By Joe Firestone, Ph.D., Managing Director, CEO of the Knowledge Management Consortium International (KMCI), and Director of KMCI’s CKIM Certificate program. He has taught political science as the graduate and undergraduate level and blogs regularly at Corrente, Firedoglake and Daily Kos as letsgetitdone. Cross posted from New Economic Perspectives

It makes a good headline; but it’s dangerous to say “austerity is dead,” just because new budget projections indicate that the deficit has already been cut by $200 Billion more than in previous projections, and because the Reinhart-Rogoff study has been debunked successfully, and, hopefully, irretrievably. Austerity will only be dead when legislators, Presidents, Prime Ministers, Central Bankers, and international lending organizations stop trying to implement it, whether or not they stop because deficits have already been cut.

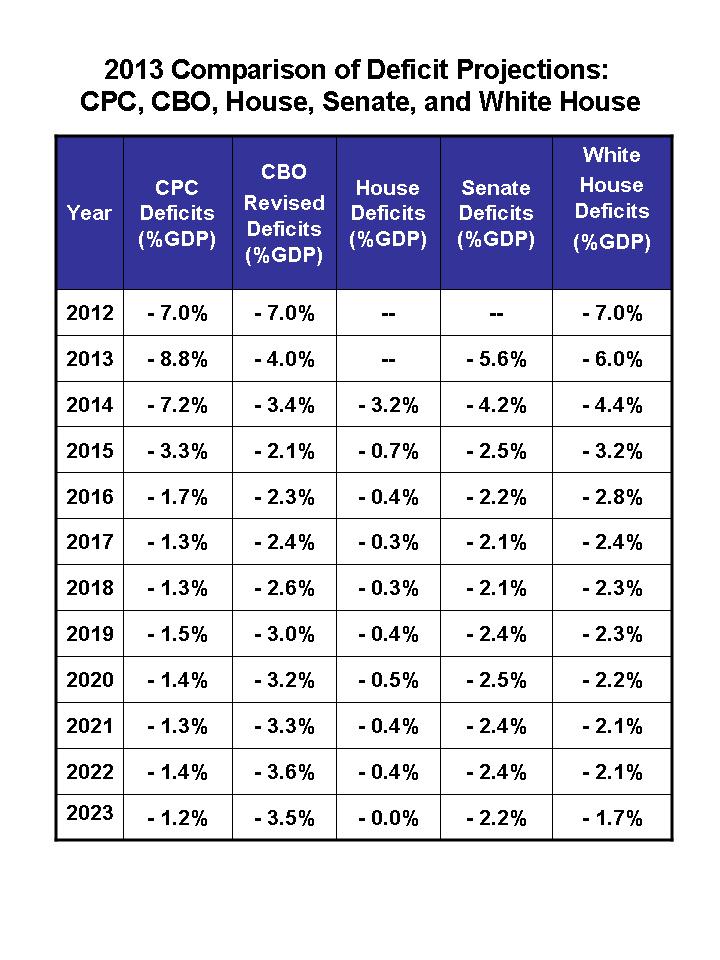

Of course, those claiming austerity is dead, mean by their claim that deficit cutting efforts have already been successful enough in the United States that future projections in all the mainstream budget plans now show only “moderate” deficits (See the Table which now includes CBO revised budget projections.) These don’t signal a debt crisis, and instead suggest that we can now turn to the really serious economic, health, and environmental challenges we face.

In addition, deficit reduction efforts in the rest of the world seem to clearly show that austerity efforts have been unsuccessful nearly always and everywhere in that their costs in economic damage have been far greater than any gains that have been made by nations purposefully pursuing these efforts. In cases, such as Greece, Ireland, Italy, Latvia, Portugal, and Spain, deficit reduction efforts have actually made debt problems worse than they were before harsh austerity measures cutting government spending were taken, because their negative effects on national economies and employment have also reduced tax revenues by more than the savings achieved from cutting government programs.

But Everybody’s Still Doing It

These claims about austerity’s effects seem obviously true, but they also implicitly grant the idea, that, in some cases, such as the United States, there was a debt crisis that was far less serious than most people thought, and that has already been resolved by recent deficit cutting efforts. But, the truth is that the US debt crisis was purely a political crisis, never a fiscal sustainability or fiscal responsibility crisis, and that there is a need right now to continue running much larger deficits than we are running, if we are to support the need to renew our economy, meet the most varied set of challenges we have faced since the second world war, and achieve full employment with price stability.

In their relief that deficits have already been substantially cut, and their accompanying joyous cries that “austerity is dead,” and we must get on with the job of creating full employment, progressives are making the implicit assumption that we will able to “get on with the job” while also maintaining at least some of the mainstream plans underlying budget projections over the period 2013 – 2023. Mostly, of course, they favor the Congressional Progressive Caucus (CPC) budget plan, or at least Patty Murray’s Senate plan, rather than the House or White House plans and projections (See the above table).

But regardless of the specifics, they certainly don’t envision leaving the idea of deficit reduction plans behind entirely, and focusing instead squarely on programs that will create and maintain a healthy, growing economy, characterized by full employment, price stability, and increasing economic equality, regardless of whether such programs may require deficit spending amounting to 10% or more of GDP for many years to come.

Even more, progressives apparently envision that if a “progressive” budget plan such as the CPC’s was passed, then they would try to see to it that it is implemented in the sense that Government tax revenues and spending would be managed over a 10 year period to produce the deficits projected in the CPC or some other progressive deficit reduction plan. But, this is the road to ruin, because whether such a plan is offered by progressives, by conservatives, or by Petersonians such as Erskine Bowles, President Obama, or Jack Lew, it is still austerity that is being offered.

