An alarming story that came over the transom is how CalPERS’ Office of Audit Services has been crippled by high levels of turnover and vacancies, poor morale, and most important, the loss of independence of the audit function.

I ran the key facts by law professor and white collar criminologist Bill Black. His reaction:

Yes, very bad. CalPERS’ top management is determined to do the wrong things – and wants to improve the odds they can get away with it. That is the only reason, given the nature of its business, that the leaders would gut internal audit. Internal audit, like underwriting at a bank, is a great test of managers. If they are incompetent or sleazy (or both) they see audit and underwriting as cost centers. It they are competent and people of integrity, they see that great controls and underwriting are the core of investor (and bank) profitability and survival.

CalPERS apparently cares more about image management than protecting the pension system. Due to vacancies, many of which are long standing, Audit Services has only 55 employees, according to a recent organization chart. By contrast, the so-called Communications & Stakeholder Relations department has over 70 employees.

Recall that CalPERS has implemented poor risk management practices elsewhere. We described in 2016 how the the investment risk management team, a compliance function, reports to the Chief Investment Officer.

Anyone with an operating brain cell knows a staffer cannot oversee his boss, at least if career longevity is important to him. Having a control function housed inside the unit it supposed oversees is precisely the arrangement that led to $6.2 billion of trading losses in the JP Morgan London Whale scandal and the fake accounts abuses at Wells Fargo. And that is why the rest of Wall Street was shocked to hear that JP Morgan had such an obviously defective arrangement.

We gave this overview of the sorry state of the CalPERS audit function in our companion post today, quoting an insider:

The atmosphere inside the PERS Office of Audit Services is absolutely horrendous with mismanagement. Many of us have gone to the union for help, and some are pushing for a group grievance on behalf of all of us against all managers. Besides having lost nearly a quarter of the staff on our public agency audit side, the nepotism and favoritism given to people who are not deserving or qualified makes it tough to deal with.

Our Clive underscored why this matters:

You definitely do need good polices and procedures drawn up and in place to manage and control your system(s). But these alone are not sufficient. And you cannot “tech” your way to preventing insider-orchestrated harm.

You need a robust and appropriately-resourced audit function to ensure it is adhered to. You also need a certain fear factor – people need to know they are being supervised and their work will be checked both routinely and at random, not just through their line management organisation structure but with a completely ring-fenced and segregated inspection regime which does not report to just the CEO or the executive function but also has a dotted reporting line directly into to board.

Anything less than this is all-too-amenable to suasion, internal (or external!) politics, favour-mongering and collusion.

A UK example: Lloyds Bank operated several control frauds. In a rare show of seriousness, former executives were jailed for 11-15 years for one of the more serious scams

Part of the go-go era prior to the global financial crisis was the systematic gutting of the audit function in that bank. And what little was left had to work within an organisational design which had the audit function report to the C-level directors of the profit centres. Little wonder, then, that the emaciated team of internal auditors heard no evil and saw no evil. Even if they had the time and wherewithal to follow up on suspicious activity, the top management would not let them speak any evil, either. It was textbook criminogenic.

And CalPERS is moving in this exact same direction.

The audit function is the last line of defence. If that’s disbanded or weakened, it’s game over for CalPERS.

Here are the warning signs:

Ending the independence of the internal audit function. Matt Jacobs is running Audit Services and editing their reports. In an organization with proper controls, the audit function should report to the CEO and/or the Board. The CEO and the Board need to receive audit information, particularly internal audits, directly, and this responsibility is even more important when the CEO and board members are fiduciaries.

Audit Services has reported formally to the CalPERS legal department since at least May 2012. However, the story is more complicated than it appears. In 2011, Audit Services was granted a charter which included a clear and strong commitment to its independence. Thus even though unit may have been formally housed within the legal department, the commitment to independence meant as a matter of practice that the General Counsel did not control the substance of its work.

In keeping, members of the Audit Services confirmed that it had provided information directly to the CEO and Board under the tenure of the previous head of Audit Services, Margaret Juncker, who retired in mid 2015.

Perhaps we have missed it, but we have not been able to find any evidence of an official change in the status of the Audit Services unit in 2015. Audit Services staffers say that they are not aware of any policy document of that sort being discussed and approved at a board meeting. It appears that the new head of the operation, Beliz Chappuie, acceded to the demands of General Counsel Matt Jacobs to influence audit operations.

