Yves here. I managed to miss this VoxEU post from last month, and it is still timely. It argues that economists have generally been using the wrong measure of relative dollar strength to assess how the level of the currency played into the loss of manufacturing jobs and insufficient internal demand, now better known as “secular stagnation”. I’m sympathetic to that thesis because the early Reagan era featured a spike in the dollar. Japanese manufacturers in particular made very strong inroads during those 24 months, and US producers were never able to claw those losses back, even when the dollar fell (Japanese carmakers had also started getting smart and anticipated the backlash by increasing their domestic content).

And US policy came to favor finance over manufacturing. Remember the Clinton “strong dollar” policy? That was Bob Rubin’s, ex co-chairman of Goldman’s, brainchild. One big objective of that approach was defending New York’s position as a financial center. As economist and political scientist Tom Ferguson has pointed out, Rubin and his followers believed that a financial center would not be able to maintain its influence if it had a weak currency.

By Douglas L. Campbell, PhD candidate in Economics, University of California, Davis. Originally published at VoxEU

The secular stagnation hypothesis is back. Several prominent economists claim that the US may have entered a prolonged period of anaemic economic growth caused by weak aggregate demand. This column argues that the build-up of trade deficits caused by the appreciation of the dollar can explain most of the decline in manufacturing employment, output and investment in the US. Aggressive monetary policy targeted at increasing inflation could help by effectively taxing the inflow of foreign reserves, thereby leading to a depreciation of the dollar.

The 2000s began with the Fed narrowly missing the zero lower bound on short-term interest rates; they ended with the US ensnared in a liquidity trap. Even the economic boom from 2003 to 2007, despite being driven by a housing bubble, was lacklustre by US post-war standards. This has led economists to argue that the US may have entered a period of secular stagnation characterised by a prolonged shortfall in aggregate demand (Summers 2014). Such shortfalls, he asserts, call for very aggressive stabilisation policies just to ensure normal growth.

Causes of the Slowdown in Aggregate Demand

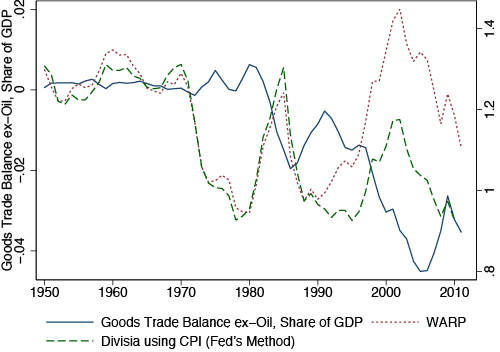

Summers suggested that the so-called Great Reserve Accumulation – the unprecedented rise in foreign reserves by many developing countries – might be a factor since it has effectively reduced aggregate demand in developed economies. This view was confirmed by Dean Baker and Paul Krugman, who also suggested that large US trade deficits since the mid-1990s (plotted in Figure 1) may be part of the underlying problem. This begs the questions: What are the causes of the trade deficit, and what can be done about it?

My job market paper seeks to identify a causal impact of real exchange rate movements on manufacturing output in the US (Campbell 2014). I compare:

• The US experience in the early 2000s to the 1980s, when large fiscal deficits led to a sharp appreciation of the US dollar; and

• Canada’s experience in mid-2000s, when high oil prices and a falling US dollar led to an equally sharp appreciation of the Canadian dollar.

I use disaggregated sectoral data and a difference-in-difference methodology. The key finding is that appreciations in relative unit labour costs lead to disproportionate declines in employment, output, investment and productivity in relatively more open manufacturing sectors.

Through the Looking Glass: A WARPed View of Relative Prices

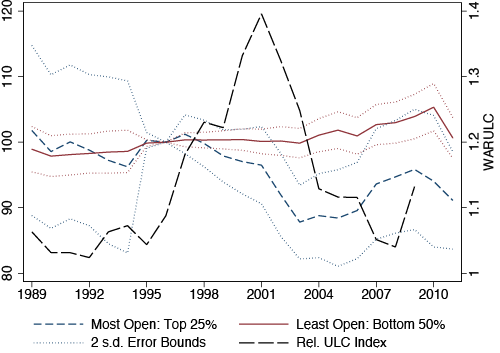

How should changes in relative prices be measured? The Divisia index using the CPI (from Campbell and Pyun 2014) extends the Fed’s widely-used Broad Trade-Weighted Real Exchange Rate Index back to 1950. This index, however, only takes into account changes in bilateral RERs, and does not take into account changes in price levels. Thus, it cannot account for compositional changes in trade towards countries that have systematically lower price levels, such as China. Fahle et al. (2008) argue that a simple weighted average of relative prices (WARP) is a more appropriate looking-glass to view RERs, as it does a better job predicting the current account.

