Yves here. Things are looking ugly indeed at Tesla. The once-celebrated carmaker has has a lot of the air removed from its stock price, so that its market cap is finally below that of major auto manufacturers like GM. But the stock has fallen nine of the past ten days, for a cumulative decline of 20%, and the bottom does not seem to be nigh.

After drinking enough Tesla Kool-Aid for the electric car maker to float stock and bond market offerings earlier this month, collective sobriety kicked in. Tesla still has a high burn rate and is nowhere close to being consistently cash flow positive. For instance, Yahoo’s cheery headline late yesterday was, “Tesla may avert bankruptcy, but it will still need $1 billion in cash.” It didn’t help that one of Tesla’s biggest cheerleaders lost confidence. From the Yahoo story:

We believe Tesla will have to raise another $1 billion in capital,” Wedbush analyst Dan Ives told Yahoo Finance’s “On the Move.” The former Tesla super bull slashed his price target on the stock again on Monday to $230 from $275, which sent shares of the money-losing auto outfit down as much as 5%.

The analyst only a month ago cut his rating on Tesla’s stock to Neutral from Outperform.

Ives’ cash projection is somewhat startling considering Tesla is fresh off a badly needed capital raise. Earlier this month, Tesla raised about $860 million by selling new stock and $1.84 billion through the issuance of convertible debt. Both efforts came despite Musk contending throughout most of 2018 that Tesla didn’t need to raise capital.

But with a stock price continuing to languish and terrible first quarter earnings in the books, Musk clearly had to take some form of action to shore up Tesla’s finances. Keep in mind Tesla’s cash pile plunged $1.5 billion in the first quarter of 2019 from the fourth quarter 2018.

Indeed, a weak cash position is the last thing Tesla needs ahead of a Model 3 production ramp, forays into robo-taxis and car insurance, and whatever else Musk dreams up. Slowing demand for Tesla’s pricey electric cars doesn’t help the company’s fundamentals.

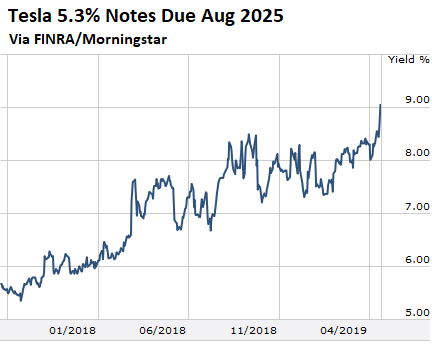

Tesla’s 5.3% bonds due 2025 now yield about 9%, according to Trace, well above the average yield for a B-rated company. The bonds have trailed the broader Bloomberg Barclays Single B U.S. High Yield Index this year by around 500 basis points, according to Bloomberg Intelligence analyst Joel Levington.

“There’s little in the form of favorable credit catalysts to turn momentum around in the near term,” Levington said in a report Monday. The bond price dropped below 83 cents on the dollar and was one of the biggest losers in the high-yield market Monday, according to Trace.

Musk, 47, recently told employees in an email that he and Chief Financial Officer Zachary Kirkhorn will personally scrutinize expenditures following a worse-than-expected first-quarter loss. After having to pay off a $920 million convertible bond with cash in March, another $566 million is due in November….

If Tesla is unable to earn profit in the second half of the year, the company may need to raise another $1 billion to $2 billion of capital, Ives said in an interview with Bloomberg Television.

“With a code red situation at Tesla, Musk & Co. are expanding into insurance, robotaxis, and other sci-fi projects/endeavors when the company instead should be laser-focused on shoring up core demand for Model 3 and simplifying its business model and expense structure,” Ives wrote in his report.

Elon Musk had promised that Tesla would produce 500,000 cars this year, then quickly corrected that to meeting a run rate of 500,000 by year end. The latest spate of stories focuses on the poor first quarter results, plus the news of a fatal crash by a driver using Autopilot, which Musk had recently been flogging hard. And recall that had serious quality problems on its Series C, faces sluggish demand (the phasing out of EV subsidies almost certainly pulled forward purchases.

Wolf Richter explains how the reaction of Tesla’s bondholders is much more grim than that of its stock investors, and why that bodes ill. Ones bonds are in the junk range, they are “story paper.” Junk bond investors look at risks very much the way equity investors do….in part because they may wind up holding equity.

S&P rates Tesla bonds at B-, which is “extremely speculative.” Moody’s just downgraded them to Caa1, which is “substantial risk”. And recall the big rating agencies tend to be laggards, as in they downgrade after the market is pricing a bond at a lower credit level.

By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street

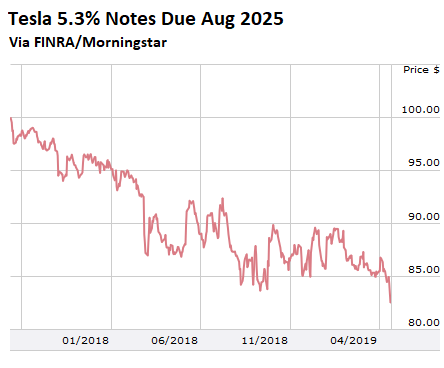

When bonds dive, it’s a bad sign. And Tesla’s bonds dove today to new all-time lows, and the yield spiked to new highs. In August 2017, Tesla sold $1.8 billion in senior unsecured notes due in August 2025, with a coupon rate of 5.3%. The most recent transaction at the moment that I see recorded by FINRA/Morningstar this afternoon was at 82.375 cents on the dollar. This is what these bonds have done in their lifetime:

Tesla’s shares are volatile and jump up and down. So they’ve been jumping down, down, down, leaving out the ups in between, as some long-term investors finally threw in the towel. They’re down 47% from their 52-week high last December, a big move in five months, when other stocks have rallied in a historic manner. However, at $205 at the moment, they’re still ridiculously overvalued, according to Tesla’s bonds.

