Financial regulators advanced some long-outstanding Dodd-Frank business last week, issuing proposed rules for curbs on executive pay. While they are more stringent than an earlier version put forward in 2011, they still have serious failings. Nevertheless, they may wind up being salutary, if nothing else, by making the speculative parts of the finance business less attractive.

The problem is that regulations are a blunt instrument and there are places where blunt approaches would have been more effective. As we reminded readers in our recent Politico article, Andrew Haldane of the Bank of England in 2010 had ascertained that systemically important financial firms inflicted such high costs on the community at large via periodic busts that they couldn’t begin to pay for the damage they do. They are purely extractive. Thus prohibiting risky products and practices is a much better approach than tinkering with executive pay.

The intent was to make the pay create better “alignment of interests.” It’s alarming to read the paper that sets forth the proposed rules fail to say that “the inmates are running the asylum,” and provides bromides like this instead:

Particularly at larger institutions, shareholders and other stakeholders may have difficulty effectively monitoring and controlling the impact of incentive-based compensation arrangements throughout the institution that may affect the institution’s risk profile, the full range of stakeholders, and the larger economy.

“May have difficulty”? Since when have shareholders ever had any understanding of, much the less influence over, internal pay structures?

Keep in mind these rules aren’t final. The comment period is open till July 22. And you dear readers, can participate, and we have a suggested fix. Plus there was a much better model that regulators ignored.

The new rules do make a stab at covering”producers”. One of the issues with systemically dangerous financial firms is that they delegate a great deal of responsibility. Worse is that senior management is often not capable of effective supervision. Jamie Dimon does not have the acumen to understand the risks in his derivatives clearing operation, which is where the real risk in his bank lies. The fact that JP Morgan was taking what Lehman staffers called “goat poo” as collateral, and that the London Whale debacle exposed that JP Morgan had risk controls that shocked other trading firms on the Street confirms this tendency. As we wrote in ECONNED:

On paper, capital markets enterprises look like a great opportunity. The firms that are at the nexus of global money flows participate in a very high level of transactions. Enough of them are in complex products or not deeply liquid markets so as to allow firms to find ways to uncover and in many cases create and seize profit opportunities. New, typically sophisticated products often provide particularly juicy returns to the intermediary. And in theory, clever, adaptive, narrowly skilled staff can stay enough ahead of the game so that the amount captured off this huge transaction flow is handsome.

Once again, however, the real world deviates in important respects from the fantasy. Why? This business model is also a managerial nightmare. We have a paradox: “success” and profitability in the investment banking context entails giving broad discretion to individuals with highly specialized know-how. But the businesses have outgrown the ability to monitor and manage these specialists effectively. The high frequency, meaningful stakes, and large absolute number of decisions made at the operational level, the geographic span of these firms, and the often imperfectly understood interconnections among business risks make effective supervision well-nigh impossible.

Pay rules will go deeper into the firms. As the Financial Times summarized it:

….restrictions would apply to a wider pool of employees at large banks — not just top executives — as well as those that work for other types of institutions.

The rules affect so-called “significant risk takers”, who include the top 5 per cent of earners at the largest banks or those able to put at risk material amounts of the institution’s capital.

5% is an arbitrary cutoff. It would have been better if this had been thought through better, since a bank with sprawling retail operations like JP Morgan and Bank of American is going to have a very different mix of earners than a Goldman or a Morgan Stanley.

Inclusion is largely based on pay levels, with the rules also including individuals who have discretion over what is deemed to be meaningful amounts of capital. In-house asset managers at behemoth banks are generally excluded. However, they do include Fannie and Freddie, credit unions, and investment advisers.

One obvious flaw is that this will include a lot of investment banking professionals, like mergers & acquisitions bankers, whose ability to do systemic harm is zero. By contrast, when Goldman’s in-house quant funds melted down, that caused serious turbulence at other quant funds. Yet internal hedge funds are excluded from the rules.

While executives have been subject to pay holdbacks for some time, extending it to the people who control business units is a new, positive development. The rules also are tiered, with the biggest firms in terms of assets subject to longer holdbacks than players in the next two strata.

More pay will be tied up longer. Again from the Financial Times:

Top executives at the largest institutions — those with at least $250bn of assets — would face the toughest restrictions. They would have three-fifths of their bonuses deferred for four years.

Those at groups with between $50bn and $250bn of assets would have half of their bonuses delayed for at least three years. Lesser restrictions apply to financial companies with between $1bn and $50bn of assets.

Right now, deferrals are typically 50% of bonuses for three years at the biggest banks. But that’s for a relatively small group of very top executives.

