We’ve been warning that the sudden rise in mortgage rates was going to create a great deal of buyer sticker shock. It’s already virtually halted refis.

Even though the increase is arguably from a low base, homebuyers tend to max out on their purchasing power. And we’ve also given reports from brokers that the rise in costs is even larger than the apparent rise in interest rates for important categories of purchasers, since the FHA stopped waving points.

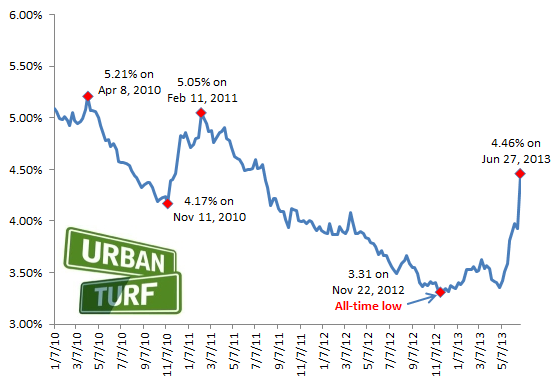

Further confirmation comes from the Urban Turf website:

UrbanTurf polled prospective homebuyers to see if the jump in rates had resulted in a delay in their housing search.

The results were revealing. Of the several hundred buyers who answered the poll, 38 percent said that they would be putting their search on hold because of rising rates, while 57 percent said that they would keep looking. (5 percent were unsure how the rate spike would influence their decision.)

Mind you, while 30 year fixed rates (per Bloomberg) have backed a bit off their last Friday recent peak, at 4.54% they are still above the level cited in the Urban Turf poll.

Admittedly, there may be sample bias. An online poll would presumably skew a bit younger than the market as a whole. But Urban Turf is a DC based blog, and Washington has been a particularly strong market, so the fear of renters being priced out (it’s a worry of at least one correspondent there) would be a lot stronger driver of behavior than, say, in cities that might also seen good price appreciation in the purchase market but were seeing softening in the rental market due to conversion of foreclosed homes to investor properties. So my guess would be that net net this sample would not be unrepresentative and if anything would be biased towards not being as deterred by rate rise as a truly national sample.

So this sort of report will also indirectly serve as a test of the Fed’s motivation for talking up the taper. If it really wanted just to take some air out of the nascent housing bubble, it’s probably already overshot, although it will take a while to see that in the data. But if it’s motivations are political, in that the central bank is sick of the heat it is taking for QE, or thinks the banks need a more positively sloped yield curve, or just thinks QE may not be such a hot idea after all and it would be getting out as soon as it conceivably can, then even this sort of early warning won’t alter its path. We’ll find out either way soon enough.

“An online poll would presumably skew a bit younger than the market as a whole. ”

An online poll would normally be presumed to be pretty worthless.

Online is where the house buyers are. Great place for a poll about house buying.

Sure, but what do you know about the poll respondents? Bupkis. Sure, rising rates will probably cool the housing market, but there’s no way you could tell how much from this poll.

Significant damage already showing up in the data. The unprecedented speed of this rate increase is a pox on Bernanke’s house. Irresponsibility writ large.

http://www.cnbc.com/id/100876300

MacCruiskeen is right. Online polls are garbage. Naked Capitalism does its reputation no favors by treating this as noteworthy or even interesting.

Let me clue you in on something: all data on housing sucks. All of it. You can’t even get a # on how many homes there are in the US with a mortgage. Estimates vary by 3 million.

Don’t feed the trolls/AstroTurf’ers Yves ;)

I’m in the market and my money is off the table not due to the rate increases per say, but due to the sellers going rabid in the “hot market”.

I had negotiated a price from $330k down to an owner counter of $270k (on the way to my target of $240k) and after a “hot market” article in the local rag, the owner came back and said nothing under list. And there it sits 3 months later with no hope of a sale.

Best of all, due to the rate moves, I’d not settle at $240k today. Shades of 2005/6 from my vantage point.