What one finds using this alternate measure is that WARP implies a dollar appreciation of 48% from 1990 to 2002, versus a 21% appreciation using the Fed’s index. Much of this difference comes from the rising share of trade with poor countries. What is more, Campbell and Pyun (2014) document that US prices in 2002 were higher relative to other trading partners than at any point since the Great Depression, and that this sharp appreciation of relative prices was due to rapidly growing trade with China.

Figure 1 Real exchange rate measures vs. the goods trade balance, ex-oil

Relative Prices, Hysteresis, and the Collapse of US Manufacturing

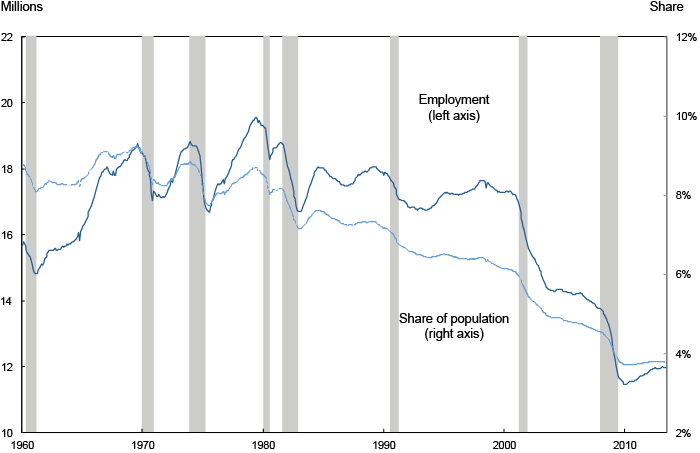

The dollar’s sharp appreciation coincided with large trade deficits and the decline of US manufacturing employment, which had, contrary to popular belief, actually declined little between 1970 and 1998. This has led to a heated debate about the causes of this recent decline in manufacturing employment.

Figure 2 US manufacturing employment

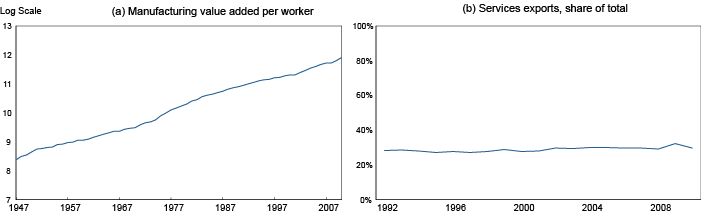

Some economists argue that the decline in manufacturing employment was caused by faster productivity growth in manufacturing and a sectoral shift toward services, reflected by the growing role of services in trade. But panel (a) of Figure 3 shows that aggregate measured labour productivity growth in manufacturing has been roughly constant during the post-war period, while panel (b) reveals that the services share of exports has been surprisingly flat.

Figure 3 Productivity growth and the services share of trade

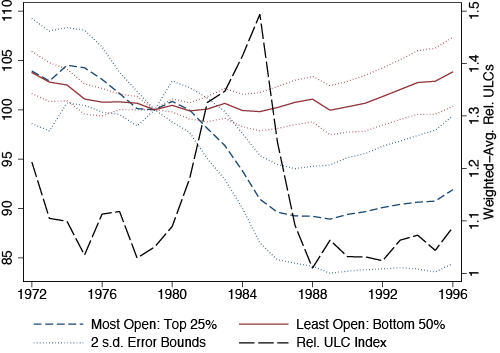

The basic research design of my job market paper is illustrated in Figure 4.

• In panel (a), I compare the evolution of manufacturing employment in sectors which were the most open in terms of trade in 1972 with those sectors which traded the least, after controlling for other factors such as year-specific shocks.

• When the dollar appreciated sharply in the mid-1980s (nearly 50%), more open sectors experienced a decline in employment relative to less exposed sectors.

• Interestingly, after relative unit labour costs returned to parity, the jobs lost in these sectors did not return.

• Much the same pattern is also evident during the early 2000s, as can be seen from panel (b).