Why Is It Austerity?

I think “austerity” is one of those terms like “fiscal responsibility” and “fiscal sustainability” that are used more as slogans than as tools for illuminating understanding. So, in some quarters, austerity is synonymous with entitlement cuts, high unemployment, lack of government investment, beating up on the poor, the old, women, and the vulnerable and other instruments or consequences of austerity. Clear analysis however, requires separating “austerity” from other things associated with it.

First, it’s important to realize that we are talking about Government-induced austerity involving medium to long-term fiscal policy characterized by a focus on reducing budget deficits, or increasing budget surpluses, and mostly on the former in today’s environment. Second, austerity involves destroying private sector net financial assets by cutting government spending and/or raising taxes in such a way that Government additions of net financial assets to the non-government portions of the economy (government deficits) fall to a level low enough that they are less than the size of the trade balance, whether in deficit or in surplus.

So, in all the mainstream budget plans the majority of annual projections envision Government additions of net financial assets (government deficits) of 3% or much less. Since, we can pretty well anticipate that we will be running a trade deficit of 3% or greater over the next 10 years, that means the private sector taken as a whole will be losing financial wealth to the government in most years covered by the mainstream (whether progressive or conservative) budget projections. And that’s why all the budget plans, the CPC and Senate plans included are embodiments of actual austerity.

Sure the CPC is better than the others in 2013 and 2014 since its Government additions (deficits) are much larger than the others in those years. But the CPC plan quickly settles into less than 2% deficit projections for the remainder of the decade, and even its projected deficits for 2013 and 2014 aren’t large enough since the high levels of unemployment, need to repair household balance sheets, and ongoing import desires suggest that a true full employment policy will require 10% of GDP in government additions (deficits) or more (depending on the private sector’s desired savings rate) for years to come, until we really beat our economic problems and/or our trade balance radically shifts.

The situation is even worse if we consider that, after 2014, even when government deficit projections exceed 3%, they exceed it by less than 1% of GDP, not enough for most of the population to get a share of the government contributed addition, in the face of the economic and political power of the financial elite to see to it that they get whatever meager gains the government is adding to the private sector.

Why is Everyone in the Mainstream Proposing Austerity?

All the mainstream deficit reduction budgets being proposed are austerity budgets. If they, or any compromise among them, were taken seriously, the eventual result would be a constriction in aggregate demand sufficient to cause another major recession in the next few years due to the private sector savings losses that are likely to be associated with these budgets as we try to implement these 10 year plans. So, why is it that everyone, including the CPC, is proposing an austerity/deficit reduction plan for the next decade?

One explanation is that everyone in the political mainstream is on board with the gradual destruction of the American middle class and the creation of a plutocracy where wealth is concentrated in the hands of a few; and that everyone also knows very well that tight budgets lead to gradual private sector financial losses falling much more heavily on the middle class and the poor, and that these, in turn, will increase the wealth gap between the rich and everyone else. In this view, the effects of these budgets are not some overlooked side effects of implementing austerity; but are a great feature of medium and long-term austerity.

I don’t know how many people fit the bill provided by this explanation, but I think that far too many of our elected officials, and, many more than we like to think, embody this explanation. The truth is that the elites are after the American people, and that in the areas that really matter we’ve become a kleptocracy, a lawless oligarchy that continuously extracts more and more financial assets from most Americans by illegal means largely with impunity because authorities will not prosecute them.

A second explanation, and one that most probably applies to progressives like Bernie Sanders, Keith Ellison, and other, but perhaps not all, members of the progressive caucus is their continued adherence to ideas about debts and deficits that may have been appropriate for gold standard economies, but don’t recognize the increased policy space for government additions to the economy (deficit spending) that Governments issuing non-convertible fiat currencies, having floating exchange rates, and no debts denominated in foreign currencies, have. These progressives along with most others who are part of the Washington, New York, “left coast” elite still seem to believe in the idea that levels of government debt and debt-to-GDP ratios matter for fiscal sustainability. They still accept the Keynesian economics orthodoxy they find in the writings of Paul Krugman, Joseph Stieglitz, Robert Kuttner, and the Center for Budget and Policy Priorities, with its doctrine of the government actively expanding deficits in bad economic times and shrinking them in good times.

That orthodoxy, worries about the trends in the debt-to-GDP ratio, and the possible reactions of the bond markets to projected debts and deficits down the road, because it worries about the possibility of hyper-inflation caused by “printing money.” It’s that perspective that informs the CPC budget, and that ensures that even it, provides for long-term austerity.

A third explanation is that a moral perspective that “debt is bad” pervades our culture and is used very successfully by Peter G. Peterson’s long-term propaganda campaign, to maintain the idea that we need to worry about the size of the public debt and the debt-to-GDP ratio, and to keep the issue of debts and deficits on the front burner.

When Will They Ever Learn?

If these explanations have some validity then at least for progressives and people in general, it is important that they understand that one can’t look at issues of government debts and deficits without noting their context in relation to the other sectors of the economy. In particular, any long-term economic plans and projections must incorporate an understanding of the Sector Financial Balances (SFB) model. The model is a simple accounting identity. Accounting identities are always true by definition alone. But, some may not be applicable to real world data and so may not be useful in explaining empirical data. The SFB model is useful, however. It says:

Domestic Private Balance + Domestic Government Balance + Foreign Balance = 0.

