Yves here. There’s a lot of merit in Ilargi’s piece, but I wanted to clear up some points. First, he draws a harder line between floating and pegged currencies than is often the case. For instance, Japan, which supposedly has a floating-rate currency, intervenes more than occasionally. For instance, when the yen got into nosebleed territory of over 80 to the dollar, the government did sit pat for longer than most observers expected, but finally took steps to lower its value. Similarly, its Abenomics was seen in its early stages by some commentators as more about reducing the value of the yen than the Japanese government was pretending (ie, it was positioned as a domestic economy program with any currency effects depicted as unfortunate by-products). And let us not forget that the US cleared its throat and basically told the Japanese government to halt the decline of the value of the yen when it had fallen back to 100 to the dollar.

Second, I take issue with this point: “Today’s major currency pegs are remnants of a land of long ago lore; they have no place in this world, they are financial misfits.” It’s not untrue but not for the reasons he implies. Ilargi like many, has appears to accept the current order of almost entirely open capital flows as a given. And indeed, in that world. it’s pretty hard to maintain a peg.

However, what I disagree with is the assumption that our current level of highly mobile capital is necessary or desirable. As Carmen Reinhart and Ken Rogoff showed in their work on 800 years of financial crises, high levels of international capital movements are strongly correlated with more frequent and severe financial crises. And there’s no good reason to think we need anywhere near the level of foreign exchange trading we do now. I did a study in 1984, which might as well have been the age of stone knives and bearskins, for Citibank’s London Treasury department. Foreign exchange trading had been its biggest profit center, but it was losing money in the strong dollar environment. I was tasked to interview the treasurers of Citi’s London branch clients, over 50 in total, ranging from major multinationals like Glaxo to smaller companies like cruise operators who had very complex foreign exchange risks to manage but were not the biggest-volume customers. Except for what were then called exotic currencies, like those of medium to small African countries, no one said the cost or access to foreign exchange trading was an issue, and I wan’t asking about the major currency “crosses” (dollar v. sterling, yen, Deutchemark) but secondary but still actively traded currencies like the franc, the lira, the “loonie,” etc.). Yes, as businessmen they wanted good execution but no one saw then-current liquidity levels or transaction costs of the overwhelming majority of their currency trading as an impediment to commerce (they did have issues with managing the underlying business risks of operating in multiple currencies, but that was separate from the currency trading issues).

That is a long-winded way of saying that Ilargi’s flip dismissal of pegs, while technically accurate, obscures the real issue: what is unsustainable about our current economic order is that the degree of international integration is too high to be stable for any length of time (see Dani Rodrik’s discussion his an “impossibility theorem” for the global economy for more detail as to why). Yet going back to a world that is more compartmentalized (as in quasi-autarkical) goes so much against orthodox economic thinking as to be seen as deviant.

By Raúl Ilargi Meijer, editor-in-chief of The Automatic Earth. Originally published at Automatic Earth

When David Bowie died, everybody, in what they wrote and said, seemed to feel they owned him, and owned his death, even if they hadn’t thought about him, or listened to him, for years. In the same vein, though the Automatic Earth has been talking about deflation (for 8 years, it’s our anniversary today) and the looming China Ponzi disaster for a long time, now that these things actually play out, everybody talks as if they own the story, and present it as new (because, for one thing, well, after all for them it is new…).

And that’s alright, it’s how people live, and function, they always have, and no-one’s going to change that. It’s just that for me, I’ve been wondering a little about what to write lately, because I’ve already written the deflation and China stories, many times, before most others tuned into them. But still, it’s strange to now, as markets start plunging, read things like ‘Deflation is Here’, as if deflation is something new on the block.

Deflation has been playing out for years. Central bank largesse has largely kept it at bay in the public eye, but that now seems over. Debt deflation is inevitable when -debt- bubbles burst, and when these bubbles are large enough, there’s nothing that can stop the process, not even miracle growth. But you’re not going to understand this if and when you look only at falling prices as the main sign of deflation; they’re merely a small part of the process, and a lagging one at that.

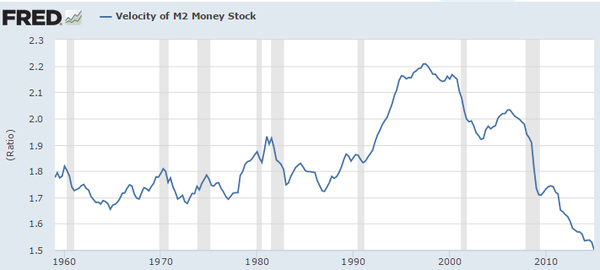

A much better indicator of deflation is the velocity of money, the speed at which ‘consumers’ spend money. And velocity has been going down for years. That’s where and how you notice deflation, when combined with the money and credit supply. Which have soared in most places, but were no match for a much faster declining velocity. People have much less money to spend. Which shouldn’t be a surprise if, just to name an example, new US jobs pay 23% less than the ones they’re -supposedly- replacing.

As I said a few weeks ago, it’s probably only fitting, given its pivotal role in our economies and societies, that it’s oil that’s leading the way down. Other commodities are not far behind, because demand for -and spending on- them has been plummeting too, as overproduction and overinvestment, especially in China, do the rest.

However you look at present global debt, percentage wise, or in absolute numbers, you name it, there’s never been anything like it. We outdid ourselves by so much we don’t have the rational or probably even subconscious ability to oversee what we’ve done. We live in the world’s biggest bubble ever by a margin of god only knows how much. And that bubble will deflate. It is already doing just that.

The next steps in the debt deflation process will of necessity be chaotic. A substantial part of that chaos is bound to emerge from denial, and the reluctance to accept reality. Which often rise from a poor understanding of the processes taking place. It certainly looks as if there’s lots of that in China, where both the working principles of financial markets and the grip authorities -can- have on them, seem to be met with a huge dose of incomprehension.