This change is particularly alarming because the choking of the information flow to the Board was never formally approved, nor was the reason for this change communicated to staff.

Another bizarre and troubling moves that undermines the effectiveness of the audit team’s work is the blanket designation of work product as attorney-client privileged. This is perverse in the case of the public agency side, since audit findings are reviewed with employers like municipalities and school districts so they can comment on them and make corrections before the reports are made final. Any document shared with a third party cannot be attorney-client privileged. From one insider:

One thing that completely mystifies us is how all “internal” internal documents have been labeled as ACP (attorney-client privileged) whereas before it was common to share information with each other.

So, for example, internal auditors who work on real estate matters can’t view the workpapers of internal auditors who specialize in IT audits. I don’t see it from management’s perspective, but there have been internal audit reports with findings that, after the internal assistant division chief spoke with the program area chief – they were reduced to discussion items. I tried to get the draft that showed this and final which shows they were removed, but wasn’t able to for timing reasons.

Along the same lines of our suspicion on internal documents becoming ACP, nearly all reports are filtered through the legal office. A senior colleague said that completely ruins our independence and objectivity if they rewrite any reports.

Another thing that was changed to ACP is our “administrative” information — it’s top secret for some reason. Say you want to request (via FOIA) a list of all projects: project number, project name, budgeted hours, actual hours, to see if how frequently overbudget our projects are, I can pretty much guarantee you’d get just a grand total of the hours.

These changes have confused and demoralized staff. As one department member said:

All the audit reports go through the legal office and into attorney-client privilege before presentation to the Board’s Risk & Audit Committee. This was not the case prior to the new chief assuming the position.

In terms of internal transparency, we are concerned that board members either don’t see the complete picture or the message is being filtered by the legal department. The line of reporting is an important consideration according to the IPPF Red Book Standards. This reporting change, whether or not it was significant, should have been communicated to staff, as Openness is one of our Core Values.