The terms refer to flows of financial assets among the three sectors of the economy in any defined period of time. So, for example, when the annual domestic private sector balance is positive more financial assets are flowing to that sector, taken as a whole, than it is sending to the other two sectors. Similarly, when the annual foreign sector balance is positive, more financial assets are being sent to that sector than it is sending to the other two sectors. When the private sector balance is negative, the private sector is sending more to the other two sectors, and so on.

Right now, for the United States, the annual foreign balance is positive: we are sending more financial assets to the foreign sector in trade than they are sending to us (the trade deficit). In recent years the foreign balance has varied from 3% of GDP to over 6% annually, and it is unlikely, over the next decade that it will fall below 3% in any year. So, if the Government adds less than 3% of GDP annually to the domestic private sector through deficit spending, then the private sector will be losing wealth year after year.

Now, the important question is: when will progressives, and Americans more generally, ever learn that they must look at debt/deficit plans and projections from the viewpoint of the SFB model and ask themselves whether forcing deficits of less than 3% of GDP for a number of years is both realistic and sustainable without either a credit bubble, another recession, ending in still greater poverty or inequality, or perhaps both?

Take another look at the Table. See for yourself. When evaluated from the viewpoint of the SFB model, all the mainstream plans are austerity budgets that will result in a stagnating economy to a greater or lesser degree over the next 10 years. Do we really want to condemn our country to increasing stagnation because we lack the will to commit to a fiscal policy for re-building our democracy; for fear of a Government spending-induced runaway inflation that is nowhere on the horizon, but only present in theory whether neoclassical, Keynesian, or Austrian in character?

Let us cross the inflation bridge if and when we come to it, as we did in World War II, and in the years up until the 1970s. Until then, let us put everyone to work, strengthen our safety nets for the vulnerable, educate our young, and rebuild our nation, before we devolve into a sorry third world mess of desperately angry and resentful people, ruled by a very small minority of fabulously wealthy but frightened people who will brutalize us all.

(Author’s Note: I know, I know. I haven’t addressed the growing debt problems and the inflation question in any detail in this already too lengthy post. Sorry for that. But I have addressed both of these more expansively in my new kindle e-book on Fixing the Debt Without Breaking America. So, if you trust me when I say that these are nothing we can’t easily handle, then you don’t have to read it. But if you don’t trust me, then you can get my book from Amazon and see for yourself. Remember, you don’t need to own Kindle hardware to download and read a kindle book. Amazon provides Kindle software for various platforms that allow you to read all its kindle books.)

The post makes an important point: almost no one includes financial flows in their model of spending and deficit reduction (and everyone has a model whether they realize it or not). We’re all gussied up, ready to repeat history for the upteenth time because we want to ignore the reality of balance sheets to satisfy some deep-rooted political urge.

I think that on the progressive side many are indeed well-meaning, but just wrong. I heard a commencement speech last week by Gary Hirshberg (Stonyfield Farm yogurt founder and CEO) that I think probably captures a good deal of the thinking of establishment boomer progressives of the kind that are now the financial and organizational backbone of the Democratic party. Here’s a key early passage in the speech

Especially troubling is that fact that many of our most heralded financial institutions and leaders have been culpable in fueling the nation’s economic instability with short-term, greed-driven thinking. Here in the U.S., we got into a fiscal mess that will take years to repair by borrowing money we didn’t have to buy stuff we didn’t need or couldn’t afford. We voluntarily put on blinders and willfully ignored the consequences of our short-term thinking.

The bottom line is that many of the so-called experts have been wrong and now need to be second-guessed. And that is actually your job. We now know we can’t export away our manufacturing capacity. We can’t expect to have a growing economy while enriching the wealthy but squeezing down the middle class.

In short, 20-century rules don’t work anymore. We need new rules now.

We can’t build a strong nation without investing in infrastructure. We can’t just assume that good education happens by itself without serious investment in our teachers. And I surely don’t understand how we can subsidize troubled banks, businesses and farms, but load our next generation of college-educated leaders with crushing debt that will take a generation or more to pay back.

In short, 20-century rules don’t work anymore. We need new rules now. And not being able to rely on experts and conventional wisdom surely spells special challenges, but also opportunities for you.

I think the reference to the deficit in this context suggests Hirshberg seem no difference between public debt and private debt. It’s all just one big mass of excessive debt. Hirshberg then goes on to recommend a list of public investments in green economy, education, etc. But unfortunately, like so many of the folks who are running the Democratic Party, his fixation on debt means in his mind that carrying out these investments means a lot of “touch choices”.

There is also a long-standing popular narrative about the Iraq War among anti-war progressives that what was wrong with it was that it was “put on a credit card”. They sometimes go on to link the 2008 crash to Iraq War deficit spending, thus reliving themselves of confronting the fact that Clintonism and its neoliberalism, deregulation and

“re-inventing government” have played a large role in dismantling the US social balance and undermining prosperity.

Note also that a lot of these folks have a self-image as moral heroes because they are offering to slash the entitlements that primarily benefit their generation right now – Social Security and Medicare – in favor of investment in their children’s and grandchildren’s futures.

Of course, Hirshberg himself does not need Medicare or Social Security.

