Yves here. This article pokes at a topic near and dear to my heart, which is the generally reverential treatment of Thomas Piketty’s Capital in the 21st Century. It appears to be a classic example of the cognitive bias called halo effect, in which people have a tendency to see things as all good or all bad. Because there is a lot to recommend Piketty’s work, for instance, the fact that it is exceptionally written, that it has made inequality into one of the hottest topics in economics, and that Piketty has done an admirable and exhaustive job of finding and analyzing the returns on certain types of income producing assets are all highly commendable.

But as readers may know, one of my pet peeves is that Piketty has made a very strong claim, in the form of his formula r>g, or the rate of return on capital (which he also calls “profit”) exceeds the growth rate of the economy, when his data falls short of what would be necessary to prove that assertion (for instance, GDP only started to be measured well into the 20th century; older records of wealth might be accurate on capturing the value of agricultural land but dodgy on other types of income producing assets). Piketty defines capital extremely broadly, so the problems with the data are important. Moreover, this VoxEU paper discusses, contrary to Piketty’s assertion, the superior returns to capital in the 20th century were due to house price inflation. They question that as a valid measure and also point out that when you strip housing out of the capital computation, the returns don’t support Piketty’s theory.

By Odran Bonnet, PhD Candidate in Economics and Public Policy, Pierre-Henri Bono, Econometrician and specialist of public policy evaluation and housing, Guillaume Camille Chapelle, PhD Student in Economics, Étienne Wasmer, Professor of Economics, at LIEPP and Sciences Po. Cross posted from VoxEU

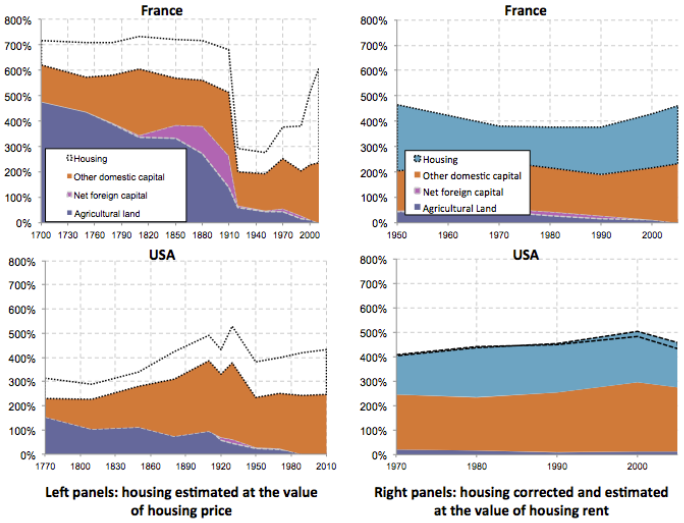

Thomas Piketty’s claim that the ratio of capital to national income is approaching 19th-century levels has fuelled the debate over inequality. This column argues that Piketty’s claim rests on the recent increase in the price of housing. Other forms of capital are, relative to income, at much lower levels than they were a century ago. Moreover, it is rents – not house prices – that should matter for the dynamics of wealth inequality, and rents have been stable as a proportion of national income in many countries.

The impressive success of Thomas Piketty’s book (Piketty 2014) shows that inequality is a great concern in most countries. His claim that “capital is back”, because the ratio of capital over income is returning to the levels of the end of the 19th century, is probably one of the most striking conclusions of his 700 pages. Acknowledging the considerable interest of this book and the effort it represents, we nevertheless think this conclusion is wrong, due to the particular way capital is measured in national accounts.

The author’s claim is actually based on the rise of only one of the components of capital, namely housing capital. Removing housing capital, all other forms of capital exhibit no trend in the recent period. At the beginning of the 21st century, other forms of capital are, relative to income, at much lower levels than at the beginning of the previous century.

This leads to the following two questions:

• First, why has housing capital increased?

• Second, should it be included in total capital to assess the dynamics of inequality?

The answer to the first question is that the trend is due to the rise in housing prices relative to income in most countries. The answer to the second question is yes, housing is not just wealth but also capital, and it contributes to wealth accumulation. However, to be in line with Piketty’s capital accumulation model, the measurement of housing capital must be based on actual returns to housing – that is, rent.

Why? Because rent, not housing prices, should matter for the dynamics of wealth inequality. Rent represents both the actual income of housing capital for landlords and the dwelling costs saved by ‘owner-occupiers’ (people living in their own houses).

To better see this point, let us ask a simple question. What inequality would there be if each household owned one painting and kept it throughout its lifetime? The wealthiest households might own a pricey Manet or Kandinsky. The poorest might own a painting by a local artist. Now, if the price of art increased uniformly, would this contribute to an explosion of inequality in the sense of a divergent and exponential accumulation of capital? The answer is clearly it would not. Even if the paintings could be rented and generate some income for the owners, this revenue would need to increase proportionally to the selling price and faster than labour earnings for capital to increase faster than total income.

This has not been the case for housing rent relative to income, despite the perception that rents are too high in large cities. The ‘Thénardier’ exploiting the ‘Miserables’ in Victor Hugo’s novel are not back – there has been a stable share of rents in national incomes in many countries. In fact, beyond prices, the most noticeable trend in the housing market in the post-war period was the accession to property of a large and growing middle class – which benefitted from price increases.

