By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street

Institutional investors that manage other people’s money grabbed subprime auto-loan backed securities because of their slightly higher yields. These bonds are backed by subprime auto loans that have been sliced and diced and repackaged and stamped with high credit ratings. But those issued in 2015 may end up the worst performing ever in the history of auto-loan securitizations, Fitch warned.

And then there are those issued in 2016. They haven’t had time to curdle.

The 2015 vintage that Fitch rates is now experiencing cumulative net losses projected to reach 15%, exceeding the peak loss rates during the Financial Crisis.

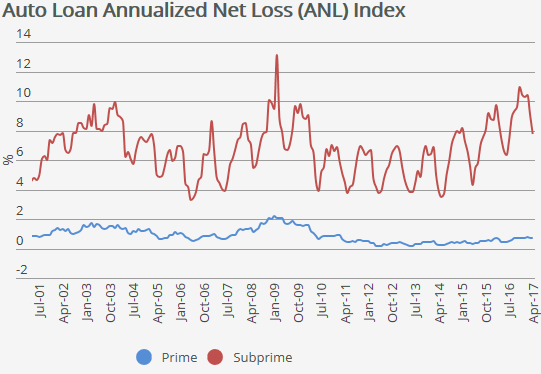

Fitch Ratings’ Auto Loan Annualized Net Loss Index shows the strong seasonality, with either May or June forming the low point each year and the winter months forming the peaks. A terrible trend took off in 2014. The winter peak last year occurred in November with a net annualized loss of 10.9%. The latest data point is for April, at 7.8%, up from 7.4% last year. The index peaked in February 2009 at 13.1%. The trend is pointing that way (via Fitch Ratings ABS):

Fitch analysts Hylton Heard and John Bella Jr. wrote in the report, cited by Bloomberg:

The 2015 vintage has been prone to high loss severity from a weaker wholesale market and little-to-no equity in loan contracts at default due to extended-term lending, a trend which was not as apparent in the recessionary vintages.

So let’s see.

Negative equity hits all-time record. The average negative equity in vehicles that were traded in for new vehicles during Q1 2017 has reached $5,195 per trade, the highest ever, according to Edmunds data, cited by AutoWeek. The percentage of trade-ins with negative equity has surged to 32.8%, also the highest ever! Average negative equity exceeded $4,000 in Q3 2013 and hasn’t looked back.

This negative equity in the trade is then rolled into the new loan, thus increasing the negative equity in that vehicle from the first second, which sends net losses soaring in the event of default.

Why is negative equity such a growing phenomenon? Because of the toxic trifecta in the auto industry, now happening.

Lengthening loan terms. The average new-vehicle loan term in Q1 2017 reached a record of 69 months, up from 64 months in 2011, according to Edmunds data. Terms between 73 and 84 months (7 years!) accounted for a record of 32.1% of all new-vehicle loans in Q4 2016, up from 29% a year earlier. Among used-vehicle loans, they accounted for 18%, up from 16% a year earlier.

The value of a new vehicle declines sharply over the first few years. But the loan doesn’t amortize at this pace and doesn’t catch up with the dropping value of the vehicle until the later stages of the loan. As many consumers like to get a new vehicle every few years, these longer terms add to the negative equity at trade-in time.

Rising transaction prices. Vehicle prices have surged in general. And consumers buy more expensive models because low interest rates and longer loan terms make this possible by keeping the payments down.

Falling used-vehicle values. The seasonally adjusted Used Vehicle Price Index by J.D. Power Valuation Services (formerly NADA Used Car Guide) in May has declined for the 10th month in a row, now down over 13% from its peak in mid-2014 and at the lowest level since September 2010 [Used Vehicle Trade-in Values Sink, Hit New Vehicle Sales].

These factors, along with aggressive lending, propelled new vehicle sales to new records in 2015 and (barely) in 2016. But now the blowback has started. The net effect going forward translates into greater losses for lenders and investors in case of default after the car is repossessed and sold, and ultimately – now happening – lower sales for automakers.

Fitch isn’t alone in warning about soaring defaults and net losses of subprime auto-loan backed securities. Moody’s also warned. And S&P Global Ratings pointed out recently that net losses even on prime auto-loan backed securities have risen at the fastest pace since 2008.