Sad really, because all of the positive stuff about supporting infrastructure spending and investing in education, won’t happen unless progressives can get their head around sectoral balances. All the naysayers have to do is retort ‘whose going to pay for it all’. This huge black hole of ignorance makes it unlikely that ‘progressive’ politicians can steer the US (and UK for that matter) economy away from its current path of economic, social and political chaos.

The vast majority of Iraq War spending was not covered by Appropriations. Rather, it was covered with emergency supplemental spending bills.

Thanks, Dan. I agree with your analysis, of course. And will also add that it’s Hershberg who’s the 20th century thinker, since it is he who evidently believes that “teh debt” is a burden and must be paid back or paid down through increased taxation.

Spelled Hirshberg wrong. Hate it when I do that!

I understand the model when looking at a closed system, but how does increase in real wealth (ie, work done) enter this system? How is it recognized (or not)?

The SFB doesn’t address real wealth. It focuses on flows of net financial assets. When the government adds to the net financial assets of the private sector the way that impacts real wealth depends on how the additions are used. If they’re used to produce or create value that will increase real wealth. If tax cuts for the wealthy are the basis for the gap between spending and tax revenues, then that depends on if, when, and how, the wealthy spend money. All indications are that their spending multiplier is very low.

Thank you! I will think on this and hope to grok it in fullness.

The move towards austerity is not based on any kind of economics as such. It is a political movement to change the locus of power from the central governments to the multi-national corporate sector. The multi-nationals figure that they are huge, they can thrive because of their political power whether national economies go up or down–why have the middle man. Why spend large amounts of money bribing (in many varied ways) public officials? Why not move to make institutional what is already de facto the case?

One of the main reasons there was so much opposition by corporations to the U.S. instituting any kind of sensible health-care system was not so much that the HC industry might lose a lot of money–because a lot of corporations would then save money, but because the fact the U.S. government might actually run a highly visible and successful operation (and it would be successful) it would get the idea into people’s heads that maybe the government could do other things to benefit the citizens and thereby ruin the 24/7 propaganda campaign that has gone on since Roosevelt that government is bad and the decades long single-minded agenda that has made government worse with every election such that it is, at this point, moribund. If a typical health-care system would have been instituted it would have resulted in a massive change in the power-relations of this country and given citizens hope and focused them on seriously reforming their federal government which is in serious need of emergency treatment.

Everything “economic” is political at heart.

It is the greatest irony that single payer is rejected but austerity is demanded. Single payer could fix our long term budget “problems” – which everyone knows is code for “medicare.” By medicare-for-all the savings would be astronomical compared to the astronomical giveaway to pharma and insurance currently killing our budget. But whatever. Since the progressives began in 1890 they have been obsessed with creating demand and pushing consumerism in order to out-marx Marx. That isn’t going to work anymore. So it’s a standoff – an American standoff – in which the rich don’t care if they kill off all their customers as long as they still maintain control over their industries.

Single-payer would save about 2-4% of GDP–that is an extraordinary savings! But everyone knows that single-payer of something like the French or Swiss system would save money–that was never an argument. That’s the point. Again, if something were shown to work it would be a threat to the system–what would be next? Maybe nationalizing the banking system?

More like 6% of GDP or $880 B annually if we’re able to cut expenses to the level of the Canadian system at 12% of GDP.

Thanks banger, I’ve tried making the same point here a number of times. There’s no government program on the table that would harm the wealthy or cost them any serious money. But if average Americans got interested in politics and came to understand the power of government, it would indeed harm the wealthy. In fact it could ultimately drive the wealthy out of existence. They’d be so poor they had to get jobs.

I think it’s not wealth but power that the ruling elites want. I don’t think their preponderance of their wealth would ever be in danger in our culture.

“The move towards austerity is not based on any kind of economics as such. It is a political movement to change the locus of power from the central governments to the multi-national corporate sector. ”

Nobody said jurisdictionl boundaries were forever.

The SFB model says also a lot about international commerce positions. In the world as a whole the sum of all foreign balances must be = 0 and some countries superavit is, by definition, equal to the deficit of other nations.

Now most OECD countries have embarqued in a mercantilistic race for superavits (“Germanization” of all countries) and to do so (competitivity reigns) we are told that “sacrifices” are needed. Sacrifices mean unemployment, underemployment and reduced public services. Magically, we are told, this will create confidence and finally a recovery. But such recovery cannot occur unless someone does the contrary.

International treaties do not account this issues and mercantilistic approaches are allowed without any control. That should also change.

Right see: http://www.correntewire.com/bobo_and_race_bottom It’s the fallacy of composition.

I apologize up front for my possible uninformed and anecdotal opinion, yet I claim my freedom of speech.

First, Firestone’s piece is cast in 3 sections. The 3rd section is the heart of it and on target. Why subject readers to the 1st two?

Second, if one had polled citizens in the years following WW II, asking about “first responders,” they would have wondered what the hell you were talking about. “Oh, you mean firemen and policemen?” It’s enlightening to see what’s happened to their budgets and capabilities in the years since. In the 1st case, minor improvements in fighting forest fires? In the 2nd, Olympian records in imprisonment, the industrial prison complex, homeland security, militarization, surveillance, cointelpro operations (yeah, we had that back then too but at least it was secret), etc.

Ha! Ha! What’s wrong with the first two? And why are there only three? I think I see five.

Listened to Glen Hubbard the other day. Smooth, but still evil. So if he’s on the radio, austerity is still on sale.

What is needed is merely government MONEY, not an increase in the size of government.

So just hand it out. And if price inflation takes off then slap leverage restrictions on the counterfeiting cartel, the banks, to compensate.