The bonds tell a story of a company that is facing a considerable risk it might default on its debts. If this scenario comes about, it would trigger a restructuring of the company, possibly in bankruptcy court, where creditors would get most or all of the equity, and current shareholders would be mostly or totally wiped out. The bond market is now saying that this risk – the risk that existing shareholders might get wiped out in a restructuring – though still distant, is getting closer.

The yield on these notes due in August 2025 has shot up to 9.06% this afternoon, the highest ever (when the price of a bond falls, the yield rises):

Standard and Poor’s rates these notes a B-. Moody’s recently downgraded them to Caa1, one notch below S&P’s rating. Both ratings are deep junk (here is my cheat sheet on the corporate bond rating scales by S&P, Moody’s, and Fitch and what they mean in painfully plain English). Moody’s Caa1 means “substantial risk” of a default.

The average yield for B-rated junk bonds in the US was 6.67% as of Friday evening. So Tesla’s B-/Caa1 rated bonds trading at a yield of 9.06% means that the market has already downgraded these bonds a lot further than the ratings agencies.

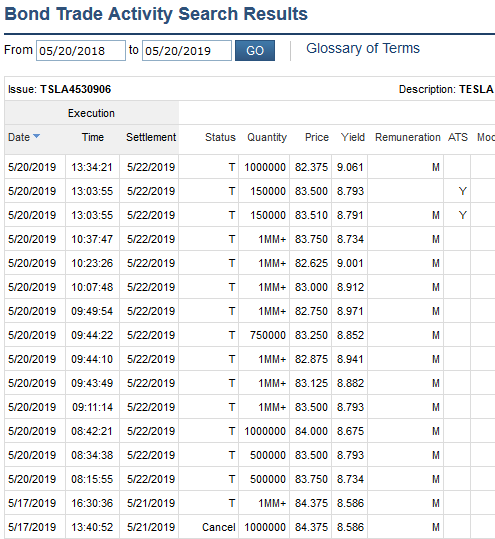

To shed some light on the obscure bond market, FINRA now publishes the data on the actual bond transactions. Here is today’s batch of transactions for Tesla’s notes due in August 2025, as of the moment I’m writing this:

In early May, Tesla closed an offering of stock and convertible notes that netted $2.4 billion, giving it sorely needed cash to keep its cash-burn machine fueled for a while longer, after having reported a huge loss and a massive cash burn in the first quarter, that would have been a lot worse if Tesla had not booked record pollution credits that it ingeniously disclosed five days after the earnings announcement.

Immediately after the stock and debt offering, shares rose because the new money would delay Tesla’s liquidity crisis by some time, depending on how fast it will burn this cash. But then reality sank in. Shares have since dropped 18% from $250 two days after the offering was announced to about $205 now. So OK, some true believers got taken to the cleaners.

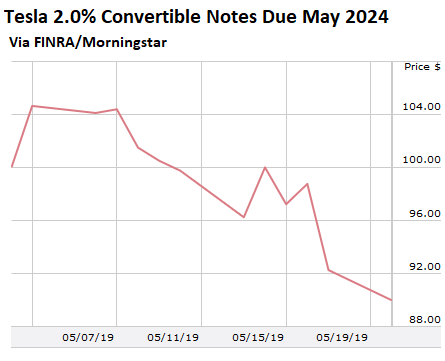

But the $1.84 billion of senior unsecured convertible notes issued at the time were supposedly acquired by institutional investors – the smart money. They were issued at 100 cents on the dollar at the beginning of May and jumped 4% to close at 104.37 on May 7. Then they started the downtrend. Today, they’ve traded in a range of 88.5 to 92, and are currently at 90. In other words, the smart money handed its cash to Tesla and two weeks later already lost 10%.

Turns out, according to CEO Elon Musk’s own admission in an email to his employees, Tesla will burn through that $2.4 billion in net proceeds in just 10 months. If Tesla’s stock is still worth anything at that time, the company will have to sell more shares or it will have to sell more debt to an increasingly nervous bond market. If it cannot do that, and thus if it cannot get more cash to fuel its cash-burn machine, it will have to default on its debts – see above scenario.

Tesla has been steeped in chaos – and chaos is absolutely the opposite of what a complex manufacturing, distribution, and retail operation needs. Musk himself has sowed that chaos. And he relentlessly continues to sow it.

One of his recent antics was that he told employees in this email last week that the company would embark on a cost-cutting drive that would entail that “all expenses of any kind anywhere in the world, including parts, salary, travel expenses, rent, literally every payment that leaves our bank account must (be) reviewed” by the CFO, and that Musk himself would sign off on every 10th page of expenses.

The CFO and Musk will be busy reviewing and signing off on janitorial department purchases of cleaning materials and toilet paper. The hope is that this amount of work will keep Musk off Twitter, but those hopes too will be dashed.

The company has already undergone waves of layoffs. Now the CFO and Musk are themselves looking at cleaning supplies to reduce the cash burn.

So let me give you, Dear Elon, a little piece of personal advice: I only ran a small company, a Ford dealership and subsidiaries with 250 employees. And I kept my eyes closely on expenses. But let me tell you, Dear Elon, that in even such a small and local operation, there are many thousands of expense items every month!

