As we’ve pointed out regularly, the SEC has been hobbled by Congress for so long that its enforcement actions focus mainly on insiders trading cases. To see the agency file a suit against Elon Musk, and (as we’ll see) on such short notice means they are highly confident they can prove that Musk violated securities laws.

The Wall Street Journal describes how Musk gave the SEC the middle finger:

The SEC had crafted a settlement with Mr. Musk—approved by the agency’s commissioners—that it was preparing to file Thursday morning when Mr. Musk’s lawyers called to tell the SEC lawyers in San Francisco that they were no longer interested in proceeding with the agreement, according to people familiar with the matter. After the phone call, the SEC rushed to pull together the complaint that it subsequently filed, the people said.

It’s one thing to have some preliminary discussions and then decide that you’ll see the SEC in court. It’s quite another to complete an agreement, have the SEC commissioners bless it, and then renege.

And indeed, it looks like the SEC has a slam dunk case. As most readers will recall, Musk tweeted that he has the financing lined up to take Tesla private:

Am considering taking Tesla private at $420. Funding secured.

— Elon Musk (@elonmusk) August 7, 2018

Analysts who called Tesla’s Investor Relations department about the details of the financing didn’t get more information but were reassured that the “funding secured” statement was accurate.

Musk later tweeted other details consistent with a deal being structured and ready to go:

My hope is *all* current investors remain with Tesla even if we’re private. Would create special purpose fund enabling anyone to stay with Tesla.”

This story was front page news for a day or so until it became clear that this going private plan was pure varporware. Musk had had four conversation about the general idea with a sovereign wealth fund, presumably from the Middle East, since it repeatedly asked Musk to open a facility there. Musk did not agree to the idea. Again from the complaint regarding the very last meeting:

The July 31 meeting lacked discussion of even the most fundamental terms of a proposed going-private transaction. For example, there was no discussion at the July 31 meeting of (1) any dollar amount or specific ownership percentage for the Fund’s investment in a going-private transaction; (2) any acqui

sition premium to be offered to current Tesla shareholders; (3) any restrictions on foreign ownership of a significant stake in Tesla; (4) the Fund’s available liquid capital; (5) whether the Fund had any past experience participating in a going-private transaction; (6) any regulatory hurdles to completion of a going-private transaction; or (7) the board approval process necessary to take Tesla private. Musk has acknowledged that the July 31 meeting was the most specific discussion of a transaction to take Tesla private between him and representatives of the Fund….Between the July 31 meeting with representatives of the Fund and the morning of August 7, Musk (1) did not have any further substantive communications with representatives of the Fund; (2) did not discuss a going-private transaction at a share price of $420 with any potential funding source; (3) had a conversation with a private equity fund representative about the process, but did not actually contact any additional potential strategic investors to assess their interest in participating in a going-private transaction; (4) did not pr

ovide Tesla’s Board of Directors with a more specific proposal to take Tesla private; (5) did not contact existing Tesla shareholders to assess their interest in remaining invested in Tesla as a private company; (6) did not formally retain any advisors to assist with a going-private transaction; (7) did not determine whether retail investors could remain invested in Tesla as a private company; (8) did not determine whether there were restrictions on illiquid holdings by Tesla’s institutional investors; and (9) did not determine what regulatory approvals would be required for such a transaction or whether they could be satisfied.

There are more damaging details in the short and readable filing, which we have embedded at the end of the post.

The stock jumped nearly 11% on the day as shorts closed out their positions.

Musk’s Twitter account was indeed an official venue for investor communications. From the complaint:

On November 5, 2013, Tesla publicly filed a Form 8-K with the Commission stating that it intended to use Musk’s Twitter account as a means of announcing material information to the public about Tesla and its products and services and has encouraged investors to review the information about Tesla published by Musk via his Twitter account.

Musk had over 22 million followers at the time of his ill-advised tweet. By contrast, Bernie Sanders has only 7.9 million followers.

Musk also made clear he hated short sellers:

Musk has complained that Tesla has been unfairly targeted by short sellers and predicted that short sellers would be “burned.” For example, on May 4, 2018, Musk tweeted, “Oh and uh short burn of the century comin soon. Flamethrowers should arrive just in time.” On June 17, 2018, Musk tweeted that short sellers “have about three weeks before their short position explodes.”

