Yves here. Summers and Stansbury take a cautious stand in this piece. While they don’t claim to have found a cause or set of causes for the way average worker wages started lagging productivity gains in the 1970s, a critical driver of skyrocketing inequality, they do rule out rapid change. That is an important finding, since the claim that technology improvements were the driver of workers not sharing in the benefits of productivity gains is used politically to argue that it is a natural or even worse, virtuous outcome of innovation.

By Anna Stansbury, PhD student in Economics, Harvard University, and Larry Summers, Lawrence Summers, President Emeritus, Harvard University. Originally published at VoxEU

Since 1973, there has been divergence between labour productivity and the typical worker’s pay in the US as productivity has continued to grow strongly and growth in average compensation has slowed substantially. This column explores the causes and implications of this trend. Productivity growth appears to have continued to push workers’ wages up, with other factors to blame for the divergence. The evidence casts doubt on the idea that rapid technological progress is the primary driver here, suggesting rather that institutional and structural factors are to blame.

Pay growth for middle class workers in the US has been abysmal over recent decades – in real terms, median hourly compensation rose only 11% between 1973 and 2016.1 At the same time, hourly labour productivity has grown steadily, rising by 75%.

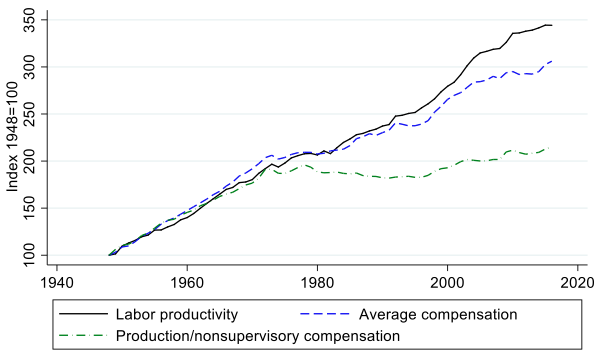

This divergence between productivity and the typical worker’s pay is a relatively recent phenomenon. Using production/nonsupervisory compensation as a proxy for median compensation (since there are no data on the median before 1973), Bivens and Mishel (2015) show that typical compensation and productivity grew at the same rate over 1948-1973, and only began to diverge in 1973 (see Figure 1).

Figure 1 Labour productivity, average compensation, and production/nonsupervisory compensation 1948-2016

Notes: Labour productivity: total economy real output per hour (constructed from BLS and BEA data). Average compensation: total economy compensation per hour (constructed from BLS data). Production/nonsupervisory compensation: real compensation per hour, production and nonsupervisory workers (Economic Policy Institute).

What does this stark divergence imply about the relationship between productivity and typical compensation? Since productivity growth has been so much faster than median pay growth, the question is how much does productivity growth benefit the typical worker?2

A number of authors have raised these questions in recent years. Harold Meyerson, for example, wrote in American Prospect in 2014 that “for the vast majority of American workers, the link between their productivity and their compensation no longer exists”, and the Economist wrote in 2013 that “unless you are rich, GDP growth isn’t doing much to raise your income anymore”. Bernstein (2015) raises the concern that “[f]aster productivity growth would be great. I’m just not at all sure we can count on it to lift middle-class incomes.” Bivens and Mishel (2015) write “although boosting productivity growth is an important long-run goal, this will not lead to broad-based wage gains unless we pursue policies that reconnect productivity growth and the pay of the vast majority”.

Has Typical Compensation Delinked from Productivity?

Figure 1 appears to suggest that a one-to-one relationship between productivity and typical compensation existed before 1973, and that this relationship broke down after 1973. On the other hand, just as two time series apparently growing in tandem does not mean that one causes the other, two series diverging may not mean that the causal link between the two has broken down. Rather, other factors may have come into play which appear to have severed the connection between productivity and typical compensation.

