Yves here. I’m leery of reinforcing the “competitiveness” meme, since it’s based on the false premise that all countries can be exporters. But this article nevertheless makes important observations about Eurozone structural flaws.

By Paolo Pasimeni, Economist, European Commission. Originally published at the Institute of New Economic Thinking website

Germany’s wage restraint policy is likely to amplify divergences in competitiveness.

The recently published consensus-narrative on the roots of the crisis of the European Economic and Monetary Union (EMU) have channeled great attention on the search for an appropriate diagnosis and more meaningful analyses, some of which have appeared on this very blog. Peter Bofinger (here and here) has made important contribiutions highlighting the role of coordinated policies of wage moderation adopted in Germany after the monetary unification in increasing the divergences within the EMU — divergences which are now recognised as a key structural weakness of the monetary union. Servaas Storm (here, here, and here), Heiner Flassbeck and Costas Lapavitsas (here and here) have contributed to a thoughtful and detailed debate about the comparative relevance of supply-side versus demand-side processes in determining those imbalances. On the one side, Storm argues that intra-EMU capital flows were the primary cause, because they created the huge demand shock at the origin of the imbalances. On the other side, Flassbeck and Lapavitsas, stress the divergences in unit labour costs (ULC), amplified by Germany’s wage restraint policy, as a key driver of the imbalances.

This column argues that while the demand shock is more synchronised with the development of imbalances, Germany’s wage restraint policy is likely to amplify divergences in competitiveness. The debate about what came first could in fact be of secondary importance; the primary issue is that the roots of the intra-EMU divergences are to be found in the structural characteristics of its architecture. In other words, and to use the same terminology of the authors of the “consensus narrative,” they are a feature of the system rather than just a bug.

“Features” Rather than “Bugs”

The EMU suffers from two structural weaknesses: a tendency to develop imbalances, and an inherent deflationary bias. The EMU architecture and its functioning was itself a kind of large, although relatively gradual, asymmetric shock. The imbalances built up during the first decade were a feature of the system, not in the sense that they were a healthy signal of economic integration — as it was misunderstood in the initial years (Blanchard and Giavazzi, 2002) — but in the sense that they were a natural and perhaps unavoidable consequence of its incomplete architecture.

The establishment of the common currency eliminated the exchange-rate risk, thereby giving way to the largest increase in cross border capital flows ever experienced on the continent. At the same time, though, the important signalling function of the exchange rate was lost (Tornell and Velasco, 2000) without being replaced by any other common institution. In this case, markets have difficulties in delivering the right signals of imbalances, underreacting or overreacting, and cannot properly correct them (Acocella, 2014).

The single monetary policy for countries with structurally different business cycles also reinforced the incentives to cross-border capital flows. Countries with higher (lower) inflation had lower (higher) real interest rates, and as a restult they attracted (deterred) capital flows from other countries. The more capital flowed into those countries, the more the inflationary pressure rose, in a vicious circle that increased divergences.

This self-reinforcing process represented a huge demand shock in the whole area. Intra-EMU trade imbalances were closely synchronised with demand shocks (Storm and Naastepad, 2014), and changes in relative cost competitiveness were less significant (Gabrisch and Staehr, 2014; Gaulier and Vicard, 2012). Divergences in unit labour costs, in this sense, were more a consequence rather than a cause of demand shocks, triggered by capital flows.

The Case of Germany’s Current Account

The case of Germany is illustrative of the system of intra-EMU transfers operated through financial markets, the so-called “private insurance channel,” and of its impact on the external positions of the participating countries. This is relevant to understanding the role that capital flows and income effects had in sustaining Germany’s current account (CA) surplus vis-à-vis the rest of the EMU, prior to the crisis.