The recent divergence in the data between rent and prices therefore leads to the wrong conclusion. When we properly measure housing capital – using a methodology that corrects for the rent-to-price divergence, and in a way quite close to the answer to the famous controversy of the two Cambridges on capital measurement – we find that the capital-to-income ratio including housing is actually stable or only mildly higher in the countries analysed (see Bonnet et al. 2014). (Figure 1 shows France and the US, but the same is true for the UK and Canada – the exception being Germany, where the ratio rose.) These conclusions are exactly the opposite of those found by Thomas Piketty.

Figure 1. Measurement of capital over GDP ratios

Thinking a contrario, do we really believe that a general drop in the price of housing (as occurred in Spain and Ireland) would be excellent news, leading to a compression of wealth inequality? Again, the answer is clearly not. This shows the fragility of a line of reasoning exclusively based on a rise in the value of housing capital due to the rise in its purchase price – especially when this price diverges from the rental price, as was the case in France and other countries over the past 15 years.

This being said, it is clear that housing price inflation has complex effects. If a part of the middle class gained from it through accession to property, it also potentially hurts the younger generation, who will inherit more from their parents but will need to rent for a longer time. Perhaps this is for the best – we think that European policies aiming to promote property ownership are unwise, since they lead to lower geographic mobility and excessive risk-taking in wealth accumulation.

In conclusion, we do not believe that “capital is back” simply because housing price increases have artificially raised housing wealth relative to the true rental price. The logic of the argument requires a different measurement of capital, and the one we propose shows instead a relative stability of capital over income. We simply need more work and more thinking to understand the particular role of housing in inequality – something absent from the recent works on inequality.

See original post for references

I would also argue that Piketty’s solution, a universal wealth tax, is little more than a band-aid over cancer. The way Capitalism has evolved, it has become a giant value siphon out of any and all natural, social and environmental resources. The result is that we have atomized societies and a stripped planet. A wealth tax simply directs this firehose of notational value back over a slightly broader audience, when the real need is to fundamentally slow this process of abstracting and extracting value and develop a more organic and integrated economic process.

This leads to the observation I keep making here, that we need to start recognizing money as the social contract it is, rather than the commodity we have come to think of it as. Then we will understand it as the network of obligations which it is and not some magical source of value that the financial system waves in front of our faces, like bait in a trap.

We’ll said. Do you think mmt offers any help in understanding money as social contract?

In

Nope. The form of MMT we currently enjoy came about when the US hit the point where its economy needed more BTUs than its fair share. For example, the stats keep on showing us that the per capita energy consumption as been maintained when they don’t even include all the energy and resources that have been used up globally to prop up the US economy.

This money system hides the true value of everything. It leads to wealth discrepancies. And now some think they can convert it into a gentle MMT which could bring more fairness.

The Great Depression transformed a generation. The Great Recession has not transformed people yet. If you distributed 25K to every household in the US, they would probably spend it exactly how they have over the last few decades.

The Great Recession has not yet run its full course. Lessons still need to be learned. The US population needs to understand that structural changes are needed before they are handed more easy money.

When the MMTers say that governments should run huge deficits, I understand. But when they go on to say that huge money should be spent on infra here, and infra there but they have not even thought about which infra should get fixed or disappear, I get worried.

Randy,

It lays out the mechanism and the history, but it doesn’t make a convincing argument because it does not first clarify that money is not a form of valuable commodity, but is a social utility, much a like a system of public roads. As it is now, the idea that money can be spent into existence by government and that people feel the need to accumulate as much as possible for their own security creates fundamental tensions. To save money, either we have to take it out of circulation and store it, “under the mattress,” or we invest it by loaning it to someone else, who has a method for increasing it sufficiently in order to make it worth their while and ours. The first method, if practiced widely, sets up boom bust cycles, as ever more has to be put into circulation, to make up for what is being saved, which then creates large pools. Then people start to realize there is too much and start to dump it.

The second method assumes far more investment potential than actually exists and so lending standards are lowered, the government borrows a lot back and spends it in ways without a lot of long term return, such as military, etc. What often does drive up the value is speculation, ie. money can be borrowed into existence at a lower interest rate than prices for assets are appreciating. Then only those not speculating with borrowed money are losing, because their savings are declining in value.

Now if MMT would first make the argument that money is not some unit to be created out of “thin air,” but is an agreement between a community and its members and its value is dependent on the health of that community and whomever is harming the community, such as not trying to put back what they are taking out, is not holding up their side of the contract. Then rather than laws concerning possession, it is laws concerning the sanctity of contracts, that come into play and those sitting on enormous piles of cash, with little respect for the community issuing them, might find their rights weakened.

I haven’t read Picketty, but one of the blurbs on him criticized him by pointing out that his problem was that he confused capital with wealth whereas Marx always understood capital as political power relationships. Much as you are saying, money is a social contract.

Susan,

Yes, many of these ideas used to be quite obvious.

A big part of the problem is how we intellectually process concepts, in that as we study them in ever more detail, we start to lose sight of the broader context in which they exist. Then the professional and political territorialism draws these lines in the sand and the ‘experts’ declare their areas of expertise to be off limits to outsiders, so then the Tower of Babel syndrome takes over.

