By Houses and Holes, who is a regular contributor at The Sydney Morning Herald, The Age, and The Drum and is a former commentator at Business Spectator. He is also the co-author of The Great Crash of 2008 with Ross Garnaut. He edits MacroBusiness. Cross posted from MacroBusiness.

Late last week, Society Generale published a succinct note explaining its view of why China’s credit growth is accelerating but its growth is not.

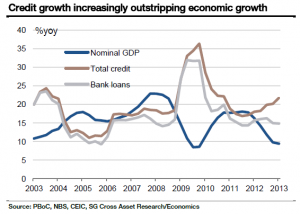

In the first quarter, China’s total credit growth – bank loans, shadow banking credit and corporate bond together – accelerated to the north of 20% yoy, more than twice the pace of nominal GDP growth. This gap has been widening since early 2012.

True, the gap was once close to 30ppt in 2009 and credit growth looked like leading economic growth most of the time in the past ten years. However, we still think the recent divergence is particularly worrying.

Since 2009, China’s credit growth has outpaced nominal GDP growth in every quarter except one (Q4 11), whereas, in previous years, economic growth managed to better credit growth more than half of the time. The excess borrowing that occurred in 2009 has never been absorbed by the real economy and now more borrowing is being piled on top of this.

In addition, the credit binge in 2009 was a result of the exogenous policy shock engineered by Beijing. Authorities were quick to boost credit supply within months of the breakout of the Great Recession, long before generic credit demand from corporates picked up. However, this time, the economic slowdown as well as the credit pick-up is largely endogenous…

Another big difference between the current situation and that which occurred in 2009 is the greater and increasing presence of non-bank credit…Borrowing from shadow channels like trusts are hardly a voluntary choice, as costs are often stiflingly high and duration unpleasantly short. Hence, there is an issue of adverse selection. It is those who are unable to roll over bank loans that have to tap the shadow banking system and refinance at more demanding terms…

Debt snowball

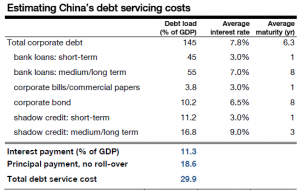

A fast rising debt load of an economy suggests either deteriorating growth efficiency or high and rising debt service cost, or in many cases both. There is clear evidence that China is suffering from both of these. We have written extensively on the point of declining growth and summarised the causes as: 1) excess capacity resulting from inefficient investment in the past and 2) increasingly marginalised private sector.Here, we focus on the debt problem. Adopting the methodology from a 2012 BIS paper 1 , we manage to estimate China’s debt service ratio (DSR) at the macro level, and the result is very alarming…

A Minsky moment?

As a reference, the BIS paper estimated that a number of economies had similar or moderately lower debt service ratios (DSRs) when they were headed towards serious financial and economic crises. Examples include Finland (early 1990s), Korea (1997), the UK (2009), and the US (2009). This is one more data point in China that evokes the troubling thought of a hard landing.

However, we also agree that the actual DSR is probably lower. The assumption of an instalment-loan schedule implies that roll-over is not an option and all debt is fully repaid at maturity. This is clearly not the case in China…Hence, the logical conclusion has to be that a non-negligible share of the corporate sector is not able to repay either principal or interest, which qualifies as Ponzi financing in a Minsky framework…some degree of credit crunch will still be unavoidable in the next three years, which lends weight to our below-consensus medium-term growth forecast.

Lambert here. On “Minsky Moment,” I’m going to quote a Krugman post, since it has one of the all-time great headlines in the political economy blogosphere:

The night they reread Minsky*

[W]hat we really need is a model that can produce a Minsky moment — the point at which margin calls force deleveraging.

And (of all places) US News (cited by Wray):

[Hyman Minsky while] teaching economics at Washington University in St. Louis, among other venues, developed a theory about how financial panics happen. His Financial Instability Hypothesis describes a process by which the normal, profit-maximizing behavior of borrowers and lenders leads inevitably to crisis. (If you’re interested, the New Yorker’s John Cassidy does a wonderful job of explaining Minsky on his blog and in his superb book, How Markets Fail.)

The panic is usually preceded by what has come to be known as a “Minsky moment”—the point when a critical mass of investors realizes that the overleveraged party is about to end, so they flee for the door—ensuring, of course, that the party ends. Market outcomes are often self-fulfilling.

NOTE * The reference:

“Ten terrific girls, but only nine costumes…”

When can kicking no longer works, disparage/crash someone else’s economy…..and then you can say, but, but, we would have been fine but X’s economy crash took everyone down…..its all X’s fault.

Maybe China can get through this rough period by cashing in some of their US debt……

I am not surprised that they are exchanging debt for pork.

Apparently, they can not satiate the demand for xiao long bao.

There is a saying, for a cow, it’s best to be born in a Hindu country; for a pig, it’s any Muslim country. Any animals born in China – bad karma from the previous carnation.

as in before I was a carnation, I was a rose?

And the best country to be a tulip in is Holland.

Minsky’s theory of past life regression.

Please, please — which country for a rose? Or maybe the color of a rose?

China’s export-driven economy, however, is based on vendor financing.

We’re seeing now how that has worked out for another major country that followed the same economic prescription: Germany.

A solution for both economies might be to promulgate policies that spur internal demand. However, in neoliberal theology, that’s an apostasy worthy of getting one burned at the stake.

I have a hard time thinking about what the trigger for the next crisis is since each country is pretty much holding each other’s b**ls (pardon the rough language). We have the second and third largest economy operating on a Ponzi scheme with several people also alleging that the biggest is similarly one. Feels like a house of cards, but what’s going to tip the whole thing over?

