Yves here. This post is useful in that it suggests short, simple ways to debunk the idea that deficit cutting is a good thing and to make the argument politically palatable. The trouble some readers will have is in positing that Obama is interested in policies that are good for middle class Americans, as opposed to his wealthy backers.

By J. D. Alt, author of The Architect Who Couldn’t Sing, available at Amazon.com or iBooks. Originally posted at New Economic Perspectives.

Many years ago, I had occasion to spend a long weekend at Ramuda Ranch in Arizona—a rehab facility where young women are helped to learn how to want to eat food again. Anyone who has had a personal encounter with Anorexia Nervosa knows what a mystifying and frightening experience it is. The young women I saw there—all of them well above average intelligence-wise, many of them stunningly beautiful in a physical sense—all suffered from the same delusion: they had convinced themselves that eating, taking nourishment into their bodies, was pathological. The delusion had variations: some of the adolescent girls looked into the mirror and—in spite of the fact they were five feet eight inches tall and weighed only 75 pounds—SAW a body that was grotesquely over-weight and fat. Others seemed to have a disconnected relationship with their bodies, as if they personally were one thing and their body another—and the “other” was something that, for complex, obscure, and compelling reasons, deserved punishment and starvation. For those of us who were visitors, observing this irrational and self-destructing behavior in young women, who otherwise seemed perfectly normal and healthy, was perplexing and painful.

I was reminded of Ramuda Ranch last Friday as I watched our nation’s leaders explain to the American people why America must now impose a new austerity upon itself. By what process, I wondered, have we convinced ourselves that we do not have enough U.S. Dollars to pay ourselves to create the goods and services we need to prosper as a society? What exactly is the “fiscal crisis” that we see when we look in the mirror? How is it that we view our national community with such detachment that we can knowingly impose upon it a painful—and unnecessary—deprivation? How can it be that we view the spending of our OWN sovereign currency to create public goods and services—the essential nourishment of our private economy—as creating a “deficit” that we must somehow repay to someone in the future? How have we bought into this massive delusion? And where is the rehab center, the clinical psychologists and counselors, who will help us overcome it?

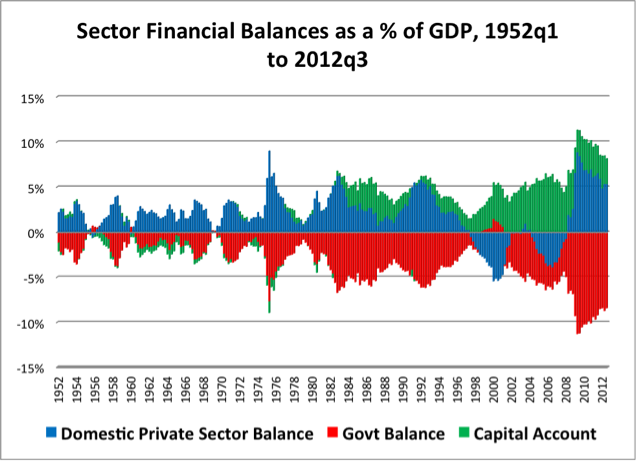

A few years ago, when the hysteria about the nation’s “deficit” first emerged, President Obama could have calmly pointed out that because the sovereign government issues the nation’s currency and spends it into the private sector, having a sovereign “deficit” is actually a GOOD thing. He could have shown the American people a simple chart and patiently explained that the federal government CAN’T limit its spending to what it collects back in taxes (creating a “balanced budget”) because that would mean no net new Dollars would remain in the private accounts of citizens and businesses—in a real sense, the private economy would begin starving.

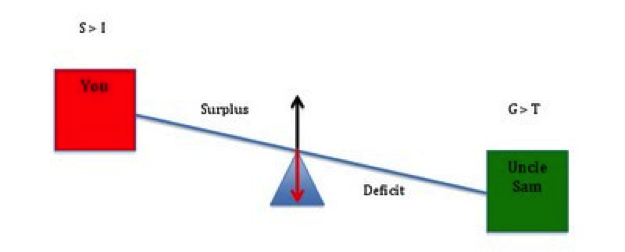

To back up that chart, he could have unveiled an even simpler one created by Dr. Stephanie Kelton at the University of Missouri Kansas City—a Teeter-Totter with numbers on it that explains the startlingly simple relationship between sovereign “deficits” and private wealth.

