Yves here. Who’d have thunk it? Curbing rentier capitalism would be bad for rentiers. It’s only recently that more and more economic research and press interest about the cost of monopolies has taken the sheen off tech giants like Google and Amazon as it becomes increasingly obvious that their outsized results result from the abuse of market power, and not providing better services (if you think Google search circa 2019 can hold a candle to Google search circa 2009, I have a bridge I’d like to sell you).

The one area of significant bipartisan distrust is big tech monopolies. https://t.co/A3d9Qr9rmH

— Matt Stoller (@matthewstoller) June 3, 2019

By Wolf Richter, publisher of Wolf Street. Originally published at Wolf Street

It’s a rare moment in recent years that US government regulators are suddenly going after four tech and social media giants simultaneously – Facebook, Amazon, Google, and Apple. These four companies are part of my FANGMAN index that also includes Microsoft, Nvidia, and Netflix.

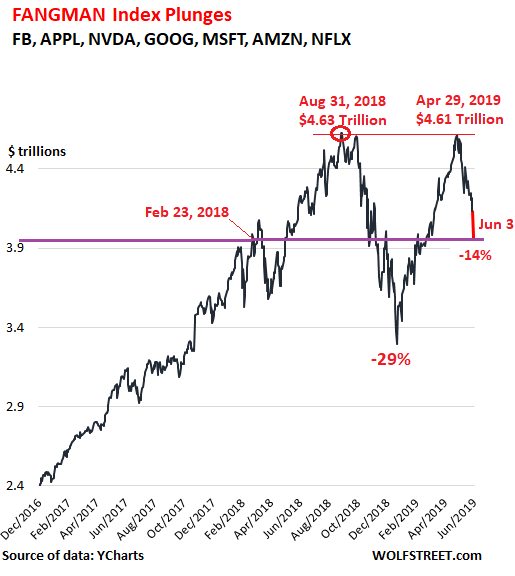

The index dove 4.3% today, the biggest percentage decline since the infamous 4.6% drop on December 24, 2018. In terms of dollars, $137 billion in market capitalization was wiped out. Over the past four trading days the FANGMAN index has dropped by 6.6%. I highlighted today’s move in red (market cap data via YCharts):

The index has gone through some brain-twisting surges and plunges over the past two years. It peaked on August 31, 2018 (at $4.63 trillion), then plunged 29% by December 24 (to $3.29 trillion), then exploded 40% higher by April 29. But that day, at $4.61 trillion, it failed to take out the August high. And then the selling started.

Since April 29, the FANGMAN index has dropped 14.0%, or by $645 billion in market cap, giving up 49% of the post-Christmas rally in just five weeks.

I track these stocks because of their outsized weight in the overall stock market, and because they range from very overvalued to immensely overvalued, depending on the stock – and symptomatic for much of the stock market.

But given the sell-off over the past few weeks, what happened since Friday in terms of regulatory pressure was quite a handful.

On Friday, the Wall Street Journal reported that, according to its sources, the Justice Department “has been laying the groundwork” for an anti-trust investigation into Google, the largest advertising platform in the world. Reuters reported on Monday that Google still “declined comment.”

The WSJ summarized the problem:

The rise of big tech has seen three corporate titans that didn’t exist 30 years ago – Amazon, Google, and Facebook – suddenly amassing the power to sway large parts of the U.S. economy and society, from the stock market to political discourse, from personal shopping habits to how small businesses sell their wares.

With their enormous size and dominance have come network advantages, data caches and economies of scale that can make it challenging for new rivals to succeed. Many firms that compete with those giants in one sector also depend on their platforms to reach customers, and they complain of being unfairly squeezed.

Google has already been hit with three mega-fines by the European Union’s antitrust regulators, totaling €8.2 billion in three years:

- In June 2017, Google was fined €2.42 billion for abusing its position as the top search engine by giving preferential treatment to its own comparison-shopping service.

- In July 2018, Google was fined €4.34 billion for pushing smartphone makers into using its Android operating system.

