Yves here. While I appreciate J.D. Alt using Hurricane Florence as a reminder of the need to push back against economically illiterate balanced-budget fetishism, Alt makes an assumption that I imagine will rankle with many NC readers, that these communities should be rebuilt. The US is failing to come to grips with the need to move people out of coastal areas that will suffer more and more as climate change progresses. If nothing else, people need to be paid to leave.

By J. D. Alt, author of The Architect Who Couldn’t Sing, available at Amazon.com or iBooks. Originally published at www.realprogressivesusa.com

What you believe America can build—or rebuild—as a collective society hinges on how you answer one fundamental question: When the U.S. government issues a treasury bond, is it “borrowing” money that must be repaid with future tax-dollars—or is it “creating” money that can be spent to accomplish big and important collective goals?

Getting the right answer to this question could be existentially important. As I’m writing, for example, Hurricane Florence is unleashing historical damage to the U.S. Atlantic coast and inland areas. Over the next weeks and months, the inevitable debate will unfold over how much America can afford to “pay” to make the lives of tens of thousands of families and thousands of local communities whole and functional again. This time, perhaps, the debate will go even further: it might begin to earnestly ask the bigger questions about the future of our coastal cities and infrastructures in an unfolding era of climate change. These bigger questions will not involve billion-dollar budgets, buttrillionsof dollars of federal expenditures.

This is why my opening question is so important. What we can allow ourselves to do—indeed, what can we payourselves to undertake and accomplish as a collective society—depends on the answer.

Before examining the question in more detail, let’s outline the basic puzzle we’re talking about. The U.S. treasury is the spending apparatus of the federal government. Congress democratically agrees upon and tells the treasury what to spend money on, and the treasury duly spends the necessary dollars. If it does not have enough dollars in its tax accounts at the various Federal Reserve banks to meet the expenditures stipulated by Congress, the treasury issues bonds to make up the difference. The bonds are traded (usually to financial institutions) for dollars (bank reserves) which the treasury then uses to pay out the balance of the spending obligations it has been assigned.

This is the common understanding of the puzzle—and the reason most people will initially answer that when the U.S. government issues a treasury bond it is “borrowing” dollars (from the financial institutions who trade for the bond) which must be repaid with future tax-dollars (when the bond matures). What other interpretation could there be? And it’s an interpretation that makes it difficult for America to commit to large, expensive undertakings—such as rebuilding (better and smarter) after a major hurricane, rather than fecklessly dabbing at the wounds (as we’ve done with Katrina, Sandy, Harvey and Maria).

The problem with this “obvious” answer to my question (in addition to the fact that it saddles us with an endless and hopeless austerity) is that, if it were true, the U.S. federal government would not have been able to spend—in real dollars—over $21 TRILLION more, over the years, than it has collected in taxes. For that is, in fact, the case: the national “debt” clock in New York City—which tracks the difference between government spending and tax-collections—currently tallies the number of dollars of over-spending to be $21,477,342,250,762. Are those reallydollars the financial institutions “loaned” to the U.S. government? If so, why aren’t they beating the bushes to get paid back? And if they aren’t getting paid back, why do they continue to “loan” such extravagant amounts of dollars to the government? Finally, does anyone really imagine the U.S. government is going to “repay” that vast sum of dollars by collecting taxes? From several different perspectives, then, the common explanations we think make sense don’t add up.

There is another perspective, however—just a slight shift—which causes all the puzzlement to disappear. Not only that, but it is a perspective that clearly makes it possible for us, as a collective society, to undertake and accomplish things we heretofore have not allowed ourselves to pursue, or perhaps even consider.

This alternative framework answers my opening question as follows: When the U.S. government issues a treasury bond it is NOT “borrowing” money but, instead, is “creating” money. It is not incurring a “debt” that must be repaid with future tax revenues but, instead, is “creating” money that can be spent to pay America’s private sector to undertake and accomplish very large, and important, collective goals.

To see how this answer can be valid, visualize a U.S. treasury bond as a container filled with dollars that has a time-lock on it. When the treasury issues the bond, it comes—already filled—with a stipulated number of “future” dollars, and a time-lock with a stipulated date when those dollars can be accessed. When that date arrives, the lock opens, and you (the bond owner) can take out the new dollars and spend them. Until that date arrives, you cannot put your hands on, or spend, the dollars.