Choosing his words carefully, he could have helped the American people understand that the Clinton era government surpluses actually were a BAD thing because they subtracted trillions of dollars of wealth from the accounts of private citizens—forcing those citizens to BORROW more and more dollars to maintain their lifestyles, unleashing a borrowing spree that was happily accommodated by a deregulated financial industry with ever more clever and dangerous lending products. He could have compassionately commiserated with the millions of American families who lost their homes AND their jobs when this credit bubble burst just before he took office in 2008. He could have apologized for being forced to re-capitalize the U.S. banks that lost it all by defrauding American mortgage holders and then gambling their fraudulent proceeds with exotic bets. He could have declared a fierce determination to unwind the unfairness that was enabling the executives of those same banks to continue raking in personal fortunes, even as their institutions were being bailed out by the sovereign government. Finally, President Obama could have gently and courageously reminded us that our nation had been brought to its knees before by reckless financial titans—in 1929—and that we had, with Franklin Roosevelt’s guidance, learned the REAL lessons of how to recover and build ourselves back to prosperity.

But President Obama didn’t do any of those things. Instead he chose to make what I fear will turn out to be the biggest mistake of his political career: he decided to AGREE with the hysterical delusion that the U.S. sovereign government is broke. He decided to hold up the mirror and say, “Yes, we DO have to reduce our nation’s deficit. Yes, we ARE spending too much creating public goods and services. We ARE going to have to tighten our belts and get a little bit skinnier. But my promise to the American people is that we’re going to starve ourselves a little more slowly—and we’re going to do it in a ‘balanced way’ so the pain is distributed more fairly.”

I go back in my mind to that long week-end at Remuda Ranch. It was, in many ways, an experience that shattered my basic optimism about the power of rational thinking. Right now I’m having similar feelings—a kind of helplessness. The good news is, I know from personal experience that, with perseverance, delusions CAN be broken and health restored.

Isn’t “wealthy backers” kind of a pointless euphemism? Obama is not just coincidentally aligned with people who happen to be wealthy. He is bought-and-paid-for corrupt.

Why not just come right out and say “Obama’s owners”?

Since an utter collapse of the system would hit those wealthy backers the hardest, it kind of makes you wonder what they’re thinking about. Now the jack-booted agenda is starting to make more sense. Beat up the political protestors, initiate random state-sponsored killings, and if the people don’t like it then beat them some more until morale improves. Say hello to big brother. Orwell was a genius.. just off on his timing by a little bit.

I read Huxley’s Brave New World in the nineties and thought he had us dead-to-rights, and that Orwell was too crude and unsophisticated.

Since the GFC, things have taken a decidedly Orwellian turn.

I never thought I’d say this, but I miss the Dubya years. At least everyone agreed Bush/Cheney/Rumsfield were evil. Unfortunately TPTB have us split on whether Obama is our post-racial messiah or a Kenyan Muslim Socialist. Can’t he just be boringly corrupt? He just doesn’t seem that deep.

This is nothing new for Obama. Remember in ’09 when he told CSPAN that the gov’t had run out of money? Remember how he convened the Simpson-Bowles Commission on his own? Remember how he has offered, and continues to offer, cutting Social Security? Obama and both Clintons are fiscal conservatives.

“Why don’t you pass the time by playing a little solitaire”….

Adding: “Barack Obama is the kindest, bravest, warmest, most wonderful human being I’ve ever known in my life.”

Has Senator Clinton ever suggested cutting Social Security and/or Medicare? (I wouldn’t be a bit surprised if

Slicky Bill hasn’t supported both, especially just nowadays lately. I came somewhat late to the realization that HClinton was not strictly and only a Slicky Bill co-conspirator).

Min, which positions do you think Obama occupies for political benefit, and which do you think are consistent with his philosophy? I struggle with this question quite a bit, so please don’t think I’m lecturing you in any way. Particularly because I agree that he is a fiscal conservative…but in what ways?

He’s been pretty liberal with military funding. It’s arguable that Hagel’s nomination wasd about working toward a more efficient use of the military’s budget, but there’s little evidence Obama is interested in shrinking the aggregate amount. I don’t know which specific social programs he has proposed gutting (say, 10%+ cuts). Nor, with the exception of Obamacare, many areas where taxes have actually been increased. With the exception of the recent recission of temporary payroll tax cuts and a partial overturn of the Bush tax cuts at the highest rate, he’s only cut.

