Yves here. We haven’t covered the debate over Social Security disability, so forgive the fact that this post starts at the deep end of the pool. But once you get past some technical details on how the program works, the analysis is straightforward.

By Matt Bruenig, who writes about politics, the economy, and political theory, with a focus on issues that affect poor and working people. He has written for The Washington Post, Los Angeles Times, The Atlantic, The New Republic, The American Prospect, In These Times, Jacobin, Dissent, Salon, The Week, Gawker and at his home base of sorts: Demos’ Policy Shop. Follow him on Twitter: @mattbruenig. Originally published at his website

Terrence McCoy has a long piece in the Washington Post about multi-generational disability. Or, more accurately, a piece about one family McCoy spent a few days with. The only parts of the piece that try to quantify multi-generational disability make very little sense.

Households With Multiple Family Members on Disability

From the article:

As the number of working-age Americans receiving disability rose from 7.7 million in 1996 to 13 million in 2015, so did the number of households with multiple family members on disability, climbing from an estimated 525,000 in 2000 to an estimated 850,000 in 2015, according to a Post analysis of census data. The analysis is probably an undercount.

The first problem is that “multiple family members” is not the same thing as “family members from different generations.” Two spouses would count. Two siblings would count. And so on.

The second problem is that you can be “on disability” without being disabled if you have a disabled parent. When a parent is receiving SSDI benefits, each child they have will receive a benefit equal to 50 percent of their parent’s benefit, subject to an overall family benefit limit. Children do not need to be disabled to receive this benefit. They receive it simply because their parent is disabled.

The third problem is that the household counts for 2000 and 2015 should be divided by the number of households in the country to convey the real magnitude of the change. In 2000, there were 104.7 million households, meaning that 0.5 percent of households had multiple family members on disability. In 2015, there were 124.6 million households, meaning that 0.7 percent fell into this category. That’s the crisis, apparently.

Rich Disabled Kids

The other data element of the piece uses the American Community Survey to determine how often disabled children have a disabled parent. This data does not show how often children and adults in the same household both receive disability benefits, only how often children and adults in the same household tell survey workers that they have one of the five serious disabilities tracked by the Census.

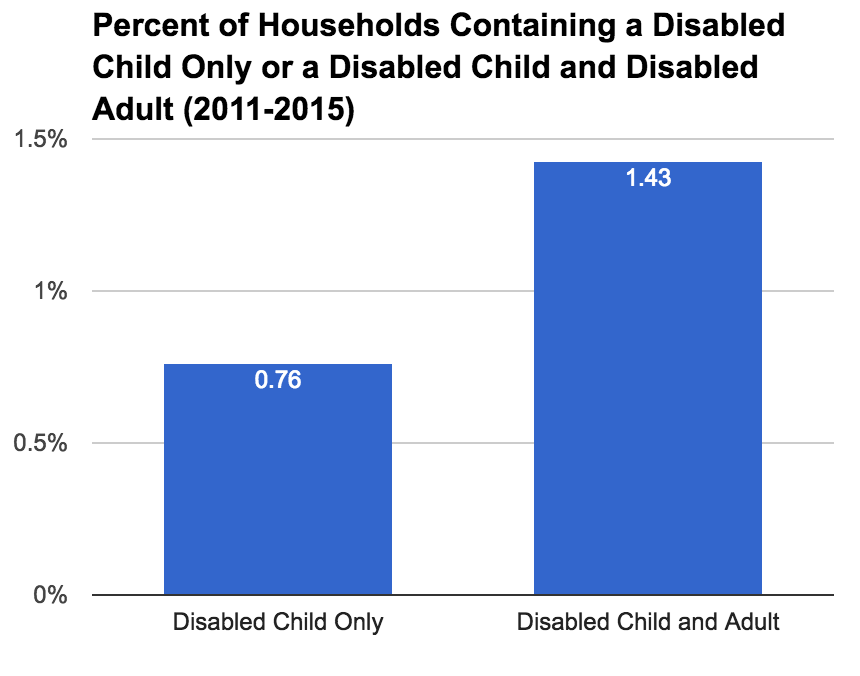

I used the same ACS file to produce a similar calculation as the one made in the piece. For my calculation, I kept things really simple. I isolated two types of households: 1) those with disabled children in them but no disabled adults, and 2) those with disabled children and disabled adults in them. Then I divided the number of households described by (1) and (2) by the total number of households in the file.