For now, downgrades of subprime auto-loan backed securities are still modest. Ratings agencies cite structural enhancements, such as the slices that take the first loss and that have been retained by the lender. Investors that bought the highly rated slices might be spared initial losses. If losses continue to surge, even highly rated slices are starting to take losses.

But auto lenders that sold the subprime securities are starting to get hit. Fitch warns particularly about those that have sprung up since the Financial Crisis and have specialized in subprime auto loans, using looser underwriting standards. Lending by these weakly capitalized lenders has grown at magnificent rates in recent years. Some of those lenders have specialized in “deep-subprime” auto loans. And those lenders might be at risk.

And at least one of them, Santander Consumer USA, the top subprime auto lender in the US, verified income on only 8% of the loans, according to Moody’s. So here we go again. Read… Liar Loans Dog Subprime Auto-Loan-Backed Securities

While this can cause trouble, it’s not going to cause nearly as much trouble as subprime mortgages. You can’t super-leverage/equity withdraw etc. your car. People (mostly investors whose fund managers bought this crap, which unfortunately is likely pension funds) get burned, but the world is not going to come down.

I think the contagion risk is less through the financial system (although I’m sure this is significant in scale) but through car manufacturing and the economy in general. If there was a major collapse this would result in a flood of cheap second hand cars hitting the market which would have devastating impacts on every car manufacturer and the entire supply chain. Who would buy a new Ford or VW when you could get a nice 2 year old BMW for a third of the price? There is also the pro-cyclical nature of car loans – people who fall on them (especially with PCP’s don’t have much assets to fall back on to pay the debts- its hard to sell an old car in a recession and its not like with a house where at least maybe you can rent out a room or something like that.

Well, yes, but the question is how much a further damage to the US economy would a car industry crash do. I’m not saying it wouldn’t be a problem – it would, but it wouldn’t be nowhere near 2007 GFC.

If people can’t keep their car, probably won’t be able to stay in their home.

This car bubble is probably what helped the real estate market bounce back up.

I’m meeting more and more people for whom their car is their home. Not only beat up old clunkers either! The best “tell” for this is a back seat or “cargo” space that is filled up with small “personal” belongings and basic living accoutrements. Many of these less obvious “homeless” are working too! Phyllis and I, being up against it ourselves, had a talk and agreed upon a maximum “handout” amount for panhandlers and hobos. We’ve become pretty good at spotting the fakes among the street grifters. A few weeks ago, a guy with scruffy clothes but new leather shoes was perched on one of the local WalMart entrance arteries’ intersections with the “Need Food” sign. I slowed down and yelled at him; “Hey buddy. I bet I know where you got those shoes!” (That’s an old street hustlers trick.) He looked down and I could almost read his lips saying; “Oh s–t!”

LA is trying to get rid of people living in their car:

http://www.latimes.com/local/lanow/la-me-ln-homeless-car-ban-20160623-snap-story.html

“Who would buy a new Ford or VW when you could get a nice 2 year old BMW for a third of the price?” Well, just about anyone who talks off the record with a BMW mechanic would probably eliminate the two year old BMW option – unless it comes as a BMW certified pre-owned with an included maintenance package.

For some reason recent model year used cars seem thin on the ground here in Vancouver. My car is getting near the replacement age and mileage but I haven’t been able to find any one to three year old examples of the vehicles I’m considering buying up for sale so the used option is pretty much out. I’ve owned three new vehicles in my life. It usually works out that I keep them for about seven years and 250,000KM.

Yep. BMW maintenance and repairs is INSANE.

I finally dumped my older model because as much as I loved the car, it was worn out. And replacing core systems in an old BMW was going to cost me 7 grand.

(Those with tools, knowledge, and time may do better)

My kind neighbor, a BMW fanatic gives me his old copies of Roundel and reading Mike Miller’s Tech Talk is enough to scare anyone away from a BMW. Maintenance for a newer BMW off warranty is $3 to $4 thousand annually on average and he puts it this way. Some years it’s almost nothing and the next something stupid like a fuel gauge not working is a multi thousand dollar repair to replace the sending unit because it’s molded into the fuel tank, and because of the saddle back design two tanks need replacing.