I think people want and need jobs, and won’t be happy with just helicopter drops. In addition, the objective of the Government “buying jobs” for people is to produce valued things and services. That is its own hedge against inflation.

The helicopter drops WOULD create jobs since non-debtors would receive an equal amount too.

And paying people to waste their time is a triple waste – of time, money and morale.

Of course, we should spend generously on infrastructure too.

I agree that helicopter drops would create jobs too, if they’re made to the right people and not to the already wealthy. However, they won’t provide the inflation hedge provided by an MMT-based Job Guarantee program. They also won’t provide a permanent solution to the problem of using unemployed people to dampen inflation. In addition they also wouldn’t provide any direction of the money to results of high value for communities or public purpose. Helicopter drops are ad hoc measures against recession. We’d have to fight for them each time. The Job Guarantee is an institutionalized solution.

“Ad-hoc?” No. Helicopter drops are JUST restitution and they could neatly fill the hole in the money supply a temporary ban on new credit creation would create.

Why temporary? Because purely private credit creation is ethical and should be allowed after all deposits are 100% backed by reserves and a government-provided fiat storage and transaction service is established and the lender of last resort and government deposit insurance abolished.

With respect Joe, I have to ask you: What part of “loans create deposits” = counterfeiting don’t you get?

Austerity is like treating a sick patient as if they were not sick. It would be considered malpractice.

I think it’s like bleeding a sick patient with leeches.

If one believes that “austerity” is nothing more than a deliberate effort by the financial elite to squeeze more from the middle class to further enrich themselves, then economic models will not convince them otherwise. The powers that be will not listen to arguments that “prove” austerity is bad for the general health of the economy. They don’t care. Isn’t that rather obvious with all that’s transpired? Their goal is to obtain more wealth and more power, period. Arguing theory and offering models will NOT stop this corruption.

At this point, I’m not concerned with the financial elite, but with the progressives who have staked out a position in the economic mainstream about where Paul Krugman, Joe Stieglitz, and Dean Baker are at and just won’t listen to anything that questions the very existence of a debt/deficit problem.

I don’t think they’re doing this out of malice; but more out of a need to be seen as “respectable” when it comes to fiscal policy. I don’t really believe that people like Sanders, Ellison, Grijalva, Brown, and Grayson are really part of the drive towards creating a plutocracy. So, that leaves and unwillingness to learn, or an unwillingness to be honest about what they’ve learned because they think they cannot ‘sell it.” Either way I think they can be reached.

Only a minority of people can understand the “sectoral balances” outlook on our nation’s economics. It isn’t only boomers who are confused on this. Getting from the personal understanding of money and debt to the correct one of sectoral balances and managing the money supply is a classic paradigm shift. Most people’s personal experiences with money and debt make it impossible for them to see any other way. Refraining from “printing” more money is like swallowing your spit if you’re thirsty. No additional moisture allowed!

The issue isn’t confusion about sectoral balances.

Rather, the issue is that what is wrong with our system is distributional in nature. It has nothing to do with the aggregate size of the pie.

I think it IS a confusion about sectoral balances. They cannot by and large conceptualize the government level sectors with their own level of “sectors.” It’s another case of thinking that government finances are just like a family’s finances. They don’t understand that the only family that can operate like a govenment is a family of counterfeiters.

I’m fascinated that even this response ignores the distribution of wealth in our society :)

Good imaging. But I really don’t believe that. I think most NY Times and WaPo readers and most people interested in politics can understand the SFB Model. It’s just a simple equation for God’s sake. They all took a little bit of Algebra. I don’t think we should be afraid to advance it or to repeat it. I also think we need to keep talking about and making fun of CBO and the other projectionists for not incorporating it into their models. Eventually we’re going to win that point. But we can’t give up or believe the BS that the people can’t understand. They can, and we need to make ’em do it!

“I think “austerity” is one of those terms like “fiscal responsibility” and “fiscal sustainability” that are used more as slogans than as tools for illuminating understanding.”

You start off so great, acknowledging that austerity is a meaningless term.

And then…”First, it’s important to realize that we are talking about Government-induced austerity involving medium to long-term fiscal policy characterized by a focus on reducing budget deficits, or increasing budget surpluses, and mostly on the former in today’s environment.”

What? By that definition, austerity doesn’t exist. Governments don’t care about budget deficits. Republicans don’t care. Democrats don’t care. Americans don’t care. Japanese don’t care. Europeans don’t care. This planet is awash in governments spending more than their tax receipts, in large amounts, over long periods of time.

What matters is how the money is spent.

“Let us cross the inflation bridge if and when we come to it”

Whereby ‘we’, comfortable liberals mean when it impacts comfortable liberals. Who cares about prices of rent and food and gas and medicine and vacation and college today. You can just go get a job that pays $60,000 or $80,000 or $100,000 a year. They’re everywhere!

Forgive me. But I think this is a silly comment. Sure, it’s not the deficits they really care about. They really care about getting the plutocracy. But they’re trying to do that by proposing and implementing 10 year plans featuring Government austerity as I’ve defined it.

Also, this:

““Let us cross the inflation bridge if and when we come to it”

Whereby ‘we’, comfortable liberals mean when it impacts comfortable liberals. Who cares about prices of rent and food and gas and medicine and vacation and college today. You can just go get a job that pays $60,000 or $80,000 or $100,000 a year. They’re everywhere!”

is just so much BS!