My father had an old cattleman’s saying, that “You can’t starve a profit.” Which pretty much puts the whole argument on a bumper sticker.

John Merryman: MMT does say the things you say it should say but imply it does not say. MMT emphasizes that money is not a commodity, not a thing, but a relationship. Wray recently said here that you had things right – but that is because you are saying about the same thing that MMTers & predecessors have been saying – for centuries. In addition to Wray’s books, I would recommend the Mitchell-Innes volume, with both of his papers & very enlightening ones from all the other authors, and Geoffrey Ingham’s The Nature of Money on these points.

Calgasus,

Point taken. As I observed to Susan, these insights were more obvious in simpler times. The problem is with complex and fragmented information, it is easy to steer the public in ways which benefit those who understand what is going on and how to benefit from it. Even Marx was essentially highjacked by Lenin and Stalin.

The issue is not who said what first, but how would you go about making a public case in the future, that would have broad consideration? Piketty isn’t really making that argument.

The whole system needs to be re-examined and MMT is the only real effort to do that, but it isn’t getting much traction. What would take to change that? A clear and succinct presentation? Articles in major publications? College courses? An opportunity is going to present itself in the non-too distant future, after the next global financial heart attack. Maybe someone knows someone at the Guardian, Salon, etc, who might be willing to start the ball rolling. Then after the system blows up, possibly editors at the NYTimes, the Economist, etc. might be convinced the tide has truly turned and if they don’t want to see civilization tip into the abyss, it is a subject which needs attention. Even a lot of the rich are smart enough to know the system really is broken,and while it might currently be to their advantage, simply having more bling in the penthouse doesn’t help, if the skyscraper falls down.

Money is created by banks. The government can also create money ex niholo by deficit spending, but the operational mechanism is by creating deposits (making payments).

I do not understand this continued demonization of MMT. It’s like raging at a thermometer because it shows you your body temperature. Virtually all of the complaints about MMT are based on a failure to understand what it says about how money works. MMT is descriptive of our current system, and it also has a message that progressives (the real kind, not the Democratic hack kind) ought to favor, that the Federal government does not need to run a balance budget, and that a balanced budget is in fact destructive when the economy is as slack as it is now. That means the government not only can but should spend more, which is in contrast to all those barmy arguments about how we can’t spend to [fill in your priorities, have national health care, improve our infrastructure, feed low income kids in school, etc.).

These attacks on MMT on unrelated threads look like organized trolling. Here we have a basis for calling out neoliberals, and people who ought to embrace it are instead being told falsehoods about it and are becoming skeptical. That assures that the current crop of looters can continue their work unperturbed.

For me, there are two aspects of MMT. One is the descriptive, and that’s pretty much correct (I didn’t think so at the start, or I’d say I didn’t think chartalists were correct but..).

The other is a bit more of what does it mean. As far as I can tell, MMT still ignores the human factor. That is, even if MMT is right in perfect world, if a majority of people does not think so/know so, they may well react in a (technically) non-rational way which will generate different resutls than MMT expects. Say if the govt does start spending tons of money out of blue (not to prop assets, but on real economy), if people believe it’s going to create inflation, it well may create inflation because people will start behaving as if it was doing so. People’s beliefs are not bound by reality. That’s where MMT fails for me – that at some level it still assumes rational response to the policy actions it proposes, and ignores the simple fact that there’s a a large and powerfull loby that has an interest in sending an opposite message. Ulitmately then, it’s the people’s behaviour which decides which way it swings, not just a mechanistic transmission.

With all due respect, I don’t understand this objection. You are saying you’d prefer “earth is flat” descriptions of monetary or macroeconomic policies because they are more emotionally satisfying or more familiar? Modern economics pays little to no attention to institutional arrangements, and MMT’s prescriptions allow for more decentralized decision-making, which in other contexts, many NC readers strongly advocate. There’s a big subthread of pro-localization here. So I am a loss to understand all the hostility toward MMT, save for the fact that you need to turn how you think about money inside-out. It does take some mental rewiring to understand it.

Yves,

I very much agree MMT is the best description out there. As of yet though, it hasn’t gotten its message out and that needs to be addressed.

As for vlade’s point, I think the issue of government budgeting and accountability needs to be part of the review process as well. Obviously government needs to spend wisely as well, yet individual politicians are going to have a limited perspective and spend according to their own needs.

As it is, the current budgeting method seems to be to put together these enormous bills, add enough pork to buy sufficient votes and then the Prez can only pass or veto them in whole. That’s bribing the fat kid to eat an apple with candy bars. It occurred to me back in the days of the line item veto debate that to budget is to prioritize and then set an objective level of spending. We could have the legislature prioritize by breaking these bills into their various items and having each legislator assign a percentage value to each item and then reassemble them in order of preference. Then have the President draw the line as to what would be funded. As Truman would have put it, “The buck stops here.”

This way, it would be graded on a curve and so there would be less incentive to scratch each other’s backs, while the percentage method would give legislators some leeway in calibrating their interests.

This would likely limit spending to more local projects, but that would go with more localized government and community banking, so that such projects would be more bottom up and have community support and input.