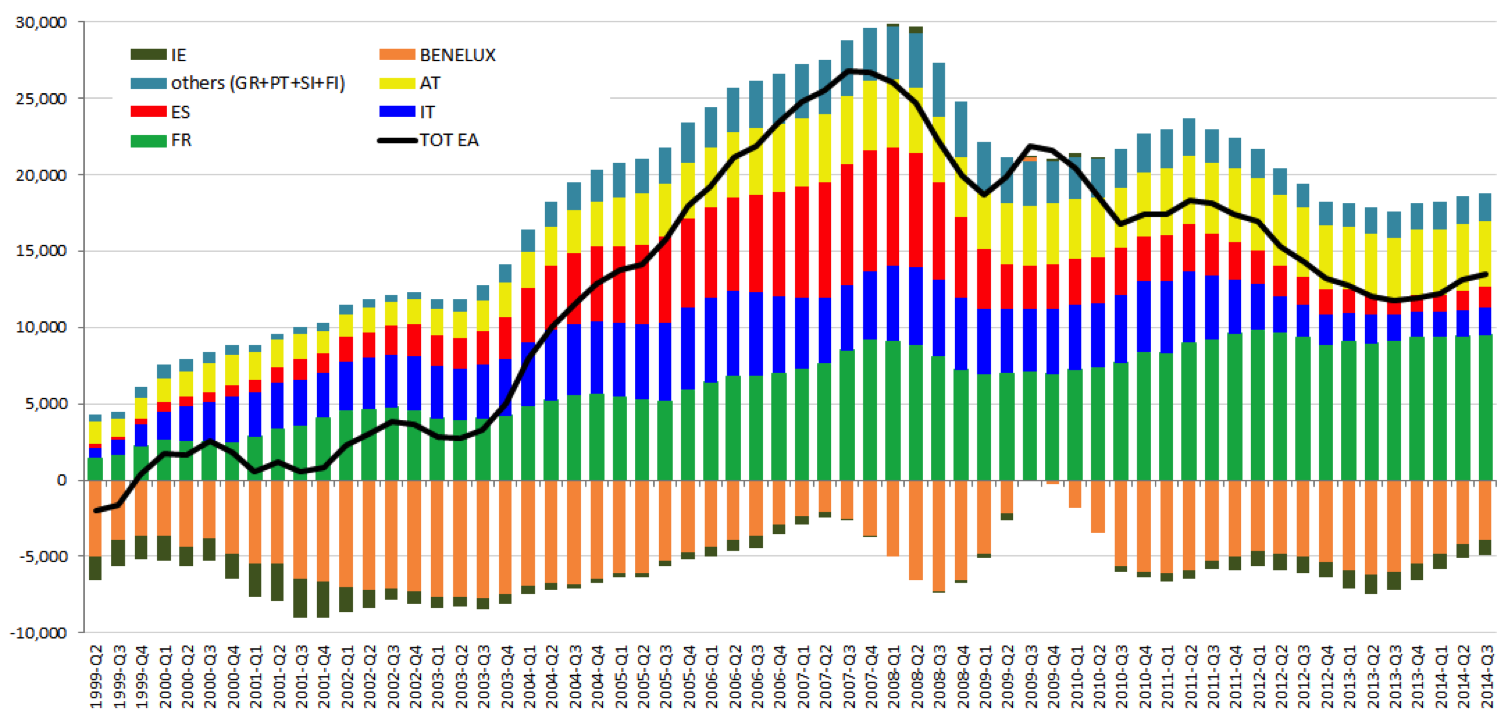

At the inception of the EMU, Germany had a rather balanced external position towards the rest of the area. From 2003 to 2007, it developed an important surplus, whose main sources were France, Italy, Spain, and Austria, and to a less extent also Greece, Portugal, Finland and Slovenia. At the same time, Germany had a deficit towards Benelux countries and Ireland.

[1] In 2008, the German surplus towards the EA started decreasing, driven in particular by shrinking demand from Italy and Spain. France and Austria, on the other hand, remained a persistent source of surplus. With the exception of end-2009, Germany’s CA position with Benelux remained on stable deficit throughout the whole period.

Figure 1: Evolution of German Current Account balance towards other EA countries

Source: own elaboration on data from the Deutsche Bundesbank.

