This is Naked Capitalism fundraising week. 1017 donors have already invested in our efforts to combat corruption and predatory conduct, particularly in the financial realm. Please join us and participate via our donation page, which shows how to give via check, credit card, debit card, or PayPal. Read about why we’re doing this fundraiser and what we’ve accomplished in the last year, and our current goal, extending our reach.

A fresh story at Bloomberg, which includes new analysis, shows the ugly student debt picture is getting uglier. The driver is that higher education costs keep rising, often in excess of the likely wages for graduates. The article’s grim conclusion: “The next generation of graduates will include more borrowers who may never be able to repay.”

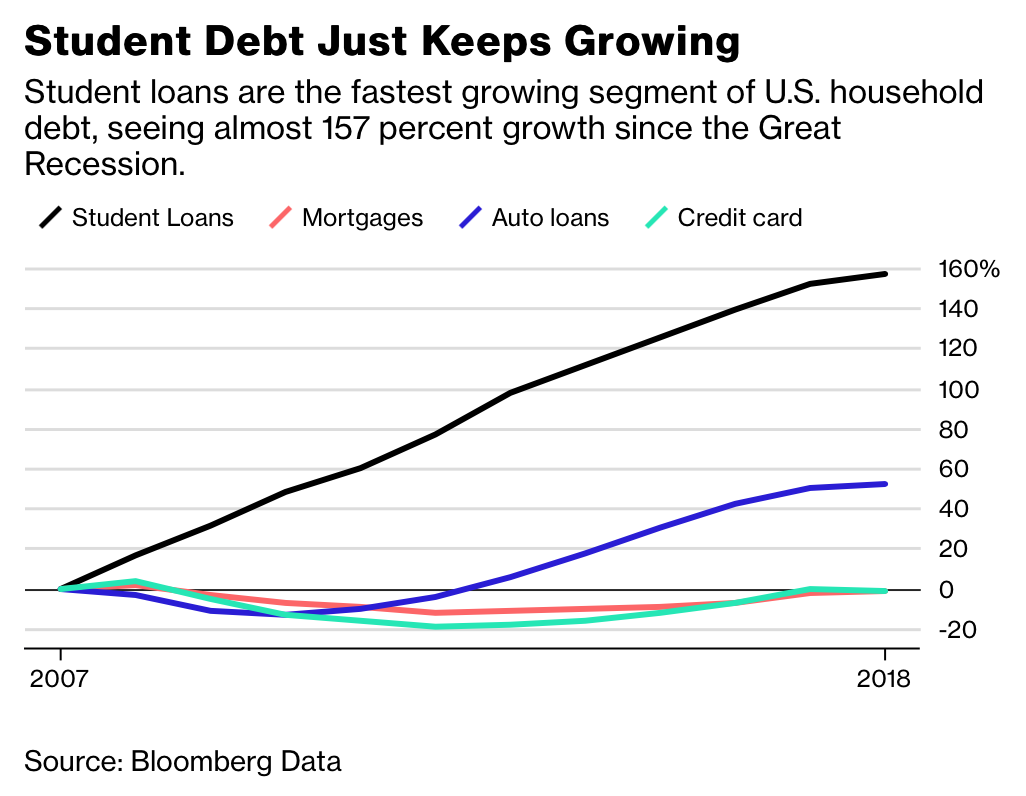

Student debt is now the second biggest type of consumer debt in the US. At $1.5 trillion, is is second only to the mortgage market, and is also bigger than the subprime market before the crisis, which was generally pegged at $1.3 trillion.1 Bloomberg also points out that unlike other categories of personal debt, student debt balances has shown consistent, or one might say persistent, growth since the crisis.

From the article:

Student loans are being issued at unprecedented rates as more American students pursue higher education. But the cost of tuition at both private and public institutions is touching all-time highs, while interest rates on student loans are also rising. Students are spending more time working instead of studying. (Some 85 percent of current students now work paid jobs while enrolled.) Experts and analysts worry that the next generation of graduates could default on their loans at even higher rates than in the immediate wake of the financial crisis.

