Yves here. It’s not hard to see why London’s status as the financial center in its time zone would be at risk in the event of a Brexit. But let me throw out some contrary thoughts for fun.

First, financial markets are networks, and that means there are strong network effects that work against relocalization. While French and German customers might be able to demand that they be served out of Paris and Frankfurt, respectively, would the trading engines necessarily be moved out of the UK? For instance, London was the world’s top center for foreign exchange trading before it joined the European Union or any of its predecessors. Similarly, why would hedge funds, which are domiciled in tax havens, need to move their management teams out of London?

Moreover, the executives in these firms have a big say in how they are managed, and one issue that is seldom discussed is that the UK has much greater depth in private schools. There are already a fair number of banking pros who work on the Continent four or five days a week and live in London because there aren’t enough spaces in the good schools in the country to which they and their competitors are assigned for all their kids to attend. And the wives often prefer London too. So while London would probably suffer some losses in terms of certain types of businesses and operations being moved to the Continent in the event of a Brexit, they may not be as large as the naysayers expect them to be.

Second, it may be that a fair number of British voters don’t like what the dominance of the financial services has done to the British economy, particularly in terms of real estate prices. I suspect many would applaud it if the Russians who’ve bought up swathes of Belgravia, Chelsea, and Kensington were to decamp and turn all those vacnt-most-of-the-year apartments back over to the natives, and that there were fewer people with big City bonuses bidding up housing. This is a point often made by Dean Baker: more affordable housing does not mean let people have cheaper debt, since that just bids up housing prices to an even higher level. It means having real estate become cheaper. So I’d like UK-based readers to chime in: do you see much correlation between those who favor Brexit and those who have come out losers as housing prices have escalated?

Third, as Willem Buiter warned in 2007 and 2008, the UK has the profile of an economy that is at risk of having a banking crisis: small and open with an outsized banking sector. It is thus arguable that the considerable dislocation of a Brexit nevertheless (if it were to shrink the banking sector) would come with the upside of reduced systemic risk, and hence taxpayer downside.

By Pia Hüttl, an Affiliate Fellow at Bruegel and Sylvia Merler, an Affiliate Fellow at Bruegel and formerly an Economic Analyst in DG Economic and Financial Affairs of the European Commission (ECFIN). Originally published at Bruegel

The UK’s competitive edge in financial services is substantial and would be difficult to dislodge. But Brexit could damage London’s attractiveness as the centre of European banking, as an entry point to the EU and as a global financial hub. FDI is also at risk.

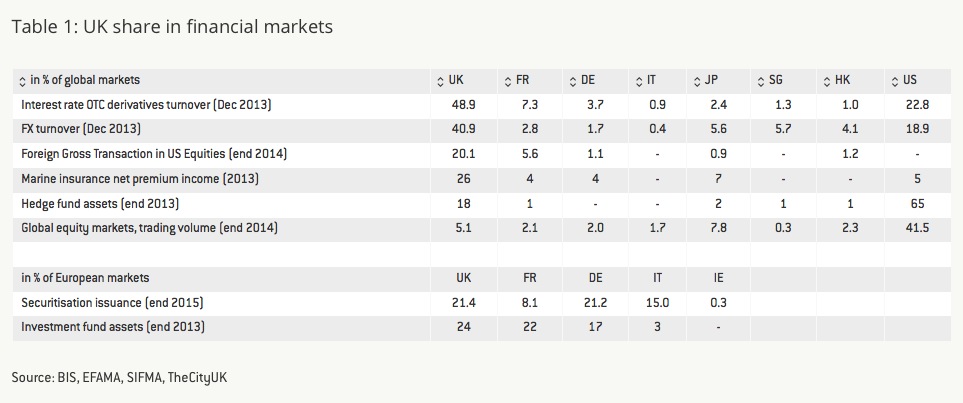

London’s strength as a global financial centre is impressive. The British capital has a share of nearly 50% in certain segments of global financial markets. Table 1 shows that the UK hosts 48.9% of the world’s interest rate over-the-counter (OTC) derivatives turnover and 40.9% of foreign exchange (FX) turnover. The UK is also one of the main players in the US equities trades, with 20% of the global market. By contrast, other European countries play only a comparatively small role in global markets: France hosts 7.3% of interest rate OTC derivatives, and 2.8% of FX turnovers. In terms of European markets, the UK and Germany each have a share of more than 20% in the issuance of securitisation. The share of investment fund assets in Europe is 24% for the UK, compared to 22% in France and 17% in Germany.