The big headfake: the triggers for bonus forfeiture and clawbacks are weak. Consider this language:

A Level 1 or Level 2 covered institution would be required to consider forfeiture or downward adjustment of incentive-based compensation if any of the following adverse outcomes occur:

• Poor financial performance attributable to a significant deviation from the covered institution’s risk parameters set forth in the covered institution’s policies and procedures;

•Inappropriate risk-taking, regardless of the impact on financial performance;

•Material risk management or control failures;

•Non-compliance with statutory, regulatory, or supervisory standards resulting in enforcement or legal action brought by a federal or state regulator or agency, or a requirement that the covered institution report a restatement of a financial statement to

correct a material error; and•Other aspects of conduct or poor performance as defined by the covered institution.

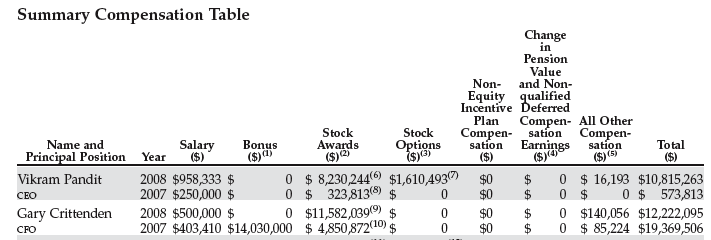

It’s the institution that “is required to consider” docking the withheld bonuses! And while you can be sure this provision will be used liberally against rogue traders, don’t expect anything meaningful for executives. Remember when Citigroup lied to investors and didn’t tell them in October 2007 about $40 billion of CDOs and liquidity puts? The bank was fined $75 million in 2010 and its former CEO, Gary Crittenden, was fined $125,000. Contrast that with his pay per Citigroup’s 2009 proxy:

So the norms for financial penalties are so low that even if an upset regulator pushed for more, these lame rules only allow them to jawbone. And even three or four times Crittenden’s fine is couch lint relative to his income.

And get a load of this:

The proposed rule would require clawback provisions that, at a minimum, allow the covered institution to recover incentive-based compensation from a current or former senior executive officer or significant risk-taker for seven years following the date on which such compensation vests, if the covered institution determines that the senior executive officer or significant risk-taker engaged in misconduct that resulted in significant financial or reputational harm to the covered institution, fraud, or intentional misrepresentation of information used to determine the senior executive officer or significant risk-taker’s incentive-based compensation.

How is the firm supposed to get money back from a former senior executive? The bonus holdback is only for four years (the “vesting” makes it sound as if only deferred comp and pensions are at issue). And it is the “covered institution” that is supposed to not only design the arrangement but also determine whether Bad Stuff Happened. How often will that take place? You can guarantee never since public companies don’t like exposing dirty laundry. The only exception might be in an entire senior management team was replaced. But again, that pretty much never happens. Recall at Salomon in the early 1990s, it was very destabilizing for the firm and led Warren Buffett to take advantage of the distress by riding in as a rescuer. Banking regulators are afraid to play kingmaker, not only out of undue respect for the pretense that banks are freestanding enterprises (when they are so heavily subsidized as to not be properly regarded as private) as well as that they might not install strong enough replacements and will be criticized as a result.

Will financial firms get around the rule by paying bigger salaries? That’s been the response in Europe, simply to move money out of the bonus bucket and into the salary category. And that increases the riskiness of the firm, since the whole point of having bonus-heavy pay was so that the firm could lower its cost base quickly and easily by reducing bonuses in bad markets, rather than firing people.

Believe it or not, the New York Fed’s William Dudley had a better proposal. I was shocked that he proposed something sound and serious. With the benefit of hindsight, he probably presented his plan when the rulemaking on the Dodd Frank pay plan was so far advanced that they would not be able to consider his scheme. From an October 2014 speech by Dudley:

However, in contrast to the issue of trading risk, unethical and illegal behavior may take a much longer period of time—measured in many years—to surface and to be fully resolved. For this reason, I believe that it is also important to have a component of deferred compensation that does not begin to vest for several years. For example, the deferral period might be five years, with uniform vesting over an additional five years. Given recent experience, a decade would seem to be a reasonable timeframe to provide sufficient time and space for any illegal actions or violations of the firm’s culture to materialize and fines and legal penalties realized. As I will argue below, I also believe that this longer vesting portion of the deferred compensation should be debt as opposed to equity…

Assume instead that a sizeable portion of the fine is now paid for out of the firm’s deferred debt compensation, with only the remaining balance paid for by shareholders. In other words, in the case of a large fine, the senior management and the material risk-takers would forfeit their performance bond. This would increase the financial incentive of those individuals who are best placed to identify bad activities at an early stage, or prevent them from occurring in the first place. In addition, if paying the fine were to deplete the pool of deferred debt below a minimum required level, the solution could be to reduce the ratio of current to deferred pay until the minimum deferred compensation debt requirement is again satisfied—that is, until a new performance bond is posted.