The last sentence is alarming. As graduates of the class of 2009 like UserFriendly can attest, the job market was desperate. And for the next few years, the unemployment rate of new college graduates was higher than that of recent high school graduates. One of the corollaries of that is that more college graduates than before were taking work that didn’t require a college degree; this is still a significant trend today. And on top of that, studies have found that early career earnings have a significant impact on lifetime earnings. While there are always exceptions, generally speaking, pay levels key off one’s earlier compensation, so starting out at a lower income level is likely to crimp future compensation.

And on top of that, interest costs are rising. The rate for direct undergraduate loans is 5% and for graduate and professional schools, 6.6%. So student debt costs will also go up even before factoring in inflating school costs. So the ugly picture of delinquencies and defaults is destined to get worse.

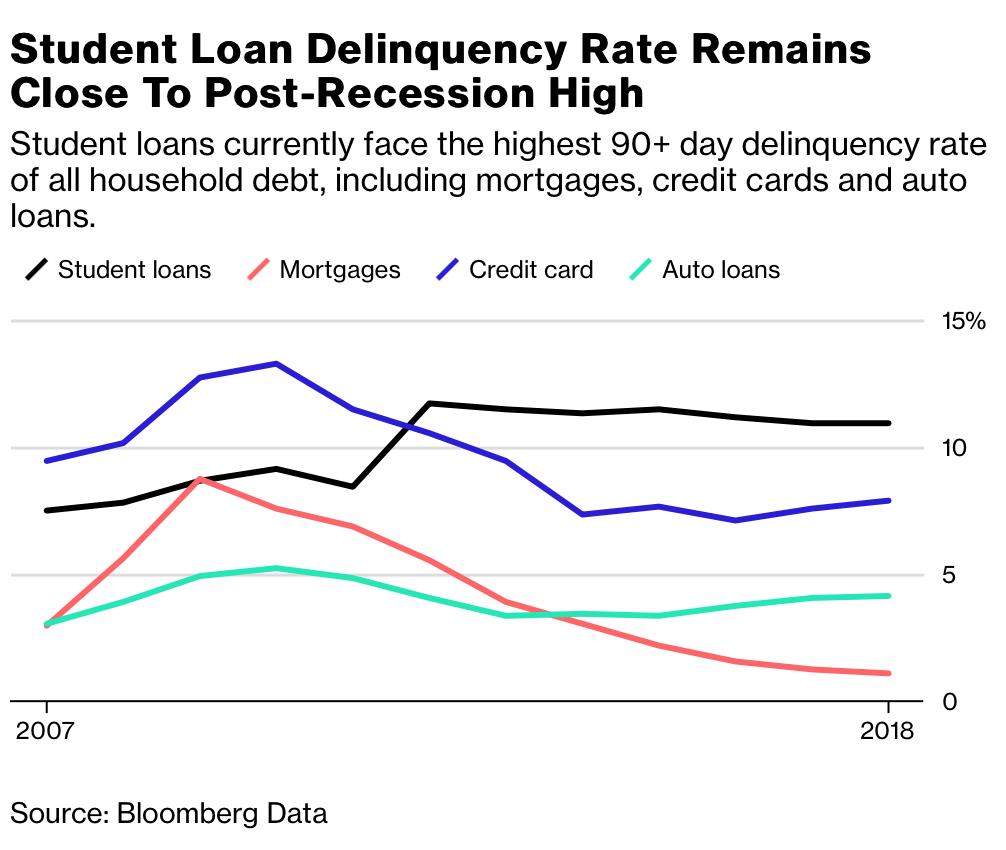

Students attending for-profit universities and community colleges represented almost half of all borrowers leaving school and beginning to repay loans in 2011. They also accounted for 70 percent of all defaults. As a result, delinquencies skyrocketed in the 2011-12 academic year, reaching 11.73 percent.

Today, the student loan delinquency rate remains almost as high, which Scott-Clayton attributes to social and institutional factors, rather than average debt levels. “Delinquency is at crisis levels for borrowers, particularly for borrowers of color, borrowers who have gone to a for-profit and borrowers who didn’t ultimately obtain a degree,” she said, highlighting that each cohort is more likely to miss repayments on their loans than other public and private college students.