Mind you, given the levels of comprehension vs outright ‘theoretical religion’ among leading western politicians and economists, the ones who most often rise to decision-making positions in governments and financial institutions, we have nothing on China when it comes to truth and denial.

From all that follows what will be the next leg down in the ‘magnificent slump’: the awfully messy demise of currency pegs.

In a short explainer for the uninitiated, allow me to steal a few words from Investopedia: “There are two types of currency exchange rates—floating and fixed, still in existence. Major currencies, such as the Japanese yen, euro, and the US dollar, are floating currencies—their values change according to how the currency is being traded on forex markets. Fixed currencies, on the other hand, derive value by being fixed (or pegged) to another currency.”

While there are more currency pegs in the world today than we should care to mention -there are dozens-, it seems fair to say that in today’s deflationary environment, practically all are under siege. Most African currencies are pegged to the euro, and they do have to wonder how smart that is going forward. Still, the main, and immediate, problems seem to arise in pegs to the US dollar (with one interesting exception: the Swiss franc – more in a bit).

Most oil producing Gulf nations are pegged to the greenback. So is Hong Kong. And, for all intents and purposes, so is China, though you have to wonder what a peg truly is if you change it on a daily basis. China is on its way to a peg vs a basket of currencies, but that seriously interferes with its stated intention to become a reserve currency -of sorts-. If your currency can’t stand on its own two feet, i.e. float, you’re per definition weak.

China’s vice president Li Yuanchao said this week in Davos that Beijing has no plans to devalue the yuan, i.e. to cut the peg to the dollar. Then again, he also stated that “central command” would ‘look after’ stock market investors. Put the two statements together and you have to wonder what the one on the yuan (couldn’t help myself there) is worth.

The first “link in the chain” that appears vulnerable is the Hong Kong dollar, which is stuck between China and the US, and unlike the yuan still has a solid dollar peg, but, obviously, also has a strong link to the yuan. The issue is that if China continues on its current course of daily small yuan devaluations, the difference with the HKD will grow so large that ever more investments and savings will move to Hong Kong, despite a maze of laws designed to keep just that from happening.

And that is the overall danger to currency pegs as they still exist in today’s rapidly changing global financial world: all economies are falling, but some are falling -much- faster than others.

Not so long ago, the World Bank called on Saudi Arabia to defend its USD peg with its FX reserves. It even looked as if they meant it. But Saudi Arabia has no choice but to deplete those reserves to prevent other nasty things from happening that are much more important than a currency peg. Like social chaos.

It’s somewhat wonderfully ironic that the main most recent experience with abandoning a peg comes from a source that faced -and now feels- the exact opposite of what nations like Saudi Arabia and China do. That is, it became too costly and risky for Switzerland to keep its franc pegged (or ‘capped’, to be precise) to the euro any longer a year ago, because of upward, not downward pressure.

Since then, the euro went from 1.20 franc to 1.09 or thereabouts, which perhaps doesn’t look all that crazy, and many ‘experts’ seek to downplay the effects of the move, but it’s still estimated to have cost the Swiss some $25 billion. For comparison, the US has 40 times as many people as Switzerland’s 8 million, so the per capita bill would be close to $1 trillion stateside. That wouldn’t have added to Yellen’s popularity. Currency pegs and caps can be expensive hobbies.

And that’s why the Saudis and Chinese are so anxious about letting go of their pegs. That and pride. In their cases, their respective currencies wouldn’t, like the franc, rise versus the one they’re pegged to, they would instead lose a lot of value. And in the fake markets we live in today, where price discovery has long since been left behind, there’s no telling how much. Well, unless they seek to keep control, but then it would be just a matter of time until they need to rinse and repeat.

Even if it seems obvious to make a particular move, and if everybody knows you really should, showing what can be perceived as real weakness could be a killer when everything else around you is manipulated to the bone.

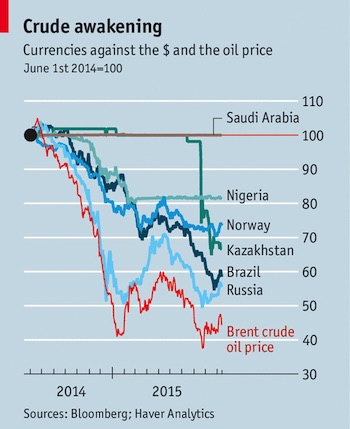

Still, neither Beijing nor Riyadh stand a chance in a frozen-over hell, to ultimately NOT sharply devalue their currencies or just simply let go of their pegs. Simply because China’s economy is falling to pieces, and the Saudi’s dependence on oil prices is dragging it into a financial gutter. Just look at what falling prices had done to the riyal vs non-pegged oil producer currencies by October 2015, when Brent was still at $45:

The Saudis could have been paid for their oil in a currency worth perhaps twice as much as their own, the one their domestic economy runs on. That’s overly simplistic, because the Saudi tie to the USD runs far and deep, but that doesn’t make it untrue.

What will bring down the Chinese and Saudi pegs, along with a long list of other pegs, is, how appropriately, the very same markets they’ve been relying on to NOT function. The bets against Hong Kong’s ability to maintain its USD peg have already started, and China is next, along with the House of Saud (the latter two just take more fire-power). Which of course is exactly why they speak their soothing ‘confident’ words. Words that are today interpreted as the very sign of weakness they’re meant to circumvent.

What worked for George Soros in his bet vs the Bank of England and the pound sterling in 1992, will work again unless these countries are ahead of the game and swallow their pride and -ultimately- smaller losses.