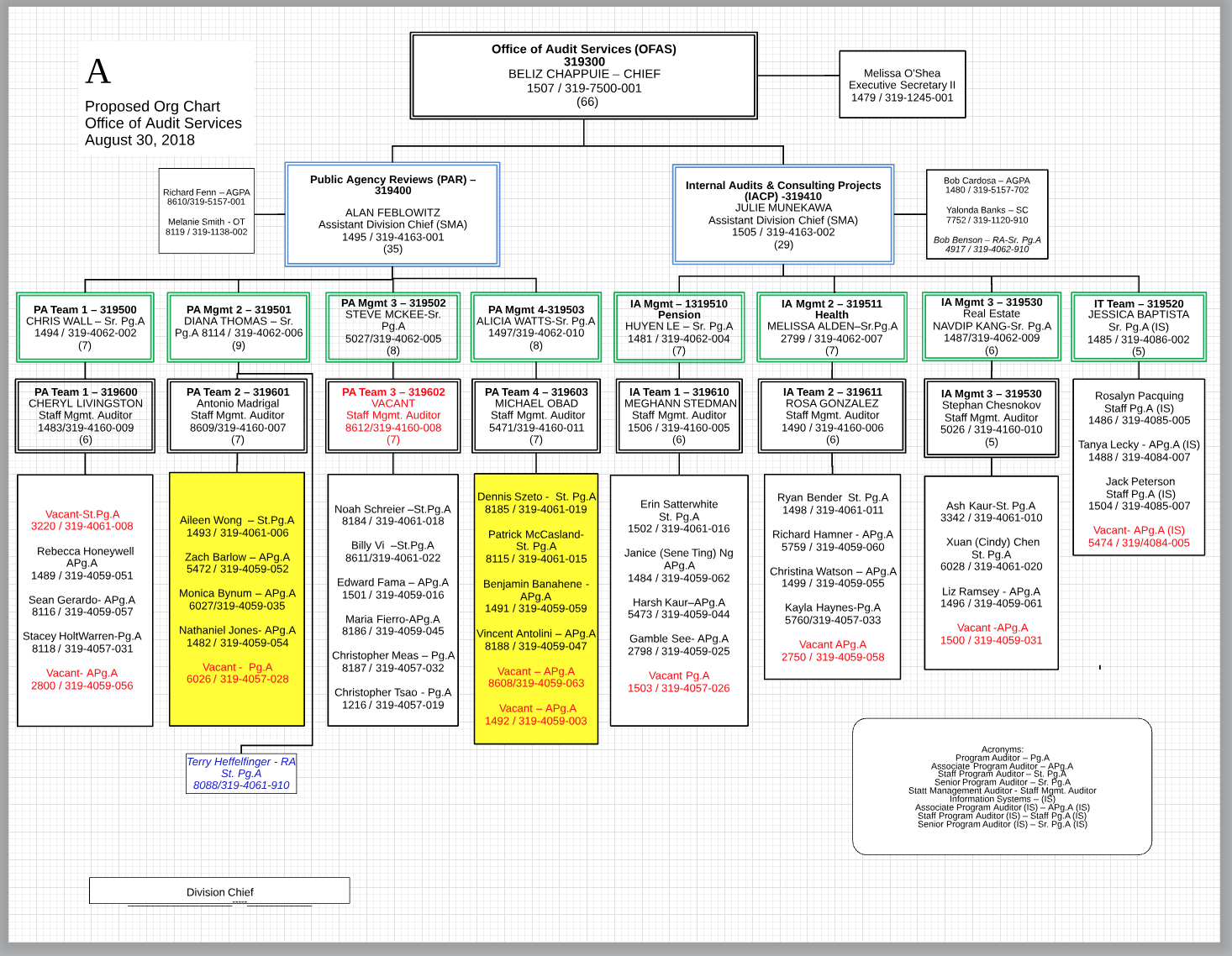

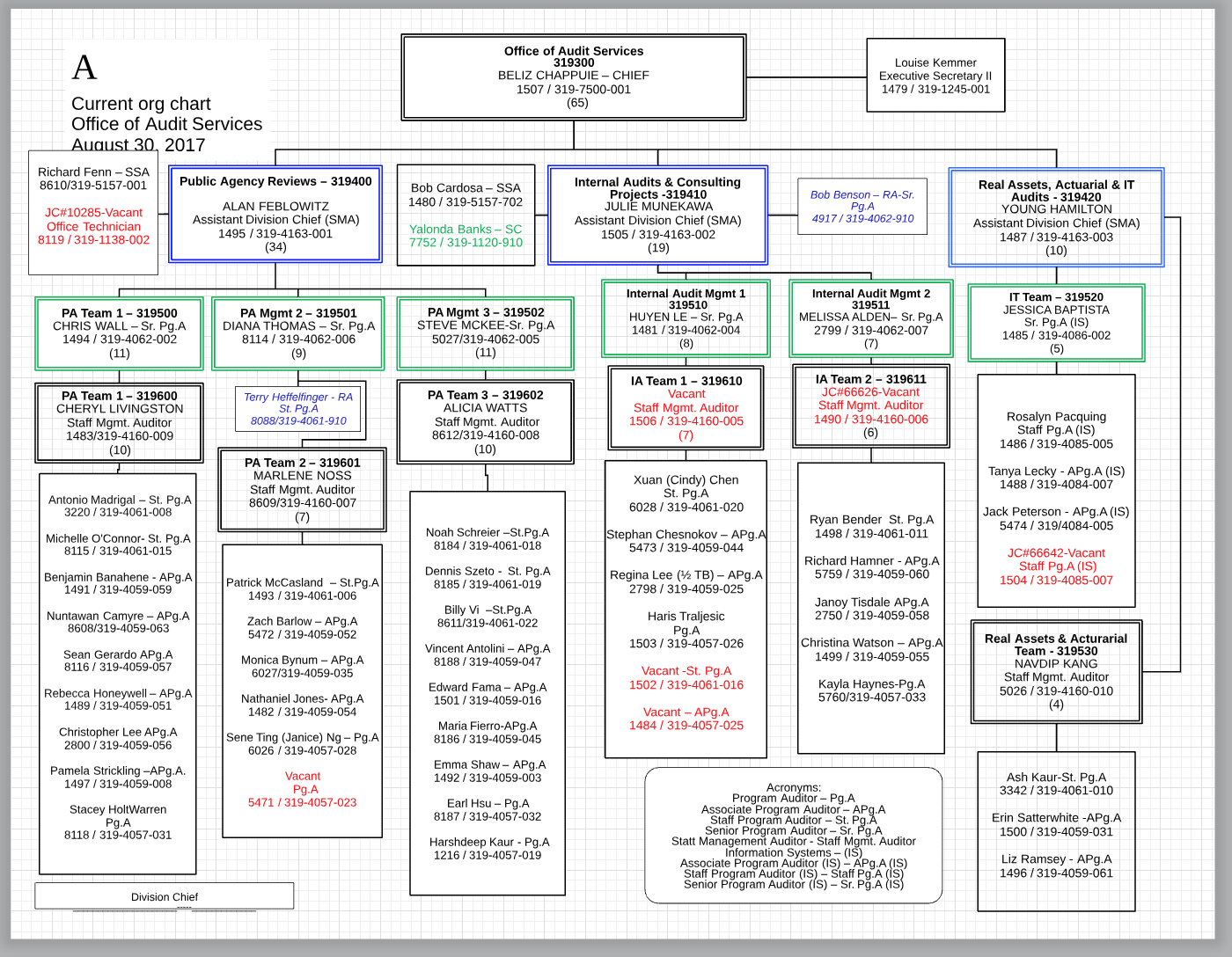

High and rising levels of job vacancies. As you can see from the organization charts below, the Audit Services unit was to have 65 employees in 2017 and 2018.1 This already seems light given that CalPERS has over 2000 pension plans, all of which should be audited periodically to prevent fraud and correct errors. Six positions were vacant as of the date of the 2017 chart and that rose to a whopping ten in 2018.

Downgrading and elimination of important functions. We will again turn the microphone over to Clive:

Did you see how they’d culled the entire designated “Actuarial” function in the Audit division? It used to be encompassed in the “Real Assets & Actuarial Team” but now you just have “Real Estate” (presumably the realty asset base) – with “Actuarial” dying in a fire. It kind-a looks like that function moved into the so-called “Pension” team (some of the Program Auditor and Associates moved into that team) – but without a designated responsibility for auditing Actuarial work. A pension fund that doesn’t, specifically, by name, audit its Actuarial function? WTF?

They’ve also lost the Asst. Division Chief (Young Hamilton), who presumably had a lot of experience in IT and with the actuaries, and not replaced that role. So there’s less coverage in the senior management positions who are going to be more stretched as a result. Has the Audit function suddenly gained some big-yet-mysterious efficiency improvements which means there’s less work to go round? Impossible. There’s no such thing as an automated audit.

