaved off paying for advisors.

There are also other issues such as “who gets the newly created money?” Well that is a select few banks who then get to choose who to loan it out to, it is never the “working man” besides when it passes through layers and layers of the government first.

Look at what has been happening since the 1970s. I think we can be sure that increasing the money supply definately is not a sufficient strategy to keep income inequality low:

https://en.wikipedia.org/wiki/File:2008_Top1percentUSA.png

http://www.tradingeconomics.com/united-states/money-supply-m1

Finally, bitcoin really is just an experiment at this point. Nothing like this has been done before, so it is difficult to know all the different ways this new tool may be used and misused.

Thanks, cpicap! Yeah, food for thought. My question was vague but you answered it by suggesting several ways of reading bitcoin through the lens of regular people.

Adam Curry and John Dvorak get several thousand dollars per show in donations on their twice weekly No Agenda podcast.

They wanted to take bitcoin donations until Curry discovered it’s impossible to cash out bicoins more than 1-2 at a time. So, they reluctantly dropped bitcoin donations.

Curry said, when I can pay my landlady quickly and easily in bitcoins, then it’s real. Until then, it’s not.

a back-of-the-envelope calculation:

(1) total amount of money in the world: let’s say 45 trillion USD

(I’m just estimating and would welcome better estimates from others here)

(2) amount of BTC the world in a few years: 15 million BTC

(this is guaranteed by the BTC algorithm. by around 2030, the max of 21 million BTC will already almost have been reached)

now let’s say a tiny amount of the money in the world “flows into” bitcoin.

say, one-tenth of one percent (0.1%) of all the money in the world.

question: how much would 1 BTC be worth then?

answer:

the math is easy, although perhaps rather startling:

0.1% of 45 trillion USD / 15 million BTC

(…cancel a million on the top and bottom of the fraction…)

= 0.1% of 45 million USD / 15 BTC

= 0.1% of 3 million USD / 1 BTC

= 3000 USD / BTC

When that happens (and I don’t see any reason why it shouldn’t – even if Washington tries to intervene – since bitcoin works like bittorent, which nobody has managed to stop, and which in fact now accounts for about one-third of all internet traffic) it may become more common to talk about a “milli-bitcoin”, rather than about a “bitcoin” (since that would be rather large) And perhaps the “milli-Bitcoin” might get a nickname such as a “Millie”.

So if 1 BTC = 3000 USD someday, we could also equivalently say that a Millie is worth 3 USDollars (recalling that a Millie is one-thousandth of a bitcoin). This would be a bit less humiliating for the dollar.

For some support for the notion that a certain, small, but non-trivial percentage of world weath could indeed “flow into” bitcoins, google the following:

falkvinge bitcoin four drivers

You will find four fairly well-written articles by a guy named Falkvinge, the head of Sweden’s Pirate Party, presenting some relatively prosaic arguments about why it will simply be convenient to use BitCoin for certain things (digital, pseudonymous/anonymous, copiable/back-up-able, no fees, limited supply).

What’s not to love?

We’ve sat around on this blog and other blogs for enough years now noting how the central banks and the too-big-to-fail/too-big-to-jail are going about a lot of things the wrong way.

Well, now they can continue to going about doing things the wrong way.

And every time they do, more money will “flow into” bitcoin, which is done the right way.

By the way, people should also pay attention to Ripple.

Ripple is a new payment system, which also includes a new currency (the Ripple, or XRP).

Ripple – the payment system – may end up seeing a lot of usage. The included currency (XRP) may also compete with BTC in some ways. It’s also limited in quantity – but it’s being handed out very differently from the way Bitcoin has been “mined”.

In addition, Ripple (as a payment system) may end up being used a sort of “decentralized MtGox” – “Let a thousand MtGoxes bloom”.

So Ripple (the currency, XRP) could unseat bitcoin – particularly because Ripple (the payment system) may be able to “net out” many transaction, and run much faster.

And Ripple (the payment system, used as thousands of decentralized MtGoxes) could also help bitcoin, by making it impossible for goverments to shut down the fiat/bitcoin gateways.

Exciting times.

An interesting quote I found on Reddit:

The number 1 news item world wide is the struggling economy. Very different people, from very different backgrounds are all looking for answers to the same financial problems that now plague the globe. The problem is corrupt banking. The answer is Bitcoin.

Whether you’re a far right Tea Party member, a far left Occupy Wall Street participant, a self-employed business man, a poor laborer, a European saver, or a Chinese manufacturer, once you understand Bitcoin, you know it’s the answer you’ve been looking for.

Bitcoin’s value is directly related to the number of people who see it’s value. It’s easier to see Bitcoin’s value as more people see Bitcoin’s value. This is the network effect.

– SpencerHanson

http://www.reddit.com/r/Bitcoin/comments/1b2120/an_objective_question_about_the_recent_surge_in/c92xokb

This message is brought to you by Bitcoin Speculators of America.

The number 1 news item world wide is the struggling economy… The problem is corrupt banking. The answer is Bitcoin.

What? No, no of course it isn’t. The problem is wealth inequality and excess private debt, coupled with insufficient government spending to boost aggregate demand. Bitcoin is if anything an anti-solution to all of those. To the extent that corrupt banks are involved, it’s because of governmental capture. BitCoin can’t do anything about that so long as people are actually dependent on the real economy (which will always be under government control)–or were you going to eat bitfood? When BofA forges documents to steal your house, the problem isn’t that your mortgage wasn’t payable in bitcoins, it’s that you don’t have a place to live.

