An important story in Reuters (hat tip Scott) described how the current expansion, in a break with the past two decades, depends on the spending of lower-income households, and that spending in turn is heavily dependent on rising debt levels. The bottom line is that the last two years of growth were brought to you by subprime borrowing.

The Reuters piece, by Jonathan Spicer, also argues that the sell-by date of this unsustainable subprime-debt-fuelled growth may have been postponed by the Trump tax cuts. If anything, the picture may be even worse than that view suggests, since some experts, as well as our own readers, have said in some, perhaps many cases, the cuts in income tax withholding looked high relative to the taxes that would be due for 2018. In other words, more taxpayers than in the past may find themselves hit with unexpected tax bills come April.

Independent of whether bigger debt millstones around the necks of subprime borrowers are a harbinger of a slowdown, high levels of personal debt are a negative for growth. Personal borrowings are almost never productive. Even the often-hyped examples of borrowing for education or borrowing to start a business are overhyped. With higher eduction overpriced and the punishment for missing a payment draconian, the merits are at best debatable, and that’s before you factor in the risk of graduating during a recession or crisis. Similarly, since 90% of new businesses fail in three years, pray tell why is borrowing to start one a sound idea?

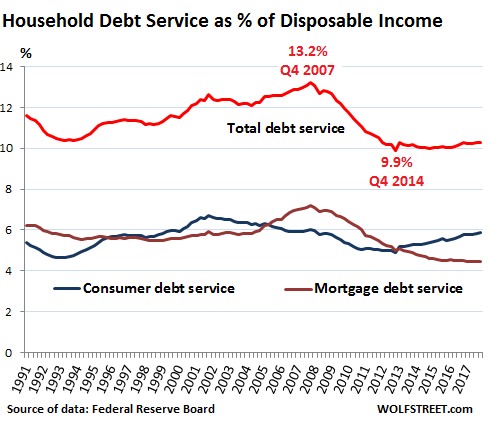

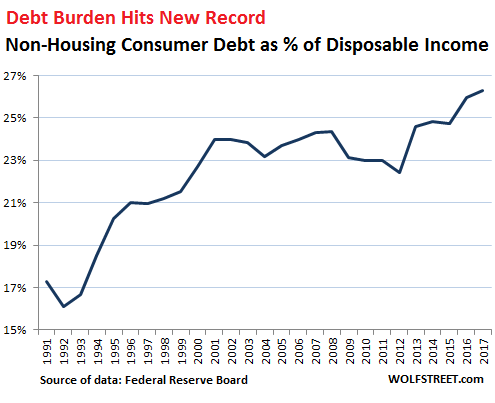

Two months ago, Wolf Richter provided some aggregate data on household debt levels:

So the ratio of non-housing consumer debt to disposable income – the burden these consumers carry on the backs in relationship to their incomes – is higher than ever, and only historically low interest rates have kept it manageable.

But interest rates are now rising, and many of these consumer debts have variable rates.

This explains a phenomenon that is already appearing: How this toxic mix – rising interest rates and record high consumer debt in relationship to disposable income – has now started to bite the most vulnerable consumers once again. And for them, debt service is getting very difficult.

In Q1, the delinquency rate on credit card debt at banks other than the largest 100 – so at the 4,788 smaller banks – spiked to 5.9%, higher than at the peak during the Financial Crisis, and the credit-card charge-off rate spiked to 8%. These smaller banks marketed to the most vulnerable consumers that had been rejected by the biggest banks.

Key section of the Reuters story, which I urge you to read in full:

A Reuters analysis of U.S. household data shows that the bottom 60 percent of income-earners have accounted for most of the rise in spending over the past two years even as the their finances worsened – a break with a decades-old trend where the top 40 percent had primarily fueled consumption growth….the rise in median expenditures has outpaced before-tax income for the lower 40 percent of earners in the five years to mid-2017 while the upper half has increased its financial cushion, deepening income disparities. (Graphic: tmsnrt.rs/2LdUMBa )…

As a result, over the past year signs of financial fragility have been multiplying, with credit card and auto loan delinquencies on the rise and savings plumbing their lowest since 2005…

In the past, rising incomes of the upper 40 percent of earners have driven most of the consumption growth, but since 2016 consumer spending has been primarily fueled by a run-down in savings, mainly by the bottom 60 percent of earners, according to Oxford Economics….