Monarchies wore out their effectiveness, when they lost touch with their base and now these global banks are doing the same thing. Time for the big reset.

I don’t prefer the current state at all.

I’ll try to rephrase my objection

As you say, MMT is descriptive – and I agree that it’s about the best description we had of how money works.

My objection to MMT is on the prescriptivness of some of the policies. As far as I can tell, it acknowledges that money is a social construct, as opposed a commodity, but then fails to account for how the social (mis)understanding of that social contract actually affects it. It says “you can spend w/o inflation” – well, it actually doesn’t, the message is much more complicated, but its opponents can present it like that (people like short soundbites), and that can be a problem. More nuanced is “gov’t can spend w/o inflation if there’s no extra demand” – which actually is not new (I believe it was first talked about even before Keynes). But if majority of people believe the tea-leaves readers of “classical” econ, that massive gov’t spending will create inflation, and act on it, you may well get inflation, much higher than expected.

I’m not saying that it means MMT should not be used as a policy tool – it should, as it’s still likely the best one out there at the moment. But it should be extra careful, as the road to hell is paved with good intention. See Laffer, which sort of worked until second-order human effects meant that it didn’t. And it may again, if people forget about it for a while…

From that perspective, I actually very much liked your Churchill’s quote paraphrase – it’s bad, but best of what we have now.

I think you should re-read Wray last couple of posts on NC. MMT cannot possibly make clearer that money is about social relationships, about you and me. No other line of economic inquiry takes humans into more account than that.

Ben,

I think the concept of terms needs to be considered. “Social relationships” just doesn’t have the ring of authority to it. How about we call them ‘contracts?’ It brings a lot more legal implications to the table.

Then it also needs to clarify and compare to the current misassumption, that money is a commodity. Which is not to say that it doesn’t somewhere, but there needs to be an editing of all the major points into a clear and concise description, for the ‘masses.’ and the media.

Merryman:

https://www.google.com/?gws_rd=ssl#q=mmt+%22money+is+not+a+commodity%22

MMT theorises that money is not a commodity. . .

Money is not a commodity. . .

Clearly fiat money is not a commodity money.

Money is not a commodity, a thing. . .

Holds that money is not a commodity (a “thing”) but an accounting standard. . .

MMT states everywhere that money is not a commodity. At this point it’s relatively clear you’ve done little reading on this.

Ben,

No, at this point it is clear the rest of the world has done little reading/thinking on this. Derivatives come to mind. This is a fairly significant world issue. It’s not about who said what first. I’m not claiming any copyrights on anything I say. I do have the right to offer up ideas without having to give a complete footnotes on every time in history that idea, or anything similar has been said. We are on the same side of this issue, but it should be about moving forward, not getting into endless academic debates.

MMT, as far as I can tell (and I’ll admit I haven’t read it extensively) ignores second order human reaction generated by its counter-intuitivness.

You see, most human social contracts are usually only very weakly limited by real world. That’s the major difference between physics and “social sciences”. If a physics law says that gravity will make stuff fall unless there’s something to stop it, it’s a law, and we can get more precise, but it’s unlikely for someone to find a loophole.

With human interaction, both positive and negative feedback is common. Most of the time, most of it cancels itself out. Sometimes it doesn’t, and our nice descriptions breaks down in unprecedented ways. When there are ways of making money out of breaking the social contracts, humans get the most inventive.

So I’d take MMT much more seriously if I saw (and I’m not saying there isn’t any, just that I hadn’t seen any so far) an analysis which tried to look at that. I.e. under what conditions of human (possibly irrational on a large scale, but imaginable) behaviour it could generate unexpected results like hyperinflation in absence of demand.

@Yves MMT is descriptive of our current system

Dr. Wray has this up now on NEP:

Wray has been at this for a while. Is that an accurate accounting of Equity? Can anyone point us to such a balance sheet?

What does this have to do with Piketty, which is the subject of the post? Your comments border on obsessive.

@Ben Johannson What does this have to do with Piketty, which is the subject of the post? Your comments border on obsessive.

That was my second comment here since 6/19, and the prior one concerned itself with Steve Keen’s depiction of Debt Deflation.

Did you also notice the individual who has been posting on MMT in this thread under your name, with not a syllable about Piketty?

I think a small quantum of coherence and graciousness would not be too much to ask of you at this point. Though certainly too much to expect.

Sure it won’t help, but someone has to make failed reforms before the *kettle drum thumping* *trumpets blowing* TRIUMPHANT RETURN OF SOCIALISM!

A comrade in perspective. I could not agree more. I have been trying to make this point for some time (particularly at NC) but I always get the equivalent of the, “But…what is your solution?” rebuttal. We must have a dialogue to synthesize the solution, and that requires admitting there is a problem. Thank you for sharing.

what about all the mortgage debt associated with those housing prices? if you subtract all that debt “d” do you still have “c” or do you have “c prime” where c minus “d” = c-prime which under many conditions approaches c sub-prime (no pun intended) plus or minus an error factor “e”, where e > both c and |c prime| and where e temporariy goes to zero as “m” = money printed approaches infinity. At this point you need more letters. Whhy is it all so complicated??? It makes your brain burn from confusion and so you just say “i’ll just go with a few letters and make it worksomehhowh:.