Figure 4 Manufacturing employment growth by initial openness

(a) The 1980s dollar bubble

(b) The 2000s manufacturing collapse (NAICs)

A variety of different estimation methods in Campbell (2013) suggest that approximately two million jobs were lost directly as a result of the appreciation in relative unit labour costs, with perhaps another million jobs lost via input-output linkages. This estimate builds on the seminal research of Autor et al. (2013), who diagnosed US manufacturing with the ‘China Syndrome’, finding that increasing exposure to Chinese imports explains a quarter (800,000) of the loss in US manufacturing jobs through 2007.

Policy Implications: A Return to Free Trade

The implication is clear – allowing your trading partners to undervalue their currencies as per the Bretton Woods II system results in the loss of manufacturing jobs. During the 2000s, the Fed was able to offset these job losses with loose monetary policy (feeding the housing bubble). However, now that the US is in a liquidity trap, as Paul Krugman has noted, capital inflows in practice subtract directly from aggregate demand. How best to encourage countries such as China to revalue their currencies? Given that direct negotiation seems unlikely to bear fruit, a passive-aggressive approach is likely to yield better results – i.e. have the Fed aim for higher inflation, which functions as a tax on the Great Reserve Accumulators. This policy also makes sense for other reasons given that US inflation is now extremely low.

See original article for references

China has been a relentless tiger when it comes to trade. When I was in China the constant feedback I got from multinational execs was that government officials looked the foreigners in the eye and told them they could not just openly export to China. They had to make substantial capital investment there to get access to the market. For those that did move, China sweetened the deal beyond low cost labor: government officials went on a massive building spree. All companies had to do was to turn off the lights at the American plant, then hire Chinese workers, and then move into a brand new building into a first, second or third tier city. Roads, sewage, electricity, etc… were ready for use. China went big while the US was mired in war spending.

American companies avoided places like India because going there would have meant spending money on infrastructure. There is also another twist which becomes obvious when you visit China and India. China is very authoritarian. Communist decision making is very structured at the macro level and policies are broad and without debate. India on the other hand is, well, democratic. Decision making takes a long time and leaves many gaping holes in outcomes.

Washington trade policy generally ignores industrial policies of other nations. Sure, they dredge up terms like “barriers to trade” but they have no response even in the face of things like currency manipulation. Countries like China, Japan, Korea and Germany have battalions of bureaucrats whose sole purpose in life is to thwart imports (especially American) while favoring domestic champions (players).

” have the Fed aim for higher inflation, which functions as a tax on the Great Reserve Accumulators.”

I do not like this one so well

for when the price of bread does swell

both rich and poor the more will pay

but rich still eats it every day

Kudos for the poetry. It was worth a smile.

As to inflation, I guess that means we must now print or pump. I would say let’s just no pussyfoot around and print up $10 trillion or so, or pump to that degree. Perhaps a $1000 check to every american resident! After all, Krugie also noted in “The Return of Depression Economics” that the problem was that anyone who tried pumping just did not pump enough for it to be effective.

Not that pumping would never work, would never lead to political considerations that would spark hyperinflation, that’s just conspiracy theory talk!

Not that publishing pieces like this creates the mindshare and memespace to build support for such pumping, nosiree!

Hyperinflation requires the banking system and happens as speculators both front-run and cause price inflation with credit backed by the inflating assets produced thereby (see George Soros’ “Reflexivity”).

But nearly everyone blames the government which, after all, only issues reserves and those according to a budget. Of course the central bank creates reserves and not just for the government but to accommodate the “needs” of the commercial banks, which are the very likely culprits of hyperinflation.

Still a burst of deficit spending could provide an initial spike of price inflation but from there the banks and speculators take over. Perhaps this is why government is so often blamed.

Good thing there’s been no hyperinflation in the U.S. since the civil war.

A five minute video shows the difference of a golden age of strict government control 1945 to 1970 to an age of letting the market decide 1970 forward too 2014. Which has given us ever increasing debts, trade deficits, unemployment, and growing larger population of poor.

Remembering that Friedman’s theory of free trade was adopted under Nixon, when Greenspan was in the cabinet looking to help some friends do business in Africa. Then Fed Chairman made recommendations in Carter administration that made possible the deregulation in Reagan administration.