High turnover. As you can see if you work through the charts below, a full 25% of the positions in the 2018 org chart are either vacant or have new incumbents. It looks like a lot of turnover for an employer like CalPERS with a good pension, excellent health insurance, reasonable pay, and theoretically low stress. One would expect to see almost no turnover in a job like that.

In addition to the issues Clive flagged immediately above, the organization structure has morphed in other ways, with a new team created under the Public Agency Reviews and considerable reshuffling of the people from the old teams who stayed on in 2018. One of the top level units, Real Assets, Actuarial, and IT Audits, was dissolved and the teams under it moved over to the Internal Audits and Consulting manager, which strongly suggests she is overextended.

As a management academic put it:

You’d expect the CalPERS audit group to change at the speed of glacial shift; it’s a job for life in what should be a boring department of (also what should be) a boring organization. Instead the year-over-year change looks more like a struggling startup. CalPERS looks like they systematically gutted their audit group.

Widespread concerns among staff about questionable credentials and experience. There are doubts among staff about the qualifications of certain incumbents, to the degree that it has damaged morale and led to many consulting with the union.

As we mentioned in our companion post today, when CalPERS was trying to change the job description for Chief Actuary to allow for someone to assume the role who was less qualified than many senior in-house actuaries, the members of that group made enough of a stink so as to force CalPERS to delay and then scuttle this plan. A similar rebellion may be brewing over doubts about the experience and qualification of certain team members and managers.