On the other hand, he hasn’t spent in areas or magnitudes that satisfy the social imperatives on which he campaigned in 2008 and to a lesser extent in 2012. So I’m stuck wondering- do I think he’s fiscally conservative because he’s initiated less expenditures than I expected/desired? Or am I off on the math?

Sometimes I wonder whether I am reading him as as fiscally conservative for his public rhetoric rather than his conduct. (And, of course, the opposite argument could be made depending on your choice of dataset.) So is he “talking” or “doing” conservatism, and which actions in terms of dollars would you say validate your conclusion?

I really don’t know about this, so please don’t think this is meant to be critical or authoritative. It’s more that I think this forum is likely to hold better informed or better considered opinions on the subject.

Deficits are wonderful. I believe that Obama ought to be able to print all the money he wants and use it on whichever oligarchs he like.

In fact it’d be best if no one had to pay taxes while he did this. We could just fund everything with deficits forever. You may think I’m being facetious here, but I’m not. Incidentally, I also have almost nothing invested in this economy, and I’d prefer it to go down the drain as fast as possible. So you may want to consider my opinion with that caveat.

By the way, people can understand the theory of astrology without believing a word of. Just because you have a convoluted theory doesn’t make it true. And goods and services are not dollar constrained. They are resource constrained. So, I have now identified why all of your fiat theories fall apart in the real world, when the resource constraints of a depleted world begin to eclipse the traditional paradigm of there being plenty of natural resources laying around to loot. Well, just think about it anyway.

Huh? First, without taxes that must be paid in dollars, the dollar would have no value. So, if you want the country to go down the drain, that’s an excellent way.

Second, what on earth does the operational reality of fiat money have to do with goods and services being constrained by resources, and not money? Looks like a simple category error to me.

No, this is all connected. I see it very clearly.

Fiat money (that has an interest component) operates on the physically impossible premise that the economy can expand infinitely. Where it does not expand, there is a collapse. That is why collapse is an inevitable fact wherever interest bearing money is used.

The drive to pay back debt (at interest) is the same drive that causes people to rapaciously plunder the earth in an ever expanding effort to turn more of nature into fiat money. By supporting ever-expanding fiat currency regimes you are supporting the destruction of nature and the destruction of traditional cultures all around the world. And there is no way you can separate out the good (what you consider good)affects of your currency from the bad.

Supporting fiat means by definition supporting wars, supporting the police state, supporting slashing and burning of the Amazon, co-opting traditional peoples from all over the world into becoming slaves in your neoliberal factories, among other things. Again, you may believe that things like that are abhorrent to you, but at the same time you lend support to the systems the perpetrate them. Abandoning these insane fiat fantasies and illusions of endless growth are the only way to repair this world and salvage the future of humanity.

ROFL, this is just breathtakingly hysterical, and so full of basic errors as to be pure comedy to boot.

“that has an interest component”..is exactly why we want government to spend, instead of banks to lend. Government can issue money that has no “interest component.”

As for endless growth, with government-issued fiat, that isn’t necessary either. We *could* use it to insulate houses, replace all the deteriorated stuff, and in general tidy the place up, all the while giving everyone a living wage, good health care, and good education–and reduce our resource use *at the same time.* It’s not the existence of some form of currency or another that matters, it’s how you use it–a point so glaringly obvious even so-called “conservatives” should be able to spot it. :\

Can you explain that again, but you know…like it’s an eating disorder.

You’ve nailed it JGordon. The problem in a nutshell. Perpetual exponential crony capitalism (is there any other kind in capitalism’s late-growth metastasized stages?) is indeed the root of all our current problems. Who issues the currency is a small side issue, which in any case, ain’t gonna be changed in our lifetimes anyway. Collapse is the only way out of our current dilemma. Although it might be wise to not underestimate or gloat over the disastrous effects that’s gonna have on people’s lives.