As such there is a spectrum of possibilities for the true underlying relationship between productivity and typical compensation. On one end of the spectrum – which we call ‘strong delinkage’ – it’s possible that factors are blocking the transmission mechanism from productivity to typical compensation, such that increases in productivity don’t feed through to pay. At the opposite end of the spectrum – which we call ‘strong linkage’ – it’s possible that productivity growth translates fully into increases in typical workers’ pay, but even as productivity growth has been acting to raise pay, other factors (orthogonal to productivity) have been acting to reduce it. Between these two ends of the spectrum is a range of possibilities where some degree of linkage or delinkage exists between productivity and typical compensation.

In a recent paper, we estimate which point on this linkage-delinkage spectrum best describes the productivity-typical compensation relationship (Stansbury and Summers 2017). Using medium-term fluctuations in productivity growth, we test the relationship between productivity growth and two key measures of typical compensation growth: median compensation, and average compensation for production and nonsupervisory workers.

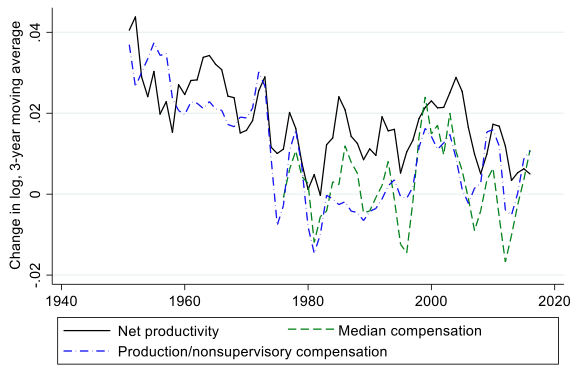

Simply plotting the annual growth rates of productivity and our two measures of typical compensation (Figure 2) suggests support for quite substantial linkage – the series seem to move together, although typical compensation growth is almost always lower.

Figure 2 Change in log productivity and typical compensation, three-year moving average

Notes: Data from BLS, BEA and Economic Policy Institute. Series are three-year backward-looking moving averages of change in log variable.

Making use of the high frequency changes in productivity growth over one- to five-year periods, we run a series of regressions to test this link more rigorously. We find that periods of higher productivity growth are associated with substantially higher growth in median and production/nonsupervisory worker compensation – even during the period since 1973, where productivity and typical compensation have diverged so much in levels. A one percentage point increase in the growth rate of productivity has been associated with between two-thirds and one percentage point higher growth in median worker compensation in the period since 1973, and with between 0.4 and 0.7 percentage points higher growth in production/nonsupervisory worker compensation. These results suggest that there is substantial linkage between productivity and median compensation (even the strong linkage view cannot be rejected), and that there is a significant degree of linkage between productivity and production/nonsupervisory worker compensation.

How is it possible to find this relationship when productivity has clearly grown so much faster than median workers’ pay? Our findings imply that even as productivity growth has been acting to push workers’ pay up, other factors not associated with productivity growth have acted to push workers’ pay down. So while it may appear on first glance that productivity growth has not benefited typical workers much, our findings imply that if productivity growth had been lower, typical workers would have likely done substantially worse.

If the Link Between Productivity and Pay Hasn’t Broken, What Has Happened?

The productivity-median compensation divergence can be broken down into two aspects of rising inequality: the rise in top-half income inequality (divergence between mean and median compensation) which began around 1973, and the fall in the labour share (divergence between productivity and mean compensation) which began around 2000.

For both of these phenomena, technological change is often invoked as the primary cause. Computerisation and automation have been put forward as causes of rising mean-median income inequality (e.g. Autor et al. 1998, Acemoglu and Restrepo 2017); and automation, falling prices of investment goods, and rapid labour-augmenting technological change have been put forward as causes of the fall in the labour share (e.g. Karabarbounis and Neiman 2014, Acemoglu and Restrepo 2016, Brynjolffson and McAfee 2014, Lawrence 2015).

