By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street

Most auto industry gurus were once again too optimistic with their dreary forecasts for new vehicle sales in the US. Kelley Blue Book had figured they’d drop 3.1% in April year-over-year to 1.45 million units. Forecasts in terms of the seasonally-adjusted annual rate of sales – a key industry metric – ranged from 16.9 million SAAR at Baum & Associates and at Goldman Sachs to 17.5 million SAAR at LMC Automotive. The analyst average forecast was 17.1 million SAAR, down 0.35% year-over-year.

But customers were under sticker shock, and were hobbled by other issues, and what the auto industry produced was this:

- Total sales in April fell 4.7% year-over-year to 1.426 million vehicles, according to Autodata; cars sales plunged 11.1% and even truck sales edged down 0.1%.

- Year-to-date sales, at 5.49 million vehicles, are now down 2.4%. At this rate, this will pan out to be the dreaded “car recession.”

- Sales in terms of SAAR fell 3% year-over-year to 16.88 million. The pessimists among the forecasters were almost there.

So April had one fewer selling day than April 2016, but this didn’t come as a surprise to forecasters. And SAAR accounts for it.

Note: These are unit sales (deliveries) by franchised dealers to their customers, and by manufacturers to large fleets and to their own employees under their employee programs.

A 4.7% drop in sales, bad as it is, wouldn’t qualify for #carmageddon. These things happen. But here’s the thing: Automakers had shelled out $3,465 in incentives per new vehicle sold, on average, according to TrueCar estimates. A record for the month of April. It beat the prior record of $3,393, set in April 2009. It amounts to about 10% of suggested retail price, similar to March. The last period when incentive spending was at this level of MSRP was in 2009 as the industry and sales were collapsing.

The #carrmageddon point to watch: despite the 13.4% year-over-year surge in incentive spending to nearly $5 billion, total vehicle sales fell 4.7%! When these massive incentives fail to even slow the sales decline, serious problems lurk beneath the surface.

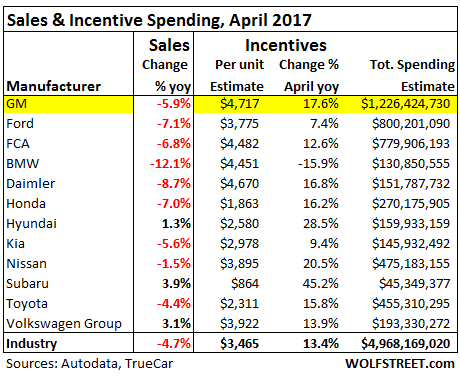

This table shows the largest automakers, their year-over-year sales performance – the sea of red ink – along with average per-unit incentive spending and total incentive spending:

GM shelled out the most incentives on average per vehicle, in total $1.23 billion. In March, it had spent about $1.3 billion. At this rate, GM is spending just under $4 billion per quarter in incentives. By comparison, in its Q1 earnings, GM reported “North America” revenue of $29.3 billion. At this rate, it is spending about 13% of its North American revenues on US incentives.

But it’s just not working out. Total sales dropped nearly 5.9%, to 244,200 units, with car sales plunging 12.5% and even truck sales falling 3.2%. A gruesome detail: Silverado-C/K pickup sales plunged 20% to 40,154 units. Total retail sales (not including fleet sales) fell 4% to 191,911 vehicles. GM ended the month with 100 days’ supply, up from the nail-biter level of 98 days at the end of March.

GM Chief Economist Mustafa Mohatarem tried to put a positive spin on the situation:

“When you look at the broader economy, including a strong job market, rising wages, low inflation and low interest rates, and couple them to low fuel prices and strong consumer confidence, you have everything you need for auto sales to weather headwinds and remain at or near historic highs.”

Ford sales dropped 7.1% to 214,695 vehicles in April year-over-year, with car sales plunging 21.2% and even truck sales falling 1.7%. While SUV sales inched up 1%, pickup sales dropped 4%. To accomplish this, Ford blew $800 million on incentives.

