Jerri-Lynn here. Perhaps the penny is about to drop on Tesla?

I draw to your attention this post in Dealbreaker – which I was going to use in today’s Links, but works better here, With His Martyrdom Approaching, Elon Musk Has Found His Saint Peter. Please click on it, for the unforgettable image of Elon Musk reimagined on the ceiling of the Sistine Chapel.

From the Dealbreaker piece:

We abhor overly dramatic analogies, but Tesla’s financial picture is starting to look a lot like The Last Supper.

Like any new car company that is totally not a messianic religion, Tesla is still in the early verses of its creation story. To that end, things have taken a turn lately in such a way that we believe Elon Musk is looking more and more likely to end up a financial martyr.

Following the rules of narrative, every messianic martyr needs to have at least one conflicted apostle capable of denying him three time. We are happy to report today that Elon finally has one of those:

Morgan Stanley is growing increasingly negative on Tesla shares.

“TSLA shares appear caught in a flywheel of concerns around demand & access to capital driving the share price lower, exacerbating sentiment around demand & access to capital,” analyst Adam Jonas wrote in a note to clients on Tuesday.

He added: “Stopping this negative cycle is a priority for the company and its stakeholders.”

Adam Jonas has downgraded Tesla…again…for the second time this year. There was a time when Adam Jonas was thought to be the Wall Street rock upon which Elon would build his church, but now the fourth Jonas brother is so full of doubt about the company that he once loved so deeply that we are comfortable categorizing Adam as a full-on Tesla apostate.

By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street.

The surprise in the SEC 10-Q filing when no one was supposed to pay attention.

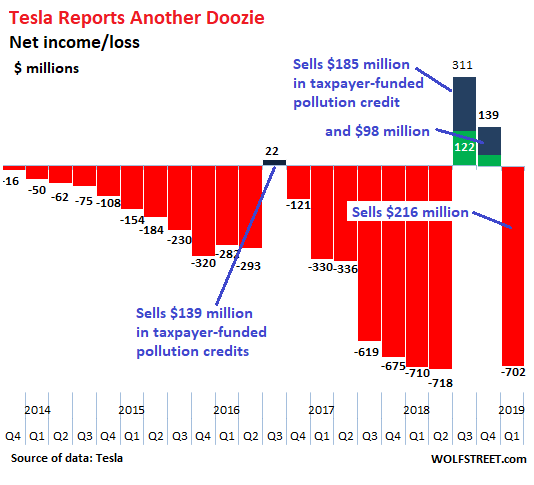

Today, when no one was supposed to pay attention any longer, Tesla filed its quarterly report Form 10-Q with the SEC. Tesla had reported “earnings” on April 24, a doozie of a net loss of $702 million. But today, after the hoopla of its earnings report had died down, Tesla disclosed a slew of things that it hadn’t disclosed last week, including a record amount of sales of pollution credits.

Without those taxpayer-funded pollution credits that Tesla gets from the government and sells to other companies, its loss as automaker and solar-panel company would have been $918 million and its negative cash flow wouldn’t have been a cash drain of $919 million but a cash sinkhole of $1.14 billion

Tesla calls these taxpayer-funded pollution credits – part of the package of rich corporate welfare programs that Corporate America benefits from in numerous ways – “regulatory credits.”

The sales of these regulatory credits are booked as revenue, so they increase revenues by that amount. Since there are no costs associated with them, they also inflate by that amount gross profits, income from operations, net income, and cash flow. In other words, those taxpayer-funded credits are at the core of Tesla’s business model and flow straight from the top line all the way down to the bottom line.

Tesla discloses these “regulatory credits” – when it finally discloses them – in two categories:

- Zero Emission Vehicle (ZEV) credits and

- Non-ZEV regulatory credits.

On April 24, as I noted at the time, Tesla disclosed merely its $15 million in ZEV credits. But it kept its non-ZEV credits secret, and for a very good reason, with this kind of earnings chart:

Today, in its 10-Q filing, it disclosed what was really going on with one sentence in a note discussing the composition of its revenues under the heading, “Automotive & Services and Other Segment” (I added the bold):

“Additionally, there was an increase of $170.6 million in sales of non-ZEV regulatory credits to $200.6 million in the three months ended March 31, 2019.”

Those regulatory credits in Q1 of $15 million in ZEV credits plus $200.6 million in non-ZEV credits amount to $215.6 million, or 4.8% of the Tesla’s revenues. These disclosures show to what extent it depends on the taxpayer for revenues, profits (well, lower losses), and cash flow.

Without Those Credits:

- Gross profit wouldn’t have been $566 million but merely $350 million.

- Net loss wouldn’t have been $702 million but $917.6 million, which would have been its largest loss ever by far.

- Operating cash flow wouldn’t have been the whopper of a negative $919.5 million that it disclosed on April 24, but a negative $1.137 billion!

This is the reason Tesla doesn’t disclose these credits fully during its earnings release when the media might jump on it (possibly) but delays the disclosure until it files its quarterly 10-Q with the SEC usually the following week.

