Mr. Market decided yesterday that the fact that the Cypriot finance minister, Michalis Sarris, was meeting as previously scheduled with Russian officials meant all would be well. And even better…Bernanke said the Cyprus banking mess would be contained. So why worry?

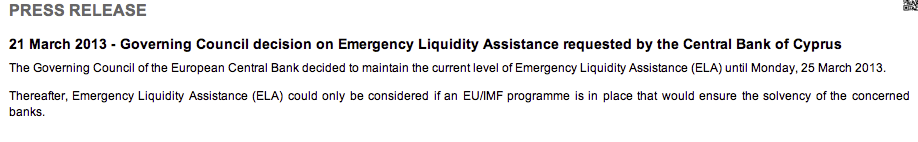

The ECB just announced that it will extend the ELA to Cyprus only through Monday. After that, it will cut off Cyprus if it has not knuckled under to an EU/IMF deal.

This is tantamount to cutting off its central bank and pushing it out of Eurozone if it does not capitulate.

During the day yesterday, Eurozone officials made it clear that they would not accept some other ideas that Cyprus had developed to try to shield depositors, such as accessing pensions fund assets, restructuring the two largest banks, and selling its gas rights to Russia. This was deemed unacceptable in that it would increase debt levels. The fallacy, of course, is that the Trokia is unduly obsessed with the numerator of this equation (the borrowings) and not the denominator (the impact on the economy). Cyprus.com estimates the impact of trashing the banking system to be a minimum 20% contraction of GDP in two years. And mind you, this is after Cyprus was a good Eurozone citizen and sent €3 billion to help the Greek government.

The overtures to Russia do not seem to have gone any better. Now it is likely that, since Anastasiades is pro-EU, that the finance minister has only offered up economic assets (the gas field interests and stakes in sick banks) and the Russians have understandably turned up their noses at that as being insufficient relative to the amount of money Cyprus needs to shore up its financial system. And they are no doubt acutely aware of the fact that the Eurozone leaders don’t want Russia involved and could retrade their contribution if Russia provided meaningful support. Prime minister Medvedev took the unusual step of convening a meeting with journalists to express Russia’s unhappiness with how Cyprus had been handled. From the Financial Times:

Mr Medvedev refused to be drawn on what form any Russian aid might take – whether from the state or, as has been mooted, from Gazprom’s banking arm, or through the acquisition of a Cypriot bank by a Russian bank.

“Today our [Cypriot] partners arrived in Moscow with a package of proposals regarding some material assets which they believe can be considered to be acquired by the Russian Federation,” he said.

But, he added, the EU should first come up with new proposals that complied with the law and “guaranteed property rights”.

Asked if Russia would seek access to natural gas deposits located off the coast of Cyprus in return for any aid, Mr Medvedev said this was “not a simple question”.

“First of all, I don’t understand fully how much they [they are worth], then we understand there are some problems from the Turkish side,” he added. “But we are prepared to listen to any ideas.”

This is actually more positive than other reports during the day Wednesday, which had Russian officials sniffing at the idea of rescuing Laiki (the number two bank which is at the epicenter of the crisis) and saying they’d only do a deal on a cold-eyed commercial basis.

Now as we and others have noted, the Cypriots have more to offer than financial assets. They have strategic assets, namely port facilities and (possibly) air field access. These are of tremendous potential value to Russia. But it is likely that pro-EU, pro austerity President Anastasiades can’t bring himself to hint they might be available, and the Russians are too cagey to ask. Now the ECB’s ultimatum might enable them to break through the veneer, but I wouldn’t give it high odds (and note we though it would be a masterstroke, but we always pegged a big Russian intervention as low odds).

This move by the EU increasingly has the smell of a proxy Germany v. Russia struggle through Cyprus. But why? I’ve had Germans say they think their future is more aligned with Russia than the US. Why go out of your way to alienate a supplier of important resources? I can’t fathom the logic here.

And there are signs the ground for a move against Cyprus was being seeded months ago. Reader Dr. Kevin sent along an article about a Russian tax fraud, Hermitage, and the headline and much of the text tries to make Cyprus somehow responsible. In fact, all the main actors were Russian and the Russian government was the loser. Our Richard Smith happens to know the case well, since it used shell companies formed by the notorious New Zealand incorporator, GT Group. Cypriot banks are known to have been involved, but to the tune of just $31Mn. At least equally at fault: New Zealand, Moldova, the UK, and, of course, Russia. Yet it is Cyprus that is attracting opprobrium (and now, much more).

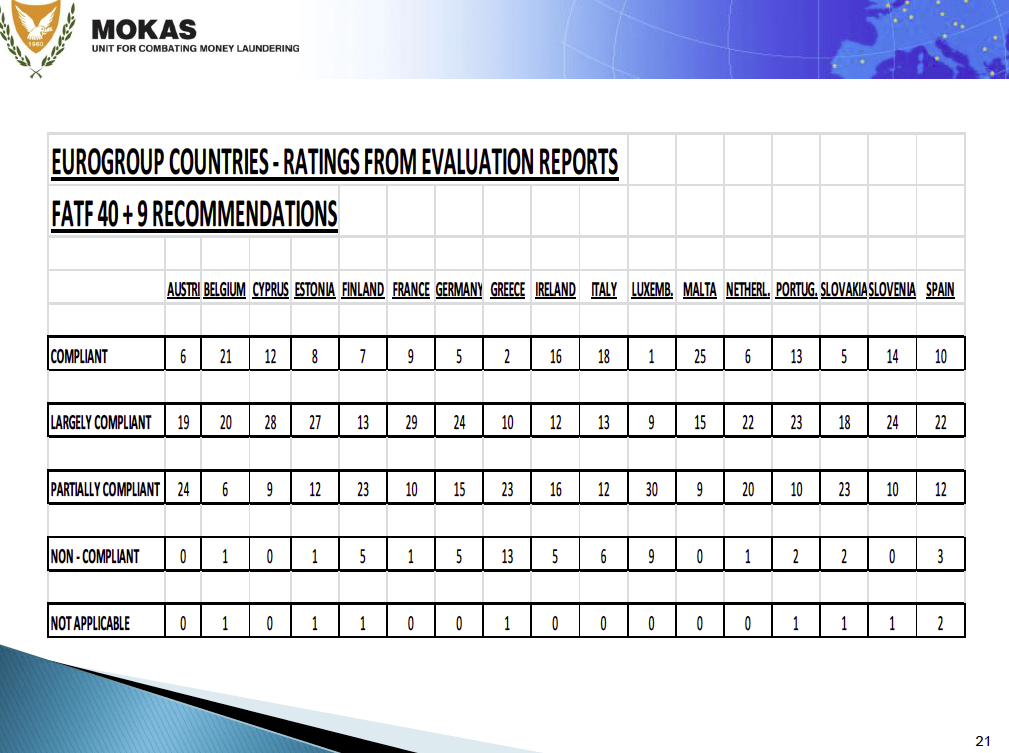

In fact, if you look at real money laundering (as opposed to tax avoidance of the sort that Apple, GE, Starbuck, and a horde of multinationals engage in through various jurisdictions), Cyprus gets better marks than Germany from the official Council of Europe body that evaluated anti-money laundering measures (cumbersomely named the Committee of Experts on the Evaluation of Anti-Money Laundering Measures and the Financing of Terrorism, aka MoneyVal). See this table (full report here). Notice that Cyprus is one of the few countries that is fully complaint (click to enlarge):

And since when is someone unhappy about the tax losses of another nation’s treasury? Have you ever heard a US official fulminate how US financial firms or professionals, or places like Luxembourg are cheating, say, the Eurozone out of tax revenues? Even when convicted tax fraud Marc Rich hid in Switzerland and continued to be a major commodities trader from there, the US did not start a campaign against the Swiss banking system (although we did attempt an extraordinary rendition of Rich which Swiss officials foiled). Any Russian tax evaders are cheating Russia, not the Eurozone.

And the propaganda against Cyprus started months ago. I pinged the author of the Cyprus.com articles we’ve featured, and he wrote:

Cyprus is (was?), bar none, the best jurisdiction for routing investment into Russia – it has the best treaty rates with Russia and you avoid the Russian tax/legal system.

so, it is practically malpractice NOT to structure investment into Russia as a Cyprus co.

(BP-Russia is a Cyprus company and their partner AAR are also a Cyprus company. So when they were fighting last year, they were having the board meetings in Limassol.