With inflation factored in, average hourly earnings dropped by a penny in May from a year ago for 80 percent of the country’s private sector workers, including those in the vast healthcare, fast food and manufacturing industries, Bureau of Labor Statistics figures show.

This anecdote gives an idea of what that bottom 40% looks like:

Myna Whitney, 27, a certified medical assistant at Drexel University’s gastroenterology unit in Philadelphia, experienced that firsthand.

Three years ago, confident that a steady full-time job offered enough financial security, she took out loans to buy a Honda Odyssey and a $119,000 house, where she lives with her mother and aunt.

Since then she has learned that making $16.47 an hour – more than about 40 percent of U.S. workers – was not enough.

“I was dipping into my savings account every month to just make all of the payments.” Whitney says. With her savings now down to $900 from $10,000 she budgets down to toilet paper and electricity. Cable TV and the occasional $5 Groupon movie outings are her indulgences, she says, but laughs off a question whether she dines out.

“God forbid I get a ticket, or something breaks on the car. Then it’s just more to recover from.”

The foundations of this “recovery” have looked shaky, and this data confirms these concerns. But when and how fast things unwind is anyone’s guess, particularly with wild cards like trade wars, emerging market crises, China deleveraging and Brexit collateral damage in the mix.

It is beginning to look as if all of the “wild cards” you mentioned in the last sentence might hit at about the same time. Probably, one hits first and a domino effect then plays out.

The other “wild card” I have not seen mentioned is the cost of energy. If the Neocons get their war with Iran, watch oil spike into the stratosphere. Then the Strategic Reserve will either have to be used, or, another neo wet dream, “saved” for strategic dominance motives. I don’t know the break point, but, at some point, increases in shipping costs associated with oil price spikes will shut down e-commerce. With ‘brick and mortar’ stores disappearing rapidly, nothing will be around to take up the slack and the economy will grind to a halt.

Fun days ahead.

So Cal is already experiencing a crash in housing prices and volume. The bottom 40% are getting desperate trying to keep up with all the expenses. The whole house of cards is ready to go all it needs is a bigger push.

So I saw a little story on the local news…uh, newsworthy because it actually dealt with the desperation of working people. I can’t remember last when I saw such a story.

It was about migrant farm workers who work in vineyards and trim the vines. They get paid a nickel for each vine they trim (apparently this is bending over to trim off the sprouts at the base of the grapevine – it looked brutal). Do the math and it is a tremendous amount of work for not very much money.

Now, the restaurant workers (and this is at upscale places with good tipping) I talk to don’t have it nearly so difficult, but the schedules are erratic and unreliable, and benefits non-existent. I think most working people live lives of quiet desperation…and can only pay rent and groceries. All the other stuff in the economy only exists because of debt and at some point these people’s borrowing capacity will be exhausted.

Good reason God had the rich Israelites forgive all debts of those less fortunate. At some point there will need to be a total worldwide reset. It can be orderly or disorderly. I would prefer orderly but something tells me its not going to happen.

And for the people who have avoided debt, bought used cars, and refrained from buying that “dream home”…?

I’m sympathetic to the argument but principle reduction always rankles me. It would be interesting to see what that rising consumer debt entails. I’d wager it’s not just the basics. That said, who doesn’t want to enjoy nice things when not toiling away, so no judgment there–just an argument for something more transformational than the occasional jubilee.

In 2008, and regularly since, there have been many voices raised about the impoverishment of the lower 80% and their growing debt burdens. My guess is most of those voices would have taken bets that the bubbles (stock market, real estate market, etc.) would have burst catastrophically by 2017. But somehow the repeat of the 2008 crash hasn’t happened, at least not overtly. Perhaps it’s the lack of some marquis fiasco the Lehmann or Bear Stearns that keeps the curtain from being pulled on the Wizard.

I’m sure none of these dire observations and warnings about debt go unnoticed by the TPTB. While I suspect they don’t really think that next time around they can just start printing money again, a la 2008, I would be really surprised if they didn’t have some kind of plan to deal with next crisis, other than decamping to Tasmania, and I wonder what that plan might entail.

Who knows? Maybe they’ll back into embracing some perverted form of MMT and say that it’s ok after all to just print more money with, perhaps, a heavier emphasis on the trickle down part of the program.

Why mess with what works? Print money for bailouts then inflict austerity to improve worker desperation and obedience. That’s nothing but win.