On the one hand, this crippling of the Audit Services unit may be the result of neglect, misguided cost-cutting, and General Counsel Matt Jacobs, who has no prior experience in a general counsel’s office, mistakenly prioritizing shielding CalPERS from Public Records act requests and even discovery over having a functioning audit department. On the other hand, this view may be way too charitable. As Clive pointed out:

The important thing to note is that, for an individual employee, when you’re working within this shared culture and sense of ethics, it is very difficult – impossible almost, certainly I didn’t detect the erosion of morality in my bank until it was glaringly obvious – to accurately determine where you are on the scale of corruption. You’re inevitably in some degree of denial (assuming you have a sense of personal responsibility and you’re not an out-and-out sociopath) about what, exactly, you’re in the midst of. We don’t like wrongdoing, we don’t like people who set out to exploit others, we don’t like the image of an organisation which perpetrates those activities and we don’t want to apply that image to ourselves.

But by the time an organisation is in the terminal stages of this cycle, the dishonest element in the workforce are the ones who are coming out on top. They tend also to bring in more co-workers who are like them.

The fact that Marcie Frost is perfectly content to let Matt Jacobs disembowel a critical control function out of his warped sense of priorities is further evidence that she is out of her depth as the CEO of CalPERS. And in terms of integrity, Frost, with her resume misrepresentations confirmed by the Financial Times, shows that the CalPERS fish is rotting from the head.

______

1 The charts show (65) under the name of Beliz Chappuie-Chief in 2017 and (66) in 201, which presumably refers to total staffing. But a count of the number of positions in 2018 shows only 65.

Apologies to non-subscribers of the FT (the link I’d sent in my narrative to a Yves about HBOS, latterly Lloyds Bank, and the fraud coverage is from there, it was free-to-view when I researched it but now is moved to needing a subscription or at least a login).

It was the best piece on this incident because it asked why the management could have been so unaware of the scam — “nobody knew” was the standard hand-wave, but the FT asked pointedly what happened during audits. The BBC coverage is free to view https://www.bbc.co.uk/news/business-38796087 and is interesting in so far as it asks

… without providing any answer.

The answer to which is “it was” https://www.telegraph.co.uk/business/2018/06/14/mps-threaten-publish-internal-lloyds-report-hbos-reading-fraud/ but due to poor organisational design, the audit function didn’t have the clout to make a big enough noise. It’s no use, as HBOS did, giving Audit a “seat at the big table” if you then insist on stuffing a pacifier in its mouth.

Why is CalPERS doing this? There’s no good reasons I can think of. But I can certainly think of a lot of bad ones.

Matt Jacobs’ name sure does come up a lot here, and not in a good way. Is he just that incompetent, or is there something more serious going on?

Non-audit of actuarial function matches the will to hire a non-actuary as the top dog in the ‘actuary’ dept. Coz then you can outsource all that hard work to your friendly third party institution, and turn your job just to lets-decide-what-to-outsource-to-whom.

I have not seen a shred of evidence that Frost would show any competence whatsoever – or any of the senior people. That is, competencies required for the job they are supposed to be doing.

This is so. much. worse. than I thought. CalPERS is being run by crooks. Hide the evidence by fictional ACP, rewrite reports to “improve” results, gag in-house cross referencing within the audit department, middle-manage audit results to the Board… While the Cali Gov and AG and the rest of the Cali one-party government looks the other way.

Thanks for your continued reporting on CalPERS, PE, and pensions.

…and cook the results of the elections with the phony online thingy.

It’s interesting that no one from the MSM has picked up this story.

Mike Hiltzik of the LA Times covered the CFO debacle and quoted NC, he’s undoubtedly following these posts.

And there’s NO coverage in the SacBee, the LA Times, The San Jose Mercury News, the SF Chronicle…. of an enormous scandal that impacts every Californian.

None, Zero, Bupkis.

Hiltzik, for one, is a good reporter, but reporters don’t decide what to publish.

On a more positive note I’m sure Attorney General Becerra will be all over this, real soon.

All of the newspapers have been hit financially and laid off so many staff that its wonder anyone is even on their staff anymore.

I do hope someone picks this up and starts running it. Both the SacBee and LATimes have done some reporting on CalPers over time. I can only hope they’ll focus more on this in the very near future.

It’s certainly a huge story, and one that’s not going away any time soon.

Kentucky KRS has 272 employees only 4 are investment professionals, only 2 are audit professionals. Bad staffing is not limited to CALPERS

Auditing governmental entities or retirement plans is not my cup of tea. So I checked the CAFR (Comprehensive Annual Financial report) for CALPERS that was issued for FYE 6/30/17. The audit firm that signed off was MGO( Marcias Gini & O’Connell). Looks like a regional firm that may also have an alliance with BDO.