And bloated inventories are hounding the automakers. According to WardsAuto.com, there were over 4 million new vehicles sitting on dealer lots and increasingly on rented parking lots at zombie retail malls. April was the fourth month in a row with dealer inventories above 4 million. The last time this happened was in 2004!

The situation of ballooning inventories, massive incentives, and falling sales is confronting automakers with tough decisions – and there are no good options: pile on even more incentives, only to see sales decline further and gut profits, which is what happened leading up to the collapse of the industry during the Great Recession; and/or cut production and deal with the fallout; or cut incentives, fasten the seatbelts, and hang on.

Consumers are now getting accustomed to these incentives, some of them reaching $8,000 or more per vehicle. Without them, consumers would just say no. Incentives are addictive. You cannot just withhold that drug. It would crush sales. That’s why it is so difficult for automakers to get off incentives once they got on them in a big way.

A number of automakers didn’t make the above list because their market share is too small, including Volvo, Mazda, Porsche, Jaguar, Ferrari, Maserati, and Tesla.

Tesla sold 3,850 car in April, according to Autodata, 44% fewer than Porsche, giving it a market share of about a quarter of a percent (0.27%), compared to GM’s 244,200 units and market share of 17.2%. Yet today, Tesla shares give it a market cap of $52 billion, compared to GM’s $50 billion. That’s how crazed this stock market has gotten.

So it’s tempting to short Tesla even as the bloodletting among Tesla shorts has become legendary. Read…. 4 Short Sellers Explain Why They Target Tesla – But Don’t Try to Do this at Home

Thank you, Yves.

This paragraph intrigued me: “Consumers are now getting accustomed to these incentives, some of them reaching $8,000 or more per vehicle. Without them, consumers would just say no. Incentives are addictive. You cannot just withhold that drug. It would crush sales. That’s why it is so difficult for automakers to get off incentives once they got on them in a big way.”

I would be interested to hear from UK based readers if they have come across similar stats and commentary for the UK. From what I hear and see in Buckinghamshire and London, it may well be similar in the UK, probably is.

There has been an up tick in the number of high(er) end vehicles, often European and sometimes American, sold in the UK this decade. One sees such vehicles in places that a decade ago would have had mid-range cars, often Japanese. Many people are moving out of expensive London for relatively less expensive Buckinghamshire, which may explain the car equivalent of gentrification, but that should not explain all of it, which is where incentives may play a big part. One, perhaps unwelcome, development associated with this, but also with multi-generational households as house prices bubble away, are front gardens being ripped up for car parking space and what were once leafy suburbs, quiet enough for horse riding a generation ago in the case of my home town, no longer being so leafy.

Former colleagues who have worked at VW’s bank, based in Buckinghamshire, and Renault’s bank, in the UK and Turkey, have talked about these addictive incentives – and also issues at the car hire fleets affiliated to these manufacturers. Friends and colleagues talk about leasing, rather than buying, and changing cars every couple of years. For readers outside the UK, car registration numbers change annually, so having a new(ish) car is a status symbol for some. Adverts for cars no longer quote a price, but the leasing package.

Many, if not most, car loans in Europe are securitised. Under EU bank capital and investment fund rules, originators must retain 5% of the credit risk, “skin in the game”, so they share the pain with the investors if the underlying loans sour. EU funds can’t invest in securitisations unless the originator has retained a share of the exposures.

Thank Wolf Richter. And am also interested in what normal practice is in the UK.

Many thanks, Yves. Yes, of course, credit to Wolf Richter.

https://www.theguardian.com/business/2017/apr/02/car-loan-boom-not-housing-bubble-still-could-be-crash-us-economy is about the only time I have seen the UK MSM cover.

Oddly enough, mum told me recently about the partner of one of her colleagues. He’s a long distance lorry / truck driver and having treatment for cancer, so his income is at risk, but has just borrowed to buy a Jaguar after his sort of step son in law bought BMW. Mum asked me, as I work in banking, but not retail, how was it possible to get a loan under such circumstances.

