By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Testosterone Pit.

It always starts with a toxic mix. Last fall when sales that had been predicted to continue their miraculous ascent were suddenly swooning, soothsayers dealt with it by developing a whole plethora of excuses. At each new disappointment, they dragged out new excuses. But in May, the toxic mix came to a boil, and now there are no more excuses: sales plunged and inventories jumped. The housing market is buckling under its own inflated weight.

And what excuses they’d come up with! Last fall, the fiscal cliff, the threat of a government shutdown, the possibility of default that was belittled by everyone supposedly made home buyers uncertain. But these issues were swept under the rug, and sales continued to drop into the winter. Polar vortices were blamed, though in California, where the weather was gorgeous, sales dropped faster than elsewhere. Then the spring buying season came around when massive pent-up demand was supposed to sweep like a tsunami over the land. But sales continued to decline. So tight inventories were blamed. There simply weren’t enough homes for sale, it went.

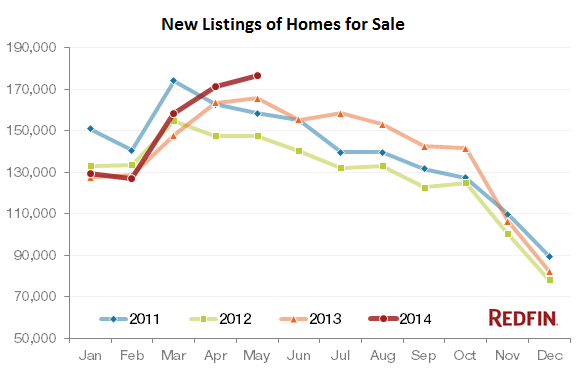

Alas, in May, new listings rose 6.5% from a year ago to a four-year high in the 30 markets that electronic real-estate broker Redfin tracks. People were dumping their homes on the market; new listings soared 25.5% in Ventura, CA, 15.8% in West Palm Beach, and 15.4% in Baltimore. This is what it looked like for all 30 markets combined:

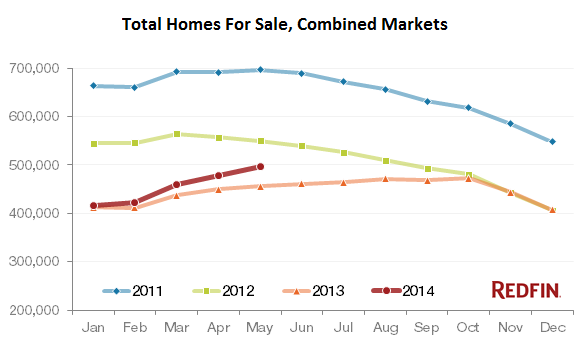

The onslaught of new listings added to the unsold inventory and pushed up the total number of homes for sale by 9.1% to the highest level since August 2012. And in this elegant manner, the final excuse of tight inventories causing the plunge in sales went up in smoke.

This rise in inventory has been going on all year. Yet, as Redfin pointed out with a soupçon of irony, it was “surprising to some, given the speculation about extremely low inventory creating intense pent-up demand among buyers who have been waiting for months with low interest rates burning holes in their pockets.”

Real estate is local. During the last housing bust, some areas started to crater in early 2006, while others hung in there for a while longer. San Francisco’s bubble hit its peak in November 2007, and everyone thought that the city, being so unique, would be immune to the pandemic of housing mayhem. A month later, it cratered. So this time too, it isn’t impacting all markets equally. In 10 of the 30 markets, inventories were actually down. But in some of the hottest markets a year or two ago, inventories skyrocketed: up 14.6% in Los Angeles, 15.5% in Washington, DC, 16.2% in San Diego, 23.1% in Sacramento, 27.9% in Orange County, 30.9% in Riverside-San Bernardino, CA, and up – I’m not kidding – 33.4% in Phoenix.

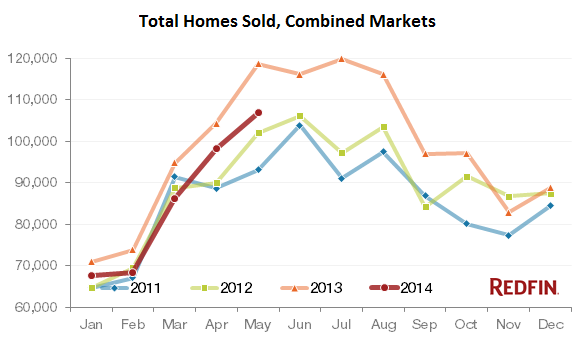

And this inventory isn’t selling: in the 30 markets, sales in May plunged 10% from a year ago. Now that homes are coming on the market in large numbers, buyers, faced with sky-high prices and higher mortgage rates, went on strike:

In some of the hottest markets of 2012 and 2013, sales are falling off a cliff: down 11.6% in Las Vegas, 12.2% in Chicago, 12.3% in Seattle, Orange County, and Los Angeles, down 12.5% in Washington, DC, 13.1% in Long Island, 13.5% in San Francisco, 14.6% in Sacramento, 20% in Phoenix, and down 20.8% in San Diego. These are ugly numbers.