I have not seen much written about the possibility of lots of people having bigger tax bills than expected next April but I suspect it will be the case. And while the GOP may shrug it off as only being liberal elites in blue states being affected, those people are buying products that are made all over the country. Every additional dollar that they now pay in taxes is a dollar they aren’t spending on vacations, new cars, etc.

This additional tax bill or lower refunds ( I think it will be the lower refunds that effect people the most ) will not happen until Q1 2019, after the mid-term elections.

Does anyone know if there is data that is broken down further by income level or population segments? The data charts do not give enough sense of perspective on the situation for me; If For example, seeing houselhold mortgage payments at 13% of disposable income in 2007 does not inherently sound bad to me ; but if the aggregate number was broken down, and that showed that 20% of the population is paying 80% of its income in mortgage payments, this would be much more illustrative of a potential problem.

Thank you to anyone who can help

TCM recently aired a 1950s movie called “No Down Payment.”

It was about the post war creation of suburbia in a lot of ways (dramatized in a soapy way), but the economy it showed has been discussed on NC.

I focused on the economics of the era rather than the soapy drama.

The movie showed how the GI bill was responsible for alot of communities with “No Down Payment” loans. Not once did I get the impression that these were adjustable rate loans that would be “gotcha” down the line. It attracted young couples and young families and lots of rules about keeping out others (a Japanese employee -also a US war vet – of one of the inhabitants of a particular community is being kept out and wants his employer to help him be admitted).

The movie also focused on class, the different classes of people in the particular community, such as the working-stiff striver vs the highly educated young scientist.

But here is the storyline that propped me up in my seat.

Another of the young couple consists of a man who always dreams big. He doesn’t want a regular paycheck job, he’s a salesman type who wants the big score. You immediately grasp that he and his wife are living above their means. His employment at the time is as a car salesman – the commissions is where he sees his chance at big scores – but sales have been slow. His bills are tight and the wife (who really loves him no matter what) is complaining. One day an older (not exactly elderly, but older) couple comes to buy a used car. They are poor. But the salesman convinces them they can afford that car they were looking out with low monthly payments. The older man says he’s had trouble getting a loan. No worries , says the salesman as he walks them into his office.

Later in the movie, after the salesman has beemed with pride that he now has some cash to his wife, there is a knock at his door. It’s his boss with the older man who had bought the car. The boss proceeds to lecture the salesman – in front of the customer -about his business practices and the high-interest (and subprime) loan he tried to saddle the old man with. He said that if word got atound he was dishing out these kinds of loans from disreputable sources, he’d be ruined. Then he made him give money back to the customer (and I imagine he killed that loan after he got a look at the paper work).

I said “wow.” Then I wondered if the boss would have done the same thing if the loan had been saddled around the neck of the Japanese family that wanted to move into the neighborhood.

But the jaw-dropping part of the movie was how rape was handled back then. Yes, one of the characters is raped and how it’s dealt with is cringeworthy. Come to think of it, that attitude for dealing with rape is culturally ingrained.

So, how was rape handled?

One reason that the G.I. Bill had to be created was that tens of millions of men who had recently been trained to use weapons, who almost died, who knew how to kill, who probably had Dad’s deer rifle in the house or far more weaponry, treated like a set of tools back then, were back from the war and in the saddle and wouldn’t put up with any nonsense from shylock car dealers or parasitical profiteers of any kind.

An armed society that doesn’t take shit is a protected society.

Now? We get returning “heroes” in small numbers who get to reapply to their Walmart jobs, take on onerous loans, apply on base for food stamps and what have you.

But Myna’s surprise at her situation makes no sense. Basic math reveals that she’s going to gross just under $34,000 a year. That means she’s taking home around $2250 per month or less, depending on state and local income taxes.

Her car payment is going to be at least $700 and her mortgage payment with taxes and insurance is going to be at least $1000. At best that leaves her about $500 per month for everything else.

Of course both loans are subprime and should never have been made, but what the family blog was she thinking?

My car payment is <$250 a month. Better check your assumptions there, GlobalMisanthrope.

Not everyone buys a $30,000+ "new" car.

You’re right. I was basing it on a 2018 Honda Odyssey and it doesn’t say that her car was purchased new.