Those most at risk of delinquency tend to be, counterintuitively, those who’ve incurred smaller amounts of debt, explained Kali McFadden, senior research analyst at LendingTree. Graduates who leave school with six-figure degrees that are valued in the marketplace—such as post-graduate law or medical degrees—usually see a good return on their investment.

I’m a little leery of cheerful generalizations like “big ticket borrowers for professional degrees do better.” “Better” may still not be that good. Recall that law school and in the last year, business school enrollments have fallen because candidates question whether the hard costs and loss of income while in school will pay off. And there are some degrees, like veterinary medicine, that are so pricey it’s hard to see how they could possibly make economic sense.

What is distressing about this ugly picture is the lack of effective activism by the victims. I am sure some are trying, but in addition to the burden of being so overwhelmed by the debt burden as to lack the time and energy to do anything beyond cope, is the fact that being in debt is stigmatized in our society, and borrowers may not want to deal with condescension and criticism. Another obstacle to organizing is that most of the victims are lower income and/or from minority groups, which means Team Dem can ignore them on the usual assumption that they have nowhere else to go. It is also harder to create an effective coalition across disparate economic, geographic, and age groups

But the experience of the post-Civil War South says things could get a lot worse. From Matt Stoller in 2010:

A lot of people forget that having debt you can’t pay back really sucks. Debt is not just a credit instrument, it is an instrument of political and economic control.

It’s actually baked into our culture. The phrase ‘the man’, as in ‘fight the man’, referred originally to creditors. ‘The man’ in the 19th century stood for ‘furnishing man’, the merchant that sold 19th century sharecroppers and Southern farmers their supplies for the year, usually on credit. Farmers, often illiterate and certainly unable to understand the arrangements into which they were entering, were charged interest rates of 80-100 percent a year, with a lien places on their crops. When approaching a furnishing agent, who could grant them credit for seeds, equipment, even food itself, a farmer would meekly look down nervously as his debts were marked down in a notebook. At the end of a year, due to deflation and usury, farmers usually owed more than they started the year owing. Their land was often forfeit, and eventually most of them became tenant farmers.

They were in hock to the man, and eventually became slaves to him. This structure, of sharecropping and usury, held together by political violence, continued into the 1960s in some areas of the South. As late as the 1960s, Kennedy would see rural poverty in Arkansas and pronounce it ’shocking’. These were the fruits of usury, a society built on unsustainable debt peonage.

Sanders has made an issue of student debt, but politicians who want big bucks from financiers and members of the higher education complex pointedly ignore this issue. As we’ve pointed out, top bankruptcy scholar Elizabeth Warren won’t even endorse a basic reform, that of making student debt dischargable in bankruptcy. So it may take student debtors becoming a bigger percentage of voters for this issue to get the political traction it warrants.

______

1 Higher estimates typically included near subprime mortgages then called “Alt A”.

There are many, many passages in this obscure old book called The Bible speaking of usury as a grave sin. So many it is actually one of the most clear and condemned sins in the entire book. Maybe we could see if any of our Congress persons have ever heard of it? They could learn something from it regarding this topic.

That said, it’s passages on gender equality and family structures are pretty outdated and abhorrent so I wouldn’t want them to get any bad ideas from this book on those subjects.

https://www.openbible.info/topics/usury

Indeed, all of the old “Iron Age religions” (Judaism, Early Christianity, and Islam) explicitly denounce usury.

The great irony of the Deep South in te USA is that they’ve been frequently banning Sharia law, even when Sharia law is one of the few types of law in the world which explicitly bans charging interest.

It is always intriguing how many politicians are so eager to endorse a literalist fealty to the social structures of the bible but ignore, or even vehemently rail against, the more balanced social restrictions on things like usury or the old idea of a debt jubilee. But then Jesus himself railed (physically) against embedding money in religion and now we have “entrepreneurial churches” who preach a “doctrine of prosperity” so I guess times have changed.

Michael Hudson wrote about the history of ‘debt jubilees’ and debt cancellation today.

https://michael-hudson.com/2018/01/could-should-jubilee-debt-cancellations-be-reintroduced-today/

I graduated 10 years ago and the most frustrating part was everyone telling me it would be alright and ignoring thw whole you never recover thing. I am still unable to find worthwhile employment and probably never will be able to.