At the same time, non-purely technological hypotheses for rising mean-median inequality include the race between education and technology (Goldin and Katz 2007), declining unionisation (Freeman et al. 2016), globalisation (Autor et al. 2013), immigration (Borjas 2003), and the ‘superstar effect’ (Rosen 1981, Gabaix et al. 2016). Non-technological hypotheses for the falling labour share include labour market institutions (Levy and Temin 2007, Mishel and Bivens 2015), market structure and monopoly power (Autor et al. 2017, Barkai 2017), capital accumulation (Piketty 2014, Piketty and Zucman 2014), and the productivity slowdown itself (Grossman et al. 2017).

While we do not analyse these theories in detail, a simple empirical test can help distinguish the relative importance of these two categories of explanation – purely technology-based or not – for rising mean-median inequality and the falling labour share. More rapid technological progress should cause faster productivity growth – so, if some aspect of faster technological progress has caused inequality, we should see periods of faster productivity growth come alongside more rapid growth in inequality.

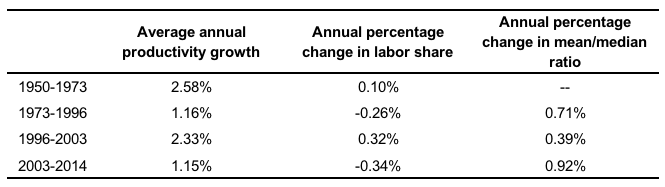

We find very little evidence for this. Our regressions find no significant relationship between productivity growth and changes in mean-median inequality, and very little relationship between productivity growth and changes in the labour share. In addition, as Table 1 shows, the two periods of slower productivity growth (1973-1996 and 2003-2014) were associated with faster growth in inequality (an increasing mean/median ratio and a falling labour share).

Taken together, this evidence casts doubt on the idea that more rapid technological progress alone has been the primary driver of rising inequality over recent decades, and tends to lend support to more institutional and structural explanations.

Table 1 Average annual growth rates of productivity, the labour share and the mean/median ratio during the US’ productivity booms and productivity slowdowns

Note: Data from BLS, Penn World Tables, EPI Data Library.

Policy Implications

The slow growth in median workers’ pay and the large and persistent rise in inequality are extremely concerning on grounds of both welfare and equity. There are important ongoing debates about the factors responsible for this phenomenon, and what must be done to reverse it.

Our contribution to these debates is, we believe, to demonstrate that productivity growth still matters substantially for middle income Americans. If productivity accelerates for reasons relating to technology or to policy, the likely impact will be increased pay growth for the typical worker.

We can use our estimates to calculate a rough counterfactual. If the ratio of the mean to median worker’s hourly compensation in 2016 had been the same as it was in 1973, and mean compensation remained at its 2016 level, the median worker’s pay would have been around 33% higher. If the ratio of labour productivity to mean compensation in 2016 had been the same as it was in 1973 (i.e. the labour share had not fallen), the average and median worker would both have had 4-8% more hourly compensation all else constant. Assuming our estimated relationship between compensation and productivity holds, if productivity growth had been as fast over 1973-2016 as it was over 1949-1973, median and mean compensation would have been around 41% higher in 2016, holding other factors constant.

This suggests that the potential effect of raising productivity growth on the average American’s pay may be as great as the effect of policies to reverse trends in income inequality – and that a continued productivity slowdown should be a major concern for those hoping for increases in real compensation for middle income workers.

This does not mean that policy should ignore questions of redistribution or labour market intervention – the evidence of the past four decades demonstrates that productivity growth alone is not necessarily enough to raise real incomes substantially, particularly in the face of strong downward pressures on pay. However it does mean that policy should not focus on these issues to the exclusion of productivity growth – strategies that focus both on productivity growth and on policies to promote inclusion are likely to have the greatest impact on the living standards of middle-income Americans.

See original post for references

Oddly missing from this article by Larry Summer and that student Anna Stansbury is mention of CEO pay increases in the same time period. There is a page at https://www.epi.org/publication/ceo-pay-continues-to-rise/ from the Economic Policy Institute which does go into the question in some depth. A helpful 30-second video clip on the same page points out that in 1965, top CEOs made 20 times their typical workers. By 2013, top CEOs made 296 times their typical worker. That and for all those executives plus all the perks and the like that go along with such jobs. Could this possibly explain where all those failed wage increases over the past 40 years went to? I’m sure that they are all totally worth it.