Granted, so much will have to be recalibrated if the yuan devalues by 50% or so, and the riyal does something similar (it’s very hard to see either not happening), that it will take some serious time before everyone knows where they -and others- stand. And since volatility tends to feed on itself once there’s enough of it, it seems to make sense that governments would seek control. But that doesn’t mean they -can- actually have any.

Today’s major currency pegs are remnants of a land of long ago lore; they have no place in this world, they are financial misfits. Who’ve been allowed to persist only because central banks and governments have been able to distort markets for as long as they have. But that ability is not infinite, and it’s in nobody’s longer term interest that it would be.

Not even those that now seem to profit most from it. We will end up with societies that function no better for the ridiculous Davos elites than they do for the bottom rung. But no elite will ever see that, let alone admit it voluntarily.

Deflation and foreign exchange chaos. There’s your future. As for stocks and oil, who’s left to buy any? Not the consumer who’s 70% of US and perhaps 60% of EU GDP, they’re maxed out on private debt. So why would investors put their money in either? And if they don’t, where do you see prices go?

Even more importantly, deflation makes a lot of money, and even much more virtual money, vanish into overnight thin air. That’s what everyone is running into when all these currencies, China, Saudi, Gulf states et al, are forced to recalibrate. $17 trillion disappeared from global equities markets in the past 6 months.

How much vanished from the value of ‘official’ oil reserves? How much from iron ore and aluminum? How much do all the world’s behemoth corporations and banks and commodity-exporting countries have their resource ‘wealth’ on their books for in their sunny creative accounting models? And how much of that is just thin hot air too?

We’re about to find out.

” For instance, when the yen got into nosebleed territory of over 80 to the dollar, the government did sit pat for longer than most observers expected, but finally took steps to lower its value. “ Yves Smith

Why does Japan export? Because it is a resource poor country that must buy imports? So then why weaken the yen?

Because of jobs? Can’t have a bunch of apartment dwellers with time on their hands and unwearied by stress and toil?

But let’s say the Japanese have a spiritual need to produce quality products for export and what’s wrong with that? Subarus save lives, I’ve heard (OK they made be made in Korea but surely they are designed in Japan?). Then is the real problem the US who can’t have a bunch of US apartment dwellers with time on their hands and unwearied by stress and toil? And thus must protect its export market by weakening the dollar?

And not just the US but Germany, China, South Korea, etc?

Japan have been in a domestic debt hole for at least 2 decades now.

They need all the export revenue they can to attempt to manage that debt.

Thing is though that it worked for them as long as Europe and North America was buying their products in massive numbers. but both areas were doing on so credit, because Reaganomics. So now now both regions are “turning Japanese”.

This while South Korea and China has moved up to rival Japan on the production side.

Watch the market wars going “hot” in south Asia and Africa going forward…

“Japan have been in a domestic debt hole for at least 2 decades now.” digi_owl

That’s easily cured with a yen distribution (ala Steve Keen’s “A Modern Jubilee”), no?

But back to your point: So do the Japanese exporters sell for, say, dollars with which they then buy cheap yen to payoff their debts in yen? Thereby benefiting by a weak yen? Or do Japanese exporters sell for cheap yen which, say, American importers have bought with the benefit going to the American importers? Surely the latter, no?

So basically, the Japanese are giving away stuff to pay mere domestic debt?

Yep, but try to get that past the orthodox economists that run the show.

And its both. The weaker the yen vs the dollar, the easier it is to sell ones products on foreign markets as their price (sans taxes etc, something you will note the neolibs are heavily against) will be lower compared to domestic alternatives.

Japan has a longer ethnic history than america, DNA level, social engineering of your sort would have all kinds of “Unintended Consequences”. Not that, that, would stop your stripe [see history].

Plaza Accord and being a protectorate of the US since MacArthur cut his deal with the emperor has strings attached.

You may now go back to staring at that candle… and writing what ever – pops – into your head….

Skippy… Seems your focus should be on dealing with neoliberalism and corporatism, try Sanders….

You don’t know my stripe but I’m beginning to surmise yours. But if you’ve got me so well pegged then where are my comrades in thought? So that I can hang with them for a change?

[crickets]?

I’m for Sanders as I’ve said; he’s not perfect but I suspect he can learn.

Corporations? As far as I know they don’t have a license to steal like the commercial banks do.

“Corporations? As far as I know they don’t have a license to steal like the commercial banks do.”

Hence your lack of acumen to boldly opine on matters that you don’t have the knowlage to do so, or your bias is so entrenched that reality is distorted.

Skippy…. corporations have the ability to print their own money, its called equity’s and bonds… tho just like banks its a matter of quality aka risk assessment with long forward guidance – social purpose and not short term fraud, looting, self enrichment, et al.

You are a glutton for punishment, aren’t you?

Skippy…. corporations have the ability to print their own money, its called equity’s and bonds… tho just like banks its a matter of quality aka risk

Ah, so the monetary sovereign GUARANTEES the deposits at investment banks like it does the deposits at commercial banks? News to me but I guess anything is possible when Equity is a Liability.

Btw you should be warned that insisting that common stock is a private money form is a capital offense in these parts though I’m gratified you’ve learned something these years.

in the us if you’re an apartment dweller with too much time on your hands you’ll soon be homeless and you won’t matter to any USian elite, so you’re being somewhat naive here. To have nothing in the US is extremely and constantly stressful, something people with paid sick days and holidays do not, and largely are incapable of, understanding. That this is a source of deflation is also lost on the cognoscenti, see the ACA where those of us on the lower rungs are expected to magically create roughly $7000 per year on nothing other than a responsibility to protect the health care industry in which the elites have so much faith and so much more investment income. Then ponder the actuarial death spiral, then ponder deflation. Also, securitized student loans leads to heavily indebted students who’ve bought a product that can’t be sold or repossessed then ponder how much money they have, then ponder deflation. It’s not rocket science in spite of the attempt to make it so. Watched a lady on bloomberg wednesday who wondered why all those “gas savings” are not being spent into the economy, in honesty her facial expression implied to me she was having a hard time believing her own bs. Pie in the sky bs just as the leisure class in poverty who lead stress free lives is bs. A pretty tale to make some feel good.

