Yves here. Richter describes the consequences of turning homes into a financial asset, combined with policies that have neglected job and wage growth. If you look at his chart, you’ll see a rise in home ownership during the stagflationary 1970s. That was also financialization of residential real estate. Properties were an inflation hedge, while equities were flagging.

By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street

Something happened on the way when the concept of “home” transmogrified to a financialized “asset class” whose price the government, the Fed, and the industry conspire to inflate into the blue sky, no matter what the consequences. And here are the consequences.

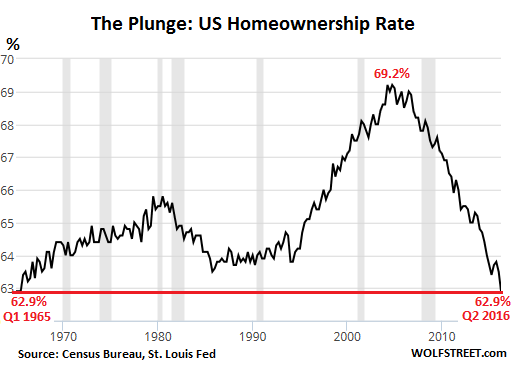

The Census Bureau, which has been tracking homeownership rates in its data series going back to 1965 on a non-seasonally adjusted basis, just reported that in the second quarter 2016, the homeownership rate dropped to 62.9%, the lowest point on record.

It matches the low point in Q1 and Q2 of 1965 when the data series began. At no time in between did it ever fall this low. And it was down half a percentage point from 63.4% a year ago.

The relentless slide has lasted for 12 years, from its peak of 69.2% in Q4 2004, which was when the Greenspan Fed’s low interest rates were boosting speculation in the housing sector, and prices were going haywire. At the time, the concept of “home” had already become an asset class that can never lose money, financialized and later shorted by Wall Street, subsidized by government agencies, and backstopped by the Fed.

And this is what happened to homeownership rates afterwards:

The 1.9 percentage point drop from Q3 2014 (65.3%) to Q2 2015 (63.4%) was the largest two-year drop in the history of the data series. It also coincided with steep increase in home prices.

On a seasonally adjusted basis, the homeownership rate dropped to 63.1% in Q2, the lowest in the non-seasonally-adjusted data series going back to 1985.

There are numerous reasons for this, some known and others still to be guessed at, including:

- Rising home prices in an economy of stagnant wages (for the lower 80%) have pushed entry-level homes out of reach for many people.

- Lower priced homes in many urban areas entail a huge and costly ($ and time) commute every day. And even then, these homes may be too much of stretch for big parts of the population in expensive urban areas.

- First time buyers are having trouble saving for a down payment since they spend their last available dime to meet soaring rents.

- Millennials have been blamed. They always get blamed for everything. They saw their parents deal with the American Dream as it turned into the American Nightmare, and they learned their lesson early in life.

- The super-low interest rate environment hasn’t made homes more affordable because home prices, in response to super-low interest rates, have soared, and in the end, mortgage payments are higher than they were before.

- Higher home prices entail other costs that are higher, including taxes, brokerage fees, and insurance.

The fact that Housing Bubble 2 in most urban areas is now even more magnificent than the prior housing bubble that blew up with such fanfare, even while real incomes have stagnated for all but the top earners, is a sign that the Fed has succeeded elegantly in pumping up nearly all asset prices to achieve its “wealth effect,” come heck or high water. In this ingenious manner, it has “healed” the housing market.

It’s two-year bout of flip-flopping about raising rates just puts some lipstick on these policies that include the purchase of agency mortgage-backed securities, which the Fed continues to buy to replace those that mature and roll off its balance sheet.

Just today, as part of its routine, it acquired $2.6 billion in agency mortgage-backed securities. On July 26, it acquired $2.0 billion. On July 25, $1.9 billion; on July 22, $1.3 billion, on July 21, $2.5 billion; on July 20, $1.9 billion…. and so on.