- And in March 2019, Google was fined €1.5 billion concerning its search advertising.

Over the weekend, it was reported that the FTC would have jurisdiction over a potential antitrust probe into Amazon’s practices. And on Monday, Reuters reported that “Amazon declined comment on Monday.”

It was reported that, according to sources, the FTC would also have jurisdiction over a potential antitrust probe into Facebook, which also owns Instagram and WhatsApp.

The FTC has long been investigating Facebook for privacy violations. In 2012, it approved a final settlement with Facebook, “resolving charges that Facebook deceived consumers by telling them they could keep their information on Facebook private, and then repeatedly allowing it to be shared and made public.” This settlement included a consent decree that Facebook subsequently was alleged to have violated by sharing user data with Cambridge Analytica.

In April, Facebook said that it expected to be fined between $3 billion and $5 billion for these violations. Sen. Richard Blumenthal (D-Conn.) and Sen. Josh Hawley (R-Mo.), members of the Senate Judiciary Committee, lambasted it as a “bargain for Facebook” that doesn’t go nearly far enough in holding the company accountable to its users and forcing changes.

“Even a fine in the billions is imply a write-down for the company, and large penalties have done little to deter large tech firms,” they wrote in the letter. “Fines alone are insufficient. Far-reaching reforms must finally hold Facebook accountable to consumers. We’re deeply concerned that one-time penalties of any size every few years are woefully in adequate to effectively restrain Facebook.”

They proposed a slew of reforms, including that “personal responsibility must be recognized from the top of the corporate board down to the product development teams.” And they added, “It is also time for the FTC to learn from a history of broken and under-enforced consent orders.”

And it was reported over the weekend, again according to sources, that the Justice Department would have jurisdiction of a potential antitrust probe into Apple, which is already entangled in an investigation by EU regulators, following a complaint by Spotify that it abuses its power over app downloads.

That puts the four companies simultaneously under the US regulatory microscope. And clearly, officials have been fanning out to let the media know. On Monday, Reuters reported that “people briefed on the matter say neither the Justice Department nor the FTC have contacted Google or Amazon about any probes, and that company executives are unaware of what issues regulators are reviewing.” So they got their info from the media.

Divvying up jurisdiction was the first essential step. The rest might take years.

Sources told Reuters on Monday that the government “is gearing up to investigate whether Amazon, Apple, Facebook and Google misuse their massive market power … setting up what could be an unprecedented, wide-ranging probe of some of the world’s largest companies.”

Congress appears to be on board, according to Reuters:

Senate Judiciary Committee Chairman Lindsey Graham, a Republican, told Reuters that the business model of companies like Google and Facebook needs to be scrutinized. “It’s got so much power, and so unregulated,” he said.

Another Republican, Senator Marsha Blackburn, said the panel would do what she called a “deeper dive” into big tech companies.

Democratic Senator Richard Blumenthal, who said on Monday that U.S. enforcers have to do more than wring their hands about the companies’ clout, also weighed in. “Their predatory power grabs demand strict & stiff investigation & antitrust action,” the Connecticut senator wrote on Twitter.

So let’s see how that will turn out — if the outcome will effectively change business practices, or if any fines will just raise the cost of doing business, costs that can be written off as “one-time charges” that analysts and the financial media eagerly exclude from earnings reports and hastily send into oblivion where they don’t matter. But for now, the FANGMAN index shows that there is a price to pay.

Finally!

While this might be good I am not thinking it’s because US regulators all of a sudden saw the light. I suspect, but others likely have better insight, that these are the real drivers…

– Trump has a known dislike for Bezos

– Several of these companies might need some hand twisting to get them in line with the new US policy with respect to China

– It’s election season and the final outcome is years off, but the initial investigation will make for good Trump supporting politics.

More likly, they are cutting too deaply into Wall Street’s action. The thing about capitlists, they hate competition.