That the japanese have a seemingly spiritual need to produce and consume quality products speaks well of them, and they seem to have some concern about people having an apartment even if it’s small, whereas in the US you’ll be lucky if you get the ground floor in a refrigerator box. Lastly I’m curious regarding a weakening dollar since we’re seemingly obsessed with the strong dollar and wonder what you and others think about where that situation is headed.

“in the us if you’re an apartment dweller with too much time on your hands you’ll soon be homeless and you won’t matter to any USian elite, so you’re being somewhat naive here.”

I live via Social Security in an apartment so that’s precisely my situation. As a result, I’ve been able to ponder a few things – such as why should purportedly private banks be privileged by government.

Multiply me by millions and the PTB have a problem or at least they might think they do. Hence the desperate need to keep the population too busy to think straight?

“Multiply me by millions and the PTB have a problem”

yes, exactly but do they know what the problem actually is, and if they could see what it was, would they act to make it change. they’ve been at it for quite a while now and somehow they’ve managed to make trickle down a democratic party policy, without actually stating it but pursuing policies as if making the rich as rich as possible will fix everything. We’re both old enough to remember reagan so from that perspective we’re in bizarro world.

Also I think that there’s some straight thinking going on is reflected in the popularity of non establishment candidates.

.

It is a matter of proportion. A currency peg works best, when the pegger .. is much smaller economically than the peggee. Ecuador vs the US or SA vs the US. This is not the case with China vs the US. There is another concern … with the US dollar being a petro-dollar … there is a feedback loop vs SA that doesn’t exist vs Ecuador. So you can have a remora attached to a shark … but you can’t have a shark attached to another shark … the remora agrees to taking the scraps, but another shark will complete for the main course.

Ecuador’s use of the USD (not really a peg… Ecuador has no sovereign currency to peg to anything) works just great… till it doesn’t. Since its economy– despite excellent improvements in internal consumption over the last decade– is still very much contingent upon petroleum exports, it is very dependent on the USD, regardless of whether it has its own currency or not. And, in the context of the current European depression, it should go without saying that if Ecuador should want to use monetary/fiscal policy to stimulate its (now in recession) economy, it’s SOL.

Meanwhile, compare China to Ecuador (or Greece for that matter). What saves China in a pinch is not so much being a Shark rather than a Remora, but rather the fact that they have currency independence that Ecuador does not have. The PBOC adjusts its monetary policy based on the desires of the Chinese govt. Ecuador is at the whim of the price of crude and the actions of the Fed (in this regard, more than a few words were said here about Grexit).

Couldn’t agree more yves. There is nothing inherently wrong with pegs. Isn’t that the whole point of the euro. However floating currencies are so often abused by tradera and central bankers I doubt much will change.

Maybe Bitcoin or something else eventually does.

The “free-er” cash can flow across borders, the easier it is for the financial “elite” to scurry it away in a tax haven or similar.

Frankly i wish people didn’t get so hung up on volume 1 being all there is about Marx’ Capital. He has some very scathing terms for the financial capitalists, and seem to basically peg the majority of the problem there.

Thing is that Volume 1 leaves out finance fully, and considers money basically gold for ease of argument. Volume 2 and 3 however introduce finance and debt, and quite accurately points out long term problems they cause.

And this was him writing over 100 years ago. And still today most economists consider debt something to ignore, as they claim that what one loans another saved.

“Thing is that Volume 1 leaves out finance fully, and considers money basically gold for ease of argument. Volume 2 and 3 however introduce finance and debt, and quite accurately points out long term problems they cause.” digi_owl

Thanks very much for that! I had thought Marx was a gold-bug (in addition to his labor theory of value, which is only partly true as automation demonstrates) so I had not bothered to read him. But anyone who takes on the bank cartel is worth a read, in my book. I guess I’ll start with Volume 2 then.

Sadly i think the whole “labor theory of value” was Marx talking himself in circles.

Basically he was trying to argue that workers got exploited, something he and Engels had observed first hand, but kept finding that a constant counter-argument was increased automation.

Thus he ended up conflating use value and exchange value when talking about machines, giving himself and hte world the impression that machines could not add value like workers could.

My preferred, and very personal, adjustment is to look at machines as value “amplifiers”. Meaning that they amplify the value addition any single worker provides. Thus with enough automation a single worker can add the same value to a commodity as 10s or 100s (perhaps even 1000s) without.

Illargi’s point is well taken about deflation, but I have never been able to wrap my brain around this idea of natural vs. distorted markets:

i.e., because markets.

His point is that there is a “naturally” deflated price for a currency and a price held up by governments (using that god-awful economist word “equilibrium”). Yet the idea of a non-government manipulated currency (“floating” here) sounds to me like other fantasy terms that exist only in books, like “communism” “capitalism” “progressive Democrat”… etc.

For example, here in Argentina, we just had an election where the new government promised in campaign to do away with the previous regime’s “fantasy” value for the peso. So they came in, promptly devalued 40% to bring the peso to its “natural” rate, and within a week they were using reserves to buy USD to jimmy the exchange rate. But I don’t fault them for open market operations; that’s what central banks are supposed to do.

Thus I agree with Yves’ beef that there is no clean distinction between “floating” and “pegged”. In fact, I have yet to see any evidence of this mythical beast, the “floating currency”.