***

All these articles are the equivalent of “discovering and being shocked by” that 100% of public companies involved in SEC violations or 100% of LLC subs of FT 500 companies engaging in tax structuring were incorporated in Delaware. Obviously, there must be something very shady about Delaware that causes SEC violations, as opposed to noting that *everyone* uses a Delaware corp, whether they are nice, mean or indifferent.

The people who are behind these articles know better and I noticed this about 6 months ago that the drumbeat of these articles started out of nowhere and just kept repeating “cyprus = money laundering for Russia”.

As if the EU just discovered 6 months ago that Cyprus has a tax treaty with Russia…and every country in the EU, the USA that all the governments obviously voluntarily signed.

That is when I knew the setup was coming. Why now? Why so consistent? Even the FT which really should know better has basically not written an article about Cyprus in the last six months without some type of ‘shady Russian’ insinuation.

This is how this test of savings confiscation is being sold in the rest of Europe. “Yeah, I know it looks bad, but it is a special case because cyprus have all this Russian mobster money there so it is fair to take their money”

The ECB has given Cyprus virtually no runway. It’s a deal by end of Monday or off with their heads. Given the difficulty of cobbling anything else together, this would seem to force Cyprus into only being able to structure yet another variant of the “rape depositors” plan. They seem either to rely on a reaction like the US had to the TARP, to having Congress capitulate after the markets swoon, or perhaps they sincerely believe that even a worse case scenario, of dumping Cyprus out of the Eurozone, is acceptable because it will tell all those lazy Latins that they’d better not even think of crossing the Troika. (It’s inconceivable that a forced Cyprus exit would not lead to deposit flight from Portugal and Spain, which will pressure the Eurozone tremendously. They’ve really drunk their own “Cyprus is a special case” PR if so.).

It’s barely 6:00 AM and I’m already getting outraged messages from readers. For instance, from Nathan Tankus:

There is no way to stress enough how extreme this is. They are threatening the lives, saving and livelihood of the Cypriot people essentially because they didn’t do what they were ordered to do the first time around. In other words, Cyprus is an open air prison that can be somewhat comfortable if they follow orders. The Troika is acting like a crooked prison guard who sees the lives and possessions of prisoners as privileges that can be taken away when abused. Somehow, the concrete effects of this point to even darker scenarios. It would be one thing if the Troika was merely being sadistic while getting what it wants, but this is unnecessary torture coupled with a plan that is bound to fail. What are they going to do if Cyprus refuses another program for writing down deposits to maintain the solvency of these banks? Will they really cut off all forms of support? That would give Cyprus no choice but to leave the Eurozone and could easily cause a chain reaction all across the periphery. If they didn’t withdraw support they would be admitting that their threats were empty and would be encouraging every periphery country to openly defy them.

Now some believe that the ECB might extend the timetable. But I can think this will happen only if Cyprus has capitulated and there are merely some formalities to be tidied up. Eurozone officials were making threatening noises all during the day Wednesday about how Cyprus could not keep its banking system shut much longer.

So all eyes will be on the Cyprus parliament. Will it defy the Eurocrats or surrender to their will? As our accompanying Cyprus post today describes, the island nation has no good choices. The one that is most destructive to all parties, that of a Eurozone exit, looks more likely than it should under any sane calculation.

UPDATE Far too long after the post goes up, Richard Smith suddenly remembers the US-Russian Magnitsky foodfight, which kicked off in earnest April 2012. Now *that* might be relevant to the situation in Cyprus, too, no?

Guardian live blog (including images of street protests in Nicosia, and a slow bank run).

Reuters live blog (including aggregation of interesting tweets)

Unconfirmed report that ATM withdrawals are now limited to EUR260, if you can find an ATM with notes in.

Unconfirmed report that Cypriot central bank head has knocked together a bill on banking reform, running down problem bank Laiki; the bill to guarantee deposits under EUR100,000 at that bank (or the first EUR100,000 of each deposit? Will have to read the text). Either way, one wonders how they will fund that, especially after some level of bank run. Voting on this bill to come tonight.

Sighting of Germans in glass houses, throwing stones.

Northern Cyprus and the Turkey connection complicating things.

UPDATE Latest proposal (Plan C I suppose) resolving Laiki may involve a huge ding to unsecured depositors (40% haircut, says Twitter’s back-of-envelope), apparently mostly these are local or Greek businesses. That doesn’t sound like a flier either, but is this the correct interpretation of the sketchy plan? Vote, anyway, in an hour or two, and more details after that, if Plan C is still a runner. Oh, and plan C apparently still leaves a shortfall of EUR3.5Bn.

“This is tantamount to cutting off its central bank and pushing it out of Eurozone if it does not capitulate”.

A possibility – expulsion from the eurozone – not contemplated in the European Treaties. But these legal niceties don’t seem to inhibit the all-powerful ECB.

If Cyprus doens’t manage to get real and substantial support from Russia it will likely succumb to the ECB’s illegal pressure. And the country will become another corpse sacrificed in the altar of the euro “guardians”.

Italy, Spain, Portugal, Greece, Cyptrus, and Latvia all should coordinate their policy response. Each government is hoping to cut a favorable deal with the gnomes, however, and leaving the hindmost to stick and the Devil. —And that’s folly. A debtor’s block would get all of them better terms, and when and as that notion sinks home, the whole game will change. Until then, those holding bonds can keep threatening those who issued them in a bassackwards fashion.

What we see is the transition stage in a political argument which has been going on since the late 1950s. This struggle isn’t new, and that is exactly why it is being prosecuted in such an intransigent way by the country who has the present advantage. Germany has argued against ‘excessive state debt’ as opposed to all the countries in crisis now who have invariably argue for liberal issue of state debt. We have a 60 year struggle, is what I’m saying, and the Germans are using their temporary advantage in a completely irrational (pigheadedly selfish) way through exasperation. And largely for the transient and largely illusory domestic political advantage of a single political party in Germany.

Everythign will be done wrong before anything will be done right. All very ‘European’ . . . *sigh*. But there will be no exits/expulsions from the euro. Eventually, the Europeans will decide upon a solution, rather than the Germans deciding everyone else is to hold their fiscal breath until the notes turn blue again.

Richard, as far as I can tell, all of those countries are currently being run (with the partial exception of Italy) by neoliberals. Why *would* they coordinate their response?

They don’t mind that the “EU” is making them do things, and even if they do, they generally (as in, that has been the pattern ever since the early 1980s) see the bits they disagree with as things they have to swallow to be able to implement their own plans.

Yves,

I think we have to realise that at this point, nobody is in control in in charge or co-ordinating things on the EU side. It started as a total mess that Merkel/Schäuble allowed to turn into a disaster.

Now like predicting the lotery.

Germany wants to call the shots (based on what domestic German electoral politics require) either directly or via the ECB. The German “leaders” are however truly incompetent when it comes to actually steering this in any meaningful way.

Irrespective of what happens with Cyprus, I truly wish that Merkel will be punished for this at home. What will it take before the Germans see that the Kaiserinn is naked (not a pretty sight).

Oh dear.

Here’s DER SPIEGEL. If this is the general quality of analytical thinking going on in Germany, the prognosis isn’t good:

“One thing, though, is clear. If the euro zone blinks in its game of chicken with mini-member Cyprus, it will be forfeiting many future duels as well.”

‘Why Europe Must Play Hardball with Cyprus’

http://www.spiegel.de/international/europe/cyprus-no-to-bailout-deal-is-a-danger-to-the-euro-zone-a-889893.html

Frankly I found the article in Der Spiegel far more balanced than anything I’ve read about Cyprus on this site.

The problem is not that one of ‘money laundering’. But fact is that Cyprus is a tax heaven. And although that might be legal, I don’t see why tax payers who don’t avoid their taxes should bear the costs of saving those who do. The fact that these are Russians doesn’t help.

der spiegel is well known in germany as being by far the worst neoliberal paper which unfortunately continues to have the reputation of being ‘left’-leaning, which is not the case, at least anymore. der spiegel is one of the principal german media serving as a propaganga tool to the german elites in their attempt to subordinate the rest of europe. If you think that what you read in spiegel about cypre is balanced, than only because you are reading what you are wanting to.

complete nonsense salvo

I’m from Portugal and I can tell you that our government is a bunch of psychopaths that happily do everything that Germany says.