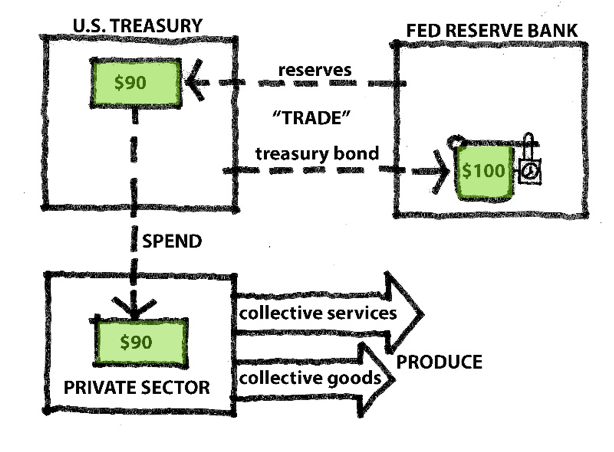

Even though you cannot immediately spend the dollars in the bond, it has a “value” that can be traded (if you choose to do so) for dollars you can spend now—but at a discount. This means that if your bond contains, say, 100 “future” dollars, someone might give you only 90 “present” dollars in trade for the bond. They might then choose to hold the bond until the time-lock opens, whereupon they’d remove the 100 dollars—making 10 dollars in profit.

This is essentially what occurs when the U.S. treasury initially issues the bond: It trades the bond (containing a stipulated number of “future” dollars)—typically to a bank or financial institution—for a discounted number of “present” dollars (reserves) which the bank or financial institution owns. The U.S. treasury then uses those “present” dollars it has received in trade to make payments for things which Congress has authorized it to make: it buys goods and services from the private sector, pays federal employees, sends out social security payments, pays local contractors to rebuild hurricane washed-out roads and fallen power-grids, etc. The “present” dollars the treasury has traded its bond for, in other words, are spent back into the private economy and end up in the bank accounts of private citizens and businesses.

When the treasury bond “matures”—i.e. the time-lock on the container opens—the “future” dollars are then removed and become “present” dollars in the private sector economy. We can diagram this process as follows:

Looking at the diagram there are three important things to see:

- The treasury bond operation results in the federal government purchasing goods and services which benefit the good of collective society. In other words, the things that Congress authorizes the treasury to spend dollars on—which causes it to issue treasury bonds—are usually things that the democratic process has determined will benefit society at large. These are the necessary and desirable things that, in general, cannot or won’t be provided by the profit-oriented market economy (for the simple reason they are goods and services that don’t generate profits, or are goods and services needed by citizens who don’t have the financial resources to pay for them—as in disaster relief).

- When the bond matures (and the time-lock opens) there is no need for the U.S. treasury to collect tax-dollars to honor the bond—the dollars are already there. When the time-lock opens, the bond owner simply reaches in and takes them out—or, more often than not, simply uses them to trade, at a discount, for a new treasury bond.

- Thus, the treasury bond operation:

- Creates money which enables the federal government to pay U.S. citizens and businesses to undertake and accomplish large, collective goals.

- The money “created” is not a debt that must be repaid to anyone—and does NOT require the federal government to collect additional tax dollars.

You may object that this is sophistry. How can you create something (money) that doesn’t exist? But remind yourself that the U.S. treasury has, in fact, created—and spent—to date over $21 trillionby this very process. Furthermore, the $21 trillion created and spent thus far now resides in the bank and investment accounts of American families and businesses—and the results of much of that spending are real things that have benefited, and continue to benefit, our collective society: roads, bridges, airports, electric grids, satellite networks, health and science research. (The list could obviously go on and on.) Sophistry does not produce concrete results such as these.

As you watch the aftermath of Hurricane Florence unfold over the next weeks and months—and as you listen to the debate about what America can “afford” to do in response to the overwhelming damage imposed upon East coast families, businesses and communities—and as you read the continued news reports about families in Houston still without housing, or the miserable conditions left unaddressed in Puerto Rico—think about the alternative perspective we’ve just diagrammed.