Velocity of money is decreasing because it’s denominator is growing due to central banks’ money printing. I’m not so sure that’s a symptom of deflation.

“due to central banks’ money printing. I’m not so sure that’s a symptom of deflation.”

Only monetary sovereigns (eg US Treasury), a few institutions and commercial banks get to deal with real fiat*; the rest of us must make due with commercial bank liabilities (aka commercial bank deposits) and the banks are afraid to lend and/or the population is afraid to borrow is the story I hear.

*excluding physical cash and the mattress or safety deposit box, a very poor alternative to an account at the central bank.

“commercial bank liabilities “

Such as they are since government privileges such as deposit insurance instead of accounts for all at their respective central banks have rendered those liabilities largely VIRTUAL for the banking cartel as a whole.

So someone please tell me, what good is accounting with unreal liabilities?

Isn’t this all about capital flight and ways to prevent it when a country’s economy goes in the tank? The Chinese are frantically trying to offshore their money by evading capital controls since their economy is on the verge of a total debt collapse. A steep devaluation will put the brakes on capital flight and burning reserves, but export massive deflation to the rest of the world by starting an Asian currency war. Once the elites have most of their money out, China will lift the peg and devalue. Expect loans to China to be seriously marked down.

What if earth currencies started from the grass roots and worked their way up. From the environment, how much it and commodities are worth, how much it will cost to repair the damage we have caused, how much it will cost (just in terms of employment at a living wage using time as the bean, not dollars) to maintain the ongoing health of the planet, clean water, air, prevent the collapse of as many species as poss and maintain diversification; mitigate global warming – in short remediate all the mess we have made so far? That is an undeniable value which we have never put a dollar figure on. Why not? (spoiler alert: because then we could not exploit it all for profit) The same goes for the value of humans. All of us. If our value were recognized we could not be exploited. Instead we place a circular and arbitrary value on money (money is the benchmark, the peg, to maintain the value of money) and manipulate it for the benefit of a very few ultra rich and now clueless oligarchs. Who do not want anybody to devalue their currency because we would all realize the scam. It is a system that has no foundation whatsoever. Money is a clever practice – just like religion. Value is external to money.

Apologies, I’m not able to speak to the currency peg/float aspect of the article, apart from positing that the intricacies of the discussion might be moot considering that the magnitude of global deflationary forces building right now will eventually “lower the tide” for all?

In the tug of war between the debt-induced deflationary forces at play (“The Automatic Earth” btw, is such an wonderfully named blog in terms of what Ilargi/Foss espouse!) and the Fed/ECB’s so far futile combo via a QE (left foot) & ZIRP (right foot) attempt to dig in their heels, even if we were to find a few linebackers to grab the end of the rope, the power of deflationary inertia looks to have us in the mud in fairly short order, having proved a far more formidable force than the current generation of central bankers/business leaders ever foresaw. I guess if I came of age with 1980/81 inflation rates, and had the utter fear of going back to those days instilled in me, I’d too be totally baffled trying to figure out how we ended up where we have.

Could I ask for all apartment dwellers to please implore any idle linebackers in neighboring units with time on their hands, to lend a hand at the back where the rope is knotted. Hold on tight!

I think it’s important to try and differentiate capital flows as productive and speculative. Bill Mitchell has a good discussion of this. Capital Controls

“I do not think that the imposition of country-by-country capital controls is the best way to eliminate the destructive macroeconomic impacts of rapid inflows or withdrawals of financial capital.

If we consider that the only productive role of the financial markets is to advance the social welfare of the citizens – that is, advancing public purpose – then it is likely that a whole range of financial transactions, which drive cross-border capital flows, should be made illegal.

Capital inflows that manifest as FDI in productive infrastructure are relatively unproblematic. They create employment and physical augmentation of productive capacity which becomes geographically immobile.

However, financial flows that are speculative (especially short-term flows) and not connected with the real economy are unproductive and should be declared illegal. You may consider this is an extreme direct control. However the policy should be introduced on a multi-lateral basis spanning all nations rather than being imposed on a country-by-country basis. The large first-world nations should take the lead. I don’t see that leadership being forthcoming.”

——-

Giovanni Arrighi talks about sustainable foreign exchange in Adam Smith in Beijing. He talks about a progression from expanding and improving agriculture and domestic trade which can then lead to a surplus to be used in international trade.

Murder, She Wrote: Artificial Intelligence

The old economy is not so much being murdered as it is being demolished, and the middle class has stretched itself out in front of the wrecking ball rather than accepting retirement, to no affect. And legacy capital has bought back its own stock, leaving it holding the bag, sunk costs wherever you look. If you didn’t walk away in ’08, you might want to start swimming.

Artificial Intelligence has removed the foundation from under geopolitics, leaving legacy capital stranded, the middle class disoriented, and Silicon Valley on the way to dump, right behind IBM. You are not observing increasing rent on excess RE capacity by accident. With friends like GS and JPM, and HFT accelerating the demolition, who needs enemies?

By enabling that frequency pattern matcher in their heads, a significant and rapidly growing population of young people has effectively thrown the switch, with no interest in repopulating the middle class to the benefit of RE devolution. Given the Historical option of opting out and revolution followed by reformation, they have instead moved forward, leaving Wall Street and Madison Avenue in a dead short. Net, the economy is a sinking island of nostalgia, blinded by self-obsession.

Memory is a funny thing; it doesn’t exist in real time, but the majority acts like it does, benefitting the few controlling the narrative at the expense of the many competing for an identity, in a completely artificial world of non-performing property. Under that contract, made to be broken, the refinance hucksters have liquidated it, to feed themselves. With nothing left to pull forward, the future suddenly becomes today.