All the same, let’s say it’s used and she has a note as small as yours. 800 bucks for utilities, phone, Internet, gasoline, auto maintenance, food, sundries, body and hair care, shoes and clothing? Plus employee share of health insurance and out-of-pocket health-related expenses such as meds and supplements…

That may well work out in a given month, but that definitely is not sustainable. It just doesn’t add up. And that’s before we get to needing a plumber…

I did a similar calculation and could see no justification for Myna Whitney’s $10K self bailout given her income. There are expenses missing from this tale or somebody’s nose is growing. In fact, none of the article’s financial sob stories compute. I am willing to suspend disbelief after reading the John Beshears, et al. NBER Working Paper (24854) reviewing behavioral household finance.

After reading his looong review, it is hard not to conclude that household financial problems in the US present a picture of serial stupid household financial decisions. The literature Beshears cites betrays widespread ignorance among Americans about loans and compounding, as well as about investing (rationalizations for not doing so). The Reuters article pretty much supports that conclusion.

If I was Alex Jones, I might conclude that the Trump’s evanescent tax cuts were actually a conspiracy intended to con his quite ignorant base until after 2018, when they are quite likely going to be writing a check to IRS for the first time vs getting one back.

If Trump really wanted to help the middle class, he would use his wealth to send every tax filer a copy of Harold Pollack’s The Index Card. But hey, if you are a billionaire, you likely know something about finance, or, have people for that :-).

Also, what about your insurance cost? Most car notes require a certain coverage and it’s paid as partbofvtge monthly note.

Or are you telling me that includes insurance? And if it does, where do you live? I’m moving.

I suspect her mother and her aunt, who were sharing the home with her had some income and maybe some assets to throw in the pot, so it is not correct to focus solely on Myna’s cash flow alone. Regardless, the fact that three adults, living together under one roof can’t find a reasonable way to live with a minimal amount of comfort tells all we need to know – or do you disagree?

But they really should be able to live with a minimal amount of comfort if they live within their means (assuming there’s not some other liability, ahem.. student loans or medical costs.. that wasn’t mentioned.)

The mortgage is 600 a month, plus another couple hundred for taxes and insurance. You can lease a new car for under 200$ a month. That leaves about1000 for food, utlities, other comforts, and hopefully savings. And that assumes the other adults aren’t getting anything like food stamps or social security

They may well be struggling if they hit other bad luck or took out massive student loans. But that would be (and is) the bigger story

No! I agree completely. I just don’t understand how or why it’s a surprise.

I’m deeply troubled that so many people don’t seem to get that living within one’s means is a matter of basic arithmetic. Lots of magical thinking going on out there. That’s all.

The economic injustice in this country is reprehensible. But I can’t help but wonder if we couldn’t get to change faster if everybody could get their heads around how little means most of us have.

Totally. No matter how good the bread or entertaining the circus, it’s all part of the distraction.

Tack on another $100 for insurance. Plus gas (will depend on her commute/local…)

Trust me, Global…you don’t want to move here! Housing alone is the killer!

SF Bay Area…

I also assumed it was a new car. I don’t have evidence for this, but I’m amazed how profligate people are with cars in the US. Just look at the extent of advertising. It’s insane.

GlobalMisanthrope’s comment touches on an important point about financial literacy. That’s an important part of the picture when it comes to the bottom 60% and how they are exploited.

Everyone should try a little thought experiment in which everyone in the U.S. overnight became thrifty, buying only the necessities, pinching every penny, living within their means etc. etc. and reflect upon how that situation might affect your source of income and that of others you know and care about. I’ve conversed online with an engineer in the auto manufacturing field who has regularly had scorn and derision for the “idiots” who take out exploitative loans to buy cars. Eventually I got him to consider that (with the change in the distribution of wealth and productivity gains over the last few decades) that those “idiots” are probably the only thing keeping his industry going and keeping him employed.

The lower consumption would be great for the planet but without some pretty major changes to our politics and society it would be pretty awful for almost every person.

Why should that mortgage not have been made. Assuming she could come up with 20% down payment the monthly mortgage is 20% of her monthly income. A google mortgage calculator tells me 563$

I was surprised that she only was only making $16.47 an hour as a medical assistant, a job which I assume requires some skill and training. I guess I’m out of touch.

I think NC had a write-up about that.

“That” being the more your job involves service or helping others, the less its valued and much of that due to it being perceived as “feminine” and not “masculine” work (although I sure alot of firemen could use raises).

I’ve posted a number of positions here that require often a masters degree and often a PhD that start in the mid-30k range. Sometimes even lower wages than that.

Any position that pays well comes with other experience that is incredibly specific such that nearly no one would have it.