America is not short of money—or the ability to create it as necessary to pay ourselves to undertake and accomplish our most pressing goals. What America is short of is visionary leadership with a true understanding of modern macro-economics.

Good description of present monetary practice. But like all models, it leaves things out. Present consumption of future income, reduces main street economic activity in that future. In a free market, the large scale practice of rollover, leads to greater and greater risk, which implies greater and greater interest rates for future debt. Of course one can, like China from one end and the US from the other, move to a “Demand Economy”. Also this neglects the influence of international trade (which for most countries primarily involves fuel imports). Inevitably the fuel producers demand more money for their product against a more risky consumer who is also buying on credit.

You can get away with many abuses, in the short run, and at small scale. Large scale abuses, taken over the long run, produce failed states.

The article contained a long and detailed rebuttal of these ideas. If you fail to rebuild after a disaster, that’s what will “reduce main street economic activity”. Federal government borrowing doesn’t crowd out anything or create “greater and greater risk”.

re: “fuel producers demand more money for their product against a more risky consumer who is also buying on credit.”

fuel producers have no say in what they’re payed for their product. prices are set by the actions of traders in New York and London…moreover, the product is fungible, so those traders have no way of demanding a higher price from “risky consumers” than from the rest of the world.

The realprogressivesusa.com link goes to New Economic Perspectives, where the article resides.

Yves Smith: You jump to the conclusion that when I say “rebuild” I mean “rebuild in the same location”—or “rebuild at the same elevation,” or “rebuild based on the same construction/ownership premises.” I also combine the term “rebuild” with the term “build”—which is intended to suggest building something entirely new, in a well considered location. I also include the phrase: building “better and smarter,” which I think speaks for itself. Finally, I suggest that this time around the debate might “begin to earnestly ask the bigger questions about the future of our coastal cities and infrastructures in an unfolding era of climate change”—which is really the whole point of the essay, as I go on to note that such a debate will involve spending in the trillions rather than the billions. When I was in graduate school in architecture at N.C. State in 1975 I did a studio project that redesigned downtown New Bern for just an event that has happened. I recall one of the jury comments at the time was, “who’s going to pay for something like that?” It was that very question which ultimately, 35 years later, led me from thinking about architecture to thinking about macro-economics.

One needs only to go to New Orleans (post-Katrina) or Houston (post-Harvey) to see what “rebuild” looks like in practice. Developers want to recover their literally sunk costs. And the government is only too happy to provide them funding to do so.

New Orleans, in particular, provided ample opportunities to re-imagine the city. Go to I-10 east of the Industrial Canal or Chalmette to see what imagination looks like now. So retro 2004!

New Orleans is a fine example of how rebuild money has been squandered.

The history of New Orleans’ flooding is vast. Due to coastal erosion and stronger storms this is only going to get worse.

The failing storm systems running on ancient pumps, with some not working, spells a journey into the “known unknowns” this city will face in the near future. As stated above the answer is not if but when the next storm disaster will make this city unlivable.

As developers swarmed in after Katrina, the city was turned over to moneyed interest. Houses were allowed to be rebuilt on the ground within a certain window of time even though Road Home, “government money”, was issued to raise the homes.

Brad Pitt homes, in the lower 9th ward, are crumbling with lawsuits being filed last week. Spotty workmanship and bad materials spell disaster in the hot and humid conditions.

I agree with Yves, pay people to move. Lower Louisiana,”down the bayou” , are the 1st climate refugees to be relocated in the US. I’m sure it will not be the last.

Preach it, Max!

I was a post-Katrina construction volunteer on the Mississippi Gulf Coast. Although the people running my teams were real sticklers for quality, we saw a lot of work that was shoddily done. I felt bad for the people who had to live in those houses.