Would be interesting to know how much the audit firm relied upon work of the internal auditors, and/or the effects of the independence issues associated with Internal Audit function described in your post, had on the audit firm’s risk assessment process and audit strategy. Specifically as it pertains to the level of reliance the auditor will place upon the entity’s internal control. Understanding, testing and documenting an entity’s system of internal control can allow the auditor to reduce the amount of detailed testing that has to be done throughout the audit before being able to formulate an opinion on the financial statements. Obviously, the higher the reliance on I/C, the less substantive testing needed and ultimately the easier it becomes to stay within the audit budget. The opposite is also true- less reliance on I/C = More time auditing = higher cost (that might or might not be recoverable from the client). So this determination is a big deal. But it also includes many judgment calls along the way.

Governmental audits require that auditors issue reports on internal control.

So I googled the following – MGO Calpers “internal Control”. There were a number of reports associated with the audit firm that popped up. Based upon the reports I quickly skimmed, it appears there were no material weaknesses reported for I/C BUT…doesn’t mean there weren’t any.

The best place to determine whether the risk assessment process, audit strategy and reliance upon internal control were performed in an appropriate fashion would be the documentation contained in the audit work paper files.That is owned by the audit firm.

However, if your concerns were communicated to whoever does the audit, prior to the start of the audit, those auditors might feel compelled to address some of those issues head on, but no guarantee

No, you are missing the bread and butter of what audit does. Please see the 2018-2019 Audit Plan

https://www.calpers.ca.gov/docs/board-agendas/201806/risk/item-8a-01_a.pdf

As I mentioned above, a big part of what they do is audit the various employers’ data who have plans with CalPERS to make sure that the payments they have made to the employees in those plans are warranted, both in terms of who gets them and the payment level. This has nothing to do with the audit of the published financial reports.

As I mentioned above, a big part of what they do is audit the various employers’ data who have plans with CalPERS to make sure that the payments they have made to the employees in those plans are warranted, both in terms of who gets them and the payment level.

I guess it would be cynical to suggest the unions or union bosses (and others) that apparently like things just the way they are at CalPERS might be benefiting from a reduced to no effective oversight by an audit department tasked with verifying the correctness of who gets paid how much?

adding: An opportunity for pension spiking by another name? From a 2014 LATimes.

Taxpayers and local governments are on the hook to pay nearly $800 million stemming from “legal” pension spiking over the next two decades, the state controller said Tuesday.

The price tag came as Controller John Chiang issued a new audit of the California Public Employees’ Retirement System.

The audit of 11 state and local government agencies found no illegal pension spiking but concluded that the country’s largest public retirement fund makes itself vulnerable to the practice by not aggressively reviewing its 3,100 member agencies’ payroll records.

(my emphasis)

http://www.latimes.com/business/la-fi-calpers-pension-spiking-20140909-story.html

i assumed, apparently incorrectly, that the internal audit also covered CALPERS own accounting records, and by extension the records included in the CAFR.

Even so, while not my area of expertise, my understanding is that many of the other retirement plans may need to have their own annual independent audits…and…if that’s the case it’s possible that the auditors of those plans may have relied on some of the work done by CALPERs internal audit team to reduce their own audit procedures, right?

If so, Independence questions you raised of internal audit could create problems for those other external audits if the third party auditors of those plans actually reduced the testing work they did based upon their reliance of work done by the internal audit team.

Just a thought.

As Yves mentioned this is a different type of audit weakness but your point is important. MGO’s superficial audit does give a false sense of security, and GFOA does a rubberstamp but is nothing more than a tick and tie adding up columns. Does not look underneath anything takes the word of CALPERS management for most numbers. Lets Private Equity managers value themselves with no 3rd party oversight.

I looked up MGO as well. It is neither a national or regional firm but based in Sacramento with other offices in California. It is merely the 15th largest CPA firm in California according to CalCPA (CPA trade association). http://www.calcpa.org/~/media/california%20cpa%20magazine/0918/0918top150.pdf?la=en So this isn’t exactly a Madoff situation where a pliable sole CPA signed off on fraudulent financial statements. But the CalPERS job is probably a significant percentage of MGO’s annual billing – which is usually a serious threat to auditor independence.