Musk’s recklessness gives the SEC a great opportunity to burnish its badly-tarnished image with a high-profiel victory. Again from the Journal:

The case ranks as one of the highest-profile civil securities-fraud cases in years. Its filing less than two months after the Aug. 7 tweets by Mr. Musk also marks an unusually rapid turnaround by an agency that has been under fire for its perceived failure to promptly bring significant cases in the financial crisis and other episodes. “It means there was not that much investigation they needed to do to get comfortable that it was a case they should bring, but also a case they can win,” said Michael Liftik, a former SEC enforcement lawyer now at Quinn, Emanuel, Urquhart & Sullivan LLP…

“It’s an easy case,” said Charles Elson, director of the John L. Weinberg Center for Corporate Governance at the University of Delaware. “He said in the tweet he had financing, and apparently he didn’t. … It’s about as straightforward as you can get.”

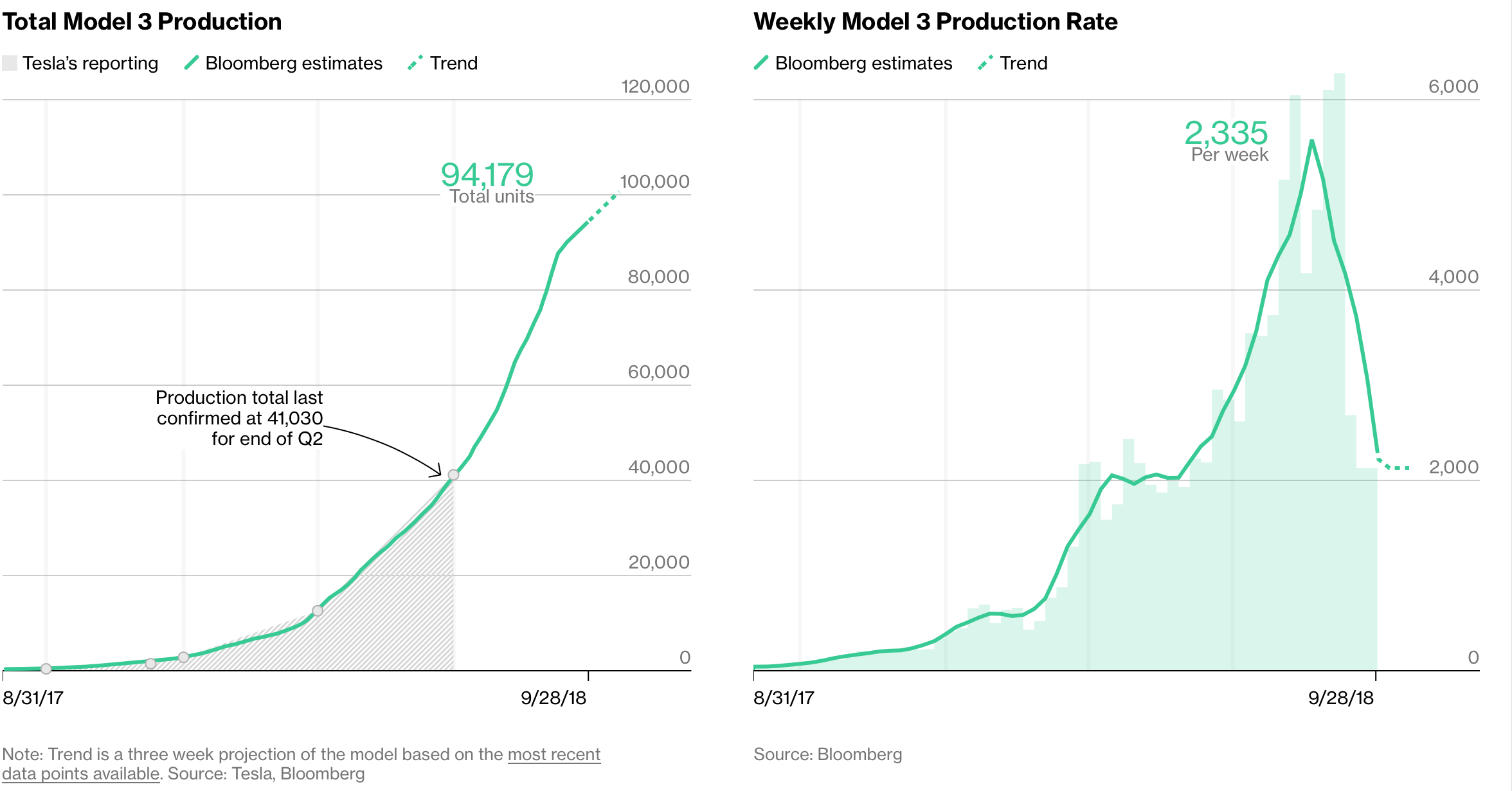

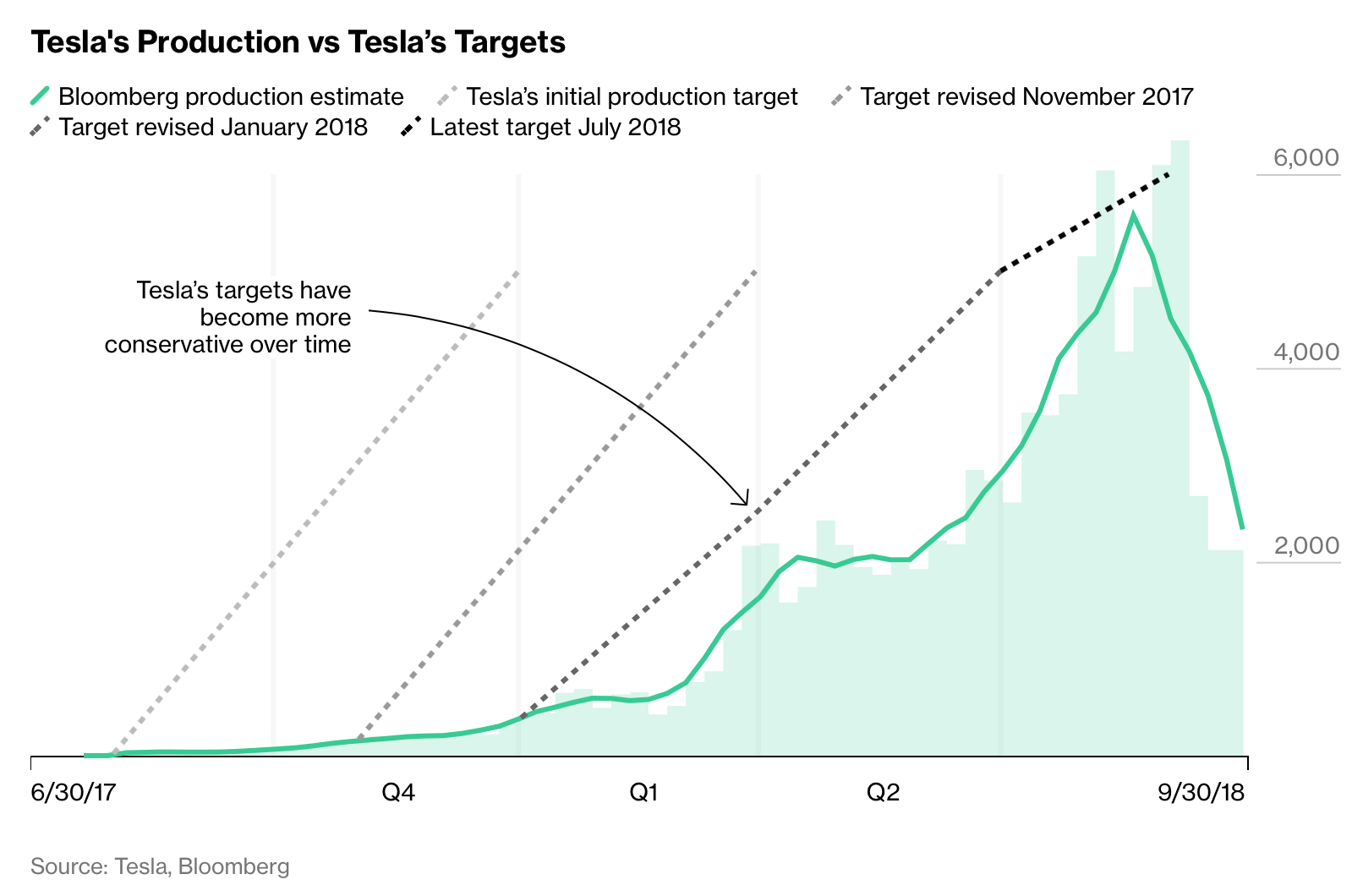

Needless to say, as the high short positions show, Tesla’s business is not faring well, despite its huge market capitalization and the enthusiasm of customers. Musk made a great show of getting production of his Model 3 over 5,000 a week. A Bloomberg tracker based on vehicle identification numbers says that was a one-shot wonder:

And reminds readers that Tesla has repeatedly fallen short of its production targets:

These figures are particularly important since Tesla is still losing money on every car sold. The company claims it will be able to show a manufacturing profit once it can produce 5,000 to 6,000 cars a week. But that seems questionable given its quality problems. From an August 31 article in Seeking Alpha:

