By Arthur Berman, a petroleum geologist with 36 years of oil and gas industry experience. He is an expert on U.S. shale plays and is currently consulting for several E&P companies and capital groups in the energy sector. Berman is an associate editor of the American Association of Petroleum Geologists Bulletin, and was a managing editor and frequent contributor to theoildrum.com. He is a Director of the Association for the Study of Peak Oil, and has served on the boards of directors of The Houston Geological Society and The Society of Independent Professional Earth Scientists. Originally published at OilPrice

The front page of The Wall Street Journal on Tuesday, February 10 proclaimed “Oil-Price Rebound Predicted” according to the IEA (International Energy Agency).

Not true.

The February 10 IEA Oil Market Report states that some “market participants are seeing light at the end of the tunnel” based on oil company spending cuts. It goes on to mention that over-supply could become as bad as in 1998 when oil prices plunged to almost $11 per barrel.

That’s some kind of light at the end of the tunnel!

I believe that oil prices will increase strongly before the end of 2015 but there has to be a reason. Budget cuts and falling rig counts may create a feeling that production will fall but markets don’t move far or for long based on feelings.

The first reason for a rebound in oil prices will be a production cut after the June OPEC meeting. That didn’t happen in November because Russia said no. I think Russia will be ready by June.

The second reason will be when North American oil production starts to fall, hopefully around the same time as an OPEC plus Russia production cut. Another reason may be a political event that introduces a fear premium into the price of oil like ISIS in Iraq, Ukraine or something not on the radar yet. That’s how the world is.

With that out of the way, let’s look at the facts. Two charts are all we need.

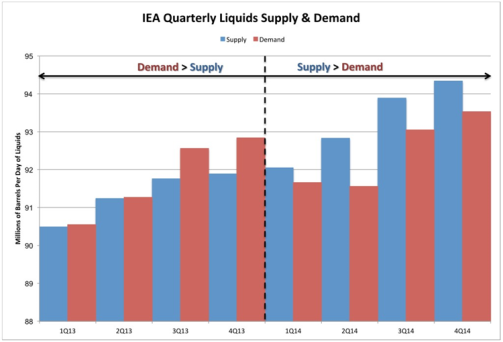

Both IEA and EIA (U.S. Energy Information Administration) released new data on February 10, 2015. I used IEA quarterly oil supply and demand data to make the following chart.

World quarterly liquids supply and demand. Source: IEA.

The chart shows that demand exceeded supply through the 4th quarter of 2013. That’s why oil prices were high in much of 2013 and in the first half of 2014. Supply has exceeded demand for all of 2014. That’s why oil prices fell (a lag before the market reacts to a change in supply-demand balance is common).

The difference between supply and demand was greatest in the 2nd quarter of 2014 (1.27 mmbpd supply surplus) and then it dropped to 0.84 and 0.81 mmbpd in the 3rd and 4th quarters, respectively. Better but still too much of a supply surplus.

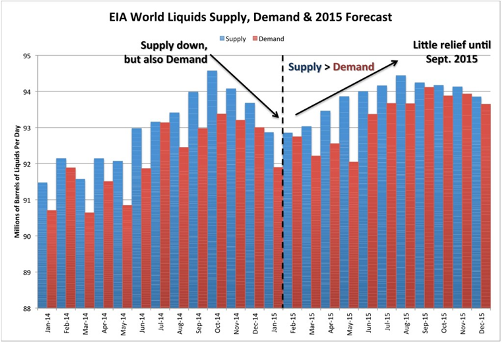

EIA publishes monthly supply and demand data, and a forecast. The second chart incorporates that data.

World monthly liquids supply, demand and 2015 forecast. Data to the right of the vertical dashed line is an estimate. Source: EIA

This chart shows that production fell from its high in October 2014 but so has demand. The difference between supply and demand in October was a 1.19 mmbpd supply surplus. It fell to 0.68 mmbpd in December but has increased to 0.97 mmbpd in January 2015 (world demand usually falls in the first part of the year).

That is better but still too much of a supply surplus. EIA data says the U.S. production continues to increase as expected but not part of a reason for an oil price bottom or rebound.

I don’t have a lot of confidence in forecasts but let’s understand what EIA’s forecast means. It suggests that supply and demand will be almost in balance in February 2015 but that the supply surplus will return in force in March. After that, the gap will narrow and by September 2015, balance will return and remain through the end of the year.

That is when oil prices may start to rebound.

EIA apparently believes that U.S. and Canadian tight oil production will have fallen enough by late in the 3rd quarter of 2015 to bring world supply and demand close to equilibrium again. If OPEC cuts production, so much the better for re-balancing the oil market.

In this week’s Musings From the Oil Patch, Allen Brooks suggests that the small oil price spike in late January may have been short covering by traders at the end of the month. He cautions that refineries are preparing for the summer driving season and will not be buying as much oil during the turnaround time which is now. That will build inventories and lower oil prices.

Mike Bodell (personal communication) is even stronger. He feels that storage inventories may reach 70-75% of capacity soon and that will crush WTI prices possibly through the end of 2015. He thinks that events in Iraq with ISIS and in Ukraine with Russia may have created a fear premium that pushed oil prices up a week ago. This fear premium isn’t over yet.

The message is reasonably clear: oil prices will rebound when something tangible happens.

It will be late summer before any drop in North American tight oil production shows up in the data. An OPEC cut may happen slightly sooner–we’re talking about only a million or so barrels per day surplus after all. A political event could happen any time…or not. Any or all of this will coincide nicely with increased demand during the northern hemisphere summer.

That’s what two charts and a bit of interpretation can offer and it’s not bad. Prices will rebound this year but not until there is a reason.