But Tesla is a large, global, complex manufacturing, distribution, and retail operation, and you, Dear Elon, will have no idea what most of these expense items are and what they’re for unless you ask the responsible manager. This, Dear Elon, takes a HUGE amount of time. Trying to do this for a company the size of Tesla shows that you are:

- Either clueless about running a complex manufacturing, distribution, and retail operation,

- Or so desperate that you can’t think straight any longer,

- Or willing to say anything no matter how silly just to boost the shares,

- Or all of the above.

I give you, Dear Elon, enormous credit for having put electric cars on the map and making them cool. No one in the world has ever been able to do this. You created an entire industry. And that was an awesome accomplishment. But this very talent of creating market hype and investor bedazzlement has a dark side, and that is now coming to the foreground.

The surprise came in Tesla’s SEC 10-Q filing when no one was supposed to pay attention. Read… Tesla Discloses Record Pollution Credits for Q1: Without Them, it Would Have Lost $918 Million and Bled $1.14 Billion in Cash

anecdotally, a neighbor started parking their tesla outside their garage around 8 weeks ago. i haven’t asked, but i keep wondering if they’re concerned that it might spontaneously combust.

Gonna be hard to get new parts for it in a few years too. Is Tesla the new Delorian?

And what of the software stack? The model 3 is completely controlled from the dashboard screen and Tesla lauds its OTA push updates as a bonus of ownership. If nobody is around to fix the bugs, we’ll good luck.

Yes. Tesla is this generation’s DeLorean.

Maybe the next generation could rig the Tesla with a Flux Capacitor.

Re do BTTF with Tesla? Thanks, but no thanks.

Ah, so that’s Elons master plan – go back in time with the True Tesla, thus retroactively (literally) validating the faith of his followers!

Somebody was talking about all those drivers who had prepaid for their Tesla cars and were waiting month after month for their Teslas to be built so that they could collect them. If Tesla crashes and burns and is taken over by the creditors, what happens to that pool of money that Tesla holds on behalf of all those purchasers? Would it be honoured or would it get listed as unsecured loans and seized for distribution to those owed money by Tesla?

No idea, but you could find from Tesla’s account (different accounting).

That said, the main problem would be all the Tesla drivers who would have all of sudden no spares, no servicing no nothing. That is, unless someone like GM etc, bought Tesla. But, IMO, they would not buy Tesla outright – why to do so, if you can wait and buy them on the cheap(er, there likely would be some price fight, but still at a fraction of the current valuation).

I think that’s the future for Tesla – its clear Musk has no idea how to run a major car company, but there are plenty of people who do. So long as he doesn’t completely torch everything, the brand name and much of his tech will be worth a lot. Someone will take it over and make a success of it, but integrated with existing manufacturing chains, not as a standalone company. My guess would be one of the companies that’s fallen behind in the EV race like Toyota or Fiat Chrysler.

I agree it’s a likely future for Tesla.

But as I wrote, no-one will buy it at the current valuation. There are likely valuable parts, but they, for example, don’t include chassis manufacturing processes IMO. Most likely it’s the control electronics and SW to run it + data (which Tesla undoubtedly collects) from running all its cars.

In fact, the data might be the most valuable part of Tesla right now, as with that, you can probably avoid a lot of blind alleys.

MorganStanley says worst case TSLA=$10, down from previous worst case $97 and current just below $200.

I can see how at $10 some large car manufacturer would buy it.

Tesla has more than $10 billion in debt. Plus an untold amount of latent liability from shareholder lawsuits, poor build quality, and the reckless rolling out of beta features that have a habit of killing people.

At $10 a share, Tesla has a market cap of just under 2 billion but considering the debt and liability I would guess it’s still a $20B purchase (or more). I can’t see any one picking up Tesla unless it is following bankruptcy.

No one will touch tesla. Bad customers with bad cars. All you’re buying is a bunch of pissed off bros “who paid a lot of money for this car!!!!”

Tsla did have a market cap of $$48 billion and an enterprise value of 36.

if you look at the assets, it’s about $20B So if you buy it for $10B in debt

and $10B in stock, it’s fairly priced just on book.

I’d say if an automaker picked it up and fixed the customer service, at anything between 17-30 Billion it’s a fair enough deal.

Remember, they are selling somewhere between 200-250K units and have

decent product. Buy it through packaged bankruptcy, and keep the customers

and the network and polish the design to have better quality.

Redesign the Model S with Grade 5 electronics.

The enterprise value of a company that loses money is less than zero.

Are you selling the bag holders, or are you a bag holder? Important question.

$10 is wildly overvalued for TSLA at this point after the brand destruction, explosion of debt, in hock on every single asset they could collateralize etc etc etc

7 or 11 seems to be the only way out for 3 to 6 months now.

Despite the formerly great plant, suppliers, hype; just imagine all the lawsuits, as these things die? There’s about to be a LOT of competition in this sector (maybe, he could work for the API as a shill?)

https://www.google.com/amp/s/www.forbes.com/sites/jimgorzelany/2019/01/22/the-coolest-new-2019-2020-electric-cars-worth-waiting-for/amp/

This is what technoutopianism leads to.

You assume a linear (or worse, exponential) future technological progress, with no setbacks and reversals.

And you design things accordingly.

With no consideration about the well known fact that the more complex things get, the more likely they are to break or be subject to failure due to “unknown unknowns” reasons.

Arthur Clarke’s “Superiority” short story used to be assigned reading for engineering students at MIT. But no longer. Which is symbolic of how the world of tech is developing.

Tesla could have designed a simple electric car without all the unnecessary software, that will run reliably for decades. It would have cost a fraction of what their current cars do (because there are thousands of engineers on six-figure salaries toiling on all that unnecessary software at the moment) and would have sold much better (looks like the projections for future sales growth did not take into account that there aren’t that many people out there who can actually afford Teslas at $80,000 a piece).