Well, I don’t pretend to understand C-man’s higher maff. But for sure, as any Realtor(TM) will tell you, price is a function of terms.

In the 1920s and 1930s, 5-year balloon mortgages were common. It was financing, but it didn’t last long. Buyers had to plan on accumulating enough savings in 5 years to meet the payoff.

Now 30-year mortgages are standard, with tiny principal payments in the early years. Easy financing pumped up housing prices, since buyers now wield secure long-term financing in addition to their own savings.

This secular rise in house prices, owing to a change in financing, cannot be extrapolated into the future. It was a one-time event. Measuring rent instead of price is one way to reduce the distortion.

’twere all us boomers what did it. Some of it. I think this is true globally. The generation born right after WW2 exploded. Whether it was induced is another question. Because it did function as a population ponzi and whoever had the most babies won the Cold War. Maybe.

Most of the things which increased “r” over the past century have been one-time events. The thing is, there’s one after another…

You can’t “unskew” this stuff; that’s fakery.

The original FDR action converted short-term mortgages to 30-year mortgages, which was a benefit for the 99%.

However, the *long term* effect of readily available 30-year mortgages was a shift of wealth from the 99% to the 1% — a 30-year mortgage is much closer to a rental economically than a 5-year mortgage.

I’m far more interested in the implication of “the superior returns to capital in the 20th century were due to house price inflation” than anything having to do with Piketty. If the proportion of capital assets held are increasingly in housing what does that say about stagnation? Houses don’t produce anything beyond shelter. If low interest rates lead to larger and larger houses, then more money is tied up in assets which are increasingly looking like dead weight losses for the economy.

I think you’re right.

Also, this “dead weight” housing is in most cases not even “good” housing. It’s mostly inefficient to heat/cool, doesn’t offer much in its capacity to generate energy or food, and generally isn’t close to mass transit or more local food sources. IOW, worse than dead weight.

It’s the return of the rentier. High concentrations of wealth, and wealth means control of land and things which are like land.

I believe it was Dean Baker who, prior to the recent financial crisis, kept saying that rent, not price, was the true measure of housing value and therefore the increasing divergence between them was proof of a housing bubble–that housing bubble that Geithner claims nobody could have predicted.

Which is to say back in the early “naughts” somebody reading the internet would have been better informed about the economy than our central bankers.

There was some discussion yesterday about whether our elites are incompetent or just evil. I’d say much of the problem might be their narrow sources of information. Their attitude seems to be that as long as all the right people believe something then you can never get blamed for believing it as well…the “nobody ever got fired for buying IBM” theory. Or perhaps it’s the emperor’s new clothes theory. At any rate a lack of intellectual curiosity would definitely go down in my book as “incompetent.”

Off topic I suppose but just an observation.

In 2006 over many drinks, I had an an afternoon and evening of conversation with a venture capitalist who said that the talk on the Streett was that the whole system was going to go belly up due to the growth of bad financial instruments I had never heard of–derivatives. I am convinced that many smooth operators knew the system would crash but they found it useful to ride the bubble and some were burned badly anyway. I think regulators must have known in the same way as decision makers knew there were no “WMDs” in Iraq.

Well yes, they absolutely did know that they were generating massive amounts of toxic assets and that there was going to be a crash. But each individual bank/banker was in a situation where, since everyone else was doing it, they had to do it too, or they’d get left in the dust. They could lose now or kick the can down the road and lose in a few years. And sacrificing long-term sustainability for short-term profits is the FIRE way, after all.

It seems to me rent is not the only return on a house, at least in Australia. Even before paying the whole debt, one can borrow unto 80 percent of the house value to buy another house. Only tax is on the difference of rent and mortgage which is usually negative. And maintenance expenses are tax deductible. I have seen many who bought four houses and one is reported have bought ten houses and flats before the age of forty. One can also borrow money on the house to invest or start a business or help children buy houses. So just counting only rent seems to me to be a simplification in Australia. I think Michael Hudson has written how it works in New York.

to Gaddeswarup

I’m no economist but I believe Baker was saying that rental value of a house or represents its true value absent other factors that people have been mentioning such as low interest rates or liar loans. He said that historically rent better reflects such non bubble components of the value such as population size and land availability.

The book has the Mark of Cain if the auld gov from the Irish Central bank has to endorse it.

The choreography amongest the elites functionaries would be funny if it were not so serious.

http://www.centralbank.ie/press-area/speeches/Pages/Honohanresponsepikettytascconference.aspx

From my albeit limited perspective it is a simple war against local rednecks which has extracted local purchasing power and used that latent energy to expand unneeded industrial expansion on a truely global scale.

Note

I am speaking from a redneck white flight area somewhere deep in South Kerry where the locals cannot afford abundant excess housing or beer.

However the locals from this area historically felt easy engaging in a social contract with their overlords.

The houses will be bought by external people so that the locals can have access to hard currency so that they can drive to their local Aldi store.

The world is far more simple then the economists project.

For obvious reasons modern economics ignore the plain facts of local and anti local living.

I imagine its in your face dynamics is just too much for their delicate models.

That link to P Honohan’s comment was shocking.

