Yves here. Be sure to read to the later part of the article about the stunning conflict of interest at the Minerals Management Service, which among other things, oversees offshore drilling.

By Donald Boesch., Professor of Marine Science at the University of Maryland Center for Environmental Science. Originally published at The Conversation; cross posted from DeSmogBlog

The Trump administration is proposing to ease regulations that were adopted to make offshore oil and gas drilling operations safer after the 2010 Deepwater Horizon disaster. This event was the worst oil spill in U.S. history. Eleven workers died in the explosion and sinking of the oil rig, and more than 4 million barrels of oil were released into the Gulf of Mexico. Scientists have estimated that the spill caused more than US$17 billion in damages to natural resources.

I served on the bipartisan National Commission that investigated the causes of this epic blowout. We spent six months assessing what went wrong on the Deepwater Horizon and the effectiveness of the spill response, conducting our own investigations and hearing testimony from dozens of expert witnesses.

Our panel concluded that the immediate cause of the blowout was a series of identifiable mistakes by BP, the company drilling the well; Halliburton, which cemented the well; and Transocean, the drill ship operator. We wrote that these mistakes revealed “such systematic failures in risk management that they place in doubt the safety culture of the entire industry.” The root causes for these mistakes included regulatory failures.

Now, however, the Trump administration wants to increase domestic production by “reducing the regulatory burden on industry.” In my view, such a shift will put workers and the environment at risk, and ignores the painful lessons of the Deepwater Horizon disaster. The administration has just proposed opening virtually all U.S. waters to offshore drilling, which makes it all the more urgent to assess whether it is prepared to regulate this industry effectively.

Separating Regulation and Promotion

During our commission’s review of the BP spill, I visited the Gulf office of the Minerals Management Service in September 2010. This Interior Department agency was responsible for “expeditious and orderly development of offshore resources,” including protection of human safety and the environment.

The most prominent feature in the windowless conference room was a large chart that showed revenue growth from oil and gas leasing and production in the Gulf of Mexico. It was a point of pride for MMS officials that their agency was the nation’s second-largest generator of revenue, exceeded only by the Internal Revenue Service.

We ultimately concluded that an inherent conflict existed within MMS between pressures to increase production and maximize revenues on one hand, and the agency’s safety and environmental protection functions on the other. In our report, we observed that MMS regulations were “inadequate to address the risks of deepwater drilling,” and that the agency had ceded control over many crucial aspects of drilling operations to industry.

In response, we recommended creating a new independent agency with enforcement authority within Interior to oversee all aspects of offshore drilling safety, and the structural and operational integrity of all offshore energy production facilities. Then-Secretary Ken Salazar completed the separation of the Bureau of Safety and Environmental Enforcementfrom MMS in October 2011.

Officials at this new agency reviewed multiple investigations and studies of the BP spill and offshore drilling safety issues, including several by the National Academies of Sciences, Engineering and Medicine. They also consulted extensively with the industry to develop a revised a Safety and Environmental Management System and other regulations.

In April 2016, BSEE issued a new well control rule that required standards for design operation and testing of blowout preventers, real-time monitoring and safe drilling pressure margins. Prior to the Deepwater Horizon disaster, the oil industry had effectively blocked adoption of such regulations for years.

About-face Under Trump

President Trump’s March 28, 2017 executive order instructing agencies to reduce undue burdens on domestic energy production signaled a change of course. The American Petroleum Institute and other industry organizations have lobbied hard to rescind or modify the new offshore drilling regulations, calling them impractical and burdensome.

In April 2017, Trump’s Interior Secretary, Ryan Zinke, appointed Louisiana politician Scott Angelle to lead BSEE. Unlike his predecessors — two retired Coast Guard admirals — Angelle lacks any experience in maritime safety. In July 2010 as interim Lieutenant Governor, Angelle organized a rally in Lafayette, Louisiana, against the Obama administration’s moratorium on deepwater drilling operations after the BP spill, leading chants of “Lift the ban!”

Even now, Angelle asserts there was no evidence of systemic problems in offshore drilling regulation at the time of the spill. This view contradicts not only our commission’s findings, but also reviews by the U.S. Chemical Safety Board and a joint investigation by the U.S. Coast Guard and the Interior Department.

Fewer Inspections and Looser Oversight

On December 28, 2017, BSEE formally proposed changes in production safety systems. As evidenced by multiple references within these proposed rules, they generally rely on standards developed by the American Petroleum Institute rather than government requirements.

One change would eliminate BSEE certification of third-party inspectors for critical equipment, such as blowout preventers. The Chemical Safety Board’s investigation of the BP spill found that the Deepwater Horizon’s blowout preventer had not been tested and was miswired. It recommended that BSEE should certify third-party inspectors for such critical equipment.