Both parties now support going after the tech giants. And recall Trump is regularly at odds with the GOP (witness on his tariffs). This action is made easier in the US by virtue of the European competition regulator already moving to impose massive fines if Google (and IIRC they are gearing up re FB) don’t make fundamental changes to their business.

“Crushed” – come back when they are down 90% when pure speculative valuations have been purged and the business value has been hurt.

The references to the fines is very optimistic. All fines have been pocket change and well within a “cost of doing business” post. Zero game change coming from the fines.

Also, are they even collected?

“Also, are they even collected?” …

You mean like any and all private plebian info hoovered up for the benefit of those very same .. uh.. ‘law-yer-makers’ (depending of course, which team holds the Lucyball !) who give Big Untelligence carte blanche to do whatever the f#ck they want !! THAT kind of collection ???

Nothing of merit will come of this while the FANGS are out of their corpserate coffins wrecking havoc amongst what’s left of civil society. They need a BIG stake shoved through each and every one of their rancid black hearts !!!!!!!!!

Saber-toothless Dog .. meet Dire-Straights Pony Show !

Any fine levied on a Corp. that could easily be paid by it’s CEO or founder from personal income in the year it is levied, cannot possibly deter any behavior.

Even if it was actually paid.

I am skeptic about any real positive outcome of this.

Exactly these companies are currently the most important ones for the US, not because of their meteoric rise in valuation, but the sheer importance they have for the US all over the world.

These are the companies that are actually important, that the US’ importance in world affairs currently rests on them. Boeing is maybe too important to fail vis their downfall of the last ~15 years and will be saved, but these must actually succeed “on their own” and more importantly, dominate everywhere in the world. Which is why China forbids them everything inside their domain for example.

Since they are so important for the US, not only to the government but the actual ruling circles, nothing will be permitted that actually really harms them. There will probably be some symbolic punishments, but that will be all.

GM was also once perceived to be this important. AIG was the world’s biggest insurer and very important to the CIA, it gave fake jobs overseas to lots of assets. ITT was even more important to the US in Latin America back in the day.

Microsoft almost certainly would have been broken up into its OS versus its apps businesses had Judge Penfield Jackson not gotten himself removed from the case by talking about it to a journalist before it was over and being replaced by a judge generally regarded as not very smart and timid, Collen Kollar-Kotelly.

Breaking up Google (making it get rid of YouTube and non-search-related acquisitions) would not be hard. Similarly, you’d break up Amazon and Amazon Web services.

And perhaps even more importantly, force all these companies to SELL books, especially eBooks rather than giving them away for free and to actually PAY authors for online content.

Collectively, they have decimated the publishing industry for mid-list publishers and almost destroyed writing as a viable career option.

https://publishedtodeath.blogspot.com/2015/09/income-for-authors-plummets.html

Article money quote from Publishers Weekly:

Preach it, Heelbiter! I know someone who used to make a good living as a midlist author. Sad to say, those days are over.

I’m somewhat surprised that Wolf didn’t include Intel and Qualcomm, given their deep reach in their domains (CPU’s for Intel, Phone SOC’s for Qualcomm)

GM was not feeding mountains of information into the US deep state maw.

>”Breaking up Google (making it get rid of YouTube and non-search-related acquisitions) would not be hard. Similarly, you’d break up Amazon and Amazon Web services.”

I must disagree, Yves. Search is not a business, the advertising is. Splitting them apart makes both non-viable. They each depend on the other. They could be severely curbed in scope, if Congress was not so cowardly, but would have required action years ago. YouTube makes no profit.

Amazon will never make money under it’s current model, AWS is all that keeps it afloat.

Amazon is the Uber of retail shopping.

It’s never hard to break up a company that abused its monopoly status. The problem is the lack of political/societal will to do it.

And yes, GM was important before the last crisis, but it also was saved directly by the US government in an unprecedented move. AIG was bankrupt, not an abusive monopoly. Neither the US car makers. ITT seems to have died slowly in obscurity just like Microsoft seems to do: the DEC or IBM of our time.