Six months ago when last in England I was listening to Radio 4 in my hire car and there was someone from the Bank of England saying that they were particularly worried about the pro-cyclical nature of car finance. They were speculating that with all these lease deals it was too easy for people to hand back cars in a downturn, exacerbating bank issues. I’m not really sure if this was part of a ‘warning’ or just off the cuff comments.

Here in Ireland there is a similar situation, but not so bad. Last year I was talking to an acquaintance who moved to Ireland from Nottingham with her mother 15 years ago, more or less on a whim by her mother. I knew her mother to be a bit of a flake – she barely works, and more or less survives by sponging off her two adult daughters and whatever she can extract from the Irish social welfare system. The girl mentioned ‘mum’s new Audi’. I did a double take. ‘How on earth can she afford an Audi?’ She said she just went back to England and got a lease deal, easy.

The effect on the market is quite obvious when viewed from Ireland. There is a huge industry here in people buying very nice second hand cars in the UK and reregistering them in Ireland, because there is a surplus of nice upmarket 2 year old cars there, so they can be bought at least 20% cheaper than in Ireland, even allowing for 1000 euro upwards tax.

But the lease/car loan/PCP system is now in Ireland. I’ve noticed the last few years a number of people I know who I know don’t earn much driving very nice up specced cars. I was curious – I don’t own a car but I was thinking about getting one to replace my little VW camper van that I use for holidays* There is an obvious push now for finance deals, although its not as overt as on UK websites. I think they are more tightly constrained here by Central Bank rules, although I couldn’t say for certain. What I could say is that some of the PCP conditions are very confusing and I would well see people not realising that they have to have the car in very good condition at the end of 3 years or they could lose a lot of money. The finance deals seem straightforward, although I suspect that the hidden cost is higher as in reality if you are buying cash you could get a bigger discount.

*I’m selling it today, I’ll miss that lovely lump of metal

>with all these lease deals it was too easy for people to hand back cars in a downturn, exacerbating bank issues.

Not a problem* in the US, you need a car to have a job, and if you don’t have a job you need a car even more to get to interviews.

*for the bankers is what I mean of course

I’ve been meaning to add this as a comment for a while, just not had the venue to fit it in until now.

My mother-in-law is looking for a new car. I get roped into going around the dealerships with her as haggling isn’t one of her strong suits. Unfortunately they see “woman on her own, widowed, money in her purse, not knowing how the market works” and circle like sharks. C’est la vie.

The aforementioned lady has bought Hondas since the year dot. So there is an element of brand loyalty there — and not without reason. They are well made vehicles, reliable and there are several models which suit her needs. There’s been a certain element of caprification, but not at VW or Mercedes Benz like levels. The choice was narrowed down (eventually…) to a loaded Jazz (“Fit” in the US market) or base spec Civic. Sticker prices are between £18,000 and £22,000.

When last my mother in law changed her car, there were similar prices. I negotiated and got a significant bump-up in trade-in for her old vehicle, if I recall correctly, it had a book value of £6,000 and the trade-in was £8,000 which equated to a £2,000 rebate. Then there was a further £1,500 straight rebate of her purchase of a £17,000 car, so the total incentive was £3,500. Or around 15%, which was a fair deal.

When I repeated the same process during the last few weeks, I got absolutely nowhere trying to get incentives for a cash deal. Nowhere. A few hundred pounds in rebate plus some other bits and pieces chucked in. What I did get pushed hard was dealer financing. If you were willing to take finance, you could almost name your price. What was difficult to ascertain was what the true cost of the credit was and what was being concealed in the convoluted contract hire arrangement which the dealer finance product was based around. Another potential problem was as my mother-in-law is almost 70, while it’s unlawful to discriminate on the grounds of age and not offer finance, I suspect that the interest rate would be higher for someone in her age group. Plus, as is often the case with older people, my mother-in-law is dead-set against borrowing money. No way Jose. The dealership said they’d arrange to take out the finance then cancel it after a few months — and pay any cancellation fees — but that isn’t acceptable to my mother-in-law.