Re “… I suggest that this time around the debate might ‘begin to earnestly ask the bigger questions about the future of our coastal cities and infrastructures in an unfolding era of climate change'”, is a good suggestion. Unfortunately and perhaps stating the obvious, no one wants to take leadership in asking the bigger questions even in my country, Canada. In my area, it has been apparent for some time that the dykes need to be raised. They were built a long time ago in a different economic era and have long since been forgotten by the populace who have no idea that the water is even being held back although some awareness is now occurring. Today, these dykes cross provincial borders, involve a large number of landowners and different provincial and municipal government jurisdictions and no one person or government can say or wants to say that they have authority to initiate action. There is no election campaign or political party that addresses the issue specifically although politicians and their representatives have been informed. Fragmented action to raise the dykes is occurring without any apparent leadership or a concerted plan. In a scenario that is not distant, one of the provinces will likely become an island at least for several days at a time. The province will be cut off from land and rail links and the economic damage of this occurring has already been assessed. Yet, one can not point to any plan. Your problem in the United States may be graver but still of the same or similar sort – no leadership. I would also suggest that the issue is even direr when “the future of” is expanded beyond coastal cities. There are parts of the United States that are predicted to run out of water and some areas are over populated for the amount of water that is required. If there is any action to redress this situation, it is like my dyke example. The action is fragmented. There is an appalling lack of plan/action for the dislocation that will occur.

No current government in Canada, at any level, and perhaps not anywhere, will touch this climate-change turkey. Insufficient political will, from the ground up, and that will be the situation until it is far too late to save everyone, perhaps not even anyone. The only way out of this crisis of political pusillanimity in time is a Benevolent Dictator. Perhaps we voters know that unconsciously, perhaps that is why we are flirting with authoritarian leaders.

Unfortunately, we may get a Dictator, but I don’t think we will get Benevolent. Generally, the people who want to be dictators are not likely to be nice guys, and the people who chose ‘strong leaders’ do not chose wise ones. And of course, the Dictator may turn out to be simply an idiot. Although I really like the Volkswagen Beetle.

100 years ago people whose homes were destroyed by some natural disaster just became refugees with nothing. Today here in Mass if you drive near the water you can see houses on stilts that someone paid to rebuild. I don’t want my taxes going to put a million dollar house on stilts . I don’t want people dying in refugee camps either.

Insurance companies forced to pay to rebuild a millionaires house just jack up my rates so , even if tax money doesn’t go there I still get to pay.

If we are causing sea levels to rise then more will be destroyed , the idea of rebuilding in a treacherous location is insane.

I think we need to let them be destroyed and not rebuilt and let the sea level rising determine what order we do it in.

Using Mass as an example , if 100 houses in Scituate get smashed and Plymouth survives this year , oh well . Next year it will be Plymouth that gets smashed. Let the sea smash and flail away as it will , people with some foresight will move , or they will be moved at the whim of nature.

Pay those that get smashed out of their home something , but not full replacement cost. Maybe create a fund for buyouts or a tax break for donating to a special type of land program to create natural areas or buffer zones. Raise tax rates on at risk areas to force people out.

But the Bayfront houses in Scituate have such GREAT VIEWS! Why, the hedonic value of those views alone more than counterbalances the occasional dips into the common wealth to put houses back where Nature says houses can’t sustain! (/s, in case it’s not clear, though I have had conversations with Rich People who voice that exact opinion, because “it’s their RIGHT! And Property!)

Hey, valuing what “we” should pay people to buy out their houses, many of which are second or third “homes” (sic) for personal pleasure, or rentals-for-profit, why, that’s a whole new set of stuff for credentialed and “interested” People of the Coast to get their complexity-generating teeth and claws into!

No Deplorables need apply (for similar relief — value judgments by your betters say you should have been more provident in your choice of domiciles.) Unless you happen to be a flipper or AirBnB mortgage-holding participant…

And of course here in FL, and many other places, the “raise tax rates to force people out” is in operation already, though the policy goal is “gentrification,” not letting the landforms evolve into more “sustainable” patterns. “We” fund “beach renourishment projects” to the tune of hundreds of millions, to scoop and deliver sand from where Gaia’s storms have swept it away from in front of rich peoples’ waterfront spots to create that ”beachfront” that the rich folks and condo and hotel developers say they are “entitled to” because they BOUGHT it (even though the “law” still sort of is that they only “own” to the tide mark, while they seek to exclude mopes from ANY access to one of those things that used to be part of the “commons…”)

Anyone remember the wisdom of old King Canute? But then he did not have a near-ocean-level Luxury Retreat to want to “protect” from the tide — one could bet that his subjects would have been tasked to “shore up” his waterfront, in that case…

The Federal flood insurance program is limited to $250k coverage, which is at least in the reasonable range as that is not enough to do a McMansion. The problems with the flood insurance program include a massive subsidy; however, even with that subsidy it is still “unaffordable” for many so they don’t purchase it, So one of the outcomes is that people with money often buy the properties of people who can’t afford to rebuild and then build their McMansion there. The local communities are excited about that because property taxes increase.