Not sure what you’re market is, but here in suburban Boston (by a good 45 miles, an hour via MBTA to South Station) some prices are still silly. I’ve seen prices dropping from ridiculous to just silly on Zillow, but have also seen homes snapped up for list or more with a weeks notice. Seems crazy for some homes that are 100+ years old and might need some passes by professionals to make sure you’re not buying a money pit, but there has been pent up demand from buyers who were on the sideline when things were truly shitty. I’m one of those types of buyers, but I’m looking for the perfect trifecta of neighborhood, home, and price. I think I’ll be sitting on the sideline for a while longer.

Oh, I’m a moron Larry =) We’re looking to do all the things we shouldn’t in this environment ;)

My wife and I “want to build the dream home” so we’re in the market for raw land, or failing that a knockdown on property in Sacramento. In either case, these are cash-only deals as Uncle Sugar doesn’t Fanny these away like homes. The market has been depressed, and there is one piece in particular that sold in the last 18 months that I kick myself for missing, but all in all the sellers are delirious.

The seller of the of the one mentioned above literally told me “you have to go back more than 10 years to find a comp”! Really? Cause a banks’ appraiser will only go back 90 days!?

They are all looking at each others LIST PRICES, but nothing has sold for north of $140k in YEARS, and yet there are $400k land listings next to homes that are maybe a $50k premium!? It’s been a very frustrating 12 months for a cashed-up buyer, let me tell you =)

Best of luck in Boston! I’ve been a Bruins fan from wayyy back (though not practicing at the moment) and I’ll need to see a game in the Garden at some point =)

Good luck in Sacramento. Sounds like people in that market are still a bit deluded. I imagine a lot of cash buyers have helped prop up the market/people’s hopes out there.

So anyone who’s sceptical of the veracity of a data source is a troll. Interesting.

And I didn’t even get mention the misleadingly precise “38%” in the headline. I guess that would make me a troll also.

“Online polls are garbage” == VERY wide brush == Troll. Don’t strawman up now with “So anyone who’s sceptical of the veracity of a data source is a troll”.

Are the phone polls now using non-land line numbers? Because there was a bit of chatter about this some years ago about how so few under 30’s/40’s had land lines anymore, thereby skewing a number of political polls/etc.

Damn this ever changing world!

I see. You can’t make an argument, so you expect name-calling to fill in the gaping void. I especially admire “strawman” as a verb. Toss in the non sequitar about phone polling and you’ve put together a wonderful word salad.

Overcounting and unrepresentative sample populations are only the most obvious problems with online polls. It doesn’t require a helluva lot of imagination or statistical competence to grasp that, but I guess it’s beyond you.

They will jump back in if they think that rates are not going to go back down. Rates have a long way to rise and a small way to fall.

Once people fear getting priced out… we’ll see a small surge. (Of course, like bonds, the prices should move inversely to the rates.)

Sure they will, but at what price? If they were stretching to cash-flow a $200k house at 3.x%, what can they afford at 4.x%? 5.x%?

There may be buyers, but this is not a positive harbinger of house prices, IMHO. Some will trade down, but this is not healthy for the move-up market. The ultimate effect will be pressure on prices because of the volume of cash-flow buyers.

Yep. I was talking volume, not price.

Fair enough! I agree there there will always be a minimum “background radiation” of volume that is likely higher then seems intuitive (to me at least). But anything above this level will be retarded by sellers not meeting the market (IMHO ;).

I think a basic policy decision has been made in the Washington/NY power corridor that it is better public policy to discourage home buying by individuals for some good and bad reasons.

There is really little practical advantage to the current system of private ownership of our own homes. During the worst of the recession massive number of people basically became land-serfs because they could not relocate because they could not sell their houses and in a culture and economy that is increasingly based on flexibility and economic insecurity home buying without the tax advantages is not a good idea.