It won’t be a kick the whole thing over situation. I think it would be more like the Asian stock market crisis of 1997. The “smart” money moved their money to more stable places such as the U.S. The U.S. economy broke when sideline money was spent and Greenspan cut hiked rates because he was concerned about an overheating economy*. Money will flow from point A to point B as countries and corporations kill the weaker herd members. The UK, Australia, Canada, and the U.S. would be the beneficiary of the rush out with their geographic isolation. If I was a fairly wealthy Chinese businessman, maybe not a titan of business then I would live on a boat which might be cool to do, I would be trying to get to Vancouver. Eventually, wealth disparity will cause problems in those same countries, but Hezbollah/whatever terrorist du jour can’t just cross the border to strike.

*He wanted to deliver the White House. If the tech bubble went on too long, W. would not have been able to steal an election.

I find it pretty hilarious that mainstream economists think the idea that markets are inherently unstable is somehow anything other than painfully obvious. That’s the whole point of government – without a referee, the game naturally devolves into a pointless and even potentially dangerous exercise.

The problem isn’t greed or irrationality or anything; reasonable individual actions cause all sorts of communal problems, from financial crashes to environmental pollution. This is why human beings are naturally social, cooperative creatures. That is a much more efficient way of organizing resources and solving problems.

Why can’t more videos be so balanced? Saved me from the new Gatsby. Might be hope for a post-WWI revival.

The underlying economy isn’t growing as fast as the credit bubble. Debt service will soon become too expensive. And the already-too-small underlying economy will crash. What is wrong with this economy? Why isn’t more emphasis put on the underlying economy in stead of cowboy economics? China should be able to do this, right? It’s a communist country. But it can do nothing about the underlying economy. That’s weird. And economists like Reinhart and Rogoff say, well after you’ve borrowed too much money for your economy to sustain, then you must impose austerity because the high level of debt slows the economy down! Nobody ever puts in terms of the “free” market v. the social good. Nobody ever does anything to create a resilient underlying economy.

Hey! This is kind of off topic but I need some guidance from an established blog.

Is it hard to set up your own blog? I’m not very techincal but I can figure things out pretty fast. I’m thinking

about setting up my own but I’m not sure where to start. Do you have any tips or suggestions? Cheers

I think you’ll find the Chinese Communist party has clamped down on the main source of the credit boom the housing market with a capital gains tax.

Well it’s a good thing China so far has refused (at least to fully implement) that less than unintelligent advice of increasing domestic consumption as I read a somewhat older article the other day on RT that Japan is now a net importer and more so with liquid natural gas now that there shutting down nuclear power, so what that says to me is there still importing raw materials and fuel to build cars and other consumer items for themselves but there exports have dropped leaving less money to import raw materials. This domestic super consumer economy idea is about as intelligent as a carpenter who buys wood to make furniture and pointlessly burns all of it instead of making furniture and selling it to buy more wood. Now it would be a different story if it was for survival but my whole point is im sure Japan and China would do just fine with public transportation and at worse mopeds and motor cycles rather than SUV’s.

And I will just wait for the all too predictable comment defending consumerism before I give my maybe solution for a “sustainable” last forever economy. But all I can say is the world has changed and not all ideas from 30+ years will work anymore.

I guess I will try to explain my belief for a more sustainable economy.

First off im not against consumption in all its forms its just that we should be careful of wasting non-renewable resources like copper and steel and where we do use them the items should be easy to fix and recycle.

Second- I think the reason most people support consumerism is because it has a wealth re-distribution effect as far as it takes people to build cars but with increasing levels of automation that is becoming irrelevant for the high level of material input required and its only a matter of time till we see NASAs Robonaut 2 or Hondas ASMO on every factory floor.

On the wealth distribution part I know everybody hates gambling but in Las Vegas and Atlantic City a lot of jobs (as in the hundred thousands, 100,000s) are created with a minimal input of non-renewable resources are used depending on how the electricity is made and that is one example. Another is restaurants which I believe but have no proof employs more people per dollar spent than manufacturing but also has a low input of mostly just food and energy which we can make for ever. But as automation advances I think we will need a basic income guarantee and early retirement as in probably be able to collect Social Security and pensions by the time your 30 and if people are bored than they can volunteer and build houses for the poor or something but not be forced to. And people always say well if people can get free money than why would anybody work but the former Soviet Union has answered that question, even tho anybody could get absolute unlimited unquestioned welfare people would still work for not spectacular wages just to have something to do or to get ahead in life as welfare didn’t pay as well as a job and they had a 6hr or 5hr workday so conditions weren’t so horrible as I have recently experienced.

And then comes the things we could do if it weren’t for the stupid limitations of capitalism like we could go all out full max production of organic and permaculture food production and if we had no where to sell or give the food than we could simply compost it to make fertilizer for next years crop rather than this capitalistic just in time food production system we have that goes berserk when theres a drought or extreme weather. We could also create jobs planting trees and new forests but of course theirs no profit to be made so it wont happen in this system we have now.

So in the end I think we need a economy and society where people eat out at restaurants and take there kids to the amusement park more often to provide jobs rather than buying the newest crossover SUV or whatever crap they make and treat you like an idiot when said product is defective (wall street manufacturers can go to hell).

I think Minsky said that there also has to be a change from hedge financing to ponzi financing, I think he defined it as using debt to finance debt for speculation. The Chinese culture values saving not borrowing. So i wonder how thay will play into all of this.