As far as taxes, or lack thereof: of course Lambert is right that the government must collect taxes of some sort just to give its currency validity, but I’ve always found it curious that in all these ongoing various tax debates no one EVER brings up the idea that maybe we should just cut to the chase already and try to decide what the IDEAL level of taxation IS. As in, we know the rich will never be satisfied with whatever tax cuts they “negotiate” with OBummer, so why not simply come right out and state what they view their ideal “level” of taxation to be and negotiate straight for that? And of course it’s because the answer is obvious. Their answer is ZERO, which they wisely realize they can’t yet achieve, so in the meantime we’ll have a perpetual public “negotiation” going on about how their taxes are holding the rest of us back, and they’ll merely take them back anyway through all the countless legal maneuvers they’ve developed over the years and by simply usurping the government’s powers through the now thoroughly corrupt election and/or lobbying process.

Bottom line: taxation and austerity is a war that’s already been fought and won by the rich and powerful (in fact, they were the only ones who realized it was going on and showed up to fight it!). All the current histrionics are merely meant as entertainment for the citizenry watching the results on TV, and as a palliative to ease the bitter pill’s soon to be noxious effects.

ALL capitalism is based on the idea of infinite expansion. If you think infinite expansion is impossible, which it is, you should become a socialist or something. Being a capitalist and believing infinite growth is impossible is almost contradictory.

All capitalism is based on perpetual growth, regardless of fiat or non fiat. Why? Because compound interest debt grows infinitely. If you have a system with debt based loans, the economy MUST grow, or else debts cannot be repaid. Whether the debts are backed in gold or paper alone is irrelevant.

Fiat or non fiat has absolutely nothing to do with this AT ALL, regardless of which is better. This is a problem completely intrinsic to capitalism.

I read the rest of your post, and I dont understand… You do know that debt bearing interest is used with or without fiat right? Even under the gold standard, pretty much the same forms of interest were present.

Why are you still a capitalist when you see the problem so clearly? This isnt a fiat-nonfiat issue, this is a problem intrinsic to all existing forms of capitalism. I dont see how you think a gold standard or whatever would be any different at all.

Supporting capitalism, fiat or not, is supporting wars and the destruction of the amazon. Gold standard currency or whatever, the same principles of debt interest are still there and still the same.

JGordon might be a little rusty on the particulars, but in general is spot on. Fiat capitalism is far more likely to exploit the earth and it’s resources than is gold constraining capitalism. The latter MIGHT give us death by a thousand cuts, but in the long pull they’ll both eventually devour their host.

…BTW, I’m not fronting for either form of capitalism, or any form of capitalism.

JGordon might be a little rusty on the particulars, but in general is spot on.

I don’t think I’d even grant that. I think he’s just plain spot on.

Fiat money (that has an interest component) operates on the physically impossible premise that the economy can expand infinitely.

As Lambert says, you are making simple category errors. Not your fault. That is what mainstream “economics” is – a collection of category errors disguised by Big Words. Pardonable, natural a long time ago, but they were all understood and explored during the Keynesian era, before the current period of Astrology Triumphant.

A couple of points: All money is and always was “fiat” money. There is no, can be no other kind. The interest component – the exponential growth? Whoop-de-do.

Sorry to break it to you, but the exponential function grows – EXPONENTIALLY!!!!! Oh My God!! We are all DOOMED!! Math textbooks illustrating y=e^x will have to use infinite amounts of paper!! Oh, the humanity!!

In reality, we could decide to put a zero at the end of all our nominal “fiat” credits and debts every year. 900% interest & inflation inbuilt. Exponential Growth Forever. Wouldn’t change anything.

I was just thinking about the different ways people think about things. In fact, there was an article you all posted in the links section recently that was incredibly insightful. I link it again here in case you missed it:

http://www.psmag.com/magazines/pacific-standard-cover-story/joe-henrich-weird-ultimatum-game-shaking-up-psychology-economics-53135/

Americans particularly as a culturally ingrained preference think analytically. I would say that permaculture training is an introduction in how to start thinking about systems holistically. From putting these things together, I think that the problem with NC and economists in general is that you have certain analytical beliefs that fall apart when viewed from a holistic standpoint. That is what I was thinking after I read that article. I don’t see any easy way for you to find your way out of that cognitive trap that Americans are most severely afflicted by, of all the people in the world, but I have hope.

Americans particularly as a culturally ingrained preference think analytically.