As MBS mature and are redeemed, the Fed takes this money and goes to its primary dealers (list) and buys more of them, which puts downward pressure on mortgage rates and prevents the free market from playing any kind of role, all in the religious believe that inflating home prices beyond all recognition is somehow good for the economy and Wall Street, despite the consequences, such as plunging homeownership rates, as America turns from a country of homeowners into a country of renters, often dwelling in a corporate-owned financialized asset class.

At the luxury end, something new is hitting the housing market: Manhattan and Miami are already getting mauled. Now it’s expanding to San Francisco, Silicon Valley, Los Angeles, San Diego, even Texas! Read… US Government Mucks up Money-Laundering in Real Estate, Puts Luxury Housing Bubbles at Risk

Here in Tucson, I like to count “for sale” signs while I am riding my bicycle. During a five-mile ride, it’s easy to find at least 10.

And here’s another data point: Many of these properties have been on the market for months.

Calling a sales and appreciation slowdown in Tucson, AZ.

This morning’s report: 16 “for sale” signs counted during a 6-mile bike ride near Downtown Tucson.

If I tell my Democratic friends that under Obama, home ownership just hit the lowest level ever recorded (yes words parsed for dramitic impact to drive a point), their reaction will probably be similar to their earlier indignant reactions to “Obama has been at war longer than any Predident in US history.” Looking forward to it – a disturbance in their everything is awesome meme.

Cognitive dissonance – the American way

I posted this, and a friend immediately blamed it on Bush. Unreal.

Don’t read MSM much, wonder if this will be reported. I recall it used to be followed by the media with some importance. But with some saying MSM is lining up for Clinton & against Trump, this may be one way of seeing it.

Well, your friend is partly correct. But Bush shares the blame with Bill Clinton, Phil Gramm, Alan Greenspan, Sandy Weill, Angelo Mozilo, Dick Fuld, Robert Rubin, Larry Summers, Ben Bernanke, Maurice Greenberg,Timmy Geithner, Barry Obama, and a bunch of other Republicans, Democrats, and plutocrats.

Yep. I tried to explain(Clinton, the characters you mentioned, deregulation, the works, etc etc) and said one must get out of the red v. blue mindset, but got nowhere. He is blaming the major de-reg on Reagan and Bush II, and saying how he is happy Sanders pushed HC to the left and that he is very(!) confident she will overturn Citizens United and nominate lefties to the SC. I give up.

Last night while people were commenting on the speech(both here and friends on faceborg), Bad Moon Rising popped into my head. Had the worst feeling in my gut that we’re in for a pretty bad ride.

Have you recommended that your friend read Listen Liberal, by Thomas Frank? This book explains just how destructive the Clinton and Obama regimes have been. Frank has excellent left wing bona fides, which can be verified in his books Pity the Billionaire: The Hard-Times Swindle and the Unlikely Comeback of the Right and The Wrecking Crew: How Conservatives Ruined Government, Enriched Themselves, and Beggared the Nation.

The only problem I see in “Listen Liberal” is that near the end of the book, in a chapter on Hillary Clinton, he doesn’t criticize her harshly enough. He should have kept the same standards for her as for Bill Clinton and Obama. Maybe when he was writing the book, Sanders seemed too unlikely to have winning chances, and Cruz, Trump, et al were too scary. Anyhow, chapters 1 though 10 are excellent.

Agreed. I just finished reading that book. Thought he was way too kind to Hillary.

Do you think really Trump would be any better at addressing these issues?

Talk is cheap, what practical actions would he take? Do you think a real estate billionaire is going to rein in practices that massively favor inflated real estate prices? Or corporatist Republican Mike Pence who will probably be running most the executive branch policy while Trump gives self-aggrandizing speeches?

We have to agree on what’s right and wrong, what works and what doesn’t for the facts on the ground. That doesn’t mean elect Trump, it means thinking things through. To blindly ignore real estate problems and elect Clinton in the sure knowledge that whatever she does is better than Trump isn’t going to help anyone. Clinton will need continual and factual pushing from the left. Occupy got people to change their framework, now everyone talks about the 99%. We need to do the same thing with monetary policy and asset class inflation if we want to get it to stop.