Another proposal would relax requirements for onshore remote monitoring of drilling. While serving on the presidential commission in 2010, I visited Shell’s operation in New Orleans that remotely monitored the company’s offshore drilling activities. This site operated on a 24-7 basis, ever ready to provide assistance, but not all companies met this standard. BP’s counterpart operation in Houston was used only for daily meetings prior to the Deepwater Horizon spill. Consequently, its drillers offshore urgently struggled to get assistance prior to the blowout via cellphones.

On December 7, 2017 BSEE ordered the National Academies to stop work on a study that the agency had commissioned on improving its inspection program. This was the most recent in a series of studies, and was to include recommendations on the appropriate role of independent third parties and remote monitoring.

Minor Savings, Major Risk

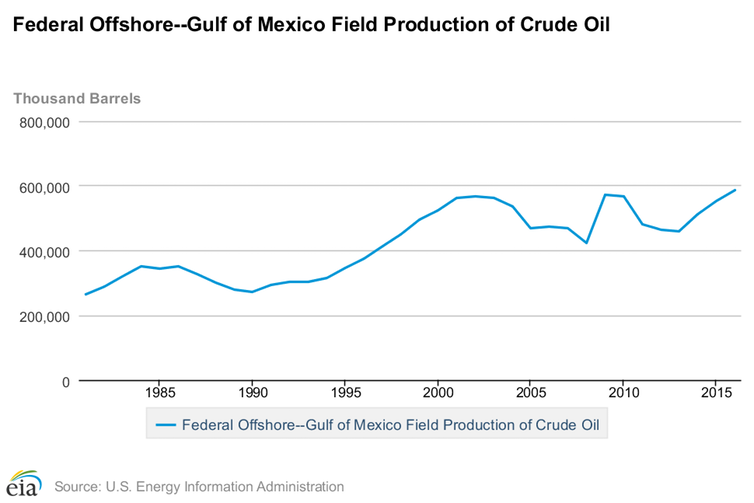

BSEE estimates that its proposals to change production safety rules could save the industry at least $228 million in compliance costs over 10 years. This is a modest sum considering that offshore oil production has averaged more than 500 million barrels yearly over the past decade. Even with oil prices around $60 per barrel, this means oil companies are earning more than $30 billion annually. Industry decisions about offshore production are driven by fluctuations in the price of crude oil and booming production of onshore shale oil, not by the costs of safety regulations.

BSEE’s projected savings are also trivial compared to the $60 billion in costs that BP has incurred because of its role in the Deepwater Horizon disaster. Since then explosions, deaths, injuries and leaks in the oil industry have continued to occurmainly from production facilities. On-the-job fatalities are higher in oil and gas extraction than any other U.S. industry.

![]() Some aspects of the Trump administration’s proposed regulatory changes might achieve greater effectiveness and efficiency in safety procedures. But it is not at all clear that what Angelle describes as a “paradigm shift” will maintain “a high bar for safety and environmental sustainability,” as he claims. Instead, it looks more like a shift back to the old days of over-relying on industry practices and preferences.

Some aspects of the Trump administration’s proposed regulatory changes might achieve greater effectiveness and efficiency in safety procedures. But it is not at all clear that what Angelle describes as a “paradigm shift” will maintain “a high bar for safety and environmental sustainability,” as he claims. Instead, it looks more like a shift back to the old days of over-relying on industry practices and preferences.

Boy, I wish going forward folks would refer to this as a ‘blowout disaster’ .

A spill is a few ounces of milk on a table-top.

Words, diction, matter.

I think it would be illuminating if someone obtained an oil development lease just offshore from Mar-a-Lago and demonstrated an intention to immediately proceed with exploration and possible development. The illuminating part would be how quickly “onerous government regulations” would be conjured up to thwart this entrepreneurial activity. At least then we would all see how the costs and benefits are distributed.

Hopefully, Michael Moore carries thru with his threat:

https://www.famefocus.com/news/documentarian-michael-moore-going-frack-offshore-mar-lago/

One wonders how many Trump properties will have special ha dling, while others will just fail on the first spill.

The cause of the BP blowout was a decision made ‘on the beach’, not on the rig, to displace drilling mud in the riser before a ‘good’ cement test was verified. At the time, people on the rig had concerns about why they were displacing when test results were in question. It was common knowledge what the result of a bad decision there could be. Yet to save a few hours they went ahead and displaced. The accident was the result of a decision made at BP headquarters to hurry up. Putting a hundred or so thousand people out of work by cancelling offshore operations was a big mistake. It penalized the companies and employees who would never have dreamed of acting so irresponsibly.

If the workers on the rig were so concerned about the issue, why didn’t they call up reporters and walk off the job? Why not stage a wildcat strike over the issue – it was their lives at risk, as well as the rest of the Gulf of Mexico ecosystem?