Blue collar labor, and labor unions, have been crushed. Ipso facto class warfare.

Bingo! That also features, and is ignored by our esteemd senior economists.

They would not want to upset their paymasters, by telling them something unpleasant.

Well said.

That is absolutely true. The authors seem to ignore the inconveniences of reality. In general I find all those regressions worthless when there are so many factors involved and do not give indications on causal effects. For instance the fact that productivity growth correlates with salary growth. How do you interpret that result? The authors argue that policies should promote productivity growth since it is accompanied by salary growth and less inequality. Why not thinking the other way around? Policies that support salary growth migth cause productivity growth (should I have written “almost certainly”?) for reasons that are evident. For instance, when workers feel they get a fair share of wealth creation, they will be more firmly implicated and productivity will increase.

So, with the very same results you can end recommending policy sets favouring productivity growth or favouring wage rises. Which of those would be more effective? My bet would be the second set.

They are, after all, economists.

Thank you for pointing out the human element in this. From my perspective, having dealt with small businesses for the most part during my career, good old fashioned greed combined with rather powerless labor are the main drivers in this part of the economic spectrum.

I doubt that CEO pay is directly enough to influence overall inequality levels or pay v. productivity.

And that increase in an effect of a different causes, which are public companies moving to stock-price linked pay and the weakening of unions and labor bargaining power generally.

So, taking Rev Kev’s figures let’s look at it in this simplistic way…

A business of 100 workers all make a dollar each and the CEO earns 20 dollars by the 1965 model.

By 2013 let’s say those 100 workers still make a dollar – the CEO gets $296. In 1965 that business would have to make a profit of $120 but in 2013 it’s $396

Now I know this is crude and oversimplified maths but the fact that the top guys are extracting ever more from the system is a very clear indication that something is very obviously very wrong with inequality and pay v productivity.

If “policies to promote inclusion” means ” middle – income Americans” need to form robust unions, I would agree: otherwise, I can’t imagine capitalist or the present government pressing for middle-income Americans inclusion.

We do not all work in factories any more. There are vast areas of our economy – mainly health care, education, and government — where wages have gone up very nicely, thank you, and productivity has nothing to do with it.

The nurse who cares for fewer patients, the professor who teaches fewer classes, the government worker retiring early — all have achieved higher average salaries.

Salaries are indeed down in the area of tradable goods that are subject to foreign competition. Salaries are up in the hothouse industries.

Even in the fabled 1950’s, salaries went up because unions were strong and could conduct strikes. Salaries went up even in factories that were notoriously inefficient.

Productivity is kind of a false god for labor economists.

Where the [family blog] is this?????

In what alternate universe are “nurses caring for fewer patients”? The one where they are all supervisory staff, and the contract temps they manage don’t count on the employment rolls? Likewise college professors. The fortunate tenured few are working less, but classes are still being taught in ever greater numbers – by adjuncts and upper level grad students.

Artfully reclassifying workers so that their labor contribution can be disappeared, despite the more work for less pay that they are actually doing….. is part of the problem.

People act as if the period after ~1980 when pay has been de-linked from productivity is some sort of aberration. I actually suspect that the period between 1945 and 1980 when they were linked was the aberration. I am NOT trying to say that we should just shrug our shoulders and say “Markets, what can you do?” But perhaps we should try to see what was special about the post war boom and emulate it rather than just try to figure out what broke in 1980.

Free markets are a tool, not some angry God that we HAVE to sacrifice our prosperity and our democracy to. There is NOTHING WRONG with deciding that we don’t like some of the answers that free markets give us and that we will constrain them to get more acceptable ones.