We’re currently playing a game of chicken with the dealership. If they offer an incentive structure the same as was previously offered on her last vehicle, we’d do a deal. The dealership will only put significant money on the table if they get a sign up for finance. Which we won’t do.

What I conclude from all of this is, either there is absolutely no money to be made in retailing and the only margin to be made is on the finance or the dealerships are under strict orders from the manufacturer to not shift any metal without finance else face being de-franchised. Or maybe a combination of both.

I can understand now why a reported 90% of vehicle sales are on finance in the UK. It is virtually impossible to do a cash deal except at punitive (i.e. no incentives) prices. This is completely unsustainable — if interest rates rise, these rolling finance products become prohibitively expensive. Of course, everyone now needs (as in, has adjusted their business models to rely on) ZIRP to continue indefinitely…

A solution to your dilemma is to finance the car through the dealer. Once you take possession then immediately pay the loan off. It’s a little bit bothersome but if it saves you a lot of money then do it.

Yes, I did consider that — it’s a pragmatic enough idea. Unfortunately (or fortunately) you’ve never met my mother-in-law, who is a little risk-averse and worries about what could go wrong. If it went awry, I’d never hear the end of it. And in fairness, it’s alright the dealership saying it would take care of any early cancellation fees, but if there were any other junk fees or hidden gotcha’s, she’d be on the hook for them and have to try to get them refunded.

I don’t like working scams either and while not an out-and-out scam, taking finance then trying to wriggle out of it isn’t ideal.

“And in fairness, it’s alright the dealership saying it would take care of any early cancellation fees” – It’s possible they may have some discretion here, but it also sounds like the kind of thing a sales-person would flat out lie or mislead about. If you go for that, get something in writing.

Thank you, Clive.

Are you old enough to remember the Ford Capri?

BTW, your point applies to double glazing, too. I was compliance support to the Blue Eagle team that managed the debt for equity swap in Anglian Windows and was staggered by the double glazer’s MO.

Just about — we had a Ford Granada though, Mum thought the Capri was “common”. Dad steadfastly climed his way up the corporate greasy pole all the way from “2 litre GL” spec to “2.8 litre Ghia X” spec. Those things rally mattered back then! Which is where I probably get it from…

On that subject, you should check out this 1993 documentary on UK sales reps and their company cars, with their utter obsession with badges and trim levels as gradations of status.

https://www.youtube.com/watch?v=CQsMFQZa8os

Oh wow. I’m in nostalgia heaven! Simpler, happier days…

+ 1

I only first discovered that documentary series about four or five years ago. That episode on the sales reps and their company cars boggled my mind. I had no idea that there were people who were so obsessed with class signifiers like that in reality – I thought the sort of thing I had seen on British comedy shows was an immense exaggeration until I got to the part of the episode about the guy who got downgraded to a diesel Metro.

I had a 1974 Capri 2.8 as my first car – in 1987.

Thank you, Clive.

Do you remember The Professionals and their metallic grey Capri?

Yes, that’s what us kids really wanted Dad to get. Mum held sway, unfortunately, lured by the more practical enticement of automatic transmission and cruise control. Plus a cassette player with four speakers, on which my sister and I extracted our revenge by playing our Smash Hits tapes.

Thank you, Clive.

Oh, yes, Smash Hits, soon followed by Now That’s What I Call Music.

Sounds like the story of one of my American friends, Clive.

She comes from a family of five children, and they’re all quite frugal. And handy. Give any one of them an old car, and they’ll get that thing running again. They learned this valuable skill from their parents.

Here’s one of her favorite family car stories:

A few years ago, one of her brothers walked into a Tucson dealership. He was 18 years old and ready to buy a fully loaded car. The salespeople all but shooed him out of the place.

On the way out the door, he said, “I was GOING to pay cash.”

Yes, he had the money. Worked for it and saved it all up.

What I conclude from all of this is, either there is absolutely no money to be made in retailing and the only margin to be made is on the finance or the dealerships are under strict orders from the manufacturer to not shift any metal without finance else face being de-franchised. Or maybe a combination of both.