Without the revenues from selling those taxpayer-funded credits to other companies, Tesla’s operations as an automaker and a solar-panel maker would look a whole lot worse than they already do. And this comes on top of the enormous benefits Tesla still reaps from the now phasing-out taxpayer-funded credits that buyers of its vehicles obtain from the federal government and from some state governments.

The ruse that helped Tesla’s shares jump 20%. Read... Tesla Reports Another Doozie

http://brusselstimes.com/business/technology/15050/electric-vehicles-emit-more-co2-than-diesel-ones,-german-study-shows

Pollution credits, my ass.

Not sure I give a lot credence to anything published by Hans-Warner “Austerity” Sinn.

There is a widely held view in Germany that Sinn is a water carrier for Deutschland AG.

“Electric” transportation advocates – or should I more accurately say Tesla advocates – have argued that the study you you reference is fake news funded by the FF industry. Personally, I am in no way a Tesla advocate.

4,500 lb single occupant drag racers will never be green, whether powered by oil, coal, or hot air.

> When all these factors are considered, each Tesla emits 156 to 180 grams of CO2 per kilometre

True or not true? Seems plausible to me although I haven’t read any Tesla fanboi rebuttals. That’s if the battery lasts as long as projected. If average battery life decreases, the emissions increase proportionally.

Seemingly missed in all this CO2 accounting and mining rare earth minerals to make electric cars go, is the damage this mining causes beyond just adding CO2 to the atmosphere.

That study may be inaccurate (I really have no idea) but I still think you’re on the right track. How does selling credits so other companies can pollute more solve anything?!?!?

It doesn’t, whatever the Chicago Boyz say. I told a student who drives a Tesla that unless he had an extension cord that reached to Hoover Dam, his baby isn’t an “emission-free” vehicle. One of the members of the Class of 2021 who does not like me…oh, well.

You have ruined Tesla for me.

The study is BS (but successful BS, it comes high now on google searches for ‘EV’ and ‘pollution’). Its clearly been promoted by German car manufacturers who are panicking over dieselgate. I’m no fan of Tesla, but that doesn’t mean that every study purporting to ‘prove’ that their cars are as polluting as regular cars is right.

The ‘tell’ is that they are mixing in construction emissions with Tesla’s, with just fuel use for diesel cars. There are plenty of highly polluting metals used in combustion engines and their cat converters too. There have been a number of comprehensive independent studies comparing EV’s to fossil fuel vehicles, and even with ‘dirty’ electricity mixes, EV’s still come out well on top.

The study is not bullshit and not rally in contradiction to the sources you cite. The second source you cite has on page 24 its “Figure E1: Lifecycle GHG emissions of mid-sized 24 kWh battery electric (left) and

internal combustion engine (right) vehicles. ” The study from Sinn is explicitly using the Model 3 in the versions available in Germany, e.g. the Long Range version with 65 kWh. That would mean, that the battery production share of the cited greenhouse gas emissions would have to multiplied by about a factor of 2.7 and in addition the electrical consumption would be slightly higher due to the large weight of the Model 3.

Commuting 150Mm in 10 years corresponds to commuting a bit more than 30 km. If you use the car only for commuting, the most environmentally way to that, is indeed an electrical car, but not a Model 3, but one with a significantly smaller battery pack. If you need for other reasons a bigger battery pack, but still only drive 15,000 km a year, e.g. because you commute much smaller distances, but use the car to drive a longer distance (e.g. visiting relatives) a few times a year, a Diesel car easily beats the electric car in environmental friendliness. The environmentally best way would be then to use an electric car with a small range for regular commuting and borrowing a car with a larger range specifically for the long-distance trips, but there may be other reasons, why people prefer to use always the same car.

Tesla is “farming the government”. (growing their “profits” from govt tax breaks, credits, and rebates)

Well, I for one am mighty proud that tax dollars can subsidize transportation and status-projection for our Meritorious betters! It’s disruptive, or innovative, or disruptovative, or something…

What, are you some kind of malcontent, Flora?

This is just the way “things are done” in the USA.

Capitalist Ideology demands that only privately owned Corporations can ever develop any new technology because “Government” is per-definition and always wasteful, evil, stupid and best kept in a useless state. Therefore, when Government needs something developed (like missiles, rockets, solar cells, semiconductors), they have to engineer an ideologically acceptable way around “Markets”, because there are no “Markets” for things that doesn’t exists, in order to funnel Government money into Corporations who then engineers the technology and collects the profits on it should the “Market” appear.

In the older days, Government would go via the Military Industrial Complex for the technology needs, but, these days they will fund more broadly via the security services in general and in strategic technologies. Tesla is somewhat of an outlier because “The Climate Threat” was used here and the fundamentalist don’t believe in no “Communist Climate Change” (or they want to bring it on to get Armageddon sooner) so Tesla gets a lot of flack that the likes of SAIC, Boeing, Lockheed-Martin, Thiokol and whatnot of the older days never got, even though it is the exact same funding principles that apply.