With 84% of the cars rolling off the production line needing repairs, there is a strong likelihood that Model 3 is the lowest quality mainstream car ever produced. This kind of yield for any other company would only occur during prototype stages…

We are now starting to see data that shows how bad the quality problems are. For example, public Model 3 tracker shows that:

62% had defects in the first 30 days of ownership

47% had AT LEAST one visit to the service center in the first 30 days

20% were out of service AT LEAST one day in the 30 days

The same article argues, in detail, that Model 3 demand is greatly exaggerated:

Even with rapid homologation, we now estimate that Model 3 LR/P/AWD version worldwide demand to be about 2500 to 3500 a week – well below even the 5k per week production level Tesla reached in Q2. This number can double with the base short range $35K version of Model 3 but given the Company’s cost structure we do not expect to see the $35K car until mid-to-late 2019 if at all.

The consequence of the above is that Tesla now has significant amount of Model 3 overcapacity once the reservation queue is exhausted which is almost certain to happen in Q4 – if not sooner.

And Tesla’s financial condition is desperate. Interest expenses are now $640 million a year. The car company lost $743 million in its latest quarter, up 85% from the prior quarter and worse than expectations. An improvement in the burn rate did little to change the overall picture. From MarketWatch at the end of August:

The Canaccord analyst [Jed Dorsheimer] also worried about Tesla’s cash position. With $2.2 billion in cash at the end of second quarter, Tesla “only has enough cash to maintain operations for another six to nine months at its current rate,” he said.