You really can’t listen to many of us over 40.. we really lived in complete my different conditions. When I got out of college in the 90’s they were basically hiring everyone with a pulse in tech. From what I have seen from recent graduates it’s getting easier, as I am seeing a lot more intershops turn into job offers. But for the generation that you are part of, it’s an economic hole that may never be recovered from simply because you were born at the wrong time.

Looking at that graph, notice how the only debt that is backstopped completely by the federal government is growing the fastest. The no default on student loans rules have to be rescinded.

I graduated in the 1990s, and if you were not in tech, the job market was just as lousy as it is now.

I graduated into the dot com/9/11 crash—no one hiring. Became self employed and was starting to do really well right before the financial crisis of 2007-2009. I finally feel like I am getting into the swing of it again and am terrified of the next crisis.

Meanwhile rents and house prices are astronomical because senior citizen Dems join hands with landlords to prevent new high-density housing construction in my blue state major metro. I have never known the kind of economy that Baby Boomers have as their mental model of how the world works.

Thank God I graduated with “only” $22000 in student debt all those years ago, slightly below average.

I think you mean Lovable Uncle Joe Biden’s contribution to the Bankruptcy Reform Act of 2005, which provides that student loans cannot be discharged in bankruptcy. Why do people think he would be a good candidate with that albatross around his neck along with several others? Not to mention his younger son working for a Ukrainian oligarch.

Extrapolating from these trends, then in a few years the only young people that would be able to afford higher education in the United States would the the children of the ten per cent – plus a smattering of scholarships to talented individuals found worthy of supporting. It follows then that as these educated people entered the workforce, that over time that the people that would be running the country would be children of the elite in a sort of inbred system. It sounds a lot like 19th century class-based Britain that if you ask me.

As for the country itself it would be disastrous. Going by present population levels, it would mean that instead of recruiting the leaders and thinkers of the country from the present population of 325 million, that at most you would be recruiting them from a base level of about 30-40 million. It is to be hoped that these people are not from the shallow end of the gene pool. You can forget about any idea of an even-handed meritocracy and America would be competing against countries that might employ the idea of a full meritocracy in the recruitment of their leaders. I wonder how that might work out.

You could put that whole paragraph in the present tense quite nicely.

“I wonder how that might work out.” Ummm …. the Monty Pythons had an idea in the 1970’s.

The “Upper Class Twit of the Year” competition. Gotta love the “Kick a Beggar” event.

“America would be competing against countries that might employ the idea of a full meritocracy in the recruitment of their leaders. I wonder how that might work out”

Would the performance of U. S. men in international soccer competition be a similar situation?

The US was deeply unequal right through the 1930s, and that was reflected in universities. First year university students actually wore little beanies, to give you an impression of what a twit bastion it was. Normal people went to trade schools, teachers colleges, or something similar, which morphed into universities after WWII and the GI Bill.

Oh, and the profesors were gentlemen scholars who paid for their research mostly out of their own pockets or by networking their way into government or foundation grants where merit was less important than loyalty.

Why is America so determined to reconstruct an aristocracy its founders abhorred?

They only abhorred the British aristocracy, they framed to Constitution to create a home grown one; and, they succeeded beyond their wildest dream.

Because they think it will help them stay rich?

Alexander Hamilton liked the idea very much. It’s why the musical is SO popular among the neoliberal set.

The concept of student debt as it exists today would be repulsive to our Founders. Not just for the larger issue of our country being on the trajectory of becoming an economic aristocracy, but specifically because the Federal government is profiting tremendously from this crushing usury being applied to majority and the least among us.

Our Founders had no problem with the conquest and seizure of Native Americans land, and they fully respected the rights and claims of other European countries to do the same. One of their strongest repudiations of the aristocracy was the expansion of private property rights beyond what was known under any monarchy on the planet to that point in history. In the pre-industrial world the vast majority of people lived in an agrarian society and economy. Owning land secured you with your livelihood, your living, and much of your resources; it fully supported most families.

