By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street

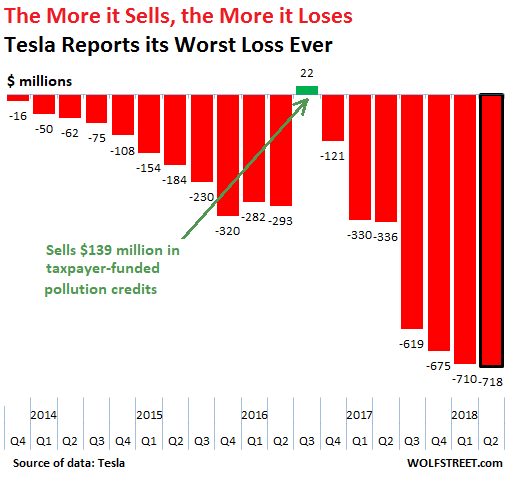

Tesla never ceases to astound with its hype and promises and with its results that are just mindboggling, including today when it reportedits Q2 “earnings” – meaning a net loss of $718 million, its largest net loss ever in its loss-drenched history spanning over a decade. It was more than double its record loss a year ago:

The small solitary green bump in Q3 2016 wasn’t actually some kind of operational genius that suddenly set in for a brief period. No, Tesla sold $139 million in taxpayer-funded pollution credits to other companies, which allowed it to show a profit of $22 million.

Tesla adheres strictly to a business model that is much appreciated by the stock market: The more it sells, the more money it loses.

Total revenues – automotive and energy combined – rose 43% year-over-year to $4.0 billion in Q2. This increase in revenues was bought with a 113% surge in net losses. When losses surge over twice as fast as revenues, it’s not the light at the end of the tunnel you’re seeing.

In between the lines of its earnings report, Tesla also confirmed the veracity of the many videos and pictures circulating on the internet that show huge parking lots filled with thousands of brand-new, Model 3 vehicles, unsold, undelivered, perhaps unfinished, waiting for some sort of miracle, perhaps needing more work, more parts, or additional testing before they can be sold, if they can be sold.

But these thousands of vehicles were nevertheless “factory gated,” as Tesla said, to hit the 5,000 a week production goal. And so they’re unfinished and cannot be delivered but are outside the factory gate, and Tesla didn’t totallylie about its “production” numbers.

Now it put a number on these “produced” but undelivered vehicles: 12,571 in Q2 on top of the 4,497 in Q1, for a total of 17,000 vehicles sitting in parking lots. So here we go:

It said it “produced 53,339 vehicles in Q2 and delivered 22,319 Model S and Model X vehicles and 18,449 Model 3 vehicles, totaling 40,768 deliveries.” The difference between what it “produced” and what it delivered is 12,571 vehicles.

Sure, some are in transit, etc.

But this discrepancy started with the Model 3. In Q1, Tesla “produced” 34,494 vehicles and delivered 29,997 deliveries. In other words, it “produced” 4,497 more vehicles than it delivered.

But in Q1 2017, before the arrival of the Model 3, Tesla produced 25,418 vehicles and delivered 25,051 deliveries. The difference was a logical 367 vehicles.

In Q1 and Q2 combined, Tesla “produced” 87,833 vehicles and delivered 70,765 vehicles. The difference: 17,068 vehicles. They’re now stuck on various huge parking lots somewhere. How unfinished or problematic are these cars? When can they be sold? Canthey all be sold?

If they’re all Model 3 vehicles with an average cash price of $50,000, then Tesla has $850 million tied up in these unfinished cars.

This is the result of its unabated “manufacturing hell,” as CEO Elon Musk had aptly called it, combined with the absolute and existential necessity to do whatever it takes to pump up its stock price.

Those touted production numbers of 5,000 vehicles a week were used to keep shares from collapsing. So 17,000 unfinished vehicles were “factory gated” over those two quarters and are now sitting outside the factory gate but cannot be sold. Compare this to the 18,449 Model 3 vehicles Tesla claims it “produced” in Q2.

SEC, are you checking into this?

Then there’s the horror story of cash flow. Tesla burned $812 million in cash in the quarter: $130 million in its operations and another $682 million with “capital expenditures,” “payments for the cost of solar energy systems, leased and to be leased,” and “business combinations.”

It also raised $399 million in various financing activities, including from borrowing and the sale of asset-backed securities.

On net, its cash-burn less the money it raised pulled down its total cash-on-hand by $436 million in three months, to $2.24 billion as of June 30.

Tesla has borrowed a lot of money from a lot of folks: $942 million from its customers via deposits; $11.6 billion in long-term debt and capital leases, including the current portion; and $2.6 billion in “other long-term liabilities.”