The company has managed “to stem the flow of cash burn” from $1 billion to roughly $740 million quarter-over-quarter, but has not managed to achieve profitability since a short stint in 2016.

The financial press is hotly debating what sort of life, if any, Tesla has if the SEC succeeds in forcing Musk out of the company. Of course, Musk can attempt to escape the practical effect of an SEC win (save for whatever fine it imposes) by taking the company private. That may be the reason Musk’s lawyers decided to blow the agency off. However, if the SEC prevails, the bar would include any company that had public debt, not just public shares, which would restrict Tesla’s financing options. But the bigger barrier is that Tesla’s prospects don’t seem likely to improve, particularly as the company has seen high executive turnover in the last two years and Musk has been more and more erratic. And losing to the SEC has other downsides. From the New York Times’ Dealbook’s daily e-mail:

If the commission convinces a jury that Mr. Musk misled investors, he could be blocked from serving as an executive or director of any public company. That could force him to assume a different position at Tesla. It could also affect his other companies, SpaceX and the Boring Company, were they to go public, and potentially harm their ability to raise money from investors….

Andrew [Ross Sorkin]’s take:

Mr. Musk will want to prove that his intent wasn’t to mislead investors, probably by demonstrating that he had real conversations to take the company private. But his intent is almost beside the point. He can be found guilty simply for being “reckless.” And naïveté isn’t a defense.

This is turning into a sad story for Tesla’s employees, investors and ultimately everyone who has followed Mr. Musk’s efforts to transform the auto and energy industries.