For its founding and for generation after generation the United States government gave land to countless men for military service, government service, homesteds, etc. Expansions by the Louisiana Purchase and war and treaties with other European nations, quickly resulting in making these lands available for settlement to our citizens and to immigrants.

The point is that for well over 100 years the government provided to its citizens a huge amount of what our citizens needed to live their lifetimes through these grants of land. These land grants were then passed from generation to generation and formed the economic foundations for millions of people, their children and their next generations.

Our Government did this.

The United States ceased to be a predominantly agrarian country in the mid 20th century. But they did not stop aiding our people and their economic needs. Our government (Federal and states) did continue to provide to our population through public education (very affordable college), the GI Bill that served millions with income, housing and educational benefits, Social Security, Medicare, etc.

Since our country’s very founding our government has recognized the benefit and need to facilitate the support of its citizens. The American economy became the greatest on earth because of our land conquest heritage and our collective investments as a nation. No one did it all on their own, and no one pretended they did.

Reagan killed this legacy. Reagan claimed that our nations success and our heritage was built on our history of rugged individualism and that our government was the obstacle to returning to these roots. It was a lie; nothing could have been further from the truth.

Student debt, as it exists to day, is crippling the economic futures of the millions who have accrued this debt and the millions to come, year after year, who will do the same. The student is debt is robbing our nation of the economic activity that historically matriculated out from those passing from college to the world. That has come almost to an end. Worse yet, our government has positioned itself to also profit off this debt, and to prevent the indebted from escaping this type of debt through the legal means available for virtually all other forms of debt.

Our student debt is un-American. It is a cancer on our economy. It exists for the vast short term profit of the few at the expense of our nations future.

Amazing essay, thank you!

Admirable and well thought-out post.

I hope people keep in mind it was the Democrats, specifically Joe Biden, who made student debt even more crippling and heartless by changing the bankruptcy laws so that creditors can garnish your Social Security benefits (assuming Mitch McConnell doesn’t gut them first).

Republicans are open about what they hope to accomplish, you have to clear the verbal BS that clouds what Democrats are after, but at the end of the day they are both about enslavement and debt bondage over unwashed masses.

There is no future for this shithole country. The only emotion I have towards my country is rage.

I’m sure it’s often the parents that end up paying the debt, as my sister is doing. Parents have deep pockets and are desperate to help their loved ones get a good start in life.

In my sister’s case, they sent their girls to private high school, where they spent the money that could have paid for college. Not a smart decision. But they love their children and really wanted to do give them the best.

Now the girls are struggling to make a living and my sister cannot afford to retire.

I feel for your sister but while many people are in that boat, the median household income of $60k means the vast majority of parents can do little more than co-sign loans.

There are so many feedback loops, multipliers, and perverse incentives driving forward this bubble (and its calamitous social and cultural effects) that it’s hard to know where to begin.

As Goldman Sachs have pointed out, student-loan-based securities are increasingly “attractive” investments for speculators:

So the more student debt there is, and the higher the interest rates are, the better, from that perspective.

It’s undeniable, too, that high student loan burdens mean graduates are slower to form households and will probably have fewer children than they would otherwise. Their diminished spending power, meanwhile, adds to the ongoing erosion of the “real economy,” in favour of the financial one. Student loans therefore disrupt the basic means of social reproduction. The resulting declines in fertility then demand high rates of immigration to compensate. A fact cheered on, inevitably, by the open borders crowd (a substantial number of whom, oddly or not, seem to work in or for universities).

So we see yet another instance in which “right” neoliberalism and “left” identitarianism go hand in hand–forming, indeed, two heads of the same beast. Student loans have enabled the enormous inflation in tuition costs that have plagued the Anglosphere over the last couple of decades. This fees income feeds the academic beast (or at least its administrators and senior managers), while driving the one economic and social crisis (mass migration and the resulting populist backlash) that “left neoliberals,” centrists, and Clinton/Progress types appear to care about. It’s a self-licking ice cream of catastrophic size and reach.

Can you name some of these “open border” advocates, or suggest where their writings might be found? I don’t believe I’ve ever seen one. The Republicans accuse Democrats of being those exotic beings, but, as I say, I’ve never seen one myself. While I can think of arguments that could be made in favor of the concept, they would not be “politically correct” at the present time, and probably would not work in practice.