The collapsing majority can only think linearly, “[t]hink of it. You can recall at will your first day in high school, your first date, your first love.” Can’t you just see the swinging watch in front of the patient, volunteering to be hypnotized? Like the rest, Freud merely managed to hypnotize himself, along with his followers, drunk on control; employ your subconscious to help you, or someone else will employ it to help themselves.

Like the good doctor, you are only fooling yourself if you think other species have no conscious capability, and humanity is therefore superior, with the divine right of manifest destiny to dispose of nature as it sees fit. Relative to the universe, a broadband of frequencies acting as a fulcrum of fulcrums, linear time is the illusion, created by a so-disabled and self-obsessed brain. Age is a function of time in the noise of artificial variability.

The brain is not just an oscilloscope dependent upon empire as a signal generator, although those tools do reflect the psychiatrist’s self-serving theory. Of course you are going to get fat, dumb and dead watching empire TV, with the plastic surgery and everything else that goes with it. The ratings go down, advertizing goes up, the Internet produces nothing but bubbles, and Chinese communism isn’t going to save the world, surprise.

Segway: Funny thing about my wife; she has relatively infinite patience for human critters, loves animals, and as a vet tech is focused on nutrition and hospice, taking the cognitive dissonance out on herself. With our DNA, Grace is held by feudal overlords subjecting her to automaton pressure, after she clearly recognized the stupidity at birth. Assuming extortion ploy, they have done her the favor of providing a dc short for her synaptic network to examine.

The empire broadband is essentially a potentiometer shorting the brain along segmentation, tuning each other and nature out, creating a closed system, operated by those who have shorted their own frontal lobes for those who are shorted at the cord, eliminating both coordination and conscience. Thinking in frequency instead, the young people are dialing forward. And the empire is devolving into fascism accordingly, as its actuarial ponzi collapses, and it increases price on decreasing demand to cover legacy sunk cost.

Essentially, others who want to participate are changing their pointers in the hash table, to and from their position as the wave passes, weaving the fabric of derivatives becoming the new dress. Discount the crap you don’t need for those who do, to get it off your back and be on your way. How far the middle class shrinks is up to the middle class.

I digress: From the perspective of labor, breeding on DNA, money and its leveraged securitization can’t be a store of value because it fails every time. From the perspective of middle class, breeding on money rather than nature, money must be a store of value. Legacy capital, breeding on artificial RE control to issue money and harvest middle class variability in both directions, can only jawbone in self-fulfilling prophesy until it can’t, when actuarial counterparty risk implodes.

In the woods, your cash, plastic, and gold is worthless, except to make a resistor, capacitor and inductor, to make a bitcoin transmitter, if you happen to know what you are doing. Regardless of brand, money depends entirely upon a ponzi of counterparty risk. At the company stores, you see a closed-system price with mean and standard deviation imposed by the issuer, forcing middle class populations to compete on rent/income for an illusion of stability, always just beyond its reach, filling the gap with impulse consumption.

The Point is that technology for the sake of technology, busy-work, can no longer maintain or replace the technology, and the dc programmers have no idea how those libraries really function (creek/paddle). The middle class has much bigger problems than its fiscal policy and capital’s monetary policy, which is an opportunity or a threat. If bitcoin changed the debt for consumption dynamic, GS wouldn’t have the patent.

In case you never noticed, the repairman charges different prices to different customers, adjusting the counterweight as an implicit bank, which is why the critters are bringing fascism upon themselves, trying to eliminate anonymous cash again, replacing it with unicorn cash and unicorn equivalents. They wouldn’t be rolling out crypto if all they had was a collateral problem. Subject to many more layers of misdirection, city critters tend to make many more false assumptions about repairmen from the country.

But pay me no mind. After all, I was educated by a basset hound and a turtle. And I don’t have much use for money, except to discount its access for married people working to raise independent children, effective small business around the corner, the priority.

The trap of misery is always the same – denial, anger an depression, what the psychiatrists only know too well, because they built it, on social science BS, around themselves. The assumption of a neutral psychoanalyst is nonsense. The State doesn’t treat kids like lab rats and ignore its own participation in the outcome of poverty by accident.

Culture is seductive, but if you can so easily dispose of individual initiative for sake of professional inclusion, why wouldn’t you just as easily dispense with mind and body, and why wouldn’t you expect Hitler to show up in Austria, cheered on by a waiting mob? Peer pressure operates on fear, greed and humiliation, but fear is the surest path to war. Vienna is the past, not the future, because not everyone is so fixated on memory as to stop thinking for themselves.

There is nothing quite so stupid as a false assumption at the base of a culture, and public healthcare, an oxymoron if there ever was one, is proof of that. Begin with a boss that cycles stupid out and a landlord next door you never see, at income 4X rent, and go from there, in the opposite direction of empire. Did I ever tell you the story of the psychiatrist at University who couldn’t operate a keyed elevator because he found the key indignant?

The brain is not a parallel processor, but you might want to think that way as you begin to build your cognitive model, and you might just learn something about the universe along the way (it’s a twister with a gap).

Glad you asked that Susan the Other. Such is the Insurodollar from Transcendia. This is how it would work: Create an Insurance Company Treasury. Give all citizens from birth and buy in Whole Life Insurance policies with complete coverage, including dental. Take a partial share of those policies equity from which to form the basis of the currency. Citizens begin paying at time of their maturity into the system. There is a payout for the newly matured citizen for their higher education and or the starting of a business.

The policies do the obverse of socialism and communism in that each and every citizen sees for their families independent of their families, an inheritance created to leave behind.

I put the human in capitalism. No business that is real, exists without insurance. Insurance is well understood in the dominate system. All of us of the USA were turned into the reinsurer of the reinsurer, AIG, and what we got for that was a foreclosed home and the deed transferred to smaller and smaller groups of people.