But that would have gone against the way people in SV think.

Well… Nissan, BYD & Geeley, Kia/ Hyundai and BMW simply don’t get media attention leaking over from the car/ renewable tech blogs and remaining dedicated enthusiast publications? CNG/ microturbine hybrid utility vehicles, all electric traction/ busses and fuel cell vehicles will simply be ignored, depricated, vilified… until they just become invisible from ubiquity. Kia’s getting more dependable than Lexus, maybe they’ll do it? Meanwhile, the press will focus on Tesla’s crash and burn (so to speak). Status quo?

CNG/ microturbine hybrid utility vehicles…

Turbines are really bad at moving cars, high exhaust temperatures, and really low torque at low rpm.

Relax, boss. The turbine doesn’t move the car. Why people , so touchy, here?

https://www.capstoneturbine.com/news/press-releases/detail/3556/

https://www.google.com/url?sa=t&source=web&rct=j&url=http://www.energy.ca.gov/2018publications/CEC-500-2018-019/CEC-500-2018-019.pdf&ved=2ahUKEwjFqefB_67iAhULwlkKHVBSB-oQFjAAegQIARAB&usg=AOvVaw1mt0HemEBQNROrnnlH-xG5

“Tesla could have designed a simple electric car without all the unnecessary software, that will run reliably for decades. It would have cost a fraction of what their current cars do…”

Such vehicles already exist, have been around for a good while, and are doing very well – partly because they take account of the real, peak-everything, no-more-growthforever, climate-shifting future into which we’re really heading, behind all the cloud-cuckoo-land economicgrowthforever fantasy paradigm.

They’re called velomobiles. (qv) Doing great in Holland.

In affirmation of your “Superiority” / MIT anecdote, I was recently in Charlotte. I had rented a car and was delighted when they upgraded me to an Audi S3!

Everything you needed was built into the software and visible on the dashboard display.

Way cool!

Two nights later, at a friend’s house about 10 miles away from where I was staying, I switched it on. The Cruise Control Panel was frozen, insisting on asking me to set a speed that could not be entered.

What? I never even TOUCHED the cruise control unit.

After 40 minutes on hold to the car rental hotline, followed by another 20 minute while the agent spoke to a technician, I finally heard the bad news.

The car had to be rebooted!

It’s one thing when your laptop crashes and you can take it to a shop. It’s quite another when your car bricks. Fortunately, I was parked in my friend’s driveway and not in a honky-tonk parking lot in DELIVERANCE country. After some finagling, I managed to drive it home (though with no headlights).

A little bit of research on the web indicated this is a well known bug.

The next day, I managed to drive the Audi to the airport, where the rental agent informed me that he, too, had been a huge Audi fan until he actually owned one and had encountered similar problems.

They downgraded me to a Nissan Altima, which, although it didn’t have the cachet of the Audi, seemed the perfect synthesis of the electronic and the mechanical. Even the GPS, though far more rudimentary than that on the Audi, was far more intuitive and gave better directions.

I cannot believe that this doesn’t happen more often than not, and I wonder about the poor Tesla owners to whom this will invariably happen, “Who you gonna call?”

One digression in the next post.

Heck, Nissan was integrating electronics with their robust, dependable, cleverly engineered mechanical systems for a decade before their crazy merger. Our “creative class” seems to lead all of us into some kind of specious gullibility we’re gavaged (magical thinking for rich folks… broke down in heavy traffic, with a pissed-off boss and misdiagnosed repair bill to those of us who used to fix our own cars?) Buy an old mechanical Toyota Celica GT?

Another thing that is alluded too but never mentioned directly in the article and posts, is, what exactly is RUNNING all this software?

Answer: An ECU (Electronic Control Unit).

They are bespoke for each car model, and some ECUs are more bespoke than others. And as I understand (I could be wrong) normally, they can only be reprogrammed if you buy a $10K unit from the car manufacturer.

Should Tesla go under, who’s going to manufacture the replacement ECUs? The ECUs monitoring apparatus.

A former TV repairman who now works on ECUs (mostly on VERY heavy industrial equipment with a sideline in automobiles) told me about a recent occurrence that happened to him. He lives in country estate country, and the ECU on someone’s £1.5m Ferrari had packed up, and he’d been unable to repair it.

There had only been four of these models made, and there was no replacement ECU. So essentially the man now owned a £1.5m paperweight.

My friend pointed out that the lower production run, the more difficult replacing the ECU becomes, a problem which will only get worse as the car ages. And Tesla? With a sliver of the market?

His advice? Buy a Vauxhall Corsa. There will always be replacement ECUs available.

Yes, exactly.

And everyone with the ability to think further than the next quarter is well aware of the future that awaits all modern cars.

You still have cars built 40,50,60,70 years ago running perfectly fine if they had been maintained properly.

No such possibility with modern cars, who will be a pile of scrap metal the moment the software is no longer maintained,

I personally don’t drive at all, but if I am forced to buy a car one day, I would very much want to get one without an ECU at all, and with as little electronics in it as possible, preferably none. The problem is there will be no such option on the market when that time comes. And it may well be illegal to drive such a car too in the not too remote future

Another alternative is mandate standardisation of car software, akin to the IBM computer era, and simply have different OS:es available, with some bells and whistles (not yet standardized features) left up to the proprietary OS of Tesla, Volvo and so on.

We could do a repeat of the computer once again, this time in our cars instead of in our phones!

… but seriously, if people keep expecting cars to be feature rich, they’ll be computers on wheels rather than pure transportation tools, and a gradual standardization is probably the best we’ll get.