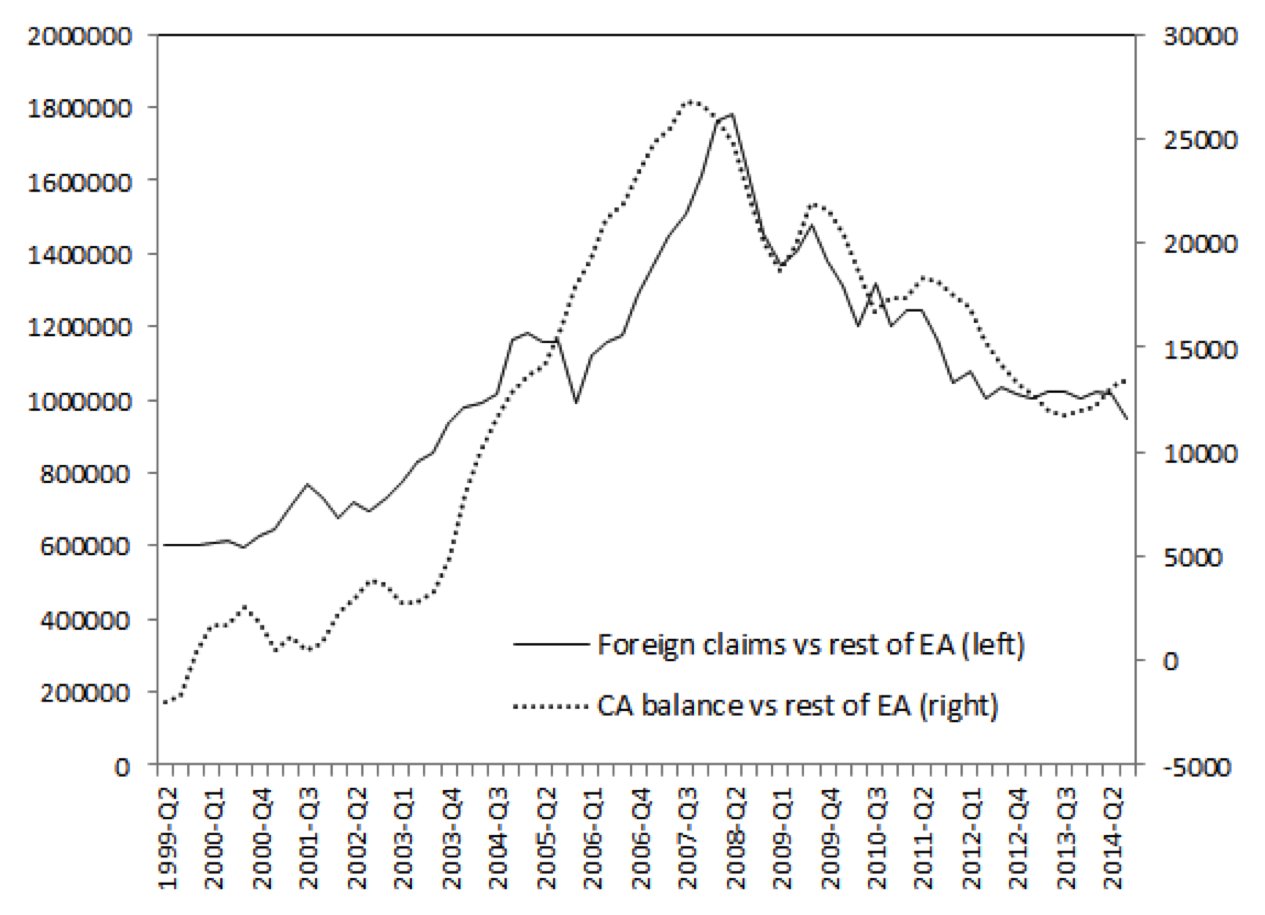

Germany ran the largest current account surplus in the EA, and its banking sector developed an increasing exposure toward the rest of the currency union. A first, stylized fact is the similar trend of the gross exposure of the German banks and the country’s CA balance with the rest of the Euro Area.