Oh, I almost forgot: In the overall global auto market, Tesla gets lost as a rounding error. It’s total deliveries in the quarter of 40,768 vehicles amount to a market share of about 0.2% of the 20 million or so cars delivered in Q2 globally.

Tesla is just an amateur niche manufacturer in a world full of pros. And that would be OK, except for its idiotic market capitalization of around $50 billion, its ballooning mega-losses, its cash-burn, and the fact that it is jimmying its production numbers in an existentially desperate effort to pump up its share price.

A high share price is the crux to Tesla’s survival. Given its cash burn, Tesla must constantly find new investors and creditors to hand it more fuel to burn. Without this fuel, Tesla will burn out. This works only if the share price is very high: Creditors think that a high share price guarantees the debt because Tesla can always sell new shares to raise more money to service its debts; and shareholders think that a high share price begets an even higher share price. And the institutional crowd has too much invested in Tesla, and they cannot bail out without causing the share price to collapse, thus hurting their own gains. So the circularity must be kept alive at all cost.

GM, Fiat Chrysler, and Ford all got ugly in unison, in one day, something we haven’t seen since the Financial Crisis. Read… Carmageddon in Detroit

what could go wrong? only the mother of all lithium-ion battery fires. it would be days before any fire company could get close enough to survey the damage.

https://www.zerohedge.com/news/2018-07-11/tesla-whistleblower-accuses-company-overstating-model-3-production-figures

I think that it was Arizona Slim that pointed out that all these cars stored in parking lots will not stay in pristine condition but will start to deteriorate over time. I think that he called it “lot rot” in his description.

Excellent point about the possibility of a battery fire getting out of control. I am trying to imagine hundreds of parked Teslas going off in a chain like Chinese firecrackers and they may need to call in those aerial water tankers to help bring such an inferno under even partial control – maybe.

Yes, that was me. And lot rot is a thing. Car dealerships want to avoid it — for obvious reasons.

Car buyers also want to avoid it. Link:

https://axleaddict.com/auto-sales/How-to-Avoid-Lot-Rot-When-Buying-a-New-Car

“aerial water tankers” – nope! Lithium + water = highly exothermic reaction.

Think of the insurance payouts!

imagine elon submitting the claim:

elon: errrmm, 1,500 model s automobiles were damaged by fire today.

gecko: how did the fire start?

elon: errrmm, well, one of the model esses had a faulty battery pack and self-combusted.

gecko: how did the fire spread?

elon: errrmm, well, the model esses were parked too closely together.

gecko: have any other tesla’s spontaneously combusted before?

elon: errrmm…….

gecko: denied.

capitalism at work, right!? Markets are efficient at capital allocation..and other nonsense.

I toured a Tesla 3 the other day. For a $50 to $75,000 car (the $35 stripper model is just a marketing teaser), in my opinion, it looked no different than a $20,000 econobox.

it just isn’t a good looking car. many people [especially at the high end] are vain. How many more cars can Elon push with a Mies-ian minimalist interior and frumpy exterior?

PS, the model 3’s minimalist interior will be jarring to many people. There’s a reason why that there isn’t overwhelming demand for Mies-ian/”Grand Design”-style glass and steel box houses—-to many it’s sterile, boring and unwelcoming. https://www.bbc.co.uk/programmes/b0074nxb

your mileage may vary.

I’ll stay with my 2 year old Golf Sportwagon, $22k out the door. 40MPG on a modest run, and I know that in 5 years time I’ll be able to repair it.

I will never buy a car requiring OTA firmware updates.

I haven’t really paid much attention to Teslas, and I really don’t know what the interior looks like. But these are the cars where the doors open upwards? Is that correct?

I’m guessing that’s the main draw. It shouts out: Look at Meeeee!!!!! Plus: I spent ton$ of moneeeeey on my caaarrr!!! I’m soo cool.

Every now & then I see one of these bogus looking cars and have a reaction similar to what I have when I used to see all of those zillions of gas-guzzling, super uncomfortable, very stupid-looking Hummers back in the day (nowadays I only see Hummers once in a blue moon): there goes stupid).

There is nothing as good as a Lexus hybrid. These Tesla vw’s are way overpriced and the car is a fudge. Go Lexus hybrid every time.

Tesla has lots of storage space….in orbit!

Like the share values…watch out for asteroids!

If it looks like a Ponzi, quacks like a Ponzi, it’s a Ponzi. Time to hand over the drawing board Elon.

Someone did find a lot full of Teslas apparently just sitting there:

https://twitter.com/devtesla/status/1020051847762071552

In the high priced segment, they are demand rather than production limited.

maybe that’s why musk was so pissed off that the thai rescue team didn’t use his submarine; he wanted good publicity to distract from the tesla woes.