I have a 2009 Corolla that came from one of the final days of the Toyota Fremont manufacturing plant, the union shop over the hill that was closed and later became Tesla. That would be a fun circle to see completed.

We’d discussed the long lamented Corollas, Prism, Matrix, Nova and Vibe models from that plant. Imagine dependable cars like those as plug-in hybrids or EVs! That you could charge from PV arrays and re-battery yourself…

oh, that’s right… WE’RE in the USA! Oh well.

I am absolutely ready for that!

It is practically a given that Tesla will be bought back by someone with deep pockets. The brand, customer database and the IP is worth a lot.

IMHO, Apple has stalled its development of the Apple Car because it knows that it will eventually pick up Tesla.

Apple will either launch an IPO on Tesla when it is a penny stock followed by a recapitalisation, or the reverse way round, or it will provide Debtor-in-Possession financing and propose to exchange all Tesla debts at par, including customer deposits. Considering Tesla would file in Chapter 11 in California, the court would view Californian companies more favourably. Elon Musk would be named Chairman Emeritus with a Golden Parachute and concentrate on SpaceX. Everybody is happy, except the ones who rode Tesla on the way down of course !

If I was Apple, I’d NOT buy Tesla at any cost.

Apple knows less about car manufacturing then Tesla does, and while it throws of lots of cash, doing the whole car manufacturing shtick correct would be still a few bln a year business. Apple’s electronic HW is of entirely different bent that what Tesla needs (real time life-or-death systems vs consumer electronics).

Apple’s SW is not great in my experience either. (as in not really better than your average large company).

It would be a huge millstone around Apple’s neck.

Now, if Apple could get a deal with a traditional car manufacturer where Apple would do the interior design and (some) electronics, that would be a different story.

Yes, lots of rumours around, but it does seem that Apple went a long way with their car before they realised that mass car manufacture is nothing at all like manufacturing phones, its vastly more complicated and they didn’t have the knowhow for that.

They were smart enough to know they were out of their depth (maybe because the CEO is a process guy, not a ‘creative’). They would have little to add to Tesla. It will be an existing car manufacturer who buys it and will integrate to ‘good’ bits of Tesla (apparently, their electric drive train is significantly better than anyone elses) into a line of premium cars. VW is an example, they integrate their premium brands (Audi especially) into their main brands in a very efficient and profitable manner.

Right, Apple would be even worse at this than Tesla has been.The tech bros out in California think all companies can be run like tech companies, and it shows on the factory floor. “Ship it”, “fix it with a patch”, keep the marketing wheels spinning…and outsource manufacturing to the lowest bidder. It’s not that big a deal with phones and apps, which are all essentially luxury goods, but you want pacemakers and cars to be built by people who take the time to be careful.

The company’s technology and customer rolodex are valuable as Autoline reported. Besides Apple, who else could be some other major players to buy Tesla out when it hits bottom? Boeing, GM, BMW, Honda, China?

Like in “Boeing fix lack of good engineering with software patches”?

Why would anyone in China buy Tesla:

https://cleantechnica.com/2019/04/10/china-q1-ev-sales-grow-118-year-on-year-fossil-sales-fall-13-charts/

dont mean to be disagreeable charles 2

exactly no one who looks at their balance sheet will buy them.

the brand is being destroyed everyday with customer service and parts issues.

the IP is worth nothing. they rank dead last compared to autonomy competitors.

the customer database might be able to be monetized to find marks for future IPOs like LYFT, UBER etc

Prospective buyers never provide DIP financing. It takes a lot of technical skill and a very few banks own that market.

And no one competent would buy Tesla on the verge of bankruptcy, particularly given litigation risk. That’s not how the pros do it.

To think he could have just had a nice niche electric sports car company which over time [tm] might have put a floor under institutional memory – infrastructure and expanded as demand allowed.

Naw … software scaling mentality for the quick bucks did a 8ball and forgot it was Mfg …. investors were like the lines ….

Hubris makes people do funny things.

too tru

“the smart money handed its cash to Tesla and two weeks later already lost 10%.” No.

If you look at the transaction in detail, Tesla paid >400m to the underwriters to purchase a call option so that if converted the stock is not diluted (which would make it less interesting to investors). That means that effective cost of funds to Tesla is >8%. But, if Tesla issued 8% bond, it would look really desperate (well, it is, but it doesn’t want to look like that).

If the value of the option is >400m, then it is about 20% (accounting for coupon) of the notional, and as the stock plunges, I’d expect the value to move in that range.

Covered bond holders tend to go short the underlying stock to compensate for these moves. So the losses would be less than 10%, if any (any hedging has slippage. Given the fast fall in the shares, it’s entirely possible the hedge would be sitting in the money now).

But to add to the Tesla story rather than dvelve on technicalities of CB.

Remember that “solar roof” that Musk peddled few years back? The one why he bought SolarCity (which was in problems, and just happened to be run by his cousin) for way more than anyone else thought it was worth? I’ve read that he’s making enough of those tiles to do three, yes THREE, houses a week. Not an hour, not a day, a week.

A lot of the factory cell capacity is sold to its direct competitors I’m also told.

And don’t get me started on Tesla autopilot. Tesla is the only proponent of self-driving cars that not only doesn’t use LIDAR, but Musk actively says LIDAR is wrong, and no use. Even assuming self-driving cars will amount to anything anytime soon (some sort of automation IMO will happen, but nowhere the full dream), it’s very likely that LIDAR will play a role (there’s just no way I can see how camera images can, in real time, without very significant hardware gains, provide the same 3D picture of environs as LIDAR can). And, as someone pointed out, if it does, Tesla will get asked this question in the inevitable court case of a Tesla self-driving car harming someoene. And then it would be damned by the very mouth of its can’t-keep-my-mouth-shut CEO.