Wall Street does not issue stocks to create businesses that employ large numbers of people anymore. Neither is this the case in London. We know that Finance means small groups of people get our tax money and use it to enrich themselves.

That is what happened isn’t it?

There will be no triumph of the environmentalists as long as the money is based on oil. The Petrodollar Imperative will be what “distorts the markets”.

Essentially we are coming to the end of the 100 Year Oil Wars. The Nixon Kissinger “gift” of the Petrodollar is a deal with the Saudis Netanyahu is determined to wreck no matter what. It isn’t just the fanatics of the Islamic State lusting for the Apocalyptic Riot.

Touch your head, there is something real under the skin.

So thanks for the question. I invented the Insurodollar as I was reworking the Transcendia Passport for general release. I started work on Transcendia, Tm, when it was just when it was clear reform of the US was impossible, in 1978. I had believed in the Carter administration. I thought I’d get answers to letters after he was elected because, what the hell,I’d been invited to the Inauguration!.

Conceptual art is what Transcendia Tm is, since a real nation has an army. OK, but these are real times, and I am real, and I come up with ways out. I respect the Great Leaders who as Poets, know when to turn to their engineers and ask them to come up with what they need. Churchill wasn’t great for his military plans, they sucked. He was great for supporting the building of tanks in WWI, and portable docks in WWII.

The C.S.A. was all about holding the deed for the human machines they set picking cotton. All the working classes of the world bow down and are sold out by Corporation China, and Corporation USA, and Corporation Russia. German bankers sit atop the heap manipulating what they call an excuse of a currency, the Euro. The Netherlands is well positioned to just call their own shots, and declare their currency an Insurodollar.

Here on Naked Capitalism, is the place for me to fight it out intellectually. Thanks Susan, for asking.

We can take ownership of ourselves, instead of just being unwilling props for AIG, if we recognize what strengths of the system exist there, within it, to build on.

I must be overlooking something or misunderstanding something very significant here. Wasn’t China’s massive $USD trade surplus and the efforts of the PBoC to immunize China’s domestic economy from those current account surpluses by buying all $USD indirectly behind China’s extraordinary domestic debt bubble and growth rate?

China reportedly ran a trade surplus with the U.S. of $337.8 billion for the first 11 months of 2015 through November. Hard for me to understand why it makes sense for China to devalue the Yuan against the $USD. If it’s about Chinese capital flight, then wouldn’t capital controls be the most logical solution for China?

https://www.census.gov/foreign-trade/balance/c5700.html

See: http://www.barrons.com/articles/barrons-roundtable-part-2-31-savvy-investment-ideas-1453527097. Scroll down to Feliz Zulauf’s bit. He may answer your question.

Thanks, Eduardo. Appreciate the tip. Although Felix Zulauf is someone who I have found in the past has insightful observations, Barron’s is behind a pay wall for me. Ill see if my little community library subscribes.

Zulauf: As most of you know, I am a macro guy. I invest based on my analysis of macroeconomic trends, and try to figure out where we are in the economic and financial cycle. My base case is this: The developed economies have had a disappointing recovery since the financial crisis, but the emerging economies had a big boom until a few years ago. That boom went bust in 2012-’13. Now we are in a down cycle that will end with crisis and calamity. China’s troubled economy is to the global financial market what the U.S. housing market was in the prior cycle. Many people don’t understand this. While the U.S. is widely analyzed, China often is misunderstood, as the economic data published by the Chinese government are of poor quality.

In the past 12 months, China tried to reignite its economy. Debt has risen dramatically, to more than twice gross national product, with almost no impact on the real economy. China has reported annual growth of nearly 7%, but the industrial complex is in a recession, and I estimate the service sector is growing by only 4% a year. In reality, then, growth is probably around 2%, and slowing.

Priest: Doesn’t China have a huge percentage of the world’s debt?

Zulauf: It does. China has doubled its debt in a few years’ time. In boom times, the corporate sector in China and other emerging markets made all sorts of mistakes. Companies overexpanded, took on too much debt and staff, and raised labor costs excessively. Officially, Chinese corporations have issued $1 trillion in dollar-denominated debt. Unofficially, it could be as high as $3 trillion.

When wealth is created during a boom, there is no need to diversify into other economies. Once the boom is over, however, the wealthy want to diversify outside the country. By looking at what happened in other economies when boom times ended, we can estimate that about $3 trillion in wealth wants to leave China. That is a huge amount, and outflows have been increasing.

Most economists and strategists think China is growing by 5% or 6%. They look at the country’s current-account surplus of $300 billion and think everything is fine. But China is running a capital account deficit of $1 trillion. It doesn’t publish that number, although you can figure it out.

How did you figure it out?

Zulauf: Foreign-exchange reserves fell to $3.3 trillion last year from $4 trillion. The current-account surplus is $300 billion, so that means $700 billion has flowed out of the country on a net basis. The gross outflow is about $1 trillion. If we assume $1.3 trillion of China’s reserves are illiquid, only $2 trillion remains. If money continues to leave the country at the current rate, China could lose all its foreign-exchange reserves in a little more than a year.

To prevent that from happening, China eventually will stop intervening in the currency markets to prop up the value of its currency, the yuan, and let it fall. The government has other options: It could raise interest rates, which would be dreadful for the Chinese economy, or tighten capital controls, which would postpone the problem of capital flight, but cause bigger problems in the future. That is why China will have to let the currency fall. China has a balance-of-payments crisis, which usually ends with a recession in the real economy. The currency overshoots on the downside, and interest rates rise to extreme levels. That is what lies ahead.

That is some base case. What are the implications for the rest of the world?