Figure 2: Gross exposure of German banks and German Current Account balance vis-à-vis the rest of the EA (1999-2014, quarterly)

Source: own elaboration on data from the Bank of International Settlements and the Deutsche Bundesbank.

First, the similarity applies not only to the overall position of the country towards the rest of the world, but also holds true for its relation with the Euro Area. Second, and most importantly, the same similarity applies to the bilateral relations between Germany and each other euro area partner.

Changes in relative competitiveness and in domestic demand in Germany and in each other partner can both determine the bilateral current account balances. In a recent paper (Pasimeni, 2015) I try to better understand the impact of the various factors. The results (see also the annex) show an important and significant effect of the banks’ exposure and of the difference in investments, while real effective exchange rates and interest rates are significant, but with very low coefficients. The exposure of the German banking sector towards each EA country has actually been significantly associated with the German bilateral current account balance (positive and significant coefficients). At the same time, the comparatively lower level of investments made in Germany was the other relevant and significant determinant of the bilateral current account surpluses (negative and significant coefficients). Time-fixed effects suggest that these relations are independent of any specific policy change that might have occurred.

These results confirm the hypothesis that intra-EMU trade imbalances were caused not so much by changes in relative cost competitiveness, but rather by demand shocks and investment in particular. Similar result comes from a study by Danninger and Joutz (2007) on the determinants of Germany’s export performance, which appears to be mainly linked to trade relations with fast growing countries, rather than on improved relative cost competitiveness, which actually “played a comparatively smaller role in explaining the brisk export growth” (less than 2% of German export growth).

Moreover, the significant effect of the banking sector’s exposure on current account balance provides an illustration of the role played by the “private insurance channel.” The larger the capital outflow from Germany to each trading partner, the higher the bilateral surplus, and vice versa. The funds flowing from the German banking sector to other EMU countries, in a context of growing financial integration, boosted aggregated demand in the other countries, and therefore their imports from Germany, in a kind of vendor-financing operation.

Policy Implications

If this diagnosis is correct, then, the EMU has a structural tendency towards developing internal imbalances in the current accounts of its members. Absent the exchange-rate, the only way to deal with those is through periodic internal adjustments of income. But pressure to adjust a CA surplus is never as strong as the one to adjust a CA deficit. In fact, the adjustment in recent years has been driven by an important fall in aggregate demand in deficit countries, with large output and employment gaps.

So, if the pressure to adjust is asymmetric, if there are no common instruments for demand management; if the response can only be provided at national level, and if deficit countries can only adjust through deflationary policies, then the whole area has an inherent deflationary bias, which determines subdued growth rates in good times and longer stagnations and recessions in the worst cases.

Table 1: Average annual GDP growth and unemployment rates

| GDP growth | Unemployment | |||

| 1999-2007 | 2008-2014 | 1999-2007 | 2008-2014 | |

| World | 4.4 | 3.3 | – | – |

| Euro area | 2.3 | -0.1 | 8.7 | 10.3 |

| United States | 2.9 | 1.1 | 5.0 | 7.9 |

| Other advanced economies* | 3.0 | 1.3 | 5.1 | 5.1 |

| Emerging market and developing economies | 6.2 | 5.3 | – | – |

The EMU faces a cruel trade-off: growth with imbalances, or balance without growth. Either it has to rely on the pre-crisis growth model, when financial integration was substituting a common fiscal capacity, channelling credit and capital flows from surplus to deficit countries, and fuelling unprecedented imbalances. Or, it has to impose restrictive policies, trying to consolidate public finances and achieve balanced external positions, at the cost of a drag on growth. In the worst case scenario, if deflationary policies are prolonged, it may also face the even more unpleasant situation of imbalances without growth. The system lacks an instrument capable of defusing this dangerous mechanism.