I’ve realized that most of it is motivated by fear. The idea that neither the Republicans nor Democrats, and therefore the entirety of the people in control of the political apparatus of the US, are not on their side is just too terrible to contemplate. It’s better to just pick a team and cheer for it despite and evidence to the contrary.

You CAN (fairly) easily afford an actual home (not a Tiny Home, which while cute, are really not THE answer). You just have to decide to live in or around bohunk cities and towns where the jobs aren’t.

Say goodbye to NYC, LA, San Fran, Denver, Chicago, etc, and say hello to Deevers, West Lafayette, Lima, etc. Little towns and cities of the midwest. OR live much farther from work than you may prefer. Get out in the sticks where houses are cheaper…and just make sure you have a cheap-to-operate/own economy car so you can afford to drive to work and back each day. Instead of being cashier at a big city Wal-mart, or waiter/waitress at some big restaurant, be a cashier at a smaller town Wal-mart, or a waiter/waitress at a truck stop. Same shit job but the money goes further.

Hh? Did you miss those places don’t have jobs? How do you pay for that cheaper house with no income?

Note that Indianapolis has a median house price of 122k. Louisville 120k Campaign Il, 150k. As to jobs a number of large companies have moved back office functions there, and if I were an exec I would move all the backoffice functions to the center of the country. In Louisville you also have UPS, Memphis Fed Ex etc. Let alone talk about Fort Wayne In at 95k. Jobs are there, but because housing prices are lower wages are somewhat lower. Of course a lot of folks have done this by moving to Tx where until recently there were a lot of jobs. (Not all of Tx is oil related). Also if doing a call center the center of the country is good on a time zone basis as it is about 1/2 way between the time on the east coast and the west coast.

Has this been indexed with median household wealth? I don’t imagine turning 8.3 percent of the public into renters or homeless people has had a beneficial effect.

My personal definition of a housing bubble is when the median household income in a given area is too low to qualify to buy a median-priced home in that same area. Once that happens, it means speculators have flooded the market… and that collapse is only a matter of time. After all, if someone earning a median income can’t purchase that house, it’s unlikely that one can generate a positive cash flow renting that house to someone making a median income. (Rents = house payment + repairs + profit. If the average person can’t afford the house payment, you’re going to run a negative cash flow). Any income is derived by the home appreciating in assessed value… again, speculation.

On a side note: my view on home ownership versus renting is that buying a home is like an inverse annuity: rather than purchasing a steady income stream, you’re locking in a predictable housing expense. So, home ownership is indeed a financial investment… it just isn’t one that should be viewed as generating income.

By that standard, there are places on the California coast that have been in a bubble for decades. Prices are approaching 8-10x median household income, and rental yields are sad. Some people leave, but others pay more than half their income in rent, double- or triple-up with roommates instead of getting their own place or move in with family, the poor squeeze into very high density. And it persists year after year.

Los Angeles median income is $54,000 and median home price is $582,000.

Historically, in any given housing market, the median home price has been 3x the median income. Alas, this metric has taken a holiday during the last decade.

Ditto for the price of a rental house. If you’re going to be the landlord, you should pay 100-120 times the monthly rent that you expect to collect. Sorry to say, this metric is also on leave. Has been for about a decade.

So what should ownership percentage be?

Great question. IMO the high point of 20th century america was somewhere from 1960-1970, with a definite end point being Nixon’s abrogation of the Bretton Woods monetary agreement. 63-64% may in fact be “normal.”

Also, no mention of student debt or increased insurance costs? Homebuyers of the 2010’s no longer have the disposable income of their parents or grandparents.

And note that the homeownership rate started its Great Leap Upward during the 1990s. When the husband of The Inevitable One was POTUS.

ISTR him signing a bill that tax-exempted $250k of capital gains on residential sales. Wondering if that correlates with the sudden ascent of homeownership.

$250 capital gains for each person on title. For married couple, the majority of homeowners, the capital gains exemption is $500,000.