My take: NO! Actually, Americans particularly as a culturally ingrained preference, prefer to think that they think analytically, when in fact, they most often think reactively, just like everyone else. In fact, even – and especially! – more so!

American Exceptionalism? No. American Conceit!

The disconnect is not between the approach ie holistic vs. analytic… it is in – the core belief[s… by which the optic is ground – produced.

Skippy… Bias formulated of – ignorance – is not discretionary imo.

The government doesn’t need to cut back spending to balance the budget. If economic activity picks up tax revenue will increase. Just bypass the stagnant and saturated credit markets so stimulus goes straight to the economy.

Borrowing money to build ice rinks in Arizona is not of the same value of fixing falling bridges in Minnesota. The idea that borrow no matter what is positive fails basic logic. Borrowing money to to gamble in Vegas helps the casino owners and the ten of thousands of workers get small raises.

Borrowing money to subsedize the TBTF financial institutions doesn’t help the economy a bit. Borrowing money to improve schools and invest in research help in the short and long run.

Obama’s problem is not the Simpson/Bowles commmision and the belief in lower deficits. His problem is that he supports the TBTF and wants to destroy the safety net.

Oh for the days of political economy. Although Yves warned us, I am so tired of economists who are such naïve idiots when it comes to even the simplest politics.

Isn’t the sectoral balances approach overstated? Banks create money and get their actions backed by the Fed. This doesn’t zero out because of the problem of interest. Deficit spending is one way for the government to deal with this problem. The sectoral balance approach ignores this.

For JGordon, the best way to understand money is to forget about it for a while. The first question that needs to be asked is what kind of a society we want to have both for ourselves and each other. From there, the resources we have to examine the resources we have to create it. Resources are not just raw materials. Much more importantly they are people, their knowledge, skills, and goodwill. People are always our greatest resource. The next step is to consider how resources we have can best be distributed to create the society we want. Government can calibrate this through spending, taxing, legislation, and regulation. It is only at this point that money needs to come back into the discussion. It simply the medium to effect the distributions we need. Nothing more.

I can not say this often enough but this is the proper way to think about these things. Social purpose is at the very beginning and it is this which guides each of the following steps. Our present kleptocracy divorces money from its social purpose, indeed makes money its own purpose. This is by design because such a scission is necessary for looting. MMT has similar problems because it starts at the level of money, in other words at the end of the process. It therefore becomes very easy to criticize it for failing to take resource limitations or social purpose into account. Some MMTers try to make these connections, but their attempts are unconvincing precisely because their theory begins so far down the process. a

I agree it is important for us as members of societies to think about what kind of society we want. I also agree that this should be the starting point when considering the design of social systems. I also agree that the monetary system is an element of that design and that to consider it as the only important factor is silly. However, I disagree with your criticism of MMT. MMT is a theory about the monetary system and its relationship to macroeconomic factors. It doesn’t say that it is a political theory or a social theory. Essentially your argument is that apples are better and the problem with the orange is that it is not an apple.

I agree – all this talk of resource constraints is a weak argument. Sure, oil may disappear…we got along just fine without it but, progress brings along problems and, structures are set up around our dependencies on different resources, and we find it hard to look for alternatives but, that does not limit our progress…. it forces us to look for other ways to do things. Wealth creation only happens when human labor is employed to create something from the planet around us…something that other people want or that we ourselves make for ourselves….. books, art, food, shelter, philosophy, a habitable planet etc. Your only resource limitation is the planet itself…. it comes down to what humans value.

I may be stupid but; our value systems must be screwed-up. Otherwise, we must value human misery over human joy, war over love, money over life, controversy over co-operation, rent extraction over wealth creation.

For example: We have a food system where we trash 50% of the food grown… then we make dumb-ass arguments over resource constraints even when food is shipped all over the world. We argue that our brown friends from south of our border do jobs that Americans won’t do……(the sentence is never completed as, it should be) ‘Do jobs Americans will not do at that pay grade’. That is food production!! I have not met anybody that does well without food… is it too much to pay these folks a decent wage??? I guess we do not value food and the people who produce it -(not the financial services companies or the Monsantos of the world that only lay, ridiculous claims, on other-peoples wealth creation and natural renewable resources)

Another example (remember..I am the idiot so I babble on): We charge interest on loans to students who want to advance their education….interest is supposed to be a measure of risk….everyone yammers on about how education is so important to the nation and competitiveness… I may be stupid but, isn’t the risk located in not getting an education? And look at the market that the financial services companies destroyed – it works out for them (the financial services companies) cause it allowed them to gain an interest stream on the inflated asset(the educated person) and reduced the ability of that educated person to spend into the economy (interest servicing) by having over financed that poor educated fellow.