In general, the UK has been accumulating substantial surpluses in trade of financial services over the last 15 years. Looking at the geographical distribution of UK financial service export in 2013, we see that 30% was with the European Union, while 70% was with the rest of the world. .

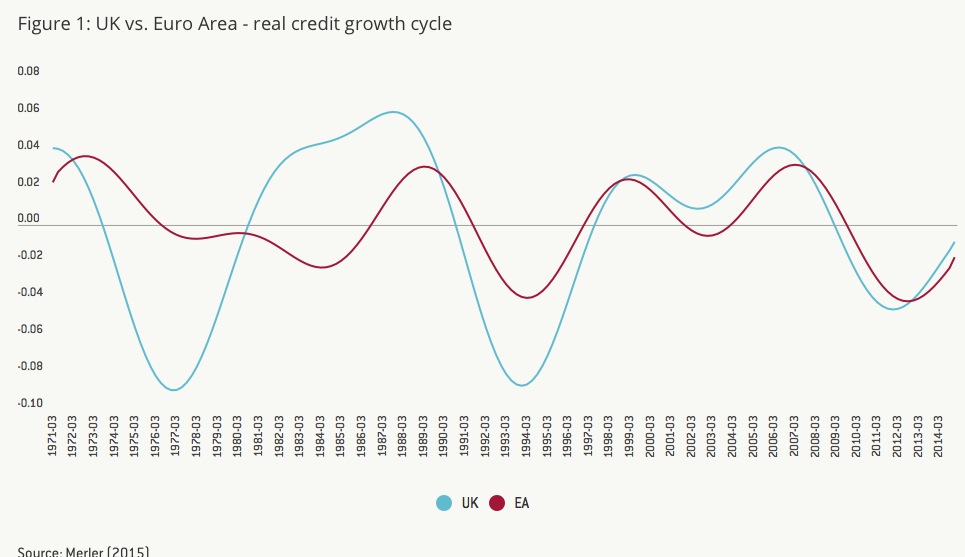

Recent research has found that the synchronisation of business cycles between the UK and the euro area has increased since the end of the 1990s. Campos and Macchiarelli have recently argued that this probably increases the costs of a potential UK exit from the EU. In a recent paper, we found that the UK credit cycle – measured here as the filtered growth of real bank credit to the private sector – has also become significantly more aligned with the credit cycle of the euro area, particularly since the end of the 1990s (figure 2). This suggests that EU-UK financial linkages have become tighter, although it does not tell us who would suffer the most from the financial consequences of Brexit. We should therefore look more in depth at specific aspects of UK-EU financial integration.