Why did a experienced judge talk to a journalist or why was he then removed from the case? Why was the case given to a timid judge afterwards? Even if he split the company up, how many more courts would that ruling have to go through for it to actually implemented? How many fortitious events like this to be exploited or maybe even events made, could have happened with those years, maybe decades, of legal proceedings?

Look no further than recent ATT Time Warner merger that ultimatively the government would also have an important say: “national security” is always a great argument.

Right now, the companies are good for the US on several fronts: economically, for the NSA, influence in foreign countries, etc. Therefore they will be protected like the ITTs and AIGs of old. If/When they are not as useful anymore, if there are new companies that can replace them, they will be. But this time is not yet.

PS: how do you propose to reign in Facebook with their data protectin violations? If you do, the company is dead. The amount of data the CIA can get from it in foreign countries however is too good to pass up.

As Yves noted, GM was considered important and they make a tangible product that the majority of people need to get by in this country.

Netflix allows you to stream movies. Not so important.

These companies may be saved if they do decline further, but it may be more due to what friends they have in the Beltway, and even then you never know. I thought Bush would bail out Enron when it was in decline and was very wrong.

I kept looking for a lingk to the Onion. Can this really be happening?

Could this be the beginning of a shake-down of Facebook, Amazon, Google, and Apple by the Feds? I mean, a Mohammad Bin Salman can just round up his country’s billionaires and have them physically leant on in a hotel but the Feds can’t. But if there were things that the Feds wanted these companies to do or finance with their billions, dragging them through an examination of their affairs may be the way to remind them that you “don’t fight the Feds”. Just a possibility mind.

That assumes a level of foresight and planning that hasn’t been demonstrated by this particular government.

I believe that you might be on to something. It might be about leaning onto them to remind them that the polite requests from authorities for data might best be replied to with haste and if employees at these firms object then the business might compare the value of the employee with the value of being friends with the government. Valuable employees might not be as valuable as they thought.

These cases in EU:

https://www.irishtimes.com/business/eu-scrutinises-google-s-tax-arrangements-in-ireland-1.3859945

Might possibly be similar. Based on what I hear then I believe that it is at least a possibility that the tax-authorities are acting as an arm of the government and might possibly be not quite as strict in audits (if they even happen) of companies believed to be a flight-risk… But for now, in the EU I believe it might be more likely that the case presented officially is also the same as the real case.

Why does the government always get the settlement money and not the consumers who have been harmed?

Blumenthal is smart, and can follow the details.

Blackburn investigating much of anything is a scary thought.

This is a long overdue consequence of GOP led 1995 killing off, defunding, and institutionally demolishing the Office of Technology Assessment.

https://en.wikipedia.org/wiki/Office_of_Technology_Assessment

If the Gingrich-luddite clan hadn’t been so hostile to the future, just as the entire Internet economy was coming in to being, Facebook and Google would have been better understood 20 years ago, and knowledgable, informed public policy might have been able to guide their growth. Instead, we’ve had metastasis and political ignorance of the details and implications of important technical developments.

Congress, and the GOP in particular, are going to have a huge learning curve.

Defunding the OTA was a classic case of Congress cutting off its nose to spite its face. Too bad it’s short-sighted, budget slashing foolery has had such horrendous consequences.

Thanks for that link.

It mentions the Government Accountability Office has since establiished a TA unit to take on the former duties of the OTA.

It also says that the Europeans have the same idea of technology assessment, with a similar office.

We can ask, how differently would the OTA have done, and what the European TA has done, versus what the GAO’s TA unit has done.

Congress, and the GOP in particular, are going to have a huge learning curve.

A$$uming Congre$$ and the GOP want to learn.

Nice business ya got there. Shame something might happen to it.

I will be surprised if anything of substance comes from this. A fine of a few billion dollars means nothing to any of these companies.

The Big Four CPA firms audit 98% of SEC registrants by market cap and have for years. They audited the big banks which got $700 billion in federal bailouts about ten years ago. And? The PCAOB supposedly “inspects” and disciplines these firms. I await Congress looking into this.