It is no accident that a segment of the finance oligarchs has decided to buy up massive numbers of properties–I’m almost certain that they got the green light on this from the usual fixers in Washington that Congress and the administration would pursue pro-investor policies and discourage ordinary home buyers and gradually move towards a market that was more rental based. Personally I think this is the correct path take. I believe the home buying fetish had origins in countering the political power of unions such that corporations could easily relocate and leave workers stranded and powerless thus increasing the corporate bargaining position. I have seen this and know, for a fact, it is true.

Let me get this straight: The American Dream of home ownership–real or imagined–was driven by anti-union collusion to strand workers?

I don’t know what’s on the Periodic Table of Elements up two rows from tin foil but I think you may be wearing a leisure suit of the stuff.

Well, that’s a little bit of a drastic critique of what I said. Certainly weakening worker bargaining power was not the only reason for the ideology of home ownership. As for the whole silly notion of painting ideas that indicate collusion among powerful interests as worthy of “tin-foil hattery” that, seems to me, to reflect on your buying into American Exceptionalism or an ignorance of history and what some of us call being “streetwise.”

The fact is that conspiracies, backroom deals, cynical manipulation is and has been recorded as the center of political activity starting with Herodotus and many Americans believe that all that stopped as soon as the Stars and Stripes started flying. I may be wrong but I’m not insane or close to it as you imply. I have personally seen and witnessed (been in the room) when cynical conspiracies were hatched so I know they occur. My reading of history including American history shows me the same tendency.

As student of game theory as applied to politics I know that if I was in a meeting of owners of manufacturing businesses who were interested in lowering labor costs that encouraging a stable debt-ridden working population would create a more stable atmosphere for me because workers would be reluctant to move or to make changes in their lives if they had to face a mortgage payment and moving to a more lucrative job would be a problem. There is evidence that places with higher rates of home ownership have higher unemployment and longer commuting times since when you change a job you can’t relocate easily if you own a home. But that should be obvious.

When public policy is created in Washington it is not made on the basis of what’s best for the great majority of the American people–it is made by two sets of people: 1) powerful oligarchs who want to make money and preserve or expand their power and income; and 2)politicians who act as power-brokers to make sure that everyone sitting at the table gets something and agrees to a common policy–that’s the rule in Washington and has been for some time occasionally these people come together, when it makes practical sense, to do something for the American people as a whole but that is the exception not the rule.

I’m shocked, shocked!

Yeah, my take is exactly the opposite. This seems like the last piece of the puzzle for the capitalist class: absolute mobility from labor. Your expected to pick up and move to the bakken oil fields or god knows where if you want to survive. Or, a company wants to up and move to a location that they were able to extort more subsidies and tax breaks from. I would say an inability or resistance of workers to move serves as some counterweight to their demands.

And then we’ll have David Brooks bemoaning the lack of “community” and “social bonds” all the while studiously ignoring that neoliberalism doesn’t allow us to have these things.

About the dumbest thing a person could do in this economy is buy a house on mortgage. Prices have nowhere to go but down, and what working person has time for the 1001 responsibilities of ownership?

You don’t own the house; the house owns you. And most of the houses are gimcrack construction. For those who would control their lives: don’t own a house, don’t marry; don’t breed. I admit, it doesn’t sound a fulfilling life style, but if you look around to find a common denominator among those who are relatively ‘happy’, you might be surprised by the number taking this path.

The interesting thing is we have the technology to create really well-built houses which are incredibly energy efficient–a couple of weeks ago I was talking to a builder about just that–at this time it’s more expensive but if you could mandate energy efficiency the economy of scale would kick in and the energy efficient home would be only a bit more than the normal ticky-tacky houses that get built now.

If the house owns us then, really, it is the power-elite that control the RE market and the finance market that own us.

“And most of the houses are gimcrack construction.”

Yeah, but in much of America, it’s not the house that costs, it’s the land. Ask Henry G.

They should have also asked in the survey how many new home buyers will not be able to close on the homes that are under construction.

http://www.eclecticinvestor.com

I disagree with the idea that everyone maxes out their purchasing power. I would say that in high-priced areas that is much more the case (NYC, FL, CA, DC to start). So if you looked at DC, you would see a bigger impact on the rate increase, not a smaller one. The idea of being ‘priced out’ is also one that exclusive to higher-priced areas. If prices aren’t increasing, no one worries about needing to buy now.