The Myth of the Great Moderation: Keynes vs Greenspan

https://www.youtube.com/watch?v=6zsXUDQXKuQ#t=42

“Free trade” as practiced by the US is the enemy of manufacturing. When China entered GATT / WTO and WalMart told every manufacturer to source from Asia, the big sucking sound predicted by Ross Perot began to hum. It is a well documented labor and regulatory arbitrage that in the short term rewards management and the long term destroys the industrial base of the US.

Inflation is a very bad idea that is impossible to sell to the general public. Wage growth will lag inflation driving more people into poverty and diminishing aggregate demand. The wealthy will get richer by investing in inflation protected assets like commodities, stocks, real estate, foreign currencies and of course TIPS.

A ban on new credit creation would cause massive deflation as existing credit was repaid with no new credit to replace it (100% reserve loans could still be made). So hand out new fiat, say to the poor, at a rate metered to just match or slightly exceed the decrease in the money supply as existing credit is repaid. Continue till all deposits are 100% backed by reserves.

So poor people get new money yet with no increase in the money supply. So where’s the price inflation to come from? Some Austrian’s arse?

Why not just direct the Fed to begin massively purchasing foreign currencies? Just announce an exchange rate 10% lower than the current amount, and accept unlimited bags of money at every US govt. outpost throughout the world (embassy, post office etc.) If you show up with 5 million Chinese renminbi, the US government will give you $1 million (at the new $1=5RMB exchange rate, rather than at the old $1=6.1 RMB) arbitrage will drive quadrillions of Japanese yen, RMB, Korean won, Swiss Francs, Danish Kroners into out coffers. Assuming foreign governments retaliate, then all governments including DC will just be sitting on massive (500 quadrillion) foreign exchange reserves. Everyone will be as in debt to the US as the US is in debt to Moscow and Tokyo.

Dean Baker over at CEPR has been beating this drum for several decades now. Kenneth Austin has a great piece on this same issue in World Development.

The result will be a currency war with each central bank nullifying the move of its adversary.

“competitive devaluation’. He who does not devalue ( the euro? ) is lost.

To offer the obligatory additional perspective when manufacturing jobs and inflation come up:

Employment has certainly decreased, but that’s not a problem. Indeed, it is exactly what has happened to agricultural employment. That’s a Good Thing. It is called productivity – the ability to produce what we need in fewer hours of work. Wake me up when liberals stop using printers, phones, ATMs, and the web, because they deprive someone of a job.

The notion that public policy should help GM sell financing on SUVs is puzzling, to say it mildly. GM isn’t what is right with America. It is what is wrong with America, from financialization to mismanagement to the dismantling of our passenger rail system.

The US, unlike nations such as China and Germany, is largely a domestic economy. International trade is a relatively small piece of what we do. What matters for us is how we allocate our resources, whether we invest productively or simply squander wealth.

The notion that inflation is a solution is also hilarious. I had to read those last couple sentences again just to make sure I was really seeing it correctly.

The notion that inflation is a solution is also hilarious. I had to read those last couple sentences again just to make sure I was really seeing it correctly.

I had to go back and re-read myself after reading your comment. Inflation might be good for the largest Corps in this country, as well as the Banks, but in a regime with stagnant or decreasing wages for the majority of citizens, inflation is the last thing we need. The author of this piece, as well as the Fed Reserve, are dead wrong.

As Mish Shedlock often reminds his readers, those with first access win, the rest of us, the majority, lose… big time. The little piece of poetry above says it all.

As Mish Shedlock often reminds his readers, those with first access win, the rest of us, the majority, lose… big time. JCC

Which is why purchasing power MUST be created ethically.

So I take it Mish would be in favor of a distribution of new* fiat to the victims (the 99% or so) plus restrictions on credit creation to prevent the banks from inflating the benefit away?

Or, like so many Austrians insist, is real restitution to counter injustice impossible according to Mish?

Mish is a good man or at least could be, imo, but the reactionary (Is there any other kind?) Austrians have led him astray.

But thanks for reminding me of Mish. Seriously, I had forgotten him.

Notes:

*If new money is never a good thing then:

1) No money is good since all money was once new money.

2) Gold mining should be banned, no? Assuming gold is money? But what Austrian will dare advocate that; relying instead on the inherent scarcity of gold to enforce price deflation in gold? And hypocritically desiring government to enforce a gold standard so gold owners may loot by deflation?