A bit upside down in my view.

Hell, we must really value the idiots that took down the economy, we must really love selfish, the warriors, the fight, the chaos, the pain, the grief….

Regarding resource constraints, what backs up the U.S. dollar these days, now that we are off the gold standard. Isn’t it our resources? Our arable land, our infrastructure, our post secondary education system, our people? People from other countries buy our bonds because they know we are “good for it”. We are rich, wealthy and powerful. It’s NOT about money. If you assume (like the beltway denizens do) that we are broke, out of money, busted, then aren’t we the equivalent of Somalia? They don’t have money either. We both don’t have money. No one would equate the US with Somala.

The real question always is: given all these resources and wealth, WHO exactly gets how much?

MMT teaches the dollar is primarily backed by taxation. Because you must pay your tax liabilities in dollars you MUST use dollars. If government wanta to reign in inflation it can increase taxes to reduce aggregate demand.

I agree – all this talk of resource constraints is a weak argument. Sure, oil may disappear…we got along just fine without it but, progress brings along problems and, structures are set up around our dependencies on different resources, and we find it hard to look for alternatives but, that does not limit our progress….

Really?

Actually MMTers go to some lengths to assert that MMT is more than a monetary theory. The reason for this is, as many of us have pointed out, that, without a solid social purpose, fiat money is a particularly effective mechanism for looting.

In truth, I have had this conversation many, many times. If I critique MMT as solely a monetary theory, I am told by its adherents that it has a social purpose and is cognizant of resource constraints. And when I critique its social and resource positions, I am told it is only a monetary theory. In my view, this greatly weakens MMT because it doesn’t know what it is or what it wants to be. Not only are MMTers notoriously defensive but the grounds for debate keep changing. MMTers may be content with this, but as long as they are, theirs will remain a fringe theory.

You’ve been talking to the wrong people. MMT is a toolset for economic analysis, not a social agenda a way of life or a school of thought. It can be used to further a social agenda but cannot be claimed by one in particular.

@Ben… if understand the conversation, the problem is agency aka trust. As it is an extremely chaotic environment out there and so many have an innate distrust of those at the helm… go figure… whats a body to do?

Skippy… with unlimited ammo for the – creators of reality – track records count… eh. Yeah there is an information problem… what hope do people have of… the forces now asserting themselves… of doing anything positive… related to the massive problems our species confronts… by just saying… it is so… they have no shame… duh.

`But President Obama didn’t do any of those things. Instead he chose to make what I fear will turn out to be the biggest mistake of his political career: he decided to AGREE with the hysterical delusion that the U.S. sovereign government is broke. He decided to hold up the mirror and say,

O’Banka made a mistake ???

you are living in a world of delusion

this is where he was going all along

What sort of delusion makes anyone think that Obama thought or decided anything. He did and does what his handlers decide, yes he is a token to make folks feel good that they are post-racial.

This post is enlightening, but he fails in his objective: to provide simple explanations for why deficit cutting is counterproductive.

The simplest thing to say to the co-worker or family member who starts up about deficits is to point out the following:

1. Unemployment is at over 10%. Unemployed people don’t pay taxes…because they aren’t making enough money. Big business is busy shoveling money towards the 1% and not interested in doing anything about unemployment. Ergo, the government really needs to do something about unemployment to ‘solve’ the deficit ‘problem.’ Then you can go into more detailed discussions as to why the national budget isn’t a household budget, etc., etc.

As a corollary to Republican audiences, you can point out that under Ronald Reagan, 6% unemployment was a National Crisis.

In regard to social agendas MMT was used by Hitler and the Nazis and currently used by the Chinese Communist Party. You could also say that in a perverse way it was used by the Banksters to blow a housing bubble but unlike the previous two uses a bubble is by definition of greed incapable of being contained within resources namely income. So the use of MMT would appear not to discriminate as far as social agendas are concerned.