Due to the federal tax credit structure, Tesla was strongly motivated to delay selling/delivering cars until after the end of a quarter.

Once they hit 200,000 cars sold to American customers, their cars qualify for a $7500 rebate for the remainder of the current quarter, and the next quarter. (Then it drops to half for a while.)

So by delaying shipments to US customers from June to July, they extended the rebate window by 3 months.

This and Ranger Rick’s comments are probably both true – anything to keep the $7,500 rebate and make the 5,000/week target.

Wolf takes the attitude that Teslas and EV’s are a “niche” market. While that may currently be true, EVs are the fastest growth segment in the coming decade and Trump’s ending of the increase in average fuel economy will have minimal effect and may even accelerate the adoption of EVs. Mercedes has 10 models coming,

https://www.greencarreports.com/news/1117999_mercedes-benz-eqs-caught-in-spy-shots

BMW a half dozen, Volvo or Jaguar are going all EV, VW has to atone for the diesel lies, and the Chinese are coming – BYD (Warren Buffett) and EV long haul rigs are being tested. Wolf is missing the handwriting on the wall and only the Kochsuckers think that coal is going to make a comeback and make electricity coal based.

A couple of good EV websites are:

https://www.greencarreports.com/ which is relatively unbiased and

https://insideevs.com/ which are Tesla fanboys.

In the small CA town of 66,000 where I work at the municipal utility, the number of electric (PHEV and BEV) has gone from 200 to about 750 in the last couple of years. It will be interesting to see how growth increases as the rebates go away and if the fuel economy requirements drop.

On the bright side, you may be able to buy a $1,500 carbon-fibre Tesla surfboard. That way you can go surfing while you are waiting for your Tesla car to be delivered. No word if Tesla cars will have surfboard racks as an option.

“SEC, are you checking into this?”

The way this administration is run, does anyone seriously think that they would go after someone for, well, anything?

On the other hand, I could see Trump going after Tesla out of sheer spite.

The issue is actually that they are demand limited.

That may sound surprisingly, but let me explain. They have over 400 thousand reservations, but that was based on the promise of a $35,000 USD vehicle. Right now they are selling >$50,000 USD vehicles. The demand for that is small and in danger of becoming exhausted.

The problem is that the company is going to struggle to breakeven on the 35k cars. In fact they are having difficulties as is on the high priced models.

That does not take into account their debt, their short term liabilities (barring a capital raise, there is the risk of insolvency right now), and the fact that they have cut back capital expenses, which is bad for a company supposedly in a state of rapid growth.

They will be facing competition in the EV segment soon, as the existing automobile industry has been developing their own EVs.

Finally, there are huge quality issues. Tesla has some issues that are pretty much unheard of in the competitors. Given these challenges, they are facing a number of obstacles that have been growing and in many cases, self-inflicted.

Ummm…In July, Tesla was outselling the big boys:

Tesla Model 3 16,000 23%

BMW 2 + 3 + 4 + 5 Series 12,811 18%

Mercedes C/CLA/CLS/E-Class 11,835 17%

Audi A3 + A4 + A5 + A6 + A7 9,282 13%

Lexus ES + GS + IS + RC 6,866 10%

Cadillac ATS + CT6 + CTS + XTS 4,382 6%

Infiniti Q50 + Q60 3,383 5%

Acura RLX + TLX 2,536 4%

Volvo 60/90 Series 1,904 3%

Jaguar XE + XF 648 1%

Alfa Romeo Giulia 1,028 1%

TOTAL 70,674 100%

Hard to take this seriously when you don’t include Toyota or Honda, which had the biggest increase in EV sales in July.

And does not refute the bigger point that Tesla is losing more $ the more cars it sells.

They’re trying to make it by volume :)

The only thing that NPR reported from the 2nd quarter press conference was that Musk apologized for acting like an @$$. I knew the real news couldn’t be good…

Even if they sell cars, they can’t service them. Musk isn’t putting adequate money in the service facilities. Almost no other shops will work on them, many car dealers won’t take them in trade (local Porsche dealer, for example), and owner’s can’t get reasonably timed repair appointments. One guy I know bought a new Model S with all the options–very big bucks. 4000 miles later his electric door handle failed (known bug). The best service appointment he could get was 4-1/2 weeks out. He was so disgusted that he sold the car taking a big loss.

I happened to be in Silicon Valley just last week and saw some of those unfinished Model 3s leaving the factory on transport trucks. Some were unpainted (covered in a white tape of some kind) and some came with mismatched body panels (some black, some white). Sounds like a juggling act to me — “they’re not here, they’re shipped!”

Ranger Rick, you are so full of Sh$t. The plastic wrap is to protect the paint for shipping. The ignorance on this topic is incredible.