Another major problem with the flood insurance program is that the mapping is generally poor to bad. It is often out of date or has not even been done – there is little funding for it even though it is vastly cheaper than paying claims. As a result, it is difficult in many communities to actually do rational flood management because they simply don’t have the data. There was an attempt in 2012 to have a more rational flood insurance program but that was quickly rolled back in 2014 once communities and developers understood that rational policies dramatically reduce development, increase the number of people who have to buy flood insurance to hold a mortgage, and raise insurance rates. Hurricane Harvey flooding caught many people by surprise because the lack of land use policies maximized flooding and the flood mapping was woefully out of date so nobody knew that. North Carolina at least has had the “benefit” of repeated major flooding storms over the past 20 years, so they have a handle on what areas are likely to flood simply because Mother Nature has been providing real-life flood mapping in many areas.

The fundamental moral hazard related to flooding in the US is that the local communities make the property use decisions with an emphasis on increasing property and sales tax collection while the federal government provides the flood insurance and and emergency relief money. So a local community has little incentive to put in real flood management land use policies.

North Carolina is one of the states where some insurers have backed away from providing homeowner policies for wind damage etc., so the state is becoming the insurer of last resort for a significant percentage of non-flood insurance policies in high risk areas. My understanding is that they will have nowhere near enough money in the state kitty for paying out claims so homeowners throughout North Carolina are probably going to get hit with substantial surcharges on their homeowner’s insurance – I assume that will be ok with Grover Norquist since it isn’t a “tax”. In some respects, the downgrade to Category 1 will make a big difference for the state-funded insurance here because there will probably be less wind-type damage for the state to cover than if it had come on-shore with 130 mph winds.

Living through the transitions of future Climate Disruptions will be costly in many ways and there will be great loss. Who will pay those costs and absorb those losses? Who should? I believe we must treat these losses as losses to the Common. But ask a much thornier question. To what extent should losses be made good? I believe losses should be made good to the extent of the receipient’s needs rather than any consideration of the amounts of loss. What need could a wealthy person claim for a second or third home? What need for a mansion instead of an adequate dwelling? Why shouldn’t all those who once lived in a place at least have a place to live after the disaster? And what’s adequate for the wealthy should also be adequate for the poor. What about jobs and an effort to rebuild some supporting industry in the new places people must move to? The banks who loaned on houses in disaster areas should be allowed to eat the debts — the Sovereign government will absorb the important parts of those losses through FDIC or NCUA and who will miss a bank or credit union with bad management that makes loans to houses in flood zones? Private insurance companies insure less and less. We would feel losing them as we might feel losing our fleas. [Why tax bad land use away? Turn the areas into nature reserves by law.]

But we haven’t quite reached the point of transition where the forces of Climate Disruption compel greater thought or action than rebuilding mansions and second or third homes for the wealthy — right back around the old foundations. The poor and even middle class can eat their losses and either move to apartments or join the growing armies of the homeless and the hungry. But a time will come all too soon, I suspect some time when the Arctic ice melts ‘enough’, when Climate Disruption will speed up and grow to such force that the kinds of Utopian sharing envisioned at the tail of the recent post here will be absolutely necessary to the continued existence of civil society. To avoid war that sharing will need to extend past national borders and I have no idea how that could work.