If there is one thing that Silicon Valley delivers, it is “significant hardwarezone gains”, especially for a piece silicon dedicated to a specific task, such as vision and neural networks computation. Tesla achieve a factor 40 of improvement in 3 years. They say that their last hardware is enough. I don’t know, but what they have already achieved is impressive as you can see here.

As for the inevitable court case, the threshold should not be that a Tesla doesn’t harm anyone, but, like for a human driver actually, that it follows the rules of the road. But :

A) A self driving vehicle will eventually comply much better than humans to the rules of the road

B) It will have several video and radar records showing not only its behaviour, but the behaviour of the adverse party on the road.

, so I believe that it will be very hard to fight a court case on an accident with a self-driving vehicle.

In a case, Tesla would have to establish why they didn’t use LIDAR. Musk’s words on record are (empahsis mine)

‘”“Lidar is a fool’s errand,” Elon Musk said. “Anyone relying on lidar is doomed. Doomed! [They are] expensive sensors that are unnecessary. It’s like having a whole bunch of expensive appendices. Like, one appendix is bad, well now you have a whole bunch of them, it’s ridiculous, you’ll see.”’

A good lawyer (well, even a mediocre one, if I can see it) would then make a point that if LIDAR does reduce casualty likelihood, then Tesla knowingly put price (“they are expensive”) on any future casualties (i.e. the cost of future lawsuits would be less than cost of incorporating LIDAR). That tends to piss juries off I believe.

In case like this, as a defendant you’d want to show that you took all reasonable precautions. Here you have your CEO saying they are fool’s errand.

You know, he might be right. But if he’s not, the he gambles the whole company on one stupid sentence. How Musk.

Not only that, I don’t think LIDAR needs to be that expensive. I have seen LIDAR systems (admittedly not auto grade) for under $50 at decent volume. The cost will come down on them.

LIDAR (or equivalent as their are some competing ideas) could become more important as safety systems in cars expand. In particular, protecting bicyclists and pedestrians from cars requires enhance sensor systems to be built into the cars.

It all depends of what a “reasonable precaution” means. If a self-driving car without LIDAR is already safer than a human driver – which it has to be to be certified as a legit autonomous vehicle -, would it be reasonable to require the auto-maker to include LIDAR to enhance the safety further ? If one follows that reasoning for human drivers , ABS, ESP and all safety gizmos available to high end cars should be made compulsory on all cars !

And indeed, if LIDAR based safety system became compulsory on all cars, including human driven, then Tesla would have no problem including it, because competitors would have to bear the same cost than Tesla.

We are not getting fully autonomous cars any time in our lifetime. Big data types have said there are too many variables for any computer system to capture and analyze, and they don’t see this as a surmountable problem.

Less than fully autonomous cars are asking for trouble. Inattentive drivers who have to deal with an emergency when they haven’t been paying attention enough to react quickly or well. And that’s before you get to the deterioration in driving skills.

A small addendum: We’re not getting autonomous cars that are safe to co-exist with non-autonomous cars in our lifetime (nor ones that are safe to the extent people want in such cars).

Whether we’ll see fully autonomous cars on the roads, or whether manual cars will be allowed on said roads, is a different matter. With the current “move fast and break things”-bro-think and the ability to divert responsibility to others that that requires, I am quite unsure that someone (… could be anyone, but my money is on Musk or Kalanick) won’t release a “fully autonomous car” on the roads in the near future to great acclaim, and eventual sorrow.

This seems more like an “if, then” than an A leads to B…as in If a self dive can comply in all terrain and weather conditions, then it will have a record of what it’s been through. Mind you I think the software can be written and the gizmo’s can be made in some form, what to me seems not likely is mass adoption, The budget for the companies I work for does not cover brand new anything when to comes to vehicles. Sure there’s a tesla or two in the parking lot, (not the engineers, the sales guys) but the work truck is not a tesla it’s a “no don’t take the ford today there’s something wrong with it”. Full replacement of the fleet with self drive is beyond pipe dream in the real world. And that’s not even considering the likely catastrophe’s of an emerging technology. There are alternatives.

Actually, having had a bit of time to think about it, the fast drop in share price would increase the slippage. My bad. Still, the likely loss is less than 10% if the convertible bond (duh, another thing… convertible, not covered.. ) was hedged.

The question is can a car operate on LiDAR alone? Will it also need vision? If it cannot do it alone with LIDAR then what’s the point of LIDAR at all? If vision is still required enough to decipher objects and depth then what is LIDAR adding? Redundancy? Maybe but it’s not really redundant if the one cannot run without the other. At the end of the day, vision is the only thing that, realistically, can function independently of the other. That is the basis of Tesla’s position. And it makes sense. LIDAR really is a crutch unless you are only using it as a secondary sensor with vision in the primary. But again, if you’re vision is good enough to be primary, LIDAR is just extra baggage.

“Vision” is a very imprecise word in the context of autonomous cars and you ought to know that.

LIDAR adds two things over using camera images: speed of sensor processing and non-ambiguity.

That is, processing LIDAR input is much MUCH faster than using AI to “understand” an image, and far less ambiguous. The problem is that, unless you use a great number of sensors, it will leave you with holes in your coverage “nothing in front of me according to LIDAR, let’s go” (proceeds to run over small child). Visual inputs can cover a greater width, at the cost of not determining distance in the picture (except at a very rough level and with even more processing).

The ideal seems to be a combination, with cameras as well as fixed LIDAR and LIDAR sensors that can be targeted based on the data collected by the system (small vehicle detected in quadrant 3, determine distance and vector). Fetch Robotics seem to use something like that in their warehouse robots that are supposed to co-exist with humans.