The first thing I would expect to see is people shifting from fixed-rate loans to ARMs to lower their initial rate, easing qualification. You might also see sales spike for a short period if people are worried about rates going even higher.

However, in many markets, I would expect this to make a significant impact, at least short-term. The other DC related item is the hundreds of thousands of furloughed workers from the sequester.

Real estate brokers report otherwise. Just because you might be prudent does not mean you are typical. And with the Fed planning to tighten, getting an ARM is a prescription to get whacked. The move of the last two months would be enough to caution buyers about getting an ARM (admittedly different benchmarks, but borrowers have just gotten a very big reminder of how volatile interest rates can be).

Then again, the Fed may not be tightening, at least according to the latest minutes release today. And even still, what makes you think the irrational buyer you mention in reply is rational enough to avoid ARM financing? Buyers think about their rate today and probably going out to a one year horizon in my experience. My own rationality/lack of funds/daily Naked Capitalism reading has kept me out of the market for a home purchase. Then again, I’m renting a modestly sized single family home for a reaonsable price with a good land lord. I’m also predisposed to view home ownership as an essentially neutral at best/risky at worse asset thanks to Doug Henwood.

Go check Bloomberg. 30 year mortgage rates were up today v. yesterday.

As for the Fed’s talk, and there’s a post going up on this, the Fed has been very consistent in its use of language. “Tighten” does NOT refer to the end of the taper. “Tighten” refers to increases in the Fed funds rate. More careful readers don’t see a change in the Fed’s position on ending the taper.

As for ARMs, the only time they’ve been widely used were in the early 1980s (when no one could or would lock in a long term rate at 15%+) and in the early 2000s when Greenspan was pushing them and they also became a staple of the subprime market, in the form of “teaser” rates. The fact that there were so many stories on how people were burned on them would be a deterrent. How much I don’t know, but with the Fed clearly raising rates over time, any buyer who has seen the rise in 30 year rates has just gotten a big real life example of how much rates can move. The historical evidence is that large rate increases (2% in a year is considered large, and we’re almost at that in 2 months) SIGNIFICANTLY cool demand for housing.

I agree with you Yves. I think I’m biased by witnessing my local market in suburban Boston. I know people must be grabbing ARM financing to get in on real estate again, otherwise why would every bank be pushing the rates as you walk in the door? There are no statistics on it, but it’s the impression I get. People think my wife and I are foolish for not buying RIGHT NOW because prices are just going up and up again with no signs of stopping. But if you look closely it’s only the most desirable homes/micro-neighborhoods that are seeing this appreciation. But that aside, sales are brisk and more homes are on the market. So in my area, sales are not slowing down. Yet. We’ll see how that goes if mortgage rates cruise above 5%. I’m still hoping to see more substantial price drops in my neck of the woods before I even consider buying a house.

I would exercise caution in attributing a rate rise to a drop in home buying searches. As you say, the rate rise is off a very low base. While a rise in rates is certainly one possible cause, another cause could very well be a “media effect” as the rise in rates has been very widely discussed by the talking heads on the news stations, the financial blogoshere and news outlets in general.

oh an one ohter thing concerns me about this study. Of the people polled, is there anyway to determine how many of them were seriously looking? From my own personal experience, more than a few people talking about buying, are doing just that..talking(aka window shopping).

FWIW, two recent conversations in the Puget Sound region with friends buying houses: both of them beat out by “Canadian” buyers paying cash (i.e., Chinese money coming in via Vancouver, B.C.). One friend lost out on 4 houses within a 12 month period in this fashion, and finally bought the first thing she could find recently when rates began to climb.

It would be interesting to get stats on how what percentage of house sales are happening this way. For many buyers, the interest rate is not a critical consideration. An earlier commenter who mentioned housing sales via the Internet is almost certainly on to something.