What is so terribly ‘balanced’ about that Spiegel article that so happily backs undemocracy? They simply accept that the ECB may demand whatever it wants from Cyprus at face value, apparently under the impression that the ECB has good eyesight. But if that is indeed the case, then please tell me where the ECB was during the run-up to the explosion: was it constantly warning and punishing banks and CBs for letting banks blow up their balance sheets? Did it respond quickly and decisively when the Spanish CB requested repeatedly (in 2005/2006!) to increase interest rates, or to allow it to intervene to decrease lending in other ways? No, it did not. In fact they outright refused to do so.

So please, explain to me/us why you feel this article is ‘balanced’, except insofar as it hews closely to neoliberal dogmas about how to resolve the crisis, and about what caused it.

I certainly do not wish to argue that I like the tax haven status of Cyprus, but it seems to me that if my own country (NL) can get away with it, there is no reason why cypriots should be punished simply because they are a bit more obvious about it.

Foppe says:

If one observes the workings of neoliberalism, which by now are well established in Latin America, which was the first place it was road tested, one sees the creation of crises to be by design. The neoliberals purposely create crises, which they then use to usher in a whole new level of neoliberal governance.

By now this is a well established pattern, and should come as a surprise to no one.

Neoliberalism = Theft made legal

Maurice,

Please get your facts straight. Cyprus is a tax haven with respect to Russia. That is the result of a TAX TREATY which has been in place for years and was hardly a secret when Cyprus joined the Eurozone.

Please read the Wiki article on tax havens. See this part:

Until the 1950s, tax havens were used to avoid personal taxation[citation needed] but since then jurisdictions have come to focus on attracting companies with low or no corporate tax. Centres which focus on providing financial services to corporations rather than private wealth management are more often known as offshore financial centres.

This strategy generally relied on double taxation treaties between large jurisdictions and the tax haven, allowing corporations to structure group ownership through the smaller jurisdiction to reduce tax liability. Although some of these double tax treaties survive, for example a double taxation treaty still exists between Barbados and Japan, and another between Cyprus and Russia.

http://en.wikipedia.org/wiki/Tax_haven

Cyprus falls into the “offshore financial center” basket far more than it does the “tax haven” basket, where you find the Caymans, the Isle of Man, and Switzerland (due to its secrecy laws, although the US has punctured that veil to a fair degree).

It’s a curious thing. No, taxpayers shouldn’t be bailing out these banks, or any banks. Nor should depositors lose guaranteed funds.

The gamblers should lose. Everything else is a distraction.

Here’s a graph in Welt:

http://www.welt.de/finanzen/geldanlage/article114623209/Zyprer-lachen-ueber-kalte-Enteignung-in-Deutschland.html

Please do have a look at the graph:

Banks in Cyprus pay a lot of interest.

Interest is much higher than in the UK, Germany, Netherlands etc.

If a company is in difficulty, it should NOT pay any dividends.

If a bank is in difficulty, it should NOT pay any interest.

The cyprus government should have said:

The banks are undercapitalized. The customers do not get any interest for 2013 and 2014.

Compare it to e.g. bank customers in the Netherlands:

Interest paid on savings account: 1.6%

For all wealth above 20.000 euro, 1.2% has to be paid every year.

Do the calculation:

income tax for income 40.000 – 55.000 euro = 42%

income tax for income above 55.000 euro = 52%

interest on savings minus wealth tax minus inflation = – (minus!!) 2.1%

and compare that to the ‘taxation’ in Cyprus.

Anyone would get the impression the Europeans were deliberatelly cutting Cypriot throats for the sheer sadistic fun of it.

The fact is, they’ve offered two thirds of what the Cypriots were asking for, yet thet’re not getting the tiniest bit of credit for it. If they want to keep their economy going, then they have to take one of a series of un-pleasant options, the least bad of which is surelly spanking fat cat Russian oligarchs who’ve invested in a special “Russia only” tax haven. Why the f*ck should european tax payers make foreign criminals whole?

Every dog on the street knew Laiki was bust.

You see here’s the thing that makes me somewhat less sympatheitic towards Greeks and Cypriots than other victims of this global clusterf*ck.

You never hear any self criticism from them. You only need to read sites like this, and they’re full of Americans and Brits and Germans and Irish and Portugese and Italians and Spaniards criticisisng their own countries, their own systems, in considerable detail and with some acute acumen.

You never see that from Greeks or more recently from Cypriots. When did you read a Greek guy saying “yeah, we screwed up because our society totally failed to tax the wealthy in any form, and institutionalised corruption and political patronage”? Or how about a Cypriot saying ” we fu*ked up by becoming a tax haven for Russian criminals” ?

Instead, you get this sort of thing…”They are threatening the lives, saving and livelihood of the Cypriot people essentially because they didn’t do what they were ordered to do the first time around…”

Well, the Europeans aren’t willing to back your bankers 100 percent, actually. Only two thirds. We have enough of our own sh*t to deal with. The ten billion you’ve been offered would make a big Keynsian difference in Spain or Ireland or Italy or the UK.

Instead there’s loads of ranting at Germans for not willingly handing over more cash so things can stay as they are.

Wow, vitriol plus recycled propaganda. Not a pretty combination. And Cyrpus asked for its rescue nine months ago, and the deadline (a bond payment) isn’t up for another three months. This crisis was completely manufactured by the Troika. There was no reason to hold a gun to Cyprus’ head and ambush the new President.

You don’t seem to understand what tax treaties are about, do you? Russia set up a tax treat with Cyprus because FOREIGN INVESTORS IN RUSSIA prefer to go through a country with English law courts.

This is the overwhelming majority of the “Russian” $ going through Cyprus.

The mobster meme is way overdone and shows a lack of acquaintance with facts.

Now you may not like offshore financial centers. That’s another issue. But the overwhelming majority what happens in Cyprus is no different than US PE and hedge funds using the Caymans to take funds from offshore investors. Caymans is MUCH dirtier than Cyprus, go read Treasure Island for details. And tons of multinationals use tax treaty jurisdictions to lower taxes. How are Russian companies any different than GE, Apple, and Starbucks?

People like you like kicking people low on the food chain, like ordinary people in Cyprus, rather than the real perps.

Yeah, fair enough, that looks pretty bad now I read it again.

It’s just that i’ve never seen any acknowledgement from Cypriots or Greeks that their problems are self-caused at all.

And cypriots have had a few years to better re-regulate and de-leverage their banks, and they haven’t done it, despite the horrible lessons.

“What will it take before the Germans see that the Kaiserinn is naked (not a pretty sight).”

That’s just what Berlusconi said! But let’s be fair here, comparing a grown woman to a 20-year-old in a bikini is a narrow way of looking at things.

I can’t believe the Russians would want an airbase in Cyprus. That’s like the U.S. Confederate Army setting up an advanced picket line north of Trenton, New Jersey in 1862. I suspect the Russians have their eyes on the Arctic and will want some cooperation from the rest of the world there.

If you’re Cyrpus you have to ask what you’ll get for a 6% hit. If it’s an economic boom from FDI maybe your net present value is waaay positive. It may be a very good trade. But you can’t look across Europe and see that scenario anywhere.

The EuroLords overvalue their product, like an overeager salesman drunk on his own coolaid.

“Nobody is in control or in charge”. Glad to see that written down. The eternal question of history: Is it the man or the idea that makes it? I side with the idea, and it’s usually some spark from the grind of domination and rebellion that lights the fire.

Otherwise, I know nothing about this issue. Thanks for the rundowns Yves.

So Swedish Lex, it is the joke of history (told here again) that a nonentity such as Madam Merkel has had greatness thrust upon her—only to fumble goblet no hurtling toward the parquet. You state it accurately: NO one is in charge in Europe, and those who might have the position in this all to be in charge are diminuative non-statesmen of no capacity. It’s all great theater—until the power goes out.

One of the many ironies here is of course that the EU exists in order to prevent the emergence of Strong Men (wearing red, brown, black shirts or whatever).

Instead we have rule by committee. However, my ski club has a better system of governance than the euro-zone does, which opens the door for Merkelism (leader/strongman(woman)ship by bullying, ignorance and improvisation while not learning from experience).

So, in the absence of anything with a bit of vision and seriousness behind it, we are chained to “the” Merkelism in the same way that the Americans were attached to W. Bush.