As an aside, a LIDAR system would be very convenient if the intent is to fit all vehicles with transponders (a system to detect and communicate with said transponder would be needed). Maybe that’s the intent? If nothing else, in an environment without pesky humans, cameras could be eliminated and, thinking about it, it is also an easy way to end up without said humans. One way or the other. :)

I’m wondering how 5G or whatever will enable Uzbek kids to earn while they learn how to back Volvos out of wrecks, where folks were distracted, say in the back seat; then hysterically grabbed at the wheel, an’at?

https://www.citylab.com/transportation/2018/03/former-uber-backup-driver-we-saw-this-coming/556427/

https://www.google.com/amp/s/arstechnica.com/tech-policy/2018/12/uber-exec-warned-of-rampant-safety-problems-days-before-fatal-crash/%3famp=1

https://www.google.com/amp/s/www.pghcitypaper.com/pittsburgh/uber-whistleblower-says-autonomous-vehicles-routinely-involved-in-crashes/Content%3foid=12699278&media=AMP%2bHTML

I have no love for Musk who seems to epitomize the messiah-complex lunacy infecting so much of the tech bro crowd but it saddens me to see a once hopeful alternative energy icon reduced to a heap of garbage. At least it helped inspire the old guard to up their game with better electric and hybrid vehicles.

I agree – for all the joy many here see Musk taking a nose dive, he undoubtedly was a catalyst for change in the car industry, there is no way the big majors would be rushing into electric so fast if it wasn’t for Tesla – arguably he did good in solar too, even if his model didn’t work. And some of the engineering is genuinely impressive, its just a shame he could never resist a financial short cut, or for that matter, control his own rampant ego.

I disagree with the size of Musks influence. China is a major market for global auto makers and has been heavily pushing electrified vehicles. Add to that the disastrous diesel emissions cheating scandal by VAG and the subsequent crack down on emissions by European cities and countries and you have a perfect storm that forces change. Musk showed that the vehicles could be desirable, but I contend that he has not changed much about the auto industry considering his company has never earned money in this market.

There are quite a few Teslas on the road here in SoCal, so whatever else they sure are popular, even if of course only among the well off and most can’t afford them. Probably reduced smog.

” And some of the engineering is genuinely impressive”

Please elaborate! I keep hearing this and have not found anything that is impressive, or for that matter, anything that Elon himself has ever “engineered”.

He takes well worn ideas, pays lots of people lots of money to make incremental changes, and then pays a PR army to wrap him in “innovation” wrapping paper.

He is nothing but ego. That’s it. A banker turned defense contractor with an ego. Not that rare. The PR is the only thing that sets him apart.

I have found it for you : see Munro: Model 3 Electronics “Like a Symphony of Engineering” !

Munro’s all business is to tear down car and assess them. I should note that the same Munro is very critical of the build quality of Model 3, so they are not Tesla chills. This is what make me believe that Tesla will not disappear, but will just be bought by a company adept at mass manufacturing.

The Model S is widely reputed to be a very good car. Can’t even be rolled over!

Armored cars are roll-over resistant too. It’s normally just making the car wider, or lowering the center of gravity which is a normal ‘feature’ of a car with a giant battery in the floor.

I know I seem overly pessimistic, but I cant think of anything Elon has done that others haven’t done before him. It’s all PR, with lots of cash behind it.

Has anyone tried to buy the 2025’s? I have and can not find them listed for sale. 2020’s-2024’s I can buy those, sans the firesale prices.

Is it possible a shallow market is being rigged? As someone that is heavily invested in various bonds, I have to sigh.

Yes, the auto sector is going into recession.

Fun show Elon is putting on, a wild ride for sure. A godsend for media generation of clicks. Have you ever noticed that you often end up stupider after reading media ‘vibe’ driven articles? Other examples of vibe that makes you stupid. Trump!, Russia!, Venezuela!, China! Thank you nakedcaptialsm for at least attempting to make us smarter in the face of boredom.

Musk walks the line between order and chaos. Is there any other way to live a meaningful life?

I think there are likely other ways to live a meaningful life, particularly if one concedes that “meaning” is a definition of perspective.

Robert Preston lived a meaningful life in The Music Man – he got together with Shirley Jones at the end. But that was just a movie. I don’t expect a similar ending for Elon Musk, but who knows?

Is this David of Paris? Style doesn’t match, that’s all – and I’m finely attuned for any post David of Paris offers us :-) just mentioning so we don’t get double ups on handles

A Tesla is still a luxury item. And it is not a general purpose car. It’s real market is for snobs wanting to commute in the EV lane.

For the price of a Tesla, you could buy two used Leafs, and arrange for your grid-tied solar to charge one during the day net-zero and use the other.

The engineers mentioned above…drive leafs

Ha!

Fwiw, I drove a first-generation Leaf for a few months while deciding on the next car in ’15 or so. Was fantastic for my 20-miles-each-way ride to work, plus errands. It was cheap enough that the rental shops had a bunch of them they didn’t know what to do with and you could get some deals. The ~80 mile range made it useless for general use, i.e. driving to bigger cities from where I live.

But perfect commuter car anyhow.

” a general purpose car”

Not arguing with you, just curious as to what the definition of “general purpose” car is that you are using?

I like the “dual Leaf’s” idea… wish we could fix insurance so that I wouldn’t have to pay double. Atrios had a great “pay at the pump” idea but of course EVs kick that right off the table. And of course Amuricuns believe that they are all the best drivers so a pay-at-the-pump scheme would of course mean they were subsidizing those supposed other bad drivers so it was a non-starter anyway.