I’m not sure I understand. Total household debt service has been coming down since the “Great Financial Failure” and is now historically low, at least back to 1991 from the above graph. It does appear that mortgage debt has been decreasing while other debt (cars,credit cards etc) has been increasing, but overall debt level with respect to disposable income has come down.

Given that income/wealth growth has skewed to the top 5%, my hunch is that,

yes in the aggregate, leverage is going down.

But, if you make the same chart using only debt/income for the bottom 50%, you’ll see the leverage.

I would have thought that the Fed staff economists would be eager to paint a clear picture/give a nuanced view. They should have all the raw data.

Oh wait, it’s a a feature, not a bug.

I don’t consider it a good sign if the increase during the last two years were due to subprime lending.

I can imagine the vultures salivating up there in the sky. Another upwards wealth redistribution is taking shape

We’ve been waiting and waiting for the next financial crisis for about 10 years now; there will be no future financial crisis because fraud and corruption have become part of the makeup of finance. How can a crisis occur or how can reparations be made when all the rules are in favour of finance? The economy will slowly but surely erode with a myriad of disasters brought about by deregulation, institutional dismemberment, injustice aplenty and trade wars that are now being encouraged or created which will eventually siphon off all the wealth to the wealthy.

“We’ve been waiting and waiting for the next financial crisis for about 10 years now; there will be no future financial crisis because fraud and corruption have become part of the makeup of finance. How can a crisis occur or how can reparations be made when all the rules are in favour of finance?”

When a crash becomes politically beneficial for a faction, a crash will happen.

And there will be those that strike gold on the pain…a feature, not a bug.

Yves was mentioning yesterday that she anticipates that the next crisis will be economic more than financial.

I’d love to hear more about this distinction. Depending on the circumstances, any sort of crash – pain not withstanding – might be better than a gradual grinding down where there’s more despair than anger.

If only we had had someone serious about “hope and change” when pitchforks and torches were close at hand.

Even the winding down has a political timing…

“…slow and grinding…” is what the plan is…..so the frog doesn’t notice the heat being turned up….!!

What’s up here with this “Printing Money” as if we need a shortage to keep us all properly miserable?

“Congress Votes the Bill & the Treasury provides the Money.”

There is simply a fear of big numbers. Too much to count for an amateur at counting is part of the problem.

Imagine what would have happened if Obama & Geithner had let the gamblers of Finance fail, or reorganize on their own? Instead of voting to give the parasites insurance money, (We are the reinsurers of the reinsurers.) Since becoming “reinsurerers” of the parasites, now that is all the Treasury is for. Neat huh?

Imagine instead of giving cash to the parasites so they could buy all those 9 million homes they foreclosed on and raise rents, Congress had voted to end variable rate loans and locked in lowest monthly mortgage? Imagine if Congress had Voted to spend on the bridges & highways trains and all that big Infrastructure stuff? & what if Congress had voted to pay for higher education and stop the wage slavery situation that inhibits quite a bit of experimentation.

“No Garage, No Garage Band.”

The Trump Administration Treasury Policy: “States have to get used to doing without the US Treasury.”

Stupidest thing any Treasury Secretary has ever said.

There will be no Infrastructure spending that puts money into peoples pockets unless the parasites get to take the bulk of the money and continue to privatize profits and make the public pay with desperation from debt along with forfeiture of anything they have good & share.

Living within our means, huh? Well, my “basic” monthly expenses, if you will, come to about $2,100. This is AFTER taxes. Mortgage $875/month (cheap condo). Homeowners insurance $50/month. No car payment; drive a 15-year-old fuel efficient Toyota. Car insurance (liability only) is around $50/month. Umbrella insurance $12/month. Condo association fees $210/month. Health insurance paid by employer, at least for now. Limited basic cable, phone and internet $90/month. No smart phone; just a flip phone. Property taxes $120/month. Utilities average out to $100/month. Gasoline about $50/month. Groceries for one, about $80/week or $320/month. Zero vacations. Zero meals out. Charitable contributions about $130/month. Personal care about $100/month. The rest is mad money. Pray tell, where do I cut expenses? This cannot last.

A great point of reference that sustains the above argument:

Barba, Aldo and Massimo Pivetti. 2009. “Rising Household Debt: Its Causes and Macroeconomic Implications—a Long-Period Analysis.” Cambridge Journal of Economics 33(1):113–37.