And do not omit the wonderful benefits of 1035 tax free exchanges exchanges on the investor part of the real estate business.

$250k capital gains for each person on title. For married couple, the majority of homeowners, the capital gains exemption is $500,000.

And do not omit the wonderful benefits of 1035 tax free exchanges exchanges on the investor part of the real estate business.

The Cap Gain exemption probably helps at the margin, but the Great Leap upwards was due much more to declining interest rates (cheaper mortgages), and to a lesser extent a very large segment of the population reaching their peak earning years.

This is all part of the “Slow Bleed” which is the way I describe all our current conditions. The Investment banks broke the World’s economy in the early 2000’s ending with the crash in 2007. It is broken beyond repair. Just the derivatives exposure alone had become unrecoverable obligations. The “Slow Bleed” is our government and others believing that if they can just bleed the economy for long enough somehow the damage done up to the crash can be recovered and those who caused the crash won’t have to suffer. Re-inflating the bubble while syphoning fees and re-securitizing debt instruments with bubble assets seems a big part of the plan.

Mean Republicans made poor little Obama….

In Fargo, where I live, they are building vast prefab dormitories as fast as they can be put up.

I don’t get it. How many apartment blocks does one city in North Dakota need, and why right now?

But they seem to be occupied, but I can’t figure out by whom, where these tenants come from, what they do, how they pay the rent?

Another Great Mystery regarding Fargo real estate is Extended Stay Hotels? How many does one town need? And what keeps them afloat and building more?

I ask people questions about this and they look at me like I have brain damage or something.

N.b. Fargo is a long ways geographically from the Oil Patch.

Hey, sid_finster, I can relate. I ask similar questions here in Tucson. I get the same looks.

Because the market never lies!

Here in San Antonio, TX, on the farwest side (Seaworld country!) the thing is storage units. They just can’t clear land fast enough to build them. Truly astonishing. I don’t understand! Why?

Next to that, there’s an explosion of crap-tastic apartments. Apartment hell, as we like to say. They all have some cheery Post-Modern facade (the place I live is inexplicably called Laurel Canyon…I keep expecting to encounter Joni Mitchell or Jackson Brown in the parking lot, but no) but they might as well be soviet-era dormitories. Grim.

There is no such thing as a starter home anymore. There are foreclosures which require so much work that add way to much to the purchase price

And beware of the homes that were purchased out of foreclosure. If the seller is a flipper, look out.

You may find yourself ooh-ing and ahh-ing at those new kitchen cabinets and bathroom fixtures. And how ’bout that new coat of paint and that nice gravel yard with a cactus or two. Looks spiffy!

However, the flippers probably haven’t done any upgrades to the plumbing, electrical, and mechanical systems. Not to mention the roof or the foundation.

But by then you are no longer flipping, you are rehabilitating. Foundations, electrical, plumbing and structure require permits and certifications and those cost money.

My quick check: Look at the plumbing under that new kitchen sink.

Is it sweated copper?= Quality work

Glued together black plastic? Cheaper and less flexible

Screwed together white plastic? Cheapest bottom of the barrel quality. Indicates what’s hidden that you can’t see.

Second thing to look at is the electrical panel. Upgrade to higher amps? Take the cover off, if you are not chicken, and look at the quality of the wiring.

Here in central KY, Toyota-land, we have probably the lowest unemployment and the best wages in the state. Out in the county, where the building codes aren’t really enforced, the starter homes have devolved from single-wide trailers (which no one can afford any more) to Amish-built storage sheds. The Amish are cleaning up.

“The super-low interest rate environment hasn’t made homes more affordable because home prices, in response to super-low interest rates, have soared, and in the end, mortgage payments are higher than they were before.

Higher home prices entail other costs that are higher, including taxes, brokerage fees, and insurance.”

====================

One thing that has to be remembered is that low interest rates for banks (FED discount rate) does not automatically translate into low interest rates for borrowers.