I was more up on this stuff a long time ago but there is a financial reporting advantage to the car companies to have deals structured through their finance arm rather than discounted all cash deals, even when the ultimate selling price is exactly the same, and there are various payments and rewards for the dealers to keep the manufacturers happy in this way. IIRC, when you purchase making use of “incentives” and buy the car with company financing, the manufacturer can front-report (like front loading) the sale at “full price” with the cost of incentives netting out somewhere else later. Also had something to do with financial reporting for core manufacturing operations vs. for finance arms. At the union, we were pretty sure it was a way to make the manufacturing operations look less profitable and the finance operation, which the grunts in the plant of course had nothing to do with, more profitable.

Well, look at the bright side: Now is an excellent time to go ahead and get a new automobile.

I suspect the best time will be just after a significant downturn (whenever that may be). There seems a huge amount of excess capacity and if lots of people are handing back the keys, dealers will be desperate to get rid of nice cars.

I think this summer will be an excellent time to buy a car, downturn or not.

I’m seeing this play out locally, without a doubt. A dealership near me is packed to the gills with not only commuter cars but pickup trucks. A few of the used car lots have had the same cars sitting on the lot for months now.

That sounds like my theory as we saw the Great Recession approaching. When it did come, I remember a fellow who specialized in repossessing BMWs (which he stored near my friend’s hangar).

When I started looking for the “deals” I found the buyers couldn’t sell them, they owed far more than they were worth.

It seems they went back to the financial manipulators who then seemed to sell them at auctions to dealers. Whatever happened to the supposed equity in the cars, the used car dealers didn’t offer them at low enough prices for my taste, either.

For what it’s worth, my solution was to wait until gas prices dropped enough (Feb 2016) to bring down the cost of used Hybrids, allowing me to buy a used 2001 Prius for $600. I had located an excellent mechanic who specialized in acquiring them, refurbishing them, and selling them at competitive prices. I trust his work, and he went over mine after I bought it, saying he would expect $3,500 for one like it. If anything it seems the used prices are dropping even further on used Hybrids, I think because few dealers are yet willing to take the chances on refurbishing hybrid cars due to low volume, potentially more expensive repairs, and less profit potential. That does leave room for enterprising smaller shops to specialize in them, using salvageable expensive parts from a sufficient number of used or damaged ones (my friend had 8 in his shop).

Thanks for mentioning hybrids, Jim Young. A friend at work just got a howling good deal on a used Prius.

Mine seems very well built, and I really appreciated the front brake pads lasting 276,000 miles due to the regenerative braking saving the brake pad wear on typical cars. There is a trade off in battery size and weight that should be considered (a little extra tire wear, and higher load tires required) but the electric assist seems to out perform my old 327 Camero from 0-30 (making it much peppier in typical city traffic), though the 327 V8 Camero was closer on 0-60 times that most literature focuses on (it would still take the Camero a little time to catch up to the Prius, once the Camero engine started to catch up). I do admit I could modify the 327 and Camero drive train to match or beat the 0-30 time of the Prius, but that would be less civilized, and no where near the gas mileage of the Prius. Encouraged by reports of the New York City Prius Cabs that have had their Traction Batteries last the 350,000 mile limits any cab can be used as taxi in NYC, I’m seeing if mine will last that far. I already have 286,617 miles on mine (though mine has had the 1st generation modules replaced with second generation modules, I think around 200,000 miles ago, by the previous owner).

‘Now is an excellent time to go ahead and get a new automobile.’

Actually there’s never an excellent time to get a new automobile.

The price reduction on a 2 to 3-year old, low mileage used vehicle more than compensates for the 10 or 15 percent of its useful life already expended.

Having too much tied up in depreciating assets is a formula for penury, unless you’ve got money to burn. In which case, you should buy a new boat too. ;-)

Agreed. They do smell nice, though.