BMW = Beat My Wallet

With newer BMWs, it would be more difficult to repair at home than in the past.

Oh god! First houses now cars??!! What’s wrong with this country?!

What is wrong is simple:

1. Wages have not kept up so people cannot afford cars

2. There are few jobs so people cannot afford cars

3. Wall Street loves to speculate on car loans because they are so damn greedy

4. The car manufacturers want to keep up their sales so they are willing to finance sub-prime car loans

Next we will see a student loans crisis

Lol @ next…

Greed

I spent Sunday assisting a financially-distressed friend deal with an auto “death” and the subsequent replacement journey. Here are details of the financing she could secure for her next purchase:

This is for 640 FICO with a bankruptcy. 60 months, 14%. 2009 Toyota Carolla with 60k miles. Payment about 225/month. This is through Kia

This experience adds two factors which make the Wolf Street analysis worse: maintenance for high mileage autos is high and uncertain. In my personal experience, over 100k miles can easily turn into an extra thousand in maintenance. Timing belts alone are $1,500 and up. Second, dealers with the access to sub-prime credit can use that to inflate the underlying price of the auto and do so by targeting the monthly payment rather than all in cost. My friend believes the Toyota above was over-priced by about $1,500 but she needs the car for work and kids and doesn’t know if she can get financing elsewhere.

*That* is a seriously shit deal! (Maybe better off with a new car, but tiny, like a Toyota Yaris).

The bondholders should do OK on that loan: 60 month of 225 per month is 13500! The might factor in that the collateral will not be around for the whole 60 months, which does skew the price up.

A similar car here is 75000 SEK – about 8630 US – If one finance it, one is looking at about 80-120 USD per month, probably with a minimum 2000 US initial payment (Mazda is way cheaper for a car that old Toyota has a reputation for reliability so they cost more used, however, they are about the same).

https://www.autouncle.se/se/begagnade-bilar/7254231-toyota-corolla-corolla

Looking only at the monthly fee, I can buy an new Prius for the same money (probably need a 3000 initial payment, they never finance above 80% here).

She might be better off with a “Sixt Minilease”, if that kind of thing exists in the US, In a mini-lease one hires a car on a 30 days minimum contract. The hire people pay everything except fuel, one can dump the car on them after the 30 days with less than one month notice and the car is new. If the engine blows, one gets a new car. I am considering it for two of my children as a summer gift.

https://www.toyota.se/nya-bilar/prius/index.json

The American People are getting screwed over in every way possible.

https://www.sixt.dk/mini-lease/

Just goes to show that you can have zirp and high rates… a tale of two cities.

Looked at your credit car interest rate recently?

Of course in your example that $1000 repair is only four monthly payments. The greatly loved NPR program Car Talk always advised that keeping an old car is the financial right choice as long as you are willing to put up with the repairs. And in truth some of the better made current cars can easily last 200k miles which was almost never true back in Detroit’s “planned obsolescence” tail fin days. I’m convinced that one reason for the current mania to put electronics in cars is to place them on the same upgrade cycle as PCs–planned obsolescence 21st cent style.

Bumpers that can’t be bumped and tire pressure monitors that don’t work and beep at you when you you use your old tires…

Find and befriend a local “shade tree” auto mechanic. I’ve done timing belt replacements several times on our autos. It’s not too hard. If a decent “repair” manual is available, most repairs, up to and including head gasket replacements are doable “at home.” YouTube, believe it or not, has some very good videos of DIY mechanical repairs for automobiles. All one need do is be somewhat mechanically inclined, have a day out and sun or rain cover, such as a “tailgater” portable awning, and then watch as you spontaneously develop a quite rich and colourful vocabulary!

Finally, since a crunch in auto sales is coming down the pike, Bargain Hard!!!

A slight caveat I feel worth mentioning here. I own and operate an auto repair shop specializing in Euro cars. With the availability of free diagnostic scan at any auto parts store, a YouTube video showing just how easy this repair is to perform at home, the availability of cheap online parts, I see the appeal of saving money on car repair. Really, I do.