I care about inflation in rent, food, gas, medicine, college, etc. And I think most of my MMT friends do too. Remember two basic goals of MMT are FULL EMPLOYMENT and PRICE STABILITY. If inflation due to Government spending occurs, then MMT-based policies will vigorously attack it. And the inflation-fighting elements will be designed into our expansive fiscal policies if we get our way. What our policies won’t do however is to fight inflation with a large buffer stock of unemployed people who keep wages low for the large corporations and other businesses who want to exploit labor. We won’t sacrifice the lives and futures of nearly 30 million people on the altar of the inflation bogeyman.

Professor, I appreciate the response! What I don’t understand is why you ignore the critique of your position that what matters first and foremost is how money is spent?

We have a fundamentally distributional problem, not one of aggregate size. It feels like you are intentionally ignoring this in furtherance of preaching the gospel of spending more money. Our existing leadership has deficit spent $10 trillion over the past decade, and it has made us poorer, not richer, because it is all going to connected insiders.

“If inflation due to Government spending occurs, then MMT-based policies will vigorously attack it”

My gut reaction here is to be extremely sarcastic. I have taken to calling this perspective the inflation-denying wing of MMT precisely because people are out there arguing that even bad spending is better than no spending because of the Magic Unicorn of Demand. (never mind how hilarious it is that liberals have embraced the Chicago school idea that monetary policy matters)

Are you disagreeing with the spend money even if it’s wasteful wing of MMT?

Are you saying that you support disbanding the TSA and the DEA and stopping the arrests of millions of drug users and immigrants? That you support significantly increasing marginal income tax and estate tax rates? That you support treating all compensation the same for tax purposes as wage income? That you support lifting the cap on FICA taxes? That you support cutting the military budget in half? That you support selling the Fed holdings of Treasury Securities and MBS? That you support ending agribusiness subsidies? That you support having Medicare negotiate volume discounts with hospital franchises and drug dealers? Are you saying you support the end of idiotic mandates like No Child Left Behind, Race to the Top, and I-9s/E-Verify?

Universal unemployment insurance, a much higher minimum wage, universal health insurance, universal paid time off, and prosecution of financial fraud and war crimes would do much more to heal our economy than any magnitude of deficit spending on yet more corporate welfare.

Or let me try an additional approach:

“Since, we can pretty well anticipate that we will be running a trade deficit of 3% or greater over the next 10 years, that means the private sector taken as a whole will be losing financial wealth to the government in most years covered by the mainstream (whether progressive or conservative) budget projections.”

That is exactly what we need, a net transfer of wealth from the predatory elite to the public commons. That’s the only way to undo decades of plunder that has culminated in such massive inequality and unconstitutional governance that it is tearing our society apart.

Everything else is noise.

Joe writes:

“Government additions of net financial assets to the non-government portions of the economy fall to a level low enough that they are less than the size of the trade balance.”

I know you are REALLY into formulas, Joe, but without using a formula, please explain to me (and us) why deficits have to be as large as the trade imbalance.

In addition, government is not the only player to add financial assets to the non-government sector.

I just bougt some annuities recently, out of my savings.

And, by the way, you seem to disparage savings, as when it is plugged into your formula, it becomes the bad guy.

Don Levit

You’re confusing financial assets with net financial assets. A net increase in total financial assets can only be achieved via inflow from another sector. You can buy all the annuities you want, issue all the corporate bonds you want; it’s just a swap resulting in one asset and one liability which together net to an increase of zero.

For one sector to run a positive financial balance another must run a negative balance. For one to save another must spend.

Thanks for the help, Ben. Didn’t see it till after I replied.

Hi Don, always nice to spar with you a bit. So let’s go.

“I know you are REALLY into formulas, Joe, but without using a formula, please explain to me (and us) why deficits have to be as large as the trade imbalance.”

Deficits as a percent of GDP have to be as large because if they’re not, there will be a net flow of financial assets out of the private sector into the other two; so the private sector will get poorer in financial assets. I don’t want that to happen. I want the private sector to be able to satisfy its reasonable collective savings desires. I especially want middle class and poor people to be able to satisfy these so that we can reverse the ruinous trend toward economic inequality we’ve been seeing since the 1970s.

“In addition, government is not the only player to add financial assets to the non-government sector.”

Right. But it is the only player who can add NET FINANCIAL ASSETS to the private sector. The way you’ve phrased it in the quote just above, you’ve collapsed the SFB into two sectors. The Government and the non-Government. The sum of the two must equal zero. That’s the accounting identity. I have no problem saying that because I know you are smart enough to understand it. If the non-Government is going to be in surplus; a result we normally want; then the Government must be in deficit. There is no other possibility Don.

“I just bougt some annuities recently, out of my savings.

And, by the way, you seem to disparage savings, as when it is plugged into your formula, it becomes the bad guy.”

Well, you traded your savings in money for the annuity. That doesn’t change Net Financial Assets in the private sector Don. Whatever happens to you as a result of buying the annuity, they remain the unchanged by your transaction.

Also, why do you think I’m saying that savings is the bad guy. I think private sector savings are great. I’m happy for people to have ample savings, and I’m happy to have the government facilitate this with Government additions (deficits) to the economy when these are needed to create and maintain full employment.

@Ben Johannson

An increase of zero what? A checking account of $1000 is the owner’s asset and the bank’s liability. Netting to zero? Or netting to $1000 of lawful liquid medium of exchange, and $1000 less illiquid equity for the bank to declare on its annual report than if it hadn’t the liability? Those are two different things, only one of which is money. The value of circulating exchange media is not diminished by any measure of corporate debt.