Not only would this deferred debt compensation discipline individual behavior and decision-making, but it would provide strong incentives for individuals to flag issues when problems develop. Each individual’s ability to realize their deferred debt compensation would depend not only on their own behavior, but also on the behavior of their colleagues. This would create a strong incentive for individuals to monitor the actions of their colleagues, and to call attention to any issues. This could be expected to help to keep small problems from growing into larger ones. Importantly, individuals would not be able to “opt out” of the firm as a way of escaping the problem. If a person knew that something is amiss and decided to leave the firm, their deferred debt compensation would still be at risk.

This is a great idea, since it produces partnership-type incentives in a corporation. And Mark Carney, governor of the Bank of England, endorsed the idea shortly after Dudley’s speech. Yet it curiously disappeared from discussion almost as soon as it was proposed.

This plan may wind up shrinking the financial sector a bit. Some experts, including your humble blogger, have been writing since the crisis that the financial services industry is oversized and needs to shrink. That conclusion has been confirmed by a number of studies by economists that have found that large banking sectors are a drag on growth. The IMF ascertained that the optimal level for a financial system is that of Poland, although the agency conceded that they could be somewhat larger and not hurt growth…if they were well regulated.

Traders in particular are an impatient lot. Having bonuses they have historically perceived to be theirs tied up for years will not sit well with them. Some will try to decamp, although what we’ve observed with top traders is that they are often unable to replicate their success elsewhere. They are far more dependent on big capital markets firm information advantages and infrastructure than they imagine.

And the bonus holdbacks for top players may also lead ambitious young people to be even less interested in Wall Street than they are now, and to shift the profile of people who do seek a career in finance to ones who have a longer-term orientation.

You can write a comment letter! It doesn’t have to be long. You can tell the authorities that you think the big defect of this proposal is that it gives the financial firm too much discretion as to whether to implement forfeiture or downward adjustment of incentive-based compensation or clawbacks. They should be automatic in the event of regulatory fines above a not-very-low threshold and should include top executives and those in the chain of command to the business units charged with bad conduct. I would also write that the entire approach is inferior to the performance bond proposal made by William Dudley in his October 20, 2014 speech, Enhancing Financial Stability by Improving Culture in the Financial Services Industry, and you wonder why that isn’t the approach being taken, particularly since Mark Carney also supports this plan. The document on the proposed rule describes how to send comments by e-mail, snail mail, or fax, and encourages the use of e-mail. And if you have further ideas or criticisms, be sure to include them.

And those of you who do send letters: please also submit them to Neal Kashkari’s combatting Too Big to Fail initiative at the Minneapolis Fed. He has stated that the Minneapolis Fed is taking suggestions from members of the public, so this is an opportunity to weigh in. And if your Senator or Congressman is on any financial services committees, be sure to cc them as well.

Thanks for your efforts!

A couple of guys I know from LBS recently run a study (which appeared in HBR, and I think you linked to it), saying that CEOs should not get any bonus whatsoever (not sure whether they covered whole C-suite or not).

Personally, I’m ok with bonuses, as long as they are fixed amount, and relate to the company performance as whole. Individual bonuses don’t do much I believe (one can argue that it’s different in sales, but that tends to ignore the whole value of the franchise… so maybe sales where they want to pay some bonuses should be run as franchise – although not in financial industry, unless the franchisee would not be paid until all risk is off the book)

How about instead of all this trying to get wealthy criminals to play a little more fairly, we just institute a maximum wage. $250K/yr. ought to be adequate for anyone.

But excuse me if I don’t get too excited over the prospect of maybe reducing pay differentials from 400:1 to 200:1. The thought that any person’s time could be that much more valuable than another’s is simply insulting, and messing around on the edges like this isn’t doing much of value (except providing some PR cover pols and regulators), imho.

Why don’t we nationalize the primary dealers and run them as a public utility. If we’re lucky, all our top finance people will move to other countries.

Why is there no desire to follow how Canada runs their finical markets?

They didn’t have a banking crisis in 2008 or 1930!!

I’m sorry, Ed, but you are misinformed. Our PM and Finance Minister both said there was no bailout of banks during the crisis in Canada, only a “liquidity” problem. Well, that is not true. Our top banks had to receive funds from three sources–the Bank of Canada, the Canadian Mortgage and Housing Corporation and the US Federal Reserve Discount Window after the 2008 financial crisis. Our top TBTF Canadian banks were bailed out for a total of $114 Billion. You can see all the charts and tables showing what each Canadian bank received in funds here.

I wish that that information would be corrected because Canadian banks may have fared better than other banks, but we had big problems too.

(And it looks like we are building our own housing bubble in a couple of cities even now.)

In the ’30s we also suffered from drought and financial problems and that is why we now have welfare programs and employment insurance to help our society in times of need.