I’m selling my house but one potential buyer couldn’t get his loan approved because of a glitch in the paperwork – if prudent leading standards are being applied, I’m all for it – I don’t know if the problem was substantive or this bank being cautious after the horse has left the barn. Excuse me however, if I have doubts about bankers, given their history, to competently evaluate most loan applicants.

With regard to the second point, how long does it take the people running the country to figure out that raising the prices of everything, while reducing wages means that eventually nobody can afford any of this sh*t???? FOREVER, because 1% of the population does very, very well under such a scheme….

I think it’s more along the lines of the majority of people can’t afford it–if nobody truly could there would be a correction–but there are just (i.e.barely) enough people who can.

Another component is that there is a widespread fear–however irrational it may be–that somebody somewhere is getting something for nothing. I think this fear is a major reason–if not THE reason– getting universal healthcare in this country has been so difficult.

This fear permeates into land-use policy as well–how many times have affordable housing proposals been challenged–if not killed outright–on the grounds it helps the undeserving? When you have just enough people to prop up the real-estate market, coupled with the hysteria over somebody somewhere getting something for nothing, it should come as no surprise that the people running the country either don’t know or don’t care about the fact that the cost of living is outpacing wages for a significant number of people in this country (United States).

Why own? We’re all becoming migrant workers in the corporate-owned knowledge economy.

A point that was made at least once a day on The Housing Bubble Blog.

And, speaking of which, it’s nice to see some familiar faces from the HBB. IMHO, this forum is much more civil. Thanks, Yves and Lambert, for keeping things positive.

I think it comes down to class–if not societal–expectations: i.e. in order to be seen as having “made it” you have to own. There is a subset of people–it may not be many but they do exist–that view renters as of poor character, at least until proven otherwise.

I don’t think renting is anything to be ashamed of and it isn’t necessarily a fair litmus test of character–there are renters who take care their place, and homeowners who trash theirs.

I think you also raise a valid point in questioning the value of owning in an area where job security has largely become a thing of the past–losing your job before your mortgage has been paid off is not an unreasonable possibility these days.

It’s just my wife and I, no kids. Out here in the scrub-sprawl, there’s nothing affordable. It’s all 4+ bedroom monstrosities. Why own indeed.

Here in Denver, Colorado there has been a lot of hype about how the home prices are rising and the city (and perhaps the state at large) has been one of the best areas for economic growth in the United States.

There is, however, a dark side that those towing the official line omit, if not outright deny exists: home prices, and to some degree rental prices, are rising faster than wages. Furthermore, a significant portion–if not the majority–of the new supply coming online is in the luxury, or otherwise, high-end market.

Up until just a few years ago most of the area more or less had the best of both worlds: i.e. good job opportunities and reasonably priced housing. However, things have changed in the last few years and something is going to have to give: either the gap between wages and housing/rental prices is going to have to narrow, or the Denver area will be hollowed out the way the Bay Area and New York City have been.

What job/economic sector pays big bucks in Denver? I thought it was a pretty middle class town.

Depending on how you define “middle-class”, it may still be a middle-class town.

While jobs that pay big bugs definitely exists, I highly doubt that there enough of them to support the current market. In other words, there aren’t enough people who are both looking for place to live and also make enough to afford the current market, to sustain the current housing market alone.

So the pertinent question is: who else is buying all these properties? I don’t entirely know the answer to that question–I know for a fact that some of it is individual and institutional investors are snapping them up to rent out.

It’s hearsay but I’ve heard that the marijuana industry may play a role–since getting access to the banking system remains problematic, owners of dispensaries are buying up property as a way to park cash. I’ve also heard, though I can’t say if it’s accurate, that foreign money–for legitimate means or money laundering, is playing a role too like it is in other cities.

Though it’s indicative of how hard people have been hit, I’d also like to know if people (especially my age or younger) are changing their minds about owning a house. I know I am. Seems like a bad investment, and I hope policy etc will change with it (if it is, indeed a change of ideals… as car ownership might be). [1]

[1] Suppose a breakdown by income vs rates of ownership for every age group would be interesting .