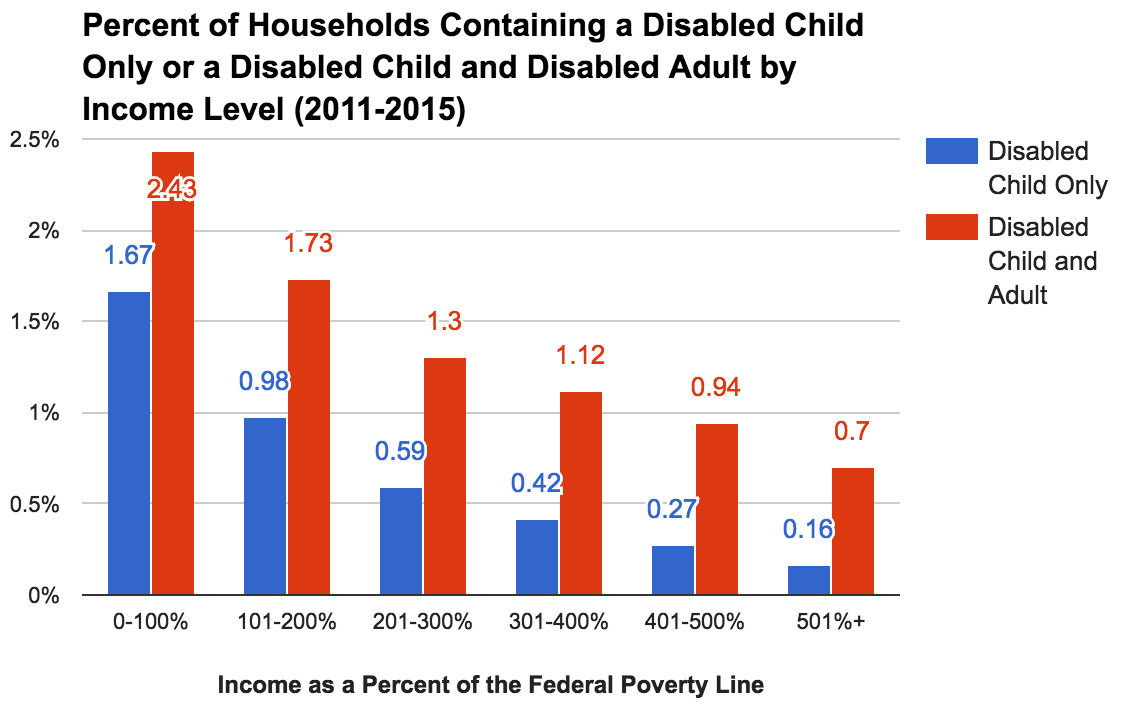

Here is the same calculation but broken up by income level, again in a similar way as the piece in question did:

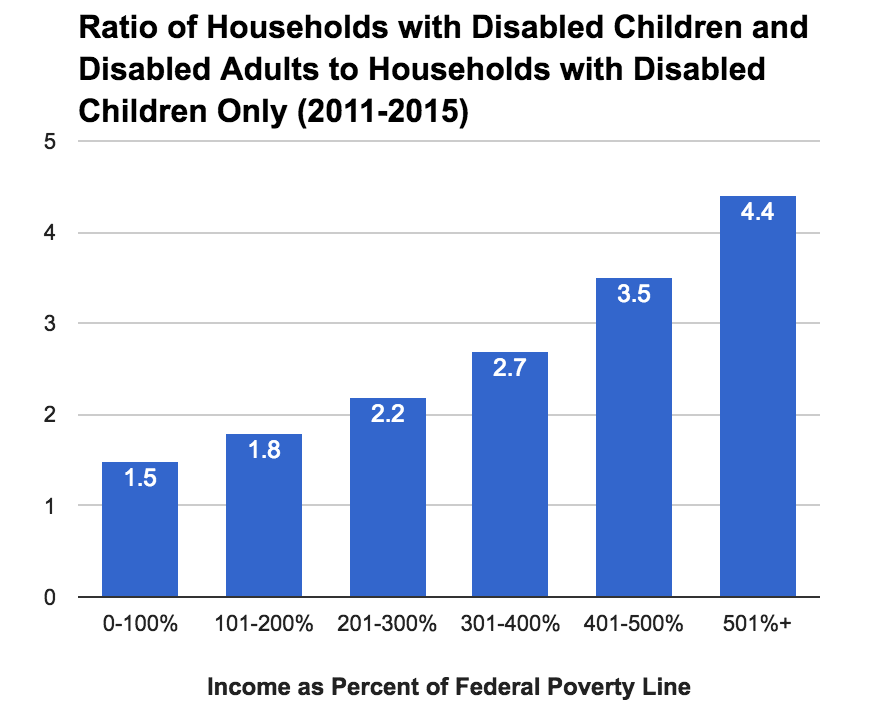

Here is the same graph, but I divide the red bars by the blue bars to get a ratio:

These figures do not substantially differ in their trend from what is presented in the piece, though they are more detailed and use all households for their denominator rather than whatever denominator the piece decided to use.