Here is a link to the 2017 MGO management letter – https://www.calpers.ca.gov/docs/board-agendas/201711/risk/item-5b-00.pdf – which reports NO significant deficiencies or material weaknesses in internal control. They do report three “observations” which appear to be only so much fluff.

The poor design and operation of the internal audit function described above are very likely at least a significant deficiency. That is, a deficiency in internal control not as serious as a material weakness but important enough to be brought to the attention of the governing body.

Sadly, none of this surprises me. I live and work in Sacramento, but not for CalPers (and not a State employee). One hears whispers of this.

Some of CA’s state departments are run very well; are mostly functional and do good work.

CalPers is not one of them, and it’s outrageous that gutless “leaders” in CA, including the Governor, permit this open rotting sore to continue.

The Board wants only to turn their heads and look the other way. No doubt they’ve got their own little kick backs to sweeten the deal. My evidence of this??? NONE. But it would be irresponsible of me not to speculate. No, not snark. I’m dead serious.

What a rotten situation.

Thanks, as always, Yves for pulling up the rocks so we can see the rot underneath.

I’m curious as to which California State Agencies you might be referring to there? My experiences (have lived and worked in Silicon Valley for decades) — and the experiences of those I’m quite close to — with California State Agencies, have been 99.9999% nightmarish, for well over a decade. The upper middle class and obscenely wealthy have nothing to worry about , but the average, or especially vulnerable person, has utterly no voice, or protection from State abuse.

My experience has been that: when someone does not have an in — or refuses to pay to play with their local, State, and Federal legislators — they may as well not bother attempting to receive said agencies public services, or benefits, in any non abusive and punitive manner; despite doing nothing whatsoever to warrant such abuse and punishment. To my mind, and life experience, corruption is ‘norm,’ in the pay to play Republic of California™.

I can’t speak for CA but some agencies in the one-party state of NY are very good. The Department of Financial Services, which also oversees health insurance, is excellent. Our DMV has a very efficient process for license renewals.

This is not all inclusive, but here are some prime California offender Agencies which I have firsthand experience with, or know (very closely) others who have: worked for; been desperately in need of services from; or been amorally harassed and targeted for easy revenues by, said State of California Agencies:

Department of Aging

State Bar of California

Employment Development Department

Department of Health and Human Services

Department of Insurance

California Medical Board

Department of Motor Vehicles

Franchise Tax Board

Public Utilities Commission

And I’d bet that the newly formed California Department of Tax Fee Administration and the California Office of Tax Appeals are likely also a nightmare to deal with, as was the State Board of Equalization, which preceded them in their responsibilities:

no offense, but that’s very confusing to me, since the worldwide notorious Wall Street (speaking of ‘financial servicing’) is in the Manhattan borough of New York City, New York State, and the New York State Department of Financial Services is never quoted as to Wall Street’s infamous and deadly effect on average citizens in the world at large?

Banks are largely exempt from state regulation due to a Supreme Court decisions that backed Federal “preemption” of state regulations. Most banks of any size are national banks regulated by the OCC.

Having said that, the recently created Department of Financial Services ran rings around Federal regulators in extracting hundreds of millions of fees per violation per bank of the foreign banks, which operated in the US through New York branches, which made them subject to the jurisdiction of the DFS. In an early action, the DFS sent an order demanding the head of Standard Chartered Bank appear at its office in less than a week and explain why the DFS should not yank its banking license. Please tell me the last time you ever heard any US regulator say anything like that, much the less in writing.

I haven’t. I wish it had of been an agency in California so noticeably fighting the rot, but that’s good to hear, and great for New Yorkers!

There is no need to speculate about corruption at CalPERS when the 2002-2008 CEO is in federal prison for filing false statements in order to cover-up kick-backs. The problem here is that the former CEO is the only person to have been convicted, and the only other individual ever charged committed suicide rather than face trial.

The ugly truth is that General Counsel Matt Jacobs was brought in on the eve of the criminal trial to engage in a cover-up to protect other potentially guilty parties, some of whom remain on the Board even though they were frequent guests at the deceased “placement agent’s” Lake Tahoe lair. Jacobs has never done any sort of legal work other than criminal law — most of that as a white-collar criminal defense attorney. He has none of the specialized knowledge and experience necessary to oversee a financial institution of any kind, let alone advise the fiduciary board of a public pension.