If insurance is unavailable, or too expensive, that is a red flag to sell to someone with the money to afford insurance or rebuild. There should be zero subsidized insurance. No, they know the cost and should not get anything from the taxpayers

Why no mention of the worst thing that this process of “money creation” is “democratically directed” to be spent on — global hegemonic for-profit it’s-a-destabilizing-racket WAR? A large part of that $21 trillion has disappeared into one horrific and feckless “Operation” after another, fattening only the war contractors and weapons makers and large numbers of thieves and corruption-breeders. And the collective demos has virtually no way to “vote” on how this money creation process directs those trillions, to rubblizing vast areas, driving millions from their homes as effectively as any “natural disaster” that traces its provenance to centuries of anti-democratic, anti-collective behavior by the real holders of power, corporations and their enablers.

Of course the war racketeers already plan to use their metastatic bigness to leverage the power to arbitrage and arbitrate how the whole planetary collective is supposed to respond to the damage and destruction now manifesting as climate collapse and biosphere devastation due to the “collective failing” of the rulers’ and owners’ persistence in running the world like it s just a mixed game of Monopoly ™ and Risk! ™

Good to reinforce knowledge of how the money creation system actually (for sovereigns, at least) operates. Might be good to explain where the underlying real wealth that these non-intuitive time-locked pots of dollars seek to explicate actually come from. “Full faith and credit,” maybe, based on the sovereign’s ability to loot resources for the short term benefit of those who actually hold the levers of power? In talking to friends and family about MMT, that question is where most folks turn away in denial.

A large part of global warming can probably be laid at the feet of the perpetual war industry. How much pollution has been generated in building weapons and fighting wars that either never needed to be spewed out into the environment or could have been directed in ways that would improve peoples lives.

How many aircraft carriers would it cost to settle mars?

You have to start somewhere. But you can’t even start so long as you have a Congress and op-ed echo chamber that refuses to understand or acknowledge modern macro-economics and continues to misinform the public about “deficit spending” and the “national debt.” I agree about the war machine—and I agree that, obviously, a very large component of the $21 trillion has been paid to the suppliers of that machine. I also agree that it is very easy to become cynical about what the government might do if it “discovered” how modern money works. But it is also possible to imagine what constructively thinking, cooperatively-minded, people might do if they made the same “discovery,” elected an informed Congress, and began thinking about big-ticket items other than air-craft carriers and ballistic missiles.

I hear you, of course. My observation is that “the government” (and of course the supranational corporation set) already full well understands “modern macroeconomics,” and has understood for generations. Also how to channel all those dollars to their purposes.

As you note, the problem for ordinary mopes is how to turn that seemingly magical engine of wealth generation toward healthier pursuits.

And all praise to you for your efforts to educate the mopery in how we are being played, and what we “collectively,” if we can overcome all the propaganda, programming, and our own trickabe tribalism, might do better.

Yves,

Many thanks for a timely post and thanks too to the author himself for responding to your critique.

Having felt the full force of a massive T10 Typhoon on a small Island in the South China Sea this weekend, I must attest to the fact that living so close to the actual sea – some 100 yards from my apartment, actually terrifies me, given, with Global Warming not only am I and those I live with under threat from rising sea levels attributed to global warming, but more unusual rather patterns and stronger Typhoon activity also, which is a double whammy as they say.

However, the Island I live on, much like Hong Kong Island, Japan & Taiwan does not have much in the way of flat land to build on, rather, what flat land exists is actually by the coast and built up rather heavily – now, given the population of Japan, never mind the high density of places like Hong Kong, I’m not sure we can actually move endangered populations centres without some mighty changes at a national and international level – although, it is possible to build housing on stilts, but they must survive the brute force of some very high winds, even if 10 metres or more above sae level – from an engineering perspective, anything is possible, but from a fiscal/economic perspective we really need a complete mindset or else millions will die sooner or later from one of these mega-storms, and that’s before even considering moving entire cities as a result of rising waters.

So, loads more work needs to be done on this, but it cannot be ignored any longer – maybe the Insurance sector should help out, as well as the Green movement.

Suffice to say, and having witnessed at least 3 other T10’s in my time in Asia, this weekends Typhoon and its proximity to Hong Kong and its Outer Islands really was a whopper and put the fear of God into me for about 6 hours – very uncomfortable and more scary given if I was a yard or two lower I’d have been flooded out.

good point, C.D.R.. .when Manhattan gets wiped out by a Category 6 tsunami, where would you rebuild it?