I wonder why VY with their emission problems has an increase in sales? Hyundai and Subaru also had an increase in sales. Looking at the incentive column it seems to be explained. All had big increases in incentives. From the chart at least for these three incentives seem to work. But if you look other brands had big incentives but sales dropped. Even well rated brands. It make me wonder what factor or factors came into play? I’m suspect that incentives weren’t the biggest factor since the three with sales increases had the smallest % as an incentive.

The VW emissions problem is corporate malfeasance, for which they paid a hefty fine. Unfortunately, the punishment has also been passed down to the buyers who wanted the fuel economy of their diesel offerings and now are forced to give up the vehicles which they no-doubt thought a lot about and desired in the first place. VW has always made a dependable, fuel efficient, and reasonably priced car and buyers know that their issue is only diesel related. Too bad the damage is done to diesel acceptance in the US. There are a few limited options, one of which is the 2.8 4cyl Thai diesel offered in the mid sized GM pickups, 30+ mpg highway is not too shabby.

Regarding the content of the article, I can’t believe the cavalier attitude of manufacturers producing and buyers opting for more and more crap piled onto base model vehicles which are unaffordable to begin with. There were 2 base models of a simple GMC Canyon/Chevrolet Colorado, both 150 miles from Boston when we bought. If they were affordable to begin with, people wouldn’t need to amortize the cost over 6+ years of financing.

Hyundai/Kia are high-featured for their price, so a niche.

Subura offer moderate sized AWD cars for those not wanting a hatchback car, not an SUV.

I bought a 2016 VW Sportwagen which includes Apple Carplay as standard, which Fords don’t even offer, and amongst the other brands appears as a premium feature bundled with over-skinny tires and other nonsense. I can attest that my VW handles really well, the small turbo engine (standard) gives 35MPG on a typical run, and as a medium sized hatchback is a very practical hauler.

>. . . It make me wonder what factor or factors came into play?

Have you followed a new Honda Civic? It reminds me of a baboon’s ass.

New cars are so ugly, the people are repulsed.

With regards to all that new car inventory sitting on dealership lots and increasingly on rented remote lots across the country;

There is a phenomenon called ‘lot-rot’ being the damage that accumulates to vehicles over time, the inevitable result of natural forces, like rust and accidental damage due to impact.

The brake rotors rust over time, often requiring replacement of pads and rotors (rotors surfaces are bare metal and corrosion can only be prevented by regular use.) If the cars are not driven, the rotors rust deeply, and when finally driven, the rust that has accumulated on the rotors is so severe that it not only necessitates rotor replacement, but often imbeds itself in the brake pads requiring them to replaced also.

People don’t like to buy cars with severe brake squeal.

Think $600-$1500/per for brake jobs on brand new cars, before you can sell them.

The constant moving of inventory leads to the inevitable bumps and scratches that require repair, think $100-$300/per, for scratched fascias, doors, and fenders.

All those cars sitting for months on end are inviting homes for rodents which routinely infest interiors, nesting and gnawing on fabric and plastic interior parts, and electrical wiring, requiring replacement.

I’ve seen estimates of over $10,000 on rodent-infested cars, which may end up to be a total loss depending on the vehicles MSRP. (complete replacement of interiors and main wire-harness)

Did I mention batteries?

When the inventory vehicle, which has been sitting for many months, on a remote lot, miles from the dealership, is finally required for a test-drive, it’s inevitably found with a dead battery.

Think $100-$200 between parts and labor/per, not to mention lost time in the sales process.

Lot-rot is a minimal problem during ‘normal’ market conditions, but the present situation with dealers holding very large new car inventories, it’s become a horror story.

Who pays?

The dealership, in holding excess inventory, may be betting on future sales, or be doing the manufacturer a favor, the cost of lot-rot is a source of argument, and tension.

I made what I considered a joke, in front of one of our manufacturer’s reps a while back, that they should ship every vehicle with an extra battery and a set of brake pads and rotors.

He didn’t think it was very funny.

I found myself in one of those lots. It’s a long story.

It was a former country club that had been fenced off. There were signs on the fence- “Warning- do not enter” followed by a long bunch of BS that implied some sort of “environmental” problems, which could make your sex organs fall off. Maybe. The fence was only meant to look like it was secure. It skipped areas with overgrowth.