Tesla has long seemed to be more a vehicle for Musk’s personal mythology than a business, despite the fact that is actually has produced quite a few cars. And Musk may have foreseen his car company’s future when he choses its name. Even though Tesla profited from licensing his inventions, he eventually exhausted his funds.

comp-pr2018-219

All the hubris in the world and finally laid low by his Twitter habit. I never understood his obsession with the short sellers, which to me was the cause of his downfall. Perhaps he was obsessed because they were uncovering the multitudes of Teslas ongoing problems and Elon knew they were largely right.

Twitter has some great accounts that have been detailing this ongoing fraud. When it’s all finally said and done it will make for a fun book. It’s got it all. Corruption, drug use, celebrity gossip, technology, and a self-proclaimed martyr at the center of it all.

The question I have is what happens to all of Teslas customers in the event of bankruptcy? The cars are highly dependent on software, in a way no other personal vehicle is. And we’ve witnessed problems with braking in the consumer reports test car that were fixed with over the air updates. If I were an owner, I’d be looking to sell my car now.

Larry, I would think the brand is valuable enough to be picked up by ????…

There are a lot of believers out there.

It’s possible the brand might get picked out of the ashes, but it’s also possible that Elon continues to be unbelievably toxic after whatever the aftermath of the SEC and DOJ proceedings. Tesla is Elon. The followers and believer flock to him as a Tony Stark come to life.

FT Alphaville has run a series of articles deflating the notion that competing automakers, or even suppliers (Magna is often mentioned as they’re very close to being able to build a vehicle themselves) would wish to buy Tesla. Competing automakers are already investing in their own electrified programs and it’s not clear that Tesla brings much of value to them. Panasonic already supplies the batteries to Tesla, so the Gigafactory (yeesh) can just continue to supply cells to other OEMs, should they even want them.

https://ftalphaville.ft.com/2018/03/28/1522248619000/No-one-needs-to-buy-Tesla/

Now maybe at fire sale prices somebody will kick the tires, but I doubt it. Elon has become toxic and the shoddy way they’re building and delivering cars is doing a lot to destroy the loyalty that a lot of their biggest fans have.

I think Tesla’s future is to be taken over by an existing big car company – it has a lot of brand and intellectual value, especially for a company thats fallen behind on electric power (for all the bad rap Tesla gets here, there is no question but some of its design and tech is groundbreaking).

I would guess that it would make a nice addition to the VW portfolio, although most likely a Chinese or Indian car company would love to own it too.

Space X is also a pretty valuable company, it seems ahead of all the other private sector rocketeers.

Agree with all of the above. Musk went past his “sell-by” date for this kind of thing a long time ago, but the stupid market made Tesla so over-valued the normal absorption process was blocked.

If he goes, the stock will go, and then (see PK).

Tata, the Indian car company that bought Rover, is currently grappling with how to make it after Brexit. SpaceX is just another company that’s sponging off the US Govt. funding!

Not so sure who would want to pick up Tesla. Half the cars built are lemons and future warranty liabilities will be an ongoing nightmare. The whole production line is chaotic and prone to fires so this would have to be totally rebuilt. Maybe it would be best to let it die a natural death by letting the markets decide if it is worthwhile going on. My guess is no.

Yep, and for all the happy talk and production hell talk coming from Musk, he’s treated his workers far better than Henry Ford. I’ve also read that Ford (and Walt Disney) filed for bankruptcy seven times…so even the over-optimism seems to be part of the early adopter karma.

Musk will be going nowhere, he is being sued only due to his political beliefs and most everyone knows it.

Im in the not most everyone category

Yves – is there any history of a high profile CEO being charged, having a deal and backing out at the last second you or your team can remember ?

Followup – what happened ?

This reminds me a bit of Mark Cuban’s tiff with the SEC a few years back in which Cuban won at trial.

This is nothing like the SEC case of insider trading against Cuban. Elon tweeted misleading statements about his publicly traded company. I also suspect that as they look at the books, the SEC and DOJ are going to find plenty more evidence that they’ll use to nail Musk to the wall. Let’s not forget about the whole take Solar City private a few years back, where Tesla swallowed the company whole and saved Elon’s (and his families) equity in what was ultimately a failed business.