I could spend the next 3 hours citing dozens of specific instances (complete with photos) where well intentioned DIY folks damaged their cars to the tune of thousands of dollars trying to save a couple hundred bucks on a seemingly simple repair.

Just yesterday, we replaced a $2k plus hydraulic pump for a convertible top on a 10 year old Benz damaged by the owner trying to refill hydraulic fluid that was leaking from a $200 line. Then we replaced the line. We did our best to not make him feel like a dumbass.

Cars have become very complex creations. Overly so, IMO. That’s a good reason to proceed cautiously with “shade tree” mechanics.

I know it sounds like I am talking my book. My intent is simply to inform. I have been broke before, and could be again, seeing the way the world works these days. But that is another rant.

For my 2c, I use an independent auto repair shop rather than dealer for anything beyond oil and filter changes, which I do myself. I change the oil (but not filter) at half the OCI, both at the OCI, and I know I’ve used the correct VW 502 spec oil.

>>My friend believes the Toyota above was over-priced by about $1,500 but she needs the car for work and kids and doesn’t know if she can get financing elsewhere.

please, please walk away from this deal. Your friend can get a better car at a lower rate — same $225/mo for 5 years. if you’re friend is patient and shops around.

While Corollas are great cars all 8+ year old cars need heightened maintenance and repair.

for financing try credit unions (eg, PenFed if you have a military connection).

for retailers try hertz car sales (ie buying an ex-rental car. Compact sedans don’t get flogged by renters and should’ve been well-maintained)

Here in Portland you can lease an electric car for under $200 a month.

As somebody who has never bought a new car, falling used car prices look like a good thing…

The way our economy is constructed, it is most definitely not a good thing. Production in the auto industry still supports a huge number of jobs and if new sales are declining than jobs will be lost. Deflationary spirals look good to buyers until suddenly everybody is sitting on the sidelines waiting for more deflation.

Nah, people need to drive in this large country. Only the well-off can afford to sideline their purchases….most really need them for work, school, kids, etc..

Wow, deep-subprime. May the force be with the lenders… What a contrast between “deep subprime” and the “enhanced” high-grade” infamous BS funds.

What is next? Totally foolish deeply sub-subprime lending

Looks like a buyer’s market soon. I’ll be hunting for a mid-trim ’15-’16 Honda Odyssey. Finance through a CU and provide 20% upfront.

I shopped for a used car after hearing about the used-car glut, but ended up buying new anyway. Used car salesmen are still used car salesmen, and the new car feeling is such an awesome high.

With the pace of car technology these days (many new cars come with blind-side sensors as standard, something not seen in models 2-3 years old) I think it would been a good idea to lease a subcompact if you just need a commuter car.

often buying used = penny wise, pound foolish. (assuming you have the means to choose between new v. used).

It’s expensive to be poor. (eg, car repair costs)

congrats on your new car. enjoy.

I disagree with this idea. Used car prices are not rational, and in fact there are good deals to be had. There are also bad deals to be had.

Some brands, such as Toyota, are irrationally expensive used, in which case buy new, if you really want a Toyota. Some brands are so unwanted (think Buick) or perceived problems (think BMW), you can pick them up in good shape for 50% off hardly used.

If you are going to buy a used car, do make sure you have a good independent mechanic that will check it out prior to purchase. Also for the more exotic euro stuff make sure you have a top notch independent mechanic in your area that can work on it.

perceived problems?

lol

I have imposed a rule in our houshold.

No more German cars.

My wife drove then for 19 years, and I was on first name terms with the service dept of each and every car dealership of cars we owned.

In that period I had a Toyota. Now my wife has a Toyota, and I a bicycle.