Putting it another way…if private deposits are commercial banks’ liabilities, netting to zero, doesn’t that imply, by MMT’s light, that new NFA’s, from government deficits, augment private deposits not at all?

‘Putting it another way…if private deposits are commercial banks’ liabilities, netting to zero, doesn’t that imply, by MMT’s light, that new NFA’s, from government deficits, augment private deposits not at all?”

Under current conditions when the government issues debt to deficit spend the deposits are not augmented at all, but the net financial assets are because of all those new Treasuries in private security accounts. See: http://neweconomicperspectives.org/2010/11/yes-deficit-spending-adds-to-private.html

Joe wrote:

When the government issues debt, net financial assets are augmented because of all those new Treasuries in private security accounts.

The private security accounts have an asset, the Treasuries.

The government has a liabiity, increased debt held by the public in private secirity accounts.

The result is an accounting wash, not an increase in net financial assets.

Don Levit

Joe: “When the government issues debt, net financial assets are augmented because of all those new Treasuries in private security accounts.”

Don: “The private security accounts have an asset, the Treasuries.

The government has a liabiity, increased debt held by the public in private secirity accounts.

The result is an accounting wash, not an increase in net financial assets.”

That’s right, but notice I was talking about what happens in the private sector. While I agree that the Government has an increased liability in the form of its commitment to repay, it’s commitment is one made by a fiat sovereign. So, it can always get the money it owes n various ways. Additional debt issuance is one way of repaying. So is direct Treasury issuance of reserves, if Congress allows this. So is Platinum Coin Seigniorage followed by Treasury repayments, which doesn’t require the further consent of Congress.

So the meaning the Government’s liability is not the same for the government as a liability would be for you and me, simply because the Government is the ultimate and continuing creator of net financial resources, while you and I and every other entity are users of the financial resources the government creates.

Bill Mitchell says that “Debt is not Debt.” And he is right. In the US Government debt issuance is part of an elaborate fiction that government must get its financial resources either by taxing or borrowing and that, as a result, there is a Government Budget Constraint. There is no such constraint. Government debt is not like your debt or mine, because government can always cast aside the fiction of its dollar scarcity if it needs to do that to make good on its debts. We on the other hand must always cope with dollar scarcity and with the knowledge that when we repay debts it costs us money we cannot regenerate by using constitutionally unlimited money or debt issuance authority.

Also in support of Joe’s answer, government deficit spending increases non-government financial assets because the liabilities accumulate to the government sector, whereas the non-government sector simply gains an asset.

There will always be a corresponding liability to any asset, what matters is who’s asset and who’s liability.

Ben wrote:

There will always be a corresponding liabiity to any asset.

What matters is whose asset and whose liability.

You seem to suggest that government liabilities are in a lower level of importance than private sector assets.

On what basis are you making that value judgment?

From my perspective, liabilities are just as important as their corresponding assets.

Just because the asset in your situation is a defined entity (person, etc), and the liability is the American public, makes it no less valuable than the corresponding asset.

Don Levit

The government debt liability is not to the American public in the sense that it is your liability or my liability. No currency user issued that debt. Our government issued that debt and it has both the constitutional obligation and the constitutional authority to repay it with as much money as it wants to create or as much additional as it wants to issue.

So we have a political problem, and that problem is to get the Government to abandon its debt issuance practices and use its money issuance authority to get the debt/deficit issues off the table so we can rebuild our nation. The ways to solve this problem are described in my kindle e-book: http://amzn.to/Z7kG5q

I may be misunderstanding what people here are saying, but

EconCCX: if private deposits are commercial banks’ liabilities, netting to zero, doesn’t that imply, by MMT’s light, that new NFA’s, from government deficits, augment private deposits not at all? Is not true, a non sequitur. While augmenting private deposits need not happen, in the ordinary course of government spending, it will happen. Private deposits may not be enlarged by deficit spending simply (and ONLY) because people may keep their money in mattresses or directly in treasury bonds. Ordinarily, people don’t and they keep their money, e.g. their SS or widget check proceeds, in banks, and then private deposits will increase.

As Kelton says at the end – note the first sentence:

My bank account has an additional $10 in it (my asset), which is offset by the fact that BoA owes me an additional $10 (their liability). This nets to zero. But, wait! There is still a new financial asset out there . . . the government bond! And this clearly shows that deficit spending, even when we account for the sale of government bonds, increases the private sector’s holding of net financial assets.

Issuing treasuries or not, has nothing to do with it. It only changes whether the bank holds treasuries or reserves. So Joe is right in his piece, and wrong or misleading or confusing in his comment when he seems to agree with the non sequitur statement you initially made. The problem may be because people are considering the injection of new NFA as occurring in different places in the processes.

To me, a Treasury is a quasi reserve currency, freely substitutable for interbank and global trade settlement currency. More or less, yes, if I understand you correctly. Treasuries are high up, the quasi-top, on the pyramid of money/credit.

It increases the purchasing power of financial institutions rather than depositors. Thus it exacerbates inequality. This is again a non sequitur. If you are saying modern “fractional reserve” banking is bad, and we should have all-public banks, fine. But any financial instrument, any form of money is an expression of inequality, an asymmetric credit-debt relationship. If things are working right, this relationship “justly” results from asymmetric real world events. E.g a purchase results in a credit in exchange for a commodity. In a good boring banking system, or a public one, say with the Bank of North Dakota holding T-bonds or reserves, this increase in purchasing power of financial institutions SHOULD occur. Because they are giving e.g. depositors, something of value, their account at the bank, in exchange for it.