“Free markets”? What a fantasy!!!!!! You should know there is no such thing. The last thing any capitalist / and or system wants is “free markets”. This would force business to truly compete with each other which is the last thing they want to do. They much prefer to create “captive markets” or monopolies.

“Free trade” is a religion. And like most religions, its adherents believe that it is holy writ that can’t be questioned. And like most religions, they ignore or subvert its teachings when they are not what they want. Forcing one’s employees to sign non-compete agreements never prevents CEOs from railing against uniions as a restraint of trade. Demanding non-competetive lease arrangements for drilling on public land does not prevent Oil companies from railing against government red tape.

If you read the “country of origin” comments in Brexit, one would see that Free Trade comes with a very large legal and compliance expenses. One that would easily defeat any but the largest business.

The “free trade” regime created is “free trade for those who can afford it.”

First of all, you are mistaking “free trade” for “free markets”; they are entirely different concepts.

The religiosity around free market proponents goes both ways, with self-declared opponents of the concept often railing against it without any actual substantial understanding of what is being railed against (sort of like mixing up free markets with free trade).

For the record, none of the behaviors you list there are consistent with free market principals. So maybe instead of trying classify “free trade” (oops you meant free markets) as a religion, you should instead be denouncing the true opponents of free markets – ie, those you claim are its false prophets.

What is this difference supposed to be? Or, better, how do you prefer to use those terms, since there are other uses such that these are not entirely different concepts? For example, ‘trade’ can be used to refer to exchange of goods, either at traditional, predetermined rates, or at rates determined through haggling on the spot. Such exchange is sometimes, but not always, instituted in markets. A market might be said to be free insofar as it is self-regulating, meaning that prices are allowed to fluctuate based on changes in supply and demand. Such a market, in which trade takes place, might very well be described as free, it seems to me (though it is important not to confuse this use of ‘free’ with ‘natural’ in most any sense, as a good deal of work, including brute force, goes into creating and maintaining such markets). This freedom comes in degrees. If all inputs for industrial production are purchased in self-regulating markets, then we have the freedom for which 19th century liberals pined. It seems to me that trade conducted within such markets, whether they’re external or internal, could well be described as free. Thus, 19th century champions of free markets were quite sensibly also advocates of free trade, or so I’ve been told. In any case, you seem to want to say that these terms should be used in a different way. What is this different way, and why insist that the rest of us speak in the same manner?

You are right, I did misspeak, I did mean to say that “free markets” are treated as a religion. The concepts are related, but you are absolutely correct that my examples are not related to free trade.

Capitalist engage in “free markets” in much the same way a bank robber engages in “free banking.”

Everyone is wrong (7.5 billion people). All economists are McCarthyites. The history of macro was mapped out in 1961. Everything said became true. It is extraordinarily simple, yet too abstract for the common mind to understand. DFIs do not loan out existing deposits. DFIs always create new money when dealing with the private non-bank sector. Why is this important? Because all bank-held savings then become idle / frozen deposits. And the only way to activate voluntary savings is subsequently for their owners, saver-holders, to invest / spend directly or indirectly (e.g., via a non-bank conduit).

So, when savings are transferred thru a non-bank conduit, there is an increase in the supply of loan-funds, but no increase in the supply of money (a money velocity relationship). And for the payment’s system, there is simply a transfer of ownership of existing deposit liabilities within the system (no funds are lost or withdrawn).

So how did secular strangulation begin? In 1961 economists hypothesized that any increase in interest-bearing bank deposits would be countered by an offsetting increase in money velocity. And this was true up until the saturation in financial bank deposit innovation in 1981 (the widespread advent of ATS, NOW, and MMDA accounts). Thereafter it was hypothesized, by the same economist, that money velocity would persistently decelerate (had reached a permanently high plateau). The remuneration of IBDDs exacerbates this phenomenon. The expiration of the FDIC’s unlimited transaction deposit insurance produced the opposite flow (causing the “taper tantrum”).

