By Don Quijones of Spain, the UK, and Mexico, and editor at Wolf Street. Originally published at Wolf Street

A serious showdown is brewing in the Eurozone as Italy’s anti-establishment coalition government takes on the EU establishment in a struggle that could have major ramifications for Europe’s monetary union. The cause of the discord is the Italian government’s plan to expand Italy’s budget for 2019, in contravention of previous budget agreements with Brussels.

The government has set a public deficit target for next year of 2.4% of GDP, three times higher than the previous government’s pledge. It’s a big ask for a country that already boasts a debt-to-GDP ratio of 131%, the second highest in Europe behind Greece. To justify its ambitious “anti-poverty” spending plans, proposed tax cuts, and pension reforms, the government claims that Italy’s economic growth will outperform EU forecasts.

Brussels is having none of it. EU Commission President Jean Claude Juncker urged Italy’s Economy Minister Giovanni Tria to desist. “After having really been able to cope with the Greek crisis, we’ll end up in the same crisis in Italy,” he said. “One such crisis has been enough… If Italy wants further special treatment, that would mean the end of the euro. So you have to be very strict.”

On Wednesday ECB President Mario Draghi held a private meeting with Italian President Sergio Mattarella in Rome, at which he reportedly raised concerns about Italy’s public finances, the upcoming budget bill, and related stock-exchange and bond-market turbulence.

The meeting evoked memories of the backroom machinations that Draghi, together with his predecessor, Jean Claude Trichet, undertook to engineer the downfall of Italian premier Silvio Berlusconi in 2011 and his replacement with technocrat Mario Monte, after Berlusconi had posited pulling Italy out of the euro during Europe’s sovereign debt crisis.

But such a drastic ploy is unlikely to work this time, since it would mean having to replace an entire democratically elected government. And Italian voters, already disenchanted with the EU, are unlikely to accept having a new technocratic government thrust upon them. But that doesn’t mean the EU doesn’t have aces up its sleeves.

Brussels knows that Italy’s banking sector, despite receiving hundreds of billions of euros of monetary support and virtually free loans from Draghi’s ECB, is extremely fragile. The longer the feud with Rome goes on, the more fragile it will grow. The Achilles’ heel for Italy’s populists is the chronically weak banking sector, whose massive holdings of Italian sovereign bonds make them particularly vulnerable to an economic downturn.

As tensions between Rome and Brussels escalate, and uncertainty grows about Italy’s economic future, investors are dumping Italian debt, causing bond values to fall and yields to rise. That, in turn, is hitting banks’ funding costs and their capital cushions. On average, banks are estimated to already have lost 40 basis points of their core capital in the second quarter and another 8 bps in the third.

As their capital base shrinks, banks are less able to write down bad loans — of which there are still frighteningly many — or issue new loans. According toanalysts at Morgan Stanley, Banco BPM SpA, Banca Monte dei Paschi di Siena (MPS) SpA and UBI Banca SpA are the most vulnerable of Italy’s largest lenders due to the size of their holdings of government debt.

It is this outsized exposure of Italian banks to Italian debt that makes any sudden deterioration in the value of Italian bonds so dangerous. The banking sector hold around 18% of all of the nation’s public debt. It’s the reason why, as investors abandon Italian bonds en masse, the shares of Italy’s banks are also nose-diving, with the stock of recently rescued Monte dei Paschi di Siena leading the way down having lost more than half its value year-to-date.

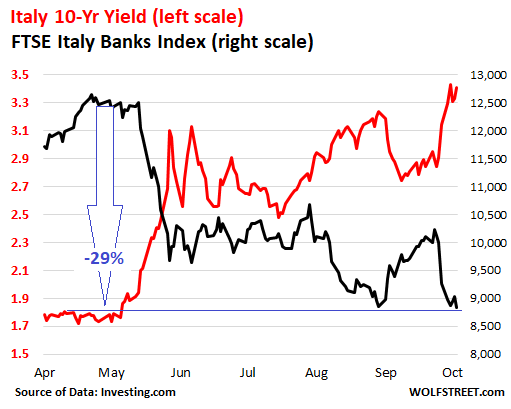

The chart below shows how the FTSE Italy Banks Index has plunged 29% since early May (black line), while the Italian government 10-year yield (red line) has nearly doubled from 1.8% to 3.4%, practically in tandem:

In other words, the dreaded “Doom Loop”– the vicious cycle between over-indebted governments in the Eurozone and the weak banks that funded them, which the ECB’s QE program was supposed to put an end to — is back in full flow.

It’s not just the banks’ shares that are feeling the impact. So, too, is the banks’ ability to raise funds.