From what I understand of MMT the entire mechanism you sketch in your second diagram is an atavistic contraption with an old history. The process you sketch raises a few questions. The step 2 discussion leaves me wondering about “the dollars are already there” — in the matured bond. Where did they come from? And to whom do they flow? Who buys the bonds and why? When I see a long-lived contraption of this sort I can’t help wondering “Cui bono?” I’m not clear on the extent to which the FED in its present form corresponds with Hamilton’s National Bank or earlier national banks abroad but I do remember what class of Americans Hamilton served.

Thinking along slightly different lines I believe theory asserts that the wealthy save much more than the poor, in effect pulling money out of circulation — and money sitting in a vault doesn’t do much to help an economy. I know taxes do not really fund the expenditures of the Federal government but what can we expect from not taxing away much of the excess money the wealthy are otherwise allowed to accumulate and control while that uncollected revenue helps government’s deficits swell beyond what they would otherwise — further bolstering fallacious arguments for austerity. And I doubt the money would always remain piled in a bank vault with so many other opportunities for acquiring more tangible wealth and power. [Investment in productive capital? — pull the other one.]

Money, even National Banks have been around for a long time. While the flaws in equating a kitchen-table economy with the National economy make a neat basis for explanations of MMT, I sense the need for digging a little deeper to root out ancient fears that color many very old beliefs and superstitions about money, the sovereign power, wages, wealth, and power.

So if I’m reading this right, the government has issued $21 Trillion dollars, which is now locked in boxes (bonds) somewhere.

And what happens when the $21 Trillion dollars gets out? Is this some sort of deferred inflation? Or is that why the government keeps rolling over the bonds, to keep the money locked away, at considerable expense, so it never gets out?

Higher taxes would be cheaper. And it would seem, much safer.

They sit on the fed’s balance sheet, other country’s central bank’s balance sheets, etc. The principle on this debt is never, ever getting paid off, so it just gets rolled over and over and over and over…. you get the picture.

There’s really no expense at all because they can just keep running the printing presses and continue issuing more bonds to create more money to keep paying off the interest.

Like Yves, I think we need to prepare for sea level rise by moving people away from the coast. Further, we need to prepare this land for submersion by detoxifying it, so that our coastal estuaries are not a toxic soup. Creating carbon sinks if possible since our only hope in slowing climate change is drawing carbon out of the atmosphere, and at the same time increasing resilience to climate change. Create jobs and development projects that further these ends, while also creating concentrated urban development is bland for displaced persons. And stop wasteful and carbon-spewing military spending and destructive war.

If taxes “do NOT pay for” Federal spending, then just exactly what DO taxes “pay for”? Why even have taxes at all? Why not just issue money to spend on the object or the project of desire?

Taxes absorb and reinvest excess saving. While Jeff Bezos is a seemingly obvious go-to example of someone with more money than they can sensibly spend (or, turning to an ethical argument, be healthily allowed to control due to it allowing a disproportionate influence on society; see also the Koch family) these are more examples of extreme cases than where the problem really is.

Inherited and “dynastic” wealth in trusts and family-run mini-fiefdoms, especially where these involve land ownership which is merely handed around generation to generation, is the more pernicious and widespread issue.

Here in the U.K. our experiment with huge inheritance taxes (now largely rolled back through avoidability) had a massive (and I would argue beneficial) impact on devitalising the undue influence of the landed gentry. The amount of revenue raised was fairly trivial. That wasn’t the intention. The intention was to put an end to hoarding assets and the demotion of a thousand-year long over-influence of a couple of hundred assets-rich families.

And on a personal level, logically I have more assets than I can ever usably “spend”. I hoard them (“over investing” in pension funding, cash) because I fear for an old age where the neoliberal society means I not only have to pay for everything via private providers, I get ripped off and scammed, so my money in retirement goes less far. If the government taxes me more, but gave me the best available health care free at the point of delivery and a liveable income in retirement plus a jobs guarantee until I’m 65, I’d happily let them have it all, or a lot of it, in tax take. That would be far more efficient for society and a lot less stress for me. That’s how it used to work here, certainly from the post-war period up until about 1980.