So as money velocity decelerated, aggregate demand, money X’s velocity, decelerated. So how did we get a deceleration in growth? Exactly as predicted in 1961, “the stoppage in the flow of monetary savings, which is an inexorable part of time-deposit banking, would tend to have a longer-term debilitating effect on demands, particularly the demands for CAPITAL GOODs”.

In other words, the McCarthyites don’t know a debit from a credit.

Thank you for posting this very thoughtful comment.

The Quantity of Money is savings, a stock. Savings is defined as income not spent, and for the most part savings, the money we already have, is not the main driver of spending. Savings that is spent, Business Investment, is chasing new money creation, gains. Money creation drives spending. No one wants to play a game where the only money to be won was your own.

Monetary economies are income-driven, not savings-driven.

A savings-driven monetary economy would be the financial equivalent of perpetual motion.

@ paulmeli:

I think you’ve got it. Unless savings are expeditiously activated (perpetual motion of income redistribution, the circuit income and transactions velocity of funds), and put back to work, a dampening economic impact is exerted.

All savings originate within the payment’s system. Saver-holders never transfer their savings outside the system unless they hoard currency or convert to other national currencies.

Historical FDIC’s insurance coverage deposit account limits:

• 1934 – $2,500

• 1935 – $5,000

• 1950 – $10,000

• 1966 – $15,000

• 1969 – $20,000

• 1974 – $40,000

• 1980 – $100,000

• 2008 – $unlimited

• 2013 – $250,000 (caused taper tantrum)

DFI’s Time deposits vs. demand deposits:

1939……..15~~~~~~ 33

1954……..47~~~~~ 121

1964……126~~~~~ 156

1974……421~~~~~ 274

1979……676~~~~~ 401

1986…1,215~~~~~ 491

1996…1,271~~~~~ 420

2006…3,696~~~~~ 317

2016…8,222~~~~1,233

Ratio of TD/DD in 1939 = 0.45

Ratio of TD/DD in 2016 = 6.67

The U.S. Golden Era in economics was where pooled savings were gov’t insured and put back to work, largely thru the S&Ls, MSBs, and CUs. Then the DIDMCA transformed these thrifts into commercial banks (which created the S&L crisis).

Ok, that should give me enough to think about for the next few months!

This is monetarism and it has proven to be an abject failure when Thatcher and Paul Volcker engaged in monetarist experiment. Changing the money supply did not correlate with any changes in macroeconomic variables. Your claims have been falsified in actual real-world tests.

I’m going to remember how dumb you are Yves. I will become the most powerful person on earth. I cracked the code in July 1979. I know the GOSPEL. Nobody else does. Nobody.

I am old enough to remember strong labor unions. Even though at the time I wasn’t particularly interested, I remember labor struggles between the UAW and the major auto firms. Whenever a new “generous” contract was negotiated, there were always productivity strings attached. Auto execs often mentioned that wage increases need to be paid for with productivity increases. Whether there are chicken and egg issues here is not as relevant as the fact that these things were connected in the actor’s minds. It doesn’t necessarily take graphs and charts to know this.

And labor unions were not crushed by accident. They were crushed as part of a conservative plan to Make America Great for Millionaires plan. The Dems, becoming Corporate Dems(tm) at the time, offered no resistance.

Yeah, Kalecki nailed down this entire relationship as a function of union strength before it even started to happen.

CLASS STRUGGLE AND THE DISTRIBUTION OF NATIONAL INCOME -1971

An interesting article as usual, but with respect, continues to refuse to see the obvious.

When there is a tight labor market, productivity gains translate into wages because employers have no choice but to bid for scarce labor. When there is a flooded labor market, and there are a dozen desperate workers competing for every job, then employers won’t share productivity gains with workers, because they don’t have to. Period.

What happened in the early 1970’s is that the government’s cheap-labor immigration policy started to flood the market for labor. OK, there were other factors as well – the entry of women into the labor force also probably had an effect, but one is reminded that the latter is limited – once all the women are in the labor force that’s it, and the effect should stop. Not so immigration, which can keep up the pressure indefinitely.