It’s hard to separate necessity from ideals sometimes. It seems like there are still a substantial number of the people on the younger side of things would own if they could;however, the math simply doesn’t work for out.

While the financial industry and realtors are hyping the fact that interest rates are at record lows, the fact of the matter is that probably makes a difference at the margins. There are many people who still couldn’t afford to buy if they could get a interest-free mortgage–not that anyone would offer an interest free mortgages for obvious reasons: i.e. the lender loses money on it.

There’s been some good pieces written here on Naked Capitalism and elsewhere about some potential structural problems looming down the road. As much as speculators have inflated and distorted the housing market, something is going to eventually have to give–the many people who have their homes as their biggest asset are on a collision course with the younger generation potentially having a lower homeownership rate than their parents.

Reg blaming millennials for the sorry state of affairs :

Seems to me like it is the turn of the millennials in the “villain rotation game”.

My friend who is a boomer used to say the boomers were demonised as entitled/rotten spoilt. Buddy says this was to make it easier to turn the public against them and makes it easier to cut SS/Medicare !!! I remember hearing such rhetoric on NPR once but I didn’t connect the dots. Another guy kinda confirmed this by his behavior : when I mentioned “cat food commission” (from – 2009-10..), he got pissed off and accused me of blaming his generation and for being a hateful person.

During the decade before 1965, the “Golden Era” of economic growth in the U.S, the annual compounded rate of increase in our means-of-payment money supply was about 2 percent. Thus for the period 1955-1964, the rate of inflation (based on the Consumer Price Index) increased at an annual rate of 1.4 percent. Unemployment averaged 5.4 percent.

This was a period where savings were activated and “put to work” (before the 5 successive rate hikes in Reg. Q ceilings for just the CBs – which in turn was responsible for stagflation – when dis-intermediation for the non-banks began in earnest).

I.e., all hell broke loose after 1965 (for various reasons). Greenspan attributed it to dis-savings (larger federal budget deficits). Actually he was right. Because commercial bank-held savings are lost to investment (and to consumption). There are now 9.5 trillion dollars of savings impounded within the confines of the commercial banking system (un-spent and un-used). You say how so? Because from the context of the system, CBs do not loan out existing deposits, saved or otherwise. Every time a CB makes a loan to or buys securities from the non-bank public it creates new money (somewhere in the system).

But don’t ask Congress, the ABA, or a commercial banker. There is nothing in their world to dispel the illusion that CBs loan out the public’s savings (in the borrow-short to lend-long, savings/investment paradigm). That individual bankers should regard their separate institutions a financial intermediaries (conduits between savers and borrowers), in the savings-investment process is understandable. No bank can make loans if it does not have a net inflow of funds. These deposits give the bank excess clearing balances, i.e., loanable funds. But the only way a banker gets loanable funds is when the Federal Reserve credits their interbank demand deposit account at their District Reserve bank.

I.e., this is the biggest theoretical error in human history. And it is directly responsible for the decline in incomes for the lower quintiles (since 1981). Everything was predicted. The S&L crisis of the early 1990 was due to the DIDMCA of March 31st 1980 (as predicted in May 1980). The DIDMCA turned 38,000 non-banks into 38,000 CBs by permitting ATS and NOW accounts. There is absolutely no way for our standard of living to get better without getting the commercial banks out of the savings business. And because en masse, this is unthinkable, our economy will inevitably flat-line.

– Michel de Nostradame

Economic prognostications within 1 year are infallible. But not for the 300 Ph.Ds. on the Fed’s technical staff. Bankrupt u Bernanke caused the world-wide GR all by himself (incredulous?). As Greenspan did “Black Monday” (“Greenspan’s put” is all wrong).

David Stockman’s only going to be right by default. Peak debt’s not real. It’s about peak income. The 1st qtr. of 2017 will be bad once more (deferred x-mas payments). While CPI inflation is above target now, inflation free-falls once again after November.

There is no economic and job stability. It’s little wonder that Capex, i.e., housing’s negatively impacted.