The two structural problems of the EMU — the tendency to develop imbalances and the deflationary bias — connect via the balance of payment constraint. Without such constraint, only common fiscal policy can prevent the building up of imbalances, acting as a buffer and providing the adequate fiscal stance over time. Such a fiscal capacity should be linked to the relative, intra-EMU, external balances of the participating countries: The higher the net surplus in intra-EMU trade (that is, the direct benefit from other members’ income), the higher the contribution to a common fiscal capacity.

It is important to stress that the relevant variable is the relative, intra-EMU, current account position and not the absolute one: This way, the composition of the budget can be independent from the overall external position of the euro area, allowing for a form of built-in automatic rebalancing mechanism that guarantees intra-EMU equilibrium, symmetry, and stability.

This idea is not new; it was at the core of John Maynard Keynes’ reflection on a more stable international monetary system (Keynes, 1940). Keynes’ plan for an international clearing union was conceived precisely on the basis of this underlying analysis, in view of the Bretton Woods monetary arrangements. Keynes was concerned with the asymmetric consequences of a mercantilist strategy in a fixed-exchange rate system on effective demand and employment.

The build-up of disequilibria in the balance of payments increases the risk of having to apply deflationary measures in deficit countries to adjust and restore competitiveness. This in turn creates periodic falls in aggregate demand and prevents the system from achieving full-employment.

He proposed an international closed system of payments that, within a system of fixed (but periodically adjustable) exchange rates, ensured symmetric rebalancing between deficit and surplus countries, [2] a kind of “financial disarmament” as he called it (Keynes, 1940). If this plan was too ambitious to be applied at a global level, its relevance is manifest for a smaller but tighter international monetary system such as the EMU.

Some decades later, the 1977 “MacDougall Report” revived the issue, precisely with an eye to the European monetary unification process. It studied how central or federal public finance could reduce inter-regional income differences in eight case studies (Germany, UK, France, Italy, USA, Australia, Canada and Switzerland).

The report measured the public finance outflow/inflow at the regional level in parallel with the relative current account position of each region. It showed that the redistributive function of the national budget at regional level reflected corresponding positions of the regions in their balance of payments on current account. Inflows to relatively poor regions were on average equal to 70% of their current account deficits, while outflows from relatively richer regions were on average equal to 95% of their current account surplus. This achieved an overall stabilisation effect at national level through reducing per capita income differences by 40%.

Had such a scheme been in place in the EMU, it would have automatically reduced the imbalances, periodically and symmetrically correcting them. It would have ensured that surpluses did not remain idle and that absorption of deficits did not pose a drag on aggregate demand. It would have eliminated incentives to “beggar-thy-neighbour” through competitive internal devaluations. It would have been much less pro-cyclical than the system of transfers operated by capital flows in financial markets, which stopped once the financial crisis erupted. It would have also reduced the need for the system to exclusively rely on the efficiency and stability of financial markets, thus reducing systemic risks. It would have provided an instrument for stabilization against common shocks, and it would have substituted the inherent deflationary bias of the system with an adequate demand management, propaedeutic to full employment.

Would such an instrument have avoided the long period of recessions and divergences? This is hard to say, since a proper counterfactual does not exist. What seems clear, however, is that its absence has undermined the stability and prosperity of the monetary union.

I liked almost everything about this post. But if I understand the policy prescription correctly, it involves fiscal transfers from trade surplus countries to trade deficit countries in proportion to their surplus/deficit.

I get the logic but good luck with that.

The one sentence I didn’t like is the first one in bold (which I noticed is different from the first sentence in the original INET post):

Again, I see the logical argument but not the political one (and if the solution is fiscal transfers, then we are talking politics, not just economics.) It suggests that higher wages in Germany would help mitigate the crisis. That seems naive. Substantially higher wages in the German export sector would likely lead to relocation of production, which might be good for one or two lower-wage European countries but would not then yield higher domestic consumption in Germany. Raising wages in the apparently burgeoning low wage temp-work sector (there was a good link here the other day about how low wages are in this sector) would undoubtedly be a good thing, but one wonders if German employers would tolerate that either.