International Integration of the Banking Sector

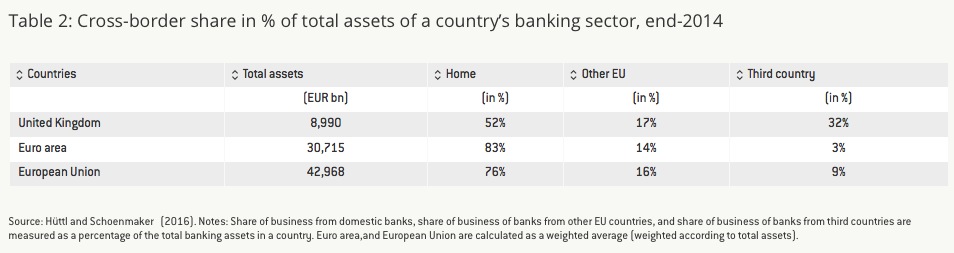

Turning to cross-border banking, table 2 shows that the banking sector of the euro area consists of 83% domestic banks, 14% banks from other EU countries, and only 3% from third countries. The rate of cross-border integration in the entire EU banking sector is even higher. 16 % of total bank assets are owned by banks based in other EU countries, and 9% by banks from the rest of the world. By contrast, the UK seems to be a special case. It is the only EU country with more claims from banks in the rest of the world (32 %) than from banks headquartered in the rest of the EU (17 %).

This can be explained through the role of major US and Swiss (investment) banks, which use their London offices as a springboard to conduct business across the EU. Indeed, when asked about the importance of EU membership for financial service businesses located in the UK, 49% of high-level professionals from “The City” cited access to EU customers and 46% cited the single regulatory framework for financial services as very important for their own business (see Ipsos Mori poll, 2013). The former is guaranteed through the role of UK authorities in ‘passporting’ banking and other financial services. Currently any firm headquartered in the UK can apply for a passport from the UK regulators to do business in the whole of the European Economic Area. The latter is granted through the European Court of Justice, which is in charge of enforcing single market rules. 84% of respondents said that the best option for the overall competitiveness of the UK as a financial center would be to remain a member of the EU.