But, but, but… the median sales price still rose 8.2% in May from a year ago, though that’s down from the 14.5% increase in May 2013, and from the 20% at the peak of 2012. Redfin reported that its agents had observed “the shift away from a sellers’ market, with buyers having more power and less competition.” But apparently, “many sellers still haven’t read the memo.”

Since early 2012, Wall Street players, armed to the teeth with the nearly free and limitless money that the Fed in its infinite wisdom has made available specifically for these purposes, piled into the market, buying up hundreds of thousands of homes helter-skelter and turning them into rental properties. It switched these homes from for-sale lists to for-rent lists, where many languished unperturbed, and it drove up prices in record time. Current homeowners welcome that.

But first time buyers, the natural force in the housing market, were effectively pushed aside and are now priced out of the market. Even many current homeowners who want to sell are locked into their homes as they cannot afford the next home, given higher mortgage rates and sky-high prices. At these prices, even investors can’t buy these homes and rent them out at a profit. In many areas of the country, that business model is kaput. So they pulled back too. This is how the Fed fixed the housing market.

The only thing lacking in this “fixed” housing markets are willing and able buyers. So inventories are piling up, and someday sellers will “read the memo.” Then prices will be whittled down to where they make economic sense in this economy. We’ve been through this before. Only this time, it’s different: the Fed, which so eagerly took credit for having “fixed” the housing market, is going to be hard-pressed to cut interest rates further, or do anything else it isn’t already doing.

“Recently, the billionaire venture capitalist Vinod Khosla went hunting for one-bedroom apartments in San Francisco.” And then he opened his mouth. Read… The untimely end of San Francisco’s Tech and Housing Bubbles

Now that they’ve put college students in permanent debt purgatory, how do they expect potential new customers to buy a home at some point in the future? It is this demographic that will have higher earning power, but they won’t make enough to plop down 20% on a mortgage. By design, government policy is to put the 99%ers into a debt vortex, which pushes wealth from the bottom to the top.

I am annoyed, here in Canada, with the attachment to the “executive house”. Half the house sits empty because of this popular attachment to the ideals of success determined by the values of a bygone era.

Delusions of grandeur.

I believe that the current housing stock does not reflect the coming cost of resources or energy and that the fed is trying to prop up a system that desperately needs to get restructured.

We have not seen anything yet.

This is precisely right. Debt from education is one thing. The dynamics of health care is changing as well, with more and more costs being shifted onto the individual. A friend of mine who is young, employed in the oh so hot biotech sector making good money, had his large corporation (Siemens) change their health care plans this year (Obamacare was mentioned in the memo). His out of pocket expenses for diabetes medicine (genetic not type II) lept up so that he will have to pay $3000/year out of pocket, up from nothing the year before. That is a rather seismic shift in costs. Nothing for daily life gets cheaper and expenses only seem to go up. While I understand we’re not suffering inflation in many of the things we buy, it seems rampant for those things we need: medicine, energy, housing, education. And on top of that they are asking us to pay exhorbinant prices for housing stock.

The Fed is like a toddler in a bathtub. It doesn’t like the waves, so it keeps splashing to make them stop.

Doing nothing and letting markets find their own level is not even considered.

Ripping a wing off the confidence fairy makes it fly in a tight descending spiral.

What is missing in the market is move up buyers that is first time buyers that are selling there long commute home and using the proceeds to move closer to the metro area or bigger homes. Traditionally its been the move up buyer that has had the necessary larger down payment generated by appreciation that could afford the next house but the bust with its massive number of foreclosures and short sales has significantly reduced the number of potential move up buyers creating the create market void.

An interesting read indeed. In fact, ‘fixing’ of price by Fed through buying homes and turning them into rental properties was the only option available to them to stop the sub-prime crisis onslaught. Some left leaning intellectuals may again regard it as ‘Socialization of Loss’ made by the financial institutions who created skewed mortgage based derivatives and collateral obligations asset class to profit, not checking health of the asset (which are sub-prime loans, that in themselves were erroneous as asset class with weakest fundamentals). What I think is our economy has already entered a debt trap and there is no way out until and unless the huge national debt decreases through inflow of extremely large amounts of capitals financed abroad. But here too a problem is there. The emerging countries are coming closer to one another on terms of trade. So, scope of market availability has also shrunk, especially with the rise of emerging countries and availability of low cost labors in them. Until and unless our country ushers in excessive technical innovations leading to accumulation of surplus and therefore capital, I don’t see any way for my country to get out of this unprecedented debt trap.