It’s bad enough that CalPERS is still trying to recover from their ill-advised 8-year employer-contribution “holiday” during the ‘90’s tech bubble and from the losses incurred in the aftermath of the 2008 crash. The two criminally-charged persons didn’t “snitch-out,” but the cover-ups will continue until any board member who served under the rotten former CEO is turfed-out, and their colleagues abandon the perceived need to hide behind a criminal defense attorney and pliable know-nothing executives.

Keep digging, Yves.

Follow the money.

Ah, there it is. I’d missed a lot of that history. Must be what originally caught Yves’ attention.

I was thinking there must be an underlying problem that is producing the weird defects Yves keeps finding at CalPERS. Lingering crookedness on the board and a general counsel brought in to orchestrate a coverup fit the bill. I missed that early on.

as the fly on the wall;

Hello, this is Marcie. Hello Marcie, this is uncle Tim. I wanted to be sure you had your preparations made to bug out? I talked to Jerry and he is getting a lot of kickback on your actions and the appearance that you are running the new Enron. We don’t know how much longer it can hold up, but we need you to deny and distract right up until you leave. New audits from our staff show you have lost over a billion on your investments and we can’t let that information slip out. Do you have the staff properly trained for what we will do if they don’t comply with your orders? One of your staff has been removed as we found they were about to send documents to NC and the papers. You will hear of their need to “spend time with their family” in the next few days. Don’t act surprised. Your funds have been deposited in Panama and when you arrive in country X they will have all the documents for you. You know that your plane landing is based on your continued work to divert attention until it is too late? Good.

I do wonder who are Marcie Frost’s mentors.

Running a pension fund with no audit function is a lot like running an election with no way to check the vote count.

I’m sensing a pattern…

Nice observation about the abuse of the attorney work product category.

If a non-legal department reports to the GC, acting as a senior manager, that does not, in itself, qualify that department’s work for protection from disclosure under any of the confidentiality privileges provided to attorneys.

Attorney work product, for example, usually requires that the work be prepared in contemplation of litigation. For that, an attorney might coordinate the work of one or more non-attorneys, receiving their work, using it in her own, and thus protect it from disclosure.

That circumstance does not apply in the normal course of business, where the GC is simply acting as an institution’s senior manager and supervising multiple functions. That’s true whether those functions be audit, accounting, or shareholder relations. In fact, widespread abuse of privilege claims can lead to the general loss of the privilege.

I realize this is minor, but it puzzled me: “a dotted reporting line directly into to board”

Is “dotted” a Britishism, or is it supposed to be “dedicated,” or something like?

No, it’s manager-speak. Sorry for not unpacking it.

A dotted line indicates a secondary but still official reporting relationship. Say you are in the sales department but are in a subgroup that hawks a highly technical product. You might have a dotted line to the product group because the managers there want to be able to communicate with you directly (and vice versa) on a regular basis (as in it would be legit for the product group to invite these sales group members directly to certain meetings, rather than have to go through the sales group to make the invite).

Thanks. Always glad to to extend my vocabulary – and that my question proved useful.

Marcie has updated her LinkedIn profile to report that she is with CalPERS and… it lists Evergreen College!

BTW, the CA STD678, the state application form lets you list:

1) UNIVERSITY OR COLLEGE—NAME AND LOCATION,

BUSINESS, CORRESPONDENCE, TRADE OR

SERVICE SCHOOL

2) COURSE OF STUDY

3) UNITS COMPLETED SEMESTER

or 4) UNITS COMPLETED QUARTER

5) DIPLOMA, DEGREE OR

CERTIFICATE OBTAINED

6) DATE COMPLETED

If you didn’t complete a degree, you specify your completion to date, There’s no need to pencil/pen in “Not completed” as reported in the Sac Bee.

I am a hiring manager working in a CA agency/department. If no degree is needed for CEO of CalPERS, why are we screening for education when we hire office technicians, staff services analysts, associate government analysts, staff services managers I and II, having people list the college courses they have completed that are applicable to specific job duties? If CEO of CalPERS needs no degree, neither does anyone else!