One specific example: hospital chaplains are facing a big retirement crisis. And yet the job requires (to be hoard certified): an undergraduate degree & then a Master’s of Divinity degree, plus a year-long residency. For a job that pays around $60,000 to $70,000. At least one school, Princeton, funds almost all of their divinity students. But I don’t think it’s the norm. And then you throw in the fact that such person ideally would be emotionally & spiritually mature, with enough life experience to meet with a wide range of people, who are often facing financial hardship due to being sick (as well as existential concerns). I don’t even know how to begin reframing the job or the qualifications or the salary to fit America in 2020. There are a lot of other angles, such as: what about well-qualified people who can’t afford seminary? I know there needs to be a way to screen-out and screen-in the best people (who won’t proselytize), but is a Master’s degree the right hurdle? But, I must say, the need for access to interfaith Spiritual Care is only increasing, as times get tougher & other hospital staff (RNs) don’t have time to sit and listen. People are in pain, not only in their bodies. One thought leader in the field has speculated that the job will just go away due to lack of advocacy & inability to evolve into a profit center.

thanks for a classic example of over -credentialization.

Namely, why on earth is a master’s degree required? A caring person who reads prayer books and wants to help others does not need to know all the history in a master’s degree.

It would be interesting to see that student loan debt chart superimposed over %adjuncts and number of administrators. Its pretty easy to guess what that would look like, but seeing that would be decisive.

I think a little delineation is in order. I’ve been an adjunct professor and believe the increasing use of adjuncts at universities has been very beneficial overall — in terms of the quality of education students are getting. Unfortunately, as we know, that’s not why universities are hiring so many more adjuncts; they’re being hired because schools can get away with paying them abysmally.

The situation is so embarrassing that, at the university where I was teaching five years ago, the full-time faculty passed a resolution asking the administration to give the entire projected increase in teaching salaries entirely to the adjuncts, an amazing act of selflessness.

The relevance to our discussion here, of course, is the insupportable increase in the annual cost of attending college even as the schools radically reduce their overall expenditures on faculty salaries.

So how long before this leads to a mass “We Won’t Pay” movement? I’m stuck on the dumb treadmill myself, but I wouldn’t begrudge an entire generation for just saying no. Sure, they can garnish wages and the like, but if 30 million people simultaneously say ‘eff this’, it’s more than just a wrench in the works…it’s drastic enough to force action.

Why DO they keep paying? The debts are always bought by debt collectors who don’t even have COPIES promissory notes. Let them sue you and show up for the hearing and demand proof. They can still ruin your “credit” but if student loans haven’t taught you to eschew credit nothing will. If EVERYONE “walked away” what could they do?

At the last meetup, I talked about how I have student loan debt collectors harassing me on my mobile phone. I still get these obnoxious robo-calls, and I don’t even have any student loan debt. Moreover, I have never borrowed a single cent from the financial industry. (I will exclude credit cards, which are technically loans even if I pay the monthly balance in full. Clive wrote about this at least once.)

It is entirely unclear how I can remove my name from these call lists. I changed my phone number, but they changed the callback number and continued harassing me on my new number.

I have sympathy for those student loan borrowers who are stigmatized and repressed as Yves and Stoller described above. I might even have empathy for these student loan borrowers, as I was privy to the shame felt by a close relative when he filed bankruptcy. (Now is your chance to look up the difference between sympathy and empathy.)

Don’t take any financial advice from me, but we should collectively sing, “We don’t need no education. We don’t need no thought control,” and then refuse to pay. Hopefully, that would cause some financial institutions to founder.

Unfortunately that is never going to happen. This society has been trained to worship at the altar of the FICO score, and most job seekers cannot afford to have a low score. Said score will be examined and potentially held against you when pursuing employment.

Also, employers frown upon employees who do not pay their bills and then have their wages garnished – at least the smaller emlpoyers do. This creates extra work for the employer and makes the employee suspect, as in irresponsible.