I am having a hard time wrapping my head around the idea that a large trade deficit raises the value of a country’s currency. What’s the economic theory behind that idea?

I am wondering if Campbell is suffering from the problem of equating correlation with causation.

Also,I am wondering how China benefits by holding large reserves of US money. They are giving us the benefit of their labor in trade for holding our currency that they cannot do anything with except leave it on deposit at the Federal Reserve. Oh yes, they are earning interest which just adds to the money they are holding that they cannot use. How do they pay for the raw materials that go into the goods that they are selling us? Does that mean that their labor adds enough value to pay for the cost of the raw materials that they can pay for that and still have huge profits left over? And they can also pay for whatever raw materials they actually use domestically? Someone needs to figure out where is all the money we give to China going. Not all of it is being used to build reserves.

I am having a hard time wrapping my head around the idea that a large trade deficit raises the value of a country’s currency. What’s the economic theory behind that idea?

A large trade deficit indicates that a country’s currency is highly valued, and that foreigners want to save the currency. It does not raise the value of the currency itself. Rather, imports not matched by exports, trade deficits will tend to depress the fx value of the currency.

They are giving us the benefit of their labor in trade for holding our currency that they cannot do anything with except leave it on deposit at the Federal Reserve. Not true., They can buy stuff from the USA or anyone else who wants dollars. E.g. they could use the dollars to buy a lot of oil. Most dollars are recirculated this way, but some build up in foreign Central Bank foreign exchange reserves. This would be a good thing for the USA if it just had the common sense to print the money to replace that accumulated there. And often in the past few decades it has, or has done so more than many other nations, now and historically.

If countries ever ran their domestic policies in a common sense way – permanently maintaining full employment, which is very easy, then the problems from foreign trade would be pretty trivial, and would always be rather less than the benefits. Unfortunately, as Keynes said – saw it just recently but forget where – he said something like – nations almost always do the exact opposite of common sense in foreign trade and finance.

They can buy stuff from the US or anyone else who wants dollars, but saying that they are accumulating large reserves of dollars is the same as saying that they are not buying as much as they could buy. That’s what I believe is called a tautology.

I wasn’t talking what they could be doing. I was talking about what they are doing.

Cambell said “The US experience in the early 2000s to the 1980s, when large fiscal deficits led to a sharp appreciation of the US dollar”. That’s what I should have said I couldn’t understand. Thanks for getting me to look at it again.

Even so, a large trade deficit does not raise the value of a country’s currency. Even your explanation says that cause and effect go in the other direction.

To which lambert adds his thanks.

China spends a lot of dollars on oil, importing our technology, buying commodities, raw materials. Much of their dollars accumulate to hold the value of their currency down relative to ours. That makes their exports cheap.

I just think I figured out what China gets out of building all these reserves. It is exactly the same question about what the .1% in this country get for accumulating all the wealth. Try as they might, they can’t possibly spend all the money they are raking in. If they were spending it, they wouldn’t be accumulating it. What they are getting and what China is getting is power and control.

You cannot come up with an economic value to explain the level of power and control that is being concentrated in the hands of fewer and fewer people. The value is psychological. If we continue to search for economic reasons for this accumulation of wealth, we will keep seeing correlations without finding the causation.

2 quick hits:

1. Put your faith not in further monetary manipulations (“print to stoke inflation and thus goose demand”) as a proposed cure to the previous bout of monetary manipulations (“EZ-credit and oo leverage to promote the chimera of ‘the ownership society’ and thus goose demand”);

2. China (and other large net-exporters-to-US) *must* accumulate US$ reserves, because they ultimately have to recycle their surpluses into $-denominated assets, and there are no markets other than US debt large and liquid enough for them to invest $trillions in without causing either massive price distortions and/or a political furor. Recall the hue and cry about “the Japanese buying everything that’s not nailed down” when they were still running large persistent trade surpluses with the US?

Is he talking about domestic demand falling before the jobs were sent to China? The only inflation he is recommending is a devalued dollar for trade. Since China will never raise the value of the yuan. That devalued dollar kind of inflation just happens to threaten our international banks’ profits; being able to buy up various foreign assets on the cheap, right? So jobs have been lost to avoid a devalued dollar which then causes more jobs to be lost. And the strong dollar benefits those at the top. Confusing. No wonder they have to use their doublespeak about the Fed’s dual mandate of price stability which is always achieved by increasing unemployment, by wage deflation. The dual mandate of the Fed should be price stability achieved by preventing the over-valuation of the dollar.