The executive branch of the government has already bet too much on Elon related to his other ventures such as SpaceX. Unlikely that DOJ will do anything about. Best hope for Musk’s critics especially Musk/SpaceX critics is for Musk’s enemies in Congress like Richard Shelby to get involved. However, the Shelby’s of the world have already been burned on multiple occasions for going after Musk. Not sure this time would be any different.

Remember Musk has already sued DOJ on multiple occasions and won or forced DOJ into settlements. Perhaps though that will make DOJ more willing to go after him.

Elon’s role at SpaceX could be clouded by his legal issues at Tesla and SpaceX could be affected too. His legal woes would put him (not necessarily SpaceX) on the Federal suspended/debarred contractors list.

People and companies end up on the list so the government avoids “doing business with non-responsible contractors.” Contractors include individuals as well as companies.

Elon’s SEC troubles (and if there is a conviction) would certainly make him (as an individual) eligible for inclusion on this list.

Well worth reading the link and applying the facts to the FAQs. (GSA maintains the master list for the government..don’t get hung up on this being a list for just GSA contracts. It’s not.)

https://www.gsa.gov/about-us/organization/office-of-governmentwide-policy/office-of-acquisition-policy/gsa-acq-policy-integrity-workforce/suspension-debarment-division/suspension-debarment/frequently-asked-questions-suspension-debarment#Q3

Not just the fossil fuel industry/Kochs going after Musk.. Now Trump’s SEC suddenly realized it’s an enforcement branch. Interesting.

It’s a tell, the Musk thing.

The Eloi ought to lay low, and face his short comings.

The best is the story of how Musk came up with the theoretical share price:

Brightest minds, people!

The parable of Icarus seems appropriate.

Or Hubris v Nemesis

thank you Yves. I came to NC ten years ago for an insight into what was wrong in the world.

And girl, have you and your team given it to us.

But, hang on just a gd second….. I am starting to laugh much too regularly and my partner is coming into my office…

30 years ago, maybe more, anything made in the USA was Q1. Now you can’t even get one of those good tools you used to see. And, when you do, it’s no longer made there.

I know what happened, so don’t need to ask. Seen a couple of Teslas up here in Cairns; about the extent of my curiosity

We just saw a sexual predator, perjure himself repeatedly (and not for the first time under oath) and he is going to be elevated to the Supreme Court. But we are going to prosecute Musk for his crimes. This seem more like what Putin does, when he selectively jails oligarchs just to keep the others in line.

I do not mean to sound like I am defending Kavanaugh, who almost certainly did lie about being a virgin and not drinking and drinking a beer somehow being legal when he was 17 (there are now rules in some states like Virginia that have legalized having kids drink wine and I would assume beer at their homes at family-only gatherings. Clearly a party would not apply). However, the sexual predator allegations, although they sound plausible given his membership in a group of preppie jocks who seemed to go for this sort of thing, are not proven and are not provable, given that the memories are so old. Experts have said these allegations don’t meet anything approaching a judicial standard. This is a classic “he said, she said.”

And regarding lying to Congress in general, be careful in discussing selective enforcement. From CNBC:

By contrast, Musk’s violations are crystal clear. They aren’t in the same category as Kavanaugh’s which seem plausible but don’t have anything approaching solid evidence supporting those appearances.

Interesting Mike what ever happened to a person is innocent until proven guilty. Perhaps you should move to Mexico

That’s the problem with commerce-led administration – industry controls the regulator. Here we see a bunch of organised short-sellers instructing the SEC to get their money back. Deplorable. Their stock-in-trade is a tame broker. We should put an end to these paper capitalists.

What every happened to going after all the banksters?

Oh, that’s right, the SEC is a bunch of banksters. How dare Elon lie to the banksters!

The SEC pursues only easy cases. The cases against the banksters were doable but not easy. This one is like shooting a fish in a barrel.

Despite this being an easy case, I half expect the SEC to lose anyway. They don’t have enough trial experience.

https://www.cnbc.com/2018/09/28/teslas-musk-pulled-plug-on-settlement-with-sec-at-last-minute.html