Despite the ECB’s NIRP, which still reigns in the Eurozone, yields on Italian bank bonds have soared over the past week. On Thursday, a bond maturing in January 2023 from UniCredit, Italy’s largest bank by assets, yielded 2.67%, over two-and-a-half times the 1% it yielded when issued early this year. But smaller banks are frozen out of the market altogether, unable to issue new unsecured debt at rates they can afford. And that is putting renewed pressure on their liquidity, which, in turn, is restricting the amount of fresh credit reaching the broader economy. In August, total loans to companies and consumers slumped to their lowest level in two years, according to data from the Italian Banking Association.

The biggest fear is a return of the credit crunch that throttled Italy’s recovery after the euro debt crisis seven years ago, says Nicola Nobile, a Milan-based economist. Before that happens, Brussels hopes that Rome will do the decent thing and back down. The Italian government did offer a compromise of sorts on Wednesday by promising slightly smaller deficits in the medium term. But both coalition partners — the anti-establishment Five Star Movement and the nativist League — have dug in their heels on the 2019 budget.

Sooner or later, one side is going to have to blink, for the longer this uncertainty lasts, the greater the risk that Italy’s systemically vital banking system slips over the edge, taking Italy’s economy with it and potentially doing serious damage to the Eurozone economy.

Not sure how this is going to work out. I looked up the relative sizes and nominal GDPs for European countries at https://en.wikipedia.org/wiki/List_of_sovereign_states_in_Europe_by_GDP_(nominal) and it is very revealing.

Greece currently is at number 20 but Italy itself is right near the top at number 4. Only German, the UK and France are any larger so if the Italian economy blows up it may cause unholy chaos in the economy of the European Union.

To make the picture more complicated, the EU must know that Trump is in the background looking for any weaknesses on the part of the EU in order to give himself more leverage in negotiations. Any chaos caused by Italy would be welcome news for him indeed.

As an italian citizen who over the years has lost any hope about the will/ability of our politicians to serve the long-term interests of the country, I must say I’m impressed with the current state of affairs. The current majority (and government) is for one half made of mostly clueless populists who think they can ‘defeat poverty’ by giving out money we don’t have to the unemployed and for the other of racist nationalists with not-so-underhanded plans to get out of the monetary union, if not from the EU at large. They have cobbled together a budget law that backtracks on previous reforms and has no other vision than pleasing the electorate of both parties in order to reap votes in the forthcoming EU parliament elections – EU rules on the fiscal deficits be damned because ‘we are going to change the rules next year’ (5 stars movement) or ‘we’d be better off out of the eurozone’ (League). Financial markets are driven by ‘speculators’ to whom our heroes won’t surrender ‘not even if the BTp-Bund spread reaches 400’. All of this is happening with the full, and growing, support of more than half of italian voters, a consensus that in-charge governments have never enjoyed in this country in the last ten or more years.

I struggle to imagine how this can possibly end well.

While its not relevant to the EU and Italy today, two things for you to consider:

1. Both Canada and the US reconcile province or state defects and surpluses through the Central Government. The EU has, because of Germany’s instance, has not implements such a system.

2. Modern Monetary Theory is relevant to the 2% of GDP maximum defect.

The combination of German instance the their surplus is not used to the common good, and the EU budget defect rules provide and impossible conundrum for EU governance, the consequence of which is a combination of general impoverishment (the peasants) couples with an Aristocratic system, were a very small percentage of Aristocrats (the 0.1%) own everything.

A return to revolutionary France, or the Italian Renaissance Governance.

If Italy goes belly up then we are in for another GFC I fear.

What happens then?

The so called GFC just kicked the debt can down the road with the so called Quantitative Easing and bail out of Wall St and thebig banks.

Now we have big financial bubbles everywhere, all waiting for a pin.

Italy may be the pin, but there are a few other potential fairly obvious candidates (the known knowns, e.g. China, Japan, US, every other massively indebted government, war potential – Iran, N.Korea, S China sea, Ukraine etc.

And there are the the unknowns, to continue the Rumsfeldian nomenclature.

With the financial interconnectedness of the digital age rapid contagian is pretty much a given.

Hunker down people, it will probably be much worse than the GFC next time.

Didn’t we, in the last couple of days, see small German banks also put behind the 8-ball?

We could see, behind this policy, a power grab on the part of the people who have nearly everything and want to get the rest. It’s an attack on Small is Beautiful. It’s an attack on local power, local awareness, and financial due diligence that works because it knows directly what it’s talking about.

Another spin of the garberator.

Our economists don’t know enough to see what’s wrong with austerity.

Even the IMF economists are in the same boat.

The IMF predicted Greek GDP would have recovered by 2015 with austerity.

By 2015 Greek GDP was down 27% and still falling.

Neoclassical economists don’t consider the money supply or debt and this is where the problem lies.

You need to know that something extra that only central bankers know.

The money supply ≈ public debt + private debt

The “private debt” component was going down with deleveraging from a debt fuelled boom. The Troika then wrecked the Greek economy by cutting the “public debt” component and pushed the economy into debt deflation

Richard Koo has worked in a central bank and so knew that extra information.

https://www.youtube.com/watch?v=8YTyJzmiHGk

Ben Bernanke read Richard Koo’s book and ensured the US didn’t cut Government spending. He could understand the book due to his central bank experience.