Overvaluation of the currency protects the assets of the wealthy and prevents debtors from having their burden automatically diminished relative to wages.

Inflation would diminish the value of the assets of both the rich and the poor, but it would diminish the value of the debt that the poor owe to the rich. Since the poor have more debt and the rich have more assets, it is easy to figure out who benefits from a strong dollar. Furthermore a weak dollar makes the rich share in some of the loss of value that we may have earned by our own excesses. (More of the rich’s excesses than the excesses of the poor.)

It seems to me that a weak currency is something a country needs if it is trying to save export-based jawbs. But how absurd! Exporting real goods and services makes a country poorer so why should we make it easier?

Instead, let’s aim for an equitable distribution of wealth and income and we wouldn’t need jobs at all costs. Let’s be guided by the rich who desire a STRONG currency to make their imports cheaper because they don’t need jobs.

That thing called justice? It has real, practical benefits.

Bear in mind that most Chinese people didn’t have much say in their country’s trade and monetary policy.

While China as a country is accumulating a lot of USD, nevertheless Chinese workers who are producing real goods for export are not receiving the purchasing power in exchange that their efforts deserve.

It’s natural that the USA will be tempted to simply inflate away much of what they owe for the real goods they’ve purchased from other countries. A nice joke on the people who produced those real goods. So not only do Chinese workers get shortchanged by their own bosses, but their customers will decide to default on them, too. I suppose, to the extent that they feel nationalistic, Chinese workers may console themselves that their efforts and sacrifices will have at least helped to establish a modern industrial base, even if they all got ripped off in the process.

What’s destroying the competitiveness of American labour is their own country’s ability to simply export fiat currency. How do you make your living selling real goods and services when your country can produce new currency at will? A major US export is its fiat currency. It’s like a bizarre case of Dutch Disease. Every American worker is forced to compete against the fiat export potential of the central bank. Unsurprisingly, the American worker is not winning this competition, and the only thriving sector is finance.

There have been some exporting countries that have looked to diversify away from USD, but some of them have been subjected to economic sanctions or physical attack. The US financial sector has a vigorous enforcement subsidiary. Note that this also inhibits correction in the market value of USD.

I suppose, to the extent that they feel nationalistic, Chinese workers may console themselves that their efforts and sacrifices will have at least helped to establish a modern industrial base, even if they all got ripped off in the process. Roland

I read somewhere that he who humbles himself shall be exalted and vice versa.

Now China need only add justice to humility and voilà serve the US a big slice of humble pie? And that’s not out of the question for reasons I won’t go into.

Personally, I would like the US to beat China to the punch re justice but I suspect the honor will go to them instead.

Yves ends with:

“This policy also makes sense for other reasons given that US inflation is now extremely low.”

The argument that inflation is ‘extremely low” is getting tired. The Billion Prices – MIT report on prices shows that inflation is now north of 4% on an annualized basis.

Just how high would Yves like inflation to get??

Link to the Billion Price index:

http://statestreetglobalmarkets.com/research/pricestats/

Thanks for the Billion Price link!

NAFTA started 1993 when the dollar was at the bottom. Labor-arbitrage started before the big dollar-rise in the end of the 90´s. Tech-boom and budget-surpluses by Clinton-administration(i.e) increased capital-inflows to the US(The Great Moderation-era and another step in finanzialisation of the economy were also factors). Dollar-value relate to capital-movements. Tech-crash and 9/11 caused outflow and the dollar to fall. WTO-agreement incl China which became Most Favoured Nation 2001. The dollar was back to the level from the mid 90´s when labor-arbitrage took of again.

I think the lack of demand has to do with the slowing of new domestic investment. This trend has been going on since the 70´s(especially when extracting residential investments). Stagnating investments leads to stagnating wages which in turn leads to stagnating demand. A feed-loop.

Big corporations(on stock-exchanges) always have to grow. When the US reached “maximum” consumtion-share of the economy(70% of GDP) corporate America has to expand by M&A from the 80´s(often failures) and later(90-00´s through outsourcing production lowering labor-costs. Globalization also increased market-demand. Since then the dollar has been pretty stable against G8-currencies but falling against the Yuan.