The data element in the piece is presented without much commentary, but the patterns shown in the above graphs are actually at odds with welfare cheating story that the piece is trying to tell.

The only disability benefit children can get for being disabled themselves is from the Supplemental Security Income (SSI) program. That program is means-tested, meaning that only children in lower-income families can receive it. For those with incomes over the quite low limits, claiming your child is disabled is of no use to you as far as welfare income goes. Yet, child disability is related to adult disability up and down the entire income distribution. In fact, the odds of a disabled child also having a disabled parent gets larger as you move up the income scale.

The welfare-cheat model suggested by the piece is supposed to be that you have an adult who is on disability; they then realize that if they claim their kid is disabled, they can get more benefits; so they do that. But this model would predict the opposite of what you see in the last graph. The likelihood that a “disabled” child is in the same household as a disabled adult should go down as you climb the income ladder because there is no way to cheat welfare money when your household income puts you above the SSI eligibility thresholds. Instead, the likelihood goes up and up and up even as the incentives to spoof your kid’s disability go down and down and down.

A view from the trenches on SSDI/SSI

Note that SSI and SSDI are two very different programs; The previous link I posted is about SSI. This is a related link that draws a distinction between the two.

This post was about SSDI. There is a perceived crisis with SSDI as the percentage of the public claiming SSDI benefits has risen markedly. Of course, we also have a rapidly rising levels of diabetes, which over time typically translates into physical issues, like loss of sensation in the feet and resulting balance problems (along with other issues) and an apparent real problem with rising pain levels in people who have done manual labor much of their careers (due likely to a combination of factors: narrower jobs, with more repetitive movements, and fatter Americans, so that even when they don’t become diabetic, merely being on your feet with more weight means more joint stress. And long hours sitting at desks isn’t good for you either. Blue collar workers are expected to sit there for extended periods, while white collar workers generally can organize their time and get up and move about.

That is a long-winded way of saying you may mean well (I can’t tell) but the introduction of SSI to a focused post is diversionary and potentially confusing.

Well Bruenig’s post is responding to a WP story about multi generational disability featuring grandkids attempting to get on SSI. As Bruenig points out, children can be recipients of payments if the parent is an SSDI recipient. But a disabled child alone cannot receive SSDI, and as an SSI recipient is subject to income limits. Bruenig:

So I don’t mean to be confusing (and I’m definitely not trying to be diversionary), but in my opinion multi generational disability is all about SSI and families like the one that is the subject of the WP story, and based on the above quote it appears to me that Bruenig may well agree with me.

However, I don’t agree with Bruenig’s analysis, as I don’t see how self reported disability rates in the ACS can refute what he calls the “welfare cheat model” as that quote invokes a strange causality that somehow people who cannot benefit from welfare fraud (high income) should somehow self report lower child disability rates in the ACS.

Assume the reverse, that some % of reports of disabled children are fraudulent claims by parents trying to increase their welfare payments. If that were the case, one would assume that the odds of disabled parent claiming their child is disabled would rise as income decreased…but that’s not what happens. So arguing that poor disabled adults are disproportionately reporting their children to be disabled (which is what you would see if this sort of welfare fraud was a real issue) is simply not backed up by the data. Which doesn’t mean no one has ever done that, but it does mean that it’s not a widespread phenomenon.

First, let’s talk about “welfare.” It is in the title of the post. People who have worked and paid into Social Security are eligible for certain disability under SSDI. People who have never worked, including children, are eligible for certain “welfare” benefits through SSI for low income kids.

I totally understand your point, which is actually Bruenig’s point (as best I understand it):

So Bruenig’s point is that we are looking for fraudulent disabled children. He looks at disabled children by income and says that rich kids are more frequently disabled and that this is evidence against the “welfare cheat model,” even as he admits that more affluent kids are not eligible for SSI.

Ok, so lets do a thought experiment of what this data would need to look like to support the “welfare cheat model.” Disabled kids in poor families would need to be more prevalent. Then you could say, “Jeez, look at all those disabled poor kids in poor families eligible for SSI that could benefit from cheating at welfare. It is so totally out of line with how many non-poor kids could not benefit from cheating.” But that isn’t the cited data. There are more disabled rich kids. So why exactly do disabled rich kids not eligible for SSI have anything to say about welfare fraud for poor kids. I don’t think it does. Let me know why if you do.

Lost somewhere in all this is fact SSI/SSDI is an extremely difficult qualifying task.

It is not coincidental that lawyers are constantly advertising their services to those stuck in the bureaucratic maze. It can take years to qualify. Case in point is my daughter that was terminally sick for a long period. After a lengthily period her benefit was finally approved. Got the notice personally as executor of her estate, six months after she died. I suspect there are many more going hungry or homeless for lack of benefit than actually cheat.