That’s the catch – you really need to have a good independent mechanic that you can trust with your life (or be one yourself) to make buying used a safe option. Sadly, a lot of us don’t have that. When I bought my first car at the age of 17 (in 1987) I didn’t even know how to change the oil. The car was a 1974 Capri 2.8 4 speed. The first two mechanics (both recommended by friends of my family) turned out to be both incompetent and dishonest. By the time I got rid of the car about five years later not only had I learned to change the oil but also to replace the clutch cable, overhaul the carb, gap the plugs and points, change the gearbox (after the input shaft bearing let go scattering metal throughout the original box) and align the clutch, replace the exhaust and weld up a failed exhaust header and completely tear down and rebuild the engine. Yes, the car was a bit of a heap. Since those days my cars have been two small pickups retired from service as delivery vehicles in the business my family had, usually at about the 200,000KM mark, a 98 Nissan pickup (sadly written off at a young age when someone hit me) and two Honda Elements, a 2004 and a 2010 bought in summer 2011. The 2010 is now at the 195,000KM mark and has recently needed a couple of expensive repairs.

I have a 2004 Honda Civic, 140,000 miles. The most reliable, low maintenance car ever. Almost 40mpg hwy. Bought used. I hope it last another couple years so I can get a used Honda Civic Hatchback. I don’t see the point in buying a new car.

My mechanic is an independent and very busy and popular. I asked him about what my next car should be: Mazda, Toyota, Honda, VW. Hands down he said a Honda. That’s all he drives.

Which reminds me: my dad drove a 911 porsche back in the day. I had a Civic SI hatchback that he would ask to drive because it was so fun and zippy.

Shhh. Keep that a secret. Let them drive Toyotas and Mazdas.

It’s way more fun to drive a slow car fast, than a fast car slow….

Are there any Credit Default Swaps associated with the junk this time?

(calling AIG…)

I work at a restaurant in Memphis. Guys here are always getting screwed buying beaters from places like Bulldog Motors. Those car lots charge an insane interest rate on a high sticker price. The cars get repoed so often, they end up selling the same car 3 times. Easy to repo because of the gps/kill switch they install. No payment. Car will not start and gps tells tow truck where to come get it. We finally had to have a meeting with staff about car buying. Told everyone to download kelley blue book app and look at craigslist. Explained sub-prime interest as well. None of these guys ever had experience with traditional banking or ever known anyone to buy a car that didn’t get screwed over.

Mass car ownership was one of the worst ideas in history. How many families are functionally below the poverty line because of vehicle expenses? If fully autonomous robotic vehicle technology is actually feasible, it can’t come soon enough.

By the way, if you can have the car thoroughly examined by a mechanic first, buying a 1-2-year-old used car for book value is almost always a better deal just because of how much a car depreciates in this first year of ownership. I’ve had friends who did a lot of searching and saved a lot of money, but then, the time consumed was considerable, too.

My two cents worth. New job for the Mrs. in late 2015 meant instead of her commuting an hour away, it was my turn now!

Sale of existing paid off house as part of the move (yes, we have a mortgage again, blerg) left us with around $20 to $25K to spend.

Local Toyota dealer’s sales rep worked closely with me to find a Certified Camry Hybrid – commute is 100 miles per day 5 days a week, thus Certified thus Toyota thus Hybrid – and further endeared themselves to me by not trying to palm some financing deal off on me as part of the deal.

Paid $21K for a Certified 2014.5 Toyota Camry Hybrid with 29K miles (leaving 71K of original 100K warranty)… including the set of new Goodyear Assurance Fuel Max tires, since the existing ones were a little worn (!).

Averaging 37 to 38 mpg while driving at 80 to 85 mph on Interstate now. Various Millennial offspring starting to replace college cars so recommending Certified as preferred purchase option, with credit union financing for best possible rates.

OTOH the 1998 to 2001 Hondas and Toyotas the kids drive have survived a variety of low speed traffic accidents, racked up between 150K to 250K miles per unit thanks to regular oil and fluid changes (and Hankook Optimo A/S tires good for 80K) so there’s that.

The days of the $500 or even $5000 beater are gone gone gone. Anything less than $10K and/or older and you are buying your Car Talk mechanics a boat one repair at a time.

The 2014.5 Camry Hybrid replaced a 1994 Mazda MX-6 and a 1999 Mazda B3000 4×4 (Ford Ranger clone), both did fairly well up until the last couple of years. New car safety tech very attractive for us long commuters too.

We’ve all seen this movie before and I suspect we all remember how it ends and who the villains are.