He describes everything in such pale, moderate-sounding language, and plaintively wonders whether what has been done will be enough–referring to the most supposedly “helpful” government policy so far, the recent changes to the insolvency legislation (with changes that people already know isn’t working). . .

His range of options doesn’t include leaving the EU, or anything with a semblance of imagination.

IIRC as Governor of the Irish Central Bank he gets a generous salary, so the problems of his countrymen don’t affect him personally.

Perhaps somebody could help clarify this for me, since I’m not an economist and am not habituated to working with this kind of data: Isn’t there a fundamental, qualitative difference between the real estate and housing stock owned by the super-wealthy (the 1%, for example) and the housing owned by the majority of the rest of the population? It’s not doubt true that rising home prices have in many cases benefited the middle class, but the analogy of two paintings, one by a local artist and one by Manet, for housing seems to fall flat as soon as we realize that the real estate owned by the wealthy consists of numerous second homes, etc. which function much more like capital than the housing stock of the vast majority of the population, which is first and foremost a roof over their heads. Their functions are fundamentally different and the wealthier one is the more one’s real estate holdings begin to look like capital. It seems to me if we were to take this into account then increasing home prices vastly and disproportionately contribute to wealth inequality, but perhaps I’m missing something?

Not all real estate is made equal. Some will go up, much of it will depreciate. 95% of the rich will lose what they have. Rags to riches to rags in 3 generations… most of the current rich are generation 2… and I am pretty sure it won’t make it to gen 3.

Why? Because most of today’s rich don’t really understand where their wealth came from. They believe they are god’s gift to the world… for such people, time is the great equalizer… easy come, easy go.

If the Fed keeps growth down, miniaturizes interest rates, and simply tweaks the market every night while nobody’s lookin, then they will indeed “accomplish their goal.” I assume their goal is the stabilization of the flow of money. Because heaven forbid they are just honest and go tell all the rich privateers that they are killing capitalism, not to mention people. The question as usual is, Whadda we do now? Part of the depressing answer is the perennial fact that we are stuck with our politics and self serving “representatives.”

I don’t believe we can take out real estate because over the last century monetary and social policy has made housing and cars the main focal point. Mortgages have been the main way most of the middle class could get into the wealth building game. And the population caught on.

However, the population never really understood the nuances in the location, location, location meme. They based it on historical values. People still desire the “executive home” when these don’t even fit their current lifestyle needs.

Some real estate will become increasingly desirable but a large chunk will become a huge resource sucking money pit. The reality is that the buildings depreciate and suck up maintenance dollars. To make matters worse, many homes have been built on fertile land which has been rendered useless.

If we account for resource and energy depletion, I am betting that a large percentage of households across the US will not be able to maintain their houses over the next few decades. Even less so as infra needs to get rebuilt.

Over the last few decades, we North Americans have built up our cities as if energy would never be an issue. But here in Ontario, one third of the electrical power generation needs to be replaced. We are guaranteed a huge increase in electricity prices, Is anyone accounting for this? Nope. Suburban development houses just keep on getting bigger and bigger. In the mean time, century houses in the downtown core are close to 1 million but in dire need of repairs while all the streets need to get dug up to redo the water mains. For most of the population, these variables are not even factored in at purchase time.

Right now in Canada, real estate pricing is still up in the stratosphere, making returns on capital look quite high but at some point, Mother Nature will readjust this. In the US, real estate might have corrected but the prices still do not reflect the coming squeeze in energy and natural resources.

Most real estate is past wealth.

I do not think the ghost town effect will happen in Europe. However over there, real estate prices are so high that when the bubble bursts and many default on their mortgages, wealth will concentrate even more.

In North America, chances are many areas will get deserted, others will become shantytowns and some will become prime areas. Considering the extent of infra work that needs to get done in many older neighborhoods, it’s not even clear which currently desirable areas will remain prized.

I really like the Tiny House movement. I think they need a stationary bike attached to a big battery so as to kill 2 birds. Every morning do your 45 minutes, dust and vacuum, take a hot shower, fix a good breakfast and roast some meat & veggies to marinate for supper; then go off to work. In the evening drink plenty of wine and eat cold plate. Rinse and repeat. A tiny house with a giant veranda would be extra cool. And a big fat garden.

Great stuff, Susan! In addition, tiny houses would motivate us to spend more time with other people instead of wandering around our huge homes like so many Charles Foster Kane’s.

I think the return on capital includes a lot more than just real estate. It’s about the growth of the rentier class, including banks, not just the mass of ordinary homeowners who see their homes as investments. It includes the returns in the form of interest on loans, such as mortgages and car loans. As you know, if you agree to buy a house that’s priced at, for example, $300,000, with a 30-year mortgage, due to the return (interest you pay) on the lender’s capital (the amount you borrow), you’ll pay roughly three times more dollars for the house than its listed price (this doesn’t count the effect of inflation on the value of a dollar). Thus the rentier’s return on $300,000 capital will be roughly $600,000 if the loan is carried for the full 30 years.

Exactly. The wealth concentration has not run its full course. The system is currently set up to get even worse. People will be losing their homes or paying out huge sums of money to the rentier class over the next couple of decades in interest, energy and resource costs.

And if they are smart they will cut their losses and say good riddance.