I don’t know her situation or whether she was trying to qualify for SSI or SSDI, but this might explain the bureaucratic nightmare.

Yes, everyone has a story about how somebody “cheats” the system, and of course, we should make policy based on that cheat and not consider the thousands upon thousands of people who do not cheat the system – in fact, let’s make those thousands and thousands of non-cheats suffer for the few cheats! Isn’t that the American Way?

Whether you like it or not, something bad is happening in this country. Death rates are rising in the middle class in this country. Mental illness rates are also rising in this country. Why would you assume that amount of people on SSDI would not rise also – or that the rise in the amount of people on SSDI must be, as you imply from those articles you posted, from “cheating”?

As Bruenig points out, just looking at the gross numbers doesn’t really tell you much – but it can give you a false opinion of what is actually happening here.

“Welfare cheating” is a faux crisis with regard to the Monetarily Sovereign federal government.

Unlike state and local taxes, which fund state and local spending, federal taxes do not fund federal spending. Therefore, though cheating on welfare paid for by state and local governments does cost taxpayers money, cheating on welfare sponsored by the federal government costs taxpayers nothing.

In fact, while cheating on federally sponsored welfare programs may be morally repugnant, it actually stimulates the economy, thereby benefitting all Americans.

Those who do not understand the implications of Monetary Sovereignty, do not understand economics.

That is an interesting point of view. Given Yves response to my earlier post, I think you need to provide more context to enable people to understand what is and is not “welfare” and to understand your point of view.

SSDI is more like an insurance program where you have to have worked (or in some cases your parents have to have worked) in order to receive benefits. It is in some ways a social insurance program. If you are going to call it “welfare” you more or less have to call all of social security welfare.

SSI however is not accounted for through the social security system. It is a pure social welfare transfer payment program. And it most certainly is used to move people from state based aid to federal aid that is accurately described as “welfare.”

All Federal spending can be (and probably should be) directly financed (i.e. not “sterilized” by taxation or borrowing). Regardless of how the financing of the different programs is currently structured, it is a truism that the Federal gov’t can purchase anything it wants that is available for sale in dollars.

What SSDI appears to do is pay a basic (albeit grossly insufficient) income with the attached stigma of mental health. If this is how social order is supposed to be maintained, we can see it is fraying at the seams. Highly concentrated wealth, income, power and information creates social isolation and destroys safety nets in communities racked by poverty. Combined with demagoguery and xenophobia, it’s toxic. No wonder hate crimes and terrorism are escalating globally.

Let’s have some fun with with the presentation of numbers:

-2000 to 2015 the number of households receiving benefits increased by 0.2 percentage points. (Well, that’s not going to draw eyeballs to an article.)

-If we rephrase to “…the number of households receiving benefits increased by 40%!” Now we’ve got an eye catching figure to work with. Let’s juice it some more

-From 2000 to 2015 the total number of households grew by 19% while the percentage of households receiving benefits grew by 40%! Now we’re really getting somewhere. It can be factually claimed that:

“The Number of Households Receiving Disability Benefits Grew By More Than Double the Rate of New Households Created!”

It’s all in the presentation

I know two people on SSDI. One is a woman in her late 60’s who’s been ill and has so many health problems that she’ll never work again. She won’t qualify for any of the other programs she’s paid into for years.

The other is a man in his mid 50’s. He’s not ill and is in fact, quite healthy. But he’s unemployable and has focus issues that he’s been able to blame on his military experiences in his early 20’s. SSDI became a way for him to have a basic income to keep is head above water (VA benefits help him with housing and health care).

I’m sure some Republican somewhere considers both of those people cheats and they should go get a job at 7-11 or somewhere (like that’s even possible).

Job destruction ensures that we’re going to have lots more people in situations where they are unemployable because there is enough able-bodied labor that will work for lower wages that they can’t find any employer that will put up with diminished abilities due to health (mental or physical). Mental problems are particularly dicey, as the shooting in Florida makes clear, companies keep these guys around as long as they can but eventually they are too disruptive and damaging to the rest of the company and have to be let go.

I’ve worked in an adjacent field for 20 years – in state workers’ comp claims. What I have seen is that the threshold for getting SSDI is as high as ever, but far, far more people are applying. In ordinary times, we used to see more marginally-injured applicants for workers comp returning to the labor force after using workers comp as a lifeline during recessions. Now, people know that the slightest emotional, mental, or physical disability means, unless they’re in a sheltered middle-class position, they’re never working again. They come to learn very quickly that unless they get SSDI, they’re going to be in big, big trouble once the other benefits run out. Twenty years ago, I think maybe 5% of my workers comp cases involved applicants who were also claiming SSDI. Now, the overlap is closer to 60-70%. People are not committing more fraud, they’re just vastly more desperate.