Tesla stock tracks Oil chart almost exactly.

Doesn’t someone realize that electric cars need juice which is supplied by…..multiple forms of oil (since coal is def out of the picture w/this administration)?

Gotta get the plug into the wall, the energy gets to the garage from the line going to the alley. That goes to the transformer on the pole, big pipe of electricity goes back to the power generating center – which is run by oil, diesel or natural gas. I drive by the plant every time I go into the city doing 65 and using lots and lots of hydrocarbons.

The only downside I see to lower gas prices is those honkin’ big trucks that take up 2 car lengths and the drivers never pay attention at the green light. Gas pedal is on the right. Drive it like you stole it b/c in my mind – you’re hogging lane space.

Just to clarify, are you saying U.S. electricity is generated by oil?

http://www.eia.gov/electricity/data/browser/

Fyi, coal is still the leading fuel for generating electricity in the U.S., followed by natural gas (which is not oil, but a different fossil fuel), nuclear, hydropower and renewables. Oil is responsible for less than 1% of electricity generation.

Oil is only really used in Hawaii to generate electricity.

If forecasting commodity prices from supply and demand (which must balance, adjusted for storage) were easy, we’d all be rich.

After crude oil crashed in the second half of 2008, it promptly doubled again in 2009. On the other hand, when crude oil crashed in the 1990 recession, its price remained basically flat for the next 8-1/2 years.

http://www.mrci.com/pdf/cl.pdf

This time round, who knows? If you have insight into what happens next, the futures market will pay you handsomely for it. Me, I’m just a price taker.

It’s hard to believe that gas prices won’t go up for summer this year. It’s like the oil companies won’t have Christmas… unthinkable.

Gasoline prices and oil prices do not always move in tandem.

Hi,

This is slightly off topic but I thought it might be of some interest!

Caltech engineering and applied science professor David Rutledge:

Abstract:

How much oil, gas and coal will be burned in the long run? How long will our fossil fuels last? The conventional wisdom today is that even with a large expansion in production, there would be no significant pressure on supplies for more than 100 years. For example, in the IPCC climate assessment report this year, carbon-dioxide emissions from fossil fuels in the business-as-usual scenario RCP8.5 do not decline until after 2150. In this presentation, I will show that there is little historical evidence that supports this assumption of enormous resources. On the contrary, I will argue that the historical experience suggests that it is more likely that fossil-fuel production will be in a substantial decline in the second half of this century. This may be the “Goldilocks” outcome, slow enough to allow the development of alternative energy, but fast enough to mitigate climate impacts.

Bio:

Rutledge is the Tomiyasu Professor of Engineering at Caltech, and a former chair of the Division of Engineering and Applied Science. He is the author of the textbook Electronics of Radio, published by Cambridge University Press, and the popular microwave computer-aided-design software package Puff. He is a Fellow of the IEEE, a winner of the IEEE Microwave Prize, and a winner of the Teaching Award of the Associated Students at Caltech. He served as the editor for the Transactions on Microwave Theory and Techniques, and is a founder of the Wavestream Corp., a manufacturer of high-power transmitters for satellite uplinks.

Current storage chart shows far above 5yr avg.

Your chart projects excess supply in every month this yr, I.e. New record storage every month.

If chart correct price falls throughout the year.

No recovery until demand exceeds supply and storage declines.

Saudi badly wants deal with Russia to jointly cut, but Saudi also wants to hit hard expensive supplies, cracking, sands, deep water, and funding for same… And Russia shares this objective, even if current price is painful. Note also painful for Saudi… But slashing competitors, and their funding sources, beneficial in long term.

The real question is, how log can they hold out? Russia and gulf producers can go another year or longer, even better if other opec producers once again learn to cut when Saudi says cut.

Why put faith in the EIA view on this at all? Did they alert anyone to a looming global slowdown in demand not just from China, but from Europe and Japan as well? Did they notice how much of the new ‘surplus’ supply was coming from Libya and Iraq, or by extension, what real stability over any length of time in that region would mean for the price of oil? Did they ever factor QE into the entire price regime?

Any forecast right now clearly lies in the realm of the difference in our individual filters for each of our ‘takes’ of the overall situation more than an interested party’s (EIA) numbers at this time. The renewed commitments in Minsk are likely to be violated if there is not simultaneous movement on the entire US/Saud/Israel/Jordan vs Syria/Iran/Russia equation centred on the remnants of the blasted States of Syria, Iraq (and later, one would hope, Libya, Yemen and so on). After all, a Qatar-to-Syria-to-Europe gas pipeline to break European ‘dependence’ on Russian gas was a big driver for the entire effort to replace Assad in the first place.

Meanwhile markets are dancing on what I judge to be Central Bank interventions as Grexit insurance amidst a flood of optimistic ‘consensus’ projections and conventional arguments so sanguine you’d not think this a crisis at all, but rather the plan hatched at the G20 to deliver the $2 trillion in global stimulus it pledged to last November – not that I’m suggesting that, but that I think the ‘West’ has far less tolerance for pain than either Russia or Iran, we misjudge how committed they are to the belief that being in the right matters, and for any real agreement to come will have to mean much bigger concessions on ‘our’ side than what the consensus seems to believe is the case. And what would the neocons and perma-war crowd in both Houses of Congress and throughout mainstream media have to say about that? Trench warfare stalemated for years when all the top brass on both sides thought it would be months tops – unless deliberately triggered, I don’t see the escalated war on IS as driver enough to move prices as it just wouldn’t be credible for it to be considered a strategic threat to the Saudi or Iraq oilfields with the US all over the space. We’ll see soon enough in Ukraine if anything’s changed.