I know as well as central bankers because I made the effort to find out.

Something our economists could try.

The Euro-zone is going down the pan because its economists won’t get their finger out and learn what is necessary to see what’s wrong with austerity.

The ECB has no excuse, watch the video above.

Ben Bernanke could get there after learning from Richard Koo, I am sure the ECB can too.

“The money supply ≈ public debt + private debt ”

According to this logic, the money supply in Italy is 30% higer than nominal GDP.

How can this happen?

The problem is that deficits (the increase in debt, but not debt in itself) increase nominal GDP (and in case of slcak of demand, real GDP too).

Deficit != Debt.

So it’s true that italian economy needs an increase in gevernment deficits, on this the M5S and the Lega are right (expecially since Italy is a net exporter since 2011); if everything works well, the increase in nominal GDP would make the burden lighter for both government and private debt.

The problem is that the EU had to give more space for deficits to the previous governments (that were europhile), the EU didn’t and therefore finds itself in the choice to:

a) force the italian government to stop, for example having the ECB say that italian bonds are not safe anymore, thus causing a collapse in the italian economy;

b) let the borderline europhobe M5S and, worse from my point of view, the crazy extremist right wing Lega do their policies, which will probably turn out to be beneficial to the italian economy if the EU doesn’t pull the rug under their feet.

Bot choices suck from the point of vieu of the EU.

Italy needs a boost to the feeble domestic demand, but it certainly doesn’t need short-sighted and distortive measures like those the government wants to implement, nor can afford to fund long-term transfer payments with deficits. They could leverage the Genoa bridge tragedy to launch a proper notion-wide investment plan in infrastructures (as opposed to the current envisioned €15 billion over three years, which were already planned by the former government), but that wouldn’t have worked as well with voters as giving an income guarantee of €780, facilitating retirement, pardoning tax debts, etc etc.

Up to now, the only good thing in the planned budget is the sterilization of the VAT hike (and even then, they just postponed it to 2020 and 2021 in order to pretend the deficit will decline).

While I agree in part with you, the M5S is not really offering an income guarantee, they are just bumping up the unemployment insurance to 780€.

Not everyone without a job can collect unemployment insurance, there are a lot of conditions attached, so it is not the same.

The ECB directly controls the interest rates on Italy’s debt. It uses this control to force Italy’s democratic government to follow a policy of austerity. And it is breaking its own rules to do this. The ECB is engaging in economic malpractice. Italy’s economy is 6% smaller than it was in 2008.

Italy needs to exit the Euro/EU. Until it does its economy and its democracy are at the mercy of the ECB. Italian unemployment is nearly 11%. Germany is at 3.5%. Who benefits?

Thank you for the on target analysis.

I watched the video wherein Warren Mosler explained that Italy needed to be able to use the Lira and had the choice of doing so with or without the permission of the ECB or the EU.

It is the same for Greece or any of the EU nations. The evidence is in and the Euro as working out is a failure, at least if the goal is general prosperity for the people in the nations of it.

War by other means is economic warfare that I see as in Greece as the German Company Fraport take over of Greek International Airports and all the profits that represents.

Imposition of austerity on sovereign nations of the EU by the ECB is nothing but an old game under a new name. You demand unsustainable payments in a foreign currency, and then take real assets. Something like that brought about WWII, did it not? What happened to Greece, is not forgotten, and won’t be.

The Euro has proven to be for EU nations, especially of the Southern region a foreign currency.

There are two things any legitimate government must do, defend and educate. If the nature of the war is economic there is no difference when the result is the same. The financial system must be as much ordered so as to maintain territorial independence as whatever its military is supposed to do for it.

Greece was conquered. Italy is up and will be as well if its government doesn’t issue again its own sovereign currency as Mr. Mosler gently explained.

“The Achilles’ heel for Italy’s populists is the chronically weak banking sector, whose massive holdings of Italian sovereign bonds make them particularly vulnerable to an economic downturn.”

And there is the fundamental flaw of the Euro: no sovereign currency. Normally, those sovereign bonds would be conservative, safe-as-houses (there’s an outdated cliche) assets. In the context of the Euro, they’re a risk. Of course, the “flaw” was absolutely intended, a way to impose reactionary policies on a fundamentally social-democratic polity (western Europe).

The trouble is, what is unsustainable will end, probably badly. And a very large economy (3rd or 4th in the EU, and heavily intertwined with the rest – again, absolutely intended) in a very bad mood is precisely how it could happen. It probably doesn’t help that the Italian governing parties are so new to governing.

I sort of hope Juncker and the others realize that they aren’t dealing with Greece this time – that reference was pretty sinister. It’s a game of Chicken, so the question is: who blinks?