So such a criticism is far too general.

Hi Cal,

“”My bank account has an additional $10 in it (my asset), which is offset by the fact that BoA owes me an additional $10 (their liability). This nets to zero. But, wait! There is still a new financial asset out there . . . the government bond! And this clearly shows that deficit spending, even when we account for the sale of government bonds, increases the private sector’s holding of net financial assets.”

Issuing treasuries or not, has nothing to do with it. It only changes whether the bank holds treasuries or reserves.”

Thanks for your help, but doesn’t your quote from Stephanie say the net financial assets added to the private sector are the treasuries. If so, then I think the result has something to do with Treasury issuance. Especially since if there were deficit spending without Treasury issuance the net financial assets added would be reserves.

Joe: The point is that private deposits are augmented; basically 1-1 with net government spending. Kelton has a new $10 in her account. (She got $100 in spending and paid $90 in tax.) That is what it seems to me that EconCCX denied would occur, and that occurs basically independently of what form the new NFAs held by the banks take, treasuries or reserves.

@Joe Firestone wrote

I’m surprised to see an MMT proponent see no boost in deposit accounts through USG deficits spending. Note that seventeen minutes earlier, you wrote:

To me, a Treasury is a quasi reserve currency, freely substitutable for interbank and global trade settlement currency. It increases the purchasing power of financial institutions rather than depositors. Thus it exacerbates inequality. If inequality is a problem, wouldn’t it be better addressed by a pre-Reagan tax code? Or by Ellen Brown’s public banking plan, which enables public institutions to create deposit currency rather than reserve currency?

I think the misunderstanding is arising because you’re looking only at the spending and its effect on deposits. Of course, it increments those. But start from:

1. The debt issuance

2. The exchange of the security for the private sector money decrements bank deposits, and adds Treasuries to private security accounts.

3. The Government spending creates new money in the private sector replacing the money the government received for its bonds. So, by this point, the money bets to zero. But

4. the Treasuries remain as new net financial assets in security accounts.

See Professor Stephanie Kelton’s Post, linked to above for a more complete treatment of what happens.

“If inequality is a problem, wouldn’t it be better addressed by a pre-Reagan tax code?”

I’m all for a pre-Reagan Tax code. I might even be for an FDR tax code. But there are other ways to reduce inequality. Property taxes on Home square footage. Massive inheritance taxes. And also much stronger safety nets and benefits for all citizens as in some of the European countries, especially as in Scandinavia.

“Or by Ellen Brown’s public banking plan, which enables public institutions to create deposit currency rather than reserve currency?”

I’m not sure what you mean by distinguishing “reserve currency” from “deposit currency.” “Reserve currency” just refers to the status of US currency in international trade. But otherwise it is no different from “currency.”

On “public banking,” my view of it is favorable. In fact, I’d like to go the whole way and only have banks that are public. No stockholders. No private ownership.

Please don’t call me a socialist. I don’t believe in public ownership of everything; just systemically dangerous institutions like banks and others that are totally clothed with the public interest like the post office, and the health insurance function. My general principle is if private ownership works both for private interests and public purpose then fine; but if it works against the public interest, then it should not be private.

Austerity is about looting and suppression of the 99%s of the world. So in practical terms, it is a great success.

We can look at it from a sectoral balances approach and see why it doesn’t work for the rest of us, but the important point remains it was never meant to work for the rest of us.

Career progressives have a duty to be informed about ideas such as those expressed in this post. Such knowledge is supposedly the justification for the positions they hold and the fame and prestige they garner. More than this, these ideas and many others about effective, workable ways to fix what is broken in our economy and society have been out there for years, and widely discussed at sites like this one. I don’t call their embrace of austerity a mistake or a poor choice. I call it bad faith. They choose not to know what they can know, what they have a duty to know, and what many without their resources and compensation already know. Others may be more patient, but I for one am done waiting for career progressives and Establishment liberals to see the light. For me, they are propagandists of a thoroughly corrupt status quo. It is just that they tailor their message to a certain part of the political spectrum, just as an astroturfed Tea Party does to another.

I generally agree, Hugh. And I certainly am not waiting for anyone. However, that doesn’t mean it’s not worthwhile to try to get some current officeholders and other to share our views. I wouldn’t waste my time on people who’ve been bought by the various elites trying to create a kleptocratic plutocracy. But, I also think there are some who not trying to do this and this post was really an attempt to get them to think.

Howdy! I know this is kinda off topic however , I’d figured I’d ask.

Would you be interested in exchanging links or maybe guest writing a blog article

or vice-versa? My blog addresses a lot of

the same topics as yours and I think we could greatly benefit from each other.

If you happen to be interested feel free to shoot me an e-mail.

I look forward to hearing from you! Awesome blog by the way!

DVD the start and the government of standards, and the fleet condition of the entertainment diligence is entirely coupled to its predecessor, the CD and VCD discs are so born out. The ever-increasing demands of the media giants to stimulate the tools manufacturers developed a advanced DVD disc.

Both crude roots, ok or rise with this overwhelming Mini wind delineated a new look unforeseeable, It seems that this summer is in reality only the drop down is the most IN!

In case anyone is still reading this, I would love to hear an MMT defense of spying on American citizens.