Foreign Direct Investment in the UK

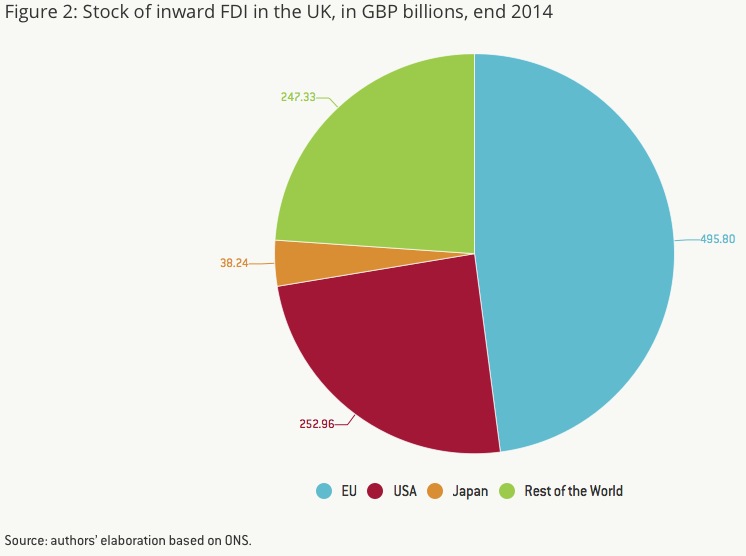

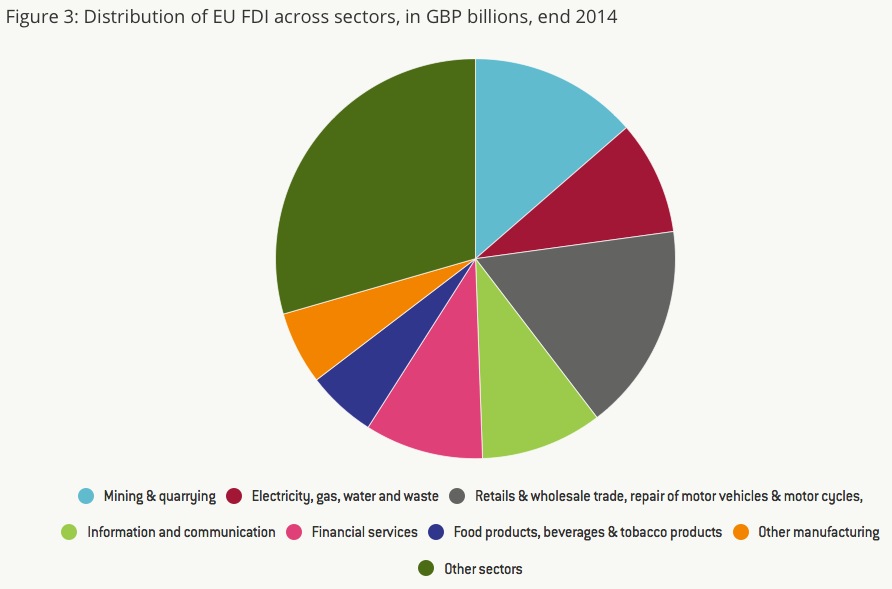

Beyond financial services, many European firms invest in the UK in a variety of sectors. When looking at the inward stock of Foreign Direct Investment (FDI), the EU is the biggest FDI investor in the UK, with nearly 500 bn GBP invested in 2014, as opposed to 253 bn GBP invested by the US (figure 3). The FDI investment of European firms is spread across different sectors (figure 4), in 2014 most notably retail and wholesale trade (83.2 bn), mining (67.5 bn), IT (48.7 bn) and financial services (47.5 bn).

In this context, 415 members of the Confederation of British Industry (CBI) in a survey conducted by YouGov in 2013 also valued the financial aspects of EU membership: 52% of respondents said that the ability to invest in other EU states without restrictions had a positive or very positive impact on their business; 42% said that the ability of their company to attract inward investment from companies based in the EU would be negatively affected by the UK leaving the EU and 32% said that their company’s ability to attract investment from companies based in non-EU countries would be reduced. A sizable 75% of respondents expected that Brexit would have a negative impact on the level of FDI.

Brexit Uncertainty

If Brexit happens, the advantages of EU membership that businesses appear to consider the most significant could be at risk. The UK’s passporting capacity in financial service might have to be re-negotiated. The UK’s adherence to a single rulebook would also be called into question, as exiting the EU would mean exiting the jurisdiction of the European Court of Justice. However, much would depend on the exact form of EU-UK relationship that was built after Brexit. The UK could opt for a Norwegian-style agreement, and join the European Economic Area (EEA) with full access to the single market. It would then fall under the jurisdiction of the EFTA Court of Justice, which enforces European laws in countries which are part of the EEA, but outside the EU.This would mean adopting regulations and standards without much influence on their development, an awkward situation for the EEA’s preeminent financial centre. Another alternative would be free trade agreements or bilateral agreements, which could guarantee access to the single market in selected sectors while preserving independence in others.

However, the outcome of any negotiations for single market access or shared regulation is uncertain. This uncertainty alone could prove destabilising. Even if a new deal were eventually reached, the confusion surrounding the negotiations would have negative consequences for European firms operating in the UK and might endanger FDI flows to the UK. The attractiveness of London as a global financial hub and springboard to Europe might also suffer.

Left unmentioned here is how the “City of London” basically is like the Vatican City within Rome — it has its own rules and allows bankster secrecy and lack of regulation. There is a reason why a lot of the financial skullduggery in Wall St (e.g. AIG) took place in the City, not New York.

From my POV one need only look at the largest boosters for “Remain in the EU” — Tony Blair, The Prince of Darkness (a/k/a Lord Peter Mandelson, forced to resign twice from Labour government over sleazy financial dealings), the banks of course, the establishment press… If these are all against Brexit, I’m for it.

And if it deals a blow to the financiers in the City, so much the better.

Yves, as for your question re locals — I visit London frequently and all the “regular” people are disgusted and angered by how the rise of the wealthy has made it impossible to buy a home unless one is rich. Note of course that Labour and the Tories both made it easy for foreign kleptocrats to launder their money in the UK (or in the Channel Islands) and buy up property through shell companies registered in the Caymans or the like.

Bah bloody humbug, let the whole house of cards crash down!

That was my first thought on reading the headline: one more entry on the plus side of the ledger for Brexit. Remove themselves from an undemocratic, dysfunctional institution and get rid of a bunch of financial parasites at the same time. What’s not to love?