The parking lot of the former CC was PACKED with brand new, or very slightly used luxury cars. They still had the customs window stickers. I couldn’t find a common source, they were from all over the place, but all very high end luxury models.

The lot was just far enough from the road that you couldn’t really see what was going on there. It was so sketchy. Environmental disaster security. Probably a trend of the future. I bet they get a tax break on the property too.

Wonder if this is a result of the relative disinterest in vehicle ownership among millennials starting to hit the bottom line of the manufacturers. Would also explain why the lux brands took the biggest hit in the yoy sales for April (BMW, Daimler), but the ones that make better econo boxes (Subaru, VW, Hyundai) saw gains. Millennials that are buying are going for more utility (literal utility, not SUV “utility”) than flash.

They sure aren’t going for driver’s licenses the way kids used to. Source:

http://www.npr.org/2016/02/11/466178523/like-millennials-more-older-americans-steering-away-from-driving

+1

Millennial here and I ditched my jeep for a bicycle.

It’s cheap to run (no gas), cheap to fix, and in NYC it’s faster than driving places, easier to park too.

Thank you, all.

Has there ever been a product more sensitive to the state of the economy than cars? They’re an extremely expensive purchase that is frequently the general public’s first encounter with capital-D debt. According to any reasonable measure they make no financial sense to own if it weren’t for the necessity of using them to get to work.

And, of course, there’s the used-car market, which dwarfs the new-car market in both sales and volume to the point where I’m sure automakers find it depressing.

Even as we comment the auto maker’s lobbyists are going to Trump Towers and asking for a revival of the “Cash for Clunkers” bailout/boondoggle.

And, this time, watch people hang onto their clunkers.

I had the misfortune of finding myself in the used-car market shorty after Cash for Clunkers (thanks to somebody hitting and totaling my ride at the time).

No lie, the program did indeed hoover up the good used car inventory for years afterwards. I have always paid cash for a used car and have never bought new, but this time I really thought that I was going to have to resort to buying new. The only things left were at the extreme high and low ends of the market, and I didn’t want to buy a thousand dollar car.

youtube.com/watch?v=kzim1iYhmGA

This was also when I first experienced the new reality mentioned in previous comments that paying cash no longer got you a better deal, but instead just made you a hassle for the salesmen.

Luckily, a low-milage deal surfaced on Craigslist and was able today avoid the joys of new car debtorship.

It was sickening. Economists that didn’t protest this, which is just about each and every one of them, should hang their heads in shame.

I hope the cars they drive eat their wallets.

This may, or may not mean anything. And even if it does, its just one anecdote. But the dealer has been calling my cell phone several times a day and sending me mailers telling me they want to by my older Ford Focus. And they are starting to get annoying. Some times its a person doing the calling. I am starting to just hang up on them. It’s not as if I didn’t already tell them NO yesterday.

Any one else notice this?

I’ve been on the receiving end of this marketing from Ford a few times over the past 10 years. I would occasionally get a mailer indicating that there was a high demand for my used ’99 Taurus and they would give me a great deal on a trade-in. I responded to one of these out of curiosity, and they offered me $200-300 of credit for a trade in. I put another 80k miles on the car after that, and just recently donated it to charity with 230k miles on it (it had 30k when I bought it in 2001). These are just a ruse to get you onto the lot.

Car dealers don’t sell cars. It’s a common misconception.

Car dealers sell car loans, secured by a car. The car is just a vehicle for the loan process.

LOL @GM shill:

“When you look at the broader economy, including a strong job market, rising wages, low inflation and low interest rates, and couple them to low fuel prices and strong consumer confidence, you have everything you need for auto sales to weather headwinds and remain at or near historic highs.”

Uh, you just described a headwind-less state of economic bliss. So for us non-paid-to-lie-ers, the more-apt summary would be

“The sales drop is especially shocking when you look at the broader economy, including a strong job market, rising wages, low inflation and low interest rates, and couple them to low fuel prices and strong consumer confidence.”