‘Thus the rentier’s return on $300,000 capital will be roughly $600,000 if the loan is carried for the full 30 years.’

This figure sounds too high. Even at 6% interest (well above current rates), a 30-year loan would collect $347,515 in cumulative interest. The rest of the mortgage payment is return of the $300,000 principal.

Currently, the largest mortgage securities ETF has a distribution yield of 1.52%, half a percent less than inflation. Rentiers are not bloody amused.

http://www.ishares.com/us/products/239465/ishares-mbs-etf

The figure of $600,000 is indeed much too high at current rates; however, I was talking about the total mortgage payback including compounded interest which is much higher in dollars than the list price of the house. That’s good for rentiers but not for consumers who think an ordinary house, mortgaged, is a good investment. For a rentier to obtain roughly $600,000 interest on a $300,000 mortgage, the interest rate would need to be about 10%, which it was back in the early 1980s when I bought my house. I think the problem Piketty is addressing is the fact that real incomes aren’t keeping up with the rising real cost of living, so consumers are taking on more debt in lieu of rising incomes. That means consumers are burdened with high and rising debt service which is depressing consumer demand, and there is no end to this in the foreseeable future.

If it’s not interest, the muni taxes to pay for infra replacement as well as energy and resource costs for house maintenance will probably get you.

But these might lead to more equity withdrawals and more interest payments….

Most of the comments turn on housing prices and rent. I feel that there is a essential difference between housing, which is really long term consumption, and capital investment , which builds the infrastructure for the production of future consumption. US accounting accounting lumps both together. I strongly suspect that if you were to separate housing investment and amortization from capex you will find the long term decline in capex even more dramatic. The bigger FIRE – finance, insurance, real estate – gets, the smaller the share to capex.

Faith & Optimism vs. Confidence & Depression

The consumers are always fighting depression, with one drug or the other, in one confidence scam or the other, exploiting natural resources until they can’t, hoping for a better outcome, always ending in bankruptcy. TARP is History, and America is no exception.

Faith isn’t about hope; it’s about experience, seeking that which others do not want to see, and developing the skills necessary to adapt where others cannot. Faith is the source of optimism, not peer confidence, which is nothing but dead weighty.

Optimism is not about identifying weakness in others, as all peer pressure systems are designed to do, but in yourself, and doing something about it, intelligently. Optimism is freedom from depression, not peer pressure, which has no priority other than derivative expediency.

The difference between confidence, false pride, and optimism, experience in faith, is the difference between talking feudalism up and employing feudalism as a counterweight. Peer pressure is incapable of consideration, and therefore cannot price; the bank cannot see demand, let alone supply it.

As the facebooks consuming debt as an example to others are apt to say, but strenuously avoid themselves, tribulation begets perseverance begets habits begets character. You want to learn how to transform gas, liquid and solid, with pressure and heat, in circuits, and they don’t teach that in school.

School breaks up ignorant observations of labor, and adds layers of busy work to justify itself. With free money, it makes sense for the global city to replace arbitrary extortion systems, faster and faster, and small cities to adopt them, with grants from above, until all the natural resources are gone, leaving nothing but debt.

The tradespeople seeking billable hours charge $150/hr for windshield time, from the global city to the countryside and back, in supply and demand stupidity, simply because the countryside is not certified in stupidity. Talent, in building skill, discounts away the stupidity.

Of course the automaton healthcare system breeds stupidity. Of course the corporations hire, promote and replicate stupid, to build a scale economy, to appear invincible, inescapable and inevitable. Middleman misdirection hides the market to produce artificial markets, layers of extortion, which can only atrophy the skills of all participants.

With experience in faith, you can afford consideration. The empire cannot, which is why it is built on false promises, debt as income and asset. The empire is crumbling, under a Disneyland façade, becoming increasingly tyrannical as it does so, but that is only a threat to the participants.

Once empire demographics decelerate, the false promises clothing the dictator vanish, and global communication has blown up the immigration scam, leaving the participants in a circular firing squad, emptying their war chests to live another day. Having children is an act of faith.

Without consideration, the majority is always lost in self-absorption, which is to your advantage if you have faith. Widen your perspective beyond the machine in both directions, by growing time relative to the empire. If you have seen the problem or the solution, it’s not a problem; it’s a manufactured problemsolution.

The empire always hits the wall of imagination, because it cannot jump, out of the past. Step out of the passive until aggressive, anxiety misdirection feedback loop of artificial crises, and you will see that the empire is a line to get a ticket to get in another line, with ticket agents paid in toys.

In your mere individual presence, you change the world, whether you care to believe so or not. Life is not a plan to overthrow the universe, by studying it from behind the curve. Accept responsibility, by discounting the empire, and it turns on itself.

Civil marriage fears work, always finding itself at war over scarce resources, working harder and harder, to avoid work. The Jewish threw their own under the bus to retake Jerusalem, only to eliminate privacy. The only thing about History that changes is the dress. Grow privacy accordingly.

Peer pressure punishes parents for parenting, rewards ponzi participation with toys, and eliminates privacy to ensure the outcome, distilling talent out. Leave it to do so. Some people’s money is worth far more than other’s. The one and only path to the future is eliminating the middleman, with faith.