Whether you’re a far right Tea Party member, a far left Occupy Wall Street participant, a self-employed business man, a poor laborer, a European saver, or a Chinese manufacturer, once you understand Bitcoin, you know it’s the answer you’ve been looking for.

So whether you want:

1) reinstatement of 1950s-style social repression and dismantling the welfare state if its benefits go to people of color; or

2) debt jubilee; or

3) more customers, who don’t stiff you, and a tax policy that’s less punitive toward the self-employed; or

4) greater bargaining power vis-a-vis capital; or

5) actually these guys are doing okay for now, but their demands are going to cause the EuroZone to implode–unless you mean Cyprus, in which case again the problem is government control failure, a wealth tax is a wealth tax; or

6) more power to shut down the discontent among the poor laborers who want greater bargaining power vis-a-vis capital (aka the guy from #4);

BitCoin is the answer for you?

Wow! For every problem, the same solution!

Look, if you’re that hard up for a currency whose quantity won’t expand and that isn’t supported by any government, go get some mid-1970s ruble notes and insist on transacting only in them, or whatever. But don’t tell me it’s magic pixie dust that solves every problem just because your hobby fetish object seems rare and can’t be kept in a bank account.

Lots of pointing out its a bubble “like 2011″… Looks likely, but in that very sentence you’re also admitting that bitcoin is still here.

The point of bitcoin is trust. You’re all talking as if our present financial system is anything other than abysmal, so lets get real, if there are (and there are) flaws with Bitcoin, see how those flaws stack up against those of the present money system. Credit cards solve the same problem? Do they? You sure? The present monetary system is abused by governments and banks at your cost, continuously.

Amid your mocking conviction that the value of bitcoin against currencies looks very bubbly right now (and who would argue otherwise), don’t throw the baby out with the bathwater. Of course its volatile, it couldn’t possibly be anything else, it doesn’t exist in a vacuum. That there may currently be a bubble is a trivial observation, does not define Bitcoin’s future, and misses the more interesting facets of its nature.

Suffice to Say, You let the American FEB hook on a front-end SOA architecture to this which streams in a database full of WANTED Db tables on Bad Guys or Gals which Ceases and Arrests the Transaction OR Traces it an Notify’s the Authorities where to go GPS find the culprits due to the ” Bad Stuff they’ve done and the Laundering they’ve Initiated and at that Point BITCOIN is fully Legitamate and worldwide legal. The USA is watching this system for a New World Money.

One thing they’ve left out and aren’t about to dislose IF the US FED wanted to Use a Bitcoin like Idea? Your mark and Your Number and You being trace-a-ble and found. That said, implants come to mind and logging into a Transaction requires simply a Gesture or wave of the hand across the cell phone App.

The Devil’s in the Details. But This is definitley a currency that can be used After the USA’s Next False Flag EVENT!!! Just Ask Jessie Ventura about those falsy WTC kind of ordeals. Great Idea. But Sinister once it Gets Ordained by the US FEDs or Bank Families.

FEB I meant FED. And yeah I guarantee you they got smart guys locked in rooms full of servers figuring out BitCoin II. Trying to shoot all kinds of holes in it’s Architecture. I can see it happening sometime in the End of Days for sure.

its difficult to tell if it is a bubble or not, I know that some of the inflation is the result of new companies agreeing to except Bitcoin transactions. Bitcoins are still very risky and as a result they are being kept artificially low.

That being said going from 30$ to 90$ in one month and 10$-90$ in the last 6 months is a ridicules. I’v never seen anything like this before. However, I’d like to remind people that Its very unlikely that Cyprus has anything to do with this. Instability in the currency markets does not cause a tripling in other currencies in such a short time.

The Commentary here is a 95% Majority of messagers Pro Bitcoin and quite honestly none of this stuff is unbiased. They write paragraphs that do nothing more than confuse You into buying off on the idea. Darn near Mind Control if you ask me. Bitcoin could suddenly and easily be Turned Off. You can’t say it can’t! Especially if the Attorney General frames his search warrants such that they read like this Idea resembles a Gambling Game of Chance. And well it does. No way am I gonna poor money into it and Risk it. I might as well buy Penney stocks First and then roll the dice on 1 of them striking it big.

Interesting…looking at a website that sells bitcoin “mining” machines. The maker rhymes with “flutterby”

They claim they will accept bit coins for payment for a $30k machine. They don’t give the price in bitcoins, only $.

3 payment options

Bitcoin (I can find no evedience they have ever “sold” a machine for bitcoins)

Bank wire ($)

Paypal ($10k limit)

$30k for a machine. The only way to pay for one is with a bank wire for $. Funny, that.

Bitcoins can be placed in wallets outside of MtGox into places no one knows exist besides you. Investing in the current bitcoin market is a gamble but sometimes the risk is worth the reward.

Bitcoin is ultimately a bargain especially at under 150 a coin. Interest will continue to expand faster than the supply. Unlike US currencies that overprint, Bitcoins always are produced at a steady rate. Thus the demand will continue to be higher than the supply for sometime. More institution will begin to adopt Bitcoin and Bitcoin will be the “trendy’ thing like twitter was 4 years ago and ride a wave. It’s not out of the question that BItcoin could hit $300 this year. If its a bubble its not gonna pop anytime soon.

why is the value of bitcoin qwuoted in dollars? why not quote its value against commodities? is a bitcoin worth a barrel of oil or would you have to trade it for money to buy the oil.