My anecdote is nothing close to a random sample, so I have no stats.

Keeping this type of statistic might assist policy makers in getting more clarity about what is really going on — if my anecdotal sense is at all accurate, even the Fed’s low rates still aren’t enough to help US taxpayers get into housing; they’re beating beaten out by foreign investors (and, certainly, banks).

It amazes me how many people (trolls/AstroTurf’ers) are basically making the claim that “interest rates don’t matter”.

Um… ok… I’ll bite… so they don’t matter… then why has the Fed targeted them?

“They’re off a historic low!” They sure are, 25% above that low of 2 months ago in fact… not a small move. I’d love to be able to blindly shoulder a 25% increase in carrying costs on a purchase as large as a home!

Interests rate do matter. Getting a lower rate is better than a higher rate. But a rate of 4.5% isn’t a disaster. Rates have been rising for a few months now, and likely to continue no matter what the Fed did. The super low rates were not just a result of Fed action, but also safe-haven buying driven in part by euro fears (remember that?). That trend has clearly started to reverse (see also: gold) and investors are looking elsewhere. Sure, Mr. Market reacted quickly to the Fed announcement (and it was Mr. Market that raised the rates). But it was already clear that the super-low rates of the last year were going away.

I’m in my early 30’s with a solid career – one of the lucky ones, I know – and was once told that most risk-free point in the cycle to buy property is when interest rates have peaked and are poised to fall (when appreciation is more likely due to rising afforadability).

For that sceanrio to play out in this environment, one would either have to hope that the economy really hits the skids (which no one should) in order to bring rates down from these modest historical levels, or hope that the currency wars heat up to the detriment of the USD (which no one should). It seems as though we are no longer in a “normal” world in which the Fed should at some point have to take away the punchbowl in order to dampen runaway growth.

Hence, I’ve been sitting on the sidelines for years, and I struggle to imagine an economic scenario in which the hassles of ownership will be outweighed by potential appreciation, and in which the risks are reasonably mitigated.

Which, BTW, is why the offspring of today’s house-rich will not be nearly so well-off when their parents kick-it as many believe. With so many student-loan indebted young people whose prospects (and credit scores) have been ruined right out of the gate, burned and bitter, there’s going to be no wave of “greater fools” coming in behind to buy the old/dead folks’ overpriced assets.

As for me, I have no compulsion to spend my weekends preening a lawn, so buying/renting is a purely financial decision…You sellers will have to find another sucker.

JPMorgan is raising house price forecasts; we wouldn’t be surprised

to see June-Aug home sales take a modest hit due to the back-up in rates but this

wouldn’t derail the broader story; mortgage rates could rise 200bp and housing demand

could stay on track. We upwardly revise our home price forecasts for the next two years,

due to solid net demand, lower distressed sales, and strong recent home price performance.

We now project home price growth of 10.1% in 2013 (vs. 7.2% previously), 4.9% in 2014 (vs.

3.9%) and 3.6% in 2015 (vs. 3.2%). We would not be surprised to see June-August home

sales take a hit as a result of the latest shock in mortgage rates. However, we do not think

that the recent market move will change the broader story of increased homebuyer activity.

If expected HPA, job creation, and the easing of lending standards continue to move in a

positive direction as expected, most of the negative effect on housing demand would be

offset and home sales would stay above 4.8 million, even for a 200bp rise in mortgage rates.

Talk your book much?

“If…job creation, and the easing of lending standards continue to move in a positive direction”

Really? I get that this wave of tip-dependent new earners are going to support the bubble, but did we go back to NINJA loans when I wasn’t looking?

No mind. I’m confident that our banking community only has the public’s best interest at heart, and hence openly shares its honest views for our consideration without the itention of influencing us to their profit.

And that you boys got it so right the last time around ;-)

I remember when I refinanced in March 2010, I had been warned that rates were going to go up because the federal government was ending some kind of (buying?) program. But rates didn’t increase; they went down even further. I wonder why Bernanke’s nonsense had such an impact?