A pity that we can’t talk about this. Because refusing to address the issue of demographics in an intelligent way will ultimately bring down not just the US working class, but the world.

I’m not sure that importing labor was more important than importing products built with foreign labor, except possibly in the farm and construction business. After all, the reason that the big three automakers could accept deals with the UAW for higher real wages and benefits was that the barriers to entry for the auto market are SO high. So they automakers didn’t compete against each other to pay lower wages to autoworkers. Instead an automaker would negotiate with the UAW and the other companies in the big-three would then negotiate deals that were similar enough to not create a competitive advantage or disadvantage versus the other manufacturers. This was quite cosy, and worked reasonably well until imports started becoming a sizeable portion of the domestic market.

right, whether we can talk about it or not, it’s not clear it is the driver rather than globalization which I suspect dwarfs the effect of immigration (which is not to say immigration has no effect, but just a matter of scale).

When I read headlines like “Technology is not to blame …” i’m always inclined to laugh (in a black humor kind of way) because its part of the endless search for simple solutions for complex social issues, and its part of an agenda to isolate and disconnect specific causes from the economics of our corporate environment (the economy) – thereby absolving human decision making of any blame; heck it was just technology after all, that mysterious, independent and neutral force. It’s like reading a comic book.

The economy has been massively distorted for years by a] short term profit taking (i.e. just making money) b] the elimination of strategic industrial processes, and most importantly c] the overwhelming problem of military spending (both official and unofficial) which works on a cost-plus basis, produces essentially nothing of use to society and thereby drains us of the innovation, resources and the social reproduction we need.

Not to belabor the point, but the best reference for all of this is Seymour Melman’s book “Profit without Production” from 1983, in which he analyzes the problems in such a manner that, except for his examples (which are old), one can use his analysis and conclusions word for word today – that’s how correct they were. By the way, his analysis traces the onset of this to the 1950’s.

Stagnant wages have nothing to do with technology and its sad to see that PhD students are wasting their time on such tripe. Its part of the never ending search for technical solutions to what are essentially problems in political economy, social dynamics and human psychology.

A better topic would have been real industrial and political analysis as pursued by Melman, Lazonick, Chandler and others.

Let’s not forget the Fed.

“Alan Greenspan saw the fight against rising prices as, at its essence, a project of promoting weakness and insecurity among workers; he famously claimed that “traumatized workers” were the reason strong growth with low inflation was possible in the 1990s, unlike in previous decades.

Testifying before Congress in 1997, Greenspan attributed the “extraordinary’” and “exceptional” performance of the nineties economy to “a heightened sense of job insecurity” among workers “and, as a consequence, subdued wages.”

Yes – the Federal Reserve has acted as hit-man for the neo-liberal program.

Another aspect is the blind assumption by the authors that productivity has increased , IT is somehow related to that and that increased productivity should imply better wages. Also, there is no mention of the famous IT Productivity Paradox which has been discussed endlessly in the literature, Nor do they address the fact that practically all productivity gains (in terms of revenue) have been vacuumed up by the top 10%.

So one of my questions to the author of this paper is, exactly what are they defining as productivity increase in the first place and what does that have to do with social welfare?

I.e. state their position on some of the embedded assumptions.

Whatever the measuring stick may be, its pretty clear that IT has not improved the lives of many people in the US, as witnessed by the poverty levels we are seeing today., and the question as its framed seems somewhat nonsensical to me. It’s not even clear that IT has anything to do with productivity or overall earnings levels.

On a simplistic level: If productivity is measured in terms of revenue only (generally that’s true) irrespective of origin, i.e., asset appreciation, rent, tax credits for foreign subsidiaries and so on all count, then it should be clear that it will be difficult to find any correlations due to the extreme financialization of the economy and other dynamics.

A more nuanced view includes the understanding that traditionally productivity was achieved through constant process and technology innovation, which included an increase in worker skills and allowed cost optimization, leading to higher pay and better products. Furthermore it was strategic marketplace behavior for competitive advantage and not just “money making”.