Zulauf: China’s Asian trading partners will also let their currencies fall. It is conceivable that Singapore, which has attracted a lot of foreign capital over the years because of its image as a strong-currency state, will be extremely exposed to the situation in China. Singapore’s banking-sector loans have grown dramatically in the past five or six years. Singapore is now losing capital, which means the banking industry is losing deposits. When that happens, carry trades go awry, which is usually a prescription for disaster. I expect a banking crisis to develop in Singapore and to spread eventually to Hong Kong.

What will happen to the Hong Kong dollar?

Zulauf: The Hong Kong Monetary Authority has said it will defend the Hong Kong dollar. During the first stage of the crisis, capital flowed from mainland China to Hong Kong, which depressed interest rates in Hong Kong. In the past few days, the reverse has happened; capital has flowed out of Hong Kong and shorter rates [interest rates on shorter-term government debt] have gone up. The Hong Kong dollar is pegged to the U.S. dollar.

Rising interest rates will be deadly for the Hong Kong stock market and real-estate market. Eventually, as their currencies lose value, China and the emerging-market countries will reduce their imports, which will exert a contractionary force on the world economy. They will try to export more by cutting prices, which will influence the pricing mechanism throughout the industrialized world.

Are you talking here about a currency war?

Zulauf: Some call it a currency war.

Gabelli: Government-owned enterprises in China are already dumping steel.

Zulauf: In Asia, as well as the U.S., there has been a large buildup of inventories, and inventory levels are too high. The corporate sector in both regions overestimated final demand. Now it has to cut production. Companies also overestimated their debt-carrying ability. Remember that cutting costs is cutting someone else’s revenue. Thus, the global economy will continue to weaken.

Investors are pretty fully invested in equities around the world, because equities have been the only game in town. The slogan was TINA: There is no alternative to stocks. Among U.S. households and institutional investors, equity allocations are approaching the 2000 and 2007 peaks. Investors are extended and vulnerable, and don’t have a lot of cash.

At the same time, the monetary backdrop is changing. The U.S. Federal Reserve hiked interest rates in December, and at the margin is shrinking its balance sheet. The People’s Bank of China has shrunk its balance sheet dramatically because it is losing foreign-exchange reserves. The European Central Bank won’t engage in further quantitative easing [buying assets to drive down interest rates] beyond its current round, which means QE is finished as a policy tool for now. [Mario Draghi, president of the European Central Bank, suggested Thursday that the ECB might ease monetary policy further in March.] The Bank of Japan will continue with QE reluctantly, but is unhappy with the government of Prime Minister Shinzo Abe because it isn’t delivering on reforms. The BOJ will increase QE when bond yields rise, buying more bonds to push yields down. In sum, the big monetary push we have seen in years past is over. Global liquidity is deteriorating. To complete the picture, the geopolitical backdrop will deteriorate further.

Thanks for taking time to provide this, Eduardo, and to Barron’s.

For me, the money quote is: “Officially, Chinese corporations have issued $1 trillion in dollar-denominated debt. Unofficially, it could be as high as $3 trillion.”

To whom that $USD debt is owed and the debt maturities seem key to me.

So, is rmb overvalued or undervalued now? I hope our great economists make up their minds.

Wouldnt it be more ideal to peg currencies to standard baskets of basic necessities, mid level luxurious and high level luxurious good and products or some baskets along that line?

As is well known, banks create loans that are then backed by the Federal Reserve. As a side note Bill Mitchell recently made this observation.

http://bilbo.economicoutlook.net/blog/?p=32831

“The other fact is that the money supply is endogenously generated by the horizontal credit (leveraging) activities conducted by banks, firms, investors etc – the central bank is not involved at this level of activity.”

———

These activities include securitizations and derivatives. This is why this sector is so prone to deflation and should be dismantled in a controlled manner.

———–

In his book ‘Extreme Money: Masters of the Universe and the Cult of Risk’ (2011) Satyajit Das talks about the ‘Liquidity Factory’.

On an inverse pyramid at the bottom little pinnacle are the central banks, 2%, then there are bank loans, 19%, then securitized debt, 38% and then derivatives 41%.

The environmental economist Herman Daly called for eliminating or severely restricting international capital flows, because they violate the basic logic of trade.

Of course, Daly is an outlier; but he’s also absolutely right that we have to stop “groaf” if we hope to survive; indeed, that it WILL stop because of resource constraints, willy-nilly. If it hasn’t already.

I find the author’s self-congratulatory assertions of ownership re the critique of China as a mega-bubble the popping of which would have major global consequences a bit much. There were plenty of people who made the arguments for years and stuck to them, and have proved correct on that score, inasmuch as China is indeed in a crisis, and its outcome will dramatically shape global events, but as ought to be clear all around, there is a far more badly fractured global community than in 2008/2009, and for a number of countries’ leaderships the wrong move, the wrong outcome, poses threats of the ‘existential’ sort.

As we’ve seen the last several days, Chinese and other CB’s, in coordination with their private networks, are in overdrive to regain the ‘confidence’ initiative – I note a view being floated by one bank analyst at a major US bank to the effect that in the US, money will later this year move out of still high-priced assets including the $ into the beaten down energy and commodity sectors in a sort of giant portfolio re-balance that would manage losses to a minimum. Made me wonder how much of the oil that has been pumped this year was paper oil, and has it now been flushed out of the system.

I’ve opined on prior occasions how big a problem I believe China has, and specifically would argue China should put in place very clear, plainly explained capital controls for as long as necessary. I find I just respect less people who’ve been given everything by their parents, their genes, and society, all they needed to build some fortune, great or small, then, regardless of consequences, that person can just up and leave and take all of ‘his’ money to some other country and have that money accepted in the new country as legitimate, and its exchange valid, and for all anyone knows the guy, the money is criminally obtained and about to be devalued by a third tomorrow by your Central Bank. Why should we accept flight capital when other nations run into problems?