—

The dirty secret is that Corporations will almost never create a new “Market” on their own. Because, why should they create new, better, things that by being better will destroy the value of their existing product portfolios? On top of that there is simply too much expense and risk involved in going from basic research to something that might well sell, but probably doesn’t and if it does then some upstart will surely grab the torch and run with it, now that the hard engineering problems are solved and the market is there! Corporations are very much like the feudal lords of old, they like Stability. No innovations, if it can possibly be avoided, when it cannot, they will procure them (and probably screw them up).

Only the WWII nuclear program seemed to be an exception to this strategy and Government probably got away with this because there was a war on and the program was a very well kept secret (people were literally locked up in a huge camp for 4 years). The WWII nuclear program is actually how the Russians went about filling their technology shelves!

Just for the benefit of us financially illiterate people – you have companies like Tesla that stay in business even through they are in the financial toilet. The same is true of those fracking companies and Uber and all the rest of them. In a classic economy they would have been wound up long ago. So my question is this. Is this all a result of the $30 trillion that the US pumped into the world economy after 2008? That all that money sloshing around is keeping all these companies afloat long after they should have gone bust?

My pure speculation: It’s a big club and you ain’t in it… And those who ARE, don’t care to be disciplined by any “free market” forces… They simply (privately, in those clubs) design the kind of lab experiment, er “society” cough cough, they think you should live in (run by them of course) and then go about implementing it through their existing control of every major social institution.

it seems the longer the high profile techs exist, the more they get a blood funnel into the sovereign finance to feed them. MMT for thee, the boot for me…

One could add Uber and Lyft to this list.

It is intersting to compare production volumes between Tesla, GM and Ford, and speculate, with Crystal Ball at hand, Tesla’s valuation.

The Crystal Ball is required to forecast the date reality strikes.

This morning’s headlines reveal a plan to raise another $2B with debt/equity sales. But at the current burn rate this is only about another year before the music stops.

Speaking of externalizing costs, what environmental sacrifice did Nevada grant Musk’s battery factory in northern Nevada? I assumed it had to be built there because the toxic trash it creates would not be tolerated by any county in California. Which is something we never hear about electric car batteries – they are just about the worst thing to accumulate environmental damage. As time goes by. I’ve wondered too if this inevitable toxic dump will leach into the ground water and find it’s way down the Truckee river and on into California anyway.

Not to minimize the environmental damage, but only Nevada water will be poisoned by the factory: the Truckee River originates in Lake Tahoe, but has no outlet to the sea. It drains into Pyramid Lake northeast of Reno.

I think Tesla kinda takes the halo off the pollution credits idea … and that goes without even questioning just how much pollution Tesla kept out of the air or wherever it was keeping ‘cleaner’.

I always appreciate Wolf Richter’s insights, but for the sake of MMT accuracy, I wish he would replace “taxpayer-funded” with “government-funded.”

He’s written that he’s not a buyer of MMT.

Predisposed historical preference.

Isn’t it really consumers of OTHER companies’ products who end up subsidizing Tesla? That is, Tesla sells credits to Ford or whoever, and Ford then passes that cost on to its customers?

Might be why F150s cost almost as much as a cheap house, so I hear…

Musk is the diametric opposite of Henry Ford, the man that helped create the Middle Class by producing inexpensive functional cars that his workmen could afford because he paid them a livable wage.

Musk drains tax credits and produces crap.

What a smear on Tesla’s name and stature, to be associated with these pieces of shit.

https://interestingengineering.com/the-life-and-times-of-nikola-tesla

Didn’t realize any of these came from taxpayers. I thought it was a regulatory thing: every car maker must make a certain percentage of its cars zero emissions. If they don’t hit the required percentage then they have to buy ZEV credits from car makers who DO hit the percentage. Since the percentage is somewhere in single digits and all Teslas are ZEV, Tesla has a lot of these credits to sell and it is part of their revenue stream. But the money in that version of the story doesn’t come from taxpayers, it comes from [customers of] car companies who didn’t make enough ZEV’s.

Here’s a slashdot comment from a few days ago, though I haven’t checked it out completely: https://tech.slashdot.org/comments.pl?sid=13850856&cid=58501456

Thank you for that link. It seems like as good an explanation as any as far as “pollution credits” go and the strategy and tactics of the various automakers, with one glaring error (Musk did not start Tesla, he bought into it after it was already in existence) which doesn’t take away from the core of the comment which is:

That comment is well worth a read with a good explanation of GM’s EV-1 go at an electric car and California’s change in standards after being lobbied by other car companies, which destroyed GM’s investment in the EV-1.

I’ll read it later… Smells pretty fishy though. If your car company is just a kind of front for selling pollution credits, that can’t be in keeping with the spirit of the law (the alleged good faith spirit of the law.)

Seems like other companies could make their own phony enviro divisions, or fronts, to rack up credits and offset their other divisions. Why can only Musk get away with BS car production.