Computing being such a generalized and non-specific function could easily fit into this paradigm, however it has to be tailored to specific industrial processes in order to have a real impact. That really hasn’t happened due to the use of commodity (therefore non-optimized) systems and a lack of foundational training as to what a computer actually is.

It’s really not enough to just buy computers, networks, databases, build IT departments, etc. and expect any kind of productivity improvement (except for the computer vendors). The hard work of re-engineering processes, training people, structuring IT operations, and integrating computational functions into business process is hardly ever done properly. To compound this problem, business is caught in a never ending torrent of hardware and software upgrades, security issues, etc. which have nothing to do with their core business and are just overhead.

Its hardly surprising that we don’t see productivity increases overall since the IT industry itself is somewhat cannibalistic in that regard.

So I find the whole approach bankrupt it the first place – just rounding up the usual suspects, creating a smoking gun distraction, but not really trying to solve the crime. What remains is wage stagnation and poverty that has nothing to do with technology and everything to do with the neo-liberal program.

Are the productivity gains we’ve seen over the years not the direct result of decreases in total worker compensation? The investment community insisted that worker compensation fall years ago so they could reap the rewards. All it took was one CEO to get the ball rolling. The others had no choice but to follow along.

“There’s class warfare, all right, but it’s my class, the rich class, that’s making war, and we’re winning.” —Warren Buffett (The New York Times; November 26, 2006)

“Actually, there’s been class warfare going on for the last 20 years, and my class has won.” —Warren Buffett, (The Washington Post; September 30, 2011)

“My Class Has Won… It’s Been A Rout.” —Warren Buffett, Huffington Post; November 15, 2011

I appreciate Mr. Buffett’s candor. What else does one need to know as to “Why” wages have remained stagnant for decades despite the increases in productivity? How that has been done and is continuing to be done is enlightening as to how they and their system work, but that is all.

Perhaps more importantly, though, it might be useful for those in Buffett’s class to ask themselves exactly “What” they’ve “won” and taken from most Americans who were utterly unaware they were the targeted victims in a class war. The opioid epidemic, levels of obesity in young people, environmental degradation, declining levels of educational attainment, falling home ownership rates, earlier mortality, incarceration rates among the general population, and low levels of discretionary income come to mind as potentially accurate barometers. There are others.

Basically this is a very roundabout way of saying that the rich took it all for themselves.

This was through a combination of union busting, lobbying, free trade (ez: send jobs to where wages and other regulations are weakest), right wing types in government, ruthless short term profit orientation, and frankly, greed.

It is only now that the magnitude of the problem has left capitalism in a legitimacy crisis that we are seeing economists ask the hard questions. They ignored these issues and advocated like a Progressive machine for the rich for many years.

Oh and this paper all but confirm ls that the claim that it is robots rather than bad economic and bad trade policy is completely a lie conjured up by rich people desperate to escape the blame they rightfully deserve.

Might be illustrative to update the chart to decouple FIRE sector productivity

Too bad these authors are not as skillful as the authors of

INEQUALITY AND VIOLENT CRIME

https://siteresources.worldbank.org/DEC/Resources/Crime%26Inequality.pdf

Slightly different topic, but the statistical sophistication seems to far exceed anything that Summers and Harvard can do.

Very late in posting this comment but has anybody modeled what the US economy would be like by now if wages had not flat-lined back in the 70s but had maintained pace with productivity? Just off the bat, I would assume that the late 20th century credit boon would not have been so significant but beyond that just I don’t know. I thought that at first this may have been simply a case of “what-if” but such a study might have shed light in how the US economy developed over the past half century.

FALLING TAXES ON THE RICH.

I’m an amateur economist, I aspire to armchair status, and even I can see the correlation.

It’s so obvious that the author’s failure to address it seems deliberate.

Technology is the reason for decreased jobs, jobs being made obsolete. Stagnant or decreasing wages is due to our Capitalist Owners whom know exactly what they are doing. Squeezing blood out of rocks, we are the rocks.