Merkel is the W of Europe; truly incompetent and not up to the task, surfing on the achievements of predecessors, incredibly bad at execution, dedicated to appearing as a “strong” (and clueless) leader, a smart tactician and very smart at identifying “foreign” villains to build platforms of domestic popularity on. Also like W; very popular at home and therefore re-electable.

Like W, who was loved by 51% of the population and loathed by the rest, Merkel is wunder-popular in Bavaria and “not so” popular elsewhere. But the Club Meds do not get to vote in Germany, like Americans do. That is the original problem; a currency without a country.

Unfortunately, Francois Hollland is hardly Alexander Hamilton. I hope I am wrong here but I fear I am not.

Total mess confirmed:

http://www.businessinsider.com/totally-chaotic-eurozone-conference-call-reveals-what-a-mess-the-cyprus-situation-is-2013-3

This the model that the EU wants to shove down everybody’s throat — abridge the rule of law, save the equity and bond holder and screw the little guys.

We are all Cypriots now!!!!!

Two options given to Cyprus:

1. Rape your depositors and stay in the Eurozone, triggering bank runs all across Southern Europe, or

2. Hope we’re bluffing and will back down, triggering a push-back against austerity all across Southern Europe.

God knows it isn’t funny, but:

http://www.youtube.com/watch?v=Z_JOGmXpe5I

More apropos methinks…

Harumphing with the Governor -@ the ECB et al…

http://www.youtube.com/watch?v=NzbhbetwYFU

Both of those Blazing Saddle clips are appropro, IMO :)

I was just reading this article on Cyprus… EU gives Cyprus bailout ultimatum, risks euro exit http://www.reuters.com/article/2013/03/21/us-cyprus-parliament-idUSBRE92G03I20130321

and it struck me that the ECB (et al) and Cyprus are basically playing chicken http://www.youtube.com/watch?v=u7hZ9jKrwvo

As melodrama, it plays well… tho not so much for the citizens of Cyprus.

Did someone say melodrama!

James Dean and Ronald Reagan: RARE Not Seen in 50 Years

http://www.youtube.com/watch?v=iqNDWEwP92o

Skippy…. I’ve got a gun man, I’m a big man!

Haven’t seen any report of other peripheral citizens rushing to their banks though. Maybe they all think that it can’t happen in their backyard(?), but perhaps someone needs a reason to take profits or correctly enough, this does not quite matter.

Please re-read the post.

The risk is a slow motion run, mainly from big commercial depositors, who are worried about having money in, say, Portugal and it leaves the eurozone. You’d expect a 30% to 50% loss on the currency.

There was already a deposit run of that very sort underway prior to the OMT, which was implemented last September.

I’m not expecting a “hot” bank run, of people lining up outside banks. The risk is of the slow motion run that was underway but was arrested restarting.

@Yves

This is actually quite logical.

The global banks assets are worthless.

In fact these conduit assets which really farm the value hidden within Fiat was always worthless.

The days of farming fiat is over……….as the land is poisoned.

The banks which control western treasuries (IMF) must simply subtract the fiat in a more direct manner.

They must go out and Hunt.

KILL KILL KILL.

The fox is in the chicken coop or coup even.

The chickens are now domesticated , they have no natural survival instincts remaining.

We will witness a scene of utter carnage.

Dork – your comments always have a way of smacking me awake. Last week you gave figures on oil/energy consumption tanking in Italy as a tell-tale of the irreversible implosion taking place. Your blade only becomes apparent when its about to strike the heart.

http://www.nakedcapitalism.com/2013/03/wolf-richter-a-politically-explosive-secret-italians-are-over-twice-as-wealthy-as-germans.html#comment-1129994

Cyprus is /was a very small oil pie but everything counts now as the big banks operations require the constant eating of yet more pies.

The little Cypriot pie

http://www.iea.org/stats/pdf_graphs/CYTPESPI.pdf

http://www.youtube.com/watch?v=W8ISHByGTmU

I realize this has nothing to do with Cypress directly, but I bet this Swiss gold sales referendum will pass all of it’s hurdles in the next few days.? It will be interesting to see how it goes in view of the current conditions.

http://www.reuters.com/article/2013/03/20/us-swiss-gold-idUSBRE92J0Z320130320

No one even talks about smaller (300,000 peeps) and poorer northern Cyprus, but it’s become an unflattering comparison for euro-afflicted Greek Cypriots:

http://www.globalpost.com/dispatch/news/afp/130320/turkish-cypriots-paradise-lost-south

C’est la vie, simplement? Non.

A poisoned fruit is the euro. Because thou hast eaten of the euro tree, cursed is the ground for thy sake; in sorrow shalt thou eat of it all the days of thy life. Thorns also and thistles shall it bring forth to thee, and thou shalt eat the herb of the field. In the sweat of thy face shalt thou eat bread, till thou return unto the gold which I have given thee for money.

Poor Cyprus: eu(ro)thanized by the diabolical denarius of Bruxelles. Cast off thy fetters, Cypriots!

You know, I was going to say that what I take from this is that one shouldn’t base one’s economy on pleasing the western bankster-technocrat/eastern oligarch criminal elite.

Fool me once…

How could they possibly have anticipated the problem?

It’s 2013 after all. They’ve only had 5 years to learn the lessons of Ireland, Iceland and the UK, about how suicidally dangerous it is to lumber yourself with a financial/banking sector worth many times more than your real economy.

Suicidally dangerous for the polity, perhaps, greatly enriching and consequence free for the people in charge. (Maybe that has something to do with it?)

The reason the Cyprus banking sector is so large has nothing to do with the Irish or Iceland case, both of which were based on massive lending bubbles in the DOMESTIC economy.

Cyprus is an international banking center. So is Switzerland, England, Luxembourg, and Singapore, to name a few.

The criticism should be for not regulating the banks aggressively if you are in that business as a matter of national strategy, and not the size of the banking center per se, at least if you are small. If you are gonna have big deposits relative to your GDP, you REALLY need to make sure the banks aren’t making risky bets.

It’s hard to see how any solution that doesn’t involve 100% protection for insured depositors with €100k will not lead to an immediate run on the banks when they open on Tuesday.

Insured??? Insured by whom?

There are some 30 billions euro’s in accounts < 100.000.

I.e. some 200% GDP.

It has NEVER been believable that the Cyprus government, i.e. the Cyprus taxpayers, would have been able to pay-out twice its GDP.

If I recall correctly, this blog and many of its comments were in FULL agreement when the Icelandic people voted NO to pay out the 'insured' English and Dutch account holders.

Deposit insurance only works to prevent bank runs when it is credible. The moment depositors no longer believe their deposits are safe is the moment you head into the sort of unstable equilibrium we had during the Free Banking Era in the US where panics and runs were a regular occurrence and the average lifespan of any bank was just a few years.

That having been said, your comment gets at a deeper point which is that any economy that depends on financial services for 45% of GDP and where net financial sector debt is over 800% of GDP is an inherently unstable economy that can’t be sustained for any length of time.

Carol,

If I remember correctly, the analogy doesn’t work. Iceland refused to guarantee deposits to British and Dutch subsidiary, which where supposed to be covered by the deposit insurance schemes of both of those countries. They covered deposits for accounts housed within its administrative jurisdiction.

Or to restate, based on my limited understanding of the issue, the FDIC guarantees the deposits for accounts housed within TD or BMO’s (two Canadian banks) US branches and subsidiaries.

Steve

The savings accounts were legally under the Icelandic deposit scheme!

In fact, many people in the UK and Netherlands were initially interested because of the high interest rate. They found out that in case of problems, they would have to ‘learn Icelandic’ and go to court in Iceland. That’s why many decided NOT to put their money in the Icelandic bank branches.

When those banks failed, the governments in UK and the Netherlands decided to pay the money (up to 100k) in advance. The Icelandic president forced a referendum, and the voters refused to pay.

So the people in UK and Netherlands who did not take the risk in return for high interest, were forced by their governments to bail-out the risk-takers, who not only got their deposit back but the very high interest too.

Carol,

If you read the background the promoter of Icesave made promises that it was never clear the Icelandic government backed. The status of Internet deposits looks to have been ambiguous and various experts warned about the risks of putting money with Icesave long before it collapsed:

http://www.guardian.co.uk/business/2010/mar/05/icesave-crisis-savings-landsbanki

And the international court approved Iceland’s action:

http://online.wsj.com/article/SB10001424127887323375204578269550368102278.html

from your WSJ link:

The directive “does not lay down an obligation on the State and its authorities to ensure compensation if a deposit-guarantee scheme is unable to cope with its obligations in the event of a systemic crisis,” the ruling said.

Even without that ruling: that’s why many people, liking the high interest, but disliking the associated high risk, did NOT put their saving into the Icelandic branches.

And that’s why it is unfair to ask taxpayers to bail-out those risk-takers.

That’s why there can be no insured deposit scheme of upto 100k, if there is 30 billion euro of those in an 17 billion euro GDP country.

That’s why the eurogroup should have communicated to have savers refrain from the very high interest rate for only 2 years (instead of calling it a deposit haircut).

Carol,

Anybody who goes cross border should know they need to be extra careful. I’m really not sympathetic with cross border investors of any kind getting burned. A depositor who puts their money in a bank outside their legal system is taking a risk.

Yves,

I fully agree.

Perhaps I have not expressed myself clearly enough, but had hoped from my comments above that all the hoopla about the 100k deposit insurance is overblown.

I.e. in the case of Iceland, the insurance was paid by UK and Netherlands taxpayers who had not taken the risk associated with the high interest.

Similarly with Cyprus today.

The initially proposed 15.4% on accounts > 100k, would only have meant no interest for 2,5 years.

Savers in the UK, Germany, the Netherlands, etc. have been forced to accept minimal interest for 4 years now.

I suspect there’s a signficant split in the German ruling elite. Some want to establish closer links with Russia and re-establish links with their former colonies in the East.

Others wish to maintain their obesiance to Washington. This probably reflects tensions between industrial and finance capital in the German political system. (I suspect finance will emerge victorious, but who knows..?)

This could play out in unpredictable ways as the crisis deepens. The US establishment does not want closer relations between Russia and Europe, and strategic planners Stateside are no doubt particularly concerned over Europe’s increasing dependence on Russia’s energy resources.

Little Cyprus is now caught in a low intensity, proxy war between divided elites and predatory power systems. Whether these divisions will give them room to maneuver or simply push them into a tighter corner remains to be seen.

Does anyone know how much Cyprus’s natural gas is worth?

I am wondering whether the end-game will see it sold off cheaply.

Less than the 8 Tcf announced, perhaps as little as 3 Tcf recoverable, but that assumes several hurdles are overcome, like Turkish claims, Russian ambition, pipeline finance and long-term hard currency offtake deal.

“This resource belongs to two communities, and the future of this resource can’t be subject to the will of southern Cyprus alone. (We) may act against such initiatives if necessary,” one of the Turkish officials told Reuters.

“The exclusive use of this resource … by Southern Cyprus is out of question … and unacceptable.”

Foreign companies have been pulling out of Greece for the past year: Coca Cola and Fage: http://www.guardian.co.uk/business/2012/oct/11/coca-cola-hellenic-quits-greece-london

http://www.johntreed.com/Run-on-the-euro.html

My guess is that Cyprus will capitulate. Just as the US Congress did after its initial vote to not go aheard with TARP. The alternative is a complete collapse of the government, as there will be no money to pay anyone. Sad but true. “This is the way the world ends: not with a bang but a whimper.”

If Cypriots had a sufficiently unified political will not to get jerked around by the western bankster-technocrat/ eastern oligarch criminal elite that so many Cypriots seem to have rendered themselves dependent upon, Cyprus could create a Cypriot currency that would enable the government to stay open, public services to function, and daily life conducted on the island. From there they could buy time to devise a rape prevention plan.

But, you know, said politics is the key. I have heard that “politics is the easiest thing in the world” so I expect a solution forthwith.

TARP was just a game. It didn’t cost anything and didn’t mean anything. The real bailout happened in the fall of 08 while they were having these games and circuses with stuff like the “TARP”.

That is the way they work it.

Cyprus is not the US. Take a look at the Reuters piece Swedish Lex flagged:

http://www.businessinsider.com/totally-chaotic-eurozone-conference-call-reveals-what-a-mess-the-cyprus-situation-is-2013-3

TARP passed because Paulson scared Pelosi, and Obama (who remember had huge Wall Street donations) whipped aggressively for it. Even then, the final version had hundreds of pages of pork added to it.

I think we’ve all been waiting waiting waiting for things to come to a head, both in the Eurozone and the USzone, but the powers that be simply refuse to let that happen, and will do anything to prevent their bubble from popping, with a bang, not a whimper, so we ordinary folk can pick up the pieces and get on with our lives, finally. I have a feeling they’ll scare the bezeezus out of the Cypriot parliament, which will, I predict, cave at the last possible moment, probably Monday.

Whitman once said, “I was simmering, simmering, simmering. Emerson brought me to a boil.” But Merkel and Co. are no Whitman, they will simply never permit that kettle to boil, our Leaves of Grass will never get written, and we will never sit down to have our nice cup of tea. In other words: this Ponzi scheme is too big to fail. And if there isn’t enough money left in the whole wide world to keep it bubbling indefinitely, why then, like it or not, Merkel will have to print some.

Hollowed out currency? The Euro. Paying less tax, increases available currency to lien against for the interest stream ‘earned’ by the financial services sector (also a tax in functioning) – predatory financial capital? – Not wealth producing – definite wealth extraction.

Gas and oil – real national wealth on which to back and extract the predatory interest stream – to capture the economic surplus and avoid the tax. Economic rent extraction and privatization gone wild the world over – Flash point Cyprus today, dominoes tomorrow. Throw the predator a bone or it shall bite your hand.

Reality – that predator will come to roost upon your flesh, throwing that bone only puts off the inevitable, delays history a little bit – Suggest you go full sovereign instead of wasting away til your unable to defend yourselves. Claim your wealth producing resources for yourselves, do not let it be slowly stolen from you, you can’t grow grapes if the predatory drain the water from your vines – no wine in the end.

I’m not sure Europe is far enough along the learning curve yet. All the masses of Europe have to do is turn their head towards Latin America to see what’s in store for them. Latin Americans have been fighting this monster longer than anyone, well nigh on 40 years now.

Confucius said “A wise man learns from his experience; a wiser man learns from the experience of others.”

History, however, has revealed there aren’t very many wiser men. This fact caused the historian Carroll Quigley no small amount of consternation. As Harry J. Hogan wrote of Quigley: “It always frustrated him that each nation, including our own, regards its own history as unique and the history of other nations as irrelevant to it.”

Very funny … another country poised at the brink. How many, now? Greece is number one, Ireland … number two … where is France?

Nobody learns anything, oh well too bad. Errors are repeated until silly humans learn not to. There are only two hundred or so more countries to go. Enough countries into the toilet and the lesson becomes be unnecessary … perhaps that is the ‘Grande Strategy’.

To become King of the (very low) Hill.

ECB is poised to shoot itself again if ‘Country X’ doesn’t commit suicide first. The implication is that Cyprus would be a healthy member of a vibrant euro-zone if it wasn’t for the machinations of evil …. (fill in the numerous blanks). Of course this is false, Cyprus has been among the walking dead for decades before the euro was a gleam in Rubert Mundell’s eye. Now it stands in line before the Inferno along with all the other countries.

How ECB is set to deal with the bank runs is unmentioned. These runs are certain to come. The assumption is that all flight (money) capital will flow into North-European countries (Germany) as if that country can bear the increase in liabilities.

The same sort of increase in liabilities that has supposed to have undone Cyprus. Of course, flight out of the euro into other currencies such as the dollar or local currencies is the end of the euro … so would capital controls, ipso facto. When bank runs start who knows how they end. In the US in 1933 there were only two of 48 states with functioning banks and those two states are at the lip of the abyss. Unlike the US in 1933 there is no FDR in Europe to take charge, only pip-squeeks, no easy solutions like exiting the gold standard and currency depreciation. It’s fair to say the proximate cause of the euro’s problem is competitive deprecation courtesy of US central bank. Sorry Europe, you lose …

If/when Cyprus exits the euro-zone what happens to all those Target2 liabilities? From here it looks like a German exit from the ‘zone as well, with the blame fixed upon those greasy, thieving Cypriots who always spoil everything.

Problem solved right … except guess what? Even with a euro-zone restructuring and the ejection of unwanted parts … the crisis will still carry on! Horrors! To amputate ones’ feet and hands and to still be sick! What’s left to cut off, who is left to blame?

Sorry children, lesson not learned you have to repeat your mistakes one more time!

I’m not going to say anything more, I would be accused of inserting a ‘Peak Oil Rant’ here and we certainly don’t want that, do we. It might spoil the fantasies.

Another country poised at the brink. How many, now?

At this point, Steve, it’s a two-way horse race between Cyprus and Argentina to see who can default first.

Such is the desperation in Argentina that the government has just imposed a 20% surcharge on foreign travel. You can get it refunded a year later … after inflation has haircut its purchasing power by another 30 percent. Meanwhile, folks have to cough up the cash at the airline counter at Ezeiza, or they ain’t goin’ nowhere.

Meanwhile, the grey-market dollar has exploded 10% higher in two days, as locals sniff the deepening panic in the Casa Rosada. Check out the fever chart of the ‘dólar informal’ in this article — no translation needed:

http://www.lanacion.com.ar/1565317-cristina-convoco-al-equipo-economico-en-medio-de-rumores-por-la-corrida-del-dolar-paralelo

The angry Black Widow’s two-bit gaucho regime is goin’ down.

Argentina is doing very well. Its main problem is that idiots in the US, creditors of the discredited former government, are trying to seize its foreign assets.

Luckily it isn’t very dependent on foreign assets, so it can default on the foreign-law bonds with no problem. The problem is then preventing the US military from conducting raids.

Nathanael,

The US is deploying its instruments of state violence to the Southern Cone under the guise of “The War on Drugs.”

If you read Spanish, there are a couple of great articles that explain what’s currently going on in the region:

“The War on Drugs: The US’s Strategy of Control in South America”

http://aldeaglobal.jornada.com.mx/2012/octubre/guerra-contra-el-narcotrafico-estrategia-estadunidense-de-contencion-en-sudamerica

“The Strategy”

http://aldeaglobal.jornada.com.mx/2013/febrero/la-estrategia

And as these articles make clear, there is almost a seamless collusion between what Peter Dale Scott calls the US “deep state” — the CIA, NRO, NSA, DIA, DEA, NED, USAID, etc. — and the drug cartels.

But they are nevertheless distinct. Sandra Ávila Beltrán, the Queen of the Pacific, characterized the relationship as a “marriage.”

@Nathaneal

Take a look at the chart of Argentina’s central bank reserves in this La Nación article:

http://www.lanacion.com.ar/1565063-desconcierto-en-lineas-aereas-y-agencias-de-turismo-en-el-inicio-del-nuevo-regimen-de-la-afi

The BCRA’s reserves are being plundered to support the operating budget — the rough equivalent of burning your furniture to stay warm in winter.

A country which slaps a 20% tax on foreign travel and blocks all but essential imports (in open violation of its Mercosur obligations) is not ‘doing well.’ The grey-market peso’s headlong collapse this week only heightens the pressure.

Much of this would be still occurring even if the ‘holdout’ litigation in New York were settled. The massively overvalued official peso rate is utterly unsustainable, and only exacerbates capital flight.

It must really grate you that Cristina has such a stellar approval rating — 70% — which hasn’t budged despite all the economic problems plaguing the country:

http://vn24.com.ar/?p=900

Knock yourself out, Jim, but I think the memory of what life was like under the jackboot of the US/IMF is still plenty fresh in Argentines’ minds.

@ Jim Haygood

The difference between Argentina and Cyprus is that Argentina is part of an alliance which includes Brazil, Uruguay, Bolivia, Veneuzuela, Ecuador and some smaller Latin American countries, all operating with the specific goal of slipping out from under the neoliberal jackboot. Argentina is not alone in its battle.

As far as I can see, however, Cyprus is all alone. The only country in Europe that has shown any gumption at all in fighting back against the eurocrat shock troops is Italy, and that’s far from a done deal. The rest of Europe is still solidly under the iron fist of the transnational capitalists.

You are right that Argentina is a member of Mercosur. The pact works well for passport-free travel, and reasonably well for labor mobility.

However, Argentina has zero prospects of raising loans from any country other than Venezuela. And with Chávez having departed, that option is foreclosed also. None of its neighbors are going to walk the plank and provide pre-default financing.

@ Jim Haygood

I know you think Kristina Kirchner is a loose canon.

But I would suggest she had an ace up her sleve when sent word to the US Federal judge in New York to take her court order and shove it up where the sun don’t shine.

In addition to MERCOSUR, there are IIRSA, IPEA and UNASUR.

There are also those strange rumblings coming from Evan Ellis in the Pentagon: “In the era of globalization, to have Chinese banking advisers is the equivalent of having military advisers from the Soviet Union in Cuba and Nicaragua during the Cold War.”

http://www.voselsoberano.com/index.php?option=com_content&view=article&id=13981%3Ala-alianza-estrategica-brasil-venezuela&catid=2%3Aopinion&Itemid=10

@from Mexico,

It seems some have read a book (or two) and inserted themselves – into – the **narrative** lock stock… as a human being… cough… religiously. A personal choice of freewill imo that clearly defines their character, that out of all the possibilities available, they chose death over life… if it hits their back pocket or threatens their religion (self-identity).

I would add that there are three individuals (on this blog) that constantly attack government[s yet nary a peep about – any – malfeasance – on part of the corporate sector – private sector, its complete capture of the said governments (of the people) and reserve special vitriol status especially to those that are attempting to thwart the aforementioned actors.

Skippy… devolution has a name in economics – anarcho capitalism – and as the link states – private uncountable tyranny’s vs state tyranny’s (where one has some accountability) and the pinnacle of tyranny is corporate tyranny, a complete top down authority structure with out recourse. Libertarianism is a guise~

http://www.youtube.com/watch?v=RxPUvQZ3rcQ

PS. IN ANCIENT ROME / THERE WAS A POEM / ABOUT A DOG / WHO FOUND TWO BONES / HE PICKED AT ONE / HE LICKED THE OTHER / HE WENT IN CIRCLES / HE DROPPED DEAD / FREEDOM OF CHOICE / IS WHAT YOU GOT / FREEDOM FROM CHOICE / IS WHAT YOU WANT

http://www.youtube.com/watch?v=9jVoroHx3IU

US senators at work to generally screw tax-payers when the next crisis comes.

http://www.huffingtonpost.com/2013/03/20/wall-street-deregulation-_n_2916795.html?1363804456

• Yves said:

It’s important to remember that Merkel and other top German leadership are the poodles of the transnational capitalist class, and do not give a tinker’s damn about the wellfare of the German people.

• Yves said:

The heads of the Troika are criminals, who come fully equipped with criminal minds. Here’s how Scott Noble describes their mentality:

They’ve gone too far, though. The “protection racket” mentality only works up to a point. Once everyone in the neighborhood is completely ticked off at you, it stops working; they kill your thugs and send their heads back in bags, and they get their OWN thugs.

This has basically already happened in South America.

Why is this blog so inconsistant? It really confuses me.

Yeah for Iceland! Forget about the people that deposited money.

Yeah for Cyprus! Protect the people that deposited money.

The UK had to pay billions to reimburse people who had money in Icelandic banks.

Iceland covered all its insured domestic deposits — deposits made by voters with small amounts of money. These are the deposits made by the people who determine whether the government survives or falls.

The UK decided to cover UNINSURED Icelandic deposits by UK citizens. UK’s choice, UK’s problem. UK citizens don’t matter from an Icelandic point of view.

Cyprus proposed to cheat insured domestic depositors. This was a really, really bad idea.

It is exactly the same as Iceland. Deposits are only insured up to 100,000 in Cyprus.

The Icelandic government treated deposits from abroad differently from domestic deposits. It covered it’s own citizens, but not citizens from other countries.

Cyprus could do the same, but will they? And will Yves support that option for Cyprus as she did for Iceland.

Iceland acted worse than I remembered.

Domestic customers suffered zero losses, every bit of their money was guaranteed. While foreign customers didn’t even get the minimum guaranteed money back (20,000 per customer).

The Germany’s objective seems to be removal of support for the Cypriot banking system overall, and in such a way that it can no longer function as a large offshore financial center or, even, a financial center or even a banking center.

The only caveat:

On Monday (I guess. Though the ECB is actually scheduled to meet on Thursday) when the ECB Governing Council convenes, it requires a 2/3 majority (15 out of 23 votes) for the ECB to halt the ELA to Cyprus.

And, although Germany, The Netherlands and Finland would vote yes, I wonder if Britain, Spain, Italy, Greece and Portugal (and some of the cash strapped peripherals) may have other ideas – it’s, perhaps, not a shoe-in for a 2/3 majority.

Still, if ELA is halted, and if Russia doesn’t lend sufficient support, Cyprus, its people and its place in the world come crashing down. And, Germany appears ready to live with the Cyprus limping out of Europe and the “sad” consequences of a flight of capital to London and Frankfurt.

We used to hear a lot about another former ‘British island’ in the Med – Malta. Dom Mitroff was often in our news playing Britain off against the USSR. Current Cyprus stuff rings these old bells from the 60’s. We didn’t use the term geopolitical then, but much happening now sounds the same.

I approach organisations from incompetence theory (wider than Argyris’ ‘skilled incompetence’). I haven’t fully developed the theory yet and let me be the first to say this is down to my incompetence. It wasn’t unusual in my time as a company doctor to discover everything existing management were fretting about had little to do with what mattered. Financial gaffs like not investing money received overnight and chronic inventory management were fairly normal.

What we don’t hear on Cyprus is much real about the money and how it has been turned to debt. I’d want to know what incompetence and criminality was involved in that – much as I’d want to peg cash drains in any ailing business – typically bringing in cash limit management (board-level decisions on anything over $5000). One would also look at new funding such as whether existing equity holders could be squeezed for more with a decent plan and various cash flow alternatives. One would also look for LOMBARDS (taking loads of money but actually right dicks) and other staff reduction and re-leveling management (usually assuming these skills were in the lower workforce). Most of this retrenchment was unpleasant.

Simples! But why do we have almost no ‘reality’ to work on over Cyprus – and the wider financial sector mire? In reality the smart money is already off to Singapore or already otherwise offshore. This smart money should be marked with electronic Smartwater. It’s been cropping up all over in small economies causing disaster (Iceland, Ireland ,,,) and Switzerland and Singapore now have financial ‘assets’ 7 times GDP (not unlike Cyprus now)- Lord knows what the UK ratio really is. This smart money is largely criminal, looted from third world people or tax dodging through transfer pricing and the rest. When present in economies it seems as productive as a hurricane at an outdoor church fete.

I’m a simpleton and thus can’t get past thinking the smart money is counterfeit in some way – much as in various crackpot schemes to collapse enemy economies by printing large fake amounts of cash. I note none of it ever seems to fund factories or other useful productivity. One would think safely invested it might fund a few bank salaries and a small cut of the interest. I suspect we have no idea where to invest this money, that its owners have built all the dream houses they can be bothered with and its presence in the system now prevents us printing our own money to better the world and the general lot through real investment and its rate of return.

The answer in the Unsaid would be to identify all this smart money and be rid of it, possibly through investment in real production and wages.

Stealing Cyprus gas is probably the fore-runner for goes at Swiss and Singapore accounts (who is waiting for the exodus – is Montague Norman smiling in his grave?)and a cunning British plan to exit Cyprus and hand over bases to US?Nato cost whilst expanding the UK/US offshore that has nothing to do with physical assets at all, except, perhaps, having the hot money to buy at fire-sale prices. I wonder more on who the master-banker is, than the continuation of Churchill’s (a JP Morgan man) mad Eurasian conflict with the Russians in which Germany and Japan were the suckers (and of course the British and American soldiers).

As usual the troika’s ace in the hole is the local government, in this case Anastasiades. So any Cyprus first solution that might actually work is probably off the table from the start. What’s left is the details of the capitulation, the manner in which it will be carried out, and the length of time (not long) before Cyprus hits the wall again.

I mean it was heartening to see the Cypriot Parliament reject the bank tax so decisively, but a viable, popular alternative also needs to be up for consideration to push back against the troika and Anastasiades. So far I don’t see any and that just leaves variants of the troika plan up for discussion.

We have seen this again and again, but the first step in resisting the Northern and local kleptocrats is to throw out all the current politicians and replace them with people who will fight for the local 99%.

As it is, the greatest danger to the troika and the Northern kleptocrats remains, not Cypriot resistance to their plans, but their own capacity for miscalculation.

Really Yves, where have you been hiding?

America has, is and will continue to wage war on the Swiss banking system and American expatriates everywhere based on the moral propaganda to “punish tax cheaters.”

It is not only Germans who have a self-righteous moralizing tone in their discourse when they are attempting in fact to fleece citizens of their earnings.

Americans living abroad (and I lived in Europe for 34 years and in Switzerland for 24 of those years) are exposed to some of the most onerous tax reporting requirements of any country in the world. America alone taxes its expatriates for money earned on wages outside of the USA, No other country does that, and especially none of the European countries. The government with FATCA http://en.wikipedia.org/wiki/Foreign_Account_Tax_Compliance_Act requires banks world wide to find, identify and disclose American account holders. This has most clearly been used against the big Swiss Banks – UBS and Credit Suisse. My bank accounts in Switzerland were closed by diktat by the Swiss banks due to this pressure and I had to make other arrangements for payments to me from my Swiss payments. Most Swiss banks now avoid American clients even if you live in country and own property in country it is becoming difficult to bank there for AMerican (but not e.g. Germans or Russians!) Many citizens are giving up their US citizenship or choosing NOT to be affiliated with US citizens because of this tax vendetta.

I used to joke that Switzerland was a free country as long a you can pay – as a matter of fact America is becoming the country where money speaks, votes and wields power – not the people – one nation of the money by the money and for the money.

You are MISSING THE POINT!!!!

When people cheat on our tougher tax system (Marc Rich was CONVICTED of tax fraud, hid in Switzerland, and continued to do a monster commodities trading business from there), we did not go to war against the Swiss banking system. More recently, we have, but that’s been specific, to force disclosure of the tax cheats, not to trash the banking system (of course, secrecy being so important to the Swiss model, the disclosure was something they loathed deeply).

By contrast, why should anyone except the Russians care if some of the people who use Cyprus are Russian tax cheats, as opposed to corporate tax minimizers or foreign investors using Cyprus to avoid double taxation? The tax issue is a Russia v. Cyprus issue, and the EU getting up in arms about it is completely disingenuous.

And yes, I lived in Australia for two years, remember? I’m well aware of the horrible US tax treatment of expats.

Hi Yves,

You’ve stated several times that Cyprus is not primarily a tax haven or money laundering center, but rather an offshore banking center for foreign investments headed to Russia. Fair enough. But IMHO, those are just different points on the spectrum of cheats. FWIW, I don’t like the Caymans, Isle of Man, the state of Delaware, North Dakota (for credit card companies), and so on either. Just because the loopholes are legally created doesn’t necessarily imply they’re correct.

Be that as it may, the status of the Cypriot banking sector ceased being a bilateral Russian-Cypriot matter when the rest of Europe was asked to bail it out. While European actions over the past few years have certainly had a domino effect and likely are contributing to Cyprus’s banking woes, the fact is that it is Cyprus who is seeking external help to keep its banking sector solvent. As much as I dislike the Troika and believe many of its actions are misguided if not outright malicious, I don’t think it’s unreasonable of them to wonder how much of their money will go to ordinary retail depositors and how much will go to people / enterprises who are solely there for purposes of tax and regulatory arbitrage.

Are Apple / Google / etc better than cocaine dealers and human traffickers? Yes. But if they park their profits in Cayman bank accounts to avoid paying American taxes, then they don’t deserve any protection from the failure of said Cayman banks. If they’re sophisticated enough to engage in such tax avoidance structures, they’re sophisticated enough to assess the sovereign and political risks of doing so.

In a similar vein, while I personally believe that the European community should protect Cypriot retail and business depositors, I have no such sympathy for businesses, legitimate or not, who are based in Cyprus for the sole purpose of avoiding, legally or not, the taxes of their natural domicile. To ask the very countries they’ve stiffed of revenue (be it Europe or Russia) to bail them out is quite galling.

In reality, there may not be a way to easily distinguish the two cases, so inevitably there will be genuine Cypriot businesses / individuals who are screwed and tax avoiders who are helped. But I’m all for any plan that at least attempts to make that distinction.

I think it is astonishing to see the way you’ve fallen for PR about Cyprus. What evidence do you have that a significant amount of the money going through Cyprus is involved in sex trafficking? Or to be more precise about the issue, that the % of money related to suspect activity is any greater than you see in banking anywhere in the world? Don’t you get that the dollar amounts involved in large corporate transaction related to investments in Russia would dwarf the amounts involved in low level crime? And that Cyprus is clearly the best jurisdiction for investing in Russia due to the tax treat with Russia, which was in place when the EU let Cyprus in? It’s not as if Cyprus radically morphed its business model in two years. The EU knew full well what Cyprus’ economy was based on when it was admitted.

My God, the Swiss banks are full of money from the very worst sorts, leaders of third world countries who steal billions. blood diamond merchants, ex Nazis, etc. Citigroup was and is THE destination for Latin American flight capital, and a lot of that was theft of government funds.

Second, a US company that got Defense Department money, Dyncorp, engaged in sex trafficking.

Third, a US bank, Wachovia, laundered $834 billion of Mexican drug money. And that’s only what got caught after years of activity. It’s generally understood that the ONLY net cash inflow into US banks during the acute phase of the crisis was from drug traffickers who recognized that no one was gonna ask questions about money laundering then. You KNOW the Tim Geithner Treasury would never make inquiries about that.

There’s been a general meme in many of the ‘Cyprus comments’ that intimate if not outright discriminate Cyprus’ Financial Center status as a bastion of money laundering and international corruption. This is then used to reason a justification for why Cyprus is simply getting its comeuppance. To be clear, I am neither an apologist for Cyprus’s present predicament nor a belligerent activist against tax havens, such as the Cayman Islands or Isle of Man.

Cyprus is a low-tax jurisdiction, not a tax haven. Cyprus is on the OECD’s ‘white list’ of jurisdictions complying with the global standard for tax co-operation and exchange of information. Its fiscal and regulatory regimes are fully aligned with the acquis communautaire and the Code of Conduct for Business Taxation of the EU and the requirements of the OECD, the FATF, and the FSF. However the Cayman Islands’ maintains only 12 bilateral tax information arrangements; and The Isle of Man, 14. Cyprus an arrangement with all of its OECD bilateral (double-taxation treaty) partners – 46 fully, 6 being ratified.

Within these 52 countries, Cyprus has double-taxation treaties with about every country in the EU, and includes China, the US, Russia and, practically, every Middle East country. All the double-taxation treaties concluded by Cyprus were drafted on the basis of the Organization of Economic Co-operation and Development (OECD) model treaty.

The primary objectives being:

1.) Clarify and determine the taxing rights of each contracting state;

2.) Reduce or avoid the impact of international juridical double taxation; and

3.) Introduce anti-avoidance provisions and mechanisms to prevent tax evasion.

Cyprus is an exemplar of an OECD ‘low-tax jurisdiction’ country (one that the US constantly, it seems, want to emulate) since it combines a low-tax regime with an extensive network of double-taxation treaties (which neither the Cayman’s nor the Isle of Man does).

One of the most powerful ‘tools’ used by entities such as the Cayman Island and the Isle of Man is the (internationally accepted) ‘Passive Dividend Rules’ – where the foreign participation tax exemption applies to foreign dividends onshore.

‘Passive Dividend Rules’ apply, typically, when (the numbers differ):

1.) Investment income, direct or indirect, is less than (say) ‘50 percent’ of the paying company’s activities;

2.) The foreign tax burden on the income of the paying company is not substantially lower than the tax burden on the resident parent company (the shell).

3.) The taxable funds are held by the company within jurisdiction for a period of time (say, 50 days).

So, of course tax avoidance funds/profits are washed through the Cayman’s and Isle of Mann which ‘facilitates’ (in too many ways) nominally, declared high company tax and with zero resident tax and allow ‘bed and breakfasting of funds’ (period end off-shoring at night, back in the morning).

However, Cyprus’ ‘The foreign Participation Tax’ almost wholly mollifies (in that there is a substantive article of tax) the “tax haven-ish” parts of the ‘Passive Dividend Rules’, which it applies to any capital gains realized by a Cyprus-resident company on a sale of shares in a foreign subsidiary, regardless. And to further button it down, ‘Investment income’ is defined as any income which is not derived or does not accrue from any business, employment, pension, or annuity paid by reason or in connection with past employment. None of which is the case with ‘The foreign Participation Tax’ used in the Cayman’s and Isle of Man.

Cyprus’ ‘Foreign Participation Tax’ and use of Passive Dividend Rules are, explicitly, intended to prevent non-resident companies, over which domestic taxpayers have a controlling or substantial interest, from converting passive income into exempt dividend income, while adhering to the principle that anti-avoidance measures should be used only to maintain the equity and neutrality of national and international tax laws.

Additionally, Cyprus’ targets only passive income not derived from genuine business activities. They do not extend to activities such as production, normal rendering of services, or trading by companies engaged in real industrial or commercial activity, and they are not applicable to countries in which the taxation is comparable to that of the country of residence of the taxpayer; it’s not until the subsidiaries start to distribute dividends, that any exemptions become available’. Again, in tax havens, passive dividends are, typically exempt from tax before distribution.

I am sure there are many tax accountants who could, no doubt, find loophole and issues with Cyprus’ tax methodology (or this summary); there always will be – it’s their job. But, the point is intent, and Cyprus intends it not too easy to be seen or used as a tax haven; other Sovereigns boast quite the opposite.

As mentioned before (in another post), I am sure that Cyprus has its own fair share of Banking, AML, Mafia, Drug Smugglers, non-paying dog license owner’s etc. issues. You may not like tax treaties, or tax havens or even Cyprus itself (fine let’s discuss that in general terms for all countries), but, to equate the blatant money laundering and tax evasion of the Cayman’s, Isle of Man or Chinese pawn shops that Romney, GE, Apple, Siemens, and their directors have so effectively used to evade tax, to the vastly more transparent inter-mediation of Cyprus Banks is ill-informed and abusive.

Hi Yves,

I think you misunderstand me. I’m not saying most of Cyprus’s economy is based on sex traffickers and drug dealers. I’m saying *even if* Cyprus is primarily a tax/regulatory vehicle for legitimate investment in Russia, that still doesn’t make it worth bailing out. It’s only better on the spectrum of tax cheats. That’s what I meant by comparing to the Caymans. If Apple lost its $100bil cash horde because it stashed it in the Caymans to avoid US taxes and the Caymans went bust today, then tough cookies. They engaged in tax abritrage and can deal with the consequences. The fact that Apple is better than a money laundering drug dealer still doesn’t make it worth bailing out.

Hypothesis: Trash the country, encourage resource flight to the center, loot the gas and assets for pennies on the dollar and ensure the Russians are kept is the game plan.

Now that’s a plan I can believe Yonatan!Bill Black also told us the best way to rob a bank is to own one, or at least get inside to do the job. Laiki apologized some while back for investments in Greece and the government took an 84% stake, but one wonders who lost all the money/leveraged up to make Laiki and Cyprus so vulnerable. Maybe smart banks sold them pups as part of the coordinated action you suggest.

If we could see the real books we might know – I’ve looked at the formal published accounts bu these just read like rearguard damage limitation inside PR bull reporting percentage profit drops and margin squeezes with a smile. It looks like the money was gone before the ‘nationalisation’ some months back I’d need forensic accounting and a lot of leg work to know who had the cash and where it went. The trick of claiming you gave it to a man for a handful of magic beans I first heard after clapping cuffs on a Ponzi man (I’m old, we could still nick them back then). It’s usually not true and you find kickback from the ‘dismally invested money’ further down the line.

S&P downgrades Cyprus credit rating to CCC from CCC-plus http://www.chicagotribune.com/business/sns-rt-us-cyprus-downgrade-standardandpoorsbre92k16b-20130321,0,233053.story

Wow! CCC! What’s the job spec – must remember to bolt the stable door after the horse has bolted? I wouldn’t mind raking fees for decisions like that. Does everyone know Makeking has been relieved? I get paid to predict the future (sort of) not the past.

What is to stop any EMU member from remaining in the union while creating its own national currency pegged to the euro, this on an emergency basis allowing it to deal with its banking system’s solvency issues on its own terms? In other words, how much of the utter lack of due diligence that was allowed by institutions managing the EMU must by force be mitigated by sovereigns who otherwise are being made victims? The same question even applies to the relationship between the U.S. Federal Reserve and the U.S. Treasury. On this note the great mystery of our time is unmasked: how is it Alan Greenspan remains a free man while Bernie Madoff is locked up in prison?