Answer: they were afraid of being blacklisted by BP which would mean no more work for them in the oil industry. Incidentally, BP is notable for putting far more money into ‘corporate responsibility’ PR campaigns aimed at creating a ‘green image’ – while cutting safety corners on all their operations (see the Texas City BP refinery explosion, for example)

Clearly, BP executives should have been charged with criminal negligence and sent to jail – but just as with corporations like Goldman Sachs who played leading roles in the 2008 crash, these entities use their bought-and-paid-for Republican and Democratic politicians as well as the captured regulatory agencies to avoid criminal charges – just as the Mafia did in the 1950s and 1960s and 1970s. It’s organized white-collar crime.

“Clearly, BP executives should have been charged with criminal negligence and sent to jail – but just as with corporations like Goldman Sachs who played leading roles in the 2008 crash, these entities use their bought-and-paid-for Republican and Democratic politicians as well as the captured regulatory agencies to avoid criminal charges – just as the Mafia did in the 1950s and 1960s and 1970s. It’s organized white-collar crime.”

What’s missing from the legal structure of our late stage neofeudalist empire is any real sense of accountability, nevermind personal culpability. Corporate executives aren’t held responsible for the consequences of their decisions, nor are government officials and politicians. Unless this changes Americans can expect ever more egregious behavior on the part of rich and powerful corporations and those who control them. Privatized profit, socialized risk; what could possibly go wrong? Again?!

Wind developers are struggling to get turbines off the coast due to resistance from locals. It will be interesting to see if there is much oil industry interest in the leases as there is much more on-shore infrastructure required for oil and gas than wind. That requires state and local permitting, not federal.

As somebody who deals with permitting, the holdups usually come at the state and local level, not the federal. You see this in everything , right down to treehouses in Florida. http://www.journal-news.com/news/national-govt–politics/supreme-court-won-take-florida-couple-treehouse-dispute/fbdbwE0qh9WxyuqYsVH73I/

Maybe people could say: “We’ll let you put up an oil rig but you have to put a wind turbine on top of it!”. Seriously, I am beginning to think that the conservation cause is in the same boat as the antiwar boat – nobody really can get wound up by it all. It is blatantly obvious that the government is not listening to the bulk majority of the population but only those with the big bucks. Protest too much and people know that that will get you on an FBI watch list with probably a few infiltrators to boot.

And so Trump & the oil industry will get their way and ring the coastlines with oil rigs – until the next disaster. At that point everybody will point the finger at Trump, whether he is still President or not, and let the oil industry get off scot-free. Maybe the oil industry can get in on the scam that the nuclear industry got going for it. If something there goes south, the nuclear plant operators only have to make a small payment for restitution and the government has to pick up the tab for untold billions of dollars in dealing with the catastrophe.

Perhaps they will suck up all the clathrates and thus reduce the tsunami weapon potential?

Or is it to lay out more clathrates that the drilling is to proceed with less safety in place?

Hmmm …..

“You can always count on Americans to do the right thing – after they’ve tried everything else.” Winston Churchill.

While that may have been true “back in the day,” I’m not not it is true at present. More and more I see denial, and repetition of the same mistakes.

We wrote that these mistakes revealed “such systematic failures in risk management that they place in doubt the safety culture of the entire industry.” The root causes for these mistakes included regulatory failures

Risk management is the key component in systemic industrial, corporate, financial and government failures. Whether it was BP Horizon or NASA ignoring the Challenger’s O ring warnings, or Enron Risk management disaster onto the 2007 mortgage and derivatives disaster inspite of Cassandra warnings such as CTFC head Brooksley Born about derivatives.

Sociologist Diane Vaughan who’s an expert in industrial and organizational malfeasance, defines these systemic failures as normalization of deviance. She states, “people within the organization become so accustomed to a deviant behavior that they don’t consider it deviant, despite the fact that they far exceed their own rules for the elementary safety. But it is a complex process with some kind of organizational acceptance. The people outside see the situation as deviant whereas the people inside get accustomed to it and do not see. The more they do it, the more they get accustomed.”

Clearly, it’s accepted practice at many levels from organizational onto our cultural drift whereby circumstances classified as not okay are slowly reclassified as okay.

In the case of BP Horizon, government and corporate regulatory standards were dismissed by management because the culture of taking risks prior to the disaster became the new normal. Essentially they assumed as does Trump who’s a recidivist risk taker and bankruptcy junkie, that boring regulations and rules interfere with profit. Heck who needs brakes on a car if all you want to do is go real fast?

Bluster and noise aside, I have to wonder just what is the appetite in the industry these days for wholesale offshore drilling? After spending $ billions, Shell’s big zero in the Chukchi Sea in 2015 kinda put a damper on offshore North Slope Alaska. Offshore California is unlikely to be attractive for a variety of reason separate from the famously hostile state government. Maybe the Gulf is THE big deal?