I bought a new 2016 Golf Sportwagen, which is an de-trimmed Audi A3 with VW badging, for $21k OTD. I get 40-44MPG with a run of 50 miles, and it will take a 10 pack of 10′ long poly pipes inside. That’s as general purpose as I need.

Never heard of the Nissan Leaf so went looking online for info. I found that they will start shipping them to Australia in August for just under $50k before on-road costs. That is about $35 in US dollars. Ouch!

Media, including blog aggregators (since well before David Brock stomped out dissent) ignored practical solutions, incremental progress and real innovation, since these threaten the status quo. If people equate some wacko blowhard con-man with silly-ass virtue signalling yuppie “$80K electric car fad,” nobody is going to notice all their neighbors replacing 24-36 mpg cars with ever thirstier crossovers & trucks, or Ford laying off thousands while switching production to big $30-$50K trucks. No, it’s nothing new. But it’s invisible to smart hip, educated people, somehow?

Another comment on Tesla. As someone commuting in the SF Bay Area, I’ll comment that Prius and Leaf drivers behave like my 84 year old grandfather (slow acceleration, looong braking distances for others to cut into), while the aggressive cutting in is often by a Tesla.

That’s real. I figure they’re virtue signaling their gentle care for the planet. /unclosed statement

well some if it might be trying to hypermile. Gliding to a stop does reduce fuel use, don’t’ know about slow acceleration.

That’s a good point jrs. I’d be gamified by the onboard performance screen, too.

Back in the day surveys would show that other drivers consistently thought that BMW drivers were the biggest ass***es on the road. Have Tesla drivers taken that mantel where they have reached critical mass?

There are so few of them in our area (AZ) that one would never know – it is mostly big wheel diesel trucks which are the problem here.

Maybe they’re using autopilot and paying less attention to the road?

In Australia, the joke/reputation was always about VOLVO drivers. Because they were such safe solid cars, the drivers were inattentive and lazy to compensate. Radio announcer ‘ and this morning, watch out for potholes, and VOLVO drivers..’

Your 84-year-old grandfather sounds like a good driver.

What is the point of careening to a stop when you’re going to be stopped anyway?

Remember that half of all drivers are below average!

And 90% think they’re above average.

90% of women, 99.9% of men :)

…and don’t forget that 84.334% of all statistics are made up on the spur of the moment!

(and honest to Yahweh, a few people have responded with “Really? That high?”)

Not really, half of all drivers are below median, but not necessarily below average. Some drivers are contributing more than their fair share to accidents (the young and the males essentially, young males being the worst). This is one reason more than 50% of drivers think they are above average, before one takes into account the Wobegon effect.

Thank you. There is really no point to careening to a stop in city traffic especially. OP said SF Bay area so that has to include at least some city or rush hour driving. I live in LA so maybe I’m biased but I always see drivers trying to flex by accelerating quickly at a light only to have to slam on the brakes one block later.

I can see the logic (even if it’s not safe) in speeding to a green light or even a yellow light before it turns. But to a red light or a stop sign? Someone explain this to me.

When the CFO is reviewing every single disbursement, they are circling the wagons, preparing for litigation and BK.

I have a serious, completely non-ironic question for the great minds of the commentariat: are there any currently non-public Silicon Valley companies with major VC backing that could possibly be worth anything near their valuation? Or even any that have “exited” recently? It just seems like such a factory of half-baked ideas held up with hype and enormous amounts of other people’s money.

In my little field of education, the SV darling is Duolingo. Its main product is a quiz-style language learning app that is such complete and utter garbage and an insult to the field of education that it is impossible to adequately convey its worthlessness to people outside the field. For starters, the last I checked it still does not have actual recordings of humans speaking, just computer-simulated artificial voices. So you are learning to sound like Commander Data, except that Duolingo teaches such a bizarre array of phrases like “the purple donkey sings well” that you would never be able to communicate even at all.

For those thinking now would be a great time to short the stock. Don’t. It’s fallen a lot in a relatively short amount of time and its now siting on a big technical level–$200/shr–where it will probably bounce higher for possibly weeks or months.

IMO Tesla buyers will be desperately looking for parts/service in the years to come.

Elon can’t use his mouth anymore to manipulate the stock (2 SEC agreements). The Co. looks to be toast.

But don’t short here.

They are desperately looking for service now:

https://www.nbcsandiego.com/news/national-international/Tesla-Owner-Frustrated-Fixes-Model-S-491889781.html

Nothing good will come of this and I see very few of these cars even here in SoCal. And I equate Tesla more with the Tucker!

https://silodrome.com/tucker-48-torpedo/

“In order to raise funds to get a car of his own design into production, Preston Tucker ran one of the first speculative IPO stock issues in American history – and raised $17,000,000. If anything, the plans for the Tucker 48 (originally known as the Tucker Torpedo) were too extravagant. Preston had engineers developing a bespoke 589 cubic inch (9.65 litre) flat-6 engine with fuel injection, hemispherical combustion chambers, and a fascinating overhead valve system that used oil pressure rather than a camshaft.”

…holy toledo!

But the Tucker movie was so inspiring! The Big 3 sabotaged him! /s

Francis hardly invented the yuppie era nightmare of bogus, feel-good, inspirational docudramas, around which our affluent boomers constructed their silly fantasy world view. Didn’t Marx work FOR Horace Greeley? Most of Audi’s innovations originated in Indiana. Ford ignored them, WE are their product!

https://en.m.wikipedia.org/wiki/Tucker:_The_Man_and_His_Dream

I see Teslas as Lemonborghini’s