By Rajiv Sethi, Professor of Economics, Barnard College, Columbia University. Cross posted from his blog.

Since the launch of the pioneering Iowa Electronic Markets almost thirty years ago, prediction markets have grown to become a familiar fixture in the forecasting landscape. Among the most recent entrants is PredictIt, which has been operating for about a year under a no-action letter from the CFTC.

Both IEM and PredictIt offer contracts structured as binary options: if the referenced event occurs, the buyer of the contract gets a fixed payment at the expense of the seller, and otherwise gets nothing. The price of the contract (relative to the winning payment) may then be interpreted as a probability; an assessment by the “market” of the likelihood that the event will occur. These probabilities can be calibrated against actual outcomes over multiple events, and compared with survey and model based forecasts. Comparisons of this kind have generally found the forecasting performance of markets to be superior on average to those based on more traditional methods.

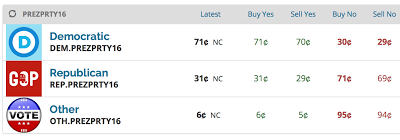

But interpreting prices as probabilities requires, at a minimum, that the set of prices referencing mutually exclusive outcomes sum to at most one. This condition is routinely violated on PredictIt. For instance, in the market for the presidential election winner by party, we currently have:

Based on the prices at last trade, there is an absurd 108% likelihood that someone or other will be elected president. Furthermore, the price of betting against all three listed outcomes (by buying the corresponding no contracts) is $1.96, even though the payout from this bundle is sure to be $2.00. Since these contracts are margin-linked (the exchange only requires a trader to post his or her worst-case loss) the cost of buying this bundle would be precisely zero in the absence of fees, and this would be as pure an opportunity for arbitrage as one is likely to find.

On IEM, or the now defunct Intrade, such a pattern of pricing would never be observed except perhaps for an instant. The discrepancy would be spotted by an algorithm and trades executed until the opportunity had been fully exploited. Profits would be small on any given trade, but would add up quickly: the most active account on Intrade during the last presidential election cycle traded close to four million contracts for a profit of $62,000 with minimal risk and effort. This trader had a median holding period of zero milliseconds. That is, the trader typically sold multiple candidate contracts simultaneously (with the trades having identical timestamps) in a manner that could not possibly have been done manually.

Why don’t we see this in PredictIt? The simple answer is the fee structure. Whenever a position is closed at a profit the exchange takes 10% of the gains; losing trades don’t incur fees. Taking account of this fee structure, the worst-case outcome for a trader betting against all three outcomes in the example above would be a win by someone other than a major party nominee. In this case the trader would lose $0.95 and gain $0.99, incurring fees on the latter of around ten cents. The result would be a net loss rather than a gain, and hence no opportunity for arbitrage. Prices could remain at these levels indefinitely.

Still, algorithmic arbitrage can prevent prices from getting too far out of line with meaningful probabilities. The extent to which this happens depends on whether the events in question include some that are considered highly unlikely. In a market with only two possibilities (such as that referencing confirmation of Merrick Garland) price distortion will be lowest if both outcomes are considered equally likely. For instance, if the prices of the two contracts were each 53, betting against both would cost 94, and fees would be a shade above 5 no matter what happens. These prices could not be sustained, so the distortion would be at most 5%.

But in the same market, prices of 99 and 10 for the two outcomes could be sustained, for a distortion of 9%. The cost of betting against both would be 91 but if the less likely outcome occurs, the fee would wipe out all gains. Hence no opportunity for arbitrage, and no pressure on prices to change.

Given that PredictIt is operating as an experimental research facility with the purpose of generating useful data for academic research, this situation is unfortunate. It would be easy for the exchange to apply fees only to net profits in a given market, after taking account of all losses and gains, as suggested here. This does not require any change in the manner in which margin is calculated at contract purchase, only a refund once the market closes. If this is done, prices should snap into line and begin to represent meaningful probabilities. The decline in revenue would be partially offset by increased participation. And the transition itself would generate interesting data for researchers, consistent with the stated mission of the enterprise.

Betfair Exchange in the UK is much more liquid, basically does the same thing, although it uses digital odds which you then turn into probabilities, rather than a futures-style 0-100 trade. Has always been more liquid than the likes of InTrade. Check out the Presi election there for example. And Betfair does as you suggest, taking a cut (5% or less depending how much you trade) on the net profit of each market.

The house has to make money somehow.

Three things:

1. Vigorish and Visigoth have the same intra-ocular trauma effect.

2. Cannot remember where I read how the house could make money losing, given the right circumstances, due to the vig. If they reorient, Predictit can still generate useful data for academic research,

3. Wisdom of the Crowds: remember the giddy days of Freakonomics, back when the economic fields still had flowers and we didn’t think we needed to sweat the details? Mandatory mention of Banerjee and Duflo to mask the bitter taste. Thanks to NC for sweating details.

Good to know there is a 108% chance that someone will replace Obama

Does that model taxation on profits? Does it mean there are arbitrage opportunities in real-world markets, but only for tax cheats?