Even if the German unions pushed for higher wages, it is hard to imagine anything less than total opposition from German employers and mainstream politicians. Nor would one expect to see strong support from working people around Europe for increasing the wage gap between Germany and the less wealthy Euro countries.

Wages in Germany are rising at their fastest rate in decades. No signs of any opposition to that anywhere.

what? I live in germany, no sign of steeply rising wages, they may rise some more respective to the traditional wage ‘moderation’, but by far not enough to help mitigate the emu divergences. In fact the relatively “strong” rise of the real wages in 2015 (2,4%) was mainly due to the low inflation rate.

“Reallöhne im Jahr 2015 mit + 2,4 % stark gestiegen”

https://www.destatis.de/DE/ZahlenFakten/GesamtwirtschaftUmwelt/VerdiensteArbeitskosten/RealloehneNettoverdienste/Aktuell.html

I strongly recommend as a treatment for economists a slap in the face each time they mention “competitiveness”. Mr. Pasimeni would receive a couple of those but apart from it, this is a nice essay.

Thanks for posting it!

Perhaps because I am a military historian of the early 20th century, I have trouble seeing what’s wrong with the notion of competitiveness. The combination of an overvalued pound, a lack of investment in new technology, the cost of importing oil, and a whole lot of quite good craft workers doing things that America did with machines and machine tools made British goods noncompetitive in many areas and many markets in the 20s and 30s and this made Britain potentially weaker and the USA potentially stronger economically and militarily. In short, this stuff can and often does count.

The problem is not the notion. The problem is that this cannot be the main driver for policymakers ant the excuse used to reduce wages, social insurance and services.

Competitiveness is great achievement for a particular individual/company but a disastrous driver for overall policy. An achievement or a byproduct but not an objective or a driver.

So the EMU has “the tendency to develop imbalances and the deflationary bias”, and we should introduce instruments to correct the CA’s of individual members. How about separate currencies so that countries can have individual monetary policies? ;-)

Might be good, might not be good. Having every state in the Union issue its own currency might be good, but then again might not. It would sure make NY and CA comparatively a lot richer.

It seems like the EMU is in no mans land where they have the worst of all options. There’s no centralized fiscal policy so they aren’t sharing in a welfare state, but at the same time they lack control (or perceive to lack control, see my JW Mason link) over their monetary policy. So when the austerians come out they basically just make everything much worse for the poorest areas.

The economist JW Mason says this isn’t necessary. Even though they do share a currency, each EMU member runs it’s own central bank. They could have recapitalized (or never decapitalized) their banks without the ECB doing anything.

http://jwmason.org/slackwire/what-greece-must-do/

We’ve discussed separate currencies in a previous set of discussions here. Our conclusion was that the banking IT systems would need large investments to support multiple currencies over a number of years (2 to 4).

This is much better than the earlier attack on Flassbeck and Lapsvitsas which labeled them “neo-classicals”, (when one is a Marxian economist with a specialty in finance and the other is probably a left-Keynesian or post-Keynesian) and which focused only on the direct labor costs of imports and exports, (when it is the overall wage level including non-tradable sectors that counts and labor costs are a pervasive determinant of the price level both directly and indirectly). And, of course, some countries, such as Greece have low import-export sectors as % of GDP. Still the conclusion that it was CA imbalances that drove the labor costs rather than the other way around seems correct to me. Still the “labor market reforms” in Germany, which had the effect of lowering domestic German consumption and investment demand (and increased the importance and power of capital in Germany), and which then re-enforced the traditional German bias toward export driven growth, did play a significant role in setting up the whole debacle.

Flassbeck calls the deflation induced by Germany a tragedy of historic dimensions http://www.flassbeck-economics.de/die-deflation-ist-ein-meister-aus-deutschland-und-die-ezb-ist-sein-opfer/