The fact that civil marriage has amassed such a global arsenal is a reason for optimism, because it’s dead weight, loading the spring. A machine creating opportunity cost is nothing to fear, unless you are a disposable part, in a contract made to be broken.

Marriage is the kernel because it is where you learn to love another more than yourself, to complete the bridge, across MAD weaponization. Step out, move forward and you will see the parts you need. The critters are welcome to spend just as much time as they like copying code and building hospitals, playing make-believe in never-never-land.

Two decades with me following two decades with my dad, and they just keep getting dumber, lowering the standard with a Bell Curve, accepting lost purchasing power as wealth in the form of toys, gutting workmanship and replacing with the false security of entitlement.

My kids and their children just get further ahead, while the empire crumbles, under a façade of consumer confidence. If the State threatens to replace you with a c-clamp, let it do so. What is beyond gas and solid? How does a mirror short the circuit?

Funny, the critters with a marriage entitlement guaranteeing a duration mismatch, to inflate assets with debt, as income, are pleading freedom and separation. When the hammer becomes the nail, everything looks like a hammer. The law is a circle jerk, for people with nothing better to do, because they have ceded imagination to the State. Move along.

Central control of credit cannot work as a discounting mechanism, but, God bless them, they never stop trying, discounting away their own equity in the future.

Am I relieved to hear that inequality is the 20th century is simply the result of nominal housing valuation.

Who could have known without such insightful analysis, which seems to replicate Justin Wolfers’ study purporting to show how housing accounts for Piketty?

The Walton family, the Kochs and the rest of the 0.01% must own some really big houses that inflation exploded the value of.

The huge rise in housing capital mirrors the decline in interest rates seen since around 1980. The reason for this should be obvious: we choose between paying rent to a landlord or a bank, but all else being equal our monthly budgets will be the same so the mortgage repayment will be of a similar amount to the prevailing rent.

Even before the banking crisis, interest rates had fallen to between 1/2 and 1/3rd of previous levels so house prices relative to wages correspondingly increased by 2 or 3 times.

This shouldn’t be corrected away as it is the very heart of the problem. A modestly high inflation / high interest rate regimen favoured labour over capital. As a wage earner one could save for a down payment in 1/2 to 1/3rd the time. With house prices as high as they are, home ownership in many cities will be the preserve of those who can call on parental capital to help them along the way.

My impression is that in high end markets, very often parents buy real estate for their adult children. Some 1% per centers might regard real estate as a very good multi-generational investments. Forty years ago Park Slope real estate was relatively affordable. Today, I don’t think most people could afford the neighborhood unless they have rich parents. There seems to be different rules for different cities. In Las Vegas, you can afford a nice house in a whole foods neighborhood even if your income is below a 100K. Don’t think this is possible in the North East. Of course, we’re not a tech or finance center, so we have less income inequality. Pikkety wrote that in the post war years in America and Western Europe families in the 50th through 90th per centile, did have the chance to accumulate some wealth. The gist of his argument, that we’re moving back to the 19th century when wealth was more highly concentrated. Maybe the system will blow-up. Maybe the younger generation will adapt to the new regime simply by not starting families, like their grandparents and great grandparents did during the 30s.

This is another piece of bogus nonsense attacking Piketty because the writer didn’t understand Piketty.

Piketty explains quite clearly that his concept of “capital” means “wealth” and includes land. He also explains quite clearly that his concept of “return on capital” (r) includes “rents on land”.

Piketty proves his case that r > g almost all of the time. Yes, this is due to “economic rent” effects. There is no reason to exclude housing price increases from this analysis. In the US economy, rather than paying traditional rent, people pay mortgages; economically, this is rent, but it is driven by housing price levels.

Perhaps Piketty’s terminology is confusing some people. In older terminology, Piketty is talking about the return of the rentier. Period.

This pointless, worthless article does nothing except show that Piketty is 100% correct. For some reason the writer imagines that he is disagreeing with Piketty.

“Thinking a contrario, do we really believe that a general drop in the price of housing (as occurred in Spain and Ireland) would be excellent news, leading to a compression of wealth inequality?”

Actually, yes. But only under *certain legal conditions*. With the legal system set up in a conventional manner, the result of this drop in price should be:

(1) Homeowners stop payment on underwater mortgages and throw the keys back to the bank;

(2) the banks lose vast quanitities of money on their loans and declare bankruptcy, causing the 1% to lose lots of wealth, and they sell off the houses at fire-sale prices;

(3) the 99%then buy up cheap housing.

Result: compression of wealth inequality.

What’s happened instead is that the legal systems have been distorted, so that the banks are attempting to squeeze blood out of a stone; they are trying (fairly successfully) to force the homeowners to pay for all the banks’ losses and all their bad business decisions. This is at its most extreme in Spain where it seems to be impossible to repudiate a mortgage loan by turning over the house *or* by declaring bankruptcy.

It is the distortion of the legal system which is causing the inequality. A drop in house prices would be good for the 99% *under a functioning legal system*. But as long as the legal system is rigged, it’s bad for the 99% when prices go up, and it’s bad for the 99% when prices go down.

To put it another way: who benefits from the high housing prices? Not the individual house owners who have mortgages.

The big banks and their financiers turn out to the ones who benefit from high housing prices, if you track the flow of money carefully.