Our national debt has been and continues to fall, and as a percentage of GDP is right about where it was in the first year of the Eisenhower presidency (hardly a period of national disaster). Banks and corporations have about 3 trillion dollars just sitting around in their coffers, and have been on a massive stock buy-back campaign with virtually free dollars from the Discount Window. The subprime housing stock that needed to be bailed out could have been for $800 billion directly to the buyers. Instead, we have pumped over 3 trillion in free money into the economy directly to the banks, and they have used it for pump and dump bubble operations and to lend to Americans at 18% through their credit cards and 8% in private student loans.

Your analysis is, to say the least, flawed.

$800 billion directly to the buyers.

That’s a good idea. It should be, though, equal money to all, and not just to the buyers (or homeowners).

And if we do that on a regular basis with printed new money, it would be Money Creation Via the Little People Spending it Into Existence.

Instead, we have $3 trillion in an attempted trickle down via Big Business.

And probably another $3 triliion or more, in military/security/world domination spending in another attempted trickle down via Big Government…because MMT is merely descriptive of how money is created currently (let Big Brother spend it into existence).

So inventories are piling up, and someday sellers will “read the memo.” Then prices will be whittled down to where they make economic sense in this economy. We’ve been through this before.

Whittling these houses down to affordable prices versus median income levels will require a slash of about a quarter of housing ‘value’ in most markets, before you’re back at 1990’s levels:

http://www.forbes.com/sites/zillow/2013/04/16/high-home-price-to-income-ratios-hiding-behind-low-mortgage-rates/

That’s not a whittling, that’s a major correction.

Huff Post DC Section just reported on this yesterday about what’s happening in DC.

http://www.huffingtonpost.com/melissa-terzis/summer-were-so-glad-youre_b_5497022.html

Wolf Richter’s posts are at the top of my NC favorites list. Just back from East Bay (San Francisco) on an initial survey of houses on sale. Using Redfin app daily shows non-scientifically that houses go on sale everyday providing ample supply. Prices are still outrageously high. Buyers still offer way over asking price. The local legend is “the Google people buy everything.” As far as I know, Google’s employees don’t outnumber Walmart’s. It seems that sellers as well as buyers don’t read memos.

despite the moniker, I am living in the Sacramento area. I was lucky to have sold my townhouse in the Washington DC suburbs last year. But I can attest that the selection has gone way down since I arrived here, and the prices have gone up. So much for markets….

Trying to be rational – if it doesn’t make sense to buy a house, I won’t buy a house. I would like a house with a big lot, but not if its irrational. In the long run the market will adjust, and I’ll be dead. problem solved.

Folk:

Look at the refinancing level – non existent even though mortgages are at historic lows.

In our area mortgages are not available – they say the credit score is too low but surprisingly a recent credit card application shows a credit rating of 750 plus.

Folks, I smell red lining.

I’m also seeing sellers holding onto delusional valuations. A lot of the lower end homes we’ve been looking at are priced way over any reasonable “real” values. Anecdotal evidence we’ve gathered suggests that a very large chunk of the potential seller class are so underwater, they’re trapped. The banks are of no help at all. One deal we explored would have required the short sale of the house at a figure not too far below the principle balance. The bank said flat out; “No sale at anything below our full recovery figure.” We’re hoping for the feds to raise capital reserve percentages to something saner than those in effect now. Then those pesky banks will have to start unloading. (We’ve also seen lots of decent lower priced homes literally falling into ruin.) My wife remarked yesterday, as we were driving around a small town in Mississippi where we had looked at yet another overpriced property that; “This place looks like some Old West Ghost Town.”

After the S&L debacle, my wife and I bought a foreclosed property for about $20,000. It needed another $ 10k worth of work over the years that we lived in it. It was a nice, basic little ranch. Built in the late 50’s. When they were saying that the S&L crisis would cost each American $ 10,000 to fix, we thought that buying that house was the only way we would ever see any of that money again. Fast forward to the current Housing Bubble/Bust/BS-at-the-hands-of-the-yet-to-be-prosocuted-bankers and there is simply no way for the average (or possibly even above average) American to recover from this. New England housing prices have not dipped as much as in other areas, homeowners think they can get whatever they want, the rental stock is tight, and rental prices are nearly double what they were 5 years ago. The economy in no way supports those rental prices, so we are seeing multiple families living in single family housing. Frankly, I have given up hope on the system as it exists now. Sadly, my children are going to come of age into a Country where even a very basic house is going to be completely unobtainable. I am going to teach them to build their own housing from natural materials. Time to go find a couple of acres for a few houses. Good Luck everybody, It is going to be a very, very rocky ride.