The unspoken assumption in the MSM and among out-of-touch pundits generally, is that ordinary people give two farts about the interests of financiers. We all watched how they defrauded and looted everything they could lay hands on, and then took bonuses for doing us the favor of crashing our economy. Nobody who isn’t in the FIRE sector is shedding any tears for the looters. In fact, most people are actively rooting for their downfall. Which is why it’s so hilarious when the “serious” people come out with all their hand-wringing about policies that might damage the financial sector.

Except that I have read other commentators (particularly in Private Eye) arguing that the Hedge Funders in particular want us to leave. Leaving would do two things – cause short term volatility, which the hedge funders love, and also prevent the EU from imposing any new financial rules on the City. If we do leave, I expect the City will lobby for and get a significant relaxation of various regulations, and we’ll end up with more tax-haven like finance activities in London, not less.

I think that reducing the role of the financial sector in the UK is a good thing for the UK, even if it is bad for the City of London.

I don’t see the compensatory growth in any other sector of the British economy to make up the losses. That doesn’t mean Brexit is a bad thing, but I don’t see it as a very good thing. Britain’s problem is an entrenched elite less porous to new ideas and more odious than at any time since the late Middle Ages. Whether they collaborate with Continental elites or compete with them, they are still the obstacle to a better society over there. And I don’t see the Brexit as weakening them one whit. And without European courts or European laws to appeal to, it may make the average Briton even more in thrall to the panopticon security state the British elites have been entrenching for decades.

An interesting conundrum: will wresting power from one group of oligarchs simply empower another? Even so, a Brexit will enhance popular sovereignty if for no other reason than laws will be subject to increased democratic review. Not without risk, but a step in the right direction.

Good points. Thanks for making them!

A vote for Brexit will destroy the City?

Electing Sanders will cause US defense industries to move to Europe?

My. Lots of hysteria in neoliberal land. Do they think the world is coming to an end? /s

what about the new guidelines from the BIS that the mega banks (our 5 big investment banks) can only be domiciled in countries, US and China?, wealthy enough to bail them out? the UK probably ranks way below us in deep pockets. But Germany, ergo the EU, is determined to prevent anymore taxpayer bailouts ever again, so where does this all come together? Can the UK reduce the size of its banking industry to satisfy the BIS and the EU and still be filthy rich? or is that all over with anyway?

I think the key point about the impact of Brexit on the financial industry in London is that in any negotiation on trade (relating to banking or anything else) Britain will have a much weaker hand – the EU is much bigger than Britain, and in dealing with the US, China, etc., Britain simply won’t have the same hand in negotiations. So as with any negotiation featuring a strong party and a weak party, the latter will always be on the defensive, and the former will always be looking to see what extra advantage they can get.

In practical terms, this means that Germany, France and others will be looking to see what they can gain. Ireland may well have a major say too as Dublin has developed something of a back office role to the City of London – and could well see an advantage in pushing for EU rules which would encourage non-EU banks to see Dublin (in addition of course to Frankfurt and Paris and Milan) as a ‘foot in the EU’, so at the very least they will split their investment, rather than putting it all in London. To give one example I personally know, a friend is involved in a company which provides back office support to hedge funds and around the world, and they set up their European branch in Dublin rather than London, not for tax reasons, but just because they found it easier and cheaper to staff their office. There are hourly flights from Dublin to London, and the flight is just an hour, so they didn’t see any significant disadvantage. The senior London based partner simply works from home near London.

So I don’t see London suffering immediately – there is simply too much of an historic investment in human capital in London for companies to willingly shift. But I would see a significant amount of ‘nibbling at the edges’ of finance activities in favour of other European cities, which in the longer run could undermine its role.

Another issue – its not a subject I’m an expert on, so perhaps others could comment – is that Britain has always played a strong role in Europe in undermining any attempt by the Commission to put pressure on tax havens and in looking at financial transaction taxes. Without a seat at the table, you could well see a new impetus for financial regulation and taxation, which could potentially be very bad news for London.