Fangman ?? Who invited nvidi ?? Always read the family blogging acronym as the GANA-F-M krewe

Yeah, Nvidia is a surprise, as opposed to putting Qualcomm in his tracking.

Wolfe invited Nvidia. It’s his stock grouping.

Nvidia has a dominant share of video gaming and 3D graphics chips.

“Who invited Nvidia?” — Well, FAGMAN probably wouldn’t play very well among polite company. ;)

If I were Bernie Sanders, or AOC, as part of my GND I would propose a government-created search/social networking site that would work like GOOG/FB circa 2009. No ads, minimal data collection, firewall it off from the rest of the government, with external oversight. Yes people would be worried about giving the government their data, but is it really any better giving it to private monopolies (who will turn right around and hand it to the government anyway?) I think this is a winning issue. This avoids the whole how do you punish/regulate big tech – just provide a utility alternative, and let the best platform win.

Amazon, though, I think is a much stickier wicket.

Which would be politically simpler and more possible: this govenment-created search and social service?

Or forcibly stripping WhatsApp back out of Facebook and resurrecting it as a private stand-alone company? And if choice two, would it be possible to make the price of being rescued from the Facebook Gulag be that the rescued and revived WhatsApp be strictly user-pay for being on the social network and user pay for using the search engine?

Perhaps such a rescued and revived WhatsApp could call itself UserPay Search and Social.

They are supplying personal data of users to advertisers and marketers who are requesting it. Entire business plans are prepped around mertrics expected from the FANGMAN.

Much of the mainstream discussion on tech is really a discussion about advertising (which is what most of the surveillance is for and national security is equated with corporate dominance in this system).

Are the legislators going to grow a pair and tell ALL of those instigators to privacy invasion that there are things about people that it’s not your business to know?

Sherman Act may need some redefinition to address the unique monopolistic advantages related to having a monopoly on “access to the consumer” (advertising and/or sales) as I like to call it.

Sure they are targeting ads to us but is that any different than the hours of ads we watched on TV in the past? If advertising money is what brings us Google free I am all for it. It looks more like the politicians are trying to divert the public from the issues that really matter like a progressive tax system, national health care, immigration, campaign finance reform and the military industrial complex. Just focusing on these issues would do so much for the nation. Over half of our national budget is spent on war. Both the Dems and Repubs are in bed on this together. If I don’t want to be on facebook I don’t have to sign up. If I do not want to use Google maps I can use a paper map.

I don’t use Google, or Facebook or Twitter. I avoid Amazon as much as I can. However, while I gleefully non-participate (with a middle finger held high), the power of huge data companies to engage in massive scale psychological/sociological manipulation isn’t diminished.

Same here. Avoid those at all cost. I use DuckDuckGo as my search engine.

There was a good interview by Harry Shearer Sunday of Professor Shoshana Zuboff, author of The Age of Surveillance Capitalism.

It is not simply a matter of tracking us to sell a few ads. They are trying to measure every aspect of our lives to offer us ads at our most vulnerable moments. The next step is to modify behavior through information presented to us online.

https://harryshearer.com/june-02-2019/

We live in a world of many problems. The problems you cite are problems. The CyberLords’ pattern of Big Biznazi Mass Mind Control is also a problem

And the transformation of Google from a Search Engine into a Search preVENTion Engine is a major irritant, if not a major problem.

The celebrated jumping fraud of cavalier accounting?

Applause!

Nice, Wuk

The PTB need to reassure voters that representative democracy is the bee’s knees. They wish to protect the legislature whereas voters recognize that the candidates put up by the two big parties don’t represent the voters at all – they are in the process for the money and reputation.

There is a grave danger people will want to have a neighbor or school friend at the bottom level of democracy so they have a point of contact. Actually, the greatest defect in our political system is the permission we give representatives to form groups.

Once that is stopped we can bring the country under the control of the people step by step and really enjoy the advantages of society.