This problem was created by the political class and is going to require a political solution, i.e. legislation to assist the student loan borrower or a debt jubilee. Unfortunately, there’s too much money being made off the student borrower – even if the practice is killing the host. And the “I got mine” crowd will not allow a jubilee even if it is for the greater good of society. Lastly, student loan borrowers coming from a different era (who have paid off their loans) will begrudge the forgiving of the loans and consider them undeserved. In this case, perhaps the best resolution is to give everyone money toward their student loans – whether they are currently paid or unpaid.

I cannot jeopardize my employment by joining in a “eff this” movement as much as I would like to. Instead, I will continue on this treadmill called life, pay my bills and hope to escape as unscathed as possible.

Not yet a mass movement, but the idea is already here — check this link out, it was mentioned in a recent Naked Capitalism post re student debt:

https://debtrevolution.org/

The judges will just take their word for it

based on the receipt for their payment to the original (possibly false) creditor. We saw it during the foreclosure crisis in 2009-2012.I work for a company that contracts with department of Ed to get student loan borrowers out if default and back into the hands of loan servicers. The amount of money sloshing around is stunning. I’m sure they’ve got well paid lobbyists telling legislators that people will be unemployed if student loans are reformed. I owe well over six figures so the irony is not lost on me. Hiring one half of the working class to debt collect from the other.

Who pays for diploma-mill educations, and why? I have always assumed that people attended cash-n-carry schools because they did not qualify aptitude/grade-wise for entrance to a state school, OR a 3rd party like DOD or VA was footing the tab. Both assumptions appear to be supported by data. Given the far-above-average drop/flunkout rate of diploma mills. I know from my military career that enlisted members sign up for courses (local or online) at diploma mills to get extra points toward promotions – at Navy expense. Personally, I would not pay to send my dog to such institutions to learn how to sit up and beg.

One thing is certain, collich kidz do not appear to spend nearly as much time researching where they go to $chool as they do buying the car they drive.

Jumping into the conversation a little late, but my alma mater recently embarked on a major rethink of the college business model, and cut tuition from around 50k to around 30k. We even got a writeup from Frank Bruni for it.

College officials (I’m relatively active as a fundraiser for my class) describe it as a shift to a “philanthropy model” of funding. Which worries me for lots of reasons. But at least it’s a conversation-starter.

It’s also very much a school that is not for people looking to buy a future income flow, but rather an education.

“Education should prepare you for all of your life. It should make you a more thoughtful, reflective, self-possessed and authentic citizen, lover, partner, parent and member of the global economy.”

—–

Thanks for that link! I went to a similar school.

Three cheers for St. John’s college!

I learned a lot about the US for-profit private college aspect of this, how they run their business to get as many of those gov-backed grants as possible, and why people still sign up for ill-advised debt for degrees from Tressie McMillan Cottom’s Lower Ed. She has personal experience and a wider sociological perspective that I think is key to understanding all the factors that have got us to this point. It’s not that people are too stupid to see what’s going on. They’re making decisions based on a very limited set of choices.

Making students indebted serves the usual interest of the conqueror in relation to colonies. One of the first things Rome did was slap debt onto the nations they conquered, as did the French. Geoffrey Race (War Comes to Long An) notes that the Viet Cong persisted in their fight against the better-armed, better-funded Americans because the Americans were propping up the French oligarchy’s debt structure that the Vietnamese knew would leave them in hopeless debt peonage.

Student debt serves two additional bits of the neoliberal agenda: 1. It makes graduates reluctant to take lower paying jobs that might do public service, and 2. Ultimately, it discredits education as a scam that won’t deliver the income it promises.

Of course a major cause of this “rising” educational expense is the reduction of Federal funding. Federal funding for higher education has declined 55% since 1972 (says David Cay Johnston), and state funding has often declined even more. Oklahoma reports a 37% decline in just the last decade…but Oklahoma has really bought the neoliberal line, reducing taxes to the point that their K-12 teachers are leaving in droves, and they’ve been talking about a four day school week.

The neoliberl thinking: Better to not have a well-educated, critically thoughtful public if you want to continue to pull the same old scam.

As one Aussie says: “You Yanks don’t consult the wisdom of democracy; you enable mobs.”