I completely agree that the UK Govt acts very directly as agent for the City of London during EU negotiations, as a cuckoo in the nest making sure that anything damaging to the financial sector’s short term interests is blocked – such blocking the Tobin Tax (Robin Hood Tax).

Maybe that’s why they want to stay in – to block any EU efforts to rein in offshore

Yves – to answer your question, in my experience there is little link between “losing out” in the house price wars and backing Brexit. Young Londoners are at the forefront of that war, but the ones I know are mostly pro-EU. I’ve only ever met one couple who were out-bid on a flat by a Russian, but they were crazy enough to be trying to buy in Chelsea. The rest of us are pragmatic enough to know we were never going to live in Zone 1 anyway. Also, I don’t see leaving the EU stemming the tide of foreign money (Russian in particular). If there’s a dive in the pound doesn’t that make central London property even more attractive to them?

If you look at the 2015 election, UKIP gathered most support in run-down working class towns, particularly on the coast, where property prices are cheap (because no-one wants to live there). If you use UKIP support as a proxy for voting to leave the EU (which isn’t perfect I admit), you’d expect to find the same pattern. There was a fascinating documentary last year made my a former editor of the Economist, where they actually managed to catch a UKIP councillor saying (I’m paraphrasing) “I know the EU isn’t to blame for my town’s decline, but I still want to leave”. There doesn’t seem to be much rational thought going on from either side at the moment.

I generally agree with the take on Brexit relationship to housing. The bigger factor is the macroeconomics of the Russians, Saudi’s and Asian’s investment appetite and capacity in London. MSM has already picked up on a downturn in the Nine Elm’s area where the skyline is littered with cranes.

In as far as FSI and Brexit, I think you have to make a distinction between the banking and shadow banking systems. The BOE, PRA and Parliament have had a systemic focus on ring fencing retail from Investment Banking and the UK banks have been exiting European investments as quickly as the market will allow for it. IMO, the major FSI’s will continue to get favourable treatment from the Brits as long as they do not have large concentrations of retail deposits in the UK, or if they do they are truly ring fenced and cordoned off. The FSI’s would rather deal with the Brit’s than the EU, and most certainly be GBP based vs Euro.

Conversely, I can see shadow banking following the tax havens and , at least from a regulatory and governmental perspective, not getting much incentive to stay. But I am also far less knowledgeable on this sector than the FSI’s.

Re. the title — you say that as if it were a bad thing. On the contrary – and I’ve found myself using this phrase on multiple occasions in the past few months in the context of “the time for reform attempts is past … this sucker needs to be smashed” fin/econ/politics topics – ’tis a consummation devoutly to be wished

+10

Marriages arranged by deception rarely favor the party deceived.

All those in favour of Brexit should also favour Scottish Independence. Precisely the same arguments support one and the other.

All those in favour of Brexit should also favour Scottish Independence. Precisely the same arguments support one and the other.

Even among Scottish Independence supporters, suprisingly few do. I find the SNP’s faith in the EU alarmingly at odds with my own.

The last thing a newly formed nation needs is the straitjackets that the european project demands its members don.

The EU is a great convenience in dedemocratising national electorates and enabling neoliberal deformations.

It is a battering ram for these, not the bulwark people imagine.

1. The threat to london is from regulation which trumps network effects. This matters less for things like fx but but a lot for things like swaps or equities. It would be very simple for the EU to force equities trading or bond trading back to France or Germany by simply taxing extra EU transactions. I have absolutely no doubt on this. It’s why the UK has never seriously considered Brexit since EU entry. Much of this could be side stepped, but if France was determined eventually they will kill london.

2. Outside of the City, the cost benefit is finer. There are a lot of Japanese manufactures who use UK plants cos they are a cheap EU entry zone. But I think the concerns of the regions was never the key political driver. It was always about london.

So long as the City remains the Land of a Million Brass Doorplates, its hub status is secure.