The 70´s was about inflation-shocks and slowing investments. The 80´s about tax- reductions, the start of the new Wall Street era and new tech making productivity improvements(start of lowering employment in old industrial sectors). Labor-unions

losing power. The 90´s with extreme M&A-activity and more productivity-gains leading

to loss of manufacturing-jobs. Today M&A looks to restart again now when stock-buy-backs

maybe are reaching it´s top(?).

The dollar is not the cause. It is the natural process of diminishing returns. Next step is already here with robots and a steady flow of new (alternative) products.

Stagnating investments leads to stagnating wages which in turn leads to stagnating demand. A feed-loop.

You have it exactly backwards. Lack of demand results from unjust wages because productivity gains from previous investment have not been justly shared.

Otherwise, capitalists would be eager to take advantage of low interest rates, low taxes and abundant skilled labor.

Y’all best learn to do capitalism ethically unless you yearn for a far less satisfactory replacement.

“Lack of demand results from unjust wages because productivity gains from previous investment have not been justly shared.”

Just what I wrote regarding how lack of demand comes from lack of increased wages.

But as You say, productivity gains could also be shared unjustly. It´s also about new demand for different skills were old skills don´t match. I would not say I got it backwards. We all know how capital-share of GDP has been rising while labor-share falling. The biggest difference came with outsourcing of labor(and capital) from the 00´s.

Still there must be increased domestic long term real business-investments to take back lost labor-share. We are though experiencing large shifts in technologies which corporations take advantage of. Old skilled labor are transferred to the lower-paid service-industry. The same happend in the Great Depression when farming was going through tech-shifts. Labor were abundant.

It´s also about new demand for different skills were old skills don´t match. Christer Kamb

Why is that bankers never have to learn new skills? Because the creators of the rat-race need not run in it? Just have enough wits while young to legally steal a lifetime’s income?

Also, new skills do not address the fact that employers need fewer workers period as automation improves/increases. Yes, the decreasing percentage of workers who are needed will probably need new skills but beyond those why train for a job one has little chance of landing?

Because bankers are always needed for their basic services were money can be created out thin air. Unfortunately they still get away with “stealing” by frontrunning everyone and everything. Prop trading i.e has to be shut down completely. There is still many loopholes in Barney Frank´s bankreform-legislation.

Yes, there will be hard times ahead. Even for youth with new and appropriate skills.

The hard times are not necessary so woe to those who insist on them anyway.

As for banks, the only possibly ethical ones are 100% private with 100% voluntary depositors. Anything else violates Equal Protection Under the Law as redlined black people can attest to. People can try and try and try but one cannot fix what is inherently dishonest.

Tasking China as a currency manipulator is a bit much coming from the owners and issuers of the global reserve currency, its stupendously lucrative lootin- oops – intermediation opportunities not to mention its ability as a finger on the trigger over everything denominated in dollars, good enough reason in itself for China and others to afford themselves major buffers, or as ‘savings’ or even ‘investments’ depending on the situation. We also know China is now engaged in a serious effort to have its currency play a big piece in the proposed basket of currencies being considered as an alternative to the dollar. If China manages to navigate its landing it will have demonstrated what investors need to know, and that reserve currency alternate will be a go.

It’s not as if the US was not at the table during the entire globalization process – it was, and it signed up for neoliberal global corporate planning, which amounts to no planning at all in any positive sense, rather a mad race for unheard-of financial and political, even State power all in private hands. Who did not see this coming? The entire China ‘story’ has been about US (and other industrialized countries) global corporations getting US (and other) politicians to allow these corporate giants to abandon host country responsibilities, the better to order their operations globally with a completely free hand. They’ve helped themselves to a bonanza while fueling what many believe is the biggest bubble on the planet in China.

China made a huge mistake going for so much urban growth for so long – the environment has been very heavily damaged and far too much of the ‘growth’ is a write-off relative to what that country will actually need to do to deal with what will in not too long be the over-riding priority, i.e., dealing with its national environmental damage and as bad, the great droughts, water shortages and crop failures coming with Climate Change, as is already evident. On the other hand, if anyone has the smarts to come up with a decisive clean energy technology, or some other game-changing breakthrough, it’s as likely to be China as anyone. I, for one, would be delighted.

Instead, China is being set up as the next ‘enemy’ or co-enemy as if it was the inevitable playing out of historical forces, an aging Empire challenged by a rambunctious usurper, when nothing could be further from the truth. Globalization as we see it has been a disaster for this planet and everyone on it – and especially China.