In regard to social agendas MMT was used by Hitler and the Nazis and currently used by the Chinese Communist Party.

Might or might not be, but in any case you don’t offer any support for your accusations and you also paint with a broad brush (smear) by using the terms Nazis and Chinese Communist Party in a knee-jerk, reactionary manner. Refine your argument please.

The universe is running out of space. Sooner or later if we don’t start shrinking fast it’ll squeeze down to a tiny dot and we’ll all be crunched together like a rugby scrum. Youze all better be neat and clean with fresh breath. Nobody knows what money is. Even the MMT folks don’t know. They stand on the edge of a vast and wild ocean and look out and see only sky. It helps to have no formal training or education in these matters, it cleanses the vision. You can do this at home or on the bus or even walking down the street. Reading books is too exhausting. It’s easier just to look at it in your mind and channel it up while you have a glass of wine looking vacantly out a window. You can’t get a job as an economist but you will be indisputably correct.

The universe ain’t running out of space, although humans might be. Humans are learning the hard way that the universe ain’t their divine shitting grounds, no matter the price assessed or the profits accrued. A lesson seemingly so easy even a western capitalist human could grasp it. Question is, WILL WE?

Ok, so someone help me here. I’m trying to navigate all of these various theories. But here’s what I’ve come up with.

Money has no inherent value since it’s just paper (except to start a fire with I guess). Therefore money is a claim on a resource (person’s time, gasoline, etc).

This leads me to the conclusion that the money supply may/should only grow at the same rate as population growth+productivity gains since this is the resource base from which money derives its value. If it grows faster then you get inflation. Additional dollars do not buy the same amount of resources because the resources have not increased, while the claims on those resources (the money) has increased.

Written another way.. please explain how printing pieces of paper make a society richer?

Additional dollars do not buy the same amount of resources because the resources have not increased, while the claims on those resources (the money) has increased.

Money is not a direct claim on any resource. That is to step into the pitfall of delusion of commodity money. Money is credit/debt, which is a relationship between two economic agents. The above misses the fact that printing money can make resources less scarce, because it prevents unemployment, fully utilizes labor and other resources, increases production, without inflation.

Written another way.. please explain how printing pieces of paper make a society richer? Because money, credit is intimately involved in every aspect of production. The division of labor is logically impossible without credit.

Modern economies are run in a fantastically stupid way.

Money is made so scarce that lack of it prevents full employment, forces millions upon millions to NOT work, just as if we randomly put people in cages. Their labor is a colossal resource which is squandered, destroyed for all time, because of nonsensical economic theories, and this resource-destruction leads to inefficiencies everywhere else, as well as being a crime against the unemployed, the poor and everyone else who does not have a sociopathic morality.

Another way of answering is – How can written orders lead an army to victory? After all, isn’t just a bunch of soldiers flailing wildly and individually each at each other the most efficient way, because it doesn’t use resources on coordination?

And in any case, we always know that there should only be a fixed number of orders issued but not carried out at any time. Because otherwise, each order would have less force, and no order can actually improve fighting chances.

Those last two paragraphs make about as much sense, are a decent parallel to, the idea that printing money cannot make a society richer.

I think your war parallel is quite dangerous. It implies that there is a “goal” for an economy and that everyone should be working towards it. Who sets this goal? I think the USSR proved (and China is in the process of proving) that command economies fail spectacularly and generate levels of corruption far beyond the current US version of crony capitalism.

Money is absolutely a claim on a resource. I exchange $4.27 for one gallon of gasoline. If the govt prints a ton of money to employ people to dig holes and then fill them back in (it’s a hard fact that government does not direct resources to their most efficient uses) then I’ll have to pay $5.00 for a gallon of gas and my quality of life has decreased. This has a dramatic effect on older people who see the value of their savings eaten away by inflation.

Wouldn’t it be better if instead of spending money on food stamps and welfare the government could use that money to put those people to work and pay them for their work. Employment would increase and we wouldn’t be punishing savers like we are today.

If all of a society’s resources are being used, then “printing pieces of paper” doesn’t make it richer.

If (on the other hand) the society is like the U.S., UK, Japan, and the countries of the European Union, it has many idle resources (including workers) and not enough money in the hands of people who want to utilize them. In